Modified PTFE Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431870 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Modified PTFE Market Size

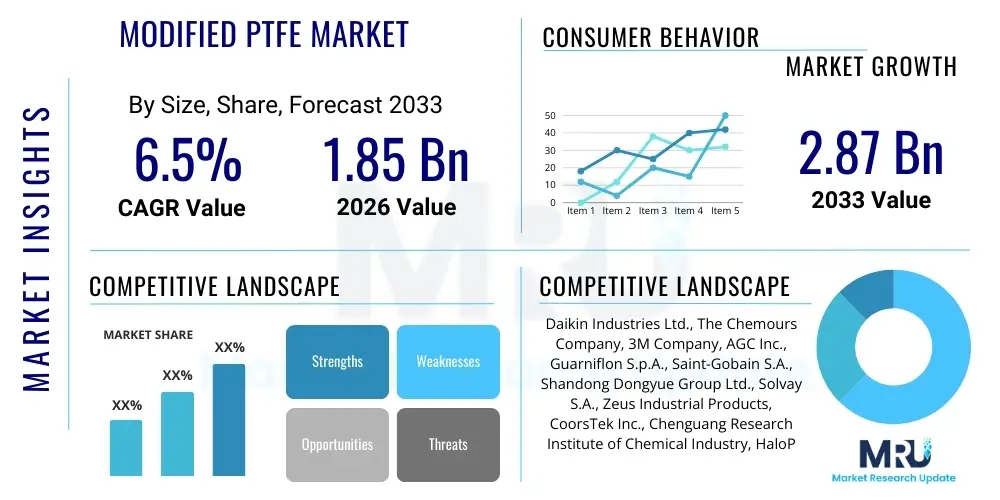

The Modified PTFE Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 1.85 Billion in 2026 and is projected to reach USD 2.87 Billion by the end of the forecast period in 2033. This consistent growth trajectory is primarily driven by the increasing demand for high-performance fluoropolymers in critical industrial applications where chemical inertness, high thermal stability, and superior dielectric properties are paramount. The modification process enhances the basic properties of virgin PTFE, particularly improving characteristics such as mechanical strength, wear resistance, and, most crucially, reducing cold flow, making these materials indispensable in demanding environments like aerospace and semiconductor manufacturing.

The market expansion is heavily influenced by infrastructural development and the globalization of stringent regulatory standards concerning material safety and longevity, especially within the chemical processing and automotive sectors. Modified PTFE, often achieved through copolymerization with small percentages of monomers like perfluoropropyl vinyl ether (PPVE) or hexafluoropropylene (HFP), offers engineers the ability to design components with greater reliability and extended service life compared to traditional polymers. Furthermore, the push towards electric vehicles (EVs) and advanced battery systems significantly boosts the demand for specialized PTFE grades utilized for insulating wires and producing durable seals and gaskets that withstand harsh electrochemical conditions.

Modified PTFE Market introduction

The Modified PTFE Market encompasses the global production, distribution, and utilization of polytetrafluoroethylene that has been chemically altered or structurally reinforced to enhance its intrinsic properties, particularly melt-processability, creep resistance, and radiation resistance. Modified PTFE, a subset of high-performance fluoropolymers, typically involves the incorporation of perfluoroalkyl vinyl ethers or similar comonomers during polymerization, resulting in a polymer structure that retains the excellent thermal and chemical characteristics of PTFE while overcoming its major drawback of poor cold flow and difficulty in traditional molding processes. Major applications span critical industrial sectors including electrical and electronics, automotive, chemical processing, aerospace, and medical devices, where material failure can lead to catastrophic consequences.

These specialized materials are crucial for manufacturing components such as high-frequency electrical insulation, corrosion-resistant linings for pipes and vessels, low-friction bearings, and intricate sealing components that operate under extreme temperatures or exposure to aggressive chemicals. The inherent non-stick and low coefficient of friction properties of Modified PTFE further solidify its role in demanding applications, reducing maintenance requirements and improving operational efficiency across various industries. The sustained growth of this market is fundamentally driven by the global expansion of the semiconductor industry, which relies heavily on ultra-pure fluoropolymers for fluid handling systems, and the accelerating transition in the automotive sector toward complex, heat-resistant components required for next-generation propulsion systems.

Modified PTFE Market Executive Summary

The Modified PTFE Market is characterized by robust commercial trends, primarily driven by the miniaturization of electronic devices and the increasing use of high-purity materials in cleanroom environments, particularly in Asia Pacific. Business trends indicate a strong focus on strategic mergers, acquisitions, and technological collaborations aimed at vertical integration and expanding product portfolios to offer customized grades addressing specific end-user requirements, such as enhanced plasma resistance for semiconductor manufacturing equipment. Key manufacturers are investing heavily in R&D to optimize polymerization techniques and develop novel functionalization methods that further improve the mechanical load-bearing capabilities of the resulting materials, thereby capturing high-value applications in the aerospace and defense sectors.

Regional trends demonstrate that Asia Pacific (APAC), led by China, Japan, and South Korea, is the dominant and fastest-growing region, fueled by rapid industrialization, massive investments in electrical infrastructure, and the centralization of global semiconductor fabrication facilities. North America and Europe maintain stable growth, driven by stringent safety regulations that necessitate the replacement of conventional materials with high-performance fluoropolymers in regulated industries like medical devices and chemical processing. Segment trends show that the highest growth is expected in the granular modification segment, favored for its use in hydraulic and pneumatic seals, while the major end-user application driving demand remains the electrical and electronics sector, specifically related to wire and cable insulation and printed circuit board components.

AI Impact Analysis on Modified PTFE Market

User inquiries regarding AI's influence on the Modified PTFE market frequently center on how artificial intelligence can accelerate material discovery, optimize complex polymerization processes, and enhance quality control in high-volume manufacturing. Common concerns revolve around predictive maintenance of fluoropolymer processing equipment, the role of machine learning in forecasting raw material price volatility (specifically fluorspar and methanol derivatives), and the potential for AI algorithms to simulate and predict the long-term performance and chemical degradation of modified PTFE under specific operational stresses, thus reducing reliance on time-consuming physical testing. Users are highly interested in leveraging AI for supply chain transparency and ensuring the ultra-high purity required for semiconductor and biomedical applications.

AI is projected to significantly revolutionize the manufacturing workflow, moving beyond simple automation to deep process optimization. Machine learning models can analyze vast datasets of reaction parameters, including temperature, pressure, initiator concentration, and stirring rates, to identify optimal conditions for achieving specific molecular weight distributions and controlling the level of comonomer incorporation, critical for desired modification characteristics. This analytical capability allows manufacturers to reduce batch variability, increase yield, and drastically shorten the development cycle for new, specialized Modified PTFE grades, such as those with superior dielectric constants or extreme plasma resistance, responding more rapidly to niche market demands.

Furthermore, the application of Generative AI in computational material science holds immense promise for the Modified PTFE domain. AI models can simulate thousands of possible comonomer combinations and structural architectures to virtually screen for materials possessing targeted performance profiles—such as improved mechanical strength at elevated temperatures or reduced permeation rates for corrosive gases—before physical synthesis is attempted. This capability not only saves considerable resources in R&D but also accelerates the introduction of next-generation fluoropolymers essential for advanced technologies like fusion reactors, high-speed telecommunications, and cutting-edge medical implants, ensuring the market remains aligned with future industrial requirements.

- AI-driven optimization of polymerization reactor conditions leading to enhanced yield and purity.

- Predictive maintenance analytics applied to extrusion and molding machinery, minimizing downtime and scrap rates.

- Machine learning algorithms used for virtual screening of novel comonomers to design specialized PTFE grades.

- Enhanced quality control systems utilizing computer vision and AI for defect detection in extruded rods, sheets, and tubes.

- Supply chain risk management and demand forecasting optimization, particularly concerning fluctuating prices of critical fluorine raw materials.

- Simulation of long-term material aging and stress degradation under diverse thermal and chemical exposure conditions.

- Automation of regulatory compliance documentation and material traceability using AI and blockchain integration.

DRO & Impact Forces Of Modified PTFE Market

The Modified PTFE Market is primarily driven by the escalating demand from high-growth industries requiring materials capable of withstanding extreme operational parameters, such as the semiconductor industry's need for ultra-pure, chemically inert components and the automotive sector's adoption of EV technology necessitating lighter, more durable insulation and seals. However, this market faces significant restraints, including the high initial cost of Modified PTFE compared to commodity plastics, the inherent complexity of processing fluoropolymers which requires specialized machinery and expertise, and stringent environmental regulations governing the use and disposal of fluorine-containing chemicals and intermediates. The principal opportunities reside in the expanding medical device sector, where biocompatibility and sterilizability are key, and the burgeoning renewable energy sector, specifically in solar panel components and fuel cell membranes, demanding exceptional thermal and chemical resistance for long-term reliability.

Impact forces within the market are predominantly centered on technological innovation and regulatory shifts. Technological advancements aimed at improving melt-processability and reducing fabrication costs act as powerful market accelerators, making Modified PTFE accessible to a broader range of mid-tier applications. Conversely, geopolitical instability affecting the global supply of fluorspar, a key raw material for all fluoropolymers, poses a significant threat, potentially leading to sharp price increases and supply bottlenecks. The high switching cost associated with transitioning from established conventional materials to specialized Modified PTFE grades also exerts a restraining force, requiring comprehensive cost-benefit analysis before industrial adoption, especially in large-scale infrastructure projects.

The competitive rivalry among key manufacturers pushes continuous product refinement, focusing on developing proprietary blending techniques and filler systems that further enhance specific attributes like conductivity or abrasive wear resistance, providing high-value differentiation. Environmental, Social, and Governance (ESG) mandates are increasingly acting as a strong opportunity driver, encouraging the development of sustainable Modified PTFE production methods and exploring recycling technologies, aligning business practices with global sustainability goals. This confluence of high-stakes application requirements, complex material processing, and environmental scrutiny dictates the dynamic trajectory of the market.

- Drivers (D):

- Accelerated growth in the semiconductor industry requiring ultra-high purity fluid handling components.

- Increasing adoption of Modified PTFE in the rapidly expanding Electric Vehicle (EV) sector for insulation and seals.

- Mandates for high thermal and chemical resistance in critical aerospace and defense applications.

- Superior properties such as enhanced creep resistance and reduced cold flow compared to virgin PTFE.

- Restraints (R):

- High manufacturing complexity and initial material cost compared to conventional engineering plastics.

- Volatile pricing and geopolitical risk associated with the supply of fluorspar and other fluorine intermediates.

- Challenges related to waste management and disposal of fluoropolymer materials due to environmental concerns.

- Opportunity (O):

- Growing utilization in sophisticated medical devices, implants, and pharmaceutical processing equipment.

- Development of new Modified PTFE grades with improved radiation and plasma resistance.

- Expansion into renewable energy applications, including fuel cells, high-performance solar components, and wind turbine systems.

- Impact Forces:

- Bargaining Power of Suppliers: High, due to concentrated supply chain for primary fluorine chemicals.

- Bargaining Power of Buyers: Moderate to High, particularly large OEMs demanding custom formulations and competitive pricing.

- Threat of New Entrants: Low, due to high capital investment and technical expertise required for production.

- Threat of Substitutes: Moderate, from other high-performance polymers like PEEK and high-end elastomers, though Modified PTFE maintains a niche for extreme environments.

Segmentation Analysis

The Modified PTFE Market is meticulously segmented based on the type of modification, the final product form, and the specific application industries, reflecting the diverse and specialized requirements of end-users. Segmentation by product form—which includes granular/powder, fine powder, and dispersion—is crucial as it dictates the processing technique and, consequently, the final component properties. Granular powders are typically used for compression molding components such as bearings and seals, while fine powders are essential for paste extrusion processes used in thin-walled wire insulation and tubing. Furthermore, the market is highly differentiated by application, with the electrical and electronics, chemical processing, and industrial sectors acting as the major revenue generators, each requiring unique material characteristics tailored to performance under varying degrees of chemical attack, thermal stress, or mechanical load.

Segmentation by modification type is equally critical, focusing on intrinsic modifications achieved through copolymerization (e.g., small addition of PPVE resulting in TFE/PPVE copolymers) versus extrinsic modifications involving the inclusion of performance-enhancing fillers such as carbon fibers, glass fibers, bronze, or molybdenum disulfide. Intrinsic modification primarily improves melt flow and reduces cold flow, facilitating complex manufacturing, while extrinsic modification focuses on enhancing mechanical properties like stiffness, wear resistance, and thermal conductivity. Understanding these segments is vital for market participants to tailor their material offerings and distribution strategies effectively, ensuring they target the specific high-value niche applications within automotive powertrain components, aerospace hydraulics, or advanced fluid handling systems.

- By Type of Modification:

- Chemical Modification (e.g., introduction of perfluoroalkyl vinyl ethers to improve processing and reduce cold flow)

- Filler Modification (e.g., compounding with glass fiber, carbon, graphite, bronze, or stainless steel)

- By Form:

- Granular/Molding Powder

- Fine Powder (for paste extrusion)

- Aqueous Dispersion

- Pellets (for melt processing of specific grades)

- By Application/End-Use Industry:

- Electrical and Electronics (Wire and cable insulation, semiconductors, connectors)

- Chemical Processing Industry (CPI) (Pump and valve linings, gaskets, seals, expansion joints)

- Automotive and Transportation (Gaskets, shaft seals, brake systems, fuel system components)

- Aerospace and Defense (Hydraulic seals, lightweight wire insulation, aerospace bearings)

- Medical and Healthcare (Catheters, surgical instruments, pharmaceutical processing liners)

- Industrial and Mechanical (Bearings, sliding plates, hydraulic seals, bellows)

Value Chain Analysis For Modified PTFE Market

The value chain for the Modified PTFE Market begins upstream with the procurement of critical raw materials, principally fluorspar (CaF2), which is processed to yield hydrofluoric acid (HF). This HF is then used to synthesize the essential monomer tetrafluoroethylene (TFE) and the specific comonomers (such as PPVE or HFP) required for modification. This upstream phase is characterized by high capital intensity and concentration among a few large chemical manufacturers, granting suppliers significant bargaining power over the cost of fluorine intermediates. The quality and purity of these raw materials are absolutely critical, especially for Modified PTFE destined for high-purity applications like semiconductor fluid handling, where even minute impurities can compromise performance.

The core manufacturing stage involves the sophisticated process of polymerization and subsequent modification, where TFE and comonomers are reacted under precise conditions, typically via aqueous dispersion or suspension polymerization. Leading manufacturers focus on optimizing particle size distribution, molecular weight, and the precise incorporation of the modifying agent to achieve desired properties like melt-processability and enhanced mechanical integrity. Following polymerization, the polymer is processed into various forms (granular, fine powder, or dispersion) and sometimes compounded with fillers, defining the midstream segment. Distribution channels are highly specialized; direct sales are common for large volume custom orders to major OEMs in the aerospace and chemical sectors, while indirect channels utilizing specialized distributors and agents handle smaller volumes and provide technical support to regional processors.

The downstream segment involves fabrication and end-use application. Fabricators (molders, extruders, and coaters) transform the raw Modified PTFE powders into finished components like seals, liners, cables, and bearings. The expertise required for precision machining and sintering of these high-performance polymers adds significant value. Direct distribution ensures rapid supply and technical collaboration between the producer and the fabricator, especially when complex specifications are involved. End-users, such as automotive OEMs and semiconductor foundries, are the final consumers, their demanding specifications driving innovation and quality standards throughout the entire value chain. The complexity of the material necessitates a highly integrated and quality-controlled value chain from mine to component.

Modified PTFE Market Potential Customers

The primary potential customers and end-users of Modified PTFE are sophisticated industrial entities that require materials offering a unique combination of extreme chemical inertness, high temperature resistance, and superior dielectric strength, where conventional engineering plastics are inadequate. The automotive sector, particularly manufacturers of electric vehicles (EVs) and hybrid vehicles, represents a high-growth customer base. These companies utilize Modified PTFE for high-voltage cable insulation, battery component seals, and lightweight, high-durability seals and gaskets within powertrain and thermal management systems, seeking materials that ensure safety and long-term reliability under fluctuating thermal and chemical conditions specific to EV operation.

Another major segment comprises manufacturers within the chemical processing and petrochemical industries. These customers require robust lining materials, bellows, pump components, and valve seats that can withstand prolonged exposure to highly corrosive acids, bases, and solvents at elevated temperatures and pressures. Modified PTFE offers significantly improved service life and reduced maintenance cycles compared to un-modified fluoropolymers or metal alloys in these environments, making it an economically viable choice despite the higher initial material cost, due to the minimization of system downtime and leak risks. Customers in this sector prioritize chemical resistance, mechanical strength, and minimal permeation characteristics.

Furthermore, semiconductor fabrication equipment manufacturers and high-end electronics producers form a critical customer segment. Semiconductor processes demand ultra-high purity fluid and gas handling components, including tubing, valves, and filter housings, to prevent contamination that could ruin microchip batches. Modified PTFE, due to its low extractables profile and plasma resistance, is the material of choice for these critical wet processing and etching steps. These customers seek materials that meet stringent regulatory and cleanliness standards, ensuring reliability in cleanroom environments, alongside its superior electrical insulation properties necessary for high-frequency telecommunication applications and aerospace wiring harnesses.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.85 Billion |

| Market Forecast in 2033 | USD 2.87 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Daikin Industries Ltd., The Chemours Company, 3M Company, AGC Inc., Guarniflon S.p.A., Saint-Gobain S.A., Shandong Dongyue Group Ltd., Solvay S.A., Zeus Industrial Products, CoorsTek Inc., Chenguang Research Institute of Chemical Industry, HaloPolymer OJSC, Trelleborg AB, Kureha Corporation, DIC Corporation, Fluorocarbon Company Ltd., Gapi Group, Techno-Polymer Co., Ltd., E.I. du Pont de Nemours and Company (Historical relevance), Jiangsu Meilan Chemical Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Modified PTFE Market Key Technology Landscape

The technological landscape of the Modified PTFE market is dominated by advancements in polymerization chemistry and sophisticated compounding techniques designed to optimize performance characteristics. A crucial technology is the utilization of emulsion and suspension polymerization methods coupled with precise control over the introduction of modifying comonomers, such as perfluoropropyl vinyl ether (PPVE) or perfluoro-2,2-dimethyl-1,3-dioxole (PDD). These chemical modifications are essential for disrupting the highly crystalline structure of virgin PTFE, which, in turn, enhances melt-processability, reduces the tendency toward cold flow, and improves weldability, allowing for the creation of components via conventional thermoplastic processing methods like injection molding and extrusion, which are generally impossible for pure PTFE.

Beyond intrinsic chemical modification, the market relies heavily on advanced compounding and filler technology. Key technological progress focuses on ensuring homogeneous dispersion of high-performance fillers—including carbon nanotubes, specialized ceramics, and metallic powders—into the PTFE matrix. The objective of compounding is often to impart specific functional characteristics such as electrical conductivity, increased hardness, or superior wear and abrasion resistance, without significantly compromising the inherent chemical inertness of the fluoropolymer. Developing proprietary surface treatments for fillers to ensure maximum adhesion and uniform distribution within the polymer matrix remains a core competitive technological differentiator for leading manufacturers.

Furthermore, plasma etching and surface functionalization technologies represent a growing area of innovation, particularly for applications requiring the bonding or adhesion of Modified PTFE to other substrates. While PTFE is naturally non-stick, achieving durable adhesion is vital for applications like circuit board substrates or composite linings. New technological advancements are focused on developing environmentally benign processing aids and innovative recycling methods to address sustainability pressures, including advanced pyrolysis and depolymerization techniques aimed at recovering high-purity monomers from end-of-life fluoropolymer products, thereby enhancing the circular economy potential of the material and stabilizing raw material costs in the long term.

Regional Highlights

The regional dynamics of the Modified PTFE Market are heavily skewed toward Asia Pacific (APAC), which currently holds the largest market share and exhibits the fastest growth rate globally. This dominance is attributable to the region's concentration of global manufacturing bases, particularly in the electrical, electronics, and semiconductor industries. Countries like China, South Korea, Taiwan, and Japan are massive producers of microelectronics and consumer electronics, necessitating vast quantities of high-purity Modified PTFE for insulation, internal wiring, and crucial fluid management components in fabrication plants. Government initiatives supporting infrastructure development and the rapid expansion of data centers further bolster the demand in this region.

North America and Europe represent mature markets characterized by high technology adoption and stringent quality standards, driving demand for premium, custom-engineered Modified PTFE grades in high-value sectors such as aerospace, defense, and advanced medical devices. In North America, the significant investment in aerospace programs and the strong presence of major chemical processing and pharmaceutical industries ensure sustained, stable growth. European growth is stimulated by strict environmental and safety regulations (such as REACH), which encourage industries to adopt reliable, long-life, chemically resistant materials for industrial sealing and fluid transfer applications, minimizing leakage and environmental risks.

The Middle East and Africa (MEA) and Latin America (LATAM) markets are showing increasing potential, driven by investments in oil and gas infrastructure and chemical production facilities. While smaller in scale, these regions require Modified PTFE for specialized seals, pipe linings, and corrosion protection components to manage harsh operating environments and corrosive feedstock materials prevalent in the hydrocarbon industry. The growth in MEA is particularly tied to large-scale petrochemical projects and the modernization of energy infrastructure, positioning Modified PTFE as a critical material for enhancing operational safety and extending equipment lifespan in challenging desert and offshore conditions.

- Asia Pacific (APAC): Dominant market share and fastest growth; hub for semiconductor manufacturing, electronics production, and significant automotive sector expansion (especially EVs).

- North America: Strong demand from aerospace (high-specification wire and cable insulation) and established pharmaceutical/chemical processing industries. Focus on compliance with stringent military and medical standards.

- Europe: Stable growth driven by high-value industrial manufacturing, automotive parts (premium vehicles), and adherence to strict environmental and safety regulations (ATEX compliance).

- Latin America (LATAM): Emerging demand fueled by infrastructure projects and growth in local oil and gas processing industries, requiring robust sealing and lining solutions.

- Middle East & Africa (MEA): Growth concentrated in large-scale petrochemical projects and power generation facilities, emphasizing materials with extreme thermal and chemical resistance.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Modified PTFE Market.- Daikin Industries Ltd.

- The Chemours Company

- 3M Company

- AGC Inc.

- Guarniflon S.p.A.

- Saint-Gobain S.A.

- Shandong Dongyue Group Ltd.

- Solvay S.A.

- Zeus Industrial Products

- CoorsTek Inc.

- Chenguang Research Institute of Chemical Industry

- HaloPolymer OJSC

- Trelleborg AB

- Kureha Corporation

- DIC Corporation

- Fluorocarbon Company Ltd.

- Gapi Group

- Techno-Polymer Co., Ltd.

- Shanghai 3F New Materials Co., Ltd.

- Suzhou Ruihua Fluorine Plastic Technology Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Modified PTFE market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Modified PTFE and how does it differ from standard PTFE?

Modified PTFE refers to polytetrafluoroethylene that incorporates small amounts of a comonomer, such as perfluoropropyl vinyl ether (PPVE), during polymerization. This modification significantly improves its mechanical properties, specifically enhancing creep resistance (cold flow) and making it melt-processible (allowing injection molding or extrusion), unlike standard PTFE which typically requires specialized compression molding and sintering.

Which end-use industry drives the highest demand for Modified PTFE?

The Electrical and Electronics industry, particularly the semiconductor sector, is the primary driver of demand. Modified PTFE is crucial for high-frequency electrical insulation, specialized wiring harnesses, and ultra-high purity fluid handling components required in microchip fabrication plants due to its low dielectric constant, chemical inertness, and minimal extractable ions.

What are the main market restraints affecting the growth of Modified PTFE?

The most significant restraints include the high initial cost of the material compared to many conventional engineering plastics, the necessity for specialized processing equipment and expertise for fabrication, and the volatility and potential geopolitical disruption in the supply chain of key raw materials, namely fluorspar and hydrofluoric acid derivatives.

How is the Modified PTFE Market segmented by material form?

The market is primarily segmented into three forms: Granular/Molding Powder, which is used for compression molding seals and bearings; Fine Powder, which is utilized in paste extrusion for thin wall tubes and wire insulation; and Aqueous Dispersions, used for high-performance coatings and linings on various substrates.

What role does filler material play in compounding Modified PTFE?

Filler materials (such as glass fiber, carbon, graphite, or bronze) are compounded with Modified PTFE to enhance specific physical attributes. Fillers increase the material’s stiffness, load-bearing capacity, dimensional stability, and resistance to wear and abrasion, making the composite material suitable for dynamic applications like high-pressure seals and low-friction bearings.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager