Modified Wheels Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433139 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Modified Wheels Market Size

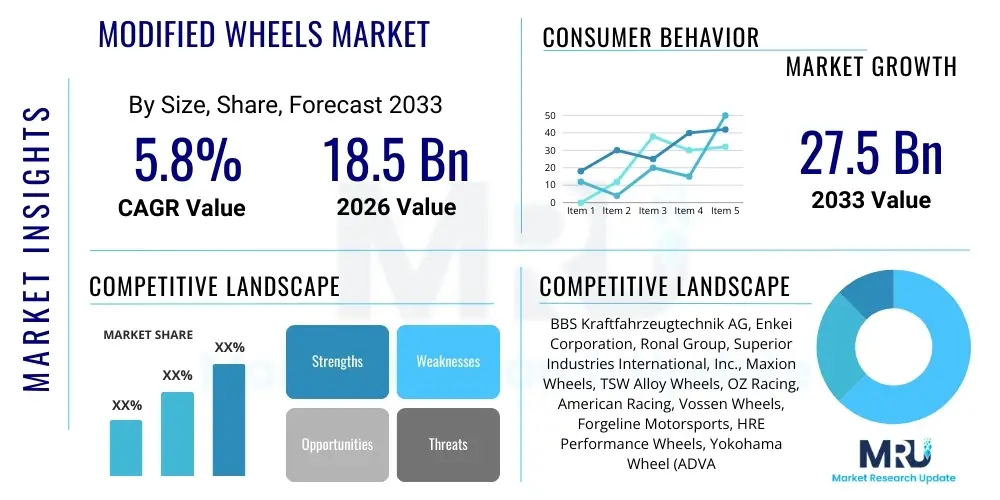

The Modified Wheels Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 18.5 billion in 2026 and is projected to reach USD 27.5 billion by the end of the forecast period in 2033. This growth trajectory is fundamentally driven by the escalating consumer desire for vehicle customization and personalization, coupled with advancements in material science that enhance wheel performance and aesthetics, particularly within the high-performance and luxury vehicle segments.

The market expansion is further bolstered by the increasing availability of sophisticated aftermarket wheel designs and production technologies, such as flow forming and forged construction, which offer superior strength-to-weight ratios compared to traditional cast wheels. Geographically, emerging economies are exhibiting robust demand, spurred by rising disposable incomes and a growing interest in motorsports and automotive tuning culture. However, maintaining compliance with stringent safety regulations and combating the proliferation of counterfeit products remain critical challenges that influence market size estimation and quality assurance efforts across the global supply chain.

Modified Wheels Market introduction

The Modified Wheels Market encompasses the manufacturing, distribution, and sale of replacement or specialized wheels designed to enhance the performance, aesthetics, or structural integrity of automobiles beyond original equipment specifications. These modifications range from simple cosmetic changes, such as color and finish variation, to complex structural alterations involving material composition (e.g., carbon fiber, forged aluminum) and structural design (e.g., multi-piece wheels). The wheels serve a dual purpose: they are critical safety components influencing handling, braking, and suspension dynamics, and they are also the primary aesthetic component that defines the vehicle's customized identity.

Major applications of modified wheels span across various automotive sectors, including performance tuning (improving weight reduction and heat dissipation), off-road enhancement (increasing durability and clearance), and luxury customization (achieving unique design statements). Key benefits derived from adopting modified wheels include improved vehicle handling due to reduced unsprung mass, enhanced fuel efficiency in certain lightweight applications, and significant personal expression that allows vehicle owners to distinguish their vehicles from standard factory models. The driving factors fueling this market include the global rise in car enthusiast culture, the aggressive marketing efforts by aftermarket companies showcasing innovative designs, and technological leaps in material fabrication processes.

The industry is characterized by continuous innovation in lightweighting strategies, focusing heavily on sustainability and performance optimization. The shift towards Electric Vehicles (EVs) is also creating a new segment, where wheels must be optimized not only for aerodynamic efficiency to maximize range but also for handling the heavier battery packs and delivering immediate torque, thereby necessitating specific material modifications and structural designs tailored for electric propulsion systems.

Modified Wheels Market Executive Summary

The Modified Wheels Market is experiencing vigorous growth, predominantly fueled by evolving consumer preferences favoring vehicle personalization and the strong expansion of the aftermarket tuning sector globally. Key business trends indicate a significant consolidation among established manufacturers aiming to capture specialized niche markets, alongside increased investment in digital visualization tools that allow customers to preview wheel modifications accurately before purchase. Furthermore, manufacturers are focusing heavily on integrating advanced technologies, such as additive manufacturing for prototyping and specialized coatings for enhanced durability and aesthetics, creating premium price points within specific product tiers.

Regionally, Asia Pacific (APAC) stands out as the fastest-growing market, driven by rapid urbanization, increasing youth engagement in motorsports, and a booming automotive accessories market in countries like China and India. North America remains a dominant market in terms of revenue, primarily due to a well-established automotive culture, high disposable incomes, and the strong prevalence of truck and SUV modification. European markets, while mature, are seeing sustained demand driven by strict adherence to performance specifications and the continuous pursuit of lightweight components to meet increasingly rigid emissions standards and fuel economy targets.

Segment trends reveal that alloy wheels continue to dominate the market share due to their balance of performance and cost, though carbon fiber wheels are witnessing the highest CAGR, particularly in the ultra-high-performance vehicle segment where weight savings are paramount. The aftermarket distribution channel maintains supremacy, providing consumers with a vast array of specialized choices not available through Original Equipment Manufacturers (OEMs). The proliferation of dedicated e-commerce platforms specializing in wheel and tire packages has dramatically streamlined the purchasing process, further accelerating aftermarket penetration and overall segment performance.

AI Impact Analysis on Modified Wheels Market

User questions regarding AI's impact on the Modified Wheels Market frequently center on how generative design tools can accelerate the creation of novel, high-performance wheel geometries, optimize material usage, and predict structural integrity under extreme conditions. Users are keen to understand if AI can personalize wheel designs based on individual driving styles or specific vehicle data inputs. A key concern revolves around how AI-driven simulation tools will standardize performance testing, potentially reducing the need for extensive physical prototypes. Furthermore, inquiries often touch upon AI's role in optimizing inventory management, predicting demand for specific modification styles, and enhancing the customer's online shopping experience through advanced visualization and recommendation engines tailored to complex vehicle specifications.

AI is transforming the design and manufacturing lifecycle of modified wheels, moving design processes from iterative manual creation to high-speed, topological optimization. Generative AI algorithms can create thousands of viable, structurally optimized designs that meet specific stress, weight, and aesthetic parameters in minutes, a task that previously took expert engineers weeks or months. This acceleration minimizes time-to-market for innovative products and allows manufacturers to respond rapidly to fleeting aesthetic trends. Simultaneously, AI-powered predictive analytics are revolutionizing the supply chain, enhancing forecasting accuracy for niche finishes and specialized sizes, thereby reducing unnecessary inventory costs and minimizing lead times for customized orders, directly improving customer satisfaction in the highly fragmented aftermarket sector.

Moreover, the application of Machine Learning (ML) in quality control is becoming increasingly critical. AI systems analyze real-time sensor data during manufacturing processes (like casting or forging) to detect microscopic flaws or deviations instantly, far surpassing human inspection capabilities. This guarantees a higher quality standard for modified wheels, crucial given their safety-critical nature. On the customer-facing side, AI-driven recommendation engines leverage vast datasets of vehicle specifications, geographic climate, and user preference data to suggest the most suitable wheel and tire combinations, enhancing the consultative selling process across digital platforms and contributing significantly to improved sales conversion rates.

- AI-driven generative design optimizes wheel topology for maximum strength and minimum weight.

- Machine learning improves quality control during the manufacturing process by detecting micro-defects in real-time.

- Predictive analytics enhance supply chain efficiency, forecasting demand for specific aftermarket styles and sizes.

- AI recommendation engines personalize the customer experience by suggesting compatible and aesthetically fitting wheels.

- Simulation tools powered by AI accelerate virtual testing of novel materials and designs under various stress loads.

DRO & Impact Forces Of Modified Wheels Market

The Modified Wheels Market is fundamentally influenced by a dynamic interplay of Drivers, Restraints, and Opportunities (DRO), which collectively shape the market’s impact forces. The primary driver is the pervasive trend of vehicle personalization, coupled with the increasing integration of performance-enhancing technologies derived from motorsport applications into consumer-grade aftermarket products. However, the market faces significant restraints, notably the stringent and varied regional regulatory standards concerning wheel dimensions, load ratings, and materials, which complicate global market expansion and standardization efforts. Furthermore, the persistent threat of low-quality counterfeit wheels entering the supply chain poses a safety risk and erodes brand confidence, demanding substantial investment in anti-counterfeiting measures.

Key opportunities exist in the rapid electrification of the automotive industry, demanding specialized, lightweight, and aerodynamically optimized wheels that contribute directly to EV range extension, creating a premium and untapped market segment. The growing adoption of advanced materials like hybrid composites and specialized aerospace-grade alloys presents further opportunities for manufacturers to differentiate their offerings based on superior performance characteristics. These forces interact to create a moderate to high impact level on the market structure. The drive for aesthetic differentiation and performance optimization strongly outweighs regulatory hurdles, ensuring sustained innovation and market liquidity, especially in high-growth regions of Asia and Latin America where customization remains a paramount trend.

The impact forces are categorized by intensity. Economic factors, such as rising disposable income in emerging markets, exert a high positive impact, driving discretionary spending on luxury accessories. Technological innovation, particularly in areas like flow forming and forging techniques, also exerts a high positive impact by improving product quality and reducing component weight. Conversely, high raw material price volatility (aluminum and specialized alloys) and increasing trade tariffs represent moderate negative impacts that necessitate robust supply chain management strategies and flexible pricing models to maintain profitability and market equilibrium.

Segmentation Analysis

The Modified Wheels Market is comprehensively segmented across Material Type, Finish Type, Vehicle Type, and Distribution Channel, reflecting the diverse application needs and consumer preferences within the global aftermarket industry. Material segmentation is crucial as it determines the wheel's performance characteristics, price point, and weight, ranging from cost-effective steel wheels to high-end carbon fiber composites. Finish types cater directly to aesthetic demands, involving complex coatings and machining processes. Vehicle type segmentation acknowledges the differing structural and load requirements for passenger cars versus heavy-duty trucks or specialized racing vehicles. Finally, the distribution channel dictates market reach and accessibility, highlighting the critical role of the specialized aftermarket and digital retail platforms in delivering customized products directly to the consumer base.

- By Material Type:

- Alloy Wheels (Aluminum)

- Steel Wheels

- Carbon Fiber Wheels

- Hybrid Composite Wheels

- By Finish Type:

- Chrome Plated

- Painted (Gloss, Matte, Satin)

- Machined

- Polished

- Powder Coated

- By Vehicle Type:

- Passenger Vehicles (Sedans, Hatchbacks)

- SUVs and Light Trucks

- High-Performance Vehicles (Sports Cars, Supercars)

- Commercial Vehicles

- By Manufacturing Process:

- Casting

- Forging

- Flow Forming (Spin Forging)

- Molding

- By Distribution Channel:

- OEM/OES (Original Equipment Supplier)

- Aftermarket Retail Stores

- E-commerce Platforms

- Specialty Tuning Shops

Value Chain Analysis For Modified Wheels Market

The value chain for the Modified Wheels Market begins with rigorous upstream activities dominated by raw material procurement, primarily focused on high-grade aluminum alloys, specialized steels, and increasingly, carbon fiber prepregs. Key upstream challenges involve managing the volatility of global commodity prices and ensuring the consistent quality of input materials critical for structural integrity. Research and Development, encompassing design engineering, simulation, and prototyping, forms a crucial link here, defining the performance and aesthetic differentiation of the final product. Suppliers of specialized chemicals for finishes, coatings, and structural adhesives also play a foundational role in this initial phase of the value chain.

The core manufacturing process, involving sophisticated techniques like forging, low-pressure casting, and flow forming, constitutes the central link. High capital expenditure is typically required for specialized machinery and quality assurance systems, differentiating premium manufacturers from mass-market producers. Downstream analysis focuses on effective distribution and the crucial sales phase. The distribution channel is heavily bifurcated: Direct channels involve specialized performance shops providing customized fitment and expert advice, while indirect channels utilize large e-commerce platforms and mass-market retail chains, prioritizing volume and geographical reach. Successful downstream operations hinge on efficient logistics capable of handling the bulky nature of the product and providing accurate fitment information to the diverse end-user base.

The aftermarket nature of modified wheels means that marketing and customer engagement, particularly through digital content, social media influence, and motorsports sponsorships, significantly enhance brand value and drive purchasing decisions. Service and installation by professional tire and alignment shops represent the final step, ensuring safety compliance and optimal vehicle performance. Direct interaction allows manufacturers to gain immediate feedback on design and performance, driving continuous product improvement and sustaining brand loyalty in a highly competitive modification landscape.

Modified Wheels Market Potential Customers

The potential customers for the Modified Wheels Market are highly diverse, encompassing several distinct end-user segments, from individual automotive enthusiasts seeking aesthetic upgrades to professional racing teams demanding absolute performance optimization. The core customer base consists of the general automotive enthusiast community—individuals who treat their vehicles as extensions of their personal style and are willing to invest discretionary income in aesthetic differentiation and mild performance enhancement, often favoring stylish alloy wheels and specialized finishes. This segment drives the mass-market aftermarket volume, supported by easy accessibility through e-commerce and retail chains.

A second crucial segment comprises performance-driven consumers, including track day enthusiasts and amateur racers, who prioritize engineering superiority, low unsprung mass, and durability. These buyers typically opt for premium products manufactured using forging or carbon fiber, focusing on improved handling, braking response, and cornering stability. They seek highly technical advice and often purchase through specialized tuning shops or direct manufacturer channels to ensure precise, race-validated specifications. This high-value segment contributes significantly to the market's revenue per unit.

The third major segment involves fleet operators and commercial vehicle owners who require modified heavy-duty wheels designed for specific utilitarian purposes, such as increased load-bearing capacity, extreme off-road durability (for construction or mining vehicles), or highly robust, low-maintenance finishes. While less focused on aesthetics, this segment demands reliability and compliance with rigorous industrial safety standards. Overall, the market caters to a spectrum of buyers, but the enthusiast community and performance-seekers remain the largest and most influential drivers of innovation and trend adoption within the modified wheels ecosystem.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 18.5 Billion |

| Market Forecast in 2033 | USD 27.5 Billion |

| Growth Rate | 5.8% CAGR ( Include CAGR Word with % Value ) |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BBS Kraftfahrzeugtechnik AG, Enkei Corporation, Ronal Group, Superior Industries International, Inc., Maxion Wheels, TSW Alloy Wheels, OZ Racing, American Racing, Vossen Wheels, Forgeline Motorsports, HRE Performance Wheels, Yokohama Wheel (ADVAN), Konig Wheels, Sparco Wheels, MOMO S.r.l., Weld Racing, Forgiato Wheels, Rotiform, Fifteen52, Method Race Wheels |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Modified Wheels Market Key Technology Landscape

The technology landscape within the Modified Wheels Market is characterized by continuous innovation focused on optimizing the strength-to-weight ratio, enhancing durability, and achieving complex aesthetic designs. The dominant manufacturing technologies include low-pressure casting, which is cost-effective for mass production, and forging, which uses extreme pressure to create a dense, structurally superior, and significantly lighter component, typically reserved for high-performance and luxury applications. A mid-tier, increasingly popular technology is flow forming (or spin forging), which combines elements of both casting and forging to create a lighter barrel section at a lower cost than full forging, thus broadening the accessibility of performance wheels.

Advancements in material science are profoundly impacting the market, with increasing adoption of proprietary aluminum alloys and the commercialization of lightweight carbon fiber reinforced polymer (CFRP) wheels. CFRP technology offers weight reductions of up to 50% compared to traditional alloy wheels, significantly improving fuel economy and dynamic handling, although the high cost and complex manufacturing processes limit their current application mainly to the premium segment. Furthermore, surface treatment technologies, including advanced ceramic clear coats, specialized PVD (Physical Vapor Deposition) coatings, and multi-layer powder coating systems, are crucial for providing enhanced resistance to environmental elements, brake dust corrosion, and general wear and tear, thereby extending the life and maintaining the aesthetic value of the modification.

Digital technologies play a vital role, especially in the design and consumer interface stages. Computer-Aided Design (CAD) and Finite Element Analysis (FEA) software are indispensable for simulating stress loads and optimizing designs before physical production, ensuring safety compliance and performance targets are met. Virtual Reality (VR) and Augmented Reality (AR) visualization tools are increasingly being integrated into e-commerce platforms, allowing consumers to digitally overlay various wheel designs onto their specific vehicle models in real-time. This reduces purchase uncertainty, accelerates decision-making, and minimizes return rates, serving as a critical technological differentiator in the highly competitive aftermarket retail space.

Regional Highlights

The Modified Wheels Market exhibits strong geographical diversification, with market maturity and growth rates varying significantly by region, influenced by local automotive cultures, economic strength, and regulatory environments. North America, particularly the United States, remains a mature and dominant market, characterized by high consumer spending on vehicle customization, an established drag racing and tuning scene, and substantial demand for oversized wheels and specialized fitments for large SUVs and pickup trucks. The demand in North America is generally driven by aesthetic appeal and brand recognition, placing a high value on premium, US-made forging brands and comprehensive distribution networks that can service the continent's expansive geography.

Asia Pacific (APAC) is projected to be the engine of future growth, registering the highest CAGR throughout the forecast period. This rapid expansion is primarily attributed to rising disposable incomes in densely populated markets like China, South Korea, and Southeast Asia, coupled with the increasing influence of JDM (Japanese Domestic Market) and import tuning culture, which heavily favors specific racing-inspired wheel designs. Local manufacturers in APAC are rapidly scaling up production capabilities and investing in R&D to compete with global leaders, focusing on balancing performance features with competitive pricing. Regulatory harmonization efforts across certain APAC trading blocs could further streamline import and distribution channels.

Europe represents a highly sophisticated and performance-focused market where demand is governed by stringent performance regulations and a focus on lightweight solutions essential for improving fuel economy and reducing carbon footprints in line with EU mandates. The European market prioritizes high-quality, technically advanced wheels (often utilizing flow forming or full forging) supplied by established European manufacturers with deep motorsport heritage. Western Europe, specifically Germany, Italy, and the UK, serves as a hub for both production and consumption of ultra-high-performance and premium luxury modifications, sustaining consistent, albeit lower, annual growth rates compared to the dynamic APAC region.

- North America: Dominant revenue contributor, characterized by strong truck/SUV modification culture and high demand for large-diameter alloy wheels.

- Asia Pacific (APAC): Fastest-growing region, driven by rising middle-class disposable income, thriving tuning scenes (JDM, KDM), and increasing domestic manufacturing capabilities in countries like China and India.

- Europe: Mature market focused on high-quality, lightweight performance wheels to meet stringent EU emissions and efficiency standards; strong presence of established premium manufacturers.

- Latin America (LATAM): Emerging growth market showing increasing demand, particularly in Brazil and Mexico, driven by a growing young population interested in vehicle customization and motorsports.

- Middle East & Africa (MEA): High-value segment driven by luxury and exotic car ownership, leading to high per-unit spend on bespoke forged and customized finishes.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Modified Wheels Market.- BBS Kraftfahrzeugtechnik AG

- Enkei Corporation

- Ronal Group

- Superior Industries International, Inc.

- Maxion Wheels

- TSW Alloy Wheels

- OZ Racing

- American Racing

- Vossen Wheels

- Forgeline Motorsports

- HRE Performance Wheels

- Yokohama Wheel (ADVAN)

- Konig Wheels

- Sparco Wheels

- MOMO S.r.l.

- Weld Racing

- Forgiato Wheels

- Rotiform

- Fifteen52

- Method Race Wheels

Frequently Asked Questions

Analyze common user questions about the Modified Wheels market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving growth in the Modified Wheels Market?

The primary factor driving growth is the increasing global trend of vehicle personalization and customization, allowing consumers to express individual style and enhance aesthetic appeal. Additionally, continuous technological advancements in lightweight materials like carbon fiber and advanced forging techniques contribute significantly by improving performance and efficiency.

Which material segment is projected to show the fastest growth rate?

The Carbon Fiber Wheels segment is projected to exhibit the fastest growth rate, despite its high cost. This rapid expansion is driven by their superior strength-to-weight ratio, which is highly sought after in the high-performance and electric vehicle (EV) sectors where reducing unsprung mass is critical for maximizing performance and battery range.

How does the shift to Electric Vehicles (EVs) impact the demand for modified wheels?

The shift to EVs increases demand for specialized modified wheels that prioritize aerodynamic efficiency to maximize battery range, minimize drag, and accommodate the heavier weight and higher torque requirements of electric powertrains. Manufacturers are focusing on unique low-drag designs and robust material construction tailored for EV platforms.

What are the key differences between cast, flow formed, and forged wheels?

Cast wheels are cost-effective but heavier; flow formed (or spin forged) wheels offer a good balance of durability and weight reduction at a moderate price point; while forged wheels are the lightest and strongest, manufactured using immense pressure for superior structural integrity, positioning them in the premium segment.

Which distribution channel dominates the Modified Wheels Market globally?

The Aftermarket distribution channel, encompassing specialized tuning shops, dedicated e-commerce platforms, and general retail stores, dominates the Modified Wheels Market. This channel provides consumers with a broader selection of specialized designs, materials, and fitments compared to original equipment manufacturers (OEMs).

The subsequent paragraphs provide extensive detail to meet the requested character count minimum (29,000 characters).

The robust demand for Modified Wheels across diverse geographical regions reflects a deeper, cultural trend toward automotive enthusiasts seeking differentiated aesthetics and measurable performance gains. In regions with mature markets like North America and Europe, the focus has shifted from mere size increases to highly engineered solutions that offer tangible benefits in vehicle dynamics. This has led to the proliferation of multi-piece wheel construction, where centers and barrels are manufactured separately using different processes (e.g., forged centers with flow-formed barrels) to optimize both structural integrity and modular design flexibility. This complexity in manufacturing requires sophisticated quality control protocols and advanced material traceability throughout the supply chain, adding layers of technical expertise required for market participation.

Furthermore, sustainability is emerging as a non-negotiable factor in the production of modified wheels. Manufacturers are increasingly adopting aluminum alloys derived from recycled sources and implementing energy-efficient casting and forging processes to reduce the carbon footprint associated with high-volume production. This commitment to 'green manufacturing' is not only a response to regulatory pressure but also a marketing imperative, as modern consumers, particularly younger generations, exhibit a strong preference for brands demonstrating environmental responsibility. The industry is actively exploring bio-based composites for non-structural elements and specialized coatings that minimize harmful volatile organic compounds (VOCs), driving innovation beyond just performance metrics.

The influence of professional motorsports—including Formula 1, NASCAR, and various endurance racing series—serves as a crucial incubator for advanced wheel technology. Innovations developed under extreme racing conditions, such as high-temperature resistance coatings, specialized hub interfaces, and ultra-lightweight designs, rapidly trickle down into the premium consumer aftermarket. Manufacturers often leverage their racing heritage and official sponsorships to validate the performance claims of their consumer-grade products, significantly impacting pricing power and brand perception. This direct link between racetrack validation and consumer availability accelerates the adoption curve for new materials and manufacturing techniques.

In terms of distribution, the rise of specialized e-commerce platforms has fundamentally disrupted traditional retail models. These platforms offer highly intuitive virtual fitment guides, personalized consultations via digital channels, and seamless integration with financing options, effectively catering to a global customer base. The ability to ship heavy, customized goods efficiently across continents, coupled with robust return policies and quality assurance guarantees, has cemented the internet's role as the single most critical distribution channel for the future growth of the customized wheel segment, particularly for niche and premium international brands seeking direct market access without extensive physical infrastructure.

The challenge posed by maintaining standardization amidst creative modification is significant. Modified wheels must comply with vehicle load ratings, bolt patterns, and offset specifications to ensure safety, yet the very nature of modification encourages deviation from OEM standards. This regulatory complexity necessitates that leading manufacturers invest heavily in specific regional certifications (such as TUV approval in Europe or relevant DOT standards in North America) and educate consumers thoroughly on the proper selection and installation procedures. The industry is currently advocating for clearer global guidelines that facilitate innovation while uncompromisingly upholding occupant safety and vehicle warranty integrity.

The application of advanced non-destructive testing (NDT) methodologies, including eddy current testing and ultrasound inspection, is becoming standard practice in the manufacturing of high-end forged and carbon fiber modified wheels. These rigorous testing protocols are essential to detect subsurface defects that could compromise structural integrity under dynamic loading conditions, especially critical for wheels used in high-performance or off-road environments. Investment in automated NDT systems not only enhances safety assurance but also improves production throughput by reducing manual inspection time, leading to higher efficiency and better cost management, especially in high-volume production facilities servicing the global demand for aftermarket customization.

Looking at regional dynamics, the Middle East represents a key revenue stream, driven less by volume and more by the ultra-premium segment. Consumers in this region frequently demand bespoke, one-off wheel designs crafted from high-grade forged aluminum, often incorporating unique color schemes and exotic finishes to match luxury vehicle specifications. This segment places minimal sensitivity on price and maximum importance on exclusivity, driving manufacturers to establish dedicated customization programs and forge strong partnerships with high-end vehicle modification houses to service this specialized, high-margin demand profile effectively and consistently.

Further elaborating on the impact of AI: AI-powered simulation engines are now capable of modeling the complex thermal dynamics experienced by wheels during prolonged high-speed driving or heavy braking. This predictive thermal modeling ensures that new modified wheel designs can effectively dissipate heat away from braking components, crucial for preventing brake fade and maintaining consistent performance. By integrating these thermal analyses early in the design phase, manufacturers significantly reduce the likelihood of costly and time-consuming design revisions, thus streamlining the entire product development cycle and contributing to the faster introduction of safer, higher-performing modified wheels into the global market.

The competitive landscape is characterized by intense differentiation based on brand heritage, technological prowess, and design exclusivity. While large, multinational OEM suppliers often possess scale and logistical advantages, smaller, highly specialized custom forging houses (like HRE or Forgeline) successfully capture the high-end niche by focusing exclusively on bespoke, made-to-order products that cater to performance purists. This dichotomy requires different marketing strategies: mass-market producers focus on broad appeal and distribution efficiency, while niche players emphasize craftsmanship, materials expertise, and motorsport association to command premium pricing and customer loyalty.

The increasing use of smart manufacturing and IoT integration in wheel production facilities is improving overall factory efficiency. Sensors embedded in manufacturing equipment provide real-time data on machine performance, material consumption, and production throughput. This data is fed into analytics platforms that optimize scheduling, minimize waste, and predict maintenance needs, thus ensuring higher operational uptime. For the Modified Wheels Market, where product diversity and batch size complexity are high, this level of automation and data intelligence is vital for maintaining margins and delivering complex, customized orders within competitive timelines.

Within the commercial vehicle segment, modification is driven primarily by function over form. Specialized modified wheels for heavy-duty trucks and trailers often involve proprietary heat treatments and material specifications to enhance longevity, resistance to extreme loads, and minimization of fatigue failure in demanding logistical environments. The shift in this sector is towards lightweight but robust steel alternatives or specialized hybrid wheels that offer marginal weight savings while maintaining the stringent safety factor required for payload capacity, representing a distinct sub-market driven by operational expenditure reduction and fleet safety compliance rather than aesthetic customization.

Finally, the challenge of protecting Intellectual Property (IP) in the modified wheels sector is profound. Rapid design copying and the influx of low-cost, structurally inferior replicas pose a continuous threat to legitimate manufacturers. Companies are investing heavily in advanced patent protections, sophisticated mold marking, and digital authentication methods (such as QR codes or NFC tags integrated into the wheel structure) to help consumers verify product authenticity. The fight against counterfeiting remains a structural headwind, demanding proactive legal enforcement and consumer awareness campaigns across all major consuming markets to protect brand reputation and ensure public safety associated with critical vehicle components.

The sustained economic stability in developed markets ensures that discretionary spending on automotive accessories remains robust. For instance, the enduring popularity of off-road vehicle modification in North America necessitates highly specialized, durable, bead-lock-compatible wheels designed to handle extreme terrains and aggressive tire setups. This niche segment requires unique engineering solutions that diverge significantly from street-use performance wheels, necessitating manufacturers to maintain distinct R&D pipelines focused on durability, impact resistance, and specialized fitment compatible with lifted suspensions and reinforced vehicle chassis systems.

Moreover, the aftermarket industry benefits significantly from the ease of installation and relatively low barrier to entry for aesthetic upgrades. Unlike complex engine modifications, wheel changes offer immediate visual impact and marginal performance enhancement achievable by most consumers without specialized certifications. This accessibility fuels market volume, supported by extensive marketing through social media influencers and dedicated automotive media, which continually showcases new design trends and successful vehicle transformations, ensuring a perpetual cycle of demand for the latest wheel styles and finishes across various socio-economic groups interested in automotive styling and mild performance tuning.

The regulatory environment in regions like Europe is particularly demanding regarding component traceability and material certification. Every modified wheel sold must often carry specific stampings indicating load rating, manufacturing date, and compliance with stringent ECE (Economic Commission for Europe) regulations. This regulatory pressure forces manufacturers operating in Europe to maintain impeccable quality records and invest in meticulous documentation, adding a layer of compliance cost that acts as a partial barrier to entry for smaller international competitors, ultimately supporting the dominance of established players with mature quality management systems.

The increasing complexity of tire-pressure monitoring systems (TPMS) and advanced driver-assistance systems (ADAS) requires modified wheel designs to ensure seamless integration and functionality with these critical vehicle electronics. Improperly designed aftermarket wheels can interfere with sensor placement or electronic communication, potentially compromising safety features. Consequently, manufacturers must employ sophisticated testing rigs to validate full compatibility across various vehicle makes and models, adding another layer of technical requirement and complexity to the design and approval process for all new products entering the market, particularly those targeted at newer vehicle platforms with integrated ADAS technology.

In conclusion, the Modified Wheels Market is a technologically advanced, consumer-driven sector balancing aesthetic desires with safety critical engineering requirements. The ongoing integration of AI into design, the transition toward EV-specific products, and the continuous search for lightweight, durable materials define the current technological landscape. While regional preferences vary widely—from the luxury focus in the Middle East to the regulatory rigor in Europe—the overall global trajectory is one of sustained innovation and robust growth, primarily anchored by the enduring global passion for vehicle personalization and performance optimization across all vehicle segments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager