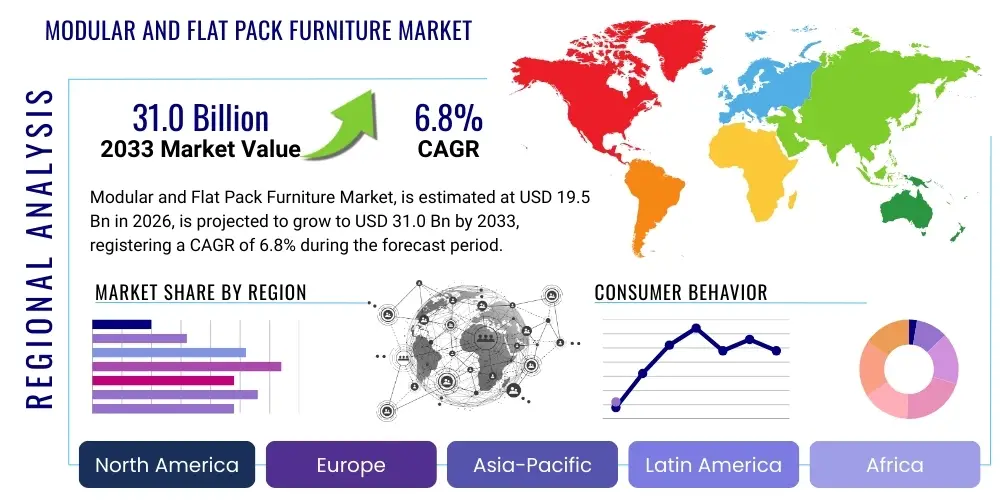

Modular and Flat Pack Furniture Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436821 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Modular and Flat Pack Furniture Market Size

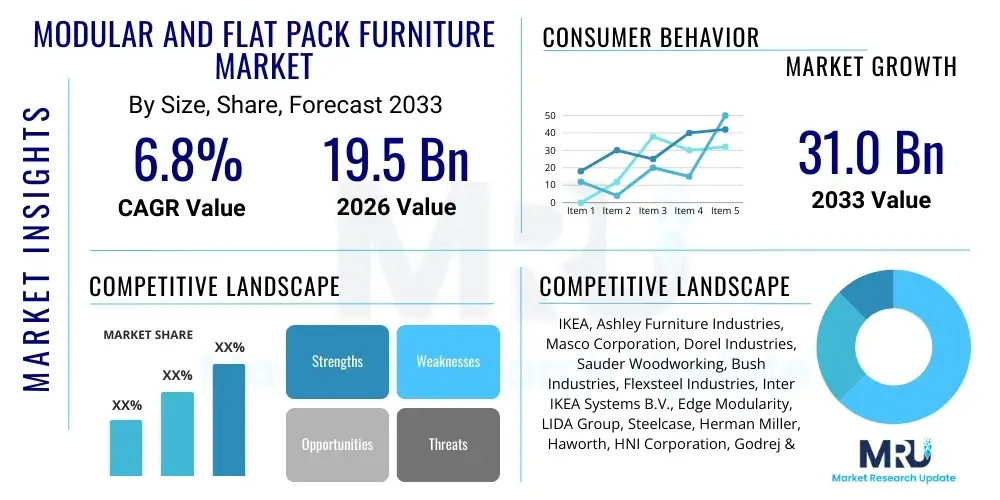

The Modular and Flat Pack Furniture Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 19.5 billion in 2026 and is projected to reach USD 31.0 billion by the end of the forecast period in 2033.

Modular and Flat Pack Furniture Market introduction

The Modular and Flat Pack Furniture Market encompasses prefabricated furnishing solutions designed for easy assembly by the end-user, characterized by their cost-effectiveness, portability, and space-saving attributes. This market segment has gained significant traction due to increasing urbanization, the proliferation of smaller living spaces, and heightened consumer demand for flexible and customizable interior solutions. Modular furniture, unlike traditional fixed furniture, allows users to reconfigure and adapt components based on changing functional or aesthetic requirements, driving its appeal among millennials and urban dwellers globally. The concept of flat pack design optimizes logistics, reducing shipping volume and costs, which is a critical efficiency driver for large-scale retailers and e-commerce platforms.

Major applications for flat pack and modular furniture span both residential and commercial sectors. In residential settings, key applications include bedroom sets, kitchen cabinetry, living room storage, and home office solutions, where versatility and ease of installation are paramount. Commercially, this furniture is widely adopted in co-working spaces, temporary offices, student housing, and hospitality units due to its durability, scalability, and ability to be quickly deployed or relocated. The affordability factor, coupled with continuous innovation in material science—such as lighter composite woods and sustainable plastics—further broadens the market's penetration across various socio-economic groups, particularly in fast-growing developing economies.

Key benefits driving market growth include enhanced convenience, affordability, and the environmental advantage of reduced packaging waste associated with optimized transport. The primary driving factors are the rise of e-commerce, which perfectly complements the flat pack distribution model, and the demographic shift toward smaller, multi-functional homes where every square foot must be utilized efficiently. Furthermore, advancements in digital assembly instructions, including augmented reality (AR) guides, are mitigating the historical restraint related to perceived difficulty in self-assembly, thereby improving the overall consumer experience and market acceptance.

Modular and Flat Pack Furniture Market Executive Summary

The Modular and Flat Pack Furniture Market is experiencing robust growth driven by converging business trends, favorable regional dynamics, and strong segment performance in online retail and residential applications. Business trends are strongly characterized by the integration of sustainability practices, where manufacturers increasingly use recycled or certified materials (FSC-certified wood) to meet conscious consumer demands. Furthermore, technological adoption, specifically in supply chain management and customer interaction (e.g., virtual reality visualization tools), is defining competitive strategies. Strategic mergers, acquisitions, and collaborations between traditional furniture makers and specialized logistics providers are common strategies aimed at optimizing last-mile delivery and reducing turnaround times, thus reinforcing the market’s inherent logistical advantages.

Regional trends indicate that Asia Pacific (APAC) is emerging as the fastest-growing market, primarily fueled by rapid urbanization, massive infrastructural development, and the expansion of the middle-class population in countries like China and India. North America and Europe, while mature, maintain substantial market shares due to high consumer spending power and the established presence of global retail giants specializing in flat pack goods. These developed regions are focused on premiumization within the modular category, emphasizing smart furniture integration and high-design aesthetics, which allows companies to maintain high Average Selling Prices (ASPs) despite inflationary pressures.

Segment trends highlight the dominance of the residential application segment, though the commercial sector shows accelerated growth driven by flexible office solutions (Activity-Based Working models). Within distribution channels, online retail is outpacing traditional offline stores, capitalizing on the convenience of direct-to-consumer delivery for bulky items. Product-wise, storage units and modular kitchen systems remain the highest revenue generators, reflecting the consumer need for maximizing utility in compact living environments. The continuous development of durable, easy-to-clean, and aesthetically pleasing surface materials is ensuring the sustained relevance and growth across all key segments.

AI Impact Analysis on Modular and Flat Pack Furniture Market

User queries regarding the impact of AI on the Modular and Flat Pack Furniture Market predominantly revolve around how artificial intelligence can simplify customization, enhance the shopping experience, and optimize the supply chain. Consumers frequently ask about personalized furniture recommendations based on their living space dimensions and style preferences, often querying the reliability of AI tools for visualizing assembled products in their homes. Manufacturers are keen on understanding AI's role in predictive maintenance for machinery, automated quality control of precision-cut components, and demand forecasting to manage inventories of thousands of distinct flat pack parts efficiently. The core concerns center on whether AI can truly democratize high-end customization without inflating costs and how machine learning algorithms can streamline complex logistics involving multi-component shipments.

AI is transforming the modular furniture space by enabling mass customization at scale, a traditionally costly endeavor. Using generative design algorithms, AI can take user input regarding room dimensions, budget, and functional needs, and instantly generate optimized furniture configurations that fit perfectly, greatly reducing the design cycle time. Furthermore, AI-powered chatbots and virtual assistants are improving customer service by handling routine queries related to assembly instructions, missing parts, and product compatibility, ensuring a faster and more satisfying resolution process. This adoption significantly mitigates customer frustration often associated with self-assembly products, thereby boosting brand loyalty and reducing returns.

In manufacturing and logistics, AI algorithms optimize cutting patterns to minimize material waste (an essential sustainability goal) and enhance machine learning models to predict potential disruptions in the global supply chain, which is critical for components sourced internationally. Moreover, sophisticated inventory management systems use AI to determine optimal stock levels for individual components based on real-time sales data and seasonal demand fluctuations, preventing both stockouts and overstocking. This high degree of operational efficiency afforded by AI is instrumental in maintaining the cost-competitive advantage that flat pack furniture offers to the consumer market.

- AI-driven mass customization and parametric design, allowing personalized configurations.

- Enhanced inventory forecasting and supply chain optimization for multi-component kits.

- Augmented Reality (AR) visualizations, often powered by AI, for in-situ product preview.

- Automated quality control and defect detection during the component cutting and packaging stages.

- Improved customer support via AI chatbots for assembly and troubleshooting guidance.

- Optimization of cutting plans to reduce material waste (Green AI in manufacturing).

DRO & Impact Forces Of Modular and Flat Pack Furniture Market

The Modular and Flat Pack Furniture Market is powerfully influenced by inherent drivers such as accelerating urbanization and the global housing crisis, which necessitates space-saving and affordable furnishing solutions. Restraints include prevailing consumer perceptions regarding the longevity and quality of flat pack materials, coupled with increasing raw material price volatility (especially wood pulp and metal components). Opportunities are abundant in the integration of smart home technologies and the expansion into underserved emerging markets where the demand for modern, scalable furniture is rising exponentially. These forces collectively shape the market landscape, dictating strategic investment decisions regarding production capacity, distribution network expansion, and R&D efforts aimed at sustainable material substitution.

Key drivers include the growth of e-commerce, which provides an ideal platform for the standardized shipping and direct sale of disassembled items, bypassing high retail overheads. The demographic shift towards younger generations who frequently move and prioritize flexible living arrangements also strongly favors modular designs. However, the market faces significant restraints, including the complex intellectual property environment surrounding unique assembly mechanisms and the operational challenge of ensuring perfect component compatibility across millions of units globally. Furthermore, the reliance on detailed, easily understandable assembly instructions represents an ongoing operational hurdle that impacts user satisfaction.

The primary impact forces—market entry barriers, bargaining power of buyers and suppliers, threat of substitutes, and competitive rivalry—are moderately high. Competitive rivalry is intense due to the low differentiation potential of basic flat pack designs, forcing companies to compete aggressively on price, logistics efficiency, and service quality. The threat of substitutes, largely traditional custom-built furniture, is mitigated by the significant price difference and logistics convenience offered by modular alternatives. Ultimately, the market benefits from the opportunity to innovate through materials and digital services (e.g., AR assembly) to overcome the traditional quality perception restraint, ensuring sustained market expansion.

Segmentation Analysis

The Modular and Flat Pack Furniture Market is comprehensively segmented based on material composition, the specific products offered, the primary distribution channels utilized, and the application area. This detailed segmentation allows stakeholders to accurately target marketing strategies and resource allocation. The market’s segmentation reflects the diversity of consumer needs, ranging from budget-conscious shoppers utilizing plastic and metal flat pack options to premium buyers investing in high-end modular wooden systems for commercial fit-outs. Understanding these distinct segments is crucial for identifying white spaces in the market and forecasting demand trends based on material preferences and sectoral growth rates.

- Material:

- Wood (Plywood, MDF, Particleboard, Solid Wood)

- Plastic (Polypropylene, High-Density Polyethylene)

- Metal (Aluminum, Steel)

- Glass and Composites

- Product:

- Tables (Dining, Coffee, Side)

- Chairs and Seating (Office Chairs, Dining Chairs, Sofas)

- Cabinets and Shelving (Kitchen Cabinets, Wardrobes)

- Beds and Bedding Accessories

- Storage Units and Racks

- Distribution Channel:

- Offline Stores (Specialty Stores, Departmental Stores, Hypermarkets)

- Online Retail (E-commerce Portals, Direct Company Websites)

- Application:

- Residential

- Commercial (Offices, Hospitality, Education, Healthcare)

Value Chain Analysis For Modular and Flat Pack Furniture Market

The value chain for modular and flat pack furniture is optimized for efficiency and cost reduction, starting with upstream activities focused on raw material procurement, primarily wood derivatives, metal, and plastic resins. Upstream analysis involves managing supply volatility and ensuring sustainable sourcing (e.g., FSC certification), which directly impacts production costs and market perception. Key upstream challenges include negotiating favorable contracts with large raw material suppliers and implementing precise quality control standards for sheet goods, which are critical for the accuracy required in flat pack design. The transition towards sustainable and recyclable materials is a major strategic priority in this phase.

The central phase involves design, manufacturing, and packaging. Design involves advanced CAD/CAM software to ensure modularity and ease of assembly. Manufacturing focuses on high-precision cutting, edge-banding, drilling, and quality inspection, requiring significant automation to achieve scale. Packaging is uniquely important in this value chain; highly specialized packaging engineering ensures minimal void space and maximum protection during transit, contributing heavily to the "flat pack" efficiency. This phase often involves Just-in-Time (JIT) production methodologies to manage the complexity of numerous component Stock Keeping Units (SKUs).

Downstream activities center around distribution and sales. Distribution channels are bifurcated into direct (company-owned stores, e-commerce) and indirect (third-party retailers and marketplaces). The shift to online retail necessitates robust logistics for handling heavy, bulky, yet fragile components, relying on specialized third-party logistics (3PL) providers capable of last-mile delivery. Direct sales through proprietary e-commerce platforms offer higher margin control and direct customer feedback, crucial for continuous product iteration. Post-sale services, including dedicated assembly hotlines and spare parts replacement, complete the value chain, ensuring high customer satisfaction and repeat purchases.

Modular and Flat Pack Furniture Market Potential Customers

The primary customer base for modular and flat pack furniture comprises urban residents, young professionals, and millennials who frequently relocate or occupy smaller apartments where space optimization is essential. These buyers prioritize function, affordability, and modern aesthetics, often preferring the flexibility to disassemble and reassemble furniture during moves. The residential segment is further segmented into first-time homeowners seeking cost-effective furnishing solutions and students requiring temporary, functional furniture for dormitories and rented accommodations. This group is highly digitally engaged and heavily relies on online visualization and review platforms before making purchasing decisions.

The second major cohort consists of commercial entities, particularly businesses involved in the rapidly growing flexible workspace market, including co-working operators and temporary office setup providers. These buyers value scalability, durability, and the ability to quickly reconfigure office layouts to adapt to changing organizational needs and tenant requirements. Educational institutions and healthcare facilities also represent significant end-users, requiring standardized, hygienic, and long-lasting furniture that can be installed quickly and withstand high usage, such as modular laboratory benches or student housing furniture.

A burgeoning niche customer segment includes eco-conscious consumers who are attracted to the sustainable sourcing and reduced carbon footprint associated with optimized logistics and minimized packaging inherent in flat pack designs. Furthermore, DIY enthusiasts are natural buyers, appreciating the control and personal involvement offered by self-assembly kits. Targeting these diverse customer segments requires differentiated marketing strategies, utilizing digital channels for the younger demographic and focused B2B sales teams for commercial and institutional buyers, highlighting total cost of ownership (TCO) and rapid deployment capabilities.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 19.5 Billion |

| Market Forecast in 2033 | USD 31.0 Billion |

| Growth Rate | CAGR 6.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | IKEA, Ashley Furniture Industries, Masco Corporation, Dorel Industries, Sauder Woodworking, Bush Industries, Flexsteel Industries, Inter IKEA Systems B.V., Edge Modularity, LIDA Group, Steelcase, Herman Miller, Haworth, HNI Corporation, Godrej & Boyce Mfg. Co. Ltd., USM Modular Furniture, Kartell, Thonet, Roche Bobois, Hooker Furniture Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Modular and Flat Pack Furniture Market Key Technology Landscape

The technological landscape of the Modular and Flat Pack Furniture Market is defined by innovations aimed at enhancing the design process, improving manufacturing precision, and revolutionizing the customer assembly experience. Key technologies include advanced Computer-Aided Design (CAD) software and Building Information Modeling (BIM) tools, which allow designers to model complex modular systems and ensure precise component fit across large product catalogs. Automation in the factory, involving CNC (Computer Numerical Control) machinery for high-precision cutting and robotic arms for assembly line tasks and packaging, is crucial for maintaining the low-cost structure and consistent quality expected by the market.

Furthermore, consumer-facing technologies are significantly impacting market acceptance. Augmented Reality (AR) applications allow customers to virtually place furniture items in their homes before purchase, dramatically reducing uncertainty and return rates. Similarly, virtual reality (VR) tools are utilized in commercial sales to design and visualize entire office floor plans using modular systems. On the backend, advancements in Enterprise Resource Planning (ERP) systems and sophisticated Warehouse Management Systems (WMS) are essential for tracking the hundreds or thousands of individual components required for just-in-time flat pack production and global distribution.

Material science innovation also plays a central role. Technologies related to lightweight, high-strength composite materials, formaldehyde-free engineered wood products, and durable, scratch-resistant surface laminates are constantly being developed to address consumer concerns regarding longevity and environmental impact. The integration of "smart" technology—such as built-in wireless charging, integrated lighting systems, and adjustable components powered by micro-motors—is creating a premium sub-segment within the modular furniture market, attracting tech-savvy consumers willing to pay for added functionality and convenience.

Regional Highlights

- Asia Pacific (APAC) Market Dominance and Growth: The APAC region is anticipated to demonstrate the highest growth rate, driven by exponential urban population growth and massive infrastructure spending on residential and commercial developments, particularly in China, India, and Southeast Asian countries. The rising middle class in these nations possesses increasing disposable income and an affinity for modern, space-saving designs. Local manufacturers are rapidly scaling production capacity, often leveraging lower labor costs, although competition from international giants like IKEA and local e-commerce platforms is intense. The preference for culturally relevant, multi-functional furniture tailored to high-density living situations strongly supports the modular concept.

- North America's Maturity and E-commerce Integration: North America maintains a substantial market share, characterized by high consumer awareness, large e-commerce penetration, and robust demand for home office and storage solutions. The market here is driven by convenience, with consumers willing to pay a premium for expedited delivery and specialized assembly services. Sustainable sourcing and high-quality materials are key differentiators, as North American consumers often associate flat pack with temporary solutions, prompting manufacturers to invest in durable, aesthetically appealing designs to counter this perception.

- Europe's Sustainability Focus and Design Prowess: Europe, particularly Western and Nordic countries, represents a highly mature market where flat pack furniture originated and reached critical success. Key drivers include environmental legislation promoting sustainable material use and a strong design culture favoring minimalist and functional aesthetics. European demand is increasingly focused on smart modular systems and products made from certified recycled or locally sourced materials. Germany, France, and the UK are primary revenue contributors, driven by renovation activities and the replacement cycle of older furniture.

- Latin America (LATAM) and MEA Opportunities: LATAM and MEA present significant untapped opportunities. In LATAM, economic stabilization and increasing investment in housing projects are boosting demand for affordable furniture solutions, making flat pack systems highly relevant. In the Middle East and Africa, the market is primarily concentrated in urban centers (e.g., UAE, South Africa). The hospitality and commercial real estate sectors are major buyers, seeking quickly deployable, high-volume furniture for new developments. Challenges in these regions include complex logistics and fragmented retail distribution networks, which companies are addressing through regional partnerships.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Modular and Flat Pack Furniture Market.- IKEA

- Ashley Furniture Industries

- Masco Corporation

- Dorel Industries

- Sauder Woodworking

- Bush Industries

- Flexsteel Industries

- Inter IKEA Systems B.V.

- Edge Modularity

- LIDA Group

- Steelcase

- Herman Miller

- Haworth

- HNI Corporation

- Godrej & Boyce Mfg. Co. Ltd.

- USM Modular Furniture

- Kartell

- Thonet

- Roche Bobois

- Hooker Furniture Corporation

Frequently Asked Questions

Analyze common user questions about the Modular and Flat Pack Furniture market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the Modular and Flat Pack Furniture Market?

The Modular and Flat Pack Furniture Market is projected to exhibit a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033, driven primarily by increasing global urbanization and e-commerce penetration.

Which geographical region holds the highest potential for market expansion?

The Asia Pacific (APAC) region is expected to demonstrate the highest growth rate due to rapid infrastructure development, population density, and rising disposable incomes favoring affordable, space-saving furniture solutions in countries like China and India.

How is technology, specifically AI, influencing modular furniture?

AI is significantly influencing the market by enabling advanced mass customization tools for consumers, optimizing complex component inventory management in the supply chain, and providing AR visualization for easier purchasing decisions.

What are the primary restraints affecting the growth of this market?

Key restraints include consumer concerns regarding the perceived durability and longevity of flat pack materials compared to traditional furniture, alongside persistent challenges related to raw material price volatility, particularly for wood derivatives.

What are the major applications for flat pack furniture?

The major applications span both the residential sector (kitchen cabinets, storage units, bedroom sets) and the commercial sector (co-working spaces, temporary offices, student housing, and hospitality units), prioritizing flexibility and quick installation.

The Modular and Flat Pack Furniture Market analysis presented here serves as a critical resource for investors, manufacturers, and retailers seeking strategic positioning in a rapidly evolving consumer goods landscape. The emphasis on digital integration, sustainability, and logistical optimization is defining future success. The market's resilience, even amidst global economic fluctuations, is testament to the enduring consumer demand for affordability and functional efficiency in modern living environments. Continuous innovation in materials and assembly technology will be key differentiators, allowing top players to navigate competitive pressures and capitalize on the vast market potential across emerging economies.

Further strategic insights indicate that companies successful in the next decade will be those that master the digital-physical interplay, offering seamless online configuration experiences coupled with rapid, reliable physical distribution networks. Investment should prioritize sustainable sourcing initiatives not only to meet regulatory requirements but also to cater to the growing segment of environmentally conscious buyers. The commercial application segment, fueled by the shift toward flexible and dynamic office architectures, represents an accelerating revenue stream that requires specialized B2B marketing and product design focused on high-volume, standardized solutions. Addressing the core concern of product quality through advanced manufacturing techniques and transparent material documentation remains paramount to solidify long-term brand trust.

Moreover, the integration of smart home functionalities into modular systems is transforming flat pack furniture from a basic necessity into a high-value consumer electronic category. Products offering integrated charging, environmental controls, and automated movements command higher profit margins and attract premium buyers. Regional strategies must be meticulously tailored: focusing on price sensitivity and basic utility in APAC and LATAM, while emphasizing high design and smart features in North America and Europe. The competitive landscape is forcing a continuous cycle of product refresh, ensuring that aesthetic trends are captured quickly, maintaining the modular furniture’s image as a contemporary and adaptable furnishing solution for the global urban population.

The market is experiencing a significant shift toward customizable options, moving away from purely standardized designs. Modern manufacturing capabilities, powered by Industry 4.0 principles, allow for efficient batch production even for highly individualized designs. This customization trend is particularly evident in kitchen and wardrobe systems, where spatial constraints mandate bespoke solutions built from standardized modular components. Suppliers who can deliver a broad catalog of interchangeable parts and quick turnaround times will secure dominant positions. Furthermore, post-purchase support, including easily accessible digital assembly guides and affordable replacement part services, is transitioning from a customer expectation to a crucial competitive necessity.

In terms of distribution, while e-commerce dominates, the importance of physical showrooms and experience centers cannot be overlooked, particularly for higher-ticket items like modular sofas and full kitchen sets. These physical locations serve as vital touchpoints for customers to assess material quality and visualize scale, bridging the gap between digital discovery and high-value purchase commitment. Hybrid models, integrating online customization tools with physical consultation services, are proving highly effective in mature markets. Retailers are also exploring subscription models or furniture-as-a-service (FaaS) for commercial clients, leveraging the inherent portability and reconfigurability of modular systems to offer highly flexible lease agreements.

Looking ahead, geopolitical factors influencing global trade routes and raw material sourcing will necessitate diversified supply chain strategies. Companies are increasingly seeking regional manufacturing hubs to mitigate risk associated with lengthy international shipping and duties. Investment in local assembly or finishing facilities closer to major consumer markets is becoming a common tactic to improve lead times and decrease logistics costs, thereby reinforcing the overall cost-effectiveness that defines the flat pack furniture segment. The long-term trajectory of the market remains overwhelmingly positive, supported by foundational demographic and economic forces globally.

The innovation trajectory in the Modular and Flat Pack Furniture Market is deeply intertwined with advancements in adhesive technology and connection mechanisms. Companies are focusing heavily on "tool-free" or simplified assembly systems (e.g., click-together or cam lock replacements) that significantly reduce the complexity and time required for installation, directly addressing a core user frustration. This push for user-friendly assembly is key to unlocking broader consumer acceptance among demographics less inclined toward traditional DIY tasks. Successful implementation of these simplified systems not only enhances customer satisfaction but also reduces the likelihood of damage during assembly, minimizing warranty claims and returns for manufacturers.

Environmental responsibility continues to mature as a major market requirement rather than just a differentiating factor. Beyond sustainable sourcing, manufacturers are actively focusing on the end-of-life cycle management for flat pack products. Designing for disassembly (DfD) and using mono-materials to facilitate recycling are becoming standard engineering practices. Certifications beyond basic governmental standards, such as LEED or BIFMA for commercial products, are increasingly sought after, providing third-party verification of environmental claims and building trust with institutional buyers who have strict sustainability mandates.

Market consolidation, particularly among specialized component manufacturers and large global retailers, is expected to continue. Smaller innovative firms often become acquisition targets for their patented assembly mechanisms or specialized material expertise. This consolidation drives efficiency but also intensifies competition, compelling large market players to continually optimize their logistics networks and manufacturing processes. The global competitive environment necessitates investment in sophisticated data analytics capabilities to forecast regional aesthetic trends and tailor product offerings rapidly, ensuring that modular furniture maintains its position as a fashionable, practical, and highly accessible consumer choice.

The dynamic interplay between market accessibility and design customization is a defining characteristic of the Modular and Flat Pack Furniture sector. The digital interface, acting as the primary point of sale and interaction for many consumers, is being constantly upgraded to offer sophisticated visualization tools that bridge the gap between abstract components and the final assembled product. This digital proficiency, including the provision of detailed 3D models and precise measurement guides, minimizes errors and enhances the confidence of the online buyer, which is essential given the reliance on direct-to-consumer models. The continued scaling of cloud computing resources and high-speed internet globally supports the growing need for high-fidelity interactive online catalogs.

Moreover, the integration of data from smart homes and smart office systems provides manufacturers with unprecedented insights into usage patterns, durability performance, and preferred configurations. This data allows for highly targeted product development, ensuring that new modular systems directly address real-world functional requirements. For instance, data showing high wear in specific areas of a product can inform changes in material specification or design reinforcement in the next iteration. This feedback loop, driven by IoT and data analytics, establishes a competitive advantage for firms that can quickly translate usage insights into product improvements.

Finally, skilled labor availability, particularly for complex installation and commercial fit-outs, is a growing concern, especially in developed markets. While flat pack is designed for self-assembly, large commercial projects often require professional installation. Companies are addressing this by either employing in-house assembly teams, partnering with third-party professional services, or simplifying the assembly process to the extent that standard construction labor can easily manage it. This focus on simplifying both manufacturing and assembly underpins the entire market strategy, ensuring that the inherent cost savings of modularity are realized at every stage of the value chain.

The Modular and Flat Pack Furniture Market remains characterized by its strong connection to residential real estate trends, particularly the increasing average age of first-time homebuyers and the continued demand for apartment living. As younger generations delay home ownership, they seek furniture that is aesthetically pleasing, relatively inexpensive, and mobile—qualities perfectly embodied by flat pack design. This demographic trend provides a stable foundation for demand, irrespective of short-term economic fluctuations. The adaptability of modular units also appeals strongly to multi-generational households, allowing for flexible common areas and private spaces within a single dwelling.

Innovation in surface finishes and aesthetics is crucial for sustained market growth. Modular furniture must shed its perception as being purely utilitarian. Manufacturers are investing heavily in technologies that mimic natural materials (wood grains, stone textures) with high fidelity and superior resistance to wear, moisture, and fading. High-pressure laminates (HPL) and specialized foils are constantly being improved to offer both high design value and industrial durability, positioning modular products to compete effectively with higher-end, traditionally manufactured furnishings while maintaining a cost advantage.

The market faces ongoing pressure regarding intellectual property rights, particularly concerning unique locking mechanisms and design configurations that enable simple assembly. Companies are aggressively protecting their patents, leading to fragmented market competition and requiring manufacturers to constantly innovate assembly methods to maintain market distinctiveness. For consumers, this translates into a continuous stream of products boasting faster and simpler assembly methods, often becoming a key selling point highlighted in marketing campaigns and product reviews, further cementing the importance of technological differentiation beyond mere aesthetics.

The emphasis on material efficiency and waste reduction in the manufacturing process is not merely a marketing claim but a fundamental operational requirement. Flat pack design fundamentally minimizes material usage by optimizing the cutting of sheet goods (MDF, particleboard) to reduce offcuts. This precision manufacturing, often aided by AI and advanced sensor technology, ensures that high material costs are contained, directly contributing to the attractive price points offered to consumers. The shift towards circular economy models, where manufacturers take responsibility for product recovery and recycling, is an emerging trend that will reshape the logistics and material sourcing strategies in the long term.

Furthermore, the competitive dynamic is heavily influenced by rapid prototyping and product cycle times. Given the highly trend-sensitive nature of interior design, modular furniture manufacturers must be able to move from concept to retail floor faster than traditional furniture makers. The standardization inherent in modular systems allows for rapid iteration—new colors, handles, or component sizes can be introduced quickly without redesigning the entire system. This agility is vital for maintaining relevance and capturing transient consumer preferences in a crowded marketplace.

In summary, the Modular and Flat Pack Furniture Market is a highly dynamic sector characterized by intense competition, technological adoption, and a strong commitment to consumer convenience and cost efficiency. The synergy between digital sales channels and logistics expertise is the core engine driving profitability. As global living spaces shrink and urbanization accelerates, the demand for adaptable, high-value, and easy-to-handle furniture will ensure sustained expansion throughout the forecast period, making it a critical segment within the broader home furnishings industry.

The integration of modular components with sophisticated hardware and fittings represents another critical area of technological advancement. Modern modular furniture utilizes high-quality, concealed connectors, dampening mechanisms for drawers and doors, and advanced hinge systems that provide durability and a premium user experience, addressing past criticisms related to component fragility. These hardware advancements often originate from specialized European component suppliers, forming a vital, high-tech sub-segment within the broader value chain. The quality and reliability of these fittings are paramount, as they directly influence the structural integrity and lifespan of the assembled flat pack unit.

The growth of the rental market for housing globally further propels the demand for modular furniture. Renters require solutions that are non-permanent, non-damaging to existing property, and easily movable. Modular kitchen islands, freestanding storage walls, and flexible shelving systems that require minimal structural modification fit these requirements perfectly. This renter economy provides a continuous, high-turnover demand source, distinct from the traditional furniture replacement cycle of property owners, creating a robust baseline for sales volumes, particularly in metropolitan areas with high rental rates.

Finally, the health and safety compliance of materials, especially regarding Volatile Organic Compounds (VOCs) and formaldehyde emissions from engineered wood products, is becoming a non-negotiable factor. Regulatory compliance, such as adherence to CARB (California Air Resources Board) standards, provides a significant barrier to entry for lower-quality manufacturers and serves as a strong quality assurance measure for consumers globally. Leading market players are transparently communicating their adherence to these stringent health standards, utilizing low-emission or no-added formaldehyde (NAF) materials, positioning themselves as safer and more responsible choices in the competitive marketplace.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager