Modular Building Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438049 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Modular Building Market Size

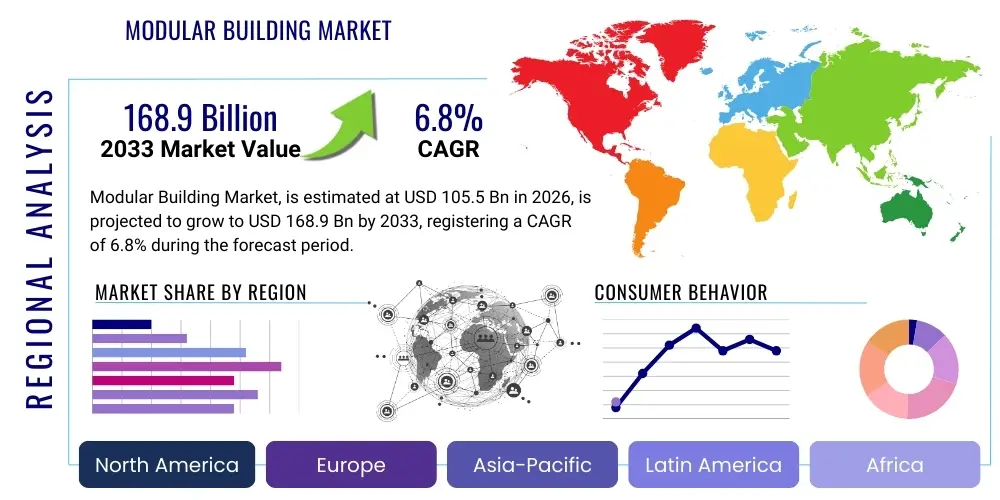

The Modular Building Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $105.5 Billion in 2026 and is projected to reach $168.9 Billion by the end of the forecast period in 2033. This substantial growth is fundamentally driven by the escalating demand for rapid, cost-effective, and sustainable construction solutions across developing and developed economies, particularly within the residential, healthcare, and educational sectors.

Modular Building Market introduction

The Modular Building Market encompasses the pre-engineered, factory-built construction units or modules designed to be delivered to a site and assembled into complex structures, offering significant advantages over traditional stick-built construction methods. Key applications span across residential housing, commercial offices, healthcare facilities, temporary workforce accommodation, and educational institutions. The primary benefits include reduced construction timelines, enhanced quality control due to factory production, minimization of on-site waste, and superior energy efficiency. Market expansion is primarily driven by global urbanization trends, increasing governmental focus on affordable housing, advancements in material science enabling lighter yet stronger module construction, and the compelling need for construction projects that adhere to stringent environmental and sustainability standards.

Modular Building Market Executive Summary

The Modular Building Market is characterized by robust business trends focusing on digitalization and increased factory automation, leading to improved production efficiencies and customization capabilities. Regionally, the market is spearheaded by North America and Europe, which are mature markets emphasizing permanent modular construction for high-rise residential and commercial use, while the Asia Pacific region exhibits the highest growth potential driven by infrastructural development and rapid urbanization requiring scalable and swift housing solutions. Segment trends indicate a strong shift towards permanent modular construction over temporary usage, with wood and steel frame modules dominating materials due to their structural integrity and recyclability, particularly benefiting the educational and commercial segments which require flexible and expandable space configurations.

AI Impact Analysis on Modular Building Market

Analysis of common user inquiries regarding Artificial Intelligence (AI) in the Modular Building Market reveals significant interest focused on optimizing the pre-construction phase, specifically concerning generative design, supply chain prediction, and factory floor automation. Users frequently question how AI can expedite module design iterations, predict potential supply bottlenecks for critical materials like steel and specialty insulation, and enhance quality assurance processes during the factory assembly phase. Key expectations center around AI models generating cost-optimized structural designs that comply instantly with regional building codes, reducing material waste through precise cutting algorithms, and creating fully automated assembly lines that require minimal human intervention, thereby lowering labor costs and increasing production throughput significantly.

The integration of AI is transforming the lifecycle of modular construction, moving beyond simple data aggregation to complex predictive modeling. AI algorithms are increasingly employed in demand forecasting, matching inventory levels with projected project timelines to mitigate storage costs and material expiration risks. Furthermore, machine learning is being applied to site logistics planning, optimizing the delivery routes and scheduling the crane operations for module placement, which is critical for minimizing on-site costs and delays. This technological layer ensures that the inherent efficiency benefits of modular construction are amplified, resulting in faster project completion rates and better capital expenditure management.

Another crucial area where AI demonstrates profound impact is in quality control and compliance monitoring. Vision systems powered by AI are deployed on factory floors to continuously inspect welding seams, structural connections, and surface finishes, identifying defects far more rapidly and accurately than manual inspectors. This proactive quality management ensures that modules arrive on site meeting exact specifications, drastically reducing the risk of costly rework once installation commences. The data generated from these AI-driven inspections feeds back into the design phase, creating a continuous improvement loop that refines manufacturing standards and maximizes the structural integrity of the final built environment.

- AI-driven Generative Design: Automated optimization of module layouts and structural specifications for cost and material efficiency.

- Predictive Supply Chain Management: Machine learning forecasts demand and material lead times, minimizing inventory risks and bottlenecks.

- Automated Quality Control: AI vision systems inspect factory assembly for defects, ensuring high-tolerance component manufacturing.

- Robotic Process Automation (RPA): Increased deployment of robots in welding, painting, and material handling on the production line.

- Site Logistics Optimization: Algorithms calculate optimal delivery sequencing and assembly schedules, reducing site congestion and installation time.

- Energy Performance Simulation: AI models predict the thermal and energy efficiency of proposed modular designs under various climate conditions.

DRO & Impact Forces Of Modular Building Market

The Modular Building Market is primarily driven by the imperative for faster construction coupled with lower operational costs, catalyzed by widespread labor shortages in traditional construction. However, market adoption is constrained by challenges related to transportation logistics for large modules and the perceived lack of design flexibility compared to conventional builds. Significant opportunities arise from governmental initiatives promoting sustainable and affordable housing projects, alongside technological advancements in materials and factory automation. These dynamics create powerful impact forces, where the demand for quick project turnover significantly outweighs the initial resistance to change, positioning modular construction as a vital component in addressing modern infrastructural needs and urban density challenges.

Segmentation Analysis

The Modular Building Market is comprehensively segmented based on Construction Type, Module Type, Material Type, and End-User, providing a granular view of market dynamics and emerging investment pockets. The analysis reveals that the permanent modular construction segment dominates due to its applicability in long-term, high-quality structures, while wood and steel remain the prevalent material choices offering a balance of strength and sustainability. Understanding these segment interactions is crucial for stakeholders aiming to tailor their manufacturing and distribution strategies to meet specific regional demands, particularly within the burgeoning residential and commercial sectors that demand scalability and speed.

- By Construction Type:

- Permanent Modular Construction (PMC)

- Relocatable/Temporary Modular Construction

- By Module Type:

- Volumetric

- Panelized/Pre-cut/Flat-pack

- Modular Flat-rack

- By Material Type:

- Steel

- Wood

- Concrete

- Plastic/Composites

- By End-User:

- Residential

- Commercial

- Educational

- Healthcare

- Industrial

- Hospitality

- Others (Military, Disaster Relief)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East and Africa (MEA)

Value Chain Analysis For Modular Building Market

The modular construction value chain begins with highly specialized Upstream Activities, primarily encompassing raw material sourcing and design engineering. Upstream suppliers provide critical inputs such as structural steel, engineered wood products (like CLT and Glulam), specialty insulation materials, and pre-fabricated building envelope systems. The quality and cost of these raw materials directly influence the overall manufacturing efficiency and the structural integrity of the final module. Design engineering, now heavily reliant on Building Information Modeling (BIM) and digital twinning, establishes the precise manufacturing specifications, ensuring seamless integration between structural components and MEP (Mechanical, Electrical, and Plumbing) systems well before factory production commences. This pre-planning minimizes design errors and facilitates a highly optimized production workflow.

The midstream segment involves the core manufacturing process, where advanced factory automation and quality assurance protocols are implemented. This segment is characterized by assembly line production within controlled environments, offering advantages such as protection from weather delays and the ability to utilize advanced machinery for precision cutting and assembly. Distribution Channels are bifurcated into Direct and Indirect models. Direct distribution, often preferred for large-scale governmental or commercial projects, involves the manufacturer handling logistics, transportation, and direct site coordination. Indirect channels involve partnerships with third-party general contractors or specialized modular distributors who manage the final site preparation and assembly, extending the manufacturer's market reach without requiring extensive in-house logistics resources.

Downstream activities focus on site preparation, transportation logistics, final assembly, and post-installation services. Transportation is a critical bottleneck, requiring specialized heavy hauling and adherence to complex dimensional regulations, particularly for volumetric modules. Final assembly involves the careful integration of modules, connection of utilities, and final finishing touches. The end of the value chain is focused on the end-users, who receive a high-quality, rapidly deployed structure. Post-installation services, including maintenance and eventual deconstruction or relocation services, add residual value to the modular construction model, making it a sustainable and attractive long-term asset.

Modular Building Market Potential Customers

The primary End-Users and Buyers of modular buildings span a diverse array of sectors, all seeking efficient construction methods that address labor constraints and accelerate project timelines. The largest volume of demand emanates from the Residential sector, particularly for affordable and multi-family housing projects where standardization and speed are paramount for achieving high density urban development goals. Government agencies frequently serve as major customers, procuring modular solutions for military facilities, public schools, and disaster relief housing, valuing the rapid scalability and dependable quality control afforded by factory production.

The Commercial and Educational sectors represent significant, growing customer bases. Commercial potential customers include major corporations requiring rapid deployment of new office spaces, retail outlets, or data centers, where minimizing business disruption during construction is critical. For educational institutions, modular buildings offer a fast, flexible solution for accommodating sudden spikes in enrollment or replacing aging infrastructure without extensive campus disruption, often utilizing relocatable modules to address temporary capacity needs or permanent modules for long-term expansions.

Furthermore, the Healthcare and Industrial sectors show specialized demand. Hospitals and clinics utilize modular construction for adding specialized wings, isolation units, or temporary testing facilities with stringent cleanliness and compliance requirements that factory settings can ensure. Industrial customers, particularly in the energy and mining sectors, require robust, relocatable workforce accommodation and specialized control room structures that can withstand harsh environments, making the durability and rapid deployment of modular units highly advantageous for remote operations.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $105.5 Billion |

| Market Forecast in 2033 | $168.9 Billion |

| Growth Rate | CAGR 6.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Laing O’Rourke, Skanska AB, Red Sea Housing Services, Algeco Scotsman, Sekisui House Ltd., Kiewit Corporation, Lendlease Corporation, VINCI Construction, Bouygues Construction, Kleusberg GmbH, ATCO Ltd., Bechtel Corporation, Fluor Corporation, Champion Home Builders Inc., Daiwa House Industry Co. Ltd., Modular Space Corporation (ModSpace), Tempohousing, Wernick Group, Vantem, Guerdon Modular Buildings |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Modular Building Market Key Technology Landscape

The technological evolution of the Modular Building Market is centered on enhancing precision, automation, and material performance to maximize efficiency throughout the factory-to-site workflow. Building Information Modeling (BIM) stands as a foundational technology, enabling comprehensive digital representation of modules, clash detection, and coordination between architectural, structural, and MEP disciplines before any physical material is cut. This digital pre-assembly capability drastically reduces errors and facilitates the necessary integration for subsequent technologies, serving as the single source of truth for the entire project lifecycle, from design iterations to final installation guides and long-term asset management.

Advanced manufacturing techniques are rapidly being adopted within modular factories, mirroring practices found in the automotive and aerospace industries. This includes the use of highly precise Computer Numerical Control (CNC) machinery for automated cutting and drilling of structural components, ensuring micron-level accuracy crucial for module fit-up on site. Robotics and advanced automation systems are increasingly deployed for repetitive and hazardous tasks such as welding, painting, and material handling, which not only improves speed and consistency but also addresses labor shortage issues prevalent in traditional construction sectors. These technologies are pivotal in ensuring that modular construction maintains its promise of superior quality control compared to traditional methods.

Furthermore, the focus on sustainable and high-performance materials is driving innovation. The adoption of Cross-Laminated Timber (CLT) and Glued Laminated Timber (Glulam) is growing significantly, offering lightweight, sustainable alternatives to traditional steel and concrete, particularly in mid-rise residential and commercial applications. The integration of Smart Building Technologies, including IoT sensors for energy monitoring, predictive maintenance, and occupant comfort management, is now standardized within many high-end modular products. This technological convergence positions modular construction not merely as a fast building method, but as a platform for delivering technologically advanced, highly sustainable, and operationally efficient structures.

Regional Highlights

North America (NA) represents a highly mature market segment characterized by strong adoption rates in both permanent commercial structures and relocatable workforce housing, particularly driven by large-scale infrastructure and resource extraction projects. The United States and Canada are leading innovation, heavily investing in large, automated modular factories to address severe housing shortages and capitalize on the efficiency gains offered by off-site construction. Regulatory bodies in these regions are increasingly adapting building codes to specifically accommodate the nuances of modular construction, reducing bureaucratic friction and accelerating project approval timelines. The commercial sector, including tech campuses and specialized healthcare facilities, drives high demand for bespoke, high-quality permanent modular solutions.

Europe is a key region for modular construction, heavily influenced by stringent sustainability regulations and a long-standing commitment to factory-based production, particularly in the Nordics, UK, and Germany. The European market strongly emphasizes the use of sustainable materials, such as engineered timber (CLT), aligning with ambitious decarbonization targets. Countries like Sweden and the Netherlands have demonstrated high penetration rates of modular housing, utilizing factory production to mitigate seasonal construction delays and ensure predictable costs. The European modular market is characterized by a strong focus on energy efficiency (e.g., Passive House standards) and sophisticated architectural integration, moving beyond the perception of modular buildings as merely temporary solutions.

Asia Pacific (APAC) is projected to be the fastest-growing region, fueled by unprecedented rates of urbanization, population growth, and massive government investment in infrastructure and public housing (e.g., in China, India, and Southeast Asia). The requirement for rapid deployment of structures to support economic expansion makes modular construction a necessity. While the market initially focused on temporary structures and basic housing, there is a clear shift toward high-rise permanent modular construction. Japan, with its advanced manufacturing capabilities and requirement for earthquake-resistant structures, continues to be a technology leader in the modular space, setting high benchmarks for quality and structural integrity.

Latin America (LA) is an emerging market where modular construction is primarily driven by industrial and resource sector projects requiring rapid, remote workforce accommodation and temporary facilities. While adoption in the residential sector remains nascent compared to North America and Europe, governmental efforts in countries like Brazil and Mexico to address housing deficits are beginning to incorporate modular techniques. Key challenges involve managing complex logistics across diverse geographies and securing standardized quality supply chains, but the potential for cost savings and speed remains a powerful long-term catalyst for market penetration.

Middle East and Africa (MEA) exhibits unique demand patterns, with significant uptake in the Middle East for high-end hospitality projects, temporary structures for major events (like expos or sporting events), and large industrial camps related to oil, gas, and renewable energy infrastructure. The requirement for construction methods that mitigate the risks associated with extreme climate conditions and rapid construction timelines makes modular ideal. In the African context, growth is concentrated in commercial infrastructure development and humanitarian efforts, where the speed of deployment is essential for establishing critical facilities in remote or underserved areas.

- North America: Focus on commercial high-rise, advanced automation, and affordable housing initiatives.

- Europe: Leadership in sustainable materials (CLT) and energy-efficient standards (Passive House).

- Asia Pacific (APAC): Highest growth rate driven by rapid urbanization and large-scale public infrastructure projects.

- Latin America: Emerging growth, concentrated in industrial and resource sector remote accommodation.

- Middle East and Africa (MEA): Strong demand for hospitality, industrial camps, and climate-resilient solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Modular Building Market.- Laing O’Rourke

- Skanska AB

- Red Sea Housing Services

- Algeco Scotsman

- Sekisui House Ltd.

- Kiewit Corporation

- Lendlease Corporation

- VINCI Construction

- Bouygues Construction

- Kleusberg GmbH

- ATCO Ltd.

- Bechtel Corporation

- Fluor Corporation

- Champion Home Builders Inc.

- Daiwa House Industry Co. Ltd.

- Modular Space Corporation (ModSpace)

- Tempohousing

- Wernick Group

- Vantem

- Guerdon Modular Buildings

Frequently Asked Questions

Analyze common user questions about the Modular Building market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between permanent and relocatable modular construction?

Permanent Modular Construction (PMC) involves modules designed for long-term use and integration with traditional foundations, meeting or exceeding local building codes, and providing the durability of conventional structures. Relocatable Modular Construction is designed for temporary use and ease of dismantling, transportation, and reuse, often serving purposes such as temporary classrooms or construction site offices.

Are modular buildings more sustainable than traditional construction methods?

Yes, modular buildings are generally more sustainable. Factory production significantly reduces material waste by enabling precise cutting and optimizing resource use. Furthermore, the construction process is less disruptive to the site environment, and the structures themselves often integrate higher levels of insulation and energy efficiency measures, leading to lower operational carbon footprints.

How does modular construction address the skilled labor shortage in the construction industry?

Modular construction shifts approximately 70-90% of the building work from the unpredictable construction site to a controlled factory environment. This allows manufacturers to utilize specialized, automated machinery and a smaller, more centralized skilled workforce, effectively mitigating the dependence on large, fluctuating crews required for conventional on-site building.

What technological advancements are driving the growth of the modular market?

Key technological drivers include the widespread adoption of Building Information Modeling (BIM) for precise design and coordination, advanced factory automation using CNC machines and robotics for manufacturing components, and the integration of high-performance engineered materials like Cross-Laminated Timber (CLT) which enhance structural integrity and sustainability.

What are the main logistical hurdles facing the expanded adoption of volumetric modular construction?

The main logistical hurdles revolve around transporting large, three-dimensional volumetric modules from the factory to the site. This requires extensive planning, specialized heavy transport equipment, adherence to stringent road and dimensional regulations, and potentially costly temporary infrastructure adjustments (e.g., utility line removal) along transit routes, particularly in urban areas.

How do modular buildings compare in terms of cost and construction timeline?

While the initial factory costs for a modular unit can sometimes be comparable or slightly higher than traditional framing, modular construction offers substantial cost savings through reduced labor hours on site, minimal weather delays, and greater certainty regarding project schedules. Construction timelines are typically 30% to 50% shorter because site preparation and foundation work occur concurrently with factory production.

Which end-user segment is exhibiting the highest demand for modular solutions currently?

The Residential segment, particularly for affordable and multi-family housing projects, currently exhibits the highest demand. This sector leverages modular construction's ability to provide high-volume, standardized housing units rapidly, effectively addressing urban density and housing crisis challenges faced by governments and developers globally.

What role does digitalization play in the modular construction value chain?

Digitalization, spearheaded by BIM and digital twinning, is fundamental. It ensures that the design, engineering, and manufacturing specifications are perfectly synchronized, minimizing errors and facilitating automated assembly. Digital platforms also optimize supply chain management and track module progress from the factory floor to final installation, providing unparalleled project transparency.

Is modular construction limited to low-rise buildings?

No, modular construction is no longer limited to low-rise structures. Advancements in structural engineering and the use of materials like steel frames and CLT now enable the construction of permanent, high-rise commercial and residential buildings, with modular methods successfully utilized in structures exceeding 20 stories in urban centers worldwide.

How are regional climate differences managed in modular building design and production?

Regional climate differences are managed through highly specific engineering during the design phase, utilizing sophisticated materials and insulation systems tailored for the destination environment (e.g., hurricane-resistant structures in coastal regions or enhanced thermal envelopes for extreme cold). Since construction is done indoors, climate does not affect the quality or schedule of the factory assembly process.

What are the primary challenges related to financing modular construction projects?

Financing can be challenging because traditional construction financing models are tied to on-site progress (draws based on physical completion at the site). Since modular components are manufactured off-site, developers often require bridge financing or need lenders specialized in off-site construction who understand the need to fund large portions of the project cost before modules reach the final foundation.

How is quality control assured in factory environments compared to traditional construction?

Quality control in factory environments is significantly enhanced through standardized processes, dedicated quality assurance teams, and controlled, climate-independent settings. The use of automated inspection tools, such as AI-powered vision systems, ensures that modules adhere to precise, repeatable tolerances, eliminating many quality issues inherent to outdoor, manual labor on conventional sites.

Which material type holds the largest market share in the modular building industry?

Steel remains one of the dominant material types, particularly for commercial, industrial, and high-rise applications, due to its exceptional strength and durability. However, wood, especially engineered wood products like CLT, is rapidly gaining market share, driven by sustainability goals and the preference for lighter, more environmentally friendly building materials in residential and educational sectors.

What impact do governmental policies have on the growth of the modular building market?

Governmental policies are a major catalyst for growth. Initiatives focusing on affordable housing, rapid infrastructure development, and mandating high levels of energy efficiency (e.g., net-zero goals) create a favorable regulatory and demand environment, often leading to public-private partnerships that utilize modular construction for large-scale municipal projects.

How is the modular market integrating smart building features?

Modular construction facilitates seamless integration of smart features because wiring and sensor installation occur in a controlled factory setting. This includes pre-installed IoT sensors for remote monitoring, energy management systems, automated climate controls, and integrated security features, delivered to the site as ready-to-connect smart modules.

Does the Modular Building Market include only volumetric modules?

No, the market is diverse and includes panelized (2D wall, floor, or roof elements), flat-pack, and modular flat-rack systems, in addition to volumetric (3D room-sized units). Panelized construction is often used for maximizing shipping density and flexibility in design, while volumetric units prioritize minimizing on-site work and achieving maximum speed of assembly.

How does the resale value of modular homes compare to traditional homes?

For high-quality Permanent Modular Construction (PMC) that adheres to local building codes and standards, the resale value is generally comparable to site-built homes. Factors such as location, quality of materials, and maintenance are more impactful on valuation than the method of construction itself, provided the modular structure is recognized as permanent housing.

What security considerations are important for modular building factories?

Security in modular factories is paramount to protect high-value materials and specialized automation equipment. Considerations include securing intellectual property related to proprietary designs (BIM models), controlling access to prevent industrial espionage, and implementing advanced physical security measures to protect modules undergoing construction before shipment.

What is the role of specialized software beyond BIM in modular construction?

Specialized software includes Enterprise Resource Planning (ERP) systems tailored for manufacturing environments to manage inventory and production flow, Finite Element Analysis (FEA) software for structural stress testing, and specialized logistics software to optimize the packing, loading, and transportation of irregularly sized modules.

How are modular builders mitigating transportation risks for oversized loads?

Mitigation strategies include optimizing module dimensions to fit standard transportation limits where possible, utilizing specialized heavy-haul carriers, conducting extensive route surveys to identify obstructions (bridges, power lines), securing necessary permits well in advance, and employing piloting services to guide oversized loads safely across state or international boundaries.

Can existing buildings be expanded using modular construction techniques?

Yes, modular construction is highly effective for expanding existing buildings, particularly for vertical additions (rooftop construction) or horizontal extensions. Modules can be manufactured to match existing architectural styles and integrated seamlessly, minimizing the duration of noisy and disruptive on-site work required for the expansion.

What is the competitive advantage of modular construction regarding project risk management?

Modular construction offers a significant advantage in project risk management by transferring risks associated with weather delays, theft, labor strikes, and on-site inconsistencies to the controlled factory environment. This allows for fixed pricing and guaranteed delivery schedules, offering clients greater financial and timeline certainty.

What is the typical lifespan of a permanent modular building?

A permanent modular building, constructed to the same stringent codes as traditional construction, is designed to have a comparable lifespan of 50 to 100 years or more. Its longevity depends on the quality of materials, proper foundation installation, and ongoing maintenance, just like any site-built structure.

What emerging material types are gaining traction in the modular market?

Beyond wood and steel, emerging material types include high-performance composites, specialized lightweight concrete panels, and various recyclable plastics for non-structural components. These materials are chosen for their superior thermal properties, reduced weight (beneficial for transportation), and contribution to the overall building's energy performance.

How does the insurance industry view modular construction projects?

Initially cautious, the insurance industry is increasingly recognizing the reduced risk profile of modular projects due to better fire safety in the factory, improved quality control, and shorter exposure times on site. Specialized policies are now available that cover the modules during production, transit, and installation, reflecting the segmented nature of the construction process.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Prefabricated Modular Building Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Modular Building Market Statistics 2025 Analysis By Application (Residential, Commercial, Industrial), By Type (Stationary Tiny House, Mobile Tiny House), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Panelized Modular Building Systems Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Timber Frame, Light Gauge Structural Steel Framing, Concrete, Other Product Types), By Application (Residential, Commercial, Infrastructure, Industrial and Institutional), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager