Modular Cleanroom Solutions Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431758 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Modular Cleanroom Solutions Market Size

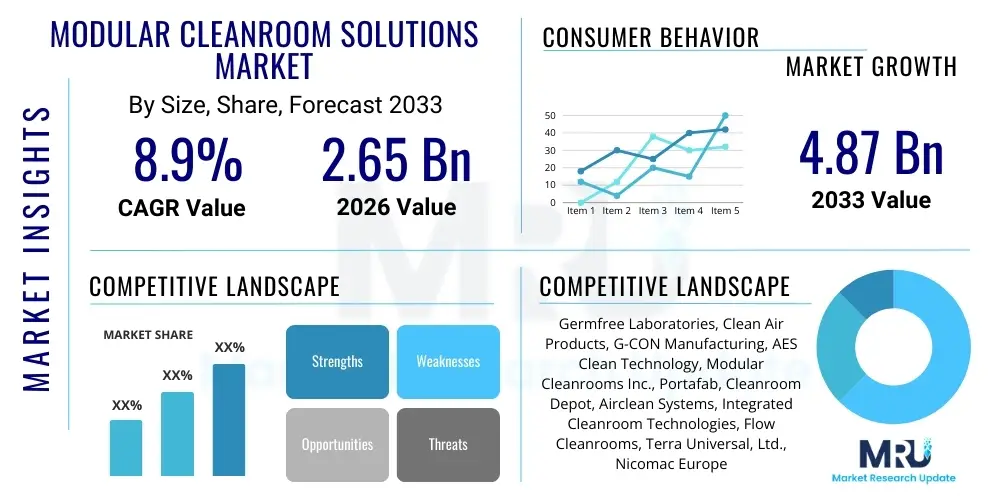

The Modular Cleanroom Solutions Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.9% between 2026 and 2033. The market is estimated at USD 2.65 Billion in 2026 and is projected to reach USD 4.87 Billion by the end of the forecast period in 2033.

Modular Cleanroom Solutions Market introduction

The Modular Cleanroom Solutions Market encompasses prefabricated, customizable, and rapidly deployable controlled environments designed to meet strict international standards for airborne particulate control, such as ISO 14644-1 and cGMP guidelines. These solutions utilize standardized wall panels, ceilings, lighting, and HVAC systems integrated into a self-contained structure, offering superior flexibility and scalability compared to traditional stick-built cleanrooms. Key product types include softwall, hardwall, and rigid wall modular systems, catering to diverse needs across industries where contamination control is paramount. The increasing complexity of manufacturing processes in pharmaceuticals and electronics necessitates clean environments that can be quickly installed, reconfigured, or relocated, driving significant demand for these modular systems globally.

Major applications of modular cleanrooms span critical sectors, including pharmaceutical and biotechnology manufacturing (especially cell and gene therapy labs), microelectronics and semiconductor fabrication, medical device assembly, and specialized laboratories for research and development. The intrinsic benefits driving market adoption include faster project turnaround times, lower capital expenditure relative to traditional construction, and inherent flexibility allowing easy expansion or adaptation to evolving production demands. Modular systems also offer superior quality control during construction, as components are manufactured off-site under optimized conditions, leading to better compliance with stringent regulatory requirements.

Driving factors propelling the market forward include the robust expansion of the global biopharma industry, fueled by the accelerating pace of drug discovery and the need for localized vaccine production facilities. Furthermore, the relentless miniaturization in the semiconductor industry requires increasingly cleaner environments (e.g., ISO Class 1 and 2), which modular solutions are highly effective at achieving and maintaining. Regulatory pressures from bodies like the FDA and EMA demanding higher levels of contamination control and traceability in manufacturing processes are also catalyzing investment in modern, compliant modular infrastructure. The inherent advantage of business continuity offered by easily deployable and scalable cleanrooms is proving essential for companies navigating rapid market changes.

Modular Cleanroom Solutions Market Executive Summary

The Modular Cleanroom Solutions Market is experiencing robust growth driven by accelerating technological innovation across high-tech manufacturing sectors and stringent global regulatory frameworks focusing on product integrity. Current business trends indicate a strong shift towards incorporating smart cleanroom technologies, including integrated environmental monitoring systems and predictive maintenance capabilities, enhancing operational efficiency and compliance. Leading companies are focusing on developing hybrid modular designs that integrate the rigidity of traditional construction with the flexibility and speed of modularity, particularly targeting large-scale pharmaceutical and biotech manufacturing facilities. Strategic alliances and mergers, along with geographic expansion into emerging Asian markets, are defining the competitive landscape, prioritizing turnkey solutions that minimize installation time and complexity for end-users.

Regional trends reveal Asia Pacific (APAC) as the fastest-growing market, primarily fueled by massive governmental and private investments in semiconductor fabrication plants (fabs) and the booming biopharmaceutical sector in countries like China, India, and South Korea. North America and Europe, while mature, remain dominant in terms of market value, driven by strict adherence to cGMP regulations and high adoption rates in cell and gene therapy research infrastructure. In North America, the focus is heavily on rapid deployment capabilities to meet urgent demands for specialized manufacturing capacity, particularly in the aftermath of global supply chain disruptions. Conversely, European markets prioritize energy efficiency and sustainability features within their modular designs, aligning with regional environmental directives.

Segment trends underscore the dominance of the hardwall modular cleanroom segment due to its superior durability and capability to maintain lower ISO classes (Class 5 and below), essential for microelectronics and sterile drug production. However, the softwall segment is showing notable growth, especially in the medical device and packaging sectors, offering highly cost-effective and flexible solutions for non-sterile or less stringent applications. By component, the HVAC systems segment maintains the largest market share, reflecting its critical role in controlling air change rates, pressure differentials, and filtration quality (HEPA/ULPA). The turnkey solutions sub-segment is rapidly gaining traction as end-users prefer comprehensive, single-vendor contracts covering design, manufacturing, installation, and validation, streamlining the entire project lifecycle and accelerating time-to-market.

AI Impact Analysis on Modular Cleanroom Solutions Market

User questions regarding AI's influence on the Modular Cleanroom Solutions Market commonly revolve around three core themes: How can AI enhance real-time contamination control and predictive maintenance? Will AI integration increase the complexity and initial cost of modular systems? And how can AI streamline the regulatory validation process for flexible cleanroom environments? The primary concern centers on leveraging AI for proactive rather than reactive control, ensuring continuous compliance in dynamic modular settings. Users anticipate AI will optimize energy consumption by intelligently managing HVAC systems based on occupancy and real-time particulate load, thereby reducing the high operating costs typically associated with controlled environments. Furthermore, there is a strong expectation that machine learning models will significantly improve the accuracy of environmental monitoring and accelerate the complex documentation required for validation in highly flexible GxP-compliant modular spaces.

The integration of Artificial Intelligence is poised to revolutionize the operational efficacy of modular cleanrooms by moving beyond basic automation towards intelligent control and optimization. AI algorithms are essential for analyzing the massive streams of data generated by numerous sensors monitoring parameters such as temperature, humidity, pressure differential, and particle counts. By applying deep learning techniques to this historical and real-time data, systems can predict potential failures in filtration or HVAC units, forecast contamination spikes related to specific operational activities, and automatically adjust air handling parameters to maintain optimal ISO classification with minimal human intervention. This shift drastically improves the reliability of the clean environment, which is paramount for sensitive manufacturing processes like advanced semiconductor lithography and aseptic filling.

AI also plays a critical role in enhancing the lifecycle management of modular cleanrooms, providing significant long-term value. For example, AI-powered digital twins can simulate changes in cleanroom layout or equipment placement before physical modification, predicting the impact on airflow patterns and cleanliness gradients. This capability is particularly beneficial for modular systems, which are frequently reconfigured. Furthermore, AI tools are accelerating the critical validation and qualification (IQ, OQ, PQ) processes by automatically generating compliance reports, analyzing validation runs for anomalies, and ensuring that all regulatory checkpoints (e.g., EU Annex 1 revisions) are met efficiently, thereby reducing the validation bottleneck associated with facility expansion or relocation.

- AI optimizes HVAC energy consumption based on predictive load and occupancy sensing.

- Predictive maintenance algorithms reduce downtime by anticipating filter saturation and mechanical failures.

- Machine learning models enhance real-time contamination source identification and mitigation.

- AI streamlines GxP validation and compliance documentation for rapid deployment and reconfiguration.

- Integration of AI-driven environmental monitoring systems ensures continuous, proactive contamination control.

- Digital twin technology utilizes AI to simulate and optimize complex airflow dynamics during design and modification.

DRO & Impact Forces Of Modular Cleanroom Solutions Market

The Modular Cleanroom Solutions Market is fundamentally shaped by a powerful confluence of drivers related to speed and compliance, balanced against persistent restraints concerning initial cost and standardization, while capitalizing on pervasive opportunities arising from technological convergence. The primary driver is the accelerating demand for agility in manufacturing, especially in biopharmaceuticals where time-to-market for novel therapies is critical, and modularity offers unmatched speed of deployment. Conversely, the high initial capital investment required for comprehensive, fully integrated modular solutions, which often includes sophisticated environmental controls and monitoring systems, acts as a significant restraint, particularly for smaller enterprises. The pervasive opportunity lies in the global expansion of high-tech manufacturing, specifically the construction of gigafactories for electric vehicle batteries and advanced semiconductor foundries, which require large-scale, ultra-clean facilities that modular construction can deliver efficiently. These dynamic forces — speed, cost, and high-tech demand — dictate the strategic direction of market players, compelling them to innovate solutions that offer both rapid deployment and superior regulatory compliance.

The impact forces within this market are predominantly positive, stemming from global regulatory harmonization and the inherent structural advantages of modular design. Regulatory bodies worldwide are continuously tightening manufacturing standards (e.g., ISO 14644 updates and Annex 1) to enhance patient safety and product quality, thereby mandating investment in highly controlled environments that modular solutions easily provide. The low operational footprint and reduced construction waste associated with off-site fabrication also represent a major impact force, aligning with increasing industry focus on Environmental, Social, and Governance (ESG) criteria. However, a countervailing negative impact force is the lingering perception that modular facilities, especially softwall variants, may lack the long-term structural integrity or cleanliness grade necessary for the most stringent applications (e.g., ISO Class 1). This perception necessitates continuous market education and technological advancement in materials and paneling systems to demonstrate equivalence or superiority to traditional construction.

Key market drivers include the global expansion of the cell and gene therapy sector, requiring customized, contained, and often BSL-rated cleanrooms that must be built rapidly. Additionally, the semiconductor industry’s capital expenditure cycles, which demand fast scaling of production capacity, strongly favor modular fabrication solutions. Restraints also include the complex logistics associated with transporting large modular units and the initial challenge of securing financing for customizable modular projects compared to standardized building construction loans. Opportunities are vast, encompassing the integration of IoT sensors and advanced Building Management Systems (BMS) into modular designs, creating 'Cleanroom as a Service' models, and expanding penetration into non-traditional cleanroom users, such as precision engineering, aerospace component manufacturing, and specialized food processing.

Segmentation Analysis

The Modular Cleanroom Solutions Market is meticulously segmented based on wall type, product offering, application, and end-user, reflecting the diverse and specialized requirements of the contamination control industry. Understanding these segments is crucial for manufacturers to tailor their design and technology investments. The wall type segmentation (hardwall, softwall, rigid/hybrid) dictates the level of cleanliness class achievable, structural permanence, and overall capital outlay. Hardwall systems dominate high-specification sectors like pharmaceuticals and microelectronics due to their superior airtightness and durability. The segmentation by product offering, particularly the distinction between standard and customized/turnkey solutions, highlights the increasing industry preference for integrated services that simplify procurement and validation for complex projects.

Analyzing the market by application reveals the high-growth trajectory driven by life sciences, contrasting with the high-volume demand from the electronics sector. The pharmaceutical and biotechnology application segment consistently demands the highest level of regulatory compliance (cGMP/GLP) and robust environmental monitoring, necessitating advanced modular components, especially highly efficient HEPA filtration and precise pressure control systems. Furthermore, end-user segmentation clearly shows that large pharmaceutical companies and major semiconductor fabricators are the primary consumers of high-specification, multi-room modular complexes, while academic research institutions and smaller medical device manufacturers often opt for smaller, more flexible softwall or customized prefabricated units for dedicated processes.

Component segmentation—including HVAC systems, filtration units, wall panels, and ceiling systems—provides insights into the technology supply chain. HVAC and filtration remain the most critical components, absorbing the largest share of the capital expenditure due to their direct role in achieving and maintaining required ISO standards. The overall segmentation analysis points toward a market maturing towards highly integrated, smart, and flexible solutions that cater specifically to the accelerated product development timelines common in modern biomanufacturing and advanced electronics assembly, demanding modularity coupled with comprehensive digital compliance tools.

- By Type:

- Hardwall Modular Cleanrooms

- Softwall Modular Cleanrooms

- Rigid/Hybrid Modular Cleanrooms

- By Component:

- HVAC Systems (Air Handling Units, Chillers, Humidifiers)

- Filtration Systems (HEPA/ULPA Filters)

- Wall Panels and Partitions (Single Skin, Double Skin)

- Ceiling Systems

- Flooring Systems

- Lighting Fixtures

- By Application:

- Pharmaceutical & Biotechnology Manufacturing (Aseptic Processing, Fill-Finish)

- Semiconductors & Microelectronics (Fabrication, Testing)

- Medical Devices Manufacturing (Assembly, Packaging)

- Automotive (Precision Component Assembly)

- Aerospace & Defense (Satellite Components, Optics)

- Hospitals and Healthcare Facilities (Operating Theatres, Isolation Rooms)

- By End-User:

- Pharmaceutical & Biotechnology Companies

- Medical Device Manufacturers

- Hospitals and Diagnostic Labs

- Research and Academic Institutions

- Semiconductor and Electronics Firms

- Other Industrial Users

Value Chain Analysis For Modular Cleanroom Solutions Market

The value chain for modular cleanroom solutions is complex, starting with the specialized raw material suppliers and culminating in the highly specialized installation and validation services provided to end-users. The upstream segment involves the sourcing and processing of high-grade materials, including specialized aluminum profiles, stainless steel, non-shedding polymers for wall and ceiling panels, and sophisticated filter media (borosilicate glass fiber for HEPA/ULPA filters). Key participants at this stage include material manufacturers and highly specialized component providers who must adhere to strict quality standards to ensure the final cleanroom structure meets particulate emission requirements. Efficiency in the upstream segment relies heavily on maintaining a resilient supply chain for specialized components like proprietary interlocking panel systems and high-efficiency filtration units, which are crucial for the integrity of the modular design.

The midstream stage is dominated by the modular cleanroom solution providers, who undertake the design, engineering, manufacturing, and integration. This stage involves significant R&D investment in modular architectural systems, airflow modeling (CFD analysis), and the integration of highly complex mechanical and electrical components (especially the HVAC unit, which is often custom-built). Companies often operate dedicated, quality-controlled fabrication facilities where wall panels, ceiling grids, and pre-wired mechanical skids are manufactured off-site. The competitive advantage at this stage is derived from customization capabilities, speed of fabrication, and the ability to produce components that minimize seams and potential leakage points, critical for achieving stringent ISO classes.

The downstream segment focuses on distribution, installation, qualification, and aftermarket support. Distribution channels are typically direct, given the custom nature and high cost of these systems, though specialized engineering, procurement, and construction (EPC) firms often act as intermediaries, integrating the cleanroom solution into a larger facility project. Direct sales teams work closely with end-users to manage project specifics. The crucial final steps involve on-site assembly, rigorous testing, validation (IQ/OQ/PQ), and certification by specialized third-party certifiers. Aftermarket support, including recalibration, filter replacement, and re-validation services, represents a recurring revenue stream and a vital link in maintaining the long-term compliance of the modular facility.

Modular Cleanroom Solutions Market Potential Customers

Potential customers and primary end-users of modular cleanroom solutions are concentrated in highly regulated industries where environmental control directly impacts product quality, safety, and regulatory compliance. The largest and most demanding customer segment is the pharmaceutical and biotechnology industry, specifically focusing on complex areas such as aseptic filling lines, vaccine production, and increasingly, specialized facilities for cell and gene therapy (CGT) manufacturing. These customers require rapid deployment capabilities to meet accelerated clinical trial timelines and often need flexible BSL-rated environments, making modularity an ideal fit. Their procurement decisions are heavily influenced by vendor reputation for GxP compliance, validation support, and system flexibility to adapt to changing regulatory standards.

The second major cohort comprises microelectronics and semiconductor manufacturers, particularly those fabricating advanced silicon wafers, micro-electromechanical systems (MEMS), and specialized displays. These customers operate at the highest cleanliness levels (ISO Class 1 to 3) and demand highly controlled environments free from sub-micron particles. Modular solutions appeal to this segment due to the ease of expansion and relocation required during frequent facility upgrades or technology transitions, often related to multi-billion dollar capital expenditure cycles. The emphasis for this group is on ultra-low particulate counts, vibration control, and specialized material compatibility to prevent chemical contamination.

Additional significant buyers include medical device manufacturers—especially for assembly and packaging of implantable devices—and various institutional clients, such as large university research hospitals, public health laboratories, and government defense contractors specializing in sensitive optical or micro-assembly work. These diverse customers share a common need for documented environmental control, but their key priorities vary: hospitals focus on minimizing airborne pathogens and maximizing patient safety, while research labs prioritize configurability and cost-efficiency for varied experimentation needs. The trend toward customized, smaller-scale modular facilities catering to highly specialized, localized production (e.g., compounding pharmacies) is broadening the customer base significantly.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.65 Billion |

| Market Forecast in 2033 | USD 4.87 Billion |

| Growth Rate | 8.9% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Germfree Laboratories, Clean Air Products, G-CON Manufacturing, AES Clean Technology, Modular Cleanrooms Inc., Portafab, Cleanroom Depot, Airclean Systems, Integrated Cleanroom Technologies, Flow Cleanrooms, Terra Universal, Ltd., Nicomac Europe, Klenzaids, KwangJeng Co., Ltd., Starrco Company, Inc., Exyte Group, Cimc Pharmaceutical Equipment Manufacturing, Field Controls, American Cleanroom Systems, Cleanroom Film and Supply (CFS). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Modular Cleanroom Solutions Market Key Technology Landscape

The Modular Cleanroom Solutions Market is characterized by continuous technological evolution, focusing primarily on enhancing compliance, flexibility, and operational efficiency through advanced material science and digital integration. A central technological theme is the development of next-generation panel systems utilizing materials that offer superior chemical resistance, non-shedding characteristics, and improved fire ratings, moving beyond standard materials to include proprietary composites and specialized powder-coated metals designed for aseptic environments. Furthermore, interlocking wall systems are becoming increasingly sophisticated, featuring flush, seamless integration of utilities (electrical conduits, gas lines) to eliminate potential particle traps and simplify surface cleaning, which is critical for adherence to stringent cleaning protocols mandated by regulators.

The core technology driving performance lies in the advanced HVAC and air filtration architecture. Modern modular solutions leverage sophisticated Fan Filter Units (FFUs) with energy-efficient EC (Electronically Commutated) motors, which offer variable speed control and high-efficiency particulate air (HEPA) or ultra-low penetration air (ULPA) filtration customized for the target ISO classification. Crucially, technological innovations are focused on optimizing laminar and turbulent airflow patterns through Computational Fluid Dynamics (CFD) modeling during the design phase. This ensures predictable air change rates and pressure cascade management, vital for maintaining differential pressure zones and preventing cross-contamination, especially in multi-suite modular complexes designed for high-containment processes.

Digitalization forms the third pillar of the technological landscape, focusing on the integration of the Internet of Things (IoT) and advanced Building Management Systems (BMS). Modular cleanrooms are increasingly equipped with dense arrays of wireless sensors monitoring environmental parameters in real-time. These IoT networks feed data into a centralized BMS or SCADA system that utilizes AI/ML algorithms to manage energy usage, predict maintenance needs, and automatically generate audit trails and compliance reports. This shift towards smart, interconnected cleanrooms minimizes human error, ensures continuous environmental integrity, and significantly streamlines the complex validation and qualification procedures required for GxP environments, thereby maximizing the overall operational lifespan and compliance status of the modular facility.

Regional Highlights

- Asia Pacific (APAC): APAC is projected to exhibit the highest growth rate, fueled by massive government investments in the domestic semiconductor industry (e.g., China’s "Made in China 2025" and South Korea’s chip expansion plans). The region is also the global hub for contract manufacturing organizations (CMOs) and pharmaceutical outsourcing, driving demand for compliant, scalable modular facilities. Increased regulatory enforcement and growing public health spending further solidify APAC's position as a critical demand center for cleanroom infrastructure.

- North America: North America holds the largest market share in terms of value, primarily due to the stringent FDA regulations and the high concentration of leading pharmaceutical, biotechnology, and advanced medical device companies, particularly in the US. The market here is characterized by high adoption of customized, high-specification (ISO Class 5 and better) hardwall modular solutions, focusing heavily on rapid deployment capabilities essential for cell and gene therapy manufacturing hubs and advanced research facilities.

- Europe: Europe is a mature market driven by strict adherence to EMA and national regulatory standards, with a strong focus on sustainability and energy efficiency in cleanroom design. Western European countries, particularly Germany and Switzerland, are key players, demanding advanced HVAC solutions and modular systems that comply with the latest EU GMP Annex 1 requirements for sterile manufacturing. The region favors highly engineered, turnkey solutions that offer robust validation packages and longevity.

- Latin America (LATAM): The LATAM market is nascent but growing steadily, driven by increased foreign direct investment in local pharmaceutical production and medical device assembly, especially in Brazil and Mexico. The demand is largely focused on cost-effective, easily scalable softwall and basic hardwall solutions that help local companies meet regional and international quality standards without massive capital expenditure.

- Middle East and Africa (MEA): Growth in MEA is concentrated in pharmaceutical manufacturing hubs, particularly the GCC nations and South Africa, as governments seek to reduce reliance on imported medicines. Modular cleanrooms are favored due to their speed of installation and suitability for regions with complex or limited local construction infrastructure. Investments are primarily targeted at basic pharmaceutical manufacturing and packaging facilities requiring ISO Class 7 and 8 environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Modular Cleanroom Solutions Market.- Germfree Laboratories

- Clean Air Products

- G-CON Manufacturing

- AES Clean Technology

- Modular Cleanrooms Inc.

- Portafab

- Cleanroom Depot

- Airclean Systems

- Integrated Cleanroom Technologies

- Flow Cleanrooms

- Terra Universal, Ltd.

- Nicomac Europe

- Klenzaids

- KwangJeng Co., Ltd.

- Starrco Company, Inc.

- Exyte Group

- Cimc Pharmaceutical Equipment Manufacturing

- Field Controls

- American Cleanroom Systems

- Cleanroom Film and Supply (CFS)

Frequently Asked Questions

Analyze common user questions about the Modular Cleanroom Solutions market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary advantage of modular cleanrooms over traditional construction?

The primary advantage is speed and flexibility. Modular cleanrooms offer significantly faster installation times (up to 40% reduction), lower overall construction costs, and the unique ability to be easily reconfigured, expanded, relocated, or disassembled, meeting the dynamic needs of GxP and high-tech manufacturing processes.

Which ISO class standards are typically achievable using modular cleanroom solutions?

Modular solutions are highly versatile and capable of achieving cleanliness levels ranging from the least stringent, ISO Class 8 (equivalent to Class 100,000), up to the most stringent, ISO Class 3 (equivalent to Class 1, and sometimes Class 1), required for advanced semiconductor fabrication and critical aseptic processing.

What industries are driving the highest demand for hardwall modular cleanrooms?

The highest demand for hardwall modular cleanrooms comes from the pharmaceutical and biotechnology sector (for sterile fill/finish and cell therapy) and the microelectronics/semiconductor industry, as these sectors require superior durability, pressure control, and the capability to consistently maintain ultra-low ISO classifications.

How does the integration of IoT and smart monitoring benefit modular cleanroom operations?

IoT and smart monitoring systems enhance operational efficiency by providing real-time data on environmental parameters, enabling predictive maintenance of HVAC and filtration units, optimizing energy consumption based on particulate load, and automating compliance reporting, thereby ensuring continuous adherence to regulatory requirements.

What are the key components included in a typical modular cleanroom turnkey solution?

A turnkey solution encompasses design and engineering, prefabricated wall and ceiling panels, integrated HVAC systems (including HEPA/ULPA filtration), specialized lighting, flooring, utility integration, and comprehensive validation documentation (IQ/OQ/PQ) ensuring the facility is operational and compliant upon handover.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager