Modular Compressor Station Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431900 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Modular Compressor Station Market Size

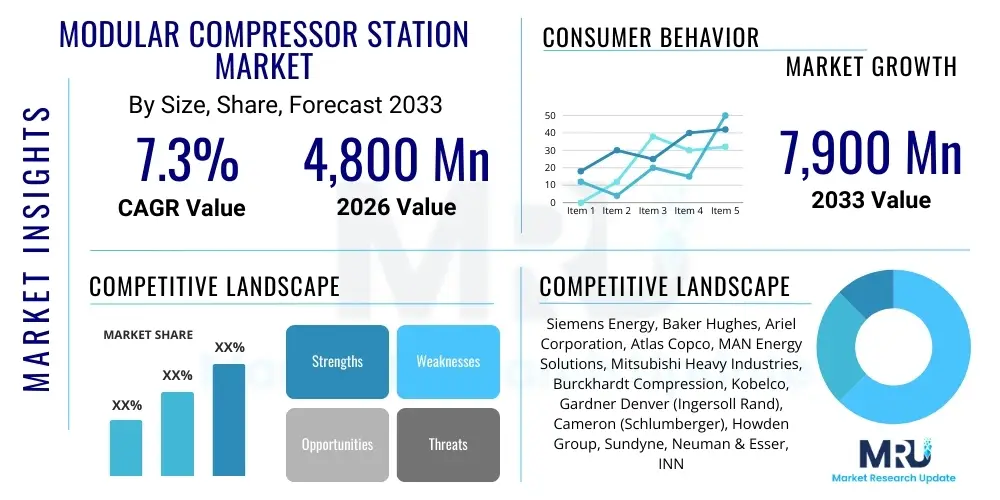

The Modular Compressor Station Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.3% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 7.9 Billion by the end of the forecast period in 2033.

Modular Compressor Station Market introduction

The Modular Compressor Station Market encompasses the design, manufacture, and deployment of integrated, packaged compressor systems delivered as pre-engineered units, ready for rapid installation and commissioning on site. These stations typically include compressors, drivers (such as electric motors or gas turbines), cooling systems, pulsation dampeners, control panels, and necessary auxiliary equipment, all mounted on a common skid or frame. The fundamental benefit of adopting modular systems lies in their standardized design, which significantly reduces lead times, minimizes construction complexity in remote locations, and offers superior flexibility for relocation or capacity expansion compared to traditional stick-built facilities. This inherent portability and ease of assembly make them highly attractive for fluctuating energy projects and fast-track developments.

Modular compressor stations are critical assets across the energy value chain, primarily serving the oil and gas sector for activities such as natural gas gathering, boosting, transmission, storage, and processing. Beyond hydrocarbons, these stations are increasingly utilized in applications involving industrial gases, including air separation units, hydrogen compression for fuel cell technology, and carbon capture utilization and storage (CCUS) projects. The modular design principle addresses contemporary industry demands for operational efficiency, reduced environmental footprint through standardized components, and enhanced safety by factory pre-testing. Furthermore, the capacity for manufacturers to customize internal components while maintaining a standard external module size allows for broad applicability across varying pressure and flow requirements.

Major driving factors fueling market expansion include the global surge in natural gas production and consumption, particularly stemming from unconventional sources like shale gas, which necessitate localized compression infrastructure. The increasing focus on decentralized energy solutions, where compression must be deployed rapidly to maintain gas pipeline integrity or support small-scale LNG facilities, further propels demand. Technological advancements, such as the integration of advanced monitoring systems and predictive maintenance capabilities, enhance the reliability and efficiency of these modular units, making them cost-effective alternatives to complex, site-specific installations, thereby reinforcing market growth throughout the forecast period.

Modular Compressor Station Market Executive Summary

The Modular Compressor Station Market is experiencing robust growth driven by strategic shifts in global energy infrastructure development toward speed and flexibility. Key business trends indicate a strong move toward standardization and digitalization, with manufacturers integrating IoT and AI-driven monitoring systems to optimize performance and reduce downtime in often remote operating environments. Mergers and acquisitions focusing on vertical integration—combining compressor manufacturing expertise with packaging and engineering services—are shaping the competitive landscape. Furthermore, sustainability mandates are prompting demand for electrically driven compression modules, reducing reliance on high-emission gas turbines and aligning the sector with broader decarbonization goals.

Regionally, North America remains the dominant market, propelled by extensive shale gas activities and necessary pipeline infrastructure modernization. However, Asia Pacific is emerging as the fastest-growing region, fueled by large-scale natural gas import terminal projects (LNG regasification) and substantial investment in petrochemical manufacturing capabilities, particularly in China and India. Europe shows stable demand, highly influenced by the necessity for gas storage facilities to ensure energy security and the concurrent deployment of pilot projects focused on hydrogen and CCUS infrastructure, where modularity is essential for initial deployment phases. The Middle East and Africa (MEA) are also experiencing moderate growth, linked to major national oil company (NOC) initiatives to monetize associated gas and expand domestic pipeline networks.

Segment trends highlight the dominance of medium-capacity stations (5,000 to 15,000 horsepower) due to their versatility in midstream gathering and boosting applications. The electric motor drive segment is rapidly gaining market share over traditional gas engines and turbines, especially in developed economies, owing to lower operational costs, simplified maintenance, and reduced environmental impact. Application-wise, the midstream sector, covering gas transmission and processing, accounts for the largest market share, though upstream applications (wellhead compression) are driving significant volume growth, given the requirement for agile deployment at new drilling sites. The convergence of hardware manufacturing with specialized engineering, procurement, and construction (EPC) services within the modularization framework is a defining characteristic of the current market structure.

AI Impact Analysis on Modular Compressor Station Market

User inquiries regarding AI's influence on the Modular Compressor Station Market predominantly focus on optimizing performance, predicting component failure, and automating operational decision-making in remote locations. Common questions revolve around the feasibility of integrating AI into legacy control systems, the effectiveness of machine learning algorithms in detecting anomalies based on vibration and pressure data, and the potential for AI to reduce operational expenditure (OPEX) by optimizing fuel consumption for gas-driven units. Users are seeking assurances on data security and interoperability standards, recognizing that AI adoption is crucial for achieving high availability and minimizing unplanned shutdowns across geographically dispersed compressor assets. The prevailing expectation is that AI will transform asset management from reactive maintenance to a highly proactive, predictive model, fundamentally changing the service and support requirements for modular stations.

AI and machine learning (ML) are set to revolutionize the efficiency and reliability of modular compressor stations by moving beyond traditional SCADA systems. Predictive analytics, utilizing vast streams of sensor data related to temperature, pressure, vibration, and flow rates, allow operators to forecast potential equipment degradation with high accuracy, enabling maintenance interventions only when necessary (condition-based maintenance). This shift maximizes run time and drastically lowers the risk of catastrophic failure, which is especially critical for stations installed in hard-to-access areas like offshore platforms or remote gas fields. Furthermore, AI-driven algorithms can continuously fine-tune compression ratios and speed settings based on real-time pipeline demand, ensuring optimal energy utilization and significant reduction in operational costs, thereby enhancing the economic viability of complex gas transportation projects.

The long-term impact of AI involves the creation of 'self-optimizing' modular stations capable of adapting to fluctuating input conditions (e.g., changes in gas composition or ambient temperature) without human intervention. This level of autonomy is vital for minimizing personnel requirements on site, improving safety, and ensuring compliance with operational parameters. AI also plays a crucial role in managing the energy mix for electrically driven stations by optimizing power consumption against grid availability or integrating seamlessly with local renewable energy sources. This technological convergence positions modular stations as highly sophisticated, resilient nodes within the broader digitalized energy grid, driving long-term investment in smart infrastructure.

- AI-driven Predictive Maintenance: Reduces unplanned downtime by forecasting equipment failure based on real-time operational data and vibration analysis.

- Optimized Performance Control: Machine learning algorithms adjust compressor parameters (speed, load) to maximize throughput and minimize energy consumption.

- Remote Monitoring and Diagnostics: Enhances operational visibility for stations in inaccessible or hazardous environments, improving decision-making speed.

- Anomaly Detection: Early identification of minor system deviations that could escalate into major failures, preserving asset integrity.

- Autonomous Operation: Enables modular stations to self-adjust to dynamic pipeline conditions and gas quality variations, reducing human interface requirements.

- Safety Enhancement: AI assists in analyzing operational patterns to identify and mitigate high-risk scenarios and adherence to process safety standards.

DRO & Impact Forces Of Modular Compressor Station Market

The Modular Compressor Station Market dynamics are shaped by a complex interplay of global energy demand, technological innovation, and regulatory pressures. The primary drivers include the escalating global demand for natural gas as a cleaner transitional fuel and the necessity to expand pipeline infrastructure rapidly, particularly in emerging markets and unconventional resource plays. Restraints largely center on the capital-intensive nature of large-scale energy projects, the inherent volatility of global commodity prices (oil and gas), and increasing geopolitical instability affecting cross-border energy investments. Opportunities are vast, primarily driven by the expanding adoption of modular systems in novel energy sectors such as hydrogen distribution and Carbon Capture, Utilization, and Storage (CCUS), leveraging the intrinsic benefits of rapid deployment and scalability. These forces collectively dictate investment cycles and regional market attractiveness, with technological advancements acting as a strong mitigating force against price volatility.

Drivers are strongly influenced by the superior economics and operational efficiency offered by modular solutions. The ability to minimize site-specific engineering and construction time (often 30-50% faster than traditional methods) significantly reduces project risk and accelerates time-to-revenue. The standardization associated with modular design facilitates easier maintenance and inventory management across fleets of units, offering operational cost advantages over the lifecycle of the asset. Furthermore, increasing environmental scrutiny is driving demand for electric motor-driven modular compressors, which provide higher energy efficiency and substantially lower localized emissions compared to gas-fired drivers, aligning with corporate ESG (Environmental, Social, and Governance) commitments and increasingly strict governmental regulations.

The impact forces within the market are predominantly shifting towards digitalization and service integration. The high initial capital expenditure (CapEx) associated with purchasing complex rotating equipment remains a restraint, but this is increasingly mitigated by advanced financing and leasing options offered by major vendors. The key opportunity lies in specialized applications, such as small-scale LNG (SSLNG) facilities, where modularity is non-negotiable for economic feasibility, and in retrofitting older pipeline infrastructure. Geopolitical risks, especially regarding long-term pipeline commitments, continue to impact large project decisions, emphasizing the need for flexible, redeployable assets, thereby favoring modular solutions. Ultimately, the market is structurally sound, supported by fundamental shifts towards decentralized, flexible, and rapidly deployable infrastructure necessary for modern energy systems.

- Drivers: Global natural gas demand growth; need for rapid deployment in unconventional oil and gas fields; cost and time efficiency of standardized modular solutions; increasing focus on decentralized energy generation.

- Restraints: Volatility in hydrocarbon commodity prices impacting investment decisions; high upfront capital cost for complex equipment; logistical challenges in transporting very large modular units to remote sites.

- Opportunities: Expansion into hydrogen and CCUS infrastructure projects; technological integration of IoT and predictive analytics; growing market for small-scale and remote LNG applications; pipeline replacement and modernization programs.

- Impact Forces: Digitalization of asset management; stringent environmental regulations favoring electric drives; supply chain optimization for standardized components; strong competitive pressure on pricing and lead times.

Segmentation Analysis

The Modular Compressor Station Market is strategically segmented based on critical operational and technical parameters, enabling targeted analysis of industry growth pockets. Primary segmentation occurs across Capacity, Drive Type, Application, and End-Use Industry, each reflecting distinct demand profiles and technological maturity levels. Capacity segmentation (Small, Medium, Large) directly correlates with the specific phase of the gas lifecycle, from wellhead compression (small) to main line transmission (large). Drive Type (Electric Motor, Gas Turbine, Gas Engine) reflects operational preferences concerning power availability, cost efficiency, and environmental mandates, with the shift towards electric drives being a critical trend.

Application segmentation categorizes market demand into Upstream (field compression, gas gathering), Midstream (transmission, boosting, storage), and Downstream (processing, refining, petrochemicals). The Midstream segment consistently holds the largest share due to the intensive capital requirements for long-distance gas transport and pipeline integrity maintenance, where consistent, high-power compression is necessary. Conversely, the Upstream sector exhibits the fastest growth due to the proliferation of smaller, localized, and often temporary installations required for maximizing recovery from unconventional wells.

Finally, the End-Use segmentation identifies key consuming sectors, predominantly Oil & Gas, followed by Power Generation, Industrial Gases, and Petrochemicals. While Oil & Gas remains the core consumer, the growth trajectory is increasingly being influenced by industrial sectors requiring specialized compression for processes like ammonia synthesis, air separation (nitrogen/oxygen), and, notably, power-to-gas applications (e.g., hydrogen production). This detailed segmentation allows manufacturers and stakeholders to align R&R efforts and market strategies with sectors demonstrating the highest expected return and long-term stability.

- By Capacity:

- Small (Up to 5,000 HP)

- Medium (5,000 HP to 15,000 HP)

- Large (Above 15,000 HP)

- By Drive Type:

- Electric Motor

- Gas Turbine

- Gas Engine

- By Application:

- Upstream (Gathering and Boosting)

- Midstream (Transmission and Storage)

- Downstream (Processing and Petrochemicals)

- By End-Use Industry:

- Oil and Gas

- Power Generation

- Industrial Gases

- Petrochemicals

Value Chain Analysis For Modular Compressor Station Market

The value chain for the Modular Compressor Station Market begins with upstream activities focused on raw material sourcing and the design and manufacturing of critical components, specifically the compressor core (centrifugal or reciprocating), the driver (motor/engine/turbine), and control systems. Key component manufacturers, often highly specialized engineering firms, supply these elements. The strength of the upstream segment is defined by technological patents, precision manufacturing capabilities, and global supply chain resilience, particularly for specialized metallurgical components designed for high-pressure, corrosive environments. Robust quality control and testing in this phase are crucial, as component integrity directly dictates the reliability and lifespan of the entire modular station.

Midstream activities involve the specialized engineering, packaging, and integration phase, often handled by Original Equipment Manufacturers (OEMs) or specialized packaging companies. This phase transforms individual components into a cohesive, skid-mounted, or modular unit, including pipework, instrumentation, auxiliary systems, and structural enclosure. The ability to offer standardized, yet customizable, packages that adhere to varying international codes and client specifications (such as API standards) is a key differentiator. Distribution channels are typically direct, involving long-term contracts between the manufacturer/packager and the end-user (e.g., pipeline operators or NOCs) or through global Engineering, Procurement, and Construction (EPC) contractors who manage large-scale infrastructure projects. Indirect channels, such as third-party leasing or rental companies focusing on smaller, flexible units, are also emerging.

The downstream segment encompasses the installation, commissioning, operations, and long-term servicing of the modular stations. Given the complexity and criticality of these assets, after-sales service, including spare parts supply, predictive maintenance contracts (often utilizing digital twinning and AI diagnostics), and rapid field support, constitutes a significant and high-margin revenue stream for OEMs. The increasing trend towards digital services—where the physical asset is bundled with performance analytics and remote monitoring—is strengthening the downstream segment. End-users prioritize total cost of ownership (TCO) and operational uptime, making reliable service support a crucial element in vendor selection and market competitiveness. The efficiency of this downstream servicing is highly dependent on effective logistics and the pre-planning inherent in the modular design.

Modular Compressor Station Market Potential Customers

Potential customers for modular compressor stations are primarily large, established entities within the global energy and industrial sectors who require high-pressure gas handling capabilities, prioritize rapid deployment, and value asset flexibility. The largest customer base resides within the midstream oil and gas sector, including national oil companies (NOCs), independent pipeline operators, and major international oil companies (IOCs) engaged in long-distance gas transmission and storage activities. These buyers seek reliable, high-capacity stations that minimize construction time and ensure pipeline integrity and flow optimization across vast geographical areas, often demanding stringent safety and performance standards like API specifications.

Beyond traditional midstream players, a growing segment of potential customers includes specialized gas processing companies and LNG facility developers, both large-scale liquefaction plants and small-scale bunker fueling stations, where modularization is critical for scalability and economic feasibility in remote or specialized maritime settings. Furthermore, industrial gas producers, such as suppliers of oxygen, nitrogen, and hydrogen, represent key buyers. These companies use modular compression for air separation units, pipeline injection, and high-pressure storage, valuing the consistent purity and reliable operation that packaged systems provide for highly sensitive chemical processes. The integration of modular stations into emerging energy infrastructure, such as hydrogen fueling networks and centralized hubs for CCUS, is also broadening the customer landscape.

An increasingly significant customer type is the upstream exploration and production (E&P) company, particularly those focusing on unconventional resources like shale gas and tight oil. These customers require flexible, easily relocatable, smaller-to-medium capacity modular units for gas gathering, field boosting, and flash gas compression to increase well productivity and comply with methane emission regulations (monetizing associated gas instead of flaring). Power generation companies, particularly those utilizing natural gas turbines and seeking highly reliable fuel supply pressure, also constitute a stable customer base. Ultimately, the purchasing decision across all segments is driven by the need for quick installation, predictable performance, and a lower total cost of ownership over the project lifecycle, which modularization inherently supports.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4,800 Million |

| Market Forecast in 2033 | USD 7,900 Million |

| Growth Rate | 7.3% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Siemens Energy, Baker Hughes, Ariel Corporation, Atlas Copco, MAN Energy Solutions, Mitsubishi Heavy Industries, Burckhardt Compression, Kobelco, Gardner Denver (Ingersoll Rand), Cameron (Schlumberger), Howden Group, Sundyne, Neuman & Esser, INNIO, Dresser-Rand, Exterran, Valerus, Universal Compression, Enerflex, CPI (Compressor Products International) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Modular Compressor Station Market Key Technology Landscape

The technological landscape of the Modular Compressor Station Market is defined by continuous innovation focused on improving efficiency, reducing emissions, and maximizing remote operational capabilities. A key technological advancement involves the design optimization of high-speed centrifugal and reciprocating compressors, utilizing advanced metallurgy and computational fluid dynamics (CFD) modeling to handle a wider range of gas compositions and varying inlet conditions with minimal energy input. Furthermore, there is a substantial trend towards standardizing the core skid design while allowing for highly customizable internal configurations. This strategy balances the cost benefits of modular mass production with the specific technical requirements of individual client projects, improving both lead times and reliability through repeated manufacturing processes.

The integration of advanced drive technologies, particularly high-efficiency variable frequency drives (VFDs) paired with electric motors, represents a significant shift. VFDs allow for precise speed control, matching the compressor output exactly to the pipeline demand, resulting in substantial energy savings compared to fixed-speed systems. For remote locations where grid power is unavailable, manufacturers are developing optimized, high-efficiency gas turbines and engines that incorporate lean-burn technology to meet stringent NOx and CO emission standards. The convergence of these advanced mechanical and electrical systems within a confined modular package requires sophisticated thermal management and vibration isolation technologies to ensure long-term operational integrity.

Digitalization forms the third critical pillar of the technology landscape. Modern modular stations are deployed as 'smart assets,' equipped with thousands of sensors (IoT) transmitting data to cloud-based platforms. Key technologies include digital twins—virtual replicas of the physical station—used for scenario planning, operational training, and predictive maintenance modeling. Cybersecurity measures are also paramount to protect the industrial control systems (ICS) embedded within the modular stations from external threats. This pervasive digitalization transforms the modular station from a piece of hardware into a high-technology service platform, significantly enhancing the value proposition for end-users seeking maximal operational uptime and minimal intervention.

Regional Highlights

- North America: North America, particularly the United States and Canada, dominates the global market share, largely due to the sustained development of extensive unconventional oil and gas resources (shale plays). The demand is characterized by high volumes of medium to large capacity stations required for pipeline transmission and storage facilities. The market is mature, highly competitive, and leads in the adoption of electric-driven modular units due to strict environmental regulations and widespread electrical grid availability in many operational areas. Rapid deployment capability remains a crucial selling point, catering to the agile drilling schedules common in the region.

- Asia Pacific (APAC): APAC is projected to exhibit the highest CAGR during the forecast period. This growth is driven by massive infrastructure expansion across China, India, and Southeast Asia, focusing on natural gas import terminals (LNG), expansive domestic pipeline networks, and rapid industrialization requiring industrial gases and petrochemical feedstocks. While capital investment is robust, the market often prioritizes cost-effectiveness alongside reliability. Emerging projects related to hydrogen and industrial decarbonization in developed APAC nations, such as Japan and South Korea, are providing new, specialized opportunities for high-pressure modular compression.

- Europe: The European market is stable but heavily focused on energy security and the energy transition. Demand is concentrated on gas storage injections/withdrawal facilities and the modernization of existing pipeline infrastructure, particularly leveraging compression modules for higher efficiency. The market is a leader in adopting modular solutions for nascent CCUS projects and hydrogen backbone infrastructure (e.g., blending and pure H2 transmission), driven by stringent EU decarbonization mandates. The preference is overwhelmingly toward electric-driven, highly efficient, and compact modules suitable for integration into existing, often densely populated, industrial landscapes.

- Middle East and Africa (MEA): Growth in MEA is tied to major state-led initiatives to increase gas monetization, expand domestic power generation using natural gas, and boost export capabilities (LNG). National oil companies are primary buyers, requiring robust, high-specification modular stations capable of operating reliably under extreme climatic conditions (high heat, sand/dust). The modular concept is particularly appealing in this region due to the need for rapid setup in remote desert locations, often reducing reliance on scarce local skilled construction labor. Investment in gas gathering facilities to reduce flaring also fuels demand for smaller modular units.

- Latin America: This region presents moderate growth, primarily centered on Brazil, Argentina, and Mexico. Development is largely focused on deep-water natural gas production and expanding domestic distribution networks. Economic instability and fluctuating government policies pose challenges, making the rapid, lower-risk deployment of modular stations highly attractive. Key drivers include pipeline expansion to connect new resource discoveries (e.g., Argentina’s Vaca Muerta shale) to coastal processing centers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Modular Compressor Station Market.- Siemens Energy

- Baker Hughes

- Ariel Corporation

- Atlas Copco

- MAN Energy Solutions

- Mitsubishi Heavy Industries

- Burckhardt Compression

- Kobelco Compressors America, Inc.

- Gardner Denver (Ingersoll Rand)

- Cameron (Schlumberger)

- Howden Group

- Sundyne

- Neuman & Esser

- INNIO (Waukesha/Jenbacher)

- Exterran

- Valerus

- Enerflex Ltd.

- Universal Compression

- Dresser-Rand (now part of Siemens Energy)

- CPI (Compressor Products International)

Frequently Asked Questions

Analyze common user questions about the Modular Compressor Station market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the adoption of modular compressor stations over conventional stick-built solutions?

The primary driver is the significant reduction in project lead time and installation complexity. Modular stations are factory-tested and ready for rapid deployment, typically reducing commissioning time by 30% to 50% compared to traditional on-site construction, which accelerates time-to-revenue for energy projects.

How do technological advancements like AI and IoT affect the total cost of ownership (TCO) for modular stations?

AI and IoT technologies, through predictive maintenance and remote performance optimization, significantly reduce operating expenditure (OPEX) by minimizing unplanned downtime, extending maintenance intervals, and ensuring optimal energy usage, thereby lowering the overall TCO despite the initial investment in smart systems.

Which drive type segment is experiencing the fastest growth in the modular compressor market?

The Electric Motor drive segment is showing the fastest growth, particularly in developed regions. This shift is driven by stringent environmental regulations, the superior energy efficiency of VFD-driven systems, lower maintenance requirements, and the necessity to meet corporate decarbonization goals (ESG compliance).

In which region is the demand for large-capacity modular compressor stations most concentrated?

Demand for large-capacity modular stations (above 15,000 HP) is most concentrated in the North American midstream sector, driven by extensive high-pressure gas transmission pipeline networks and major centralized storage facilities requiring robust, high-throughput compression capabilities.

Are modular compressor stations suitable for new energy applications such as hydrogen compression and Carbon Capture (CCUS)?

Yes, modular compressor stations are highly suitable and increasingly utilized for hydrogen and CCUS projects. Their inherent scalability, quick deployment cycle, and adaptability to specific pressure requirements make them ideal for piloting new technologies and expanding initial low-volume CCUS or hydrogen backbone infrastructure.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager