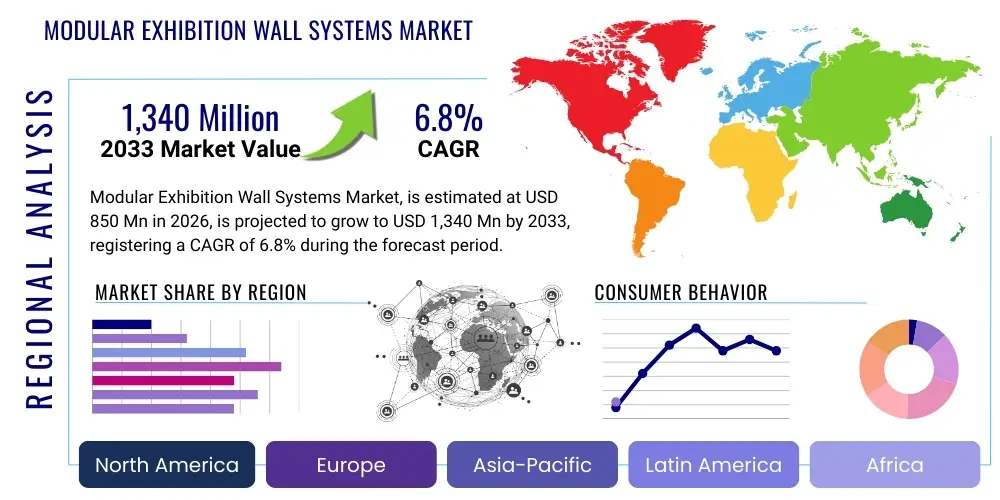

Modular Exhibition Wall Systems Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437571 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Modular Exhibition Wall Systems Market Size

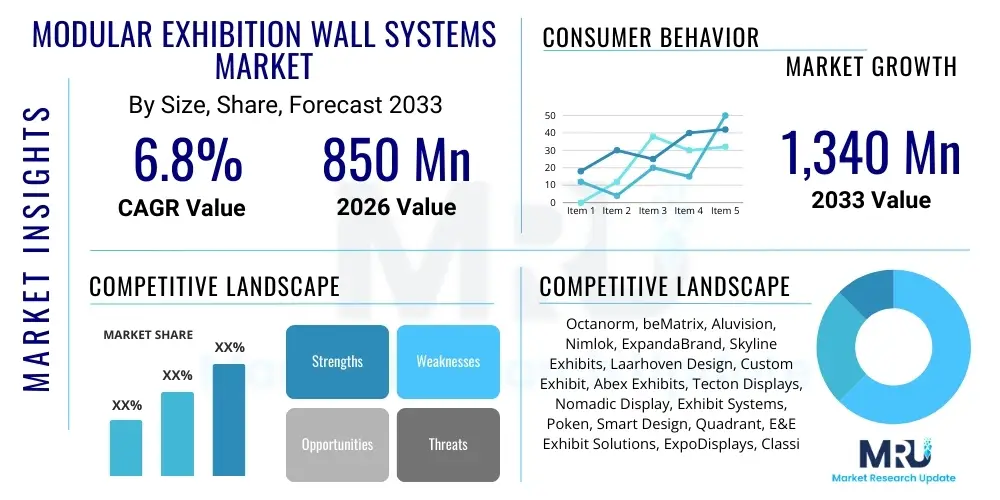

The Modular Exhibition Wall Systems Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $850 Million USD in 2026 and is projected to reach $1,340 Million USD by the end of the forecast period in 2033.

Modular Exhibition Wall Systems Market introduction

The Modular Exhibition Wall Systems Market encompasses the design, manufacture, and deployment of reusable, flexible, and often tool-free wall structures used primarily in trade shows, corporate events, and temporary displays. These systems replace traditional, custom-built stands with components that can be quickly assembled, reconfigured, and transported, offering significant cost savings and environmental benefits over their lifecycle. The inherent versatility of these systems allows exhibitors to rapidly adapt their display layout to different venue sizes and brand messaging requirements, making them an indispensable asset for dynamic marketing strategies globally. Key offerings range from lightweight aluminum frame systems to advanced composite panels that integrate digital displays and lighting technology.

Product descriptions typically emphasize ease of use, durability, and aesthetic appeal. Modern modular systems often incorporate advanced features such as integrated cable management, magnetic graphic mounting, and structural stability suitable for multi-story booth designs, aligning with the rising sophistication of exhibition architecture. These systems are designed to maximize brand visibility while adhering to strict safety and assembly regulations found in major international convention centers. The shift towards sustainable business practices further accelerates adoption, as modular components drastically reduce construction waste compared to single-use custom builds.

Major applications of modular wall systems span high-profile international trade fairs (e.g., Hannover Messe, CES), smaller regional corporate roadshows, museum exhibits requiring flexible layouts, and large-format retail promotional displays. The primary benefits driving market growth include enhanced flexibility in design, substantial long-term cost reduction through reusability, minimized logistics complexity, and a demonstrably reduced environmental footprint. Additionally, the driving factors include the rapid rebound of the global MICE (Meetings, Incentives, Conventions, and Exhibitions) industry following pandemic disruptions, combined with increasing exhibitor demand for high-impact, technologically integrated, yet sustainable booth solutions.

Modular Exhibition Wall Systems Market Executive Summary

The Modular Exhibition Wall Systems Market is positioned for robust expansion, driven primarily by favorable business trends emphasizing efficiency and sustainability in global marketing budgets. Post-pandemic recovery has seen a surge in physical events, compelling companies to invest in versatile, long-term exhibit assets rather than costly disposable structures. A key business trend involves the rapid integration of digital technology—such as large-format LED screens and interactive touchpoints—directly into the structural components of modular walls, transforming passive displays into immersive experiences. Furthermore, supply chain stabilization and advancements in lightweight material manufacturing have improved product availability and reduced assembly times, enhancing the overall value proposition for exhibitors seeking rapid global deployment.

Regional trends highlight significant growth divergence and maturity levels. North America and Europe maintain high market maturity, characterized by strong demand for sophisticated, custom-look modular solutions and a strict adherence to sustainability standards, often prioritizing recycled or low-impact materials. Conversely, the Asia Pacific (APAC) region is emerging as the fastest-growing market globally, fueled by rapid industrialization, increasing participation in international trade, and substantial government investment in convention center infrastructure across major economies like China, India, and Southeast Asia. This APAC growth is largely concentrated in high-volume, cost-effective standard modular systems, although demand for premium, digitally enhanced configurations is quickly catching up.

Segment trends underscore the dominance of aluminum-based systems due to their unparalleled strength-to-weight ratio, ease of recycling, and compatibility with diverse graphic materials. While aluminum remains the structural backbone, the fastest growing segment pertains to composite and hybrid materials, which offer enhanced lightweight properties and improved resistance to wear and tear, critical for frequent reassembly and transport. Trend analysis also indicates a growing preference among end-users for full-service providers who offer design consultation, fabrication, logistics, and on-site assembly/disassembly, migrating the market towards integrated service offerings rather than mere product sales. The corporate events segment is showing exceptional growth, utilizing modular walls for internal meetings and training setups outside the traditional trade show environment.

AI Impact Analysis on Modular Exhibition Wall Systems Market

User inquiries regarding the role of Artificial Intelligence (AI) in the Modular Exhibition Wall Systems Market frequently center on automation, personalization, and operational efficiency. Common questions address how AI can optimize booth layout design for maximum visitor flow, whether predictive algorithms can forecast material requirements for global event calendars, and how AI-powered analytics can gauge visitor engagement at the physical booth. The core expectations revolve around reducing human intervention in complex design processes, enhancing the relevance of physical exhibits through personalized content delivery, and leveraging data generated at events to improve future marketing strategies. Users are keen to understand the shift from static, human-designed displays to dynamically managed, data-driven exhibition environments.

AI's influence is transforming the pre-event design phase and the during-event operational dynamics. AI-driven generative design tools can quickly produce hundreds of optimal modular configurations based on input parameters such as venue size, budget, specific product display requirements, and desired sightlines. This significantly reduces design lead times and ensures structural integrity while maximizing aesthetic impact, resolving complex spatial limitations that traditional CAD methods handle slowly. Furthermore, AI assists in optimizing logistics planning, predicting the necessary spare parts inventory, and scheduling the transport routes for modular components across global event sites, minimizing shipping costs and delays.

During the exhibition, AI impacts visitor interaction profoundly. Integrated sensors and computer vision technologies within modular walls track real-time visitor behavior, analyzing gaze patterns, dwelling time, and traffic flow. This data informs on-the-fly content adjustments—for instance, changing the video displayed on an integrated wall screen based on the profile of the approaching visitor, thus creating a hyper-personalized experience. Concerns often focus on data privacy and the integration cost, but the consensus points towards AI becoming indispensable for exhibitors seeking measurable ROI from their physical marketing efforts, driving the market toward 'Smart Booth' solutions.

- AI-Powered Generative Design: Automated optimization of modular layouts for structural stability and visitor flow efficiency.

- Predictive Logistics: Utilizing machine learning to forecast material needs, optimize component warehousing, and reduce global shipping costs.

- Real-Time Content Personalization: AI analytics driving integrated digital screens to deliver tailored content based on immediate visitor demographics and engagement metrics.

- Visitor Behavior Analysis: Computer vision embedded in systems to track traffic patterns, heatmaps, and measure physical interaction effectiveness.

- Maintenance Forecasting: Predictive models determining component wear and tear, signaling necessary replacements before structural failure occurs.

DRO & Impact Forces Of Modular Exhibition Wall Systems Market

The Modular Exhibition Wall Systems Market is shaped by a confluence of influential factors: robust drivers emphasizing cost-efficiency and environmental responsibility; restraints primarily related to standardization and high initial investment; and powerful opportunities leveraging technological convergence. The primary driving force is the imperative for sustainability, as corporate mandates increasingly require reducing waste, making the reusable nature of modular systems highly attractive. Simultaneously, the inherent flexibility to reconfigure and adapt systems for various events allows companies to maximize asset utilization, serving as a strong economic driver. These forces interact powerfully, pushing the industry towards lighter, more durable, and aesthetically appealing material science innovations.

However, the market faces significant restraints. The initial capital outlay for a high-quality, comprehensive modular system can be substantially higher than a single-use custom stand, creating a barrier to entry for smaller enterprises or those with limited long-term exhibition schedules. Furthermore, a lack of universal standardization across different manufacturers’ proprietary systems presents interoperability challenges; components from one vendor often cannot easily integrate with another’s, limiting end-user flexibility and promoting vendor lock-in. Overcoming these restraints requires industry-wide collaboration on open standards and the development of flexible financing models that emphasize total cost of ownership (TCO) over initial price.

Opportunities for exponential growth are concentrated in the integration of smart technologies and the penetration into non-traditional exhibition settings. The emergence of 'Smart Booths'—where modular walls function as carriers for IoT sensors, augmented reality (AR) interfaces, and seamless digital displays—creates substantial added value. Another key opportunity lies in expanding the application scope beyond trade shows to include permanent installations in corporate lobbies, experiential retail pop-ups, and educational institutions requiring highly adaptable display infrastructure. These opportunities, coupled with the driving need for sustainable marketing solutions, collectively represent the dominant impact forces steering the market’s trajectory towards higher technology integration and broader application diversity.

Segmentation Analysis

The Modular Exhibition Wall Systems Market is systematically segmented based on material composition, configuration type, primary application, and the end-user profile, allowing for a granular understanding of demand dynamics and supply specialties. Material segmentation is crucial as it dictates the system's weight, durability, and cost profile, with aluminum frames dominating due to their optimal balance of strength and reusability. Configuration type reflects the structural flexibility offered, ranging from simple, straight wall panels suitable for inline booths to complex, curved, and multi-story custom designs required for premium island spaces. Analyzing these segments helps manufacturers tailor their production strategies and sales channels to specific market needs, whether focusing on high-volume standard units or specialized bespoke installations.

Application segmentation clarifies where the highest demand originates, distinguishing between core trade show environments and emerging uses like corporate internal events and retail activation spaces. The requirements for these applications vary significantly; trade shows prioritize rapid setup and dismantling, while corporate events might prioritize high-end aesthetics and sound dampening. End-user segmentation identifies the primary purchaser, recognizing that dedicated exhibition organizing companies often procure systems on a rental basis, whereas major global brands invest in permanent ownership for continuous, uniform deployment across all their global marketing initiatives. This multi-layered segmentation is vital for accurate market forecasting and strategic pricing across the diverse product spectrum.

- By Material:

- Aluminum Frame Systems (Dominant Segment)

- Wood/Timber Systems (Niche, High-End Aesthetics)

- Plastic/Composite Systems (Lightweight and Budget-Focused)

- Hybrid Systems (Combining metal frames with composite infills)

- By Configuration:

- Standard Straight Walls

- Curved Walls and Geometric Shapes

- Custom and Multi-Story Configurations

- Pop-up and Fabric Tension Systems

- By Application:

- Trade Shows and Conventions (Largest Segment)

- Corporate Events and Roadshows

- Retail Display and Pop-up Stores

- Museums and Educational Exhibits

- By End-User:

- Exhibition Organizers and Rental Companies

- Direct Brands/Corporate Exhibitors (e.g., Technology, Automotive, Pharma)

- Government and Non-Profit Organizations

- Exhibit Design and Fabrication Houses

Value Chain Analysis For Modular Exhibition Wall Systems Market

The value chain for Modular Exhibition Wall Systems begins with the upstream suppliers of raw materials, primarily aluminum extrusions, wood composites (MDF, plywood), and various plastics/polymers used for panel infills and connectors. Quality control and the sourcing of sustainable materials at this stage are critical, especially given the market’s strong environmental focus. Key upstream drivers include volatility in global aluminum prices and the cost of specialized lightweight composites. Effective management of these inputs directly influences the final cost structure and manufacturing efficiency downstream. Strong partnerships with high-tolerance aluminum extruders are essential for manufacturers to ensure the precision necessary for rapid, tool-free assembly.

The core manufacturing stage involves specialized fabrication, where raw materials are processed into proprietary components, including interlocking frames, structural connectors, graphic mounting systems, and integrating power and lighting modules. Many leading modular system manufacturers operate highly automated facilities to ensure dimensional accuracy and scale production efficiently. Distribution channels are typically a mix of direct sales to large corporate clients (for owned assets) and indirect channels through a robust network of authorized distributors, exhibit houses, and rental agencies. These agencies provide crucial local services, including storage, logistics, setup/dismantle crews, and temporary graphics printing, effectively extending the manufacturer’s reach globally.

Downstream activities center on end-user deployment. The direct channel bypasses intermediaries when major multinational corporations purchase systems for their own use, demanding high levels of customization and global support. The indirect channel, facilitated by rental partners and exhibit management firms, dominates the market volume, providing flexibility for companies that exhibit infrequently or require different configurations across various regions. The rental segment is vital for market penetration, as it lowers the barrier to entry for small and medium-sized enterprises (SMEs). Customer satisfaction relies heavily on the quality of installation services and the ability of the system to hold up to rigorous, frequent reassembly and transport cycles.

Modular Exhibition Wall Systems Market Potential Customers

Potential customers for Modular Exhibition Wall Systems span a diverse range of industries and organizational scales, all united by the need for flexible, professional, and repeatable display infrastructure. The primary group comprises Global Brands and Fortune 500 companies, particularly those in high-exhibiting sectors such as technology (IT, software, hardware), automotive, pharmaceuticals, and manufacturing. These corporate end-users seek to purchase systems outright to ensure brand consistency across international events, focusing on sophisticated, custom-look modular solutions that integrate cutting-edge digital technology and sustainable material certifications. The buying decision is often centralized within corporate marketing departments or specialized exhibition management teams.

A second major customer base includes specialized Exhibit Design Houses and Professional Event Management Agencies. These entities act as intermediaries, purchasing or renting systems from manufacturers and customizing them for their diverse portfolio of clients. They value systems that are easy to customize, quick to install, and durable enough to withstand continuous rotation across various clients and venues. Their purchase criteria focus heavily on logistical efficiency, modularity, and strong after-sales support from the manufacturer, as their reputation relies on flawless execution.

Finally, Exhibition Organizers and Convention Centers represent another critical segment, often purchasing standard modular systems to serve as basic shell schemes or dividing walls within their venues. Additionally, institutions like large museums, universities, and government agencies that host numerous temporary displays or educational exhibits are significant customers, valuing the cost-effectiveness, quick change-out capability, and long lifecycle offered by high-quality modular wall systems compared to traditional permanent installations.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $850 Million USD |

| Market Forecast in 2033 | $1,340 Million USD |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Octanorm, beMatrix, Aluvision, Nimlok, ExpandaBrand, Skyline Exhibits, Laarhoven Design, Custom Exhibit, Abex Exhibits, Tecton Displays, Nomadic Display, Exhibit Systems, Poken, Smart Design, Quadrant, E&E Exhibit Solutions, ExpoDisplays, Classic Exhibits, Featherlite Exhibitions, Moss Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Modular Exhibition Wall Systems Market Key Technology Landscape

The technological evolution of Modular Exhibition Wall Systems is centered on maximizing structural efficiency, simplifying assembly processes, and seamlessly integrating digital media. A crucial development is the adoption of advanced, lightweight composite materials, often coupled with high-grade, precision-engineered aluminum alloys. These materials reduce the overall weight of the system, lowering transportation costs and simplifying on-site handling, a critical factor for global exhibitors. Furthermore, technological advancements in frame connector systems, such as magnetic locks, quick-release mechanisms, and tool-less assembly joints, have dramatically reduced the time and specialized labor required for installation, aligning with the industry demand for faster turnaround times and lower logistical complexity.

Another significant technological shift involves the integration of high-resolution digital media directly into the wall architecture. Modular frames are increasingly designed with integrated channels and internal wiring pathways to accommodate large LED video walls, interactive touchscreens, and ambient smart lighting systems without visible external cables. This capability transforms a simple wall structure into a dynamic, engaging display surface. Technologies such as tension fabric graphics, which provide a seamless, high-definition visual aesthetic and are easily collapsible for transport, continue to gain popularity, often replacing traditional rigid graphic panels due to their superior portability and ease of replacement.

Future technology trends point toward the implementation of Internet of Things (IoT) sensors and Augmented Reality (AR) capabilities embedded within the modular structures. IoT sensors can monitor environmental factors (temperature, light, proximity) or track engagement, feeding data back to event organizers. AR integration allows walls to serve as markers for digital overlays visible through mobile devices, enriching the physical display with layered digital content. The combination of precision engineering (materials and locks) and sophisticated digital integration defines the competitive edge in the contemporary Modular Exhibition Wall Systems Market, driving manufacturers to continuously innovate product design for plug-and-play functionality.

Regional Highlights

Regional dynamics play a vital role in shaping the demand for Modular Exhibition Wall Systems, reflecting differences in economic maturity, trade activity, and regulatory environment regarding event sustainability.

- North America (NA): Characterized by a mature market with high technological adoption. Exhibitors in the US and Canada demand premium, highly customized modular solutions that provide the look and feel of traditional custom builds but with the benefits of reusability. The region leads in the integration of smart technology, including large-scale digital screens and advanced AV systems into modular frames. The high volume of large-scale international trade shows, particularly in sectors like tech (CES) and energy, sustains robust demand.

- Europe: This region is strongly influenced by stringent environmental and sustainability mandates, making modular systems a primary choice due to their reduced waste footprint. European markets, especially Germany and the UK, prioritize systems made from recycled content and those offering clear lifecycle assessments. Demand is high for aesthetically refined designs that adhere to strict fire safety and structural integrity standards, positioning Europe as a key driver for innovative, sustainable material science in the exhibition sector.

- Asia Pacific (APAC): APAC represents the fastest-growing market globally, driven by substantial investment in new convention centers, rapid economic expansion, and the increasing globalization of regional companies. While price sensitivity remains a factor, leading to strong demand for economical, standard modular solutions, emerging economies are quickly upgrading their preferences to incorporate digital and high-impact custom modular designs. China and India are particularly dynamic, reflecting accelerating trade activities and regional marketing roadshows.

- Latin America (LATAM): Growth in LATAM is steady, primarily concentrated in major economies like Brazil and Mexico. The market is moderately mature, with demand leaning toward cost-effective, durable systems. Logistics complexity in the region often favors lighter, easily transportable modular units.

- Middle East and Africa (MEA): Driven largely by global hubs like the UAE (Dubai) and Qatar, the MEA region sees high demand for high-end, luxury modular systems catering to major international events (e.g., Expo events). Investment in exhibition infrastructure is substantial, leading to preference for robust, visually impressive structures capable of handling high-foot traffic and frequent international travel.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Modular Exhibition Wall Systems Market.- Octanorm

- beMatrix

- Aluvision

- Nimlok (part of the PICO Group)

- Skyline Exhibits

- ExpandaBrand

- Laarhoven Design

- Nomadic Display

- Custom Exhibit

- Abex Exhibits

- Tecton Displays

- Exhibit Systems

- Poken (Focusing on smart booth technology integration)

- Smart Design Expo

- Quadrant

- E&E Exhibit Solutions

- ExpoDisplays

- Classic Exhibits

- Featherlite Exhibitions

- Moss Inc.

Frequently Asked Questions

Analyze common user questions about the Modular Exhibition Wall Systems market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary cost advantages of using modular wall systems over traditional custom-built exhibits?

The primary cost advantage stems from reusability and reduced logistics. While initial investment is higher, modular systems offer a significantly lower total cost of ownership (TCO) by eliminating recurring costs for design, construction, material disposal, and substantially lowering shipping and labor expenses across multiple events due to their lightweight nature and rapid assembly.

How do modular exhibition systems contribute to corporate sustainability goals?

Modular systems are highly sustainable because they minimize waste. Unlike traditional stands that are often built and demolished after a single use, modular components are designed for repeated use and reconfigurability over many years. Furthermore, leading systems utilize recyclable materials like aluminum and tension fabric, supporting ISO 20121 standards and minimizing environmental impact.

Can modular wall systems support integrated digital media and smart technology?

Yes. Modern modular systems are engineered specifically to accommodate digital integration. They feature internal channeling for concealed wiring, robust frame structures to mount large LED video walls and touchscreens, and increasingly incorporate built-in IoT sensors for tracking visitor engagement and enabling augmented reality (AR) experiences.

Which regions are driving the fastest growth in the modular exhibition market?

The Asia Pacific (APAC) region, particularly driven by economies such as China and India, is projected to experience the fastest growth. This acceleration is due to increasing participation in global trade, significant government and private sector investment in convention infrastructure, and the growing demand for cost-effective, high-impact marketing tools.

What are the key technical differences between aluminum and composite modular systems?

Aluminum systems offer superior structural strength, durability, and complete recyclability, making them the industry standard for frequent, heavy use. Composite systems (often plastic or specialized foam cores) are substantially lighter, reducing freight costs further, and are often used in specialized applications where weight is the critical constraint, sometimes compromising slight rigidity compared to their metal counterparts.

How scalable and customizable are modular wall systems for different event sizes?

Modular systems are highly scalable, enabling seamless configuration changes from small 10x10 inline booths to massive, multi-level island displays. Customization is achieved not just through structural layout but primarily through easily interchangeable graphic skins (tension fabric or rigid panels), allowing the same core hardware to project completely different branding themes rapidly.

Do modular wall systems require specialized labor for assembly and dismantling?

Modern, high-quality modular systems, especially those utilizing advanced tool-less connection mechanisms (such as quick-lock or magnetic systems), significantly reduce the need for specialized carpentry or rigging labor. They are often designed for assembly by standard exhibition crew staff or even internal corporate marketing teams, dramatically cutting down on labor costs and setup time.

What role does 3D modeling and visualization play in the sales process of modular systems?

3D modeling and virtual reality (VR) visualization are essential sales tools. They allow potential customers to see the final, custom configuration of their modular booth system in the actual venue space before fabrication begins, ensuring accurate design, material fit, and client satisfaction, thereby minimizing expensive post-production modifications.

Are there specific certifications or standards required for modular systems in international markets?

Yes, compliance is crucial. International markets require adherence to fire safety regulations (e.g., Class A fire ratings), structural engineering certifications (especially for multi-story builds), and often sustainability standards (like LEED or ISO 20121). Leading manufacturers ensure their products meet these specific requirements for major global convention centers in Europe, North America, and the Middle East.

How does the rental market segment influence the overall growth of modular systems?

The rental market is a significant growth driver, making high-quality modular systems accessible to SMEs and companies with infrequent exhibition schedules, reducing the capital barrier to entry. Rental providers continually invest in the latest modular technologies, thereby keeping system usage high and demonstrating the system's flexibility and reliability to a broader potential customer base.

What is the expected lifespan or durability of an average modular exhibition system?

A high-quality, aluminum-based modular system is typically engineered for a lifespan exceeding 10 years and capable of enduring 50 to 100 cycles of assembly, transport, and disassembly. Durability is maintained through precision manufacturing, reinforced connection points, and the use of robust, scratch-resistant surface materials.

How are modular walls adapted for different types of event graphics, such as fabric versus rigid panels?

Modular frames are versatile and support both options. Fabric tension graphics are popular due to their lightweight nature, seamless appearance, and ease of storage, fitting into specialized channels within the frame. Rigid panels (like PVC or composite boards) are typically mounted using specialized clip or magnetic systems, offering high durability and supporting heavier integrated elements.

What impact has the trend toward experiential marketing had on modular design?

Experiential marketing demands modular designs that can incorporate complex features like integrated video floors, soundproof meeting rooms, and immersive projection surfaces. Modern modular systems have adapted by becoming stronger and more flexible, allowing designers to create multi-sensory environments that facilitate deep visitor engagement rather than just passive viewing.

Are there significant security challenges associated with integrated digital systems in modular walls?

Security challenges primarily involve protecting the networked content and interactive platforms embedded in the display. Manufacturers address this by providing secure internal wiring pathways, locking mechanisms for technology modules, and offering specialized IT support to ensure data security and platform integrity during the event lifecycle.

How does the rise of hybrid events (physical and virtual) affect demand for physical modular systems?

Hybrid events increase the importance of high-quality physical displays. The modular wall system often serves as the professional backdrop for live streaming and broadcasting of event content, requiring excellent lighting integration, clean aesthetics, and stable structures to ensure a professional digital presence for the virtual audience.

What are the challenges related to standardization and interoperability across different modular brands?

The main challenge is vendor lock-in; most modular systems rely on proprietary connection mechanisms, meaning components from Octanorm usually cannot interface directly with those from beMatrix or Aluvision. This lack of universal interoperability limits exhibitor flexibility and encourages organizations to commit to a single supplier for their core inventory.

How crucial is supply chain efficiency for the global deployment of modular systems?

Supply chain efficiency is paramount. Exhibitors require their systems to be deployed accurately and on time across multiple international events. Manufacturers with robust global logistics networks, standardized packaging solutions, and centralized digital asset management tools hold a significant competitive advantage in fulfilling demanding international exhibition calendars.

What defines the 'custom-look' aesthetic achieved by advanced modular systems?

The 'custom-look' is achieved through seamless graphic integration (eliminating visible seams and joints), complex geometric configurations (curved walls, cantilevered elements), high-quality surface finishes (e.g., high-gloss laminates, wood veneers), and sophisticated, integrated lighting that hides the underlying modular framework structure.

How are new quick-connect technologies changing the labor requirements for installation?

New quick-connect and magnetic locking systems minimize the use of tools, reducing assembly time by up to 40% compared to older systems. This shift allows for smaller, less skilled installation crews, resulting in substantial savings on event labor costs and mitigating risks associated with union labor restrictions in some major exhibition venues.

What influence does the automotive sector have on demand for modular wall systems?

The automotive sector is a key demand driver, particularly for large, impactful displays at major auto shows. They require modular systems capable of supporting heavy loads (e.g., car platforms), integrating high-definition video walls for reveals, and maintaining a high-end, polished aesthetic across frequent international venue changes.

How does modular design address booth lighting and electrical needs efficiently?

Modular systems incorporate built-in electrical conduits and channels that run discreetly within the frames, allowing for professional integration of spotlights, LED strips, and power outlets without visible external wiring. Many systems offer low-voltage LED lighting solutions that are energy-efficient and easy to attach using proprietary magnetic or clip connectors.

What is the market outlook for wood-based modular systems compared to metal systems?

Wood-based systems hold a smaller, niche segment, favored for their premium aesthetic and warmth, particularly in lifestyle, furniture, or luxury goods exhibitions. However, aluminum systems dominate the overall market due to superior durability, lighter weight, better fire ratings, and greater structural versatility for large-scale, multi-story applications.

How are manufacturers adapting modular systems for outdoor or semi-permanent use?

For outdoor or semi-permanent applications (like retail kiosks or temporary showrooms), manufacturers use materials treated for UV resistance and weatherproofing. Frames are often reinforced with specialized ballast systems or anchoring mechanisms to withstand wind loads and external environmental factors, ensuring safety and longevity outside traditional convention halls.

What role do third-party exhibit houses play in maximizing the lifecycle of modular walls?

Third-party exhibit houses maximize the lifecycle by managing storage, maintenance, repair, and re-graphic production. They handle the complex logistics of inventory tracking and ensuring components are clean, undamaged, and ready for the next event cycle, effectively preserving the client's asset value over many years.

How has the rise of virtual reality (VR) and augmented reality (AR) influenced modular booth design?

VR/AR requires physical spaces that act as anchor points for digital experiences. Modular walls provide the robust, clean surfaces needed to mount VR headsets and displays, while also serving as tracking markers for AR overlays, blending the physical environment seamlessly with interactive digital content to draw attendees deeper into the product story.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager