Modular Green Wall Systems Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432237 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Modular Green Wall Systems Market Size

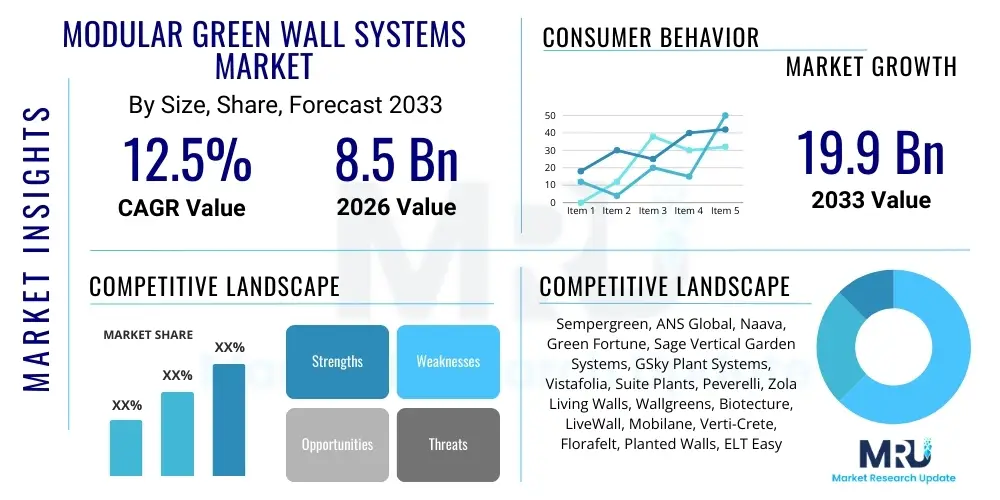

The Modular Green Wall Systems Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at USD 8.5 Billion in 2026 and is projected to reach USD 19.9 Billion by the end of the forecast period in 2033.

Modular Green Wall Systems Market introduction

Modular Green Wall Systems, often referred to as vertical gardens or living walls, represent an innovative intersection of architecture, horticulture, and sustainable urban development. These systems utilize standardized, interlocking modules or panels to create vertical facades populated with living plants, integrated within both indoor and outdoor environments. The primary function extends beyond aesthetic enhancement to critical environmental benefits, including improved air quality, enhanced building insulation, reduction of urban heat island effects, and promotion of biodiversity in dense urban settings. The standardized, modular design is a key differentiator, facilitating ease of installation, maintenance, scalability, and repair, making them highly attractive for large-scale commercial, institutional, and infrastructure projects seeking LEED certification or superior environmental performance.

The core product offering encompasses various technologies, primarily categorized into substrate-based systems, which rely on soil or mineral wool within the modules, and hydroponic systems, which circulate nutrient solutions without soil. Major applications span the commercial real estate sector, including corporate offices, retail complexes, and high-end hospitality venues, where biophilic design is leveraged to improve occupant well-being and market differentiation. Furthermore, governmental initiatives promoting green infrastructure, coupled with consumer demand for sustainable building practices, are significantly driving the adoption rate. The flexibility inherent in modular systems allows for rapid customization regarding plant selection, irrigation requirements, and architectural integration, addressing the diverse needs of modern construction projects globally.

The market growth is intrinsically linked to global trends in smart city development and sustainable construction goals. Key driving factors include stringent governmental mandates regarding energy efficiency in buildings, increasing awareness among corporate entities about the positive psychological impact of green spaces on employees, and technological advancements in automated irrigation and monitoring systems that reduce operational complexity. The benefits derived from these systems—such as thermal regulation, noise dampening, and rainwater management—establish them as essential components of high-performance buildings, securing their position as a high-growth segment within the broader construction and landscaping industries.

- Product Description: Standardized, stackable panels or units embedded with growing media and automated irrigation capabilities, designed to support living vegetation on vertical surfaces.

- Major Applications: Commercial office buildings, residential high-rises, retail centers, hotels, public infrastructure (e.g., airports, transport hubs), and educational institutions.

- Key Benefits: Improved air quality (VOC absorption), aesthetic enhancement, reduced energy consumption via insulation, noise reduction, and urban biodiversity support.

- Driving Factors: Rapid urbanization, growing focus on biophilic design principles, favorable green building regulations, and innovation in irrigation and structural materials.

Modular Green Wall Systems Market Executive Summary

The Modular Green Wall Systems market is exhibiting robust expansion, fueled by global imperatives toward sustainable infrastructure and heightened corporate investment in environmental, social, and governance (ESG) criteria. Business trends indicate a strong shift towards highly integrated, smart wall systems that incorporate Internet of Things (IoT) sensors for precise water and nutrient delivery, minimizing resource waste and optimizing plant health. Key manufacturers are focusing on material science innovations, particularly utilizing recycled or bio-based polymers for module construction to enhance the system's overall sustainability profile. Furthermore, strategic partnerships between manufacturers, architects, and facilities management companies are becoming crucial to streamline the design, installation, and long-term maintenance processes for large-scale projects, thereby boosting market accessibility and reliability.

Regionally, North America and Europe currently dominate the market due to early adoption of green building standards (such as LEED and BREEAM) and supportive government subsidies for energy-efficient renovations. However, the Asia Pacific (APAC) region is forecasted to demonstrate the fastest growth rate, driven primarily by rapid urbanization, substantial investment in mega-city projects, and increasing public health concerns regarding air quality in densely populated urban centers like Shanghai, Delhi, and Tokyo. Latin America and the Middle East and Africa (MEA) are emerging markets, capitalizing on tourism-related infrastructure development and the need for climate-resilient building technologies that address extreme heat and water scarcity challenges, often through closed-loop irrigation systems integral to modular walls.

Segment-wise, the Hydroponic Systems subsegment holds a significant market share due to its efficiency in water use and lighter weight compared to traditional soil-based systems, making it highly preferred for large structural integrations. Commercial applications, particularly the office and hospitality sectors, remain the largest end-user segment, utilizing green walls as premium architectural features that enhance brand image and occupant experience. Future segment growth is expected to concentrate on advanced frame materials, such as lightweight, reinforced metal alloys and high-density recycled plastics, offering superior durability and reduced installation complexity. The convergence of hardware modularity and smart monitoring software represents the most compelling segment trend influencing market valuation over the forecast period.

- Business Trends: Increased adoption of IoT-enabled smart irrigation, focus on closed-loop water systems, rise of prefabricated and plug-and-play installation models, and vertical integration across the supply chain.

- Regional Trends: Dominance of North America and Europe driven by established regulations; exponential growth anticipated in APAC due to urbanization; increasing adoption in MEA targeting thermal regulation and aesthetic luxury.

- Segments Trends: Shift towards hydroponic technologies for efficiency; commercial sector maintaining leadership in demand; growing preference for durable, sustainable frame materials like recycled composites.

AI Impact Analysis on Modular Green Wall Systems Market

User inquiries regarding the influence of Artificial Intelligence (AI) on Modular Green Wall Systems primarily revolve around automation, predictive maintenance, and optimizing resource management. Common questions center on how AI can enhance the sustainability of these systems, whether it can drastically reduce maintenance labor costs, and the feasibility of AI controlling micro-climates within indoor installations. Users express significant interest in AI's role in diagnosing plant health issues, such as pest infestation or nutrient deficiencies, before they become critical. This user sentiment reflects a strong expectation that AI will transition green walls from aesthetic features to highly efficient, data-driven bio-technological assets, requiring minimal human intervention while maximizing ecological benefits and longevity.

The integration of AI, particularly through machine learning algorithms applied to sensor data, is revolutionizing the operational dynamics of modular green walls. AI-powered management systems analyze real-time data on temperature, humidity, light intensity, soil moisture, and nutrient solution composition collected by embedded IoT sensors. This analysis allows the system to make autonomous, micro-adjustments to irrigation schedules and nutrient delivery, ensuring optimal growing conditions for diverse plant species while minimizing water waste, a critical factor in regions facing water scarcity. This shift from pre-set programming to adaptive, predictive control significantly improves the reliability and sustainability profile of large-scale green wall installations.

Furthermore, AI facilitates predictive maintenance and long-term health monitoring. By analyzing historical performance data and identifying patterns associated with plant stress or system failure, AI models can alert maintenance teams to potential issues before visible damage occurs. This capability reduces the frequency of costly manual inspections and prolongs the lifespan of both the plant life and the structural components. As the market matures, AI integration will become a core differentiator for premium modular systems, enabling manufacturers to offer robust performance guarantees and substantially lower total cost of ownership for commercial clients.

- AI manages real-time environmental data (light, humidity, temperature) via IoT sensors to ensure precise micro-climate control.

- Predictive analytics diagnose early signs of plant distress, nutrient deficiency, or disease, enabling proactive intervention.

- Optimization algorithms minimize water and fertilizer consumption by dynamically adjusting delivery based on actual plant needs and weather forecasts.

- Automation enhances operational efficiency, reducing the reliance on constant manual monitoring and lowering long-term maintenance costs.

- Machine learning models aid in plant selection and system design by predicting the best species suitability based on location-specific environmental variables.

DRO & Impact Forces Of Modular Green Wall Systems Market

The Modular Green Wall Systems market is shaped by a powerful synergy of drivers related to sustainability and urban densification, counterbalanced by installation and maintenance complexities. The primary drivers include governmental mandates supporting green infrastructure and energy conservation, coupled with the profound market appeal of biophilic design in modern architecture. These forces create a compelling business case for adoption, particularly in commercial and public sectors seeking measurable environmental benefits and enhanced building value. Restraints largely center on the relatively high initial capital expenditure compared to traditional facade treatments, alongside persistent concerns regarding long-term maintenance costs, water proofing risks, and the perceived complexity of managing living organisms as part of building systems. Addressing these restraints requires manufacturers to continue innovating on system reliability and ease of care.

Opportunities in the market are abundant, stemming from technological leaps and untapped geographical markets. The convergence of modular hardware with smart technology (IoT, AI) opens new avenues for optimized performance and standardized remote management. Furthermore, the penetration of green walls into public infrastructure—such as bridges, sound barriers, and transport terminals—represents a substantial growth opportunity beyond traditional commercial real estate. Impact forces, which include shifting consumer preference towards sustainable branding and mandatory building certifications (e.g., net-zero goals), strongly favor market expansion. These external pressures compel developers and property owners to integrate environmental solutions, positioning modular green walls as a necessary investment rather than a luxury amenity.

The market also faces specific impact forces related to climate change resilience. As cities grapple with rising temperatures, the heat island mitigation capabilities of green walls provide a significant competitive advantage. This necessity for passive cooling and sustainable stormwater management reinforces the market's trajectory. Successfully navigating the challenge of system standardization, ensuring plant viability across diverse climates, and reducing the total lifecycle cost will be paramount for widespread adoption. Ultimately, the powerful environmental and aesthetic drivers currently outweigh the inherent complexities, projecting sustained high growth throughout the forecast period, especially as automation addresses maintenance concerns.

- Drivers (D): Increased urban density driving demand for green spaces; strong global focus on sustainable and resilient building certifications (LEED, BREEAM); biophilic design trends enhancing well-being and productivity.

- Restraints (R): High initial installation costs; perceived complexity and cost of specialized long-term maintenance; potential risks related to water leakage and structural integrity if systems are poorly installed.

- Opportunities (O): Integration with smart building management systems (BMS); expansion into public infrastructure projects; development of drought-resistant and regionally adapted plant palettes; advancements in recycled or bio-based modular materials.

- Impact Forces: Climate change mitigation needs (urban cooling); stringent governmental environmental regulations; corporate social responsibility (CSR) initiatives and ESG investment pressures; rapid technological evolution in sensor and irrigation systems.

Segmentation Analysis

The Modular Green Wall Systems market is extensively segmented based on the system type, the primary application, and the materials used for the structural framework, providing diverse options tailored to specific installation requirements and environmental conditions. The segmentation by type—hydroponic, substrate, and felt pocket systems—reflects the evolution of cultivation techniques, with hydroponics increasingly favored for indoor, controlled environments due to its clean operation and high water efficiency. Substrate systems remain popular for robust outdoor installations requiring deep root support and natural soil interaction. Understanding these technological variations is crucial for manufacturers to align product offerings with regional climate constraints and client sustainability goals.

Application segmentation highlights the dominant role of the commercial sector, where green walls serve dual purposes: architectural statement and demonstrable environmental commitment. Within this segment, hospitality and high-end retail use green walls to create immersive, experiential spaces, driving premium market value. Conversely, the infrastructure and residential segments are gaining momentum, particularly as system costs decrease and modular solutions become more user-friendly for non-commercial buyers. The growing adoption in public spaces underscores the recognition of green walls as critical urban ecosystem services, contributing to public health and urban amenity.

Furthermore, segmentation by frame material is critical, addressing concerns related to durability, weight, and aesthetics. Metal frames (aluminum, stainless steel) offer high structural stability and longevity, suitable for large external facades, while plastic frames (often recycled or UV-stabilized PVC/Polypropylene) provide lightweight, cost-effective, and moisture-resistant solutions, dominating the indoor market. The material choice directly impacts the system's longevity, fire rating, and overall embodied energy, making it a pivotal criterion for architects and sustainable developers evaluating total lifecycle performance.

- By Type:

- Hydroponic Systems (Soil-less cultivation, high efficiency, preferred indoors)

- Substrate Systems (Soil or mineral wool-based, robust root support, preferred outdoors)

- Felt Pocket Systems (Textile-based, flexible, cost-effective for smaller installations)

- By Application:

- Commercial (Offices, Retail, Hospitality, Healthcare)

- Residential (Luxury apartments, Private homes)

- Infrastructure (Public Spaces, Transport Hubs, Sound Barriers)

- By Frame Material:

- Metal (Aluminum, Stainless Steel)

- Plastic (Recycled PVC, Polypropylene)

- Wood Composites (Used mainly for aesthetic borders or specific architectural designs)

Value Chain Analysis For Modular Green Wall Systems Market

The value chain for Modular Green Wall Systems is complex, spanning raw material procurement, specialized manufacturing, horticultural expertise, system integration, and dedicated maintenance services. The upstream phase involves sourcing key raw materials, including engineering plastics and recycled polymers for the modular panels, metals for structural frames, and specialized growing media (e.g., coconut coir, mineral wool, or hydroponic substrates). Suppliers must adhere to strict quality controls regarding durability, UV resistance, and sustainability certifications, as the quality of these components dictates the long-term performance of the installed system. Manufacturers then focus on advanced molding, structural assembly, and integrating sophisticated components like pumps, irrigation lines, and smart sensors into the modular units.

The downstream segment is dominated by specialized distribution channels and professional installation services. Distribution often involves direct sales to large architectural firms, developers, and general contractors, or through authorized landscape contractors who specialize in vertical installations. The success of the project hinges on seamless integration with the building's water and drainage systems, requiring close collaboration between the green wall supplier and the civil engineers. Given the living nature of the product, dedicated post-installation maintenance, often outsourced to specialized facilities management firms or the system manufacturer, forms a critical and recurring revenue stream in the value chain, ensuring plant viability and system functionality.

Both direct and indirect channels play crucial roles. Direct channels are typically utilized for large, bespoke commercial projects where manufacturers provide end-to-end design consultation, supply, and installation supervision. Indirect channels, involving authorized distributors, retailers, and e-commerce platforms, cater more efficiently to smaller residential or standardized commercial retrofit projects. Effective management of the supply chain, particularly maintaining the quality and timely delivery of suitable plant material from nurseries, is vital to mitigate project delays and ensure the aesthetic and ecological goals of the installation are met.

- Upstream Analysis: Raw material suppliers (polymers, metals, growing media), specialized component manufacturers (pumps, irrigation controls, sensors). Focus on sustainable sourcing and certified materials.

- Manufacturing and Assembly: Production of modular panels, frame fabrication, integration of smart irrigation systems, quality control testing, and ensuring structural compliance.

- Distribution Channel: Direct sales to architects/developers, specialized landscape contractors, and indirect sales through construction supply distributors and e-commerce platforms.

- Downstream Analysis (Installation & Services): Specialized installation teams (often certified by the manufacturer), provision of suitable plants (nurseries), and essential long-term maintenance contracts (critical for system longevity).

Modular Green Wall Systems Market Potential Customers

The primary consumers of Modular Green Wall Systems are entities operating within the built environment that prioritize aesthetics, environmental performance, and occupant well-being. The largest and most lucrative customer base resides in the commercial real estate sector. This includes multinational corporate headquarters seeking to bolster their brand image and achieve high sustainability ratings (such as Platinum LEED certification), developers of luxury residential and mixed-use complexes aiming for premium pricing, and the hospitality sector (high-end hotels and resorts) using green walls as signature, biophilic architectural elements to enhance guest experience and thermal comfort. These customers require sophisticated, durable, and low-maintenance solutions, often integrating smart technology for automated management.

A rapidly expanding customer segment includes public sector bodies and infrastructure developers. Governments, municipal agencies, and transport authorities are increasingly adopting modular green walls for public works, including vertical farming pilots, sound barriers along highways, façade enhancements for public housing, and ecological restoration of unused urban spaces. These buyers are motivated by mandates to reduce the urban heat island effect, manage stormwater runoff, and improve overall public aesthetics. Their purchasing decisions are highly influenced by the longevity of the system, ease of public access maintenance, and demonstrable ecological benefit.

The third major segment encompasses institutions and the growing residential market. Educational facilities, particularly universities, utilize green walls for both aesthetic and educational purposes (demonstrating sustainable technology). The residential segment, while smaller in volume, shows high growth in affluent urban areas, driven by homeowners seeking personalized, high-tech indoor green features. For all potential customers, the total cost of ownership (TCO), including the effectiveness of the automated monitoring and irrigation systems, is the most significant factor influencing procurement decisions, highlighting the critical role of technology and robust maintenance support in securing sales.

- End-User/Buyers:

- Corporate Real Estate Developers (High-rise offices, business parks)

- Hospitality Sector (Luxury hotels, resorts, convention centers)

- Retail Developers (Shopping malls, flagship stores for brand presentation)

- Public Sector & Infrastructure (Municipal buildings, airports, public health facilities)

- High-Net-Worth Individuals (HNWI) and Luxury Residential Developers

- Healthcare and Educational Institutions (Hospitals, Universities focusing on wellness)

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 8.5 Billion |

| Market Forecast in 2033 | USD 19.9 Billion |

| Growth Rate | CAGR 12.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sempergreen, ANS Global, Naava, Green Fortune, Sage Vertical Garden Systems, GSky Plant Systems, Vistafolia, Suite Plants, Peverelli, Zola Living Walls, Wallgreens, Biotecture, LiveWall, Mobilane, Verti-Crete, Florafelt, Planted Walls, ELT Easy Green, NeoPlants, Vertical Garden Solutions. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Modular Green Wall Systems Market Key Technology Landscape

The technological landscape of Modular Green Wall Systems is characterized by advancements in irrigation efficiency, sensor integration, and material science, all geared towards creating autonomous and sustainable vertical ecosystems. Core technology revolves around closed-loop recirculating irrigation systems, which drastically reduce water consumption compared to traditional systems by capturing and reusing nutrient runoff. Advanced nutrient dosing pumps and controllers ensure precise fertilization, minimizing waste and optimizing plant growth across various micro-environments. The move toward smart systems is paramount, utilizing low-power, wide-area network (LPWAN) communication protocols to transmit critical data from embedded moisture, pH, and light sensors to a centralized management platform, often leveraging cloud-based computing for data analysis.

Material innovation is a secondary but equally critical technological area. Manufacturers are increasingly utilizing UV-stabilized, high-density polyethylene (HDPE) or recycled plastic composites for the modular containers and panels, enhancing durability and reducing the system’s environmental footprint. Research is also focused on developing lightweight, high-strength backing materials that simplify installation and reduce the structural load on existing building facades. Furthermore, integrated drainage technology designed to prevent root rot and ensure proper aeration, alongside highly effective waterproofing barriers, is continuously refined to mitigate the primary risk factor—water damage to the underlying building structure—associated with these installations.

The market's future technological direction is heavily influenced by the rise of AI and machine vision systems. Integrating cameras and image processing software allows systems to visually monitor plant health, identify localized issues such as pest infestations, and track growth rates. This visual data, combined with sensor telemetry, feeds into AI algorithms that predict maintenance needs and adjust resource delivery with unparalleled accuracy. This confluence of IoT, material science, and artificial intelligence is transforming green walls into sophisticated, self-regulating building components, thereby improving system reliability and scalability for large urban projects.

- Smart Irrigation Systems: Closed-loop water recirculation systems and precise nutrient delivery utilizing solenoid valves and pH/EC monitoring.

- IoT and Sensor Integration: Embedded moisture, temperature, light, and humidity sensors connected via wireless protocols (e.g., LoRaWAN) for real-time monitoring.

- AI-Powered Monitoring: Machine learning algorithms for predictive maintenance, remote diagnostics, and adaptive resource allocation based on environmental data history.

- Durable and Sustainable Materials: Use of high-density recycled polymers, UV-resistant plastics, and lightweight, corrosion-resistant aluminum for structural frameworks.

- Micro-climate Control Technologies: Integrated ventilation systems and thermal buffering designs to manage temperature fluctuations on the vertical surface.

Regional Highlights

The regional dynamics of the Modular Green Wall Systems Market show a clear delineation between mature, regulation-driven markets and rapidly emerging, urbanization-fueled growth centers. North America and Europe lead in terms of market value and technological maturity. In North America, the market is robustly supported by widespread adoption of LEED certification requirements and corporate sustainability pledges, particularly in major metropolitan areas like New York, Toronto, and San Francisco. European growth, especially in Germany, the UK, and France, is driven by strict energy performance directives, public health emphasis on air quality improvement, and substantial government investment in urban green infrastructure projects. These regions demand high-quality, durable, and technologically advanced systems with established service networks.

The Asia Pacific (APAC) region is poised to become the engine of future market growth, expected to record the highest CAGR during the forecast period. This rapid expansion is a direct result of unprecedented urbanization rates, the proliferation of large-scale construction projects (including new city developments and high-density residential towers), and intense pressure to mitigate severe air pollution issues in megacities like Beijing, Mumbai, and Jakarta. Governments across China, South Korea, and Singapore are actively funding vertical greenery initiatives as a core component of their smart city strategies, leading to high volume demand for cost-effective, easily scalable modular solutions. Local manufacturers are rapidly catching up, focusing on systems adaptable to tropical and subtropical climates.

Latin America and the Middle East and Africa (MEA) represent significant emerging markets with unique demand drivers. In MEA, particularly the GCC nations (UAE, Saudi Arabia), market penetration is accelerating, driven by luxury commercial and hospitality developments seeking signature aesthetics and functional cooling properties to combat extreme desert heat. Modular green walls are viewed as crucial thermal regulators, complementing energy-intensive air conditioning systems. Latin American markets, such such as Brazil and Mexico, are seeing increasing adoption in commercial centers and affluent residential areas, motivated by local architectural trends favoring biophilic integration and environmental awareness campaigns, though political stability and fluctuating exchange rates can pose localized market challenges.

- North America: Market leader driven by LEED certification, strong corporate ESG commitments, and high-tech integration (IoT/AI). Focus on premium commercial installations.

- Europe: High adoption rates mandated by EU energy efficiency directives and national green space requirements. Emphasis on historical facade integration and robust, low-maintenance systems.

- Asia Pacific (APAC): Fastest growing region due to rapid urbanization, massive infrastructure projects, and urgent need for pollution mitigation in dense cities. Demand favors scalability and efficiency.

- Middle East and Africa (MEA): Emerging market driven by luxury real estate, tourism infrastructure, and necessity for passive cooling solutions to counter extreme climate conditions.

- Latin America: Steady growth fueled by architectural trends and increasing environmental awareness in metropolitan centers; market sensitive to regional economic conditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Modular Green Wall Systems Market.- Sempergreen

- ANS Global

- Naava

- Green Fortune

- Sage Vertical Garden Systems

- GSky Plant Systems

- Vistafolia

- Suite Plants

- Peverelli

- Zola Living Walls

- Wallgreens

- Biotecture

- LiveWall

- Mobilane

- Verti-Crete

- Florafelt

- Planted Walls

- ELT Easy Green

- NeoPlants

- Vertical Garden Solutions

Frequently Asked Questions

Analyze common user questions about the Modular Green Wall Systems market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Modular Green Wall Systems Market?

Market growth is primarily driven by escalating global urbanization, strict governmental mandates favoring green building certifications (like LEED), the increasing adoption of biophilic design principles to enhance occupant wellness, and the necessity for urban heat island mitigation strategies in dense metropolitan areas. Technological advancements in smart irrigation further reduce maintenance burdens, increasing adoption feasibility.

How do Modular Green Walls contribute to a building's energy efficiency?

Modular green walls significantly improve energy efficiency by creating a layer of passive insulation on the building facade. This plant layer reduces heat transfer into the building during warmer months and minimizes heat loss during cooler periods, thereby lowering reliance on HVAC systems and resulting in substantial reductions in operational energy consumption and associated costs.

What is the difference between hydroponic and substrate modular systems?

Hydroponic modular systems are soil-less, circulating a nutrient-rich water solution directly to the roots, offering superior water efficiency and cleaner operation, often preferred for indoor applications. Substrate systems utilize traditional growing media (like soil or mineral wool) within the modules, providing robust support and better buffering capacity, typically favored for large outdoor installations.

Which geographical region is expected to show the fastest market growth?

The Asia Pacific (APAC) region is projected to experience the fastest market growth. This acceleration is fueled by immense rates of urbanization, large-scale infrastructural development projects, and significant governmental efforts to combat severe urban air pollution and meet demanding smart city sustainability targets.

How does AI technology benefit the management of Modular Green Walls?

AI technology, integrated through IoT sensors, provides predictive and adaptive management capabilities. It analyzes real-time environmental data to optimize irrigation and nutrient delivery autonomously, diagnoses plant health issues early, and reduces the need for manual maintenance, thereby significantly lowering operational costs and maximizing plant longevity and system performance.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager