Modular Grippers Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432357 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Modular Grippers Market Size

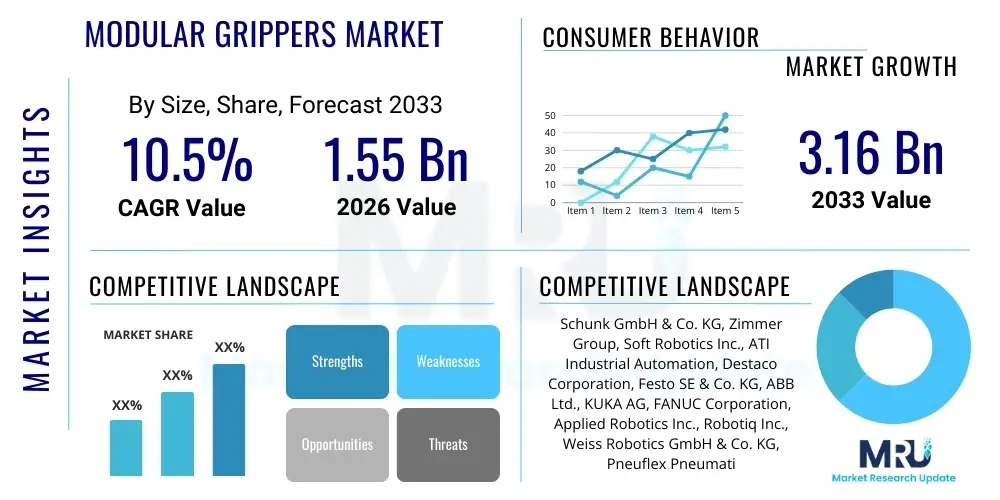

The Modular Grippers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 10.5% between 2026 and 2033. The market is estimated at USD 1.55 Billion in 2026 and is projected to reach USD 3.16 Billion by the end of the forecast period in 2033.

Modular Grippers Market introduction

Modular grippers represent highly adaptable end-of-arm tooling (EOAT) solutions designed for robotic automation systems. Unlike fixed or proprietary tooling, modular systems allow for the quick interchangeability of fingers, jaws, and sensing elements, enabling robots to handle diverse objects and perform multiple tasks without extensive downtime or complete hardware replacement. This flexibility is critical in modern manufacturing environments characterized by high mix, low volume production runs and stringent quality control requirements. These devices leverage standardized interfaces and sophisticated control mechanisms, facilitating seamless integration with industrial robots across various payloads and kinematic configurations.

The primary application sectors for modular grippers include automotive manufacturing, where they handle components ranging from lightweight composite materials to heavy engine parts; electronics assembly, requiring delicate manipulation of small, sensitive components; and packaging and logistics, where high-speed sorting and palletizing are essential. Furthermore, the burgeoning demand in the medical and pharmaceutical sectors for precise handling of lab samples and sterile components significantly drives their uptake. These grippers offer distinct benefits, such as reduced overall tooling investment through reusability, enhanced operational flexibility, and improved robotic utilization rates, making complex automation economically viable for SMEs.

Key driving factors propelling the growth of the modular grippers market encompass the accelerating adoption of industrial robots globally, particularly in Asia Pacific manufacturing hubs, and the pervasive industry trend towards smart factories leveraging IoT and advanced control systems. The ongoing labor shortages in skilled manufacturing positions globally further incentivize investments in flexible automation tools. Moreover, continuous innovation in materials science, leading to lighter, stronger, and more compliant gripping solutions (e.g., soft robotics integration), expands the functional scope of modular systems, solidifying their role as foundational elements in advanced robotic work cells.

Modular Grippers Market Executive Summary

The Modular Grippers Market is experiencing robust expansion, driven primarily by the need for increased automation flexibility and efficiency across core manufacturing and logistics sectors. Current business trends indicate a strong shift towards electric and servo-driven modular grippers over traditional pneumatic versions, favoring precision, energy efficiency, and direct integration with digital factory ecosystems. Strategic collaborations between gripper manufacturers and robotic platform providers are becoming commonplace, aimed at developing plug-and-play solutions that reduce integration time and complexity for end-users. Furthermore, the incorporation of advanced sensing technologies, including tactile and force-torque sensing, is rapidly transforming standard grippers into intelligent manipulation tools capable of adaptive grasping.

Geographically, Asia Pacific remains the dominant growth engine, spearheaded by massive investments in automation infrastructure in China, Japan, and South Korea, particularly in high-volume industries like automotive, 3C (Computers, Communication, Consumer Electronics), and logistics. North America and Europe, while mature markets, demonstrate leadership in adopting high-precision, advanced modular systems for complex tasks in aerospace, medical device manufacturing, and high-value custom production. Regional trends highlight regulatory pressures promoting worker safety and ergonomic standards in developed economies, indirectly fueling the demand for robotic handling solutions utilizing flexible modular grippers to automate traditionally hazardous or repetitive tasks.

Segment trends underscore the rising prominence of the electric gripper segment due to its superior repeatability and ease of control, aligning perfectly with Industry 4.0 paradigms. Based on application, the automotive industry continues to hold the largest market share, but the electronics and logistics sectors are exhibiting the fastest growth rates, demanding increasingly sophisticated, often customized, modular tooling capable of handling extremely delicate or irregularly shaped items at high speeds. This segmentation analysis suggests future investment will heavily focus on developing lightweight, high-payload modular systems compatible with collaborative robots (cobots), further broadening the market accessibility beyond large-scale industrial facilities.

AI Impact Analysis on Modular Grippers Market

User queries regarding the impact of AI on modular grippers frequently revolve around how artificial intelligence can move manipulation systems beyond simple programmed routines to achieve true adaptive handling. Common questions address the efficacy of AI in dynamic environment perception, specifically asking if machine learning can enable grippers to handle previously unseen or randomly oriented objects without manual reprogramming. Users are also highly concerned with the implementation overhead, inquiring about the cost and complexity of integrating AI-driven vision and tactile feedback systems into existing modular gripper setups. A prevailing theme is the expectation that AI will deliver 'zero-programming' adaptability, significantly reducing setup time and maximizing robot uptime in highly flexible production lines.

Based on these themes, the key influence of AI is the transition from rigid, pre-programmed grasping strategies to intelligent, sensor-driven manipulation. AI algorithms, particularly those leveraging deep learning and reinforcement learning, are enabling modular grippers to interpret complex sensory data—including high-resolution vision and precise tactile feedback—to determine the optimal grasp force, orientation, and jaw configuration for varied objects in real-time. This cognitive capability is essential for operations like bin picking, where objects are randomly arranged, and high-precision assembly tasks requiring instantaneous adjustments based on material compliance and surface characteristics. The adoption of AI dramatically improves success rates and cycle times, especially in dynamic logistics and high-mix manufacturing environments.

Furthermore, AI is crucial for predictive maintenance and optimization within the modular gripper ecosystem. Machine learning models analyze operational data, such as motor currents, actuation cycles, and wear patterns on interchangeable jaws, predicting potential mechanical failures before they occur. This proactive approach ensures greater reliability and minimizes unexpected downtime, a significant benefit for high-throughput factories. The combination of adaptive grasping facilitated by vision systems and enhanced operational reliability driven by predictive analytics positions AI as a core technology multiplier, transforming modular grippers into sophisticated, autonomous components of the smart factory infrastructure.

- AI enables real-time adaptive grasping based on visual and tactile input, crucial for handling diverse objects.

- Machine learning algorithms optimize grip force and position, reducing product damage and increasing handling success rates.

- Predictive maintenance driven by AI analyzes operational data to forecast gripper component wear and prevent unscheduled downtime.

- Reinforcement learning facilitates rapid self-training of gripping strategies for new or randomly presented objects (e.g., in advanced bin picking).

- AI integration reduces the need for extensive manual programming and calibration for new tasks, accelerating deployment (zero-programming capability).

- Enhanced sensor fusion allows modular grippers to interact safely and efficiently in collaborative robot (cobot) environments.

DRO & Impact Forces Of Modular Grippers Market

The market for modular grippers is propelled by strong Drivers related to industrial modernization and constrained labor markets, while simultaneously navigating Restraints concerning system complexity and initial investment costs. Opportunities are abundant, specifically in emerging areas like soft robotics integration and advanced sensory feedback loops. These elements collectively shape the competitive landscape and technological trajectory of the market, often amplified or moderated by macro-environmental Impact Forces such as global supply chain dynamics and the pace of Industry 4.0 adoption. Understanding this dynamic tension is essential for market stakeholders designing long-term strategies, particularly regarding product development and regional market penetration.

The primary Drivers include the critical global shift towards flexible automation, necessitating tooling that can rapidly adapt to changing production demands and customized product lines. Secondly, the escalating demand for high-precision handling in sensitive sectors like electronics and medical devices requires the repeatability and control offered by advanced modular systems. Conversely, the market faces significant Restraints, most notably the high initial capital expenditure required for sophisticated modular systems, which often include advanced sensors, intricate control mechanisms, and proprietary interfaces. Furthermore, the complexity of integrating these advanced components into existing legacy systems acts as a deterrent for smaller manufacturers lacking specialized automation expertise. These barriers slow down the widespread adoption, particularly outside of well-funded, large-scale industrial operations.

Significant Opportunities exist in the development of highly compliant, soft modular gripping solutions that can handle extremely fragile or bio-compatible materials, opening up new avenues in food processing and life sciences automation. The ongoing miniaturization of components also necessitates the creation of micro-modular grippers, addressing the needs of micro-assembly. External Impact Forces include the growing global competition in robotics manufacturing, which drives down component costs over time, making modular solutions more economically accessible. Additionally, governmental policies supporting industrial automation and smart manufacturing initiatives worldwide provide strong market tailwinds. However, geopolitical instability affecting key component supply chains (e.g., semiconductors for control units) represents a persistent adverse impact force requiring robust risk mitigation strategies from market participants.

- Drivers:

- Increasing necessity for highly flexible and reconfigurable manufacturing systems.

- Rapid global adoption of industrial and collaborative robots (cobots).

- Growing complexity and miniaturization of components requiring precise, variable gripping solutions.

- Labor shortages and rising operational costs demanding higher automation penetration.

- Restraints:

- High initial investment costs and the complexity associated with integrating advanced modular systems.

- Lack of standardized interfaces across all robotic platforms, hindering universal plug-and-play adoption.

- Requirement for specialized technical skills for system maintenance and custom programming.

- Opportunities:

- Development and commercialization of soft modular grippers for delicate and irregular object handling.

- Integration with IoT and advanced sensory feedback for real-time process monitoring and optimization.

- Expansion into non-traditional automation sectors such as laboratory automation and e-commerce fulfillment centers.

- Focus on lightweight modular solutions compatible with mobile robot platforms and cobots.

- Impact Forces:

- Industry 4.0 adoption mandates (Positive).

- Global supply chain volatility impacting electronic component availability (Negative).

- Technological convergence of AI, vision systems, and EOAT (Positive).

- Rising energy efficiency standards favoring electric actuation (Positive).

Segmentation Analysis

The Modular Grippers Market is comprehensively segmented across several dimensions, including the type of actuation (pneumatic, electric, hydraulic), the gripping technology utilized (jaw, vacuum, magnetic), the payload capacity, and the specific application industry. This segmentation is crucial for understanding the diverse needs of end-users, ranging from high-speed, high-force handling in heavy industry to low-force, highly compliant grasping required in sensitive assembly environments. The market dynamics within these segments often differ significantly; for example, electric grippers command a higher price point but offer superior control demanded by electronics manufacturers, whereas pneumatic grippers retain dominance in high-speed, repetitive pick-and-place operations due to their robust simplicity and cost-effectiveness.

Analysis by Actuation Type highlights the ongoing technological transition from conventional fluid power systems to electric servo-controlled units. Electric modular grippers are gaining market share rapidly, primarily due to their compatibility with energy-saving practices, precise force control, and seamless communication capabilities within digital factory networks. However, pneumatic systems maintain a strong foothold, particularly in regions sensitive to capital expenditure and applications where rapid cycle times are prioritized over ultimate precision. Hydraulic grippers, though a niche segment, remain essential for extremely high-force, heavy-duty applications common in metal fabrication and foundry work, where their power density is unparalleled.

The Application segmentation reveals that the Automotive sector remains the primary consumer, utilizing modular grippers throughout the production line, from stamping and welding to final assembly and inspection. However, the fastest growth is emanating from the Electronics & Semiconductor sector, driven by the need for grippers capable of micron-level positioning and ESD-safe handling, often requiring customized finger geometries and advanced sensory integration. The Logistics and E-commerce segment is also burgeoning, adopting modular vacuum and specialized finger grippers for handling irregular parcels and rapidly changing inventory items in automated warehouses, suggesting a significant area for future market expansion driven by consumer demand for rapid fulfillment.

- By Actuation Type:

- Electric/Servo Modular Grippers

- Pneumatic Modular Grippers

- Hydraulic Modular Grippers

- By Gripping Technology:

- Jaw/Parallel/Angular Grippers (Finger Grippers)

- Vacuum Grippers (Suction Cups)

- Magnetic Grippers

- Soft Grippers (Compliant/Adaptive)

- Specialized/Custom Grippers

- By Payload Capacity:

- Low Payload (0-5 kg)

- Medium Payload (5-50 kg)

- High Payload (>50 kg)

- By Application/End-User Industry:

- Automotive

- Electronics and Semiconductors

- Machinery and Metal Fabrication

- Food and Beverage

- Logistics and Packaging

- Pharmaceutical and Medical Devices

- Aerospace and Defense

Value Chain Analysis For Modular Grippers Market

The value chain for the Modular Grippers Market begins with upstream activities focused on the sourcing and processing of critical materials, particularly high-strength aluminum alloys, advanced plastics, carbon fiber composites, and precision electronic components such as sensors, motors, and microcontrollers. Upstream analysis involves managing complex global supply chains to ensure the quality and timely delivery of these specialized inputs. Key suppliers often specialize in high-precision machining and miniaturized electro-mechanical components. Manufacturers in this stage must prioritize material integrity and component reliability, as the performance of the final gripper is heavily dependent on the precision of these raw parts and sub-assemblies.

Midstream activities involve the core manufacturing, assembly, and integration of the modular gripper systems. This stage includes sophisticated engineering design—focusing on modularity, repeatability, and payload optimization—and the assembly of complex mechanical and electronic subsystems. Testing and quality assurance are paramount, ensuring the grippers meet stringent industry standards for force control, cycle life, and communication protocols (e.g., EtherCAT, Profinet). The differentiation at this stage often lies in proprietary software, control algorithms, and the simplicity of the standardized interfaces that allow quick connection to various robot arms.

Downstream activities center on distribution, sales, installation, and after-sales support. Distribution channels are typically bifurcated into direct sales to large, strategic end-users (e.g., Tier 1 automotive suppliers) and indirect sales through a network of specialized system integrators and distributors. System integrators play a critical role, as they possess the expertise to design and deploy full robotic work cells, selecting and customizing the appropriate modular gripper for specific application requirements. Direct distribution ensures tight control over product performance and customer feedback, while indirect channels provide wider market reach, especially to small and medium-sized enterprises (SMEs) that rely heavily on third-party integrators for their automation needs. After-sales support, including spare parts supply and remote diagnostics, is essential given the high uptime requirements in automated facilities.

Modular Grippers Market Potential Customers

Potential customers for modular grippers are diverse, spanning virtually every sector that employs automated assembly, material handling, or quality inspection processes. The primary buyers are large multinational manufacturers in the Automotive and Electronics industries that operate high-volume, highly complex assembly lines requiring rapid changeovers between product variants. These end-users demand grippers with exceptional repeatability, integrated sensing capabilities, and compatibility with the latest generation of high-speed industrial robots. Their procurement decisions are often driven by total cost of ownership (TCO) and the ability of the gripper system to minimize tooling inventory and maximize operational flexibility.

A rapidly growing segment of potential customers includes logistics and e-commerce fulfillment centers. As automation permeates warehouses to cope with increasing parcel volume and varied product dimensions, these buyers require robust, high-throughput modular grippers, often favoring large-area vacuum systems or specialized adaptive finger grippers capable of reliably handling irregular shapes, soft plastics, and diverse packaging materials. Furthermore, SMEs utilizing collaborative robots (cobots) form another crucial customer base. These companies seek user-friendly, lightweight modular tooling that is safe for human interaction and easy to program, enabling them to automate tasks previously deemed too costly or complex for traditional industrial robots.

The specialized sectors of Medical Devices and Pharmaceuticals represent high-value potential customers. These industries require modular grippers that meet strict regulatory standards, including sterile operations and the ability to handle delicate biological samples or precise components with zero contamination risk. Customers here prioritize compliance, precision, and specialized materials (e.g., FDA-approved plastics). Additionally, the aerospace sector requires modular grippers with high payload capacities and customized tooling to handle large, complex composite structures and metallic parts during assembly and non-destructive testing, often demanding unique solutions that leverage advanced gripping technologies like magnetic or advanced vacuum systems for specific geometry handling.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.55 Billion |

| Market Forecast in 2033 | USD 3.16 Billion |

| Growth Rate | 10.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Schunk GmbH & Co. KG, Zimmer Group, Soft Robotics Inc., ATI Industrial Automation, Destaco Corporation, Festo SE & Co. KG, ABB Ltd., KUKA AG, FANUC Corporation, Applied Robotics Inc., Robotiq Inc., Weiss Robotics GmbH & Co. KG, Pneuflex Pneumatic Co., GIMATIC S.p.A., PHD Inc., SAS Automation LLC, Empire Robotics (acquired by Soft Robotics), IMI Precision Engineering. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Modular Grippers Market Key Technology Landscape

The technological landscape of the Modular Grippers Market is defined by continuous innovation focused on intelligence, compliance, and connectivity, moving well beyond basic actuation mechanisms. A pivotal area is the integration of advanced sensory systems, including high-resolution force-torque sensors and sophisticated tactile sensors (e.g., strain gauges, piezoresistive arrays). These sensors provide the gripper with haptic feedback, allowing the robot to 'feel' the object, adapt its grip force precisely, and detect successful or faulty pick-up operations in real-time. This sensory layer is fundamental to enabling the AI and machine learning capabilities that are increasingly powering adaptive gripping algorithms, especially for delicate and variable materials.

Another dominant technological trend is the development of compliant mechanisms and soft robotics principles. Soft modular grippers, often made from silicone or elastomers, utilize pneumatic or cable actuation to achieve complex deformation, allowing them to conform to highly irregular or fragile objects without needing precise pre-programming or customization. This compliance significantly expands the range of materials that can be handled safely, making them highly valuable in food handling and pharmaceutical applications. Furthermore, the push for energy efficiency is accelerating the transition to high-density, compact electric servo motors that offer high precision control and simplified wiring compared to centralized pneumatic systems, facilitating easier integration onto smaller, collaborative robot arms.

Connectivity and standardization are also crucial technology drivers. Modular grippers are increasingly equipped with integrated communication protocols (like IO-Link or industrial Ethernet variants) and standardized mechanical interfaces (such as ISO flange mounts) to achieve true plug-and-play functionality. This focus on interoperability reduces the complexity and cost associated with integrating new tools into different robot brands and control architectures. Materials innovation also plays a role, with lightweighting achieved through the use of carbon fiber reinforced polymers and advanced additive manufacturing techniques (3D printing), which allows for the rapid creation of complex, application-specific jaw geometries and reduces the payload burden on the robot arm, thereby increasing its effective capacity.

Regional Highlights

The Modular Grippers Market exhibits distinct dynamics across key geographical regions, reflecting varying levels of industrial maturity, labor costs, and technological adoption rates. Asia Pacific (APAC) stands as the largest and fastest-growing market, primarily fueled by massive government and private sector investments in automation infrastructure in powerhouse nations like China, which dominates global manufacturing, and robust, high-technology industrial bases in Japan and South Korea, which specialize in high-precision electronics and automotive production. The region's focus on high-throughput assembly necessitates continuous upgrades to flexible EOAT solutions.

North America is characterized by high demand for advanced, intelligent modular grippers, particularly within the aerospace, medical device, and high-value custom manufacturing sectors. The market here prioritizes advanced features such as AI integration, detailed sensory feedback, and full compatibility with collaborative robot systems to address chronic skilled labor shortages and maintain competitive advantages in high-mix, low-volume production. Early adoption of cutting-edge technologies and a strong presence of key technology developers ensure North America remains a significant market for premium modular solutions.

Europe, driven by nations such as Germany, Italy, and Scandinavia, demonstrates strong demand rooted in stringent industrial quality standards and a historical focus on precision engineering. The European market is a leader in adopting energy-efficient electric grippers and advanced pneumatic solutions, focusing heavily on sustainability and compliance with demanding safety regulations. The presence of major automotive OEMs and a strong engineering machinery sector ensures steady demand for highly repeatable and durable modular gripper components, often customized for complex, high-tolerance applications. Latin America and the Middle East & Africa (MEA) are emerging markets, where adoption is accelerating as local industries modernize their manufacturing bases, driven initially by investments in packaging, logistics, and mineral processing sectors.

- Asia Pacific (APAC): Dominates the market size and growth, driven by extensive automation deployment in China, South Korea, and Japan across electronics and automotive manufacturing.

- North America: High penetration of advanced, intelligent grippers, focusing on aerospace, medical devices, and rapid integration with collaborative robots (cobots). Strong emphasis on AI-driven adaptive handling solutions.

- Europe: Characterized by high-precision demand, robust adherence to Industry 4.0 standards, and significant uptake of electric grippers, particularly in Germany's machinery and automotive sectors.

- Latin America: Emerging market demonstrating increasing adoption in packaging, food & beverage processing, and automotive assembly as industrial modernization progresses.

- Middle East & Africa (MEA): Growth centered around new infrastructure projects, oil & gas downstream processes, and logistics automation, with initial focus on robust, heavy-duty modular systems.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Modular Grippers Market.- Schunk GmbH & Co. KG

- Zimmer Group

- Soft Robotics Inc.

- ATI Industrial Automation

- Destaco Corporation

- Festo SE & Co. KG

- ABB Ltd.

- KUKA AG

- FANUC Corporation

- Applied Robotics Inc.

- Robotiq Inc.

- Weiss Robotics GmbH & Co. KG

- Pneuflex Pneumatic Co.

- GIMATIC S.p.A.

- PHD Inc.

- SAS Automation LLC

- Empire Robotics (acquired by Soft Robotics)

- IMI Precision Engineering

- B&R Industrial Automation (A part of ABB Group)

- OnRobot A/S

Frequently Asked Questions

Analyze common user questions about the Modular Grippers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary advantage of modular grippers over fixed end-of-arm tooling?

The primary advantage is enhanced operational flexibility and reduced downtime. Modular grippers allow manufacturers to quickly change or interchange gripper jaws and tooling components to handle a variety of products or tasks on the same production line without requiring a full EOAT replacement, significantly boosting robot utilization and reducing investment in dedicated tooling.

How are electric modular grippers changing the market dynamics compared to pneumatic models?

Electric modular grippers offer superior precision, repeatability, and variable force control, making them ideal for delicate handling tasks. They are also more energy-efficient, eliminate the need for costly compressed air infrastructure, and offer seamless data connectivity, aligning perfectly with Industry 4.0 requirements for smart factories.

Which industries are driving the fastest adoption rate for modular gripping solutions?

The fastest adoption rates are currently being observed in the Electronics and Semiconductor manufacturing industry due to the need for micro-level precision and ESD-safe handling, and in the Logistics and E-commerce sector, driven by the requirement for high-speed, adaptive handling of varied package sizes and materials.

What role does AI play in improving the performance of modular grippers?

AI significantly enhances performance by enabling adaptive grasping. Through machine learning and sensor integration, AI allows the gripper to intelligently recognize objects, calculate the optimal grip force and position in real-time, and handle randomly oriented or previously unseen items (e.g., in bin picking) without extensive pre-programming.

What are the key restraint factors limiting the widespread market adoption of modular grippers?

The main restraints are the high initial capital expenditure associated with advanced, sensor-equipped modular systems and the complexity of integration into non-standardized or legacy robotic platforms, often requiring specialized technical expertise for setup and maintenance.

What is the projected Compound Annual Growth Rate (CAGR) for the Modular Grippers Market?

The Modular Grippers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 10.5% between the forecast years of 2026 and 2033, indicating strong and sustained market expansion fueled by global automation trends.

How is soft robotics technology influencing the modular gripper design?

Soft robotics technology is introducing highly compliant and flexible modular fingers and jaws made from materials like silicone. This allows grippers to safely and reliably handle extremely fragile, irregular, or deformable items, expanding the market into sensitive applications like food processing, agriculture, and handling bio-compatible materials in medical labs.

What differentiates the demand for modular grippers in North America versus Asia Pacific?

APAC demand is characterized by high volume and rapid deployment in assembly lines (focusing on throughput), while North American demand emphasizes sophisticated integration, high-value customization, and advanced sensory feedback systems for complex, high-mix production and collaborative robot applications.

What types of modular grippers are best suited for high-speed pick-and-place operations?

Pneumatic modular grippers and high-speed vacuum systems are typically best suited for repetitive, high-speed pick-and-place operations due to their simple design, rapid actuation cycle times, and robust reliability in continuous operation environments, often optimized for medium-to-low payload applications.

What are the primary upstream challenges in the modular gripper value chain?

Upstream challenges primarily involve securing a stable supply of precision electronic components (sensors and microcontrollers) and high-tolerance engineered materials (e.g., lightweight composites) required for complex, reliable, and durable gripper mechanisms, often complicated by global supply chain volatility.

Do modular grippers require proprietary control systems?

While many advanced modular grippers come with proprietary software to utilize their unique features, the market trend is moving towards open architecture and standardized industrial communication protocols (like IO-Link or Ethernet protocols) to ensure broader compatibility and easier plug-and-play integration with different robot brands and factory control systems.

What is the significance of the shift toward miniaturization in modular grippers?

Miniaturization is crucial for enabling automation in micro-assembly tasks, particularly in the electronics and medical device industries where micron-level precision is required. Smaller, lighter modular grippers also maximize the effective payload and speed of collaborative robots and small industrial arms.

How do modular grippers contribute to sustainable manufacturing?

Modular grippers contribute to sustainability by maximizing the lifespan and utility of end-of-arm tooling through interchangeable parts, reducing material waste from obsoleted dedicated tooling, and by promoting the use of energy-efficient electric actuation over power-intensive pneumatic systems.

What is the forecast market size for Modular Grippers by 2033?

The Modular Grippers Market is projected to reach an estimated value of USD 3.16 Billion by the end of the forecast period in 2033, reflecting substantial anticipated growth driven by automation investment worldwide.

Which technology is essential for ensuring ESD compliance in the electronics application segment?

For ESD compliance in electronics manufacturing, modular grippers must utilize specific, non-conductive, and static-dissipative materials for their fingers and jaws, along with appropriate grounding mechanisms in the EOAT structure to prevent electrostatic discharge damage to sensitive electronic components.

What is the role of system integrators in the modular gripper distribution channel?

System integrators are vital in the indirect distribution channel, acting as expert intermediaries who design, install, and commission full robotic work cells. They select the optimal modular gripper and customize its integration, offering critical expertise particularly to small and medium-sized enterprises (SMEs) that lack in-house automation skills.

How does the automotive industry utilize the modularity aspect of these grippers?

The automotive industry leverages modularity to handle diverse components on the same assembly line—from large, rigid body panels to small, delicate interior components—using the same robotic arm base by quickly swapping modular jaws or specialized heads for welding, bonding, or inspection tasks, thus accommodating production model variations.

What material advancements are driving lightweighting in modular gripper design?

Advancements in materials such as high-strength aluminum alloys, carbon fiber reinforced polymers (CFRP), and precision 3D-printed specialized plastics are critical drivers of lightweighting, which helps reduce the load on the robot arm and increases the effective payload capacity and movement speed.

Define the key opportunity presented by the integration of IoT in this market.

The key opportunity lies in real-time performance monitoring, predictive maintenance, and operational optimization. IoT integration allows grippers to transmit data on cycle counts, force applied, temperature, and wear status directly to factory monitoring systems, enabling proactive service scheduling and continuous process improvement.

What is the primary constraint related to the adoption of hydraulic modular grippers?

The primary constraint for hydraulic modular grippers is their complexity, the potential for fluid leakage, and the extensive peripheral equipment (pumps, reservoirs) required, which limits their use primarily to heavy-duty, high-force applications where electric or pneumatic systems lack sufficient power density.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager