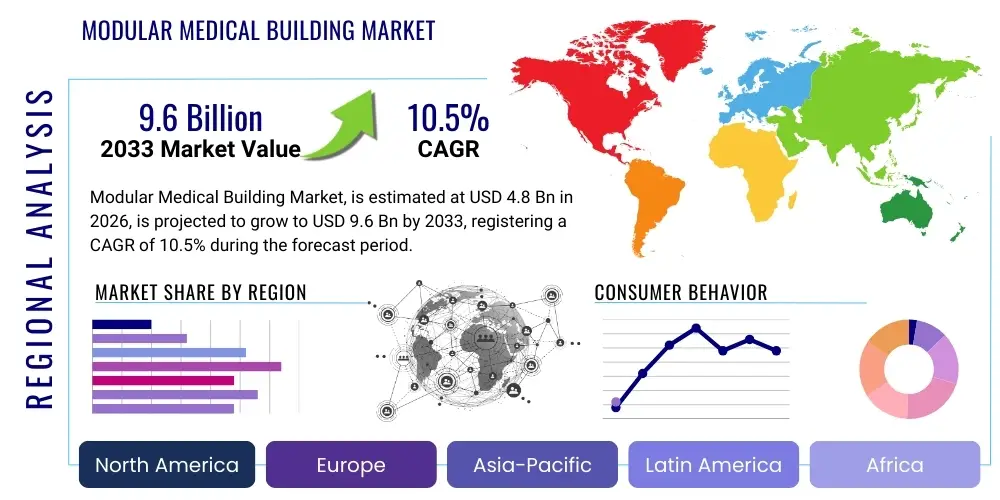

Modular Medical Building Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435626 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Modular Medical Building Market Size

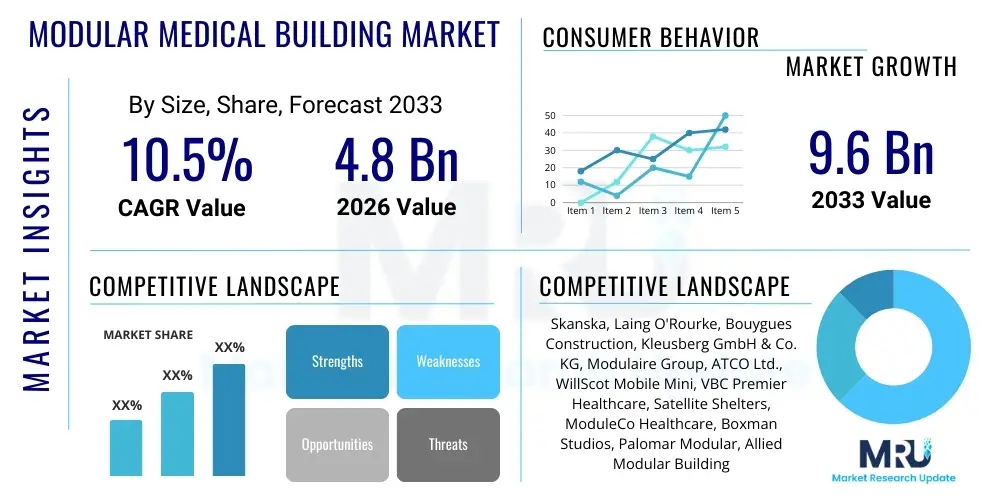

The Modular Medical Building Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 10.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 9.6 Billion by the end of the forecast period in 2033.

Modular Medical Building Market introduction

The Modular Medical Building Market encompasses the design, fabrication, and installation of prefabricated structures used for various healthcare applications, ranging from temporary clinics and diagnostic labs to permanent hospital extensions and specialized surgical units. These buildings are constructed off-site in a controlled factory environment, allowing for superior quality control, accelerated project timelines, and minimized disruption at the final location. The fundamental product offers healthcare providers a flexible, scalable, and cost-effective solution to rapidly address capacity demands, particularly crucial during public health crises or rapid population shifts. This methodology significantly reduces construction waste and overall project duration compared to traditional stick-built construction methods, appealing heavily to budget-conscious and time-sensitive healthcare organizations globally.

Major applications of modular medical facilities include acute care additions, primary care centers, dental clinics, behavioral health units, and high-tech diagnostic imaging suites (MRI, CT scanners). The key benefits driving adoption are speed to market—enabling facilities to become operational months faster than conventional construction—and enhanced site safety due to reduced on-site labor requirements. Furthermore, modular buildings offer intrinsic benefits regarding sustainability, often incorporating energy-efficient designs and reusable materials, aligning with corporate social responsibility goals and regulatory requirements for greener infrastructure. The inherent flexibility means these units can be relocated, repurposed, or expanded, providing long-term asset value management for complex healthcare networks.

Driving factors for this market surge are multifaceted, primarily fueled by the global aging population demanding increased healthcare infrastructure, chronic capacity shortages in developed economies, and the necessity for rapid, specialized isolation facilities (as seen during recent pandemics). Technological advancements in Building Information Modeling (BIM) and standardized manufacturing processes have further improved the quality and complexity of modular units, allowing them to meet stringent regulatory standards required for operating theaters and sterile environments. Additionally, government initiatives focused on improving regional healthcare access, coupled with rising labor costs and supply chain volatility in traditional construction, solidify the strategic advantage of modular construction methods.

Modular Medical Building Market Executive Summary

The Modular Medical Building Market is experiencing robust growth driven by the compelling need for adaptable and swiftly deployed healthcare solutions across various economic regions. Current business trends indicate a strong shift towards permanent modular construction (PMC), particularly for major hospital expansions, as healthcare providers recognize the long-term structural and financial viability of these prefabricated solutions. Key market players are increasingly investing in advanced manufacturing technologies, such as automation and robotics, to standardize module production, ensuring consistency in quality and reducing the reliance on highly skilled on-site labor, which addresses critical workforce shortages impacting the overall construction sector. Strategic collaborations between specialized modular builders and large general contractors are becoming common, allowing for the execution of large, complex healthcare projects that require extensive integration with existing operational hospital facilities.

Regionally, North America and Europe dominate the market, characterized by established regulatory frameworks supporting off-site construction and significant capital expenditure allocated to modernizing outdated healthcare systems. However, the Asia Pacific (APAC) region is poised for the highest growth trajectory, fueled by rapid urbanization, substantial investments in emerging economies to build essential primary healthcare infrastructure, and government mandates promoting faster public utility deployment. Latin America and the Middle East and Africa (MEA) are also showing promising acceleration, particularly in the deployment of relocatable modular units for remote access healthcare services and temporary emergency response facilities. Regulatory harmonization, particularly in the European Union, facilitates cross-border modular component trade, further stimulating regional market efficiency and growth.

Segment trends highlight the critical role of application-specific modular units. The segment focused on diagnostic laboratories and specialized clinics is witnessing pronounced growth due to the decentralization of healthcare services and the rising demand for sophisticated imaging and pathology services closer to patient populations. Material-wise, steel frame construction remains the dominant choice due to its durability, structural integrity, and ability to meet demanding fire and seismic codes, essential for acute care facilities. Relocatable modular construction, while smaller in market size compared to permanent solutions, continues to provide indispensable support for disaster relief, temporary overflow capacity, and rapidly deployed isolation wings, demonstrating continuous, stable demand driven by unforeseen healthcare events and cyclical needs.

AI Impact Analysis on Modular Medical Building Market

Common user questions regarding AI's influence on the Modular Medical Building Market frequently center on efficiency gains, predictive maintenance, and design automation. Users are highly interested in how AI can streamline the heavily regulated design process, reduce fabrication errors, and optimize site logistics, questioning whether AI-driven BIM tools can shorten the pre-construction phase from months to weeks. Concerns often revolve around data privacy when integrating AI into facility management systems and the required upfront investment in sophisticated software platforms. Expectations are high regarding AI’s ability to predict operational demands—such as energy usage or patient flow—to better inform the modular unit's design specifications for maximum long-term efficiency and operational cost reduction, signaling a shift from construction optimization to lifecycle performance enhancement through intelligent design.

- AI-Powered Design Optimization: Utilizing generative design algorithms to rapidly iterate through thousands of potential module configurations, optimizing layout for clinical workflow, energy performance, and compliance with local building codes, drastically shortening the architectural planning phase.

- Predictive Scheduling and Logistics: Employing machine learning models to analyze supply chain data, weather patterns, and manufacturing throughput to accurately predict project timelines, minimize delays, and optimize the sequencing of module delivery and on-site assembly.

- Quality Control Automation: Integrating computer vision and AI analytics into factory production lines to automatically detect minor defects in welding, material tolerance, or finish quality before modules leave the controlled environment, ensuring higher consistency and reducing costly on-site rework.

- Intelligent Facilities Management (IFM): Implementing AI systems post-installation for predictive maintenance scheduling, real-time energy consumption monitoring, and optimizing HVAC and lighting systems based on actual facility usage patterns, improving sustainability and operational longevity.

- Safety and Risk Assessment: Using AI to analyze complex construction data and identify potential safety hazards during the module installation phase, reducing on-site accidents and enhancing worker safety protocols.

DRO & Impact Forces Of Modular Medical Building Market

The Modular Medical Building Market is shaped by a confluence of powerful forces, where the primary Drivers (D) center on the urgent need for expedited healthcare capacity expansion and the cost efficiencies inherent in off-site construction, particularly in addressing complex demographic shifts like aging populations. Restraints (R) mainly involve regulatory inertia, as traditional building codes in some jurisdictions still lag in fully accommodating sophisticated modular techniques, alongside the high initial capital investment required for establishing efficient, large-scale modular fabrication facilities. Opportunities (O) are significant, particularly in leveraging technological advancements like robotics and digital twins to enhance customization and quality, coupled with untapped potential in niche areas such as specialized infectious disease control centers and highly standardized remote primary care units. These forces collectively dictate the market trajectory, emphasizing that speed, quality, and regulatory alignment are paramount for capitalizing on the structural advantages of modular solutions.

The primary driving factor remains the imperative for rapid construction deployment. In critical healthcare scenarios, such as responding to facility damage, unexpected patient surges, or integrating new diagnostic technologies quickly, modular construction offers an unmatched time advantage over conventional building. This speed translates directly into faster revenue generation and improved public health outcomes, making it a compelling investment case for both private hospital chains and public health authorities. Furthermore, the ability to control labor costs and mitigate supply chain disruptions through centralized fabrication provides a stable economic model, contrasting sharply with the unpredictable nature of traditional site-based construction projects which are increasingly vulnerable to shortages of skilled tradespeople and volatile material pricing, thereby solidifying the market momentum.

However, the market faces specific restraints that necessitate strategic mitigation. Perception challenges sometimes persist, linking modular construction solely to temporary or lower-quality structures, despite significant advancements in materials and design complexity that now allow modular units to meet or exceed the performance of their traditional counterparts. Financial constraints also play a role; while total lifecycle costs are often lower, securing specialized financing for modular projects can sometimes be more complex than for traditional real estate, potentially slowing adoption among smaller healthcare providers. Overcoming these hurdles requires intensive education of stakeholders—including financiers, regulators, and end-users—to showcase the modern capabilities, longevity, and superior quality assurance achievable through advanced modular manufacturing techniques, thereby converting perceived risks into recognized strategic benefits for market penetration.

The core Impact Forces driving market evolution include the globalization of manufacturing standards, which allows large modular producers to serve multiple international markets efficiently, and the escalating demand for sustainable building practices. Sustainability requirements, driven by governmental policies and institutional mandates, favor modular construction due to its inherent reduction in site waste and its optimized material usage during fabrication. Furthermore, the increasing complexity of medical technology necessitates highly controlled, precision-built environments, which modular factories are ideally suited to deliver. These forces ensure that the modular approach is not merely a cost-saving measure but a quality-enhancing and environmentally superior method of delivering modern healthcare infrastructure, guaranteeing its long-term viability and accelerating adoption across diverse market segments globally.

Segmentation Analysis

The Modular Medical Building Market segmentation provides a detailed lens through which to analyze market dynamics, categorized fundamentally by Type (Permanent vs. Relocatable), Application (Specific Clinical Uses), and Material used in construction. This analysis reveals strategic preferences across different healthcare providers; large hospital networks often opt for Permanent Modular Construction (PMC) to integrate complex surgical wings or multi-story additions that mirror the durability and lifespan of traditional builds. In contrast, public health agencies and smaller clinics frequently leverage Relocatable Modular Construction for flexible capacity expansion, temporary services during renovations, or establishing rapid outreach services in underserved communities, emphasizing flexibility and speed of deployment as key determinants of choice.

The Application segment is critical as it reflects the specialization level required, with segments like diagnostic laboratories and high-specification surgical theaters commanding higher price points due to stringent requirements for HVAC, sterile environments, and infrastructure for heavy medical equipment. The rise of specialized isolation facilities, necessitated by global health concerns, has created a significant niche demanding rapid, airtight, and easily scalable units. Analyzing these application trends allows vendors to tailor their manufacturing processes and certifications (e.g., ISO certifications, regional healthcare compliance) to target the most profitable and fastest-growing end-user needs, ensuring their modular solutions are optimized for clinical workflow and patient safety, which are non-negotiable standards in the healthcare sector.

Material segmentation, focusing primarily on steel, wood, and concrete, highlights the trade-offs between cost, durability, and seismic resilience. Steel frame modular buildings dominate the market for multi-story, high-demand acute care facilities due to their superior strength and long lifespan, essential for meeting rigorous structural codes. While wood-based modules are gaining traction, particularly in regions promoting sustainable construction and for smaller clinic projects, concrete remains preferred for highly specialized, heavily insulated, or basement-integrated structures. Understanding the material preferences across geographies and facility types is essential for managing the supply chain, ensuring material readiness, and complying with diverse international fire and safety regulations, thereby maximizing the competitiveness of modular solutions.

- By Type

- Permanent Modular Construction (PMC)

- Relocatable Modular Construction (RMC)

- By Application

- Hospitals (Acute Care, Specialized Units, Operating Theaters)

- Clinics and Health Centers (Primary Care, Outpatient Services)

- Diagnostic Laboratories and Imaging Centers

- Isolation and Quarantine Facilities

- Administrative and Support Offices

- By Material

- Steel Frame Modular Buildings

- Wood Frame Modular Buildings

- Concrete Modular Systems

- By Ownership

- Leased

- Owned

Value Chain Analysis For Modular Medical Building Market

The Value Chain for the Modular Medical Building Market begins with upstream activities heavily focused on raw material procurement, including structural steel, specialized medical-grade fittings, insulation, and high-quality interior finishes. Efficiency at this stage is crucial, as the off-site factory model relies on just-in-time inventory management and robust supplier relationships to ensure continuous, standardized material flow necessary for mass production. Key competitive advantages are derived from securing reliable sourcing contracts and leveraging economies of scale in material purchasing, contrasting significantly with the segmented procurement typical of traditional construction. The upstream segment is characterized by rigorous quality checks to meet the high regulatory demands of healthcare infrastructure, ensuring all components adhere to fire safety, infection control, and sterile environment standards before entering the manufacturing process.

Midstream activities represent the core transformation process: factory fabrication, assembly, and quality assurance. This phase includes the integration of advanced technologies like BIM for digital modeling, robotics for precision cutting and welding, and dedicated assembly line processes for sequential module construction. The efficiency of the manufacturing plant, measured by throughput and defect rates, directly determines profitability and project completion speed. Distribution channel management is complex; while the finished modules are shipped directly (direct distribution) to the site, logistics require specialized heavy haulage, careful routing permits, and precise scheduling to minimize transport risks. Indirect channels sometimes involve partnering with local general contractors who manage the final site preparation and utility connection work, acting as crucial intermediaries between the modular provider and the healthcare facility owner.

Downstream analysis focuses on site preparation, installation, and post-occupancy services. Site activities involve utility hookups, foundation work (often completed concurrently with off-site fabrication), and the delicate craning and stitching together of modules—a highly skilled process that defines the project’s final success. Post-installation, the value chain extends to long-term maintenance contracts, monitoring, and future expansion or relocation services, particularly relevant for relocatable units. Direct engagement with end-users (the healthcare facility administrators and clinicians) is vital in this stage to ensure the final product meets functional and clinical workflow requirements. Success in the downstream segment relies heavily on effective project management and seamless coordination between the factory, logistics team, and the site assembly crew, translating high manufacturing quality into functional operational capacity.

Modular Medical Building Market Potential Customers

The primary customer base for Modular Medical Buildings is highly diverse yet unified by the need for speed, flexibility, and quality assurance in healthcare infrastructure. Large private and public hospital systems constitute the most significant segment, frequently requiring permanent modular expansions for specialized services such as surgical suites, emergency room additions, or multi-story patient bed towers to alleviate chronic overcrowding and adapt quickly to shifting service demands. These buyers prioritize long-term durability, structural integration with existing facilities, and compliance with the most stringent regulatory requirements, often opting for high-specification Permanent Modular Construction (PMC) to minimize operational disruption during expansion.

Another crucial customer segment includes governmental health agencies and regional health authorities. These entities often focus on enhancing primary care access in remote, rural, or underserved urban areas, making them prime candidates for standardized, rapidly deployable, and often relocatable modular clinics. Their purchasing decisions are heavily influenced by procurement cycles, standardization requirements across a region, and the need for scalable solutions that can be easily repurposed for public health initiatives, disaster response, or vaccination centers, emphasizing cost-effectiveness and rapid deployment as key decision criteria.

Further potential buyers encompass specialized healthcare providers, including diagnostic imaging companies, rehabilitation centers, mental health clinics, and educational institutions requiring simulated clinical training environments. Diagnostic companies, for instance, frequently lease or purchase modular units to house expensive, bulky equipment (like MRI or PET scanners) that require precise environmental controls and structural support, enabling them to expand services quickly without lengthy traditional construction delays. These specialized users look for high customization capabilities within a standardized modular framework, viewing the solution as a critical tool for service decentralization and market responsiveness.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 9.6 Billion |

| Growth Rate | 10.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Skanska, Laing O'Rourke, Bouygues Construction, Kleusberg GmbH & Co. KG, Modulaire Group, ATCO Ltd., WillScot Mobile Mini, VBC Premier Healthcare, Satellite Shelters, ModuleCo Healthcare, Boxman Studios, Palomar Modular, Allied Modular Building Systems, Kwikspace, NRB Inc., H+B, SIKA, BLOK Modular, Wernick Group, Premier Modular |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Modular Medical Building Market Key Technology Landscape

The successful evolution of the Modular Medical Building Market is intrinsically linked to the adoption of advanced construction technologies that enhance design precision, manufacturing efficiency, and lifecycle performance. Building Information Modeling (BIM) stands as the foundational technology, allowing for the creation of detailed digital twins of the medical modules. BIM facilitates clash detection, optimizes the integration of complex mechanical, electrical, and plumbing (MEP) systems required for clinical environments, and ensures compliance with strict healthcare standards before any physical fabrication begins. This digital pre-construction phase drastically minimizes errors, reduces rework, and enables seamless communication between architects, engineers, and fabricators, accelerating the project timeline and ensuring the modules are optimized for clinical workflow and future maintenance access.

Further technological advancements center on the manufacturing floor through the use of automation and robotics. Automated welding, cutting, and assembly robots ensure dimensional accuracy and structural consistency across thousands of repetitive components, which is critical for meeting the high structural integrity standards demanded by hospital infrastructure, particularly in seismic zones. Additionally, specialized off-site assembly equipment and advanced lifting mechanisms are employed to safely handle and manipulate oversized medical modules within the factory environment. These manufacturing innovations not only improve quality but also address the persistent shortage of skilled labor in construction by shifting complex tasks from unpredictable construction sites to controlled factory settings, guaranteeing predictability in both cost and delivery schedule.

Site installation and operational technologies also play a vital role. Digital surveying and laser scanning are used to verify site readiness and ensure millimeter-level precision when setting and "stitching" together modules, crucial for forming airtight, seamless structures required for sterile or sensitive medical environments. Post-occupancy, the integration of smart building systems, utilizing Internet of Things (IoT) sensors, allows for continuous monitoring of environmental conditions (temperature, humidity, air quality), energy consumption, and equipment performance. This data integration supports preventative maintenance and optimizes operational efficiency, transforming the modular unit into an intelligent facility asset, significantly enhancing its lifecycle value and operational cost-effectiveness for the healthcare provider.

Regional Highlights

- North America: This region holds a leading market share, driven by high healthcare expenditure, significant replacement and renovation cycles of aging hospital infrastructure, and early adoption of permanent modular construction (PMC). The US market, in particular, leverages modular solutions to quickly address urban capacity crises and rural healthcare access gaps. Stringent quality standards and large-scale hospital networks necessitate sophisticated, high-specification modules for complex facilities like surgical centers.

- Europe: The European market demonstrates strong growth, supported by robust governmental focus on sustainability and efficiency (e.g., EU Green Deal mandates). Countries like the UK, Germany, and the Scandinavian nations are leaders in implementing modular healthcare solutions, particularly for rapidly deploying primary care facilities, specialized mental health units, and temporary emergency wards during peak periods. Regulatory frameworks are generally supportive of industrialized construction methods.

- Asia Pacific (APAC): APAC is anticipated to exhibit the highest CAGR due to rapid population growth, accelerating urbanization, and substantial government investment in modernizing healthcare infrastructure across emerging economies (e.g., India, China, Southeast Asia). The need for fast, high-volume deployment of standardized clinics and primary health centers, particularly in response to infectious disease control, fuels the demand for relocatable and permanent modular units.

- Latin America (LATAM): Growth in LATAM is concentrated on addressing acute infrastructural shortages and improving regional access to basic healthcare services. Modular solutions are highly valued for their ability to deliver functional clinics quickly in geographically challenging or economically constrained areas, often serving public sector initiatives aimed at expanding coverage efficiently.

- Middle East and Africa (MEA): The MEA region shows promising demand, specifically in the Gulf Cooperation Council (GCC) countries for large, complex hospital projects driven by wealth and rapid infrastructure expansion goals. In Africa, relocatable modules are crucial for providing mobile clinics, emergency response infrastructure, and temporary specialized facilities, supported by international aid organizations and public health programs focused on infectious disease management.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Modular Medical Building Market.- Skanska

- Laing O'Rourke

- Bouygues Construction

- Kleusberg GmbH & Co. KG

- Modulaire Group

- ATCO Ltd.

- WillScot Mobile Mini

- VBC Premier Healthcare

- Satellite Shelters

- ModuleCo Healthcare

- Boxman Studios

- Palomar Modular

- Allied Modular Building Systems

- Kwikspace

- NRB Inc.

- H+B (Healthcare Building Solutions)

- SIKA (Focusing on materials and integration technologies)

- BLOK Modular

- Wernick Group

- Premier Modular

Frequently Asked Questions

Analyze common user questions about the Modular Medical Building market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between Permanent and Relocatable Modular Construction in the medical sector?

Permanent Modular Construction (PMC) is structurally designed for longevity, typically integrated into existing facilities and adhering to the same building codes as traditional construction, offering long-term clinical use. Relocatable Modular Construction (RMC) is designed for temporary or emergency use, prioritizing mobility, easy disassembly, and quick deployment for surge capacity or remote services.

Are modular medical buildings able to meet the stringent infection control standards required for operating theaters?

Yes, modern modular medical buildings, especially those used for surgical suites and sterile environments, are fabricated in controlled factory settings, enabling superior quality control over airtightness, specialized HVAC systems, and clinical finishes, often exceeding the standards achievable through on-site traditional construction methods.

How does modular construction impact the total project timeline and cost compared to traditional methods?

Modular construction significantly reduces the overall project timeline—by 30% to 50%—because site work and module fabrication occur simultaneously. While initial upfront manufacturing costs can sometimes be higher, the total lifecycle cost, including financing, time-to-market benefits, and reduced site waste, often results in significant overall cost efficiency.

What are the main regulatory hurdles faced by the modular medical building market globally?

The primary regulatory hurdles involve varying local building codes and permitting processes that sometimes lack specific provisions for industrialized construction methods, requiring extensive negotiations or third-party inspections to validate compliance, particularly across different regional jurisdictions.

Which regions are driving the highest demand for specialized diagnostic modular facilities?

North America and Europe are currently driving the highest demand for specialized diagnostic modular facilities, fueled by the rapid integration of advanced imaging technology (MRI, CT) and the need to decentralize these services closer to patient communities to improve accessibility and throughput.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager