Modular Microgrids Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437909 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Modular Microgrids Market Size

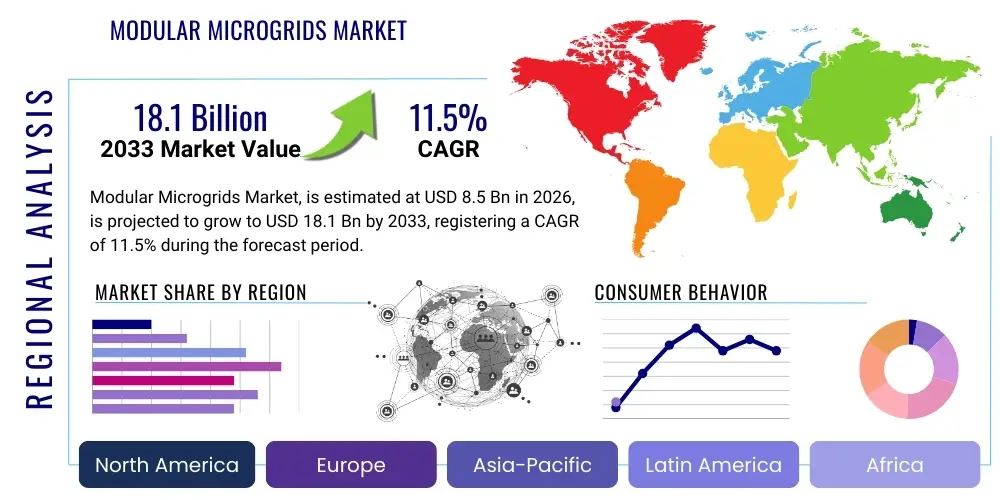

The Modular Microgrids Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at USD 8.5 Billion in 2026 and is projected to reach USD 18.1 Billion by the end of the forecast period in 2033.

Modular Microgrids Market introduction

The Modular Microgrids Market encompasses distributed energy systems designed for scalable and rapid deployment, offering localized power generation capabilities independent of or interconnected with the main utility grid. These systems typically integrate various power sources, including renewables like solar and wind, alongside traditional generators and energy storage systems (ESS). The core product constitutes prefabricated or containerized units containing generation assets, power conversion systems, control hardware, and sophisticated energy management system (EMS) software. This modularity allows for standardization, quicker installation times, reduced civil engineering complexity, and inherent flexibility in scaling power capacity based on evolving end-user demands, making them highly attractive for industrial facilities, military bases, remote communities, and disaster relief operations.

Major applications of modular microgrids span critical infrastructure protection, energy resiliency for data centers and hospitals, and providing reliable electricity access in areas with weak or non-existent grid infrastructure. Their rapid deployment capability makes them essential for military forward operating bases and temporary industrial sites such as mining or oil and gas exploration. The primary benefit these systems offer is enhanced energy security and resilience against grid failures, minimizing economic losses associated with power outages. Furthermore, by integrating high penetrations of renewable energy, modular microgrids support sustainability mandates and contribute significantly to decarbonization goals, especially when coupled with advanced battery storage solutions that manage intermittency effectively.

The market is primarily driven by escalating concerns over grid reliability dueved to aging infrastructure and increasing frequency of extreme weather events, necessitating robust backup power solutions. Simultaneously, the decreasing cost of renewable energy components, particularly solar photovoltaic (PV) and battery energy storage systems (BESS), makes the economic case for deploying self-contained modular systems increasingly compelling. Government incentives and supportive regulatory frameworks promoting distributed generation and grid modernization initiatives further stimulate market growth, compelling utilities and private entities to invest in these flexible and resilient energy solutions.

Modular Microgrids Market Executive Summary

The Modular Microgrids Market is currently experiencing robust growth, primarily propelled by the global imperative for enhanced energy resilience and sustainability. Business trends indicate a significant shift towards "Energy-as-a-Service (EaaS)" models, wherein third-party providers finance, build, and operate microgrids for end-users, lowering initial capital expenditure barriers. Technological advancements, particularly in highly efficient energy storage and predictive maintenance driven by the Internet of Things (IoT) and artificial intelligence (AI), are improving operational efficiency and reducing lifetime costs. Regionally, North America leads the market due to stringent reliability standards and high investment in modernizing aging electric infrastructure, closely followed by the Asia Pacific region, which demonstrates explosive growth driven by rapid industrialization and the need for electrification in remote areas, particularly in countries like India and China.

Segment trends reveal that the Industrial end-user segment, including manufacturing and resource extraction, dominates deployment due to the high economic cost of downtime, demanding continuous, high-quality power. Concurrently, the Hardware component segment, comprising power converters, switchgear, and generation assets, accounts for the largest market share, although the Software and Services segment is projected to exhibit the highest CAGR as complexity in integrating diverse distributed energy resources (DERs) necessitates advanced control and optimization platforms. Furthermore, power sources dominated by hybrid systems, combining solar PV with diesel backup and battery storage, are becoming the standard architecture, balancing reliability with environmental sustainability goals and reflecting a maturing technological integration capability across the market ecosystem.

Overall, the market trajectory confirms a strong move towards decentralization and digitization of energy infrastructure. Key industry players are focusing on strategic collaborations and mergers & acquisitions to enhance vertical integration and offer comprehensive, turn-key modular solutions. This competitive landscape is driving standardization in system design and manufacturing, facilitating quicker market penetration and reducing time-to-power for critical applications globally. The convergence of favorable governmental policies supporting renewable adoption and sustained technological innovation in system controls ensures a positive long-term outlook for the modular microgrids sector.

AI Impact Analysis on Modular Microgrids Market

Users frequently inquire about how Artificial Intelligence (AI) enhances the autonomy, efficiency, and reliability of modular microgrids. Key questions revolve around AI’s role in optimizing energy dispatch, predicting renewable energy generation fluctuations, managing battery degradation, and providing cybersecurity protection for decentralized assets. Concerns often focus on the required computational infrastructure, data privacy issues associated with collecting detailed operational data, and the complexity of integrating self-learning algorithms into existing energy management systems (EMS). The consensus expectation is that AI will transform microgrids from reactive systems to truly predictive and self-healing networks, drastically reducing operational costs (OPEX) and improving uptime by dynamically balancing supply and demand in real-time under rapidly changing conditions.

- AI-driven Predictive Maintenance: Utilizing machine learning algorithms to analyze sensor data from generation assets (e.g., turbines, inverters, batteries) to predict component failures before they occur, maximizing asset lifespan and minimizing unplanned downtime.

- Optimized Energy Dispatch and Load Forecasting: Employing neural networks for highly accurate, short-term forecasting of renewable generation (solar irradiance, wind speed) and load requirements, enabling precise scheduling of distributed energy resources (DERs) to minimize fuel consumption or maximize arbitrage opportunities.

- Enhanced Cybersecurity: Implementing AI-based anomaly detection systems that monitor network traffic and operational parameters, identifying and isolating potential cyber threats targeting critical microgrid control systems, ensuring operational integrity.

- Autonomous Control and Resilience: Developing self-learning microgrid controllers that automatically reconfigure the network topology and power flow pathways during disturbances (e.g., grid separation or equipment failure), maintaining continuous power supply to critical loads without human intervention.

- Advanced Battery Management: Using AI to optimize charging and discharging cycles of Battery Energy Storage Systems (BESS) based on predicted usage patterns, ambient temperature, and state-of-health modeling, thereby extending the effective lifespan and performance of expensive storage assets.

- Market Integration and Trading: Enabling microgrids to participate autonomously in wholesale electricity markets by executing optimal buy/sell decisions based on real-time price signals and predicted energy surpluses/deficits, enhancing economic viability for system owners.

DRO & Impact Forces Of Modular Microgrids Market

The Modular Microgrids Market is significantly influenced by powerful Drivers stemming from global energy transition mandates and increasing infrastructure vulnerability, while it is simultaneously constrained by high initial capital investment costs and complex regulatory barriers that vary substantially across jurisdictions. Opportunities abound in integrating advanced digital technologies, such as IoT and AI, into control systems, as well as penetrating vast untapped markets in remote and developing economies seeking electrification solutions. The impact forces underscore the essential role modularity plays in expediting deployment and mitigating risks associated with large, centralized infrastructure projects, positioning these systems as foundational elements for future decentralized energy networks globally.

The primary drivers are the increasing demand for energy resiliency among commercial and industrial users—who cannot afford downtime—and proactive government policies supporting distributed generation to reduce strain on aging centralized grids. Furthermore, the rapid decline in the levelized cost of electricity (LCOE) for renewable energy sources makes pairing these sources with modular microgrids economically competitive against traditional grid power in many geographies. Conversely, significant restraints include the non-standardized nature of interconnection agreements with utility operators, which creates administrative hurdles and delays, alongside the technological complexity involved in seamlessly integrating multiple disparate generation and storage technologies under a single, cohesive control platform. The need for specialized expertise in designing and operating these systems further limits faster widespread adoption in smaller organizations.

Opportunities for market expansion center around offering highly customizable, scalable solutions that appeal to the defense and disaster relief sectors, where rapid setup is paramount. The evolution of hybrid microgrids incorporating hydrogen fuel cells presents a long-term growth avenue, offering zero-emission, high-density energy storage. The most profound impact forces driving adoption include the climate change imperative, which demands cleaner, localized power sources, and the necessity for robust defense against physical and cyber threats targeting vulnerable centralized utility infrastructure. These forces compel industries and municipalities worldwide to prioritize investments in autonomous, modular energy solutions to guarantee continuous operation and societal function.

Segmentation Analysis

The Modular Microgrids Market is comprehensively segmented based on its core components, the types of power sources utilized, and the diverse applications across various end-user sectors. This segmentation highlights the technological complexity and the tailored nature of solutions required for different operational environments. The component segmentation differentiates between the physical hardware necessary for energy conversion and distribution, and the crucial software and services layer that provides the intelligence and ongoing maintenance required for optimal performance. Analyzing these segments provides strategic insights into investment priorities, indicating where technological innovation is most rapidly advancing and where standardization efforts are most concentrated within the modular ecosystem.

The power source segmentation reflects the ongoing energy transition, detailing the shift from reliance on traditional fossil fuels (like diesel generators) towards hybrid systems that prioritize renewable energy integration, specifically Solar PV and, increasingly, advanced battery storage. This segmentation is critical for understanding regional market dynamics, as resource availability dictates the primary energy source choice—solar dominating sun-rich regions, and wind in resource-favorable areas. The End-User analysis reveals the high-value applications, with critical infrastructure sectors like Industrial manufacturing and Military operations driving the demand for the highest reliability and capacity, thereby shaping system design requirements and procurement patterns across the globe.

- By Component:

- Hardware (Power Generators, Inverters/Converters, Control Devices, Switchgear, Energy Storage Systems (BESS))

- Software (Energy Management Systems (EMS), Distribution Management Systems (DMS), Forecasting Tools)

- Services (Consulting, Integration & Installation, Maintenance & Support, Energy-as-a-Service (EaaS))

- By Power Source:

- Diesel Generator

- Natural Gas

- Solar Photovoltaic (PV)

- Wind Turbine

- Fuel Cell

- Hybrid (Combination of Renewables and Traditional Sources)

- By End-User:

- Commercial (Educational Institutions, Data Centers, Retail, Office Buildings)

- Industrial (Manufacturing, Oil & Gas, Mining, Construction Sites)

- Utilities (Remote Grid Support, Distribution Network Optimization)

- Military & Defense

- Remote & Rural Electrification

- By Type of Connectivity:

- Grid-Connected

- Off-Grid (Islanded)

Value Chain Analysis For Modular Microgrids Market

The value chain for modular microgrids begins with upstream activities focused on component manufacturing, primarily involving original equipment manufacturers (OEMs) of generation assets (solar panels, turbines, generators), power electronics (inverters, converters), and energy storage hardware (battery cells and systems). This stage requires significant investment in R&D to improve efficiency, durability, and standardization of components suitable for containerization and rapid deployment. Key strategic decisions here revolve around supply chain resilience, ensuring access to critical materials, particularly lithium for BESS, and maintaining quality control for prefabricated modules designed for harsh or remote operating environments, often demanding specialized ruggedization techniques.

Midstream activities involve system integration, crucial engineering, and advanced software development. Integrators acquire components, design the overall system architecture, develop the proprietary Energy Management System (EMS) software that governs system operation, and assemble the modular units—often in standardized shipping containers—for transport. This phase adds substantial value through intellectual property related to control algorithms and seamless component interaction. Direct distribution often involves large engineering, procurement, and construction (EPC) firms or specialized microgrid developers who handle the entire project lifecycle from initial consultation and design to installation and commissioning, providing a comprehensive, single-source solution to the end-customer.

Downstream activities encompass deployment, ongoing maintenance, and the increasingly popular shift towards Service-based models. Direct channels are prevalent for large industrial and military projects where custom integration and direct communication with specialized engineers are required. Indirect channels, involving partnerships with local utility companies or regional technology distributors, help penetrate commercial and remote markets. The increasing trend of offering Modular Microgrids as an Energy-as-a-Service (EaaS) model transfers the operational and financial risk from the end-user to the provider, enhancing market accessibility and accelerating adoption by providing reliable, resilient power for a fixed monthly fee, thereby monetizing the operational longevity and efficiency gains achieved through superior system management and predictive maintenance protocols.

Modular Microgrids Market Potential Customers

The primary buyers and end-users of modular microgrids are entities for whom power reliability is non-negotiable and the cost of downtime is exceptionally high. This encompasses major industrial organizations, particularly those in continuous process manufacturing, such as chemicals, steel, and semiconductor fabrication, where interruptions can cause catastrophic material loss and lengthy restart procedures. The Oil & Gas and Mining sectors operating in remote, often harsh, locations are also crucial customers, relying on modular solutions to provide immediate, reliable, and scalable power generation without the logistical complexities associated with traditional power plants or long-distance transmission infrastructure development.

Another significant customer segment is critical municipal and commercial infrastructure, including large hospital networks, major financial data centers, and telecommunications hubs. For these entities, modular microgrids serve as the ultimate layer of resilience, ensuring continuous service during catastrophic regional grid failures, often mandated by regulatory bodies to protect public safety and maintain economic stability. Furthermore, military and defense installations represent a captive and growing customer base, prioritizing modularity for rapid deployment, energy security, and reduced reliance on vulnerable fuel supply chains, often requiring hardened, off-grid capabilities for forward operating bases and domestic facilities alike.

Finally, utility companies themselves are increasingly becoming customers, deploying modular microgrids for localized grid support, especially in areas prone to wildfires or severe weather events (e.g., California’s Public Safety Power Shutoffs). These units provide "backbone" resilience and can serve as vital points of connection to restore power to wider areas following major outages. Emerging markets also hold immense potential, with governments and non-governmental organizations seeking modular solutions for rapid rural electrification projects, displacing polluting diesel generators and providing first-time reliable power access to remote communities where utility expansion is economically impractical.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 8.5 Billion |

| Market Forecast in 2033 | USD 18.1 Billion |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Siemens AG, Schneider Electric SE, General Electric Company, ABB Ltd., Eaton Corporation PLC, Honeywell International Inc., Tesla Inc., S&C Electric Company, PowerSecure Inc. (Southern Company), Bloom Energy, Enel X (Enel Group), Spirae LLC, Ameresco Inc., Advanced Microgrid Solutions, CleanSpark Inc., Cummins Inc., Caterpillar Inc., Wärtsilä Corporation, Rolls-Royce Power Systems (MTU), Hitachi Energy. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Modular Microgrids Market Key Technology Landscape

The technological core of the modular microgrids market is centered on the synergistic combination of advanced power electronics, high-density energy storage, and sophisticated digital control systems. Power electronics, specifically bidirectional inverters and converters, are crucial as they manage the flow of power between disparate sources—such as DC from solar PV and AC from the grid or diesel generators—and ensure optimal power quality and frequency synchronization when operating in islanded mode. Technological advancements in Silicon Carbide (SiC) and Gallium Nitride (GaN) components are making these power electronics smaller, more efficient, and robust, which is essential for containerization and modular system density, thereby reducing the overall footprint and thermal management requirements of the modular unit.

Energy storage technology is foundational, with Lithium-ion Battery Energy Storage Systems (BESS) dominating due to their high energy density, cycle life, and falling costs. Innovation is focused on enhancing battery management systems (BMS) to optimize performance under various load conditions, mitigating degradation, and improving safety standards within containerized units. Beyond lithium-ion, the integration of alternative long-duration storage technologies, such as flow batteries and potentially compressed air energy storage (CAES) for larger, stationary modules, is being explored to address prolonged power outage scenarios and reduce reliance on traditional fuel sources for extended backup periods, further enhancing the system's operational flexibility and sustainability profile.

The critical differentiator in the modular microgrids landscape is the Energy Management System (EMS) software. Modern EMS platforms leverage cloud computing, IoT telemetry, and AI/machine learning algorithms to perform real-time optimization. These systems continuously monitor load profiles, meteorological data, utility tariff structures, and generation availability to make predictive dispatch decisions. This intelligence enables modular microgrids to operate autonomously, transitioning seamlessly between grid-connected and islanded modes, managing black starts, and optimizing economic returns for the owner by strategically using stored energy or injecting surplus power back into the main grid when prices are favorable, transforming the microgrid into a proactive participant in the wider energy landscape.

Regional Highlights

- North America (Dominance due to Critical Infrastructure Focus): North America is anticipated to retain the largest market share, driven primarily by the high degree of awareness regarding critical infrastructure resilience and significant investment from military and commercial sectors. The region faces aging transmission infrastructure and increasing grid instability due to extreme weather, particularly in coastal and densely populated areas. Regulatory mandates, such as those encouraging demand response and distributed generation in states like California and New York, actively promote microgrid deployment. Federal programs, especially within the Department of Defense (DoD), heavily fund the development of modular, resilient power solutions for military bases (base hardening) to ensure continuity of operations, solidifying the market's high value and maturity in this region. The sophisticated integration capabilities within the U.S. and Canada enable complex hybrid systems utilizing advanced software controls.

- Asia Pacific (Highest Growth Potential and Electrification Needs): The Asia Pacific region is projected to register the highest Compound Annual Growth Rate (CAGR) over the forecast period. This explosive growth is fueled by rapid urbanization, massive industrial expansion, and the substantial need for electrification in remote areas (e.g., Indonesia, Philippines, and rural India). Modular microgrids offer a scalable, less capital-intensive path to providing reliable power compared to extending the traditional transmission network across challenging geographies. Governments across China, India, and Australia are implementing aggressive renewable energy targets, directly boosting demand for modular systems that can effectively integrate solar PV and storage. Furthermore, frequent power outages impacting manufacturing operations in countries like China are compelling industrial players to invest in self-contained, resilient power solutions to safeguard production continuity and meet rigorous supply chain demands.

- Europe (Focus on Decarbonization and Grid Modernization): The European market is characterized by a strong regulatory push towards decarbonization and achieving net-zero emission targets, making the integration of renewables and storage solutions paramount. Modular microgrids are essential tools for managing congestion in densely populated urban areas and supporting remote islands or industrial clusters seeking self-sufficiency (e.g., Germany, UK, and Scandinavia). While grid reliability is generally high, the focus is on maximizing the efficiency of energy usage and enabling local energy trading. Supportive EU directives, combined with pilot projects focusing on utilizing microgrids for sector coupling—integrating electricity, heating, and transport—ensure steady, policy-driven growth. The region sees strong demand for small-to-medium-scale modular systems targeting commercial and university campuses.

- Latin America (Electrification and Resource Extraction): Market growth in Latin America is driven by the need for reliable power in the resource extraction sector (mining, particularly in Chile and Peru) and significant rural electrification gaps across Brazil and Mexico. Modular systems, particularly off-grid versions utilizing diesel/solar hybrids, offer the fastest route to reliable power delivery in infrastructure-poor zones. Economic instability and variable fuel costs necessitate solutions that optimize operational expenses, leading to greater adoption of solar PV-centric modules. Investment is often tied to foreign direct investment (FDI) in large industrial projects requiring guaranteed power supply far from centralized grids.

- Middle East and Africa (MEA) (Oil & Gas and Remote Electrification): The MEA region presents a dual market structure. The GCC countries (Middle East) utilize microgrids heavily for oil and gas operations and cooling critical infrastructure, demanding high-capacity, rugged systems often leveraging natural gas or solar. In Africa, the core demand is driven by addressing the massive energy access deficit, where modular, decentralized systems provide the most viable solution for powering remote villages, small enterprises, and telecommunications towers, often supported by multilateral development bank financing focused on sustainable energy development initiatives.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Modular Microgrids Market.- Siemens AG

- Schneider Electric SE

- General Electric Company

- ABB Ltd.

- Eaton Corporation PLC

- Honeywell International Inc.

- Tesla Inc.

- S&C Electric Company

- PowerSecure Inc. (Southern Company)

- Bloom Energy

- Enel X (Enel Group)

- Spirae LLC

- Ameresco Inc.

- Advanced Microgrid Solutions

- CleanSpark Inc.

- Cummins Inc.

- Caterpillar Inc.

- Wärtsilä Corporation

- Rolls-Royce Power Systems (MTU)

- Hitachi Energy

Frequently Asked Questions

Analyze common user questions about the Modular Microgrids market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary advantage of choosing a modular microgrid over a custom-built solution?

The primary advantage of modular microgrids is reduced deployment time and lower installation complexity due to standardized, factory-tested components, leading to faster time-to-power, enhanced scalability, and reduced project risk compared to lengthy, custom-engineered site builds.

How does the Energy-as-a-Service (EaaS) model affect the adoption of modular microgrids?

EaaS significantly boosts adoption by eliminating the high upfront capital expenditure for the end-user. Providers finance, own, and operate the microgrid, offering resilience and reliable power for a predictable monthly fee, thereby transforming energy investment from CapEx to OpEx.

Which end-user segment currently drives the highest demand for high-capacity modular microgrids?

The Industrial and Military sectors drive the highest demand. Industrial facilities, such as manufacturing and mining, require high capacity and extremely high reliability to prevent costly operational shutdowns, while military bases prioritize energy security and rapid deployment capabilities.

What role do Battery Energy Storage Systems (BESS) play in the modular microgrid architecture?

BESS are critical, providing frequency regulation, stabilizing power fluctuations from renewables, offering immediate backup power upon grid separation, and enabling energy arbitrage, thereby maximizing the system’s economic viability and operational resilience.

What are the key technical challenges facing widespread modular microgrid implementation?

Key technical challenges include achieving seamless and standardized interconnection agreements with existing utility grids, ensuring robust cybersecurity across decentralized control systems, and managing the technological complexity of optimizing multiple, variable energy sources simultaneously.

How do modular microgrids contribute to global decarbonization efforts?

Modular microgrids facilitate decarbonization by efficiently integrating a higher penetration of renewable energy sources (like solar and wind) into localized grids. Their localized control optimizes renewable resource utilization, reducing reliance on carbon-intensive centralized power generation.

What is the difference between a grid-connected and an off-grid modular microgrid?

A grid-connected microgrid operates while synchronized with the main utility grid, providing load support and potentially exporting power, but can also 'island' during outages. An off-grid (or islanded) system operates entirely independently, providing power primarily for remote locations without grid access.

What impact does AI have on the operational costs of a modular microgrid?

AI drastically reduces operational costs (OPEX) by optimizing energy dispatch decisions, minimizing fuel consumption for traditional generators, performing predictive maintenance to reduce component failures, and improving energy trading profitability through accurate forecasting.

Why is standardization important in the modular microgrids market?

Standardization is vital because it reduces manufacturing costs, simplifies site-specific engineering requirements, improves reliability through repeatable designs, and speeds up the permitting and deployment process, making microgrids more accessible and economical for diverse applications.

Which geographical region is expected to show the fastest market growth, and why?

Asia Pacific is expected to show the fastest growth, driven by massive industrial growth, urbanization, and a crucial need for reliable electricity access in remote and underserved areas where modular microgrids offer a cost-effective alternative to centralized grid expansion.

What is the significance of the shift towards hybrid power sources in modular microgrids?

Hybrid power sources, typically combining solar PV and BESS with traditional generators, offer the crucial balance between sustainability and reliability. They maximize clean energy use while ensuring continuous power availability even during periods of low renewable generation or grid failure.

How do modular microgrids ensure power quality and frequency stability?

Modular microgrids utilize sophisticated power electronics (inverters/converters) and advanced Energy Management Systems (EMS) that actively monitor and regulate voltage and frequency in real-time, especially when operating in islanded mode, ensuring high power quality required by sensitive equipment.

What challenges do complex regulatory environments pose to market expansion?

Complex regulatory environments, particularly non-standardized interconnection standards and varying permitting requirements across jurisdictions, create administrative delays and increase uncertainty, serving as significant restraints on rapid, widespread deployment.

What is the typical lifespan of a modular microgrid system?

While generation assets vary, a well-maintained modular microgrid system, utilizing robust industrial components and advanced battery management, typically has a functional lifespan ranging from 15 to 25 years, with key components like batteries requiring replacement every 7 to 15 years.

How are modular microgrids utilized in disaster relief and recovery efforts?

Their modular, containerized design allows them to be transported rapidly to disaster zones. They can be quickly deployed to restore power to critical services like hospitals, communication centers, and emergency shelters where centralized infrastructure has been compromised, providing immediate resiliency.

Which component segment holds the largest current market share?

The Hardware component segment, which includes generators, switchgear, power converters, and especially Battery Energy Storage Systems (BESS), holds the largest current market share due to the high capital cost associated with these physical assets necessary for generation and conversion.

How do advancements in IoT support modular microgrid operations?

IoT enables advanced monitoring and data collection from decentralized components. Real-time telemetry allows the EMS to make instantaneous operational adjustments, facilitates remote diagnostics, and feeds critical data to AI systems for predictive analysis and optimal control.

What is the difference between a microgrid and a nanogrid?

A microgrid typically powers a campus, community, or large industrial facility (kW to MW scale), whereas a nanogrid is a smaller, simpler, localized power system (kW scale) often serving a single building or a small cluster of homes, focusing on basic energy security for a limited load.

What emerging technology shows long-term promise for modular microgrids beyond lithium-ion?

Hydrogen fuel cell technology, combined with localized hydrogen production and storage, shows long-term promise, particularly for high-capacity, zero-emission applications that require extended periods of backup power where traditional batteries may not be economically feasible.

How do modular microgrids impact the vulnerability of centralized utility infrastructure?

By distributing generation and allowing critical loads to operate autonomously, modular microgrids reduce the overall strain on the centralized grid and act as buffers. This decentralization limits the cascading effects of failures, making the entire regional power system less vulnerable to large-scale outages.

What criteria are used to determine the optimal size and configuration of a modular microgrid?

The configuration is determined by factors including the critical peak load requirement, desired duration of islanded operation, local renewable resource availability (solar irradiation, wind speed), physical footprint constraints, and the economic viability based on prevailing utility tariffs and fuel costs.

In the Value Chain, where does the highest value addition occur?

The highest value addition occurs in the System Integration and Software development stage (midstream). This is where the proprietary Energy Management System (EMS) is developed and integrated to harmonize disparate hardware, providing the intelligence that dictates system efficiency and resilience.

How is the modular approach benefiting the military and defense sector?

The military benefits significantly from modularity due to the need for rapid deployment and redeployment. Modular units ensure energy security for forward operating bases, reducing logistical requirements for vulnerable fuel convoys and increasing tactical flexibility.

What is the key driver of the high CAGR projected for the software and services segment?

The increasing complexity of integrating multiple DERs (Solar, Storage, Gas) necessitates more sophisticated, AI-driven control software (EMS). Furthermore, the growth of the EaaS model guarantees long-term revenue streams via ongoing maintenance, optimization, and system support services.

How do solar PV costs influence the modular microgrids market growth?

The continued reduction in the Levelized Cost of Electricity (LCOE) for Solar PV makes it the most attractive and fastest-to-deploy generation component for modular systems, significantly improving the return on investment (ROI) for hybrid microgrids and driving overall market expansion.

What are the key differences between Distributed Generation (DG) and a microgrid?

DG refers to any power generation near the point of use. A microgrid is a specific type of DG system that includes defined boundaries, controlled loads, and the crucial ability to disconnect from the main grid (island) and operate autonomously, providing superior resilience.

How important is cybersecurity in the design of modular microgrids?

Cybersecurity is paramount. As decentralized, internet-connected assets, microgrids are vulnerable to attacks targeting their EMS. Robust, multi-layered security protocols, often utilizing AI anomaly detection, are mandatory to protect critical infrastructure from remote exploitation.

What is the significance of the "black start" capability in off-grid modular microgrids?

Black start capability is essential, referring to the system's ability to restart and energize itself without relying on an external power source. This feature is fundamental for ensuring rapid power restoration following a complete shutdown or during initial deployment in remote areas.

How are modular microgrids impacting utility business models?

Modular microgrids are forcing utilities to evolve from centralized energy providers to 'Distribution System Operators' (DSOs). Utilities must now integrate and manage these decentralized assets, often collaborating with microgrid providers or deploying their own modular solutions for grid stability.

Why is the Middle East and Africa (MEA) region characterized by a dual market structure?

MEA has a dual structure: the affluent Gulf Cooperation Council (GCC) countries prioritize high-capacity, reliable power for energy-intensive O&G operations and cooling, while the rest of Africa focuses primarily on humanitarian and rural electrification using smaller, cost-effective off-grid modules.

What technological advancement is enhancing the efficiency of power electronics in modular systems?

The shift from traditional silicon-based components to wide-bandgap semiconductors, such as Silicon Carbide (SiC) and Gallium Nitride (GaN), is significantly increasing the switching efficiency and power density of inverters and converters, reducing thermal footprint required in compact modular units.

In Europe, what is driving the deployment of modular microgrids beyond basic reliability?

European deployment is heavily driven by environmental mandates (decarbonization) and the push for sophisticated grid management (sector coupling). Modular systems help integrate intermittent renewables and provide localized control to achieve national energy efficiency and climate goals.

How do government policies act as both a driver and a restraint in this market?

Policies that mandate renewable integration and support distributed generation act as strong drivers. Conversely, outdated or complex utility interconnection regulations and permitting processes—which often lag behind technological advancements—act as significant market restraints.

What role does forecasting technology play in optimizing hybrid modular microgrids?

Advanced forecasting technology (using AI) predicts solar and wind output and future load demands with high accuracy. This allows the EMS to optimally charge/discharge batteries and schedule generator run-times, ensuring reliability while minimizing fuel costs and maximizing renewable utilization.

How do modular microgrids address the challenges of electrification in remote communities?

Modular microgrids offer a cost-effective, scalable, and rapidly deployable solution to electrify remote areas. By avoiding the monumental expense of building long transmission lines, they provide immediate, reliable, and often renewable-based power, boosting local economic development.

What are the typical hardware components included in a standard modular microgrid unit?

A standard modular unit typically includes power generation (e.g., diesel or solar panels), a Battery Energy Storage System (BESS), sophisticated inverters and power conditioning equipment, switchgear, protective relays, and the centralized Energy Management System (EMS) controller.

How do large industrial companies measure the Return on Investment (ROI) for a modular microgrid?

ROI is measured not just through energy cost savings, but crucially, through avoided costs associated with production downtime, material spoilage, insurance rate reductions due to enhanced resilience, and often through new revenue streams from participating in grid ancillary services.

What is the major upstream activity in the modular microgrids value chain?

The major upstream activity is the manufacturing and standardization of high-quality components, particularly power electronics (inverters/converters) and high-density battery cells/packs suitable for rugged, containerized installation and optimized for long-term reliable operation.

What factors contribute to North America's continued dominance in market size?

North America’s dominance is attributed to large government and defense investments in base resilience, high energy consumption and sophisticated grid infrastructure, high utility rates making self-generation attractive, and a large, established industrial base with low tolerance for power interruptions.

How does the containerized design of modular microgrids aid deployment?

Containerization ensures that the system is pre-assembled, wired, and tested in a factory environment, minimizing site work, reducing installation complexity, ensuring consistent quality, and facilitating rapid transport and connection anywhere in the world, dramatically cutting deployment time.

What competitive strategy are key players employing to gain market share?

Key players are increasingly pursuing vertical integration (controlling both hardware and software), focusing on developing robust EaaS models, and entering strategic partnerships with EPC firms or local utilities to offer turn-key solutions and overcome local regulatory hurdles simultaneously.

Why is the Latin American market heavily reliant on hybrid solar/diesel solutions?

Latin America relies on this hybrid approach due to excellent solar resources combined with the necessity of diesel backup to guarantee reliability in infrastructure-poor, remote areas, particularly for high-value applications like mining where reliable power is non-negotiable despite economic fluctuations.

What are the primary economic constraints limiting modular microgrid market expansion?

The primary constraints are the high initial capital investment required for generation and storage assets (especially BESS), which can be prohibitive for small and medium enterprises, and the lack of accessible, low-cost financing options tailored specifically for decentralized energy projects in emerging economies.

How does the shift towards modularity affect the role of system integrators?

Modularity enhances the role of system integrators, shifting their focus from complex, site-specific component assembly to highly specialized software integration, optimal EMS tuning, and ensuring seamless interoperability between pre-fabricated subsystems and site-specific load characteristics.

What is a key difference between DMS and EMS software in a microgrid context?

Distribution Management Systems (DMS) typically manage the flow and topology of power distribution across a broader network, whereas the Energy Management System (EMS) specifically focuses on the real-time scheduling, dispatch, and optimization of the generation and storage assets within the microgrid boundary.

How does climate change influence the market for modular microgrids?

Climate change, leading to more frequent and intense weather events, significantly drives the demand for resilient power. Modular microgrids provide localized immunity against grid damage caused by storms, floods, or wildfires, making them essential for business continuity and critical services.

What type of consulting services are most demanded by potential modular microgrid buyers?

Buyers primarily demand consulting services related to feasibility studies, economic modeling (optimizing ROI based on local tariffs), site assessment for renewable resource availability, and assistance navigating complex utility interconnection and regulatory compliance processes.

Why is the need for skilled operational expertise a restraint for widespread adoption?

Operating a microgrid requires specialized knowledge in power electronics, renewable energy dynamics, and advanced control software. The scarcity of personnel with these multi-disciplinary skills increases operational risk and complexity for entities without dedicated technical teams.

How are modular microgrids transforming the concept of resilience in data centers?

For data centers, modular microgrids move beyond simple backup generators by offering continuous, high-quality power and the ability to operate indefinitely independent of the grid using integrated renewables and storage, significantly increasing the reliability and sustainability profile beyond traditional N+1 redundancy.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager