Modular Weapon Storage Systems Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435276 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Modular Weapon Storage Systems Market Size

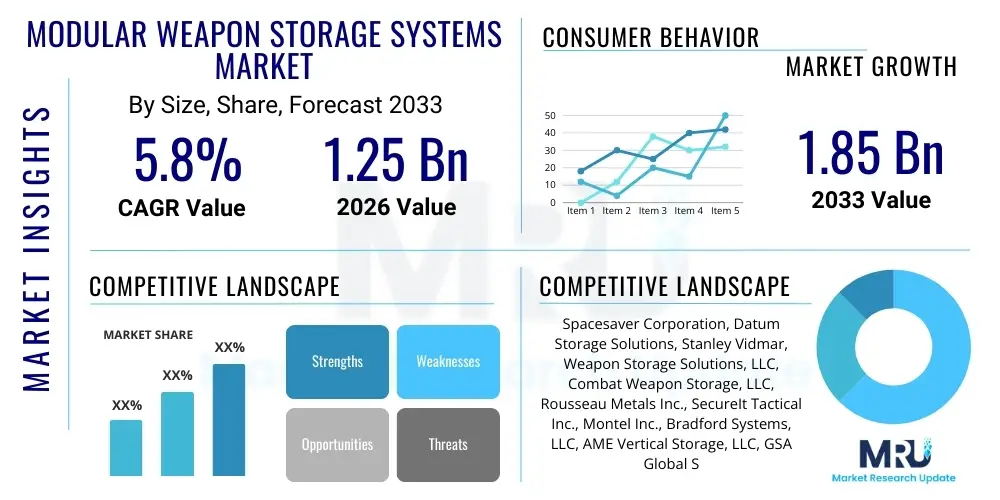

The Modular Weapon Storage Systems Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 1.25 Billion in 2026 and is projected to reach USD 1.85 Billion by the end of the forecast period in 2033.

Modular Weapon Storage Systems Market introduction

The Modular Weapon Storage Systems Market encompasses sophisticated, high-density storage solutions designed for the secure and organized housing of firearms, accessories, and associated tactical gear. These systems are characterized by their inherent flexibility, allowing users—primarily military organizations, law enforcement agencies, and security contractors—to rapidly reconfigure storage layouts based on evolving inventory and space constraints. Unlike traditional fixed armories, modular systems utilize standardized components like adjustable racks, shelves, and cabinets that can be stacked, moved, or integrated into existing facilities, optimizing space utilization by up to 50% compared to conventional storage methods. The core product offering includes vertical wall racks, horizontal cabinets, mobile carriages, and specialized storage drawers tailored to specific weapon types, ensuring rapid accessibility while maintaining stringent security protocols.

Major applications for modular weapon storage systems span national defense infrastructure, domestic security operations, and specialized governmental departments handling firearms. Military barracks, forward operating bases, naval vessels, and air force armories constitute the primary segment, requiring storage solutions that can withstand harsh environmental conditions and meet high operational readiness standards. Furthermore, domestic law enforcement agencies, including police departments, SWAT teams, and border patrol, are increasingly adopting these systems to manage growing and diversified weapon inventories securely, complying with strict regulatory requirements for firearm accountability and inventory control. The adaptability of these systems is a key differentiator, facilitating easier audits and maintenance of readiness levels across diverse institutional settings.

The growth in this market is intrinsically linked to rising global defense expenditures, modernization initiatives within armed forces worldwide, and an increased focus on asset protection and security compliance. Key driving factors include the need for rapid deployment and retrieval of weapons, the necessity of maintaining weapon integrity through proper environmental control and organized storage, and the pervasive trend toward maximizing limited storage space within existing infrastructure. The benefits realized by end-users, such as reduced inventory management time, enhanced security against unauthorized access, and improved facility logistics, solidify the value proposition of modern modular storage solutions, positioning them as essential components of contemporary defense and security logistics infrastructure.

Modular Weapon Storage Systems Market Executive Summary

The Modular Weapon Storage Systems Market is experiencing robust growth driven by escalating global geopolitical tensions and consequential increases in defense spending, particularly in North America and Asia Pacific. Business trends indicate a strong shift towards highly specialized, customized storage solutions integrated with advanced security features, such as biometric access control and RFID tracking capabilities, moving beyond simple physical storage. Leading manufacturers are focusing on lightweight, durable materials (e.g., high-grade aluminum and composite alloys) to enhance system mobility and longevity, catering to the needs of rapidly deployable military units and tactical operations centers. Furthermore, sustainability and space optimization are emerging as critical procurement criteria, compelling vendors to design high-density mobile aisle systems that significantly reduce the required storage footprint.

Regionally, North America remains the dominant market, characterized by large defense budgets, a high volume of governmental and law enforcement agencies requiring compliance-driven storage, and a rapid adoption rate of advanced security technologies. However, the Asia Pacific region is projected to exhibit the highest CAGR, fueled by the extensive military modernization programs initiated by countries like China, India, and Japan, alongside rising internal security threats. Europe presents a mature but competitive landscape, where demand is often driven by NATO standardization requirements and the replacement cycles of older, non-modular armory equipment. Emerging economies in the Middle East and Latin America are also showing increased demand, prompted by efforts to professionalize their defense forces and secure newly acquired sophisticated weapon systems.

Segment trends highlight the dominance of the Mobile Aisle Systems segment due to its superior capacity for high-density storage, making it ideal for large central armories. Concurrently, the Small Arms segment, defined by rifles, pistols, and machine guns, commands the largest market share by application, reflecting the sheer volume of these weapons requiring secure storage globally. Technology integration is paramount, with surveillance systems and computerized inventory management tools becoming standard inclusions rather than optional add-ons. End-user demand is consistently shifting towards solutions that offer both physical protection and seamless digital accountability, ensuring strict adherence to chain of custody protocols in military and law enforcement operations.

AI Impact Analysis on Modular Weapon Storage Systems Market

Analysis of user inquiries surrounding AI's influence on weapon storage systems reveals primary concerns centered on predictive maintenance, enhanced security authentication, and automated inventory management accuracy. Users frequently ask how AI can prevent system failures in complex mobile racking, whether machine learning algorithms can detect subtle signs of tampering or unauthorized access better than current surveillance systems, and the feasibility of implementing fully autonomous armory management. The consensus expectation is that AI will transform the traditionally physical domain of storage into a highly intelligent, self-monitoring ecosystem, shifting labor from manual checking to supervisory oversight of automated processes. This integration is expected to drastically reduce human error in inventory reconciliation and improve the speed of weapon issuance and return procedures.

Key themes emerging from user expectations include the potential for AI-driven anomaly detection in access logs, which could flag insider threats or procedural breaches that conventional static rules might miss. Furthermore, users are keen on leveraging AI for optimal space utilization, where algorithms dynamically suggest the most efficient placement for new weapon types or accessories within the existing modular framework, thus maximizing capacity without manual engineering input. While initial investment costs and data security concerns related to handing over sensitive inventory data to algorithmic control remain points of apprehension, the long-term benefits in operational efficiency and compliance assurance are driving increasing interest and pilot programs for AI adoption within major military logistics centers globally. The future of modular storage is moving towards 'smart armories' powered by sophisticated data analytics and predictive modeling.

- AI-Powered Predictive Maintenance: Utilizing sensor data to forecast potential mechanical failures in mobile carriage systems, ensuring maximum operational uptime.

- Enhanced Access Control: Integration of machine learning for advanced biometric verification and behavioral analytics to identify and prevent unauthorized access attempts.

- Automated Inventory Reconciliation: Employing computer vision and advanced RFID data analysis to instantaneously confirm weapon presence and location, drastically reducing audit time.

- Optimized Space Management: Algorithms dynamically analyze inventory changes and suggest modular reconfiguration to maximize storage density and efficiency.

- Insider Threat Detection: AI models analyze access patterns, time stamps, and inventory movements to detect and flag suspicious or non-standard operational behavior.

DRO & Impact Forces Of Modular Weapon Storage Systems Market

The Modular Weapon Storage Systems Market dynamics are heavily influenced by a combination of geopolitical and technological factors summarized by its Drivers, Restraints, and Opportunities (DRO). The primary drivers include continuous global military modernization efforts and substantial increases in defense budgets across leading economies, ensuring a stable demand for high-quality, scalable storage. Additionally, stringent government regulations requiring verifiable accountability for firearms and associated tactical equipment mandate the adoption of advanced, audit-ready modular systems over outdated fixed storage units. The pervasive need for enhanced physical security against theft, unauthorized access, and environmental damage further strengthens the market impetus. These drivers collectively create a compelling environment where defense logistics professionals prioritize investment in systems that boost both security and operational efficiency.

Conversely, the market faces notable restraints that could impede rapid expansion. High initial procurement costs associated with advanced modular systems, especially those incorporating electronic locking mechanisms and integrated inventory management software, can be prohibitive for smaller police departments or militaries with constrained budgets. Furthermore, the specialized nature of these systems necessitates significant infrastructural modification and specialized training for personnel, adding complexity and cost to deployment. Delays in government procurement processes and lengthy certification requirements, particularly in highly regulated defense sectors, also represent significant bureaucratic bottlenecks that slow down market adoption cycles and revenue recognition for vendors. The proprietary nature of many modular interfaces can also create vendor lock-in, which some buyers actively seek to avoid.

Opportunities for market players are abundant, primarily revolving around technological advancements and untapped regional demands. The increasing trend of integrating smart technologies—such as IoT sensors, blockchain for immutable records, and advanced software platforms—into storage solutions offers vendors a path to higher value-added products and service revenue streams. Geographically, emerging markets in Southeast Asia, Africa, and parts of Latin America, undergoing significant security sector reform and military expansion, present substantial opportunities for new installations. Developing specialized, ruggedized modular systems tailored for use in tactical vehicles and temporary field deployments, addressing the growing need for forward operational readiness and secure mobility, also represents a promising growth vector for the specialized storage industry.

Segmentation Analysis

The Modular Weapon Storage Systems Market is comprehensively segmented based on the type of system deployed, the specific weapon category being stored, the component materials utilized, and the primary end-use application. This multidimensional segmentation allows vendors to tailor solutions precisely to the demanding specifications of military, law enforcement, and private security clientele. The market landscape is highly specialized, with product offerings ranging from static, high-density wall racks suitable for small armories to sophisticated, electrically powered mobile carriage systems designed for voluminous inventories in major logistics hubs. Understanding these segments is crucial for analyzing competitive advantages and identifying lucrative niche markets within the global defense and security infrastructure supply chain.

- By System Type:

- Static Modular Racks (Wall Mount, Freestanding)

- Mobile Aisle Systems (High-Density Storage)

- Vertical Storage Systems (Cabinets and Lockers)

- Specialized Vehicle Storage Systems

- By Weapon Type:

- Small Arms (Rifles, Carbines, Pistols, Submachine Guns)

- Crew Served Weapons (Machine Guns, Mortars, Grenade Launchers)

- Specialized Ordnance (Anti-Tank Weapons, Missile Systems)

- By Material:

- Steel/Metal Alloys

- Composite Materials (Lightweight and Ruggedized)

- Aluminum

- By End-User:

- Military & Defense Forces

- Law Enforcement Agencies (Police, Border Patrol)

- Tactical Operations Centers (TOCs) and Private Security

Value Chain Analysis For Modular Weapon Storage Systems Market

The value chain for Modular Weapon Storage Systems is complex, commencing with the rigorous sourcing of specialized raw materials and culminating in the final deployment and service support at the end-user location. The upstream segment is dominated by raw material suppliers providing high-grade steel alloys, durable composite plastics, and specialized locking mechanisms. Precision manufacturing and fabrication are critical, requiring specialized machinery to produce modular components that meet strict military standards for interchangeability, weight-bearing capacity, and longevity. Research and Development (R&D) plays a crucial early role, focusing on incorporating advanced security features like proprietary locking hardware and seamless integration interfaces for inventory management software, differentiating high-value vendors in a competitive landscape.

The midstream process involves assembly, integration, and distribution. Manufacturers often operate highly controlled production facilities to ensure components align perfectly, especially for high-density mobile systems where safety and reliability are paramount. Distribution channels are typically dual-layered. Direct channels involve manufacturers engaging directly with large governmental contracts (e.g., Department of Defense tenders), leveraging specialized sales teams and contract management expertise. Indirect channels utilize established defense and security integrators, value-added resellers (VARs), and regional distributors who handle logistics, installation, and often provide localized customization and maintenance services, particularly in international markets where manufacturers lack direct operational presence.

The downstream activities focus heavily on installation, post-sales support, and long-term maintenance contracts. Due to the high-security nature of the products, professional installation and certification are non-negotiable. Ongoing service contracts, including system upgrades, software maintenance for integrated tracking systems, and physical component replacement, are significant drivers of sustained revenue. Effective distribution and channel management ensure that products meet stringent delivery timelines required by military logistics, while robust customer support maintains the necessary operational readiness levels demanded by critical end-users. The reliance on established, certified defense contractors for indirect distribution underscores the high barrier to entry for new market players.

Modular Weapon Storage Systems Market Potential Customers

The primary customers for Modular Weapon Storage Systems are institutions characterized by the need to manage large, varied, and highly sensitive inventories of firearms under strict regulatory and security mandates. The most significant segment remains military and defense forces globally, including national armies, navies, and air forces, which require robust, high-capacity, and often tactical storage solutions for armories, maintenance depots, and forward operating bases. Their procurement is driven by mission readiness, compliance with organizational weapon accountability standards, and the need for systems rugged enough to endure diverse operational environments, from temperate barracks to harsh desert conditions or maritime vessels.

A rapidly growing customer base includes domestic law enforcement and internal security agencies. This encompasses federal policing bodies, state and municipal police departments, specialized tactical teams (like SWAT), and border protection units. These customers prioritize ease of access for rapid deployment during emergencies, seamless integration with digital evidence management systems, and stringent inventory control to meet legal compliance standards. The shift towards higher-density, flexible storage allows these agencies to modernize existing facilities without undertaking expensive new construction projects, making modular systems an attractive cost-effective solution for facility upgrades.

Secondary but crucial customer groups include governmental agencies involved in correctional services, high-level private security contractors managing sensitive assets (e.g., nuclear facilities, critical infrastructure), and specialized paramilitary groups. Furthermore, the rising need for secure, mobile storage for weapons carried on vehicles or deployed in temporary command structures—such as those used by specialized counter-terrorism units—is expanding the customer profile beyond fixed facility armories. Procurement decisions are increasingly made by logistical and security command staff who weigh lifecycle costs, scalability, and adherence to specific national and NATO security standards.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.25 Billion |

| Market Forecast in 2033 | USD 1.85 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Spacesaver Corporation, Datum Storage Solutions, Stanley Vidmar, Weapon Storage Solutions, LLC, Combat Weapon Storage, LLC, Rousseau Metals Inc., SecureIt Tactical Inc., Montel Inc., Bradford Systems, LLC, AME Vertical Storage, LLC, GSA Global Supply, Southwest Solutions Group, Inc., EZ-Rack Industries, Global Industrial, Inc., International Security Products, Inc., Lista International Corporation, Delta Group International, LLC, Acme Storage Systems, Inc., Fenco Solutions, LLC, Precision Storage Systems. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Modular Weapon Storage Systems Market Key Technology Landscape

The technological evolution of Modular Weapon Storage Systems is moving rapidly beyond mere physical security toward comprehensive digital asset management and integrated logistics. A core technological advancement is the widespread incorporation of high-frequency Radio Frequency Identification (RFID) technology directly integrated into storage components and weapon tags. This allows for real-time, automated inventory audits and instantaneous accountability checks, drastically reducing the time required for manual counting and minimizing the risk of administrative errors. Furthermore, the deployment of robust software platforms that interface directly with these RFID readers and electronic locks forms the backbone of modern armory management, providing digital logs, tracking usage history, and generating compliance reports automatically, catering directly to the stringent audit requirements of military logistics chains.

Another significant technology trend involves advanced physical security interfaces. While traditional key locks remain prevalent, modern modular systems increasingly utilize multi-layered electronic locking systems, often incorporating biometric authentication (e.g., fingerprint or retinal scans) alongside PIN access. This ensures that only authorized personnel with the correct security clearance can access specific weapon types or entire aisles. For high-density mobile storage systems, the integration of safety sensors and motorized carriages controlled by intuitive touch screens is essential, improving user safety and maximizing retrieval efficiency. The shift is towards networked systems that can be monitored remotely, providing immediate alerts upon unauthorized access attempts or system malfunction, a capability crucial for maintaining high readiness levels.

The future technology landscape is focused on IoT integration and the development of 'smart armories.' This involves embedding various sensors within the storage environment to monitor crucial environmental parameters such as temperature, humidity, and vibration, which are essential for maintaining the operational integrity of sensitive weapon systems and optics. Moreover, the adoption of lightweight, advanced materials, such as aerospace-grade aluminum and composite polymers, is critical for reducing the overall weight of the systems, particularly for vehicle-mounted or highly deployable military applications. Technology advancements are fundamentally geared toward improving the speed of weapon retrieval, enhancing verifiable accountability, and increasing the overall density of secure storage within limited infrastructure footprints.

Regional Highlights

Geographic analysis reveals diverse market maturity and growth drivers across major global regions. North America, specifically the United States, represents the largest and most mature market segment, driven by consistently high defense spending, extensive counter-terrorism operations, and the modernization needs of both federal and local law enforcement agencies. The U.S. military's vast inventory and continuous deployment requirements necessitate the procurement of advanced, highly customized, and ruggedized modular storage solutions, often setting the global standard for integrated security and inventory technology. Procurement cycles are robust, and vendors benefit from large, long-term government contracts focused on facility upgrades and new base construction projects.

The Asia Pacific (APAC) region is projected to register the fastest growth rate, fueled by escalating geopolitical tensions in the South China Sea and along borders, prompting major military buildup and equipment procurement in China, India, and Australia. These countries are prioritizing the replacement of legacy storage methods with modern, high-density modular systems to manage their rapidly expanding and technologically advanced weapon inventories. Investment in internal security infrastructure, particularly in rapidly urbanizing areas, also drives demand from police and paramilitary forces. The market in APAC is characterized by a strong emphasis on cost-effectiveness alongside functionality, opening opportunities for both established global players and regional specialized manufacturers.

Europe maintains a substantial market share, primarily influenced by NATO standardization mandates and the necessity to update aging military facilities across Western and Eastern European member states. The region's demand is steady, driven largely by replacement cycles and the need to secure newly adopted weapon platforms compliant with alliance requirements. Post-Brexit, the UK and EU members continue substantial defense investment, focusing on integrated logistics and smart armory solutions that enhance readiness across multi-national deployments. The Middle East and Africa (MEA) market demonstrates high potential but remains volatile; growth is primarily concentrated in the Gulf Cooperation Council (GCC) states investing heavily in military modernization and internal security apparatus to address regional instability and terrorism threats. Demand here often favors highly fortified and climate-controlled storage solutions.

- North America: Market leader; driven by massive U.S. DoD expenditure, stringent regulatory requirements (ITAR, etc.), and widespread adoption by state and local law enforcement. High demand for systems integrated with advanced inventory tracking technology.

- Europe: Stable growth; driven by NATO compatibility requirements, replacement of Cold War-era armories, and focus on secure, high-density storage within dense urban military bases. Germany, France, and the UK are key procurers.

- Asia Pacific (APAC): Fastest growing market; significant investments in military modernization (China, India), growing internal security concerns, and demand for scalable solutions suitable for rapid infrastructure development.

- Middle East and Africa (MEA): Emerging growth potential; concentrated in GCC nations (Saudi Arabia, UAE) due to high investment in defense technology and counter-terrorism capabilities, requiring highly secure and customizable modular systems.

- Latin America: Moderate growth; driven by governmental efforts to professionalize defense forces and combat transnational crime, leading to steady demand for secure storage from federal police and military units in Brazil and Mexico.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Modular Weapon Storage Systems Market.- Spacesaver Corporation

- Datum Storage Solutions

- Stanley Vidmar

- Weapon Storage Solutions, LLC

- Combat Weapon Storage, LLC

- Rousseau Metals Inc.

- SecureIt Tactical Inc.

- Montel Inc.

- Bradford Systems, LLC

- AME Vertical Storage, LLC

- GSA Global Supply

- Southwest Solutions Group, Inc.

- EZ-Rack Industries

- Global Industrial, Inc.

- International Security Products, Inc.

- Lista International Corporation

- Delta Group International, LLC

- Acme Storage Systems, Inc.

- Fenco Solutions, LLC

- Precision Storage Systems

Frequently Asked Questions

Analyze common user questions about the Modular Weapon Storage Systems market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary benefit of modular weapon storage over traditional armories?

Modular weapon storage systems offer enhanced space optimization, typically increasing storage capacity by 30% to 50% through high-density mobile or vertical racking. Crucially, they provide superior adaptability, allowing rapid reconfiguration to accommodate diverse weapon inventories and evolving tactical equipment without major construction.

How do modular systems ensure compliance with military accountability regulations?

Modern modular systems integrate with computerized inventory management software and technology like RFID tags and electronic locking mechanisms. This integration provides a verified, real-time chain of custody, generating detailed audit logs that ensure strict compliance with federal and military firearm accountability protocols.

What types of security features are integrated into advanced modular weapon storage units?

Advanced systems incorporate multi-layered security features, including heavy-duty steel construction, electronic keypad access, multi-point locking systems, and optional biometric authentication. Many also feature sensor integration for environmental monitoring and connectivity to centralized alarm and surveillance networks.

Which market segment is currently driving the largest demand for modular weapon storage?

The Military & Defense Forces segment globally drives the largest volume of demand, specifically for high-capacity, ruggedized static and mobile aisle systems. This is primarily fueled by extensive modernization programs, large weapon inventories, and the necessity for high operational readiness levels in major global defense organizations.

Are modular storage systems suitable for specialized ordnance or only small arms?

Modular systems are highly versatile and are designed with specific components (e.g., specialized cradles and fixtures) to securely store all categories of weaponry, including small arms, crew-served weapons like heavy machine guns and mortars, and larger specialized ordnance such as missile components or anti-tank systems.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager