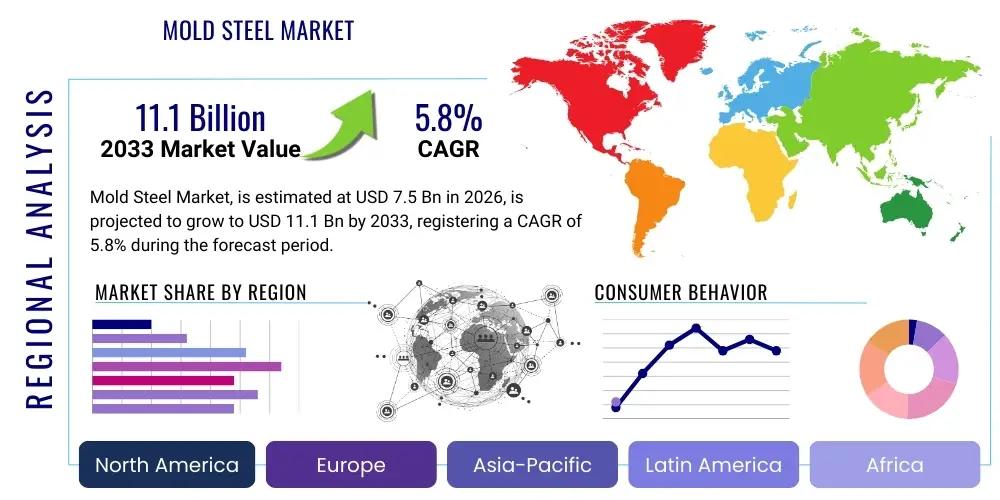

Mold Steel Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436992 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Mold Steel Market Size

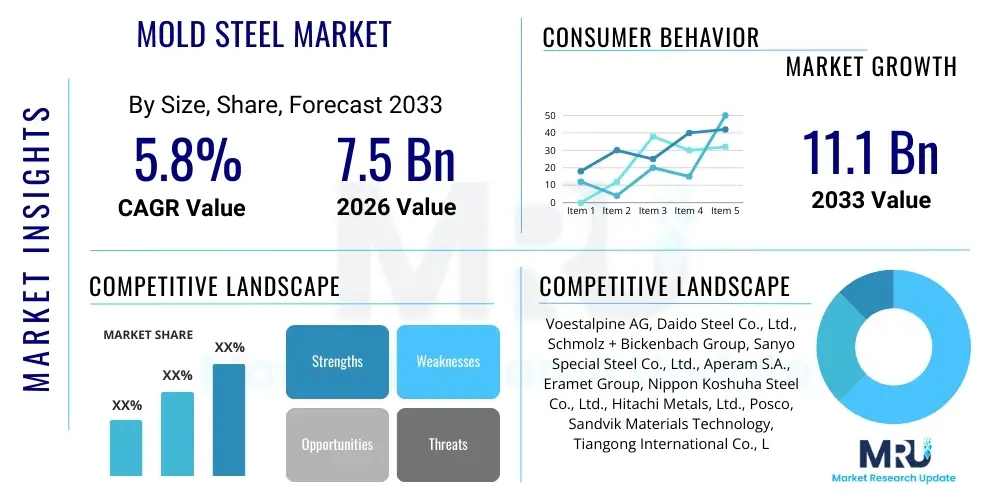

The Mold Steel Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $7.5 Billion in 2026 and is projected to reach $11.1 Billion by the end of the forecast period in 2033.

Mold Steel Market introduction

Mold steel, a highly specialized category of tool steel, is fundamental to global manufacturing, serving as the essential material for creating molds and dies used in processes like plastic injection molding, die casting, and forging. These advanced steel alloys are engineered to withstand extreme conditions, including high pressure, fluctuating temperatures, chemical corrosion, and abrasive wear, ensuring the production of complex components with high precision and consistency. The primary distinction of mold steel lies in its specific chemical composition—often including chromium, molybdenum, vanadium, and nickel—which provides superior characteristics such as excellent polishability for high-gloss finishes, exceptional toughness to resist cracking, and dimensional stability during critical heat treatment processes, making it indispensable for mass production industries.

The market encompasses several distinct grades, categorized mainly by their intended operating temperature and application complexity. Plastic mold steels (e.g., P20, 420 stainless steel) prioritize surface finish, corrosion resistance, and ease of machining, catering predominantly to the consumer goods, packaging, and electronics sectors. Conversely, hot work tool steels (e.g., H13) are designed for die casting and hot forging, where resistance to thermal fatigue and high compressive strength at elevated temperatures are paramount. The inherent benefits of using high-quality mold steel—extended mold life, reduced tooling downtime, and improved product quality—directly contribute to lower manufacturing costs and increased operational efficiency for end-users globally.

Key driving factors propelling the growth of this specialized market include the continuous expansion of the automotive industry, particularly the demand for lightweight components in electric vehicles (EVs) necessitating high-pressure die casting (HPDC) molds made from robust hot work steels. Furthermore, the proliferation of complex electronic devices and advanced medical equipment requires mold steels with high purity and stringent dimensional stability, boosting demand for steels produced via advanced secondary refining processes like Electroslag Remelting (ESR). The constant push for miniaturization and higher precision across manufacturing sectors ensures a sustained and growing requirement for premium, defect-free mold steel materials.

Mold Steel Market Executive Summary

The Mold Steel Market is experiencing robust expansion driven by pronounced macroeconomic shifts in emerging economies and critical technological advancements in manufacturing processes. Business trends reveal a strong focus among key market participants on vertical integration and strategic acquisitions aimed at securing raw material supply chains, particularly for high-purity alloying elements like molybdenum and nickel, essential for high-performance steel grades. There is a discernible market movement toward high-performance, tailor-made steel grades designed specifically for additive manufacturing (AM) processes and ultra-high-pressure die casting, positioning innovation in material science as a key competitive differentiator. Furthermore, sustainability pressures are driving investment into cleaner steel production methods, such as utilizing electric arc furnaces (EAF) and optimizing material utilization rates.

Regionally, the Asia Pacific (APAC) continues to dominate the global mold steel landscape, largely attributable to the massive concentration of automotive, consumer electronics, and plastic processing industries in countries such as China, Japan, and South Korea. This dominance is not only in terms of consumption but increasingly in sophisticated production capabilities. North America and Europe, while maintaining mature manufacturing bases, are focusing on adopting advanced manufacturing techniques, driving demand for premium, highly complex mold steels for aerospace and medical applications. The growth in Latin America and the Middle East & Africa (MEA) remains steady, fundamentally linked to localized infrastructure development and burgeoning packaging industries, though reliance on imported high-grade steel remains a characteristic feature of these regions.

Segment trends indicate that hot work tool steel is poised for significant growth, primarily fueled by the urgent requirement for large-scale aluminum die casting molds necessary for EV structural components and battery housings. Simultaneously, in the plastic mold steel segment, there is an escalating demand for pre-hardened and stainless varieties to meet the rapid prototyping needs and corrosion resistance required by the food and medical packaging sectors. The trend towards higher-volume, faster cycle production across all end-use industries is placing immense pressure on steel producers to deliver materials with improved homogeneity, exceptional thermal conductivity, and predictable long-term performance, making premium quality assurance a crucial segment focus.

AI Impact Analysis on Mold Steel Market

User queries regarding the intersection of Artificial Intelligence (AI) and the Mold Steel Market frequently revolve around optimizing production efficiency, enhancing material quality verification, and predicting tool life. Common concerns address how AI can mitigate the high cost and variability associated with traditional steel production, whether AI-driven simulation can replace costly physical trials in mold design, and the expected integration timeline for AI tools in small to medium-sized tooling shops. Users are keenly interested in predictive maintenance models using machine learning to forecast mold failure, thus maximizing uptime, and employing AI algorithms for precise management of complex heat treatment cycles essential for achieving desired mold steel properties. The prevailing expectation is that AI will democratize high-level material science expertise, leading to faster alloy development and superior quality control across the mold steel value chain.

The implementation of AI and machine learning (ML) within mold steel manufacturing holds profound implications for operational excellence. AI algorithms are being deployed to analyze vast datasets derived from primary melting processes, secondary refining (like ESR and VIM), and continuous casting to detect and eliminate microstructural defects such as non-metallic inclusions, which are fatal flaws in high-performance molds. By utilizing computer vision and advanced analytics, manufacturers can significantly improve the internal cleanliness and homogeneity of the steel billets. Furthermore, AI systems are instrumental in optimizing the chemical composition of proprietary steel grades, predicting how slight variations in alloying elements will impact final material properties like hardness, toughness, and thermal conductivity, thereby accelerating material innovation cycles and ensuring superior batch consistency.

Beyond material production, AI integration extends into mold design and preventative maintenance, directly influencing the demand profile for different steel grades. Generative design techniques, powered by AI, can rapidly iterate mold geometries that minimize stress concentration points and improve cooling efficiency, informing the selection of specific mold steel types best suited for the optimized design. For end-users, AI-based monitoring of injection molding or die casting processes utilizes sensor data (temperature, pressure, cycle time) to continuously assess the real-time wear and tear on the mold, predicting the remaining useful life of the tool. This predictive capability shifts maintenance strategies from reactive to proactive, significantly extending mold operational life and justifying the initial investment in premium, AI-compatible steel materials designed for longevity and demanding operational parameters.

- AI optimizes secondary refining processes (ESR/VIM) for ultra-clean, high-homogeneity mold steel billets.

- Machine learning algorithms predict and control complex heat treatment parameters to achieve target mechanical properties, minimizing material waste.

- AI-driven simulation tools accelerate the development of new, high-performance alloy compositions for specialized applications (e.g., aerospace).

- Predictive maintenance models using sensor data forecast mold wear and potential failure, maximizing tool uptime for end-users.

- Computer vision and AI enhance quality control by detecting surface and internal defects faster and more accurately than traditional methods.

DRO & Impact Forces Of Mold Steel Market

The Mold Steel Market dynamics are fundamentally shaped by the interplay of persistent technological drivers, structural economic restraints, and emerging sustainability opportunities, all filtered through the powerful impact of global industrial acceleration. Key drivers include the pervasive global trend toward component lightweighting, particularly in the automotive and aerospace industries, which necessitates high-strength, durable steels capable of forming complex parts via high-pressure processes. Furthermore, the rapid pace of product development and shorter product lifecycles in consumer electronics and packaging sectors demand materials that support rapid prototyping and high-volume, continuous operation molds. These drivers push steel manufacturers to continuously innovate in terms of purity and performance.

However, the market faces significant restraints, primarily centered around the volatility and high cost of critical raw materials, such as nickel, molybdenum, and tungsten, which are essential for producing high-alloy tool steels. Supply chain disruptions and geopolitical risks associated with sourcing these specialty elements can severely impact production costs and market pricing stability. Another critical restraint is the technical difficulty and energy intensity involved in the secondary metallurgy processes (like VIM and ESR) required to achieve the ultra-cleanliness and microstructural homogeneity demanded by premium mold steel users, leading to high capital expenditure and specialized operational expertise requirements that create entry barriers.

Opportunities for market expansion are strongly linked to the industrial adoption of additive manufacturing (AM), which utilizes high-quality steel powders to create complex mold inserts with conformal cooling channels, significantly reducing cycle times. This shift opens a lucrative niche for producers focusing on spherical, defect-free steel powders optimized for laser powder bed fusion (LPBF). Additionally, the rising global focus on sustainability and energy efficiency presents opportunities for mold steels with enhanced thermal conductivity, allowing molders to reduce cooling times and energy consumption per manufactured part, aligning with global green manufacturing mandates. These forces collectively dictate market trajectory, pushing for performance innovation while demanding cost and resource efficiency.

Segmentation Analysis

The Mold Steel Market is intricately segmented across various dimensions, including the type of steel composition, the specific manufacturing application, the production process used, and the primary end-use industry. This granularity reflects the highly customized nature of tool steel requirements, where specific combinations of hardness, wear resistance, toughness, and polishability are crucial for optimal performance in diverse environments, ranging from extreme heat die casting to sterile medical device manufacturing. Understanding these segmentation nuances is key for market participants to align production capabilities with evolving industrial demands and tailor material properties to specific consumer needs.

By type, the market is segmented into Hot Work Tool Steel, Cold Work Tool Steel, and Plastic Mold Steel. Plastic Mold Steel, often including pre-hardened grades like P20 and stainless variants like 420F, constitutes the largest revenue share due to the ubiquitous demand for molded plastic components across packaging, automotive interiors, and consumer electronics. Hot Work Tool Steel (e.g., H13, 1.2344) is experiencing the fastest growth, primarily driven by the expansion of large-scale die casting operations necessitated by the electric vehicle sector’s lightweighting initiatives, which require steels that maintain strength and resist thermal fatigue at high operating temperatures.

The application segmentation is crucial, differentiating between injection molding (high-volume plastic parts), die casting (metal components), forging (heavy-duty shaping), and extrusion. Each application imposes unique mechanical and thermal stresses on the mold steel, dictating specific material choices. For instance, die casting requires superior resistance to heat checking and soldering, demanding high purity hot work steels, whereas injection molding of transparent parts requires steels with exceptional polishability and surface integrity. Furthermore, the increasing adoption of high-speed machining and powder metallurgy (PM) techniques is creating dedicated sub-segments focused on materials optimized for these advanced manufacturing processes, emphasizing homogeneous microstructure and fine grain size for maximum durability and precision.

- Type:

- Hot Work Tool Steel (e.g., H13, 1.2344)

- Cold Work Tool Steel (e.g., D2, O1)

- Plastic Mold Steel (e.g., P20, 420 Stainless Steel, Pre-Hardened Grades)

- High-Speed Steel

- Maraging Steel

- Application:

- Injection Molding

- Die Casting (Aluminum, Magnesium, Zinc)

- Forging

- Extrusion

- Stamping and Punching

- Process:

- Conventional Machining

- Powder Metallurgy (PM)

- Additive Manufacturing (AM)

- End-Use Industry:

- Automotive and Transportation

- Consumer Goods and Appliances

- Electronics and Communication

- Packaging

- Medical and Healthcare

- Aerospace and Defense

Value Chain Analysis For Mold Steel Market

The mold steel value chain is characterized by high complexity, demanding significant capital investment at the initial stages of steel production and specialized expertise throughout the refinement process. Upstream activities begin with the sourcing of critical raw materials, including iron ore, scrap steel, and expensive alloying elements such as nickel, molybdenum, chromium, and vanadium. The quality and purity of these inputs directly determine the final performance of the mold steel. The subsequent primary production involves Electric Arc Furnaces (EAF) or Basic Oxygen Furnaces (BOF), followed by highly specialized secondary metallurgical processes like Vacuum Induction Melting (VIM), Electroslag Remelting (ESR), or Vacuum Arc Remelting (VAR). These steps are crucial for achieving the ultra-cleanliness, minimal segregation, and highly homogeneous microstructures required for premium tool steels, where a single impurity can compromise the final mold's integrity and service life.

The midstream segment involves sophisticated processing, including hot working (forging or rolling), followed by critical heat treatment (annealing, hardening, tempering) tailored to develop the specific mechanical properties of the steel grade. This stage demands stringent process control and is often proprietary, representing a core competitive advantage for major mold steel producers. Distribution channels for mold steel are dual-layered: direct sales channels cater to large, integrated tool makers and strategic original equipment manufacturers (OEMs), providing materials in large billet or plate formats requiring extensive customization. Indirect distribution heavily relies on specialized international distributors and local service centers, which stock various grades, offer material cutting, and provide localized technical support and initial machining services, facilitating quick turnarounds for smaller tooling shops.

Downstream activities involve the actual utilization of the material by specialized mold and die manufacturers (tool shops), who perform complex machining, finish polishing, and further heat treatment or surface coating (e.g., nitriding, Physical Vapor Deposition - PVD). The final end-users, encompassing industries like automotive, electronics, and packaging, critically depend on the quality and durability of the finished mold to sustain their high-volume production operations. The high barriers to entry in the upstream segment, driven by capital expenditure and technical know-how in secondary metallurgy, ensure that the power in the value chain often resides with the few globally recognized, vertically integrated premium steel manufacturers who control the most advanced refinement technologies.

Mold Steel Market Potential Customers

The primary consumers and buyers of mold steel are those industries requiring mass production of highly consistent, dimensionally accurate components, particularly through forming processes like injection molding and die casting. The largest segment of potential customers resides within the automotive and transportation sector, which utilizes mold steel extensively for engine blocks, chassis components (via die casting), interior plastic parts, and exterior trim. The transition to electric vehicles (EVs) has intensified this demand, as manufacturers require exceptionally durable, large-scale molds for casting complex aluminum battery casings and structural components using advanced high-pressure die casting techniques, driving consumption of premium hot work tool steels.

Another significant customer base includes manufacturers in the consumer goods and electronics industries. These sectors demand high-quality plastic mold steel with excellent polishability and corrosion resistance for producing device housings, intricate plastic components, and high-gloss consumer appliances. The rapid obsolescence and miniaturization of electronic devices necessitate mold steel that allows for quick tooling changes, high fidelity replication of fine details, and sustained performance over millions of cycles, favoring pre-hardened and stainless grades. The packaging industry, particularly for food and beverages, also represents a critical customer segment, requiring robust, often food-grade stainless mold steel for high-speed injection molding of containers and caps.

Beyond high-volume manufacturing, specialized end-users include the medical and aerospace sectors. The medical industry requires ultra-clean, corrosion-resistant stainless mold steel for producing precision surgical instruments and disposable plastic medical devices, where material purity is non-negotiable. Aerospace companies utilize specialized, high-strength tool steels for forging and hot forming complex components, demanding materials with extremely low defect rates and exceptional fatigue resistance under extreme temperature variances. These high-specification segments, though lower in volume than automotive, represent high-value markets demanding the most advanced and expensive mold steel grades produced through vacuum processes.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $7.5 Billion |

| Market Forecast in 2033 | $11.1 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Voestalpine AG, Daido Steel Co., Ltd., Schmolz + Bickenbach Group, Sanyo Special Steel Co., Ltd., Aperam S.A., Eramet Group, Nippon Koshuha Steel Co., Ltd., Hitachi Metals, Ltd., Posco, Sandvik Materials Technology, Tiangong International Co., Ltd., Finkl Steel, Uddeholm, Lucchini RS, Bohler-Uddeholm, Assab, Erasteel, Kind & Co., A. Finkl & Sons Co. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Mold Steel Market Key Technology Landscape

The technological landscape of the Mold Steel Market is dominated by advanced metallurgical processes aimed at maximizing material purity, homogeneity, and microstructural integrity, which are critical determinants of a mold's service life and performance. Key refining technologies include Electroslag Remelting (ESR) and Vacuum Induction Melting/Vacuum Arc Remelting (VIM/VAR). ESR involves remelting the steel under a layer of molten flux to remove non-metallic inclusions and improve the internal cleanliness and isotropy of the steel structure, reducing segregation. VIM/VAR are used for producing ultra-high purity grades, particularly maraging steels or specialized stainless tool steels required by the aerospace and medical industries, by eliminating gaseous impurities like oxygen and nitrogen under vacuum conditions. The adoption rate of these advanced secondary refinement techniques is a direct measure of a steel producer's commitment to high-performance segments.

Beyond primary production, significant technological shifts are occurring in material preparation and shaping. Powder Metallurgy (PM) and additive manufacturing (AM) are transforming how molds and inserts are produced. PM enables the creation of tool steel with a finer, more uniform carbide structure and superior isotropic properties compared to conventionally forged steels, improving both toughness and wear resistance. Additive manufacturing, specifically Laser Powder Bed Fusion (LPBF), allows tool shops to build complex mold inserts featuring conformal cooling channels. This innovation drastically reduces cooling times and cycle times in injection molding and die casting operations, creating intense demand for specialized, highly spherical metal powders derived from mold steel alloys such as H13 and Maraging steels optimized for AM processes.

Furthermore, surface treatment technologies represent a crucial area of differentiation and performance enhancement for mold steel. Processes such as plasma nitriding, Physical Vapor Deposition (PVD), and Chemical Vapor Deposition (CVD) coatings (e.g., TiN, TiAlN, DLC) are applied to the finished mold surface to enhance wear resistance, reduce friction, and improve resistance to phenomena like thermal fatigue or aluminum soldering in die casting. The constant evolution of these coating materials and application techniques allows mold users to extract maximum life and performance from less expensive base steel grades or to push premium grades to their operational limits, ensuring high throughput and reduced maintenance downtime, thereby maintaining the technological competitiveness of the end product.

Regional Highlights

- Asia Pacific (APAC): APAC is the unequivocally dominant region in the global Mold Steel Market, characterized by its immense manufacturing capacity in automotive production, consumer electronics assembly, and general plastic processing. Countries like China, which is the world's largest consumer of tool steel, and South Korea and Japan, which host advanced, high-precision tooling industries, drive market demand. The region’s focus on large-volume, high-cycle manufacturing, particularly for electric vehicle components and high-density packaging, ensures a high and growing consumption rate of both standard P20 and advanced hot work steels (H13). The regional market is also seeing increasing investment in domestic advanced metallurgical capabilities to reduce reliance on European and North American high-purity material suppliers.

- North America: The North American market is defined by its focus on high-value, high-specification segments, notably aerospace, medical devices, and sophisticated automotive tooling. Demand here leans heavily towards premium, specialized grades, including Maraging steels and high-quality ESR-refined tool steels, where material traceability and zero-defect requirements are paramount. While overall tonnage consumption is lower than in APAC, the average price per kilogram is typically higher due to stringent quality standards and the use of specialized materials. The resurgence of domestic manufacturing and investment in advanced manufacturing technologies, including metal AM for tooling inserts, sustains stable demand for innovative mold steel materials.

- Europe: Europe remains a powerhouse of advanced tool steel manufacturing and application, hosting key global players in the production segment. The region exhibits high demand for technically challenging applications, driven by precision engineering, advanced packaging, and premium vehicle manufacturing. European manufacturers prioritize sustainability and energy efficiency, fueling demand for mold steels with optimized thermal conductivity to reduce energy use in molding processes. Rigorous quality standards and a mature ecosystem of specialized tool shops ensure continuous, albeit steady, demand for certified, high-grade hot work and plastic mold steels.

- Latin America (LATAM): The LATAM market, while smaller, shows steady growth primarily linked to the automotive assembly sector in countries like Mexico and Brazil, and expanding regional packaging industries. The market often acts as an importer of high-grade mold steel from Asian and European suppliers. Growth is correlated with foreign direct investment in local manufacturing plants, driving localized demand for reliable, cost-effective mold steel solutions, usually focusing on standard, proven grades like P20 and basic H13 variants.

- Middle East and Africa (MEA): The MEA market is heavily influenced by construction-related industrialization and local packaging demand, particularly in the Gulf Cooperation Council (GCC) countries. Consumption is low compared to other regions but is growing, especially in the context of diversification away from oil economies. The requirement is often for standard plastic mold steels used in consumer goods and infrastructure components, with procurement frequently managed through specialized international trading houses.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Mold Steel Market.- Voestalpine AG (Bohler-Uddeholm)

- Daido Steel Co., Ltd.

- Schmolz + Bickenbach Group (Swiss Steel Group)

- Sanyo Special Steel Co., Ltd.

- Aperam S.A.

- Eramet Group (Erasteel)

- Nippon Koshuha Steel Co., Ltd.

- Hitachi Metals, Ltd.

- Posco

- Sandvik Materials Technology

- Tiangong International Co., Ltd.

- Finkl Steel (Sorel Forge)

- Lucchini RS

- Kind & Co. GmbH

- A. Finkl & Sons Co.

- Ellwood Group Inc.

- Deutsche Edelstahlwerke Specialty Steel GmbH

- Shanghai Tool Works Co., Ltd.

- SeAH Steel Corporation

- Kalyani Steels Limited

Frequently Asked Questions

What is the primary factor driving the demand for high-grade Hot Work Tool Steel?

The increasing global production of electric vehicles (EVs) and the associated need for large, high-integrity aluminum die casting molds for structural and battery components is the primary driver. These molds require hot work steels (like H13, 1.2344) with superior resistance to thermal fatigue and high compressive strength under extreme operational parameters.

How does Electroslag Remelting (ESR) technology affect mold steel quality?

ESR significantly improves mold steel quality by reducing non-metallic inclusions and minimizing chemical segregation during solidification. This results in ultra-clean, homogeneous steel with enhanced isotropy, which is critical for maximizing toughness, polishability, and overall service life of high-performance molds.

Which mold steel segment is projected to grow fastest, and why?

The segment related to steels optimized for Additive Manufacturing (AM) is expected to show the fastest growth. This is driven by the industry’s need for rapid prototyping and the capability of AM to produce mold inserts with complex internal geometries, such as conformal cooling channels, which dramatically shorten production cycle times.

What are the main restraints impacting the profitability of the Mold Steel Market?

The high volatility and costs associated with key alloying elements—specifically molybdenum, nickel, and vanadium—pose a significant restraint. These raw material price fluctuations directly impact the production costs of high-alloy tool steels, leading to pricing instability in the finished product market.

Which end-use industry is the largest consumer of Plastic Mold Steel?

The Automotive and Transportation industry remains the largest consumer, utilizing vast quantities of plastic mold steel for interior components, dashboards, lighting systems, and exterior plastic parts, requiring materials with high polishability and dimensional stability.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Plastic Mold Steel Market Statistics 2025 Analysis By Application (Construction Industry, Industrial Equipments, Others), By Type (P20, 718, 4Cr13, Other), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Mold Steel and Tool Steel Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Mold Steel, Tool Steel), By Application (Construction, Automotive, Shipbuilding, Machinery, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager