Molybdenum Manganese Paste Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431496 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Molybdenum Manganese Paste Market Size

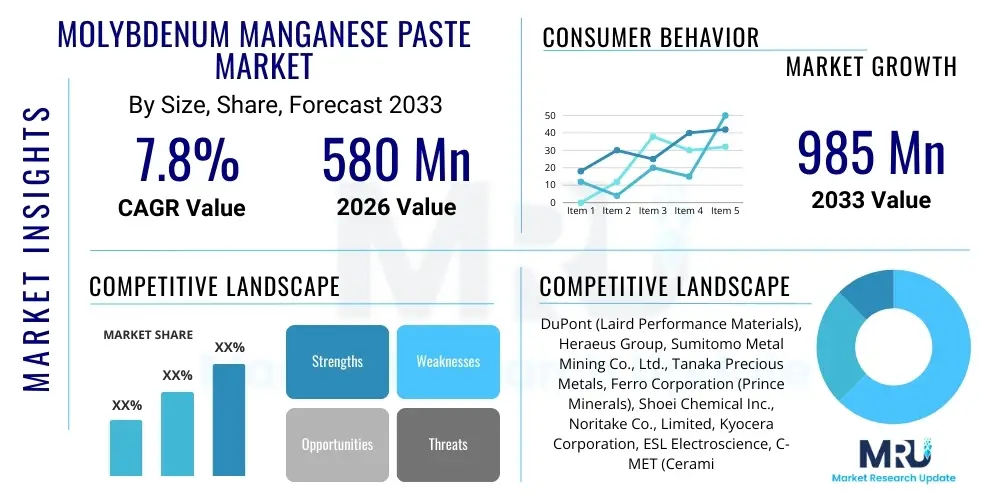

The Molybdenum Manganese Paste Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at $580 Million in 2026 and is projected to reach $985 Million by the end of the forecast period in 2033.

Molybdenum Manganese Paste Market introduction

The Molybdenum Manganese (Mo-Mn) Paste Market encompasses the specialized industrial chemicals sector dedicated to the formulation and supply of thick film paste materials utilized primarily for metallization processes in advanced electronic and ceramic components. This paste serves as a critical conductive layer, enabling robust electrical connections within multilayer ceramic capacitors (MLCCs), high-temperature co-fired ceramics (HTCC), and solid oxide fuel cells (SOFCs). The unique composition, combining molybdenum and manganese powders with specialized binders and solvents, allows for co-sintering at extremely high temperatures, creating hermetic, low-resistance interfaces essential for component reliability and performance. This material is indispensable in applications requiring high mechanical strength and excellent adhesion to ceramic substrates, particularly in environments exposed to thermal cycling and high power loads.

Molybdenum Manganese Paste is fundamentally a composite material engineered for high-performance ceramic metallization. Its primary function is to create electrode patterns on ceramic green sheets or substrates before the sintering process. The molybdenum component provides excellent electrical conductivity and refractoriness, ensuring stability at high operating temperatures, while the manganese acts as an adhesion promoter, forming a robust bond with the ceramic body during co-firing. This synergistic combination makes the paste highly desirable for manufacturing components found in power electronics, telecommunications infrastructure, and demanding automotive systems where reliability is paramount. The increasing complexity and miniaturization of electronic devices necessitate pastes with superior resolution and controlled particle size distribution, driving continuous innovation in formulation techniques.

The market growth is principally driven by the relentless expansion of the global electronics industry, specifically the rising demand for multilayer ceramic components in advanced consumer electronics, 5G infrastructure, and electric vehicles (EVs). Mo-Mn pastes are crucial for the efficient functioning of these devices, providing the durable internal electrodes required for power management and signal integrity. Furthermore, significant investments in renewable energy and alternative power generation technologies, particularly SOFCs, which rely heavily on high-temperature co-fired ceramic stacks utilizing Mo-Mn paste for interconnects, are bolstering market traction. Benefits derived from using these pastes include enhanced thermal stability, improved component density, and superior long-term durability under harsh operational conditions, making them a cornerstone material for high-reliability applications.

Molybdenum Manganese Paste Market Executive Summary

The Molybdenum Manganese Paste Market is currently navigating a period of strong growth, primarily fueled by expansive business trends centered around electronics miniaturization and the transition towards high-voltage power systems. Key business trends include aggressive capacity expansion by major Asian manufacturers, particularly in China and South Korea, aiming to meet the burgeoning global demand for HTCC and MLCC components used in 5G and data center infrastructure. There is a noticeable trend towards developing highly sustainable and environmentally compliant paste formulations, driven by stringent regulatory pressures in Europe and North America regarding solvent usage and heavy metal content. Strategic mergers, acquisitions, and technological partnerships focused on securing stable raw material supply chains (molybdenum and manganese) and enhancing paste printing precision are defining the competitive landscape, emphasizing efficiency and performance consistency.

Regionally, Asia Pacific (APAC) firmly dominates the market, serving as the primary manufacturing hub for electronic components, including MLCCs, chip resistors, and SOFCs. The sustained rapid industrialization and governmental support for electronics and electric vehicle manufacturing in countries like China, Japan, and Taiwan ensure APAC’s leadership, both in terms of production volume and consumption. Europe and North America, while having lower production volumes compared to APAC, exhibit high demand for premium, high-reliability Mo-Mn pastes, driven by their established aerospace, defense, and high-performance automotive sectors. Regional trends also reflect a differential focus: APAC emphasizes scale and cost optimization, while Western markets prioritize innovation in material science and adherence to specialized performance requirements, particularly for mission-critical applications.

Segmentation trends highlight the increasing significance of application-specific pastes. The segment related to Multilayer Ceramic Capacitors (MLCCs) remains the largest consumer, driven by continuous demand for higher volumetric efficiency and capacitance. However, the fastest growth is observed in pastes customized for Solid Oxide Fuel Cells (SOFCs) and advanced sensor applications, where the required operating temperatures and chemical environments are more severe, demanding enhanced adhesion properties and thermal expansion matching. In terms of type, high-temperature sintering pastes continue to dominate due to their use in HTCC, but there is rising R&D into intermediate and low-temperature firing pastes that could potentially reduce manufacturing costs and broaden substrate compatibility, particularly as the industry explores alternatives to traditional co-firing methods.

AI Impact Analysis on Molybdenum Manganese Paste Market

Common user questions regarding AI's impact on the Molybdenum Manganese Paste Market center on how artificial intelligence can optimize the complex manufacturing process, specifically in controlling particle size distribution, managing material input quality, and enhancing yield rates during the critical co-firing phase. Users frequently inquire about AI's role in predictive failure analysis for electronic components utilizing these pastes, and its capacity to accelerate the R&D cycle for novel paste formulations, particularly those targeting next-generation, high-density applications. Key themes emerging from these inquiries involve leveraging AI for real-time adjustments to slurry viscosity and printing parameters to minimize defects, thereby addressing the high precision and consistency required in advanced ceramic manufacturing, alongside using machine learning to mitigate the effects of raw material volatility by optimizing inventory and sourcing strategies.

- AI-driven optimization of paste formulation parameters, including particle size, solid loading, and solvent ratios, ensuring batch-to-batch consistency.

- Predictive modeling of the sintering process using machine learning algorithms to reduce defects, warpage, and improve overall component yield in HTCC manufacturing.

- Automated quality inspection systems utilizing computer vision and AI for real-time defect detection during the screen printing and drying phases.

- Supply chain risk management and forecasting for critical raw materials (Molybdenum and Manganese) based on global commodity price trends and geopolitical shifts.

- Accelerated material discovery and simulation of new binder systems and dopants to enhance paste adhesion and electrical performance.

DRO & Impact Forces Of Molybdenum Manganese Paste Market

The Molybdenum Manganese Paste Market is shaped by several dynamic forces. The primary drivers include the escalating global demand for multilayer ceramic devices in consumer electronics and the substantial growth of the automotive sector, particularly electric vehicles, which require robust power electronic modules utilizing HTCC components. These modules rely heavily on the thermal and electrical stability provided by Mo-Mn metallization. Furthermore, the push for miniaturization and higher power density in 5G telecommunications infrastructure and data centers acts as a significant catalyst. Restraints, however, pose challenges, notably the volatility and price fluctuations of critical raw materials, Molybdenum and Manganese, which directly impact manufacturing costs and profitability. Additionally, the technical complexity and high capital expenditure associated with setting up and maintaining advanced paste manufacturing facilities, coupled with the need for highly specialized technical expertise, restrict market entry. Opportunities are abundant in the development of environmentally friendly, lead-free, and cadmium-free paste variants, and in expanding applications into emerging fields such as high-frequency radar systems and advanced sensing devices, alongside the rapid commercialization of solid oxide fuel cells.

The core driving force underpinning the Molybdenum Manganese Paste Market lies in the pervasive integration of high-reliability ceramics across industrial and consumer platforms. The transition from legacy technologies to high-performance components, especially in demanding environments like aerospace and military, mandates materials that can withstand extreme temperatures and maintain long-term functional integrity. This demand inherently favors Mo-Mn paste over other metallization techniques due to its superior co-firing capabilities with ceramic substrates. Another potent driver is the continuous innovation in printing technologies, such as fine-line printing and additive manufacturing techniques, which enable manufacturers to achieve higher component density and more intricate electrode patterns, thus amplifying the utilization of high-performance conductive pastes. Successful companies focus on developing pastes with finer particle sizes and improved rheology to capitalize on these printing advancements.

The impact forces within this market are characterized by the delicate balance between performance requirements and production costs. The high technical barrier to entry ensures that the market remains consolidated among a few key players who possess the requisite proprietary knowledge regarding binder systems and particle synthesis. The critical impact of regulatory forces, particularly concerning environmental standards (RoHS and REACH compliance), compels manufacturers to invest heavily in R&D for safer, yet equally functional, solvent and binder systems. The bargaining power of major end-users, especially large electronics conglomerates, is substantial, often leading to competitive pricing pressure. Conversely, the high switching cost associated with qualifying new paste formulations and suppliers provides established vendors with a protective barrier, solidifying their market position despite raw material volatility.

Segmentation Analysis

The Molybdenum Manganese Paste Market is comprehensively segmented based on its composition type, the firing temperature required, and crucially, its diverse array of end-use applications, reflecting the specialized requirements of different electronic and industrial sectors. Segmentation by type often distinguishes between standard Molybdenum Manganese paste and modified versions that incorporate specific dopants or additives designed to optimize adhesion or conductivity for niche applications, such as incorporating nickel or copper for specialized co-firing cycles. The primary division, however, rests upon application, providing a clearer view of consumption patterns and future growth trajectories across major industrial verticals like electronics, automotive, and power generation. This structured analysis is essential for identifying high-growth segments and tailoring strategic market entry efforts.

Segmentation analysis reveals that the effectiveness and suitability of Mo-Mn paste are highly dependent on the manufacturing process of the final ceramic component. High-temperature sintering pastes, typically utilized for HTCC (High Temperature Co-fired Ceramics), remain a critical segment, serving applications that demand the highest levels of thermal stability and mechanical robustness, such as power modules and high-intensity lighting systems. Conversely, the market is beginning to witness growth in pastes compatible with lower co-firing temperatures, driven by the desire to integrate metallization steps with less energy-intensive manufacturing cycles or compatible with emerging ceramic materials that cannot withstand extremely high heat. Understanding these nuances in sintering requirements is key to segment performance forecasting and R&D prioritization within the competitive landscape.

The largest application segment, Electronics, driven by the massive production of MLCCs and thick film circuits, dictates the overall market volume. However, the Automotive segment, particularly focusing on components for electric powertrains, sensors, and safety systems, is projected to exhibit superior growth rates due to stringent performance and reliability standards within the industry, where component failure is unacceptable. Furthermore, the Energy sector segment, particularly SOFC manufacturing, presents a significant long-term opportunity as governments worldwide push for cleaner energy solutions. Each segment demands specific rheological properties, purity levels, and thermal expansion characteristics from the Mo-Mn paste, requiring suppliers to maintain highly diversified product portfolios tailored to individual end-user needs and regulatory compliance requirements.

- By Type:

- Standard Mo-Mn Paste (High Refractoriness)

- Modified Mo-Mn Paste (Enhanced Adhesion/Lower Sintering Aids)

- Low-Temperature Co-fireable Mo-Mn Paste

- By Application:

- Multilayer Ceramic Capacitors (MLCCs)

- High-Temperature Co-fired Ceramics (HTCC) Substrates

- Solid Oxide Fuel Cells (SOFC)

- Ceramic Sensors and Actuators

- High-Reliability Power Modules (Automotive/Aerospace)

- By Sintering Temperature:

- High-Temperature (>1400°C)

- Intermediate Temperature (1000°C - 1400°C)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East and Africa (MEA)

Value Chain Analysis For Molybdenum Manganese Paste Market

The Molybdenum Manganese Paste value chain commences with the upstream extraction and refining of primary raw materials: Molybdenum and Manganese ores. This initial phase is characterized by high capital intensity and susceptibility to global commodity price volatility, requiring suppliers to secure stable, high-purity sources. These refined metal powders are then processed and formulated by specialized chemical companies and paste manufacturers. The formulation stage is the most proprietary and value-additive step, involving the precise mixing of metal powders (often in nanometer scale), organic binders, and specialized solvent systems to achieve specific rheological and thermal properties crucial for successful printing and co-firing. Success at this stage relies heavily on intellectual property regarding binder chemistry and dispersion technology.

The midstream of the value chain involves the distribution and sales network. Due to the technical nature of the product, distribution often relies on specialized technical distributors or direct sales teams who provide essential technical support and application guidance to end-users. The product requires careful handling, storage, and specialized transportation due to the presence of high-purity metal powders and specific organic solvents. Direct channels are commonly preferred for large-volume customers and complex R&D partnerships, ensuring precise communication regarding paste specifications and process integration. Indirect channels, through regional distributors, are utilized to efficiently serve smaller ceramic component manufacturers across diverse geographical locations, especially in the fragmented APAC region.

The downstream segment centers on the end-user application, primarily ceramic component manufacturers, who utilize the Mo-Mn paste in processes like screen printing or tape casting onto ceramic green sheets. These components are then co-fired to produce finished goods such as MLCCs, HTCC substrates, or SOFC interconnects. End-users in the automotive and aerospace industries exert significant bargaining power, driving demand for rigorous quality control and customization. The final consumption markets—automotive electronics, consumer electronics, telecommunications, and energy—ultimately dictate the demand volume and technical performance requirements back up the chain. The shift toward electrification and 5G heavily influences the specifications required from paste manufacturers, emphasizing density, durability, and reliability under intense operating conditions.

Molybdenum Manganese Paste Market Potential Customers

The primary potential customers and end-users of Molybdenum Manganese Paste are specialized manufacturers involved in producing high-reliability electronic and structural ceramic components that utilize high-temperature co-firing processes. This includes companies specializing in the production of Multilayer Ceramic Capacitors (MLCCs) and related passive components, which form the backbone of modern electronics, requiring hundreds or thousands of Mo-Mn metallization layers in a single device. Another significant customer base lies within the manufacturers of High-Temperature Co-fired Ceramics (HTCC), which are essential for robust packaging in power electronics, sensor housings, and advanced medical devices where hermetic sealing and extreme thermal resistance are non-negotiable requirements. These buyers seek long-term supply agreements and demand impeccable quality control and consistency from their paste suppliers.

A rapidly expanding customer segment is the manufacturers focused on clean energy technologies, particularly Solid Oxide Fuel Cells (SOFCs) and Solid Oxide Electrolysis Cells (SOECs). Mo-Mn pastes are utilized to form the interconnect layers within these stacks, demanding specific thermal expansion characteristics and chemical compatibility at operating temperatures exceeding 800°C. These customers are driven by performance and longevity, often conducting extensive qualification processes for new materials. Furthermore, automotive electronics manufacturers, who integrate HTCC power modules (e.g., IGBT packages) and advanced ceramic sensor systems (such as oxygen sensors), represent a high-value, high-growth customer category. The rigorous quality standards and extended lifespan requirements of the automotive sector translate into premium opportunities for specialized Mo-Mn paste variants that offer superior thermal fatigue resistance.

In essence, the buyer landscape is segmented into high-volume commodity manufacturers (MLCC) and specialized, low-volume, high-value manufacturers (Aerospace/Defense, SOFCs). Potential customers continuously seek pastes that can facilitate miniaturization, offer enhanced electrical properties (lower resistance), and comply with increasingly strict environmental regulations (e.g., halogen-free content). The purchasing decision is typically complex, involving long-term technical evaluation by R&D teams, procurement negotiations for stable pricing, and quality assurance vetting, underscoring the necessity for suppliers to act as technical partners rather than mere material vendors.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $580 Million |

| Market Forecast in 2033 | $985 Million |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | DuPont (Laird Performance Materials), Heraeus Group, Sumitomo Metal Mining Co., Ltd., Tanaka Precious Metals, Ferro Corporation (Prince Minerals), Shoei Chemical Inc., Noritake Co., Limited, Kyocera Corporation, ESL Electroscience, C-MET (Ceramics Manufacturing Technology), Changzhou Guofeng Material Technology, Dalian Jinyuan High-Purity Material, V-Technical Textiles, Inc., TCI Chemicals (India) Pvt. Ltd., Nanjing Nanrui Electrical Co., Ltd., Foshan Hecheng Electronic Materials Co., Ltd., Shin-Etsu Chemical Co., Ltd., DOWA Hightech Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Molybdenum Manganese Paste Market Key Technology Landscape

The Molybdenum Manganese Paste Market is technologically dynamic, driven by the relentless pursuit of higher reliability, increased component density, and cost efficiency in ceramic metallization. A key technological focus is the advancement in particle engineering, moving towards utilizing ultra-fine and nano-sized molybdenum and manganese powders. The utilization of nanoparticles improves the densification kinetics during sintering, allowing for superior conductivity and enabling finer line resolution necessary for miniaturized components like high-layer-count MLCCs and micro-sensor electrodes. Advanced mixing techniques, such as high-shear mixing and three-roll milling under vacuum conditions, are crucial for achieving the necessary homogeneity and deagglomeration of these fine powders, ensuring optimal rheological stability for high-speed printing applications. Paste manufacturers are increasingly investing in proprietary surface modification techniques for metal particles to enhance dispersion stability and minimize paste settling over time.

Another dominant area within the technology landscape is the evolution of the organic vehicle system—comprising the binders and solvents. Driven by environmental legislation and occupational safety concerns, manufacturers are actively transitioning away from volatile organic compounds (VOCs) and developing low-toxicity, environmentally friendly solvent systems. These new vehicle systems must maintain precise rheological properties (viscosity, thixotropy) required for sophisticated printing methods like high-resolution screen printing and emerging inkjet printing technologies. The advancement in binder chemistry is also critical, focusing on polymers that decompose cleanly and completely during the pre-sintering burnout phase, leaving minimal carbon residue, which, if present, can significantly compromise the electrical properties and adhesion of the final metallized layer. Continuous R&D efforts are focused on improving the adhesion mechanism between the Mo-Mn layer and different types of ceramic substrates, such as alumina, zirconia, and various low-temperature co-fired ceramic (LTCC) compositions.

Furthermore, process control technologies are becoming integral to ensuring paste consistency and performance. Advanced sensor technology and digital monitoring systems are utilized to track and control variables such as temperature profiles during mixing, humidity levels during drying, and purity of raw inputs. Specialized screening and filtration techniques are employed during paste finalization to eliminate contamination and ensure the maximum particle size is controlled within tight tolerances, which is vital for preventing clogging in fine-mesh screens or inkjet nozzles. The convergence of material science with digital manufacturing principles, including the use of high-throughput testing and AI-driven quality assurance, is accelerating the iteration cycle for new paste chemistries and optimizing existing large-scale production runs, ultimately resulting in more consistent and higher-performing Molybdenum Manganese Paste products for critical applications.

Regional Highlights

- Asia Pacific (APAC): APAC stands as the undisputed epicenter of the Molybdenum Manganese Paste Market, dominating both production and consumption. This region is home to the vast majority of global Multilayer Ceramic Capacitor (MLCC) and HTCC component manufacturing facilities, particularly in China, Japan, South Korea, and Taiwan. The region’s growth is underpinned by massive investments in 5G infrastructure, the prolific expansion of consumer electronics manufacturing, and strong governmental backing for electric vehicle production. Japan and South Korea lead in technological advancements, focusing on high-end, high-reliability pastes for specialized industrial and automotive applications, while China drives sheer volume, capitalizing on lower manufacturing costs and expanding domestic demand. The concentration of end-user manufacturers in APAC ensures rapid feedback loops and quick adoption of new paste formulations designed for higher component density and performance.

- North America: The North American market is characterized by high demand for specialized, high-performance Mo-Mn pastes, particularly in the defense, aerospace, and high-reliability industrial sectors. While production volumes are lower than in APAC, the focus here is on innovative material R&D, stringent quality control, and solutions for mission-critical applications where failure tolerance is zero. The region is a key adopter of advanced ceramic technologies, including high-power semiconductor packaging utilizing HTCC substrates. Growth is driven by the expansion of space exploration technologies and the burgeoning electric vehicle battery management system market. Companies here prioritize compliance with rigorous environmental and quality standards (e.g., ITAR regulations for defense applications), resulting in a premium market environment.

- Europe: The European market demonstrates steady growth, highly influenced by strict environmental regulations, such as REACH, which drive innovation toward developing greener, low-toxicity paste formulations. Key applications include advanced automotive electronics (especially for high-voltage systems and ADAS technologies), industrial automation, and energy solutions (SOFC manufacturing). Germany, France, and the UK are central to this regional market. European manufacturers often focus on small-batch, highly customized pastes tailored for precision components, emphasizing sustainability and supply chain transparency. The push towards establishing robust domestic supply chains for critical automotive components further stimulates demand for specialized Mo-Mn products within the region.

- Latin America & Middle East and Africa (MEA): These regions currently represent smaller market shares but offer long-term growth potential. Demand in MEA is primarily driven by infrastructure development, investments in renewable energy projects (including SOFC demonstration projects), and localized assembly of power electronics. Latin America’s growth is tied to the expansion of consumer electronics assembly and limited automotive manufacturing centers. While currently reliant on imports from APAC, increasing local manufacturing capacity, particularly in Brazil and Mexico, presents future opportunities for Mo-Mn paste suppliers. The market here is sensitive to global pricing trends and relies on robust distribution logistics.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Molybdenum Manganese Paste Market.- DuPont (Laird Performance Materials)

- Heraeus Group

- Sumitomo Metal Mining Co., Ltd.

- Tanaka Precious Metals

- Ferro Corporation (Prince Minerals)

- Shoei Chemical Inc.

- Noritake Co., Limited

- Kyocera Corporation

- ESL Electroscience

- C-MET (Ceramics Manufacturing Technology)

- Changzhou Guofeng Material Technology

- Dalian Jinyuan High-Purity Material

- V-Technical Textiles, Inc.

- TCI Chemicals (India) Pvt. Ltd.

- Nanjing Nanrui Electrical Co., Ltd.

- Foshan Hecheng Electronic Materials Co., Ltd.

- Shin-Etsu Chemical Co., Ltd.

- DOWA Hightech Co., Ltd.

- Aremco Products, Inc.

- Midas Technology Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Molybdenum Manganese Paste market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of Molybdenum Manganese paste in electronics manufacturing?

The primary function is to serve as a conductive thick film ink for the metallization of ceramic substrates, forming robust internal electrodes and wiring patterns, particularly crucial for high-temperature co-fired ceramics (HTCC) and multilayer ceramic capacitors (MLCCs). It enables reliable electrical connectivity and adhesion after co-firing.

Which key market application drives the highest demand for Mo-Mn paste?

The manufacturing of Multilayer Ceramic Capacitors (MLCCs) constitutes the largest application segment, driven by the pervasive need for miniaturized passive components in consumer electronics, 5G devices, and data center equipment globally.

How does the Molybdenum Manganese Paste market address environmental concerns and regulations?

Manufacturers are heavily investing in R&D to develop environmentally friendly paste formulations, primarily by replacing traditional volatile organic compounds (VOCs) and restricted substances in solvents and binder systems to comply with international regulations such as REACH and RoHS directives.

What role does the manganese component play in the paste formulation?

Manganese acts primarily as an essential adhesion promoter. During the high-temperature co-firing process, manganese oxide facilitates the formation of a chemical bond between the refractory molybdenum particles and the ceramic substrate, ensuring long-term mechanical strength and integrity of the metallization layer.

Which geographical region leads the global consumption and production of this paste?

Asia Pacific (APAC), particularly China, Japan, and South Korea, is the leading region for both the production and consumption of Molybdenum Manganese Paste, owing to its concentrated presence of major electronic component and ceramic manufacturing hubs.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager