Molybdenum Oxide Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437230 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Molybdenum Oxide Market Size

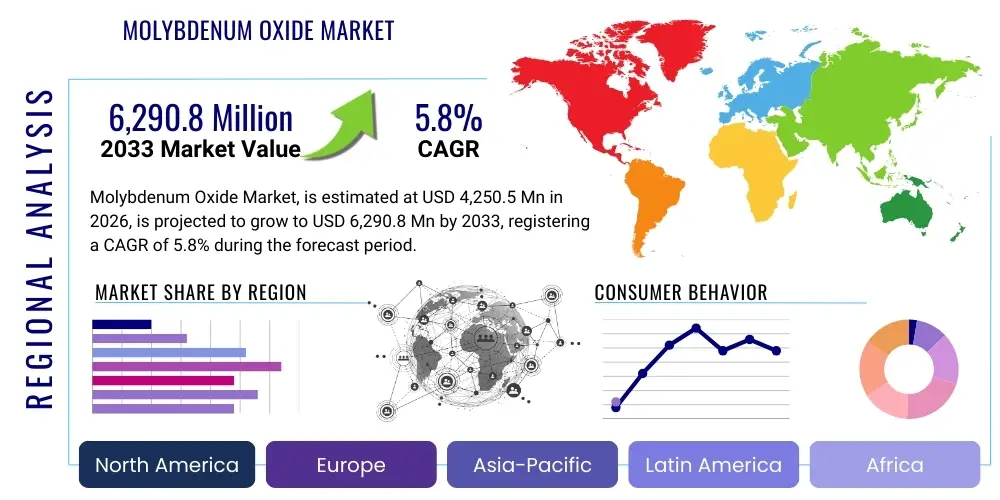

The Molybdenum Oxide Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $4,250.5 Million in 2026 and is projected to reach $6,290.8 Million by the end of the forecast period in 2033. This substantial growth is fundamentally driven by the escalating global demand for high-performance alloys in critical sectors such as aerospace, automotive manufacturing, and energy infrastructure, where the unique properties conferred by molybdenum additives are indispensable for enhancing material durability and heat resistance.

Market expansion is also significantly influenced by the robust activity in the petrochemical and refining industries, which rely heavily on molybdenum-based catalysts for hydrodesulfurization (HDS) and hydrodenitrogenation (HDN) processes. These catalytic applications are crucial for meeting stringent environmental regulations concerning sulfur content in fuels. Furthermore, the increasing adoption of specialized molybdenum chemicals in corrosion inhibitors and pigments, particularly in emerging economies undergoing rapid industrialization, contributes to the overall revenue trajectory and stability of the market throughout the projection period.

Geographical trends indicate that Asia Pacific, particularly China and India, will remain the dominant consumption hub, propelled by massive infrastructure projects and expanding steel production capabilities. However, strategic investments in new mining and processing technologies across North America and Europe, aimed at securing domestic supply chains and improving efficiency in Molybdenum Oxide production, are expected to stabilize price volatility and ensure consistent supply, underpinning the moderate yet consistent CAGR projected for the global market.

Molybdenum Oxide Market introduction

Molybdenum Oxide (MoO3), primarily recognized in its technical grade form, is a pivotal chemical compound serving as the foundational raw material for nearly all commercial molybdenum-containing products. It is a vital intermediate product obtained through the roasting of molybdenite concentrate (MoS2), existing most commonly as a pale-yellow to bluish-white powder. Its high melting point, superior chemical stability, and versatile electrochemical properties render it indispensable across a spectrum of high-technology industrial applications, making it a critical commodity in global industrial supply chains, especially those centered on enhancing material performance and catalyzing chemical reactions.

The product's major applications span three core industrial areas: metallurgy, catalysts, and specialized chemicals. In metallurgy, MoO3 is utilized directly in the production of ferromolybdenum, an essential alloy additive used to improve the strength, toughness, and corrosion resistance of steel and cast irons, vital for demanding environments like offshore drilling and high-speed machinery. As a catalyst, Molybdenum Oxide is paramount in the petroleum refining sector for removing sulfur and nitrogen compounds from fossil fuels, a process critical for environmental compliance and fuel quality improvement. Its versatility extends to chemical synthesis, where it acts as an effective oxidation catalyst.

Key driving factors underpinning the market growth include stringent global environmental regulations boosting demand for HDS catalysts, the sustained high-growth trajectory of the construction and infrastructure sectors requiring stronger steel alloys, and the technological advancements in aerospace and defense requiring specialized, lightweight, and heat-resistant superalloys. The primary benefits of Molybdenum Oxide include its ability to enhance material properties (hardness, resistance to high temperatures and corrosion) and its crucial role in promoting cleaner energy production through highly efficient catalytic processes, thereby cementing its importance in the global industrial landscape.

Molybdenum Oxide Market Executive Summary

The Molybdenum Oxide market exhibits resilience and consistent growth, primarily fueled by robust business trends centered on global infrastructure development and the increasing complexity of environmental mandates. Business trends highlight a pronounced shift towards higher-purity Molybdenum Oxide grades for electronic applications and niche catalysts, alongside continuous efforts by major producers to optimize mining extraction and processing efficiency to counter fluctuating molybdenum commodity prices. Strategic vertical integration, from mining to final alloy production, is a key characteristic observed among leading market participants, seeking to stabilize supply and maximize profitability across the value chain. Innovation in catalyst regeneration and recycling technologies also represents a significant trend aimed at resource sustainability and cost reduction in high-volume consumption sectors.

Regionally, the market demonstrates a bifurcated structure: Asia Pacific (APAC) dominates consumption due to overwhelming demand from its expansive steel manufacturing base and burgeoning petrochemical industry, particularly in China and South Korea. Conversely, North America and Europe maintain technological leadership, focusing on the production of specialized, high-value molybdenum chemicals and advanced catalytic converters, driven by stringent regulatory frameworks such as REACH in Europe and rigorous EPA standards in the U.S. Future growth is strongly anticipated in developing economies within Latin America and the Middle East and Africa (MEA), catalyzed by increased exploration activities in oil and gas and accompanying refinery upgrades, requiring large volumes of molybdenum-based catalysts.

Segment trends underscore the dominance of the metallurgical application segment, especially the ferromolybdenum production route, which remains the largest volume consumer of Molybdenum Oxide. However, the catalytic segment, while smaller in volume, is projected to register the highest growth rate due to escalating global clean fuel requirements. By grade, the Technical Grade Molybdenum Oxide constitutes the majority of the market, catering to bulk industrial needs, whereas the High Purity Grade segment, essential for electronics and specialized chemical industries, demonstrates superior value realization and rapid growth potential, indicating a gradual shift in focus towards specialty products.

AI Impact Analysis on Molybdenum Oxide Market

Common user questions regarding AI's influence on the Molybdenum Oxide market often revolve around how artificial intelligence and machine learning (ML) can optimize complex, energy-intensive processes like ore sorting, smelting, and hydrodesulfurization catalysis. Key user concerns include the potential for AI-driven demand forecasting accuracy, minimizing inventory risk due to volatile commodity pricing, and improving operational efficiency in mining and processing facilities. Users also inquire about AI's role in accelerating the discovery of novel molybdenum catalyst formulations or optimizing the lifespan and regeneration cycles of existing ones. The consensus expectation is that AI will predominantly act as an efficiency multiplier, reducing waste, energy consumption, and capital expenditure across the Molybdenum Oxide value chain, rather than directly influencing end-market demand.

The implementation of AI and predictive analytics offers substantial opportunities for market stakeholders to gain a competitive edge. In mining operations, AI algorithms can analyze geological data in real-time to optimize blasting patterns, improving ore recovery rates and reducing environmental impact. For Molybdenum Oxide converters, ML models can fine-tune reactor temperatures, pressure, and flow rates during the roasting process, ensuring maximum conversion efficiency and consistent product quality, thereby lowering production costs and reducing off-spec batches. Furthermore, predictive maintenance powered by AI sensors installed on crucial production machinery minimizes unexpected downtime, a significant factor in high-capital industrial production environments.

The influence of AI also extends significantly into the research and development domain for molybdenum-based catalysts. AI simulation tools can screen thousands of potential catalyst structures and compositions much faster than traditional laboratory methods, accelerating the development of highly selective and stable catalysts required for future energy transitions, such as those used in biomass conversion or advanced hydrogen production. This integration of AI is transforming Molybdenum Oxide from a traditional commodity chemical into a material whose application success is increasingly linked to digitally enhanced performance and utilization strategies.

- AI optimizes complex geological modeling for efficient Molybdenum ore extraction and purity prediction.

- Machine Learning enhances operational efficiency in roasting facilities, reducing energy consumption per ton of Molybdenum Oxide produced.

- Predictive maintenance systems utilize AI to minimize unplanned downtime in high-capital processing plants.

- AI-driven demand forecasting improves inventory management and mitigates risks associated with volatile commodity price fluctuations.

- Generative AI accelerates R&D for novel, high-performance Molybdenum-based catalysts used in advanced chemical processes.

- Supply chain logistics are optimized via AI, ensuring just-in-time delivery of Molybdenum Oxide to downstream users, reducing storage costs.

- AI monitors environmental parameters and process emissions, ensuring compliance with increasingly strict global regulatory standards.

DRO & Impact Forces Of Molybdenum Oxide Market

The Molybdenum Oxide market is shaped by a powerful interplay of Drivers, Restraints, and Opportunities, collectively forming the key Impact Forces determining its growth trajectory. The primary driver is the pervasive requirement for high-strength, durable materials in infrastructure and advanced machinery, directly linking MoO3 consumption to global GDP growth and industrial output. Concurrent restraints include the high price volatility of the base commodity, molybdenum, often dictated by concentrated supply sources and geopolitical factors, which can complicate long-term strategic purchasing decisions for end-users. Opportunities arise from the transition to cleaner energy sources, specifically the expanding role of Molybdenum Oxide in next-generation catalyst systems and high-temperature lubricants for advanced engines and machinery, offering new avenues for high-value market penetration.

Key drivers include the relentless expansion of the global steel industry, particularly the high-specification alloy steel sector essential for modern engineering applications. The robust demand from the oil and gas sector, particularly for upgrading refineries to produce ultra-low sulfur fuels mandated by stricter emissions standards (e.g., IMO 2020), ensures steady demand for molybdenum catalysts. Furthermore, technological advancements in the aerospace and defense sectors, requiring specialized superalloys based on molybdenum for improved jet engine components and ballistic performance, continually push the boundaries of high-performance material consumption, reinforcing Molybdenum Oxide’s market position as a critical ingredient.

However, the market faces significant restraints, most notably the high capital expenditure required for establishing or expanding Molybdenum mining and processing facilities, which limits new market entrants and concentrates supply. Furthermore, the increasing focus on circular economy principles and efficient recycling of spent catalysts and scrap metal containing molybdenum can potentially offset primary demand, posing a long-term challenge to virgin Molybdenum Oxide producers. The overall impact forces suggest a moderately positive outlook, where strong underlying industrial demand consistently overcomes pricing and supply chain complexities, provided technological innovation continues to open specialized, high-growth application niches.

- Drivers: Escalating global demand for high-strength low-alloy (HSLA) steels; Stricter environmental regulations driving catalytic hydrotreatment demand; Expansion of oil refining capacity in developing regions.

- Restraints: Significant price volatility of raw Molybdenum commodity; High energy intensity and complexity of Molybdenum Oxide production; Potential substitution by alternative alloying elements in certain low-grade steel applications.

- Opportunities: Growing utilization of Molybdenum Oxide in solar energy components and thin-film batteries; Development of specialized Mo-based coatings for extreme environment protection; Advancements in catalyst recovery and recycling technologies creating new service markets.

- Impact Forces: High bargaining power of raw material suppliers (concentrated mining); High regulatory pressure on pollution control drives catalyst consumption; Intense competition among MoO3 processors focusing on cost efficiency and purity.

Segmentation Analysis

The Molybdenum Oxide market is comprehensively segmented based on its Purity Grade, primary Application, and the End-Use Industry it serves, providing a detailed framework for understanding market dynamics and consumption patterns. Segmentation by Purity Grade distinguishes between Technical Grade Molybdenum Oxide, which is the dominant volume segment utilized extensively in metallurgy, and High Purity Grade Molybdenum Oxide, a premium product catering to sensitive sectors like electronics, specialized chemical synthesis, and certain high-fidelity catalyst preparations. This purity distinction is crucial as it directly impacts pricing and target market access, with high-purity materials commanding a significantly higher market value.

The segmentation by Application is critical, highlighting the market's primary functions: metallurgical applications, which involve the conversion of MoO3 into ferro-molybdenum or direct use as an alloying agent; catalytic applications, central to the petrochemical and chemical industries for processes such as hydrotreating; and chemical applications, encompassing use in pigments, corrosion inhibitors, and flame retardants. Metallurgical applications consistently represent the largest market share by volume due to the massive scale of the global steel industry, acting as the bedrock of Molybdenum Oxide consumption. However, the catalytic segment, driven by global mandates for cleaner fuels, exhibits the fastest growth due to continuous process upgrades and catalyst replacement cycles.

Further analysis through End-Use Industry segmentation clarifies the ultimate demand sources, including the Oil & Gas sector (refining), Automotive & Transportation (alloy steel, lubricants), Aerospace & Defense (superalloys), and Chemicals (pigments, specialty lubricants). Understanding these segments allows market participants to tailor their product offerings and strategic investments, ensuring alignment with the specific technical requirements, regulatory environment, and growth projections characteristic of each downstream industry, thereby maximizing market penetration and profitability in this highly specialized commodity market.

- By Grade:

- Technical Grade Molybdenum Oxide (Substantial volume, primarily for metallurgy)

- High Purity Grade Molybdenum Oxide (Higher value, used in electronics, specialty chemicals, and advanced catalysts)

- By Application:

- Metallurgical Applications (Production of Ferromolybdenum, Molybdenum Metal)

- Catalytic Applications (Hydrodesulfurization (HDS), Hydrodenitrogenation (HDN), Methanol production)

- Chemical Applications (Pigments, Corrosion Inhibitors, Lubricants, Flame Retardants)

- By End-Use Industry:

- Oil & Gas and Petroleum Refining

- Automotive & Transportation

- Aerospace & Defense

- Chemicals and Polymers

- Construction and Infrastructure

- Electrical and Electronics

Value Chain Analysis For Molybdenum Oxide Market

The Molybdenum Oxide value chain commences with the Upstream Analysis, which is highly concentrated and capital-intensive, focusing on the mining and extraction of molybdenite ore (MoS2), often as a primary product or, more commonly, as a co-product of copper mining. This stage involves complex beneficiation processes like froth flotation to concentrate the ore. The critical subsequent step is the roasting of the concentrate, converting Molybdenum Sulfide into the commercial product, Molybdenum Oxide. The high concentration of global Mo mining operations in a few key geographies (e.g., Chile, China, USA) confers significant bargaining power to upstream suppliers, establishing the commodity price baseline for the entire chain.

Midstream activities primarily involve the processing of Molybdenum Oxide into intermediate products, notably ferromolybdenum (FeMo) for the steel industry, or specialized Molybdenum chemicals like ammonium dimolybdate (ADM) and various catalysts. Processing companies often focus on improving the purity and morphology of the MoO3 powder to meet strict downstream specifications, particularly for catalyst manufacturers. The Downstream Analysis focuses on the utilization of these intermediate products by end-use industries, including steel mills, petrochemical refineries, and chemical manufacturers, where MoO3’s properties are incorporated into final products like alloy steels, clean fuels, and high-performance lubricants. The demand from these diverse downstream sectors dictates the required quality and volume of the Molybdenum Oxide feedstock.

The Distribution Channel for Molybdenum Oxide is multifaceted, incorporating both Direct and Indirect mechanisms. Direct sales dominate transactions for high-volume, long-term contracts between large integrated producers (those operating both mines and conversion facilities) and major end-users, such as global steel manufacturers or large refinery operators. Indirect channels involve trading houses, specialized distributors, and agents who facilitate transactions, manage logistics, and handle inventory for smaller purchasers or those requiring specialized, smaller batch quantities. The complexity of handling hazardous materials and the need for rigorous quality assurance often favor experienced global traders who can manage international shipping, customs, and financing efficiently across various geographical markets, ensuring stable delivery across the highly cyclical nature of industrial demand.

Molybdenum Oxide Market Potential Customers

The potential customers and end-users of Molybdenum Oxide are fundamentally diverse, spanning heavy industrial sectors that rely on material performance and chemical reactivity. The largest segment of buyers consists of metallurgical industries, particularly integrated steel producers and specialized alloy manufacturers who purchase Molybdenum Oxide or its derivative, ferromolybdenum, in large volumes to enhance the strength, toughness, and corrosion resistance of high-specification steels, crucial for automotive, construction, and heavy machinery applications. These customers are highly sensitive to price fluctuations but prioritize consistent quality and guaranteed supply to maintain production schedules and meet stringent engineering standards required for critical components.

Another significant group of buyers is the global consortium of petrochemical companies and oil refining operators. These entities are major consumers of Molybdenum Oxide as a precursor for catalysts essential in the hydrodesulfurization (HDS) process, a non-negotiable step in producing environmentally compliant fuels such as ultra-low sulfur diesel and gasoline. Their purchasing decisions are heavily influenced by the efficiency, longevity, and regeneration capabilities of the resulting catalysts, driven by high utilization rates and the economic imperative to minimize downtime during refinery operations. Demand here is regulated by governmental mandates on fuel quality and the ongoing pace of global refinery expansion and modernization.

Furthermore, specialized chemical and advanced materials companies form a high-value customer base for high-purity Molybdenum Oxide. These buyers utilize the compound in the manufacturing of sophisticated industrial lubricants, specifically molybdenum disulfide (MoS2), known for its exceptional lubricating properties under extreme temperature and pressure conditions. They also include pigment manufacturers, providers of anti-corrosion coatings, and niche electronics firms requiring thin films of Molybdenum Oxide for display technologies and semiconductor components. While their volume consumption is lower than steel or oil refining, these customers contribute significantly to market value due to their requirement for premium, highly specified grades, indicating a strategic growth area for high-ppurity Molybdenum Oxide producers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $4,250.5 Million |

| Market Forecast in 2033 | $6,290.8 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Freeport-McMoRan, Codelco, China Molybdenum Co. Ltd. (CMOC), Glencore, Molymet, Jinduicheng Molybdenum Group, Thompson Creek Metals (now part of Centerra Gold), S.A. Minerals, Eramet, Sumitomo Metal Mining, Molycorp, Climax Molybdenum Company, Teck Resources Limited, Grupo México, Centerra Gold. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Molybdenum Oxide Market Key Technology Landscape

The Molybdenum Oxide market's technological landscape is dominated by advancements in conversion processes, purity enhancement, and sustainable mining practices aimed at maximizing efficiency and minimizing environmental footprint. The core production technology revolves around the roasting of molybdenite concentrate (MoS2) in multi-hearth furnaces or fluid-bed roasters to produce technical grade MoO3. Current technological innovation is focused on optimizing these roasting processes, specifically by implementing enhanced gas treatment systems to capture sulfur dioxide (SO2) emissions, converting them into marketable sulfuric acid, thereby reducing pollution and improving process economics. Furthermore, continuous process monitoring and control systems, often incorporating advanced sensors and data analytics, are utilized to ensure uniform particle size distribution and consistent chemical composition, which is critical for downstream metallurgical and catalytic applications.

In terms of product specialization, the key technological focus is on developing methods for producing ultra-high purity Molybdenum Oxide (99.99% and above), essential for demanding applications in electronics, specialty ceramics, and high-performance optical coatings. Technologies such as sublimation, vacuum distillation, and various advanced solvent extraction methods are being refined to remove trace impurities (e.g., copper, iron, phosphorus) that can significantly impede the performance of high-fidelity products. This technological drive toward purity allows producers to access premium market segments with higher margins, moving beyond the bulk commodity market where price competition is severe. Investment in this area is paramount for producers aiming for diversification and technological leadership.

Moreover, catalyst technology represents a dynamic and continually evolving segment. The market relies heavily on the innovation of MoO3-based catalysts, specifically their supported versions (often combined with cobalt or nickel on alumina carriers) used for hydrotreating. Ongoing research focuses on developing nano-structured Molybdenum Oxide catalysts and utilizing advanced material science to increase catalyst surface area, improve pore structure, and enhance selectivity and stability, particularly in response to difficult feedstocks and stricter regulatory requirements. These technological advancements not only improve the refining process efficiency but also extend the lifespan of the catalyst, thereby reducing replacement frequency and waste generation, contributing to the overall sustainability goals of the petrochemical industry.

Regional Highlights

- North America: Characterized by mature, specialized markets, North America is a significant consumer of Molybdenum Oxide, driven by advanced aerospace and defense manufacturing sectors, and a strong emphasis on high-quality alloy steels. The region is also a major producer, with companies heavily investing in optimizing mining efficiency and technological innovation. Stringent EPA regulations ensure high demand for advanced catalytic converters in the refining industry. The focus is on R&D for high-value applications, including specialty chemicals and lubricants, with moderate, stable growth anticipated.

- Europe: Europe possesses a highly developed market emphasizing sustainability and high-performance engineering. Demand is underpinned by the automotive sector's transition toward specialized, lightweight steel and the sophisticated chemical industry. European environmental directives (e.g., REACH) drive innovation in catalyst and pigment segments. While mining activity is limited compared to other regions, Europe excels in high-purity Molybdenum Oxide conversion and specialized applications, with growth primarily stemming from technological upgrades and high-margin product utilization.

- Asia Pacific (APAC): APAC represents the largest and fastest-growing market for Molybdenum Oxide, dominated by China, which is both the largest producer and consumer globally. Growth is robustly fueled by massive infrastructure investment, rapid urbanization, and exponential expansion in the steel production, automotive, and shipbuilding industries. India, South Korea, and Japan also contribute significantly, particularly in petrochemical refining and electronics manufacturing. The region's growth is volume-driven, demanding large quantities of technical grade Molybdenum Oxide, although high-purity demand is rapidly accelerating due to the expansion of its electronics sector.

- Latin America: Latin America is a critical region in the upstream Molybdenum Oxide value chain, owing to the presence of world-leading molybdenum mining operations, particularly in Chile and Peru, often linked to large copper deposits. While raw material supply is dominant, downstream consumption of Molybdenum Oxide is concentrated in regional infrastructure projects and limited petrochemical refining capacity. Market growth is closely tied to global commodity prices and strategic investments in local processing capabilities to capture more value domestically.

- Middle East and Africa (MEA): This region exhibits growing demand, primarily concentrated in the Middle East due to continuous expansion and modernization of its vast oil and gas refining infrastructure. The necessity for advanced hydrotreating catalysts to meet international export standards is the core driver. Consumption in Africa is more limited, tied to nascent industrialization and mining activities. Strategic investment in new refineries and petrochemical complexes ensures a high, specialized demand for molybdenum-based catalysts throughout the forecast period.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Molybdenum Oxide Market.- Freeport-McMoRan Inc.

- Codelco (Corporación Nacional del Cobre de Chile)

- China Molybdenum Co. Ltd. (CMOC)

- Glencore PLC

- Molymet (Molibdenos y Metales S.A.)

- Jinduicheng Molybdenum Group Co., Ltd. (JDC)

- Thompson Creek Metals (now part of Centerra Gold)

- S.A. Minerals

- Eramet S.A.

- Sumitomo Metal Mining Co., Ltd.

- Rio Tinto Group

- Teck Resources Limited

- Grupo México S.A.B. de C.V.

- Climax Molybdenum Company (A subsidiary of Freeport-McMoRan)

- Centerra Gold Inc.

- Treibacher Industrie AG

- Kyocera Corporation

- Luoyang Jefine Technology Co., Ltd.

- Nippon Denko Co., Ltd.

- Cenim Mineira e Metalúrgica S.A.

Frequently Asked Questions

Analyze common user questions about the Molybdenum Oxide market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary applications driving the current demand for Molybdenum Oxide?

The primary applications driving Molybdenum Oxide demand are metallurgical additions (specifically the production of ferromolybdenum for high-strength steel alloys) and catalytic uses in the petrochemical sector for the mandatory hydrodesulfurization (HDS) process, essential for manufacturing clean fuels.

How does the volatile price of raw Molybdenum affect the Molybdenum Oxide market?

The high volatility of the Molybdenum commodity price, influenced by mining supply concentration and geopolitical factors, directly impacts the cost of Molybdenum Oxide production. This fluctuation necessitates sophisticated risk management strategies and hedging by major producers and large consumers to maintain profitability and stable pricing.

Which geographical region holds the largest market share for Molybdenum Oxide consumption?

The Asia Pacific (APAC) region, primarily driven by China's extensive steel manufacturing, infrastructure expansion, and growing petrochemical industry, currently holds the largest market share for Molybdenum Oxide consumption globally, positioning it as the central hub for volume demand.

What is the significance of High Purity Grade Molybdenum Oxide compared to Technical Grade?

Technical Grade Molybdenum Oxide is utilized for high-volume metallurgical purposes. In contrast, High Purity Grade (often 99.9% or higher) is critical for specialized, high-value applications in electronics, advanced optics, and highly sensitive catalyst formulations, commanding a significant price premium due to stricter quality requirements.

What role do environmental regulations play in shaping the future of the Molybdenum Oxide market?

Environmental regulations, particularly those mandating ultra-low sulfur content in fuels (like IMO 2020 standards), are crucial market drivers. These regulations sustain and intensify demand for Molybdenum Oxide-based hydrotreating catalysts, ensuring continued technological advancements in cleaner fuel production processes worldwide.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Molybdenum Oxide (CAS 1313-27-5) Market Size Report By Type (Technical Molybdenum Oxide, High Pure Molybdenum Oxide), By Application (Metallurgy Industry, Alloy Metals Industry, Chemical Industry, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Molybdenum Oxide (CAS 1313-27-5) Market Statistics 2025 Analysis By Application (Metallurgy Industry, Alloy Metals Industry, Chemical Industry), By Type (Technical Molybdenum Oxide, High Pure Molybdenum Oxide), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Molybdenum Oxide (Cas 1313-27-5) Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Technical Molybdenum Trioxide, High Pure Molybdenum Trioxide), By Application (Metallurgy Industry, Alloy Metals Industry, Chemical Industry, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager