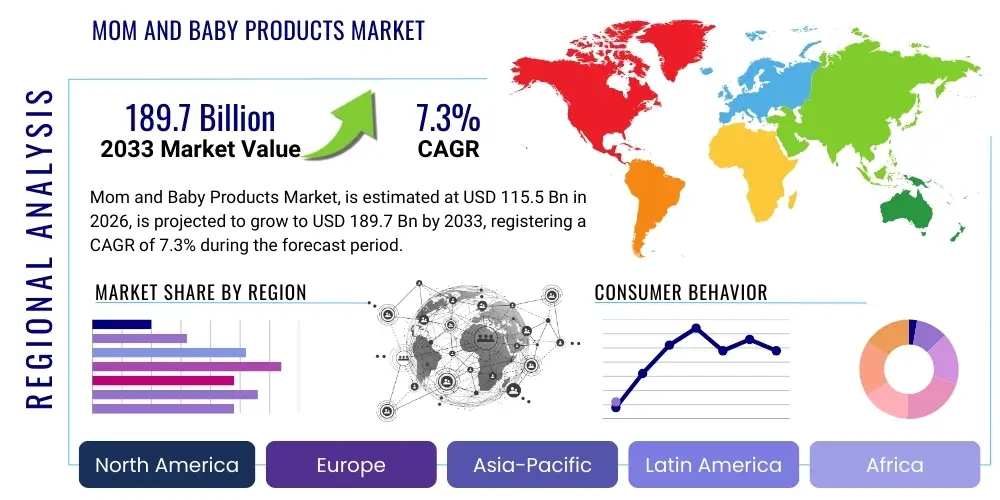

Mom and Baby Products Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438164 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Mom and Baby Products Market Size

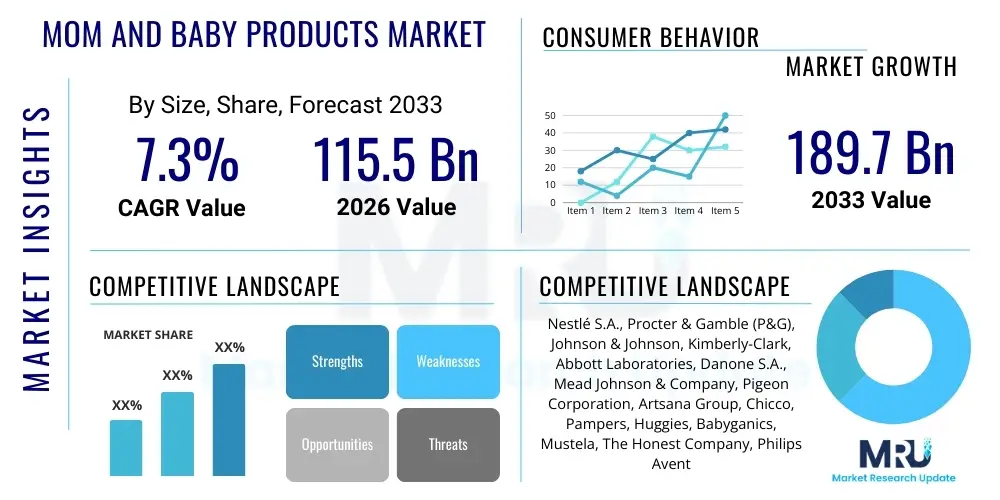

The Mom and Baby Products Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.3% between 2026 and 2033. The market is estimated at $115.5 Billion USD in 2026 and is projected to reach $189.7 Billion USD by the end of the forecast period in 2033.

Mom and Baby Products Market introduction

The Mom and Baby Products Market encompasses a broad spectrum of goods designed to cater to the essential needs of infants, toddlers, and expectant or new mothers. This expansive category includes items such as diapers, feeding equipment, skin care and hygiene products, toys, apparel, and safety gear. The core objective of these products is to ensure the health, safety, and holistic development of the child while providing convenience and support to parents. Product offerings are highly diversified, ranging from basic necessities like disposable diapers to specialized, high-tech items such as smart monitors and organic baby food formulations, reflecting evolving consumer preferences for premium and innovative solutions.

Major applications for mom and baby products span daily care routines, including feeding, bathing, sleeping, and mobility. Key benefits derived from these products include enhanced hygiene standards, nutritional fulfillment, improved safety features (especially in car seats and nursery furniture), and reduced parental stress through time-saving innovations. The market is characterized by high emotional involvement from consumers, driving demand for products backed by clinical endorsements, safety certifications, and sustainable manufacturing practices. The introduction of products focusing on natural and hypoallergenic ingredients has significantly shaped consumer purchasing behavior in recent years.

The market's sustained growth is primarily driven by several macro and micro factors, including consistently high birth rates in developing regions, rising disposable incomes leading to greater expenditure on premium baby care items, and intensive marketing campaigns focusing on child wellness and early development. Furthermore, increasing urbanization and the proliferation of organized retail channels and e-commerce platforms have improved product accessibility across global markets. The strong influence of parental education and the increasing adoption of Western parenting standards also act as substantial tailwinds for market expansion, particularly in Asia Pacific and Latin America.

Mom and Baby Products Market Executive Summary

The Mom and Baby Products Market is undergoing a rapid transformation, characterized by distinct business trends centered on sustainability, digitalization, and personalization. A major business trend involves the shift towards eco-friendly and organic product lines, driven by parental concerns over chemical exposure and environmental impact. Companies are investing heavily in biodegradable materials, clean labels, and ethically sourced components, resulting in a premium pricing strategy for sustainable offerings. Simultaneously, the integration of technology, such as smart baby monitoring systems and connected devices, is redefining product utility, emphasizing safety, convenience, and data-driven insights for parental care management.

Regionally, the Asia Pacific (APAC) stands out as the primary growth engine, fueled by a large population base, rapidly increasing middle-class income levels, and the ongoing shift from unbranded to branded products, particularly in India and China. While North America and Europe remain established markets, growth is primarily propelled by product innovation, high demand for specialized medical-grade infant products, and high penetration of direct-to-consumer (D2C) e-commerce models. Regulatory harmonization concerning product safety standards across major trading blocs is also influencing market entry strategies and supply chain resilience globally.

Segment trends reveal robust growth in the Baby Skin Care and Toiletries sector, benefiting from the 'premiumization' trend where parents prioritize specialized, dermatologically tested formulations. The Baby Food and Formula segment continues to dominate in terms of revenue, with significant innovation focusing on specialized formulas addressing allergies and specific developmental stages. The rapid adoption of disposable hygiene products remains central to market volume, although reusable and sustainable diaper options are carving out niche segments. Distribution segment trends show a decisive move towards online retail channels, which offer wider product ranges, price comparisons, and subscription services catering to repetitive purchase needs.

AI Impact Analysis on Mom and Baby Products Market

User queries regarding the impact of Artificial Intelligence (AI) on the Mom and Baby Products Market frequently center on themes of enhanced child safety, personalized product recommendations, and automated parental support systems. Key concerns revolve around the accuracy and security of collecting sensitive biometric data from infants via smart devices, and the ethical implications of AI-driven parenting advice. Expectations are high for AI to revolutionize nursery monitoring (detecting SIDS risks, tracking vital signs), optimize inventory management for essential replenishment (diapers, formula), and provide highly customized nutritional plans or skincare routines based on the individual needs of the child and mother. This focus highlights a desire for AI to move beyond simple convenience towards genuine health and safety assurance.

The integration of AI into baby care technology is fundamentally shifting product development from passive consumption items to active data generators. AI algorithms, when embedded in wearable sensors, smart cribs, or video monitors, can analyze vast quantities of data related to sleep patterns, feeding intake, and respiratory rates. This predictive capability allows for early identification of potential health issues, transforming monitoring products into proactive wellness tools. For instance, AI-enabled cameras can learn the baby's baseline behaviors and flag anomalies immediately, providing peace of mind and actionable alerts to parents, thereby raising the safety standards of consumer products dramatically.

Furthermore, AI significantly enhances the consumer experience on the retail side. Machine learning algorithms analyze purchase history, browsing patterns, and stage-of-life data (e.g., due date, child’s age) to offer hyper-personalized product bundles and subscription services. This optimization reduces decision fatigue for busy parents and increases customer lifetime value for manufacturers and retailers. Supply chain optimization, using AI for demand forecasting, ensures that fast-moving consumables are readily available, mitigating out-of-stock risks, which is crucial for highly essential product categories like infant formula and diapers.

- AI-driven personalized product recommendations and subscription optimization for consumables.

- Integration of machine learning into smart monitors for predictive health analysis (e.g., SIDS risk reduction).

- Enhanced efficiency in supply chain and inventory management using AI forecasting models.

- Development of personalized nutritional plans and formula adjustments based on infant growth metrics.

- Use of computer vision and AI in toys and educational products for developmental tracking and personalized learning.

DRO & Impact Forces Of Mom and Baby Products Market

The Mom and Baby Products Market is influenced by a dynamic interplay of Drivers, Restraints, and Opportunities (DRO), collectively manifesting through powerful Impact Forces that dictate strategic direction and competitive intensity. Primary drivers include rising parental awareness regarding early childhood development, rapid urbanization, and significant growth in digital connectivity facilitating access to information and specialized products. Restraints often center on stringent regulatory approvals for health-sensitive products (like infant formula), the high cost associated with premium and sustainable goods, and fluctuating commodity prices impacting raw material procurement for hygiene products. Opportunities abound in emerging markets through untapped rural populations, technological advancements enabling smarter and safer products, and the rising demand for specialty dietary products catering to various allergies or ethical preferences (e.g., plant-based formulas).

A key Driver is the societal shift towards smaller family sizes coupled with higher individual expenditure per child, often referred to as the "premiumization" effect. This demographic trend means that parents, particularly in developed and rapidly developing economies, are willing to spend more on high-quality, scientifically backed, and branded products. Marketing efforts effectively leverage this sentiment by highlighting safety features, hypoallergenic ingredients, and sustainability credentials, cementing brand loyalty and driving revenue growth. Furthermore, the increasing prominence of digital parenting communities and social media influencers amplifies product visibility and accelerates the adoption curve for new and innovative solutions.

Conversely, a significant Restraint involves the intensely competitive nature of the hygiene and feeding segments, where price sensitivity remains high, especially in mass-market categories. Counterfeit products, particularly in essential items like baby formula in certain regions, pose a substantial threat to brand reputation and consumer trust, requiring robust supply chain security measures. The regulatory environment demands continuous compliance and significant investment in clinical trials and safety testing, which can be prohibitive for smaller entrants. However, the emerging Opportunity lies in developing specialized D2C models that cut down distribution costs and allow direct interaction with consumers, enabling customized product offerings and stronger feedback loops.

The Impact Forces shaping the market include the significant bargaining power of consumers due to extensive product availability and ease of comparison shopping online. Supplier power is generally moderate, except for highly specialized ingredients (like certain vitamins or organic cotton). Threat of substitutes is low for essential items (diapers, basic formula) but moderate for non-essential accessories and toys. The competitive rivalry is extremely high, characterized by continuous product line expansion, aggressive pricing strategies, and high marketing expenditure by global conglomerates aiming for dominance across multiple product categories.

Segmentation Analysis

The Mom and Baby Products Market is comprehensively segmented based on product type, channel of distribution, and geographical region, providing a structured view of market dynamics and consumer preferences. Product segmentation reveals the core consumption categories, dominated by Baby Food and Beverage and Baby Care Products (including hygiene and skin care). Distribution channels are critical in determining market penetration, with a notable shift from traditional retail formats to e-commerce platforms, offering greater convenience and direct engagement with specific consumer demographics. These segments reflect distinct growth rates, with advanced digital technologies accelerating growth in smart accessories and specialized feeding segments.

Further granularity in segmentation highlights the diversification of offerings to meet specific parental needs. Within Baby Care Products, the division between disposable and reusable items (e.g., diapers) is key, driven by varying economic considerations and environmental concerns across different countries. Similarly, the Baby Food sector segments into standard formulas, specialized medical formulas, organic prepared meals, and fortified cereals, each appealing to different socio-economic strata and health-conscious consumer groups. Understanding these complex inter-segment dependencies is crucial for manufacturers developing targeted marketing strategies and optimizing their supply chains.

- By Product Type:

- Baby Care Products (Diapers, Wipes, Skincare, Toiletries, Bath Products)

- Baby Food and Beverage (Formula, Prepared Baby Food, Cereals, Juices)

- Baby Safety and Mobility (Car Seats, Strollers, Carriers)

- Baby Apparel and Footwear

- Baby Toys and Accessories (Nursery Products, Monitors, Feeding Accessories)

- By Distribution Channel:

- Supermarkets and Hypermarkets

- Specialty Stores

- Online Retail (E-commerce)

- Pharmacy and Drug Stores

- By Region:

- North America (U.S., Canada)

- Europe (U.K., Germany, France)

- Asia Pacific (China, India, Japan)

- Latin America (Brazil, Mexico)

- Middle East and Africa (UAE, South Africa)

Value Chain Analysis For Mom and Baby Products Market

The Value Chain for the Mom and Baby Products Market is extensive and complex, starting from the procurement of highly sensitive raw materials and extending through sophisticated manufacturing, meticulous quality control, and diverse distribution channels. Upstream activities involve sourcing materials such as organic cotton, non-toxic plastics, specialized ingredients for formula (like whey protein and fortified vitamins), and sustainable packaging materials. Due to the sensitive nature of the end products, supplier qualification and adherence to international safety standards (e.g., FDA, EFSA) are paramount. The high regulatory scrutiny drives up the cost and complexity of the upstream phase, requiring robust vendor management and traceability systems.

Midstream activities focus on manufacturing and production, where operational efficiency and quality assurance dominate. For baby formula, manufacturing requires sterile environments and precise formulation blending. For hygiene products, high-speed, automated assembly lines are essential for cost-effective production. Downstream activities involve warehousing, logistics, and distribution. Given the high repurchase frequency of many baby products, efficient supply chain management and inventory optimization are critical to avoid stockouts at the retail level. The perishable nature of some baby food also necessitates controlled temperature logistics.

The distribution channel landscape is bifurcated into direct and indirect routes. Direct sales are increasingly common via proprietary brand e-commerce sites and subscription models, allowing manufacturers greater control over branding, pricing, and customer data. Indirect channels, which still account for the majority of volume, utilize supermarkets, hypermarkets, and specialty baby stores. The rise of large online retailers like Amazon and specialized regional e-commerce players has redefined the indirect channel, demanding seamless integration between manufacturers' systems and third-party logistics providers. Successful distribution hinges on maximizing visibility both in brick-and-mortar shelf placement and digital search rankings (AEO).

Mom and Baby Products Market Potential Customers

The primary End-Users and Buyers of mom and baby products are new and expecting parents, supplemented by grandparents and extended family members purchasing gifts or providing supplemental care. This customer base is characterized by being highly informed, primarily utilizing digital channels for research (reading reviews, comparing safety ratings, consulting pediatric recommendations), and demonstrating a strong propensity for brand loyalty once trust is established. The purchasing decision is overwhelmingly influenced by perceived safety, product efficacy, clinical recommendations, and increasingly, sustainability credentials.

Potential customers can be segmented based on lifestyle and economic status. The affluent segment actively seeks premium, specialized, and organic products, often adopting smart technology early in the child's life. The middle-income segment focuses on branded products that offer the best balance between quality and cost, often leveraging bulk buying and loyalty programs through large retail chains. A rapidly growing segment includes environmentally conscious millennial parents who prioritize reusable diapers, plant-based formulas, and locally sourced goods, driving demand for specialized niche brands.

The B2B segment also constitutes potential customers, particularly neonatal care units, specialized pediatric clinics, daycares, and institutions that require bulk purchasing of safety equipment, medical-grade formulas, and high-volume hygiene supplies. For manufacturers, targeting these institutional buyers requires adherence to rigorous regulatory standards and competitive tendering processes. Ultimately, the market success is contingent upon meeting the evolving needs of the primary decision-makers—the mothers—who typically drive the research and final purchase decisions for their households.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $115.5 Billion USD |

| Market Forecast in 2033 | $189.7 Billion USD |

| Growth Rate | 7.3% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Nestlé S.A., Procter & Gamble (P&G), Johnson & Johnson, Kimberly-Clark, Abbott Laboratories, Danone S.A., Mead Johnson & Company, Pigeon Corporation, Artsana Group, Chicco, Pampers, Huggies, Babyganics, Mustela, The Honest Company, Philips Avent, GoodBaby International Holdings, Hengan International Group, Reckitt Benckiser, Unilever |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Mom and Baby Products Market Key Technology Landscape

The technology landscape within the Mom and Baby Products Market is rapidly evolving, driven primarily by the concept of the 'Connected Nursery' and advancements in material science focused on safety and sustainability. Smart monitoring systems represent a core technological area, integrating high-definition video, non-contact vital sign tracking (e.g., heart rate, respiration), and AI-driven analysis to provide predictive alerts and comprehensive sleep reports. These systems leverage IoT (Internet of Things) connectivity to communicate data instantly to parental devices, enhancing safety assurance and streamlining the monitoring process, moving beyond simple sound detection to sophisticated health analytics.

Another crucial technological development lies in the Baby Food and Formula segment, specifically involving advanced nutritional science and biotechnology. Innovations include the development of personalized formulas based on genetic or biometric data, and the incorporation of specialized probiotics, prebiotics, and human milk oligosaccharides (HMOs) that closely mimic the immune-boosting properties of breast milk. Furthermore, technology is being deployed to ensure food safety and traceability, utilizing blockchain technology to verify the origin and quality of ingredients from farm to shelf, building necessary consumer confidence in highly sensitive products.

In hygiene and apparel, material science is focused on developing biodegradable, compostable, and super-absorbent core materials for diapers and wipes, significantly reducing environmental impact while maximizing performance. Technological advancements in sustainable polymer chemistry are essential for meeting the growing demand for eco-friendly product lines. Additionally, digital technology is influencing retail through Augmented Reality (AR) shopping experiences, allowing parents to virtually place nursery furniture or visualize apparel on their child before purchasing, enhancing online engagement and reducing product return rates.

Regional Highlights

Regional dynamics play a significant role in shaping the Mom and Baby Products Market, with distinct growth drivers and consumption patterns observable across different geographic areas. The market remains heavily segmented, reflecting diverse cultural parenting practices, varying economic conditions, and different regulatory environments pertaining to product safety and nutritional standards. Strategic market entry requires localized product adaptation and distribution strategies tailored to specific regional preferences, particularly concerning dietary choices and product material sensitivities.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, primarily driven by China and India. This growth is attributable to expanding birth cohorts, rising middle-class disposable income, and increasing preference for branded, Western-style baby care and feeding products. The shift away from traditional, homemade remedies towards packaged, certified products is pronounced. E-commerce platforms are critical in reaching the vast and diverse consumer base, often bypassing traditional infrastructure challenges.

- North America: This region is characterized by high adoption rates of premium and smart baby technology. Consumers prioritize convenience, safety, and specialized products, leading to dominance in sectors like organic baby food and sophisticated monitoring devices. Regulatory stringency regarding chemical ingredients and manufacturing processes is highest here, driving continuous innovation in material science and safety features.

- Europe: European consumers show a strong preference for sustainability and organic sourcing. The market is mature, with growth driven largely by innovation in eco-friendly packaging, biodegradable hygiene products, and highly specialized infant formulas meeting strict EU dietary guidelines. Western European countries exhibit high expenditure per child, prioritizing natural ingredients and ethical manufacturing practices.

- Latin America (LATAM): LATAM represents a significant emerging market opportunity, marked by increasing urbanization and the expansion of modern retail formats. While price sensitivity exists, there is a burgeoning demand for basic hygiene products and mid-range branded consumables. Brazil and Mexico are key growth hubs, attracting substantial foreign direct investment in manufacturing and distribution infrastructure.

- Middle East and Africa (MEA): Growth in MEA is highly uneven, concentrated primarily in the GCC countries (UAE, Saudi Arabia) where high disposable income supports demand for imported premium brands, particularly in apparel and luxury accessories. In less developed African regions, the focus remains on essential, affordable products, often sold through informal distribution networks. Investment in local manufacturing is increasing to address supply chain gaps.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Mom and Baby Products Market.- Nestlé S.A.

- Procter & Gamble (P&G)

- Johnson & Johnson

- Kimberly-Clark

- Abbott Laboratories

- Danone S.A.

- Mead Johnson & Company

- Pigeon Corporation

- Artsana Group

- Chicco

- Pampers

- Huggies

- Babyganics

- Mustela

- The Honest Company

- Philips Avent

- GoodBaby International Holdings

- Hengan International Group

- Reckitt Benckiser

- Unilever

Frequently Asked Questions

Analyze common user questions about the Mom and Baby Products market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Mom and Baby Products Market?

The primary factor driving growth is the increasing spending power of the middle class in emerging economies (especially APAC), coupled with high parental awareness regarding child safety, health, and early development, leading to greater adoption of branded and premium products.

How is sustainability impacting product development in this market?

Sustainability is a major trend, necessitating the development of biodegradable diapers, wipes, and eco-friendly packaging. Consumers actively seek products with organic ingredients and clean labels, prompting manufacturers to invest significantly in sustainable material science and ethical sourcing.

Which product segment holds the largest revenue share in the market?

The Baby Food and Formula segment consistently holds the largest revenue share, driven by essential nutritional needs, the high cost of specialized formulas, and ongoing product innovation focused on enhanced nutritional profiles and specialized dietary requirements.

What role does e-commerce play in the distribution of mom and baby products?

E-commerce is the fastest-growing distribution channel, offering convenience, wider product selections, and subscription services for high-frequency consumables like diapers and formula. Digital platforms are critical for market accessibility and direct-to-consumer engagement.

What are the key technological innovations expected to shape the market?

Key innovations center on integrating Artificial Intelligence (AI) and IoT into smart baby monitors for predictive health analytics, and advanced material science to develop hypoallergenic, super-absorbent, and sustainable hygiene products.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager