Mono Methyl Aniline Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439642 | Date : Jan, 2026 | Pages : 245 | Region : Global | Publisher : MRU

Mono Methyl Aniline Market Size

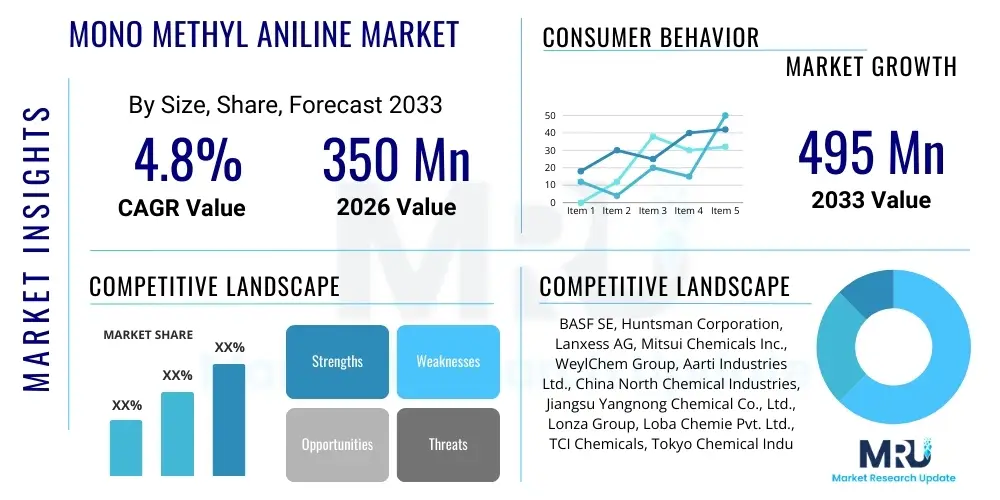

The Mono Methyl Aniline Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 650.3 Million in 2026 and is projected to reach USD 920.8 Million by the end of the forecast period in 2033.

Mono Methyl Aniline Market introduction

Mono Methyl Aniline (MMA) is a pivotal organic chemical compound characterized by the chemical formula C6H5NHCH3. It is a derivative of aniline, where one hydrogen atom on the amino group is substituted by a methyl group. This compound manifests as a colorless to yellowish oily liquid with a distinct amine odor, possessing properties that make it a highly valuable intermediate in various industrial processes. Its unique chemical structure, featuring both an aromatic ring and an amino group, confers upon it versatile reactivity, making it indispensable in the synthesis of complex organic molecules across a spectrum of industries. The production process typically involves the methylation of aniline using methanol in the presence of a catalyst, ensuring high purity and yield crucial for downstream applications.

The primary applications of Mono Methyl Aniline are extensive and diverse, underlining its significance in global chemical manufacturing. It serves as a crucial building block in the production of dyes and pigments, particularly for the textile and printing industries, where it contributes to vibrant and stable color formulations. Beyond coloration, MMA is vital in the pharmaceutical sector for synthesizing a wide array of active pharmaceutical ingredients (APIs), including analgesic and antipyretic drugs, further highlighting its role in healthcare. Additionally, it finds substantial use in the rubber chemicals industry as an accelerator and antioxidant, enhancing the performance and longevity of rubber products. Its utility also extends to the agricultural sector, where it is employed in the synthesis of certain pesticides and herbicides, protecting crops and improving agricultural yields. The compound's effectiveness as a solvent in specific chemical reactions and its role as an intermediate in the production of specialized chemicals further broaden its market footprint.

The inherent benefits of Mono Methyl Aniline, such as its reactivity, stability under specific conditions, and ability to form robust chemical bonds, drive its continuous demand. Its role in enabling the creation of high-performance materials and specialized chemicals that are critical for modern industrial processes underscores its economic importance. Major driving factors for the Mono Methyl Aniline market include the burgeoning demand from the textile and fashion industry, which relies heavily on MMA-derived dyes, the sustained growth in the pharmaceutical sector requiring various chemical intermediates, and the expansion of the automotive and construction industries, which are significant consumers of rubber products. Furthermore, increasing agricultural output globally necessitates greater use of agrochemicals, thereby boosting MMA consumption. The constant innovation in chemical synthesis and the search for more efficient and cost-effective intermediates also contribute significantly to the market's upward trajectory, making MMA a cornerstone material in industrial chemistry.

Mono Methyl Aniline Market Executive Summary

The Mono Methyl Aniline market is currently experiencing robust growth, propelled by multifaceted business trends, evolving regional dynamics, and diversified segment performance. From a business perspective, the market is witnessing increased consolidation among key players aiming to optimize production efficiencies and expand their geographical reach, often through strategic acquisitions and partnerships. There is a discernible trend towards integrating backward into raw material production to mitigate price volatility and ensure supply security, alongside forward integration into specific end-use applications to capture greater value. Companies are also investing heavily in research and development to discover novel applications for MMA and to improve existing production processes, focusing on sustainability and reduced environmental impact. Furthermore, digital transformation is influencing supply chain management, enabling more agile and responsive operations, which is crucial for managing demand fluctuations and global logistics challenges. Manufacturers are increasingly adopting advanced analytics to predict market trends and customer needs, thereby optimizing inventory and production schedules.

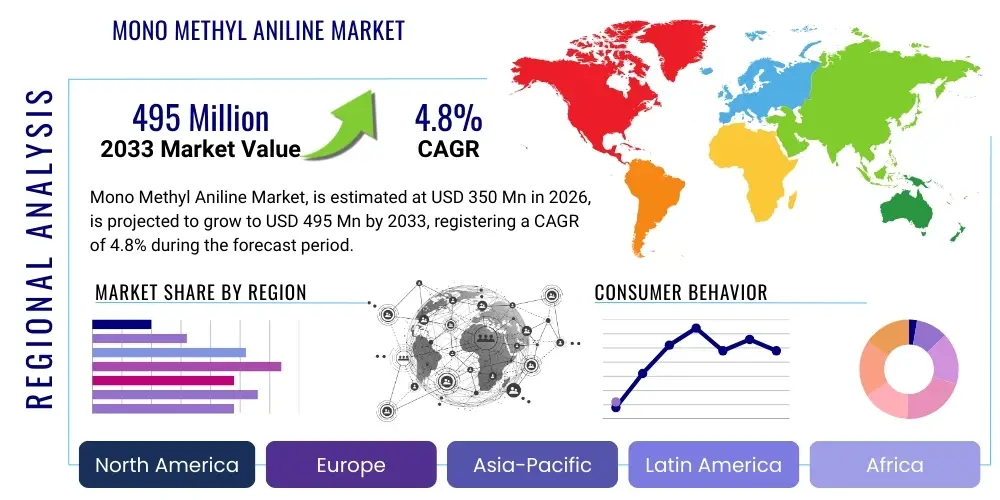

Regionally, the Mono Methyl Aniline market exhibits distinct growth patterns and competitive landscapes. Asia Pacific, particularly countries like China and India, continues to dominate the market in terms of production and consumption due to its rapidly expanding manufacturing base, especially in textiles, pharmaceuticals, and rubber industries. This region benefits from lower production costs, a vast labor pool, and increasing industrialization, making it a pivotal hub for MMA demand. North America and Europe, while mature markets, demonstrate steady demand, driven by specialized applications, stringent quality standards, and innovation in advanced materials and pharmaceuticals. These regions are also leading the charge in developing sustainable production methods and investing in green chemistry initiatives. Latin America and the Middle East & Africa are emerging as significant growth frontiers, fueled by industrial development, urbanization, and increasing investments in chemical infrastructure. Governments in these regions are often supportive of manufacturing growth, which indirectly boosts demand for chemical intermediates like MMA, though geopolitical stability and economic factors can influence growth rates.

In terms of segmentation, the Mono Methyl Aniline market demonstrates varied performance across its different types and applications. The segment by purity, typically differentiating between high-purity (e.g., >99%) and technical-grade MMA, shows that high-purity variants command a premium due to their critical use in pharmaceuticals and specialty chemicals, which require exacting specifications. The application segments, including dyes & pigments, pharmaceuticals, rubber chemicals, and agrochemicals, each contribute significantly to market revenue. The dyes and pigments segment, driven by the expanding fashion and textile industries, remains a primary consumer. However, the pharmaceutical segment is experiencing accelerated growth due to increasing healthcare expenditure and the continuous development of new drugs requiring MMA as an intermediate. The rubber chemicals segment, bolstered by the automotive and construction sectors, maintains a stable growth trajectory. Emerging applications in niche areas and the development of new chemical syntheses also represent significant opportunities for market expansion, pushing innovation and diversified demand across the various segments. The demand for specific derivatives within these segments also impacts market dynamics, driving manufacturers to offer a tailored product portfolio.

AI Impact Analysis on Mono Methyl Aniline Market

User inquiries about AI's influence on the Mono Methyl Aniline market frequently center on themes of operational efficiency, supply chain optimization, and the potential for novel material discovery. Common questions include how AI can enhance production processes, streamline logistics, improve quality control, and even predict market demand or raw material price fluctuations. Users are also keen to understand if AI can accelerate the research and development of new applications for MMA or optimize existing chemical synthesis pathways to reduce waste and energy consumption. Concerns often revolve around the investment costs associated with AI implementation, data security, the need for specialized skills, and the ethical implications of autonomous systems in chemical manufacturing. The overarching expectation is that AI will introduce unprecedented levels of precision, cost-effectiveness, and innovation, ultimately transforming the competitive landscape and driving the market towards greater sustainability and efficiency.

- Optimized Production Processes: AI-driven predictive maintenance can monitor equipment health in real-time, reducing downtime and improving operational efficiency in MMA synthesis plants. Machine learning algorithms can optimize reaction conditions, catalyst usage, and energy consumption, leading to higher yields and lower production costs.

- Enhanced Quality Control: AI-powered vision systems and sensor data analysis can detect impurities or deviations in MMA product quality much faster and more accurately than traditional methods, ensuring consistent product standards.

- Supply Chain & Logistics Optimization: AI models can forecast demand for MMA with greater accuracy, allowing for optimized inventory management, reduced warehousing costs, and more efficient logistics planning, minimizing transportation bottlenecks and delays.

- Accelerated R&D and Material Discovery: AI algorithms can analyze vast chemical databases to identify new synthesis routes for MMA derivatives or discover novel applications in areas like advanced polymers or specialty chemicals, significantly speeding up the research cycle.

- Predictive Market Analysis: AI can analyze global economic indicators, raw material prices (e.g., aniline, methanol), and geopolitical events to provide highly accurate market forecasts, assisting manufacturers in strategic decision-making and risk mitigation.

- Energy Management and Sustainability: AI can optimize energy usage in production facilities, identify areas for waste reduction, and model more environmentally friendly synthesis pathways, supporting the industry's push towards sustainable practices.

- Workforce Augmentation and Safety: AI can assist in training and decision-making for human operators, enhance safety protocols by predicting potential hazards, and automate hazardous tasks, thereby improving workplace safety.

DRO & Impact Forces Of Mono Methyl Aniline Market

The Mono Methyl Aniline (MMA) market is shaped by a complex interplay of dynamic forces, encompassing robust drivers, significant restraints, and emerging opportunities. Understanding these elements is crucial for anticipating market trajectory and formulating effective business strategies. The primary drivers fueling the market include the relentless expansion of end-use industries such as textiles, pharmaceuticals, rubber, and agriculture, all of which rely heavily on MMA as a key chemical intermediate. The burgeoning global population and rising disposable incomes, particularly in developing economies, are amplifying demand for manufactured goods, thereby creating a ripple effect that stimulates MMA consumption. Technological advancements in synthesis processes are leading to more efficient and cost-effective production methods, which in turn makes MMA more accessible and attractive for industrial applications. Furthermore, the versatile chemical properties of MMA, allowing its use in a wide array of chemical reactions and product formulations, solidify its indispensable role across diverse industrial landscapes, ensuring sustained demand for its unique functional attributes. The increasing complexity of modern chemical products often necessitates specialized intermediates like MMA, further cementing its market position.

Conversely, the market faces several significant restraints that could impede its growth. Fluctuations in the prices of critical raw materials, primarily aniline and methanol, introduce considerable volatility into the production costs of MMA, directly impacting profitability margins for manufacturers. Geopolitical instability and trade disputes can disrupt global supply chains, leading to raw material shortages or increased import tariffs, thereby complicating market operations. Stringent environmental regulations and evolving health and safety standards related to chemical manufacturing and handling pose substantial challenges, requiring significant investments in compliance, waste management, and process modifications. These regulations, while essential for environmental protection and worker safety, can increase operational costs and complexity. The availability of substitute chemicals or alternative synthesis pathways for certain applications, although limited for MMA's core uses, presents a potential threat as industries continuously seek more sustainable or cost-effective alternatives. Public perception and pressure from environmental advocacy groups regarding chemical production can also influence market dynamics, urging manufacturers to adopt greener chemistries and more transparent practices. The energy-intensive nature of chemical production, coupled with fluctuating energy prices, also presents a persistent operational challenge.

Despite these restraints, the Mono Methyl Aniline market is replete with significant opportunities for growth and innovation. Extensive research and development efforts aimed at discovering novel applications for MMA are continuously unlocking new revenue streams and market segments. This includes its potential use in advanced materials, specialized polymers, and other niche chemical products requiring specific chemical properties. The growing focus on sustainable chemistry and green manufacturing processes presents an opportunity for companies to differentiate themselves by developing eco-friendly production methods for MMA, which could attract environmentally conscious customers and comply with future regulations. Furthermore, the rapid industrialization and economic development in emerging economies, particularly in Asia Pacific, Latin America, and Africa, offer untapped market potential and expanding customer bases. Investments in infrastructure development, coupled with increasing manufacturing capabilities in these regions, are expected to fuel substantial demand for chemical intermediates like MMA. Strategic collaborations, partnerships, and joint ventures between chemical manufacturers and end-use industries can also foster innovation, optimize supply chains, and facilitate market penetration into new geographies or application areas, creating a synergistic growth environment. The drive for greater efficiency and product customization also creates opportunities for MMA producers to tailor their offerings.

Segmentation Analysis

The Mono Methyl Aniline market is meticulously segmented to provide a granular understanding of its diverse components and drivers. This comprehensive segmentation allows for a detailed analysis of market dynamics, consumer preferences, and growth trajectories across various categories. The market is primarily categorized by product purity, application, and end-use industry, each offering unique insights into the demand landscape and competitive strategies. High-purity MMA, typically exceeding 99% purity, caters to highly sensitive applications such as pharmaceuticals and specialty chemicals where even minor impurities can have significant implications. In contrast, technical-grade MMA is sufficient for less stringent applications like dyes and rubber chemicals. The application segments reveal where the bulk of the demand lies, with dyes and pigments, pharmaceuticals, and rubber chemicals standing out as major consumers. The end-use industry segmentation further refines this understanding, illustrating the ultimate sectors benefiting from MMA, including textile, automotive, agriculture, and healthcare. Each segment demonstrates unique growth drivers and challenges, necessitating tailored market approaches.

- By Type/Purity:

- High Purity (e.g., >99%)

- Technical Grade (e.g., 98-99%)

- By Application:

- Dyes & Pigments

- Pharmaceuticals

- Rubber Chemicals

- Agrochemicals (Pesticides & Herbicides)

- Specialty Chemicals

- Other Industrial Intermediates

- By End-Use Industry:

- Textile Industry

- Automotive Industry

- Agriculture Industry

- Healthcare & Pharmaceutical Industry

- Chemical Manufacturing & Processing

- Construction Industry

- Packaging Industry

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East & Africa (MEA)

Value Chain Analysis For Mono Methyl Aniline Market

The value chain for the Mono Methyl Aniline market encompasses a series of interconnected stages, beginning from the sourcing of raw materials to the ultimate delivery of the final product to end-users, highlighting the transformation of inputs into value-added outputs. The upstream segment of this value chain primarily involves the procurement and processing of key raw materials. The two most critical raw materials for MMA synthesis are aniline and methanol. Aniline itself is derived from benzene through nitration and subsequent hydrogenation, while methanol is typically produced from natural gas or coal. Therefore, suppliers of these petrochemical derivatives play a foundational role, and their pricing, availability, and quality directly impact the production cost and efficiency of MMA manufacturers. Strategic partnerships with reliable raw material suppliers are crucial for ensuring a stable and cost-effective supply chain, which directly influences the competitiveness of MMA producers in the market. Volatility in the global crude oil and natural gas markets, from which these precursors are ultimately derived, therefore has a significant cascading effect throughout the MMA value chain. Furthermore, the availability of catalysts, utilities, and other reagents also forms a vital part of the upstream activities.

Moving downstream, the value chain progresses through the manufacturing and distribution phases. Once aniline and methanol are secured, MMA manufacturers employ various chemical processes, most commonly methylation reactions catalyzed by specific compounds, to synthesize Mono Methyl Aniline. This stage involves significant capital investment in plant infrastructure, specialized equipment, and adherence to stringent safety and quality control protocols. Following production, the MMA product is subjected to purification, packaging, and storage. The distribution channel then takes over, playing a critical role in connecting manufacturers with diverse end-users across geographical boundaries. Distribution can be broadly categorized into direct and indirect channels. Direct distribution involves manufacturers selling directly to large-scale industrial consumers, such as major pharmaceutical companies, large dye producers, or leading rubber manufacturers. This often entails long-term contracts and specialized logistics, ensuring tailored delivery and technical support. Direct sales channels are particularly prevalent for high-purity or custom-grade MMA due to the specific requirements of the end-users.

Indirect distribution channels, on the other hand, involve intermediaries such as distributors, wholesalers, and chemical traders. These entities purchase MMA in bulk from manufacturers and then supply it to smaller or geographically dispersed end-users who may not have the capacity or direct purchasing power to engage with primary producers. These intermediaries often provide additional services, including warehousing, localized inventory management, technical assistance, and credit facilities, thereby streamlining the procurement process for numerous smaller customers. The choice between direct and indirect channels depends on factors such as market size, geographic reach, customer base characteristics, and the manufacturer's strategic objectives. Both channels are essential for market penetration and ensuring widespread availability of Mono Methyl Aniline across its diverse applications, from textile dyeing facilities to agricultural chemical formulators. The efficiency of these distribution networks is paramount for maintaining competitive pricing, ensuring timely delivery, and responding effectively to fluctuating market demands. Digitalization of distribution and supply chain management is also increasingly influencing these channels, allowing for greater transparency and optimized logistics. Overall, each stage of the value chain adds specialized value, culminating in the provision of an essential chemical intermediate to global industries.

Mono Methyl Aniline Market Potential Customers

The potential customers for Mono Methyl Aniline span a wide array of industrial sectors, reflecting the compound's versatility and indispensable role as a chemical intermediate in numerous synthesis processes. At the forefront are manufacturers within the dyes and pigments industry, who utilize MMA extensively to produce a broad spectrum of colorful and durable dyes for textiles, leather, paper, plastics, and coatings. These customers are constantly seeking high-purity and consistently performing MMA to ensure the vibrancy, colorfastness, and stability of their end products, which are critical for meeting evolving consumer demands in fashion, home furnishings, and industrial applications. The burgeoning textile industry, particularly in Asia, is a significant driver of demand from this segment, as it continues to innovate with new fabrics and sustainable dyeing processes. Pigment producers also rely on MMA for specific formulations, contributing to the visual appeal and functional properties of various materials. These customers often require large, consistent volumes of MMA and look for suppliers who can guarantee both quality and supply chain reliability, often under long-term contractual agreements to secure their production needs. The aesthetic and functional requirements of their end-products mean that consistency in MMA quality is paramount.

Another major segment of potential customers resides within the pharmaceutical industry. Here, Mono Methyl Aniline serves as a crucial building block for synthesizing various active pharmaceutical ingredients (APIs), including analgesics, antipyretics, and other therapeutic compounds. Pharmaceutical companies demand MMA of extremely high purity, often pharmaceutical grade, to comply with rigorous regulatory standards and ensure the safety and efficacy of their medicinal products. The continuous innovation in drug discovery and development, coupled with an aging global population and increasing healthcare expenditure, ensures a steady and growing demand for MMA from this sector. These customers often have strict quality control measures and require detailed certification and traceability for their chemical inputs. The highly specialized nature of pharmaceutical synthesis means that even small batches of high-purity MMA are vital for research and development as well as for commercial production of essential medicines. This segment is characterized by stringent regulatory oversight, demanding reliable and compliant supply partners. The need for precise chemical reactions in drug manufacturing means that the consistency and purity of MMA are non-negotiable for these buyers.

Beyond dyes and pharmaceuticals, the rubber chemicals industry represents a substantial customer base. MMA is employed in the synthesis of rubber accelerators, which speed up the vulcanization process, and antioxidants, which prevent rubber degradation, thereby enhancing the durability, elasticity, and performance of various rubber products. These include tires for automotive and aerospace industries, industrial rubber goods, and consumer products. The automotive sector's growth, coupled with demand for higher performance and longer-lasting tires, directly impacts MMA consumption in this segment. Furthermore, the agrochemical sector is a significant end-user, utilizing MMA as an intermediate in the production of certain pesticides, herbicides, and fungicides. These chemicals are essential for crop protection, yield enhancement, and ensuring global food security. Manufacturers of specialty chemicals and other industrial intermediates also form a diverse customer group, leveraging MMA's unique reactivity to develop custom products for niche applications across various industries, including plastics, resins, and coatings. These diverse customer bases highlight MMA's foundational role in modern industrial chemistry, with each segment driven by its own specific market dynamics and product requirements. The common thread amongst all these customers is the need for a reliable supply of high-quality MMA to maintain their own production schedules and product integrity.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 650.3 Million |

| Market Forecast in 2033 | USD 920.8 Million |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BASF SE, Dow Chemical Company, Huntsman Corporation, Covestro AG, Lanxess AG, Sumitomo Chemical Co., Ltd., Wanhua Chemical Group Co., Ltd., Shandong Longxin Chemical Co., Ltd., Anhui Xianglong Chemical Co., Ltd., Lianyungang Huide Chemical Co., Ltd., Aarti Industries Ltd., Atul Ltd., Mitsubishi Chemical Corporation, Nippon Kayaku Co., Ltd., Eastman Chemical Company, Arkema S.A., Sinopec, Evonik Industries AG, Toray Industries Inc., Merck KGaA |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Mono Methyl Aniline Market Key Technology Landscape

The Mono Methyl Aniline market operates within a dynamic technological landscape, driven by continuous innovation aimed at enhancing production efficiency, improving product quality, reducing environmental impact, and lowering operational costs. The fundamental technology for MMA synthesis involves the methylation of aniline, primarily using methanol as the methylating agent. This reaction typically occurs at elevated temperatures and pressures, often in the presence of specific catalysts. Early industrial processes relied on batch reactions, but modern advancements have increasingly shifted towards continuous processes, offering better control over reaction parameters, higher yields, and improved safety. Key technological developments in this area focus on optimizing catalyst systems, with a particular emphasis on solid acid catalysts like zeolites or modified alumina, which offer advantages such as easier separation from the product stream, longer catalyst life, and reduced waste generation compared to homogeneous catalysts. These catalysts are designed to improve selectivity towards MMA while minimizing the formation of undesirable by-products like dimethylaniline, which can complicate purification and reduce overall yield. The selection of the right catalyst system is critical for both the economics and the environmental footprint of MMA production, pushing ongoing research into novel catalytic materials and reaction mechanisms. Furthermore, advancements in reactor design, including fixed-bed and fluid-bed reactors, are contributing to more efficient heat transfer and mass transport, further optimizing the synthesis process for scalability and robustness.

Beyond the core synthesis, separation and purification technologies play a crucial role in delivering high-purity Mono Methyl Aniline to meet stringent industry standards, especially for pharmaceutical and specialty chemical applications. Traditional methods often involve fractional distillation, which can be energy-intensive. Therefore, significant technological efforts are directed towards developing more energy-efficient and cost-effective separation techniques. This includes the exploration of advanced distillation columns with optimized tray designs, reactive distillation where reaction and separation occur simultaneously, and membrane separation technologies, although the latter is still largely in the research and development phase for this specific application. Furthermore, process intensification techniques, which aim to achieve significant reductions in equipment size and energy consumption by combining multiple unit operations into a single apparatus, are being explored to streamline the entire production flow. This not only reduces capital expenditure but also leads to more compact and safer production facilities. The integration of advanced process control systems, leveraging sophisticated sensors and real-time data analytics, allows for precise monitoring and adjustment of reaction conditions, thereby enhancing process stability, product consistency, and overall plant safety. These control systems are increasingly incorporating elements of artificial intelligence and machine learning to predict potential operational issues and optimize process parameters autonomously, pushing the boundaries of smart manufacturing in the chemical industry.

The evolving technological landscape also encompasses a strong emphasis on sustainability and environmental stewardship. Innovations in waste treatment and recycling technologies are critical for reducing the ecological footprint of MMA production. This includes developing methods for efficiently treating wastewater containing unreacted raw materials or by-products, as well as exploring opportunities for recycling unreacted methanol or aniline back into the process. The adoption of greener chemistry principles, such as utilizing renewable feedstocks where feasible, developing solvent-free reactions, or employing super-critical fluid technology for extraction, represents a long-term strategic direction for the industry. While challenging for established petrochemical derivatives like MMA, continuous research aims to find more benign pathways. Furthermore, the digitalization of chemical plants, often referred to as Industry 4.0, is transforming the operational and analytical aspects of MMA production. This involves the use of the Internet of Things (IoT) for pervasive sensing, big data analytics for process optimization and fault detection, and digital twins for simulating and predicting plant performance. These technologies not only improve efficiency and decision-making but also pave the way for more responsive and adaptive manufacturing, allowing producers to quickly adjust to market demands and raw material availability. Such technological advancements are pivotal for maintaining competitiveness, meeting regulatory requirements, and ensuring the long-term viability and growth of the Mono Methyl Aniline market in an increasingly complex global industrial environment.

Regional Highlights

- Asia Pacific (APAC): This region stands as the dominant force in the Mono Methyl Aniline market, driven by robust industrial growth, particularly in China and India. These countries are major hubs for textile manufacturing, pharmaceutical synthesis, and rubber production, all significant consumers of MMA. Favorable government policies supporting chemical manufacturing, coupled with lower labor and operational costs, contribute to its strong position. Rapid urbanization and increasing disposable incomes are further fueling demand for end-products, sustaining the growth of MMA-consuming industries. The region also hosts a large number of domestic producers, leading to competitive pricing and extensive supply networks. Investments in infrastructure and manufacturing capabilities continue to expand, ensuring APAC's continued leadership in both production and consumption.

- North America: The North American market for Mono Methyl Aniline is characterized by stable demand from mature industries, with a strong focus on high-purity MMA for specialized applications, particularly in pharmaceuticals and advanced materials. Stringent environmental regulations and a preference for high-quality, sustainably produced chemicals drive innovation among regional manufacturers. While not experiencing the explosive growth seen in APAC, consistent demand from the automotive (rubber chemicals) and healthcare sectors ensures a steady market. Research and development activities aimed at discovering new applications and optimizing production processes are prominent, reflecting the region's commitment to technological advancement and premium product offerings.

- Europe: Similar to North America, Europe represents a mature but significant market for Mono Methyl Aniline, with demand largely emanating from its well-established pharmaceutical, specialty chemical, and dye industries. The region is known for its rigorous quality standards and increasing emphasis on sustainable chemistry, which influences production practices and product development. European manufacturers are often at the forefront of adopting advanced technologies and green processes to comply with strict environmental regulations and meet market demand for eco-friendly products. Despite economic slowdowns in some areas, the demand for high-value-added applications of MMA remains robust, particularly within niche segments that require specialized chemical intermediates.

- Latin America: The Mono Methyl Aniline market in Latin America is an emerging landscape experiencing gradual growth, primarily influenced by industrialization in countries like Brazil and Mexico. The expansion of their agricultural sectors (for agrochemicals) and burgeoning automotive industries (for rubber chemicals) are key drivers. Economic development and increasing foreign investment in manufacturing are creating new opportunities for MMA suppliers. While the market size is currently smaller compared to APAC or North America, its growth potential is significant as industrial bases continue to develop. However, economic volatility and political uncertainties in some countries can present challenges to consistent market expansion.

- Middle East & Africa (MEA): The MEA region is witnessing nascent but promising growth in the Mono Methyl Aniline market. This growth is largely underpinned by increasing investments in industrial diversification, particularly in chemical manufacturing, infrastructure development, and agriculture. Countries in the Middle East, with their abundant petrochemical resources, are looking to expand their downstream chemical production, which could boost MMA consumption. In Africa, growing agricultural activities and initial phases of industrialization are slowly increasing demand for agrochemicals and other chemical intermediates. While the market is still in its early stages, long-term projections indicate potential for steady growth as economies mature and industrial capabilities expand, albeit from a smaller base.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Mono Methyl Aniline Market.- BASF SE

- Dow Chemical Company

- Huntsman Corporation

- Covestro AG

- Lanxess AG

- Sumitomo Chemical Co., Ltd.

- Wanhua Chemical Group Co., Ltd.

- Shandong Longxin Chemical Co., Ltd.

- Anhui Xianglong Chemical Co., Ltd.

- Lianyungang Huide Chemical Co., Ltd.

- Aarti Industries Ltd.

- Atul Ltd.

- Mitsubishi Chemical Corporation

- Nippon Kayaku Co., Ltd.

- Eastman Chemical Company

- Arkema S.A.

- Sinopec

- Evonik Industries AG

- Toray Industries Inc.

- Merck KGaA

Frequently Asked Questions

What is Mono Methyl Aniline (MMA) and its primary uses?

Mono Methyl Aniline (MMA) is an organic chemical compound (C6H5NHCH3) derived from aniline, characterized by a methyl group attached to the amino nitrogen. It is primarily used as an essential intermediate in the manufacturing of dyes and pigments for textiles, pharmaceuticals (e.g., analgesics), rubber chemicals (accelerators, antioxidants), and agrochemicals (pesticides, herbicides).

What factors are driving the growth of the Mono Methyl Aniline market?

The market growth is primarily driven by increasing demand from the textile industry for dyes, the expanding pharmaceutical sector for API synthesis, robust growth in the automotive and construction industries for rubber products, and rising agricultural output requiring agrochemicals. Technological advancements in production processes and economic growth in emerging regions also contribute significantly.

What are the key challenges or restraints for the Mono Methyl Aniline market?

Key challenges include volatility in raw material prices (aniline, methanol), stringent environmental regulations and health & safety concerns in chemical manufacturing, the potential for substitutes in certain applications, and geopolitical factors impacting global supply chains. These factors can lead to increased operational costs and supply disruptions.

Which regions are key players in the Mono Methyl Aniline market, and why?

Asia Pacific is the dominant region due to rapid industrialization, large manufacturing bases in textiles, pharmaceuticals, and rubber, and lower production costs in countries like China and India. North America and Europe maintain steady demand from mature, high-value-added industries, focusing on specialized applications and sustainable production practices.

How is technology impacting the Mono Methyl Aniline production and market?

Technology is enhancing MMA production through improved catalyst systems for higher yields and selectivity, advanced separation techniques for purity, and process intensification for efficiency. Digitalization (Industry 4.0) with AI and IoT is optimizing plant operations, predictive maintenance, and supply chain management, while also driving efforts towards greener, more sustainable manufacturing processes.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Mono Methyl Aniline Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Mono Methyl Aniline Market Size Report By Type (Above 98%, 95%-98%, Other), By Application (Non Metallic Antiknock Octane Booster, Intermediate in Chemical & Agricultural Applications, Other), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager