Monobloc Air Source Heat Pumps Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433275 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Monobloc Air Source Heat Pumps Market Size

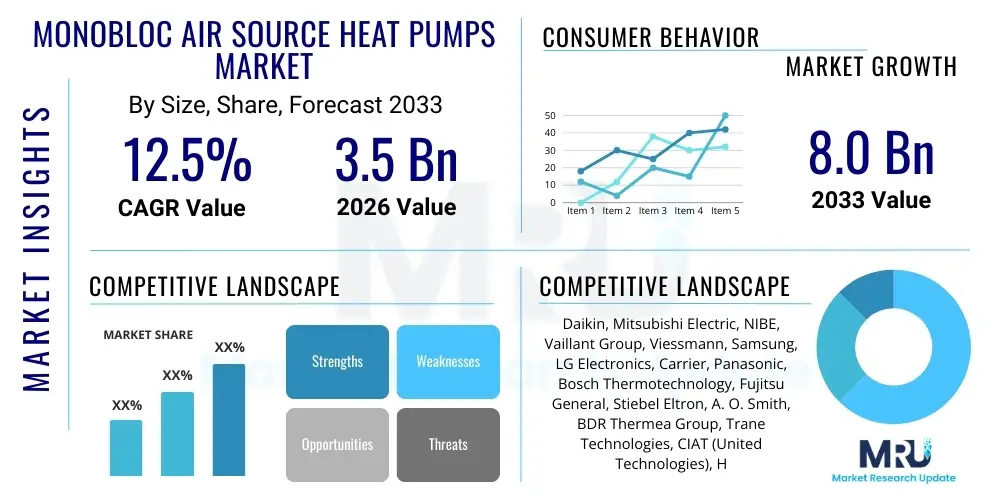

The Monobloc Air Source Heat Pumps Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 8.0 Billion by the end of the forecast period in 2033.

Monobloc Air Source Heat Pumps Market introduction

The Monobloc Air Source Heat Pump (ASHP) market encompasses advanced heating, ventilation, and air conditioning (HVAC) systems designed to efficiently transfer thermal energy from the external air into a building's hydronic heating system. Unlike split systems, monobloc units contain all refrigeration circuit components, including the compressor, evaporator, and condenser, within a single outdoor unit. This fundamental design simplifies installation significantly, as it eliminates the need for specialized refrigeration pipework handling indoors, requiring only standard water pipe connections between the external unit and the internal buffer tank or emitter system. This ease of installation has been a primary accelerator for market penetration, particularly in residential retrofit applications and regions facing skilled labor shortages for complex HVAC installations. Furthermore, the inherent safety advantages associated with containing potentially flammable or high-Global Warming Potential (GWP) refrigerants solely outside the building envelope contribute substantially to their increasing appeal in heavily regulated markets like Europe.

The core application domains for Monobloc ASHPs primarily revolve around residential heating and cooling, ranging from new build construction requiring compliance with stringent energy efficiency codes to the massive refurbishment market focused on replacing traditional fossil fuel boilers. In the residential sector, Monobloc units provide highly energy-efficient heating for radiators, underfloor heating systems, and domestic hot water generation. Their adaptability extends to light commercial applications, such as small office buildings, schools, and retail spaces, where moderate heating and cooling loads need to be met with minimal spatial intrusion and high operational efficiency. The benefits derived from these systems are multifaceted, including drastically reduced carbon emissions compared to natural gas or oil furnaces, lower operational costs due to high Coefficients of Performance (COP) often exceeding 4.0, and enhanced energy independence for homeowners through reliance on electricity rather than volatile fossil fuels.

Driving factors propelling this market are deeply rooted in global climate policy and energy transition mandates. The aggressive pursuit of decarbonization targets across OECD nations, specifically the European Union's Renewable Energy Directive and national boiler ban programs, mandates the phase-out of conventional heating technologies. Government incentives, including subsidies, tax credits, and installation grants (such as the UK's Boiler Upgrade Scheme or German KfW funding), have successfully lowered the initial capital expenditure barrier for consumers. Additionally, continuous technological advancements, such as the adoption of natural refrigerants like R290 (propane) and sophisticated inverter technology, have improved cold-weather performance and overall Seasonal Coefficient of Performance (SCOP), making heat pumps viable even in colder climate zones where performance historically lagged. This confluence of policy push, consumer financial support, and product performance improvement is fundamentally reshaping the global residential heating landscape, positioning monobloc units as a crucial element of future sustainable energy infrastructure.

Monobloc Air Source Heat Pumps Market Executive Summary

The Monobloc Air Source Heat Pumps market is currently experiencing robust expansion, driven predominantly by structural shifts in global energy policy favoring electrification and sustainable heating solutions. Key business trends indicate a strong move toward integrated energy management systems, where heat pumps are seamlessly linked with solar photovoltaics (PV) and battery storage, optimizing self-consumption and reducing reliance on peak grid electricity. This integration capability is attracting major multinational utility providers and technology firms, leading to significant M&A activity focused on securing market share and intellectual property in advanced control systems and installation logistics. Furthermore, the industry is witnessing a trend towards higher output capacity monobloc units suitable for larger homes or light commercial use, alongside a critical pivot toward refrigerants with ultra-low Global Warming Potential (GWP), such as R290, anticipating stricter environmental regulations in the latter half of the forecast period. Standardization of digital communication protocols (e.g., OpenTherm or custom APIs) is also a major focus, enhancing interoperability within smart home ecosystems.

Regionally, Europe remains the undisputed global leader in Monobloc ASHP adoption, fueled by stringent EU mandates, high carbon taxes, and substantial consumer subsidies, particularly in countries like Germany, France, and Italy, which have implemented highly effective incentive structures for boiler replacement. The sheer volume of existing outdated heating infrastructure across the European continent provides a massive addressable retrofit market, ensuring sustained growth. North America, while starting from a lower baseline, is accelerating rapidly, primarily in high-efficiency cooling-focused markets and increasingly in heating applications across the Northeast and Pacific Northwest, stimulated by policy initiatives like the Inflation Reduction Act (IRA) in the US. Asia Pacific is emerging as a critical growth region, characterized by strong demand from Japan and South Korea, which are early adopters of heat pump technology, and accelerating installation in China, driven by air quality improvement programs and rapid urbanization leading to modern construction methods favoring decentralized, efficient HVAC.

Segment trends reveal that the residential sector, specifically the low-to-medium capacity segment (up to 12 kW), dominates the market share, reflecting the widespread applicability of monobloc units in detached and semi-detached housing stock. However, the high-capacity segment (above 16 kW) is projected to exhibit the highest Compound Annual Growth Rate (CAGR), reflecting the increasing sophistication of commercial applications and multi-family housing projects seeking all-electric heating solutions. In terms of technology, inverter-driven units utilizing variable speed compressors are now standard, maximizing efficiency across varying loads and weather conditions. The immediate future suggests a segmentation shift favoring natural refrigerant-based models, driven by long-term strategic investments by major manufacturers preparing for the eventual phase-out of fluorinated gases, ensuring the market's trajectory remains firmly aligned with long-term environmental sustainability goals and operational efficiency imperatives.

AI Impact Analysis on Monobloc Air Source Heat Pumps Market

User inquiries regarding the integration of Artificial Intelligence (AI) in the Monobloc Air Source Heat Pumps market frequently center on three critical themes: enhancing predictive maintenance schedules, optimizing system efficiency in real-time, and improving manufacturing and supply chain agility. Users are keenly interested in how machine learning algorithms can analyze historical operational data (e.g., refrigerant pressures, compressor speed, ambient temperature) to predict component failures—such as potential leaks or compressor fatigue—before they lead to costly downtime. A second major concern is the promise of AI-driven optimization to achieve truly dynamic climate control, adapting heating curves not just based on the current external temperature but also on localized weather forecasts, grid load demands (demand response integration), and the specific thermal mass characteristics of the dwelling, thereby maximizing the Seasonal Coefficient of Performance (SCOP) beyond static factory settings. Finally, the strategic application of AI in supply chain logistics, particularly for forecasting component demand (e.g., variable speed drives and specific coils) and managing complex distribution networks, is frequently queried, reflecting the industry's need to scale rapidly while minimizing installation lead times.

AI's influence is fundamentally shifting the operational paradigm from reactive servicing to proactive management and continuous efficiency improvement. By employing neural networks to process vast amounts of data collected from internet-connected units, manufacturers can develop digital twins of their installed base, allowing for remote diagnostics and over-the-air firmware updates that dynamically recalibrate the vapor compression cycle. This results in unprecedented energy savings and significantly extends the lifespan of the equipment. For end-users, this translates to reduced energy bills and a heating system that intelligently learns household usage patterns, anticipating needs rather than merely responding to instantaneous thermostat settings. This sophisticated level of personalized, adaptive control is the key differentiator driven by AI, moving the heat pump from a traditional appliance to an intelligent, networked energy asset within the smart home ecosystem. Therefore, AI is positioned not just as an enhancement tool but as an essential element for realizing the full potential of high-efficiency heat pump technology in integrated smart grids.

- AI-driven Predictive Maintenance: Utilizing sensor data to forecast component failure (e.g., compressor lifespan, refrigerant level deviations), minimizing unexpected downtime and optimizing service scheduling.

- Real-time Performance Optimization: Machine learning algorithms adjust fan speeds, defrost cycles, and heating curves based on grid conditions, ambient weather forecasts, and historical usage patterns to maximize SCOP.

- Enhanced Smart Grid Integration: AI facilitates sophisticated Demand Response (DR) programs, allowing the heat pump to modulate consumption dynamically to benefit from cheaper off-peak electricity while maintaining indoor comfort.

- Optimized Manufacturing and Logistics: AI models improve forecasting of regional market demand and component requirements, streamlining the supply chain for quicker installer access to inventory.

- Automated Fault Detection and Diagnostics (AFDD): Instant identification and remote troubleshooting of operational anomalies, reducing the need for costly and time-consuming site visits by technicians.

DRO & Impact Forces Of Monobloc Air Source Heat Pumps Market

The Monobloc Air Source Heat Pumps market is dynamically shaped by a compelling balance of external drivers, inherent restraints, and substantial opportunities, collectively forming the key impact forces steering its growth trajectory. The predominant driver is global governmental legislative action centered on achieving Net Zero emission targets, specifically manifested through national-level boiler bans, stringent building codes requiring higher energy efficiency standards, and long-term decarbonization roadmaps that explicitly mandate the transition away from fossil fuel heating systems. This policy-driven momentum is substantially reinforced by financial incentives, including grants and subsidies that dramatically lower the consumer's total cost of ownership, making the high upfront investment barrier more palatable. Concurrent environmental awareness among consumers, coupled with the rising costs and volatility of traditional fossil fuels, further pushes demand toward stable, efficient electric heating solutions, creating a self-reinforcing cycle of adoption.

Despite the powerful drivers, several significant restraints impede the market's unfettered expansion. The primary restraint remains the high initial capital cost of Monobloc ASHP units and their associated installation compared to traditional gas boilers, particularly in regions where gas infrastructure is deeply subsidized. Furthermore, the efficiency and performance of heat pumps are critically dependent on system design, insulation quality, and the correct selection of emitters (radiators or underfloor heating). Poorly installed or undersized systems lead to consumer dissatisfaction, often citing insufficient performance in extreme cold or high running costs, which generates negative sentiment and necessitates intensive consumer education. A third major constraint is the current shortage of skilled installers and qualified HVAC technicians capable of commissioning, maintaining, and correctly sizing these sophisticated systems, slowing down the pace of mass market deployment. Finally, regional electricity grid capacity limitations and high peak-time electricity tariffs can occasionally negate the economic benefits of high efficiency, especially where demand side management is not yet fully implemented.

Opportunities for market acceleration are centered on leveraging technological advancements and exploring untapped geographic and application segments. A significant opportunity lies in the development and mass deployment of ultra-low GWP refrigerant systems (e.g., R290 propane), which future-proof the equipment against upcoming F-Gas regulatory changes and attract environmentally conscious consumers. Secondly, integrating Monobloc heat pumps with Smart Grid technologies and VPPs (Virtual Power Plants) offers opportunities to monetize the system's flexibility, turning it into a crucial asset for energy balancing rather than just a load, thereby unlocking new revenue streams and consumer savings through Demand Response programs. Furthermore, the expansion into emerging markets, particularly in Asia Pacific and parts of Eastern Europe, where rapid infrastructure development provides a clean slate for adopting efficient heating solutions, represents substantial long-term growth potential. Finally, the refinement of modular, plug-and-play Monobloc systems that further simplify installation and reduce dependency on highly specialized labor will significantly lower installation costs and accelerate market uptake across all key regions.

Segmentation Analysis

The Monobloc Air Source Heat Pumps market is strategically segmented based on product capacity, the type of refrigerant utilized, the end-user application domain, and the specific functional mechanism of the unit (e.g., reversible vs. heating-only). This granular segmentation is essential for understanding regional market maturity, technology adoption rates, and tailored consumer requirements. Capacity segmentation (low, medium, high power) dictates suitability across single-family homes to large commercial buildings, while refrigerant type segmentation highlights the shift toward sustainable, low-GWP alternatives. The application segmentation delineates between the dominant residential retrofit market and the high-growth new construction and commercial segments. Analyzing these segments provides strategic insights into investment priorities for manufacturers, directing research and development efforts toward areas offering the most significant returns, particularly focusing on mitigating regulatory risk through refrigerant choices and optimizing efficiency for specific climate zones.

- By Capacity

- Low Capacity (< 10 kW)

- Medium Capacity (10 kW – 16 kW)

- High Capacity (> 16 kW)

- By Refrigerant Type

- R410A (Phasing out)

- R32 (Current standard, medium GWP)

- Natural Refrigerants (R290, CO2 - High growth)

- By Application

- Residential (New Build)

- Residential (Retrofit/Renovation)

- Commercial (Office Buildings, Retail, Hospitality)

- By Functionality

- Heating Only

- Reversible (Heating and Cooling)

Value Chain Analysis For Monobloc Air Source Heat Pumps Market

The value chain for the Monobloc Air Source Heat Pumps market initiates with critical upstream activities, focusing heavily on the sourcing and manufacturing of high-precision components. Key inputs include advanced inverter-driven compressors (often requiring specialized production techniques for variable speed control), sophisticated heat exchangers (evaporators and condensers), and specialized electronic control units (ECUs) integrating complex algorithms for optimal performance. The dependence on high-quality electronic components, sensors, and microprocessors, many of which are sourced globally, introduces vulnerability related to semiconductor supply chain volatility. Manufacturers prioritize vertical integration or robust long-term sourcing contracts for core components like specialized refrigerants and high-efficiency fans. The manufacturing stage itself is capital-intensive, requiring advanced assembly lines for leak-testing and performance validation, ensuring the hermetically sealed monobloc unit achieves its rated Coefficient of Performance (COP) and Seasonal Coefficient of Performance (SCOP).

Midstream activities are dominated by the Original Equipment Manufacturers (OEMs) who assemble the final units, focusing heavily on brand reputation, product design optimization for noise reduction, and smart connectivity features. The crucial transition point involves the distribution channel, which is significantly more complex than that for traditional boilers. Direct sales channels, where manufacturers engage directly with large project developers or municipal housing associations, are gaining traction for volume procurement. However, the indirect channel remains paramount, relying on a decentralized network of specialized wholesale distributors, HVAC wholesalers, and dedicated plumbing and heating merchants. These intermediaries handle local inventory, financing, and often provide the first line of technical support to installers. Given the technical complexity of proper sizing and commissioning, the manufacturer’s relationship with and training of these downstream distributors is a critical factor in market success and system longevity.

Downstream analysis focuses on installation, maintenance, and the end-user interaction. Unlike conventional HVAC, installation requires certified professionals familiar with hydronic systems and electrical integration, although the monobloc design minimizes refrigeration-specific complexities. The installation phase often involves significant infrastructure work, such as installing buffer tanks, upgrading radiators, and integrating controls, making the installer network the most powerful gatekeeper in the market. Post-installation activities include service contracts and predictive maintenance, increasingly managed remotely via IoT connectivity, shifting revenue streams from one-off sales to recurring service revenue. End-users interact directly with these systems, driving demand for user-friendly interfaces, remote monitoring applications, and seamless integration with smart home automation platforms. Customer satisfaction relies heavily on the quality of the initial installation and the continuous operational efficiency throughout the system’s lifecycle.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 8.0 Billion |

| Growth Rate | CAGR 12.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Daikin, Mitsubishi Electric, NIBE, Vaillant Group, Viessmann, Samsung, LG Electronics, Carrier, Panasonic, Bosch Thermotechnology, Fujitsu General, Stiebel Eltron, A. O. Smith, BDR Thermea Group, Trane Technologies, CIAT (United Technologies), Hitachi, Grant Engineering, Dimplex, Aermec |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Monobloc Air Source Heat Pumps Market Potential Customers

The primary and most high-volume segment of potential customers for Monobloc Air Source Heat Pumps are residential homeowners, particularly those residing in single-family and semi-detached houses built before 2000, which are predominantly heated by fossil fuel boilers. This massive retrofit market represents the immediate growth potential, driven by energy efficiency goals and the desire to leverage government subsidies designed explicitly for boiler replacement. These customers typically prioritize ease of installation (a core monobloc advantage), minimal internal disruption, and verifiable reductions in annual heating expenditures. Their purchasing decisions are heavily influenced by local installer recommendations, manufacturer warranty provisions, and demonstrated performance in moderately cold climates. Crucially, the growth in this segment is also bolstered by affluent homeowners in new build projects who are proactively seeking premium, highly integrated smart home energy solutions, linking their heat pumps with PV and domestic battery storage for optimal self-sufficiency.

A secondary, rapidly expanding customer base is composed of construction and property development companies involved in new residential and commercial infrastructure projects. For new builds, Monobloc ASHPs offer compliance with increasingly strict thermal performance regulations (e.g., Passive House standards or local energy codes) from the outset, simplifying the planning and regulatory approval process. Developers value standardized, reliable equipment that integrates smoothly with modern building management systems (BMS). In the commercial sector, customers include owners and operators of small-to-medium enterprises (SMEs), such as boutique hotels, medical clinics, and office parks, who require efficient, scalable solutions that meet corporate sustainability goals and reduce operational carbon footprints. These commercial buyers typically focus on total lifecycle costs, system redundancy, and remote monitoring capabilities, often preferring high-capacity monobloc units or modular installations that can be scaled as needs evolve.

Furthermore, there is a significant institutional customer segment, encompassing governmental bodies, municipal housing associations, and educational establishments. These organizations often manage large portfolios of aging buildings and are mandated to undergo comprehensive energy efficiency refurbishments. Municipalities purchasing Monobloc ASHPs often do so at scale, prioritizing long-term durability, low maintenance requirements, and the ability to integrate into existing district heating networks or centralized energy management platforms. Their procurement decisions are heavily weighted by public tender requirements, verifiable energy saving projections, and proven track records in noise mitigation, as these installations often occur in densely populated or sensitive public areas. This segment, due to its scale and policy compliance, provides stable, long-term demand for high-quality, certified Monobloc heat pump systems, solidifying the market's stability and technical requirements.

Monobloc Air Source Heat Pumps Market Key Technology Landscape

The technological evolution of the Monobloc Air Source Heat Pumps market is primarily focused on enhancing efficiency, improving low-temperature performance, and transitioning toward sustainable refrigerants. Inverter technology remains the cornerstone, utilizing variable speed compressors and fans to modulate output precisely according to demand, rather than operating on a fixed on/off cycle. This modulation capability dramatically improves the Seasonal Coefficient of Performance (SCOP) by preventing short cycling and ensuring the unit operates at its most efficient point for longer durations. Modern monobloc units incorporate advanced electronic expansion valves (EEVs) and sophisticated microprocessors that analyze multiple temperature and pressure inputs to optimally control the flow of refrigerant, maximizing heat transfer efficiency even when the differential between ambient and output temperature is substantial. Furthermore, improved defrosting cycles, often managed by AI-enhanced algorithms, minimize the energy lost during these essential operational pauses, maintaining high performance during cold, damp conditions.

The shift in refrigerants represents the most strategically critical technological development. While R410A is being phased out globally, R32 has become the immediate, lower-GWP transition fluid due to its superior thermodynamic properties and compatibility with existing compressor technology. However, the long-term technological focus is rapidly shifting to natural refrigerants, particularly R290 (Propane). R290 offers a near-zero GWP, providing ultimate regulatory compliance and superior thermodynamic performance, leading to higher outlet water temperatures (up to 75°C) suitable for higher temperature radiator systems, directly addressing a key constraint in the retrofit market. The Monobloc design is ideally suited for handling flammable R290, as all components requiring specific safety standards are housed externally, simplifying indoor safety requirements and accelerating its adoption rate in densely populated residential areas. Manufacturers are investing heavily in specific R290-optimized compressor designs and stringent leak detection systems to ensure maximum safety and compliance with ISO standards.

Beyond core thermodynamics, connectivity and noise reduction technologies are differentiating factors. Contemporary Monobloc ASHPs are equipped with Wi-Fi and advanced communication modules, facilitating Internet of Things (IoT) integration for remote monitoring, performance diagnostics, and seamless integration with smart home energy management systems (HEMS). This digital connectivity enables manufacturers to perform predictive maintenance and deploy over-the-air performance updates, enhancing the user experience. Simultaneously, significant engineering effort is dedicated to acoustic performance, utilizing specialized fan blade geometries, advanced vibration dampening enclosures, and silent modes of operation. Achieving exceptionally low noise levels (often below 35 dB(A) at 3 meters) is paramount for installations in noise-sensitive urban and suburban environments, turning acoustic management into a fundamental technological prerequisite for market acceptance, particularly in Europe where noise pollution regulations are highly restrictive.

Regional Highlights

- Europe: Europe is the dominant market for Monobloc Air Source Heat Pumps, driven by extremely aggressive regulatory frameworks such as the EU Energy Performance of Buildings Directive (EPBD) and national schemes targeting the replacement of gas and oil boilers. Germany, France, and Italy exhibit the highest sales volumes, primarily due to large government grants and subsidies (e.g., German BAFA and Italian Superbonus schemes) which significantly de-risk the investment for homeowners. The market here is highly mature, with a strong focus on high-efficiency, R290-based units that can deliver higher flow temperatures suitable for older, less well-insulated housing stock.

- North America: The North American market is characterized by high growth, particularly within the residential sector across regions with moderate to cold winters (e.g., New England, Canadian provinces). Growth is bolstered by governmental policy, notably the U.S. Inflation Reduction Act (IRA), which provides substantial tax credits for high-efficiency electric heat pump installations. Due to the high prevalence of air conditioning needs, reversible (heating and cooling) Monobloc units dominate. Performance in extreme cold is a major technological focus, driving demand for enhanced Vapor Injection (VI) technology compressors.

- Asia Pacific (APAC): APAC is a high-potential market, led by advanced economies like Japan and South Korea, where high energy costs and dense population centers favor compact, highly efficient Monobloc units. Japan is a historical leader in heat pump technology, prioritizing compact designs and superior efficiency ratings. China is emerging rapidly, propelled by central government policies to combat urban air pollution (shifting from coal heating), creating a massive new build and retrofit market. The region shows strong demand for units designed to handle diverse climate conditions, ranging from humid sub-tropical to severe continental zones.

- Latin America (LATAM): The LATAM market is nascent, with adoption concentrated in specific countries like Chile and Mexico, primarily driven by commercial and upscale residential projects where energy efficiency and sustainability are key marketing advantages. Growth is slower due to lower average energy prices and less stringent building codes compared to Europe, but infrastructure development focusing on sustainable technology provides a foundational opportunity.

- Middle East and Africa (MEA): Adoption in the MEA region is currently low and heavily skewed toward cooling applications, though heat recovery and specialized commercial heating requirements (e.g., hospitality sector) are key niche drivers. The market for Monobloc ASHPs is highly dependent on utility incentives and the pace of renewable energy infrastructure development, with potential concentrated in countries committing to large-scale green building initiatives in urban centers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Monobloc Air Source Heat Pumps Market.- Daikin

- Mitsubishi Electric

- NIBE

- Vaillant Group

- Viessmann

- Samsung

- LG Electronics

- Carrier

- Panasonic

- Bosch Thermotechnology

- Fujitsu General

- Stiebel Eltron

- A. O. Smith

- BDR Thermea Group

- Trane Technologies

- CIAT (United Technologies)

- Hitachi

- Grant Engineering

- Dimplex

- Aermec

Frequently Asked Questions

Analyze common user questions about the Monobloc Air Source Heat Pumps market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary advantage of a Monobloc Heat Pump over a Split System?

The primary advantage is simplified installation and reduced complexity, as the monobloc unit contains the entire refrigeration circuit externally. This eliminates the need for an F-Gas certified installer to handle refrigerant pipework indoors, reducing labor costs and potential leakage risks, making it ideal for residential retrofits and faster deployment.

Are Monobloc Heat Pumps effective in very cold climates, and what technology addresses this?

Modern Monobloc ASHPs are highly effective in cold climates, primarily utilizing advanced inverter technology and Enhanced Vapor Injection (EVI) or Vapor Injection (VI) compressors. These innovations allow the unit to maintain reliable heat output and high Coefficients of Performance (COP) even when ambient temperatures drop significantly below freezing (e.g., -15°C to -25°C).

How is the Monobloc market addressing the transition to low Global Warming Potential (GWP) refrigerants?

The market is rapidly shifting toward refrigerants like R32 and, more significantly, R290 (Propane). Due to the Monobloc design housing all refrigerant components outdoors, it is structurally well-suited for safely accommodating R290, which has an ultra-low GWP, positioning these units as the key long-term compliant solution under future environmental regulations.

What are the key factors influencing the total cost of ownership (TCO) for a Monobloc Heat Pump?

TCO is influenced by the initial capital expenditure (unit cost plus installation), which is often offset by substantial government subsidies and tax credits. Operationally, the low running cost (due to high SCOP) and reduced long-term maintenance needs contribute to a favorable TCO compared to fossil fuel alternatives over the 15-20 year lifespan.

How critical is smart connectivity and IoT integration for the future of Monobloc units?

Smart connectivity is critical for future optimization, enabling remote monitoring, predictive maintenance, and crucial integration into smart grid Demand Response (DR) programs. IoT integration allows the unit to modulate its energy consumption dynamically based on grid signals and weather forecasts, maximizing efficiency and enabling the user to save money on variable electricity tariffs.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager