Monosultap Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434678 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Monosultap Market Size

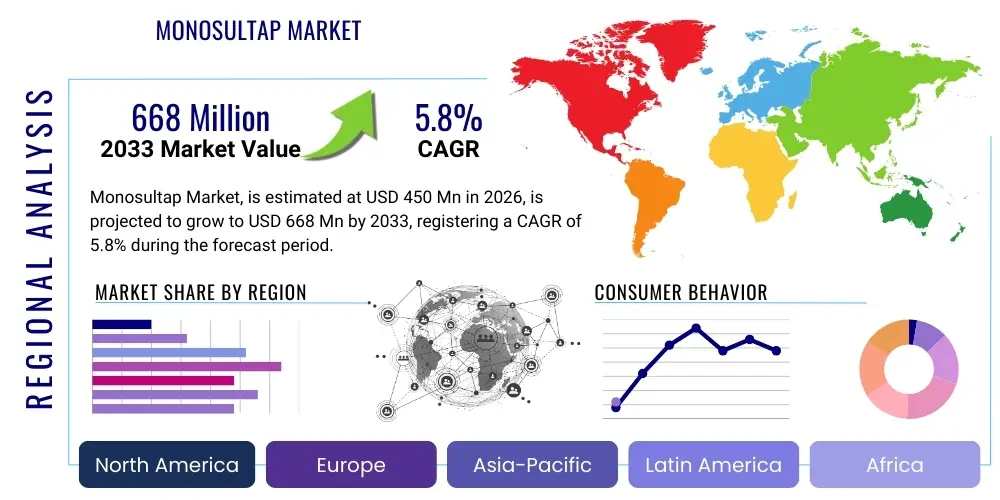

The Monosultap Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 668 Million by the end of the forecast period in 2033.

Monosultap Market introduction

Monosultap is a highly effective, broad-spectrum insecticide derived from the nereistoxin class of chemicals, primarily utilized in agricultural settings for controlling various rice pests, vegetable pests, and cotton insects. As a systemic insecticide, Monosultap acts specifically on the central nervous system of insects, functioning as an acetylcholine antagonist that disrupts nerve impulse transmission, leading to rapid paralysis and subsequent mortality. This mode of action provides significant knockdown power against stubborn pests, making it a critical component of integrated pest management (IPM) strategies, particularly in regions prone to high insect pressure and developing resistance to traditional organophosphate or pyrethroid compounds.

The product is typically available in soluble powder (SP) or technical concentrate (TC) formulations, allowing for versatility in application methods, including foliar sprays and soil treatments. Monosultap’s efficacy against stem borers, leaf rollers, and certain coleopteran pests positions it as a staple insecticide, especially for major staple crops like rice across Asia Pacific. Furthermore, its residual activity profile ensures prolonged protection, reducing the frequency of applications and subsequently optimizing labor and input costs for commercial farmers, thereby supporting consistent crop yield optimization in highly intensive agricultural systems.

Major driving factors for the Monosultap market include the persistent threat of pesticide resistance development in key agricultural pests, necessitating the continuous rotation of chemical classes such as nereistoxins. Concurrently, global population growth is driving increased demand for food production, forcing farmers to rely on high-performance agrochemicals to safeguard yields against severe pest damage. The ongoing expansion of commercial farming operations in emerging economies, coupled with supportive government policies emphasizing food security, further catalyzes the demand for reliable and cost-effective insect control solutions like Monosultap, ensuring its sustained relevance within the global crop protection landscape.

Monosultap Market Executive Summary

The Monosultap market demonstrates robust growth, primarily driven by strong demand within the Asia Pacific region, which leverages this insecticide extensively in rice and vegetable cultivation. Business trends indicate a focus on manufacturing optimization and expansion of formulation capabilities, particularly by Chinese and Indian manufacturers who dominate the global supply chain for generic agrochemicals. Significant investments are being channeled into developing co-formulations that combine Monosultap with other active ingredients to address multi-pest infestations and mitigate regulatory risks associated with single-component pesticide use, reflecting an industry-wide commitment to enhancing product stability and efficacy under diverse field conditions.

Regionally, Asia Pacific remains the undisputed market leader due to its vast tracts of rice paddy fields and high incidence of target pests susceptible to Monosultap, while North America and Europe exhibit slower growth due to stringent environmental regulations and the gradual phase-out of certain broad-spectrum insecticides. Emerging regional trends highlight increased market penetration in Latin America, particularly Brazil and Argentina, where Monosultap is being explored for use in high-value horticulture and soybean pest control, albeit facing competitive pressure from newer neonicotinoid and diamide classes. These geographical variances underscore the need for regionally tailored marketing and regulatory strategies that address local crop protocols and environmental mandates.

In terms of segment trends, the soluble powder (SP) formulation segment holds the largest market share owing to its ease of handling, stable shelf life, and superior solubility, making it highly preferred by farmers for traditional spraying applications. However, the technical concentrate (TC) segment is crucial for bulk manufacturing and export activities, providing the raw material for diverse formulations globally. Application-wise, the rice segment dominates consumption, although the vegetable and fruit segments show promising growth, driven by the increased intensity of protective sprays required for high-yield specialty crops. This segmental evolution emphasizes a shift towards specialized, high-margin applications, moving beyond solely commodity crop protection.

AI Impact Analysis on Monosultap Market

User queries regarding the intersection of Artificial Intelligence (AI) and the Monosultap market predominantly center on precision application technologies, optimization of the agrochemical supply chain, and accelerating research into pest resistance management. Key themes include the feasibility of using AI-powered diagnostics for real-time pest pressure assessment, enabling variable rate technology (VRT) for insecticide application, and leveraging machine learning (ML) algorithms to predict optimal timing and dosage, thereby minimizing environmental exposure and input costs. Users are also keenly interested in how AI can analyze complex regulatory databases and chemical synthesis pathways to streamline R&D for new Monosultap analogs or complementary compounds, ensuring faster time-to-market and regulatory compliance in diverse jurisdictions, thereby enhancing the overall efficiency and sustainability profile of the compound.

AI’s influence is rapidly transforming the conventional distribution and utilization practices within the Monosultap ecosystem. Machine learning models are increasingly deployed to analyze geospatial data, climate patterns, and historical infestation records to generate highly accurate predictive maps detailing potential pest outbreaks specific to target crops like rice and vegetables. This predictive capability fundamentally shifts pest control from reactive spraying to proactive, targeted intervention. By integrating these insights with drone or sensor-equipped sprayers, farmers can achieve unprecedented levels of precision, applying Monosultap only where pest thresholds are met, thus ensuring maximum biological efficacy while drastically reducing the total volume of chemical inputs required per hectare, aligning with sustainable agriculture mandates.

Furthermore, AI significantly enhances supply chain resilience and market forecasting for Monosultap manufacturers and distributors. Deep learning algorithms are used to optimize inventory management by predicting regional demand fluctuations based on weather forecasts, planting schedules, and commodity price changes. This allows companies to strategically manage the synthesis and distribution of technical-grade Monosultap, avoiding costly stockouts or surpluses. In the laboratory, AI accelerates the process of identifying metabolic pathways that confer resistance in insects to Monosultap, helping researchers design resistance mitigation strategies or develop novel synergistic mixtures faster than traditional biochemical screening methods, securing the long-term utility of this critical active ingredient.

- AI-driven precision agriculture enables variable rate application (VRA) of Monosultap, reducing chemical overuse by 20-30%.

- Machine learning models predict pest outbreaks (e.g., rice stem borers) with up to 90% accuracy, optimizing spray timing.

- AI algorithms analyze global supply chain logistics, minimizing lead times for Monosultap formulation ingredients.

- Natural Language Processing (NLP) tools streamline regulatory compliance checks for Monosultap registration across different countries.

- AI assists in R&D by simulating insect receptor interactions, facilitating the development of resistance-breaking formulations.

DRO & Impact Forces Of Monosultap Market

The dynamics of the Monosultap market are fundamentally shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO). Key drivers include the escalating global requirement for enhanced food security, which mandates the use of effective insecticides to prevent significant pre-harvest losses, particularly in high-density farming regions. Furthermore, the increasing prevalence of pests exhibiting multi-drug resistance to established insecticide classes, such as pyrethroids and carbamates, forces a rotational approach that consistently incorporates compounds with novel modes of action, positioning Monosultap, a nereistoxin derivative, as an indispensable alternative. The relatively low cost of manufacturing technical-grade Monosultap, especially from Asian suppliers, further enhances its attractiveness to price-sensitive agricultural markets globally.

Conversely, the market faces significant restraints, primarily stemming from stringent environmental and regulatory pressures in developed economies, particularly the European Union, concerning broad-spectrum insecticides and potential aquatic toxicity. Concerns about worker safety and residues on harvested crops necessitate extensive testing and often lead to application restrictions or outright bans in sensitive geographic areas, significantly limiting market expansion in lucrative regions. Moreover, competition from newer, highly targeted chemistries, such as the diamides (e.g., chlorantraniliprole), which often possess more favorable toxicological profiles and longer residual control, presents a continuous challenge to Monosultap's market share, compelling manufacturers to invest in more sophisticated, low-dose formulations.

Opportunities for market growth lie in the development of advanced encapsulation and controlled-release formulations that can improve the efficacy, reduce off-target exposure, and enhance the safety profile of Monosultap, potentially overcoming current regulatory hurdles. Additionally, the growing adoption of Integrated Pest Management (IPM) protocols in emerging markets encourages the strategic use of insecticides like Monosultap as a component within a rotational program, preventing pest population surges. The rapid expansion of high-value cash crops and horticulture in regions like Southeast Asia and Latin America also presents new application markets where Monosultap can be utilized effectively against specific target pests that are difficult to manage with alternative chemistries, ensuring sustained market relevance through strategic product positioning.

Segmentation Analysis

The Monosultap market is comprehensively segmented based on its formulation type, which dictates handling and application properties, and by its application, identifying the primary end-use markets. Understanding these segments is crucial for strategic market entry and product differentiation, as the performance and regulatory status of the insecticide are often tied to its specific formulation and intended crop use. The segmentation reflects global agricultural practices, where efficiency, ease of application, and cost-effectiveness are paramount, influencing farmer purchasing decisions across different regional markets.

The Formulation Type segmentation typically includes Technical Concentrate (TC) and Soluble Powder (SP), alongside minor segments such as wettable powders (WP) and granular formulations. The SP segment dominates end-user sales due to its user-friendly preparation and high stability in aqueous solutions for sprayers, favored by small and large farm operators alike. The Application segmentation clearly highlights the dependence of the market on major staple commodities, with Rice cultivation consuming the largest share due to the severe endemic pest pressure from insects like the rice stem borer (Chilo suppressalis) and leaf roller (Cnaphalocrocis medinalis) across Asian agricultural belts, where Monosultap has been a standard treatment for decades.

While rice remains the backbone of the market, the fastest growing segments are associated with high-value crops, specifically vegetables and fruits. Farmers cultivating specialty crops require robust and timely pest management to maintain premium quality standards and maximize marketability, leading to increasing demand for proven compounds like Monosultap in rotation schedules. This growth indicates a strategic opportunity for manufacturers to tailor application protocols and develop specialized labeling that focuses on efficacy against specific, high-impact horticultural pests, moving beyond the traditional reliance on mass-market commodity crop usage to capture higher-margin opportunities within the diversifying global food system.

- By Formulation Type:

- Monosultap 90% Technical Concentrate (TC)

- Monosultap 50% Soluble Powder (SP)

- Wettable Powder (WP)

- Granular Formulations (G)

- By Application:

- Rice

- Vegetables (e.g., Cabbage, Eggplant, Tomato)

- Fruits (e.g., Citrus, Pome Fruits)

- Cotton

- Other Field Crops (e.g., Tea, Sugarcane)

- By Region:

- Asia Pacific (APAC)

- North America (NA)

- Europe (EU)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Monosultap Market

The Monosultap value chain begins with the highly specialized upstream analysis involving the sourcing of raw chemical precursors necessary for the synthesis of the nereistoxin derivative. This stage is dominated by large-scale chemical producers, particularly in China and India, who leverage cost efficiencies in manufacturing and skilled chemical engineering expertise to produce the technical grade (TC) Monosultap. Key upstream activities include complex multi-step chemical synthesis, purification processes, and rigorous quality control measures to ensure the active ingredient meets international purity standards required for formulation, establishing the foundation for all downstream market activities.

The midstream stage focuses on formulation, where the technical concentrate is transformed into end-user products such as soluble powders (SP) or granular forms (G). Formulators, who may be the same companies or specialized third parties, invest heavily in grinding, blending, and encapsulation technologies to enhance product stability, bioavailability, and user safety. Distribution channels are critical, bifurcating into direct and indirect routes. Direct sales often involve large multinational corporations selling proprietary formulations directly to major agricultural cooperatives or large industrial farms. Indirect channels, which dominate in emerging markets, rely on a robust network of national and regional distributors, specialized agrochemical retailers, and local dealers who provide credit and localized technical support to smallholder farmers, ensuring widespread market penetration.

Downstream analysis highlights the end-user engagement, primarily comprised of commercial crop farmers, agricultural managers, and pest control operators who utilize the product based on specific application protocols developed through cooperative extension services or company recommendations. The ultimate success in the downstream market hinges on product efficacy against targeted pests and farmer trust, reinforced by field trials and consistent performance. The feedback loop from the end-user back through the distributor and formulator is crucial for developing updated formulations and managing resistance strategies, ensuring the sustained viability and market acceptance of Monosultap within the constantly evolving landscape of integrated pest management.

Monosultap Market Potential Customers

The primary customers for Monosultap are commercial agricultural enterprises and smallholder farmers engaged in the intensive cultivation of staple crops, predominantly focusing on rice production across Asia Pacific. These customers prioritize high-efficacy, broad-spectrum insect control solutions that offer substantial cost-benefit ratios and reliable protection against major yield-threatening pests such as rice stem borers, which can cause devastating losses if not managed promptly. Their buying decisions are heavily influenced by local pest severity, government subsidies, and the accessibility of distribution networks that provide technical advice and competitive pricing, making established local distributors indispensable partners.

A significant secondary customer base includes large multinational agrochemical distributors and regional cooperatives that serve as intermediaries, purchasing bulk technical material or formulated products for redistribution under their own brands or as part of integrated input packages. These entities value consistency in supply, regulatory documentation support, and the capacity of manufacturers to meet fluctuating seasonal demands accurately. They act as essential gatekeepers, aggregating demand from thousands of individual farm operations and ensuring that Monosultap products are seamlessly integrated into regional crop protection schedules tailored to specific soil and climate conditions.

Furthermore, Monosultap finds specific end-users within the specialty crop and high-value horticulture sectors, including vegetable and fruit growers who require precise, targeted insect control to maintain produce quality for export markets. These buyers are often less price-sensitive than commodity crop growers but demand formulations with minimal pre-harvest intervals (PHIs) and low residue profiles, aligning with rigorous consumer safety standards in destination markets like North America and Europe. This segment represents a premium opportunity, necessitating manufacturers to focus on refined formulations and comprehensive data supporting safety and residue analysis for these high-specification customers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 668 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Nanjing Red Sun Co. Ltd., Jiangsu Yangnong Chemical Co. Ltd., Shandong Hailir Chemical Co. Ltd., Lianyungang Jindun Agrochemical Co. Ltd., Hubei Sanonda Co. Ltd., Sumitomo Chemical Co. Ltd., Syngenta AG, BASF SE, Bayer AG, Rallis India Limited, UPL Ltd., Hebei Weiyong Biochemical Co. Ltd., Hunan Chemical Research Institute, Zhejiang Corechem Co. Ltd., CAC Group, Jiangsu Fengshan Group Co. Ltd., Rainbow Group, Sinochem Group, FMC Corporation, Adama Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Monosultap Market Key Technology Landscape

The key technology landscape underpinning the Monosultap market revolves significantly around sophisticated chemical synthesis and advanced formulation techniques designed to maximize the efficacy and minimize the environmental footprint of this nereistoxin insecticide. In terms of chemical production, manufacturers are continually optimizing high-yield synthesis pathways to ensure the production of high-purity Monosultap technical concentrate (TC) at competitive costs, often utilizing continuous flow chemistry and advanced catalytic processes to improve reaction selectivity and reduce waste streams. Furthermore, Spectroscopic and chromatographic techniques, such as High-Performance Liquid Chromatography (HPLC) and Gas Chromatography-Mass Spectrometry (GC-MS), are essential for quality assurance, monitoring impurities, and validating the final product's consistency across batches for global distribution.

Formulation technology represents a critical area of innovation, focusing particularly on enhancing the user and environmental safety profile of Monosultap. Microencapsulation technology is gaining prominence, allowing for the slow and controlled release of the active ingredient. This technological advancement not only prolongs the residual activity of the insecticide, offering extended protection against pests, but also significantly reduces the exposure risk to non-target organisms and minimizes pesticide runoff. Soluble powder (SP) and water-dispersible granule (WG) technologies are also continuously refined to improve dissolution rates and prevent nozzle clogging in modern spraying equipment, directly impacting application efficiency and the homogeneity of field coverage, which is paramount for effective pest management.

Another crucial technological element involves digital agriculture integration, utilizing Geographical Information Systems (GIS) and remote sensing data to inform precision application strategies. The future of Monosultap application is tied to smart sprayers and drone technology that utilize GPS mapping to target areas of high infestation, moving away from uniform blanket spraying. This adoption of digital tools ensures that the right dosage of the chemical is delivered precisely where and when it is needed, thereby maximizing the economic return for the farmer while dramatically decreasing the total environmental load. This precision technology landscape is vital for sustaining the market presence of traditional chemicals like Monosultap in increasingly regulated agricultural markets globally.

Regional Highlights

Asia Pacific (APAC) stands as the paramount region in the global Monosultap market, commanding the largest share in both consumption and production. The market dominance is primarily attributed to the vast scale of agricultural production, particularly rice, which is the staple crop highly susceptible to target pests controlled by Monosultap, such as the stem borer. Countries like China, India, and Vietnam are not only massive consumers but also major global manufacturers of the technical grade product, benefitting from robust supply chain infrastructure and economies of scale. Regulatory environments in many APAC nations, while becoming stricter, still allow broader usage of proven chemicals compared to Western counterparts, further bolstering regional demand and solidifying APAC’s role as the definitive center of gravity for the Monosultap industry.

North America and Europe represent mature markets characterized by low-volume, high-specification usage, driven by extremely stringent environmental and public health regulations. In Europe, the focus on sustainable agriculture and the precautionary principle has severely restricted the use of broad-spectrum insecticides, leading to minimal market presence for Monosultap, typically limited to highly specific, controlled applications where alternatives are inadequate or regulatory exemptions exist. North America, conversely, utilizes Monosultap in targeted crops, mainly vegetables and certain field crops, but requires extensive toxicological data and compliance with the Environmental Protection Agency (EPA) standards. Growth in these regions is primarily driven by advanced formulation technologies that promise lower environmental persistence and minimal residue, justifying premium pricing.

Latin America (LATAM) exhibits significant emerging growth potential, driven by the expansion of large-scale commercial farming, especially in Brazil and Argentina, focusing on soybean, sugarcane, and high-value horticulture. While Monosultap competes fiercely with newer chemistries, its established efficacy and cost-effectiveness make it attractive for managing key pests in complex tropical and subtropical ecosystems. Market penetration is accelerating due to improved regional regulatory harmonization and efforts by agrochemical companies to introduce localized, effective formulations. Meanwhile, the Middle East and Africa (MEA) market remains nascent but important, concentrated mainly in irrigated farming areas in North Africa and the Middle East, where localized pest outbreaks in cash crops necessitate reliable, accessible chemical control solutions.

- China (APAC): Dominates global Monosultap production and consumption, heavily utilized in rice, cotton, and vegetable cultivation. Focus is on cost leadership and export optimization.

- India (APAC): Major consumer and producer, relying on Monosultap for effective pest control in staple food crops, driven by strong agricultural output growth and subsidized pricing structures.

- Brazil (LATAM): Fastest-growing market segment outside APAC, driven by expanding high-value crops and the need for insecticide rotation strategies to manage increasingly resistant insect populations in large commercial farms.

- Vietnam & Indonesia (APAC): High dependence on Monosultap for intensive rice paddy protection against stem borers and leaf rollers, securing food security goals.

- United States (North America): Limited, highly regulated use focused on specific vegetable and specialty crops; demand centers around advanced, low-residue formulations compliant with strict EPA guidelines.

- European Union (EU): Minimal market presence due to regulatory prohibitions on broad-spectrum compounds; activities are primarily concentrated on R&D for safer derivatives or export-oriented technical material production.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Monosultap Market.- Nanjing Red Sun Co. Ltd.

- Jiangsu Yangnong Chemical Co. Ltd.

- Shandong Hailir Chemical Co. Ltd.

- Lianyungang Jindun Agrochemical Co. Ltd.

- Hubei Sanonda Co. Ltd.

- Sumitomo Chemical Co. Ltd.

- Syngenta AG

- BASF SE

- Bayer AG

- Rallis India Limited

- UPL Ltd.

- Hebei Weiyong Biochemical Co. Ltd.

- Hunan Chemical Research Institute

- Zhejiang Corechem Co. Ltd.

- CAC Group

- Jiangsu Fengshan Group Co. Ltd.

- Rainbow Group

- Sinochem Group

- FMC Corporation

- Adama Ltd.

Frequently Asked Questions

Analyze common user questions about the Monosultap market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Monosultap and what is its primary mode of action in pest control?

Monosultap is a systemic, broad-spectrum insecticide derived from the nereistoxin class. It functions by antagonizing acetylcholine receptors in the insect central nervous system, leading to disruption of nerve impulse transmission, causing paralysis, and subsequent death. This unique mechanism makes it effective against pests resistant to other chemical classes.

Which geographical region holds the largest market share for Monosultap consumption?

The Asia Pacific (APAC) region dominates the Monosultap market share. This high consumption is directly linked to the intensive cultivation of rice, where Monosultap is a crucial tool for managing major pests like stem borers, ensuring regional food security and high crop yields.

How is the Monosultap market addressing environmental safety concerns and regulatory pressures?

Manufacturers are investing in advanced formulation technologies such as microencapsulation and water-dispersible granules. These innovations aim to reduce off-target exposure, minimize environmental leaching, and improve the chemical's overall safety profile, thereby maintaining compliance with stricter global environmental regulations.

What are the key drivers expected to propel the growth of the Monosultap market through 2033?

The primary drivers are the escalating global food demand, the persistent and rising incidence of pest resistance to alternative insecticide classes (necessitating chemical rotation), and the compound's proven efficacy and cost-effectiveness, especially for staple crops in emerging economies.

How does AI impact the future application and distribution of Monosultap?

AI integrates through precision agriculture, utilizing machine learning algorithms for real-time pest prediction and variable rate application (VRA) technologies. This optimization ensures Monosultap is applied only where required, minimizing overall chemical use, improving efficiency, and aiding in strategic inventory management within the supply chain.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager