Mortgage Outsourcing Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434286 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Mortgage Outsourcing Market Size

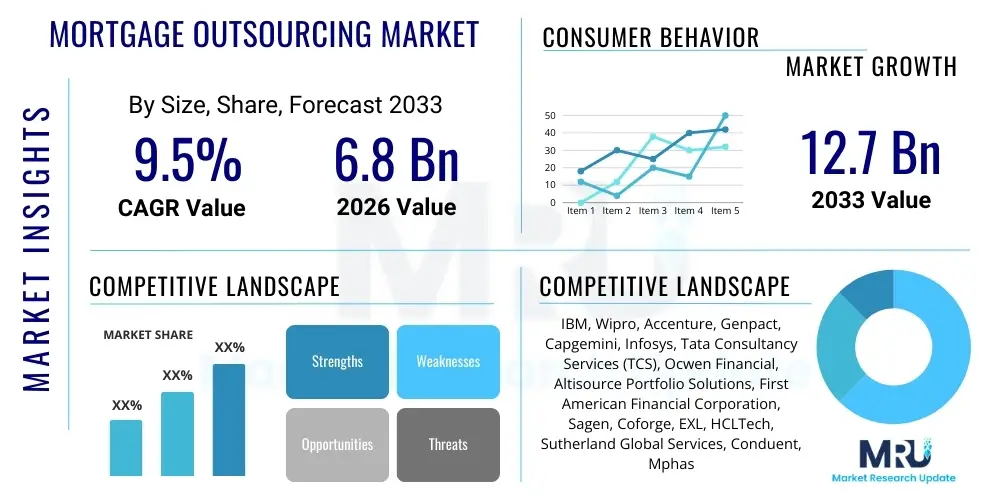

The Mortgage Outsourcing Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at $6.8 Billion in 2026 and is projected to reach $12.7 Billion by the end of the forecast period in 2033.

Mortgage Outsourcing Market introduction

The Mortgage Outsourcing Market encompasses the delegation of specific mortgage-related functions, such as loan origination, processing, underwriting, and servicing, to third-party service providers. This strategic business model allows financial institutions, including banks and credit unions, to leverage specialized expertise, reduce operational costs, and enhance overall efficiency, particularly in fluctuating interest rate environments that characterize the modern lending landscape. The necessity for strict regulatory compliance, especially post-2008 financial reforms, drives the demand for specialized outsourcing partners capable of managing complex compliance requirements efficiently. Furthermore, the inherent cyclic nature of the mortgage industry, characterized by periods of high demand followed by slow periods, makes outsourcing an attractive solution for maintaining flexible staffing and operational scalability without significant capital expenditure.

Mortgage outsourcing services primarily target back-office and middle-office functions where volume variability is highest. Products offered range from full-suite end-to-end processing solutions to niche services like quality control, closing document preparation, and default management. Major applications span residential mortgages, commercial mortgages, and specialized lending products. Key benefits realized by adopting these services include significant improvements in loan processing turnaround times, a marked reduction in error rates due to specialization, and freeing up internal resources to focus on core competencies such as customer relationship management and strategic product development. This strategic shift towards external management of non-core processes has become foundational to the contemporary mortgage ecosystem.

Driving factors propelling the market forward include the intense pressure on financial institutions to minimize costs while simultaneously optimizing the customer experience in a competitive digital environment. The technological requirement to integrate sophisticated digital platforms, coupled with the talent shortage in specialized underwriting and compliance roles, further solidifies the need for external expertise. Additionally, the proliferation of cloud-based mortgage technology platforms offered by BPO providers ensures faster adoption of advanced tools without requiring massive internal IT investment. These factors collectively accelerate the migration of mortgage processes towards specialized third-party vendors who can guarantee superior service delivery and regulatory adherence.

Mortgage Outsourcing Market Executive Summary

The Mortgage Outsourcing Market is characterized by robust growth, driven primarily by macroeconomic factors such as rising interest rate volatility, increasing regulatory burdens, and the persistent need for digital transformation among lenders. Current business trends indicate a strong move away from traditional lift-and-shift outsourcing towards outcome-based partnerships, where vendors are responsible for delivering defined improvements in efficiency, compliance, and customer satisfaction metrics. This shift mandates higher technological integration, utilizing advanced analytics and automation tools to streamline complex processes like underwriting and quality control. Furthermore, lenders are seeking partners who offer comprehensive risk management solutions, especially concerning data privacy and cybersecurity, which are critical vulnerabilities in the highly sensitive mortgage data environment.

Regional trends reveal that North America, particularly the United States, remains the largest consumer of mortgage outsourcing services due to its mature and highly regulated housing finance market and the presence of numerous large banking institutions and non-bank lenders. However, the Asia Pacific region is demonstrating the fastest growth rate, fueled by expanding digital lending initiatives in countries like India and China, and the growing maturity of established outsourcing hubs like the Philippines and Australia. European markets are focusing heavily on cross-border compliance optimization, particularly following the implementation of stricter EU financial directives, driving demand for specialized compliance outsourcing services that can navigate fragmented regulatory landscapes.

Segment trends highlight that the loan servicing segment is experiencing significant expansion, largely due to the increasing complexity of regulatory requirements concerning payment collection, escrow management, and default servicing, which necessitates specialized expertise difficult to maintain in-house. Technology adoption is polarizing the market based on component, with services remaining dominant, yet the software component, particularly platform-as-a-service (PaaS) solutions integrated with robotic process automation (RPA) and machine learning (ML), showing accelerated adoption rates. End-user demand is heavily concentrated among large national banks and major non-bank mortgage lenders, who prioritize scalability and global delivery models to manage high volume fluctuations efficiently.

AI Impact Analysis on Mortgage Outsourcing Market

User inquiries regarding the integration of Artificial Intelligence (AI) into mortgage outsourcing center heavily on job displacement, the potential for algorithmic bias in loan decisions, and the expected improvement in processing speed and accuracy. Key themes reveal that lenders are keenly interested in understanding how AI can automate complex, judgment-heavy tasks such as document recognition, fraud detection, and preliminary underwriting review, thereby reducing the need for human intervention in repetitive processes. However, a significant concern revolves around maintaining auditability and transparency in AI-driven decisions, crucial for meeting stringent fair lending regulations. The market expects AI to significantly transform BPO vendors by shifting their focus from labor arbitrage to expertise arbitrage, providing sophisticated AI models and integration services rather than just manual processing power.

- AI dramatically enhances automated document processing, accelerating loan file review and data extraction, leading to faster application turnaround times.

- Machine learning algorithms significantly improve risk assessment and fraud detection capabilities, offering more accurate predictive models than traditional methods.

- Intelligent process automation (IPA) and Robotic Process Automation (RPA) handle repetitive back-office tasks like data entry, quality checks, and verification, reducing operational costs for outsourcing providers.

- AI-powered chatbots and virtual assistants are being utilized to manage customer service inquiries related to loan status, servicing, and initial application guidance, improving the borrower experience.

- Regulatory technology (RegTech) solutions powered by AI ensure real-time monitoring of compliance requirements, automatically flagging potential regulatory violations in loan files.

DRO & Impact Forces Of Mortgage Outsourcing Market

The dynamics of the Mortgage Outsourcing Market are governed by a compelling mix of growth drivers and persistent challenges, alongside strategic opportunities that are reshaping vendor capabilities. A primary driver is the intense economic pressure on lenders to reduce the cost per loan originated, which outsourcing inherently addresses through scale and optimized labor pools. Simultaneously, the restrictive regulatory environment, particularly concerning consumer protection and data security, forces specialized compliance expertise, often best acquired through outsourcing partners. Opportunities are emerging in the sphere of digital mortgage transformation, where vendors are not just processing transactions but actively implementing new cloud-based, AI-driven platforms that integrate seamlessly with lender core systems.

However, the market faces significant restraints, chiefly stemming from data security concerns and the perceived risk of loss of control over critical, sensitive customer information when delegated to external entities. Furthermore, the inherent complexity in standardizing global mortgage regulations makes large-scale cross-border outsourcing challenging, requiring vendors to maintain highly localized compliance expertise. Impact forces suggest that technology convergence, particularly the adoption of blockchain for securing title transfers and smart contracts for automated loan servicing, will exert strong pressure on traditional BPO models, favoring those providers who can rapidly integrate these advanced technologies into their offerings.

The impact forces also involve the shifting geopolitical landscape, which affects the cost and stability of offshore delivery centers. Market leaders are mitigating these risks by adopting a balanced delivery model encompassing onshore, nearshore, and offshore capabilities, ensuring operational resilience and compliance flexibility. Ultimately, successful participation in this market hinges on a provider’s ability to demonstrate not only cost savings but also superior technological proficiency and an unimpeachable track record in regulatory adherence and data governance, transforming outsourcing from a cost measure into a strategic capability enhancer.

Segmentation Analysis

The Mortgage Outsourcing Market segmentation provides a granular view of service demand across various operational components, delivery models, and end-user types. The primary segmentation criterion revolves around the service type, differentiating demand for functions such as origination, where speed and accuracy are paramount, versus servicing, which requires long-term commitment and regulatory vigilance. Analyzing these segments is crucial for both vendors tailoring their specialized offerings and lenders seeking targeted expertise. The dominant trend across all segments is the increasing demand for end-to-end digital solutions that minimize human touchpoints, pushing BPO providers to invest heavily in integrated software platforms and cloud infrastructure to ensure continuous, high-availability service delivery capable of managing fluctuating transaction volumes effectively and efficiently.

- By Service Type:

- Loan Origination Support (Application Processing, Underwriting Assistance, Closing Support)

- Loan Processing Services (Document Management, Quality Control, Verification)

- Loan Servicing Support (Payment Processing, Escrow Management, Customer Service, Collections)

- Default Management (Foreclosure Processing, Loss Mitigation, REO Management)

- By Component:

- Services (Consulting, Implementation, Maintenance, Managed Services)

- Software/Platforms (Proprietary BPO Systems, Loan Origination Systems integration)

- By End-User:

- Banks and Financial Institutions

- Credit Unions

- Non-Bank Mortgage Lenders (NBMs)

- Others (Insurance Companies, Investment Funds)

- By Delivery Model:

- Onshore Outsourcing

- Offshore Outsourcing

- Nearshore Outsourcing

Value Chain Analysis For Mortgage Outsourcing Market

The value chain for the Mortgage Outsourcing Market begins with upstream activities focused on technology and talent acquisition. Upstream suppliers include core technology vendors providing Loan Origination Systems (LOS), Customer Relationship Management (CRM) tools, and specialized compliance software, alongside human resource providers supplying domain-specific expertise like certified underwriters and compliance officers. The quality and efficiency of these upstream inputs directly determine the capabilities of the BPO provider. Strategic outsourcing firms often partner with FinTech companies to co-develop proprietary automation and AI tools, ensuring they maintain a technological edge in a highly competitive service market. Effective upstream management is critical for controlling operational variability and ensuring high throughput during peak demand cycles.

The core of the value chain is the transformation and service delivery stage, executed by the BPO providers themselves. This involves taking raw application data and documents and transforming them into compliant, closed, and serviced loan products. Key activities include data verification, complex risk analysis, regulatory filing, and continuous customer communication. Distribution channels for these services are predominantly direct—meaning BPO providers interact directly with the mortgage lender/client. However, indirect channels sometimes involve partnerships with large consulting firms that recommend and integrate BPO services as part of a broader digital transformation strategy. The quality of service delivery is evaluated based on key performance indicators (KPIs) such as cycle time, accuracy rates, and audit compliance success.

Downstream analysis focuses on the end-users (mortgage lenders and servicers) and the final borrowers. The value captured downstream is measured by the lender's ability to reduce cost, scale operations rapidly, and enhance the overall borrower experience, often reflected in faster closing times and improved customer satisfaction scores. For the outsourcing partner, efficient downstream delivery, supported by robust Service Level Agreements (SLAs), drives client retention and cross-selling opportunities across different service types (e.g., converting an origination client into a servicing client). The entire value chain is characterized by stringent security requirements, demanding continuous investment in cybersecurity infrastructure from upstream providers through to downstream delivery.

Mortgage Outsourcing Market Potential Customers

The primary consumers and end-users of mortgage outsourcing services are diverse financial entities that originate, process, or service residential and commercial loans. The largest volume of demand originates from large national and regional banks, which leverage outsourcing to manage the immense operational scale associated with high transaction volumes and complex regulatory environments. These institutions often require full end-to-end outsourcing solutions, seeking global delivery models that offer cost efficiencies through offshore centers while maintaining rigorous quality controls and data security standards. Their procurement focus is on strategic partnerships that offer transformative technological capabilities rather than mere cost arbitrage.

Another rapidly growing segment of potential customers comprises Non-Bank Mortgage Lenders (NBMs). NBMs often operate with leaner internal structures and depend heavily on outsourcing to handle variable loan volumes, particularly during high-refinance markets. For NBMs, outsourcing provides necessary scalability and instant access to specialized expertise, such as complex loan underwriting and compliance monitoring, which would be financially prohibitive to build internally. Credit unions, though smaller in volume compared to major banks, represent a consistent demand segment, typically seeking support in highly specialized functions like servicing and default management, allowing them to remain competitive in offering specialized member services.

Furthermore, niche end-users include independent mortgage brokers and specialized investment funds that purchase and manage mortgage servicing rights (MSRs) or distressed assets. These entities require highly specialized default management and portfolio servicing outsourcing to manage risk and maximize asset value. Their buying behavior is heavily influenced by the vendor’s demonstrated expertise in navigating specific regulatory hurdles related to asset recovery and compliance reporting, making specialization a key purchasing criterion over purely volume-based pricing models.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $6.8 Billion |

| Market Forecast in 2033 | $12.7 Billion |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | IBM, Wipro, Accenture, Genpact, Capgemini, Infosys, Tata Consultancy Services (TCS), Ocwen Financial, Altisource Portfolio Solutions, First American Financial Corporation, Sagen, Coforge, EXL, HCLTech, Sutherland Global Services, Conduent, Mphasis, WNS, Concentrix, CSI. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Mortgage Outsourcing Market Key Technology Landscape

The technological landscape of the Mortgage Outsourcing Market is rapidly evolving, driven by the imperative to increase processing speed, enhance accuracy, and ensure robust security. The foundational technology remains the Loan Origination System (LOS) and Loan Servicing System (LSS), but contemporary BPO services are characterized by the heavy integration of advanced automation layers. Robotic Process Automation (RPA) is widely deployed for managing high-volume, repetitive tasks such as data input across multiple systems and generating standardized reports. This application of RPA not only reduces labor costs but drastically minimizes human error, a critical benefit in compliance-heavy workflows.

Beyond basic RPA, the market leverages sophisticated tools like Artificial Intelligence (AI) and Machine Learning (ML) for cognitive process automation. AI is crucial in document ingestion and classification, utilizing Optical Character Recognition (OCR) and Natural Language Processing (NLP) to extract unstructured data from mortgage documents, accelerating the underwriting preparation phase. Furthermore, cloud computing infrastructure is essential, enabling BPO providers to offer scalable, secure, and geographically distributed services. This shift to the cloud facilitates faster deployment of new features and ensures regulatory data storage requirements are met efficiently, providing flexibility that legacy on-premise systems could not deliver.

Emerging technologies, specifically blockchain, are beginning to influence the sector, primarily in the areas of securing property title transfers and executing smart contracts for servicing tasks like automated escrow payments or late fee calculations. While still nascent, blockchain promises enhanced transparency and reduced fraud potential, pushing BPO vendors to explore pilot programs for integration. The overall trend is towards a low-touch, highly digitized process flow, where technology acts as the primary driver of efficiency and compliance, transforming the outsourcing model from one based on labor arbitrage to one based on technological arbitrage and domain expertise.

Regional Highlights

- North America: Dominates the global mortgage outsourcing market due to the large volume of mortgage transactions, the complexity of its federal and state-level regulatory frameworks, and the high adoption rate of advanced digital lending technologies, particularly in the US. The region’s mature banking sector and strong presence of Non-Bank Mortgage Lenders drive substantial demand for both origination and servicing support.

- Europe: Characterized by fragmented national mortgage markets and diverse regulatory requirements. Growth is steady, focused particularly on compliance and anti-money laundering (AML) services following stringent directives like MiFID II. Nearshore hubs in Eastern Europe are becoming increasingly popular for banks seeking cultural proximity and strong language capabilities.

- Asia Pacific (APAC): Exhibits the fastest growth, fueled by rapid urbanization, increasing digitalization of financial services, and the establishment of new digital banks across India, China, and Southeast Asia. APAC is also the primary global delivery hub for offshore outsourcing, leveraging scale and cost-effectiveness for global clients, while also developing strong domestic outsourcing markets.

- Latin America (LATAM): Showing moderate growth, driven by regional banks seeking to modernize outdated legacy systems and improve efficiency. Nearshore providers in countries like Mexico and Brazil offer bilingual capabilities and cultural alignment attractive to US clients, particularly for customer-facing servicing functions.

- Middle East and Africa (MEA): Currently represents a smaller share but is poised for growth due to infrastructural development and government initiatives promoting homeownership. Demand is concentrated in specialized services that adhere to Islamic finance principles (Sharia-compliant mortgages), requiring niche expertise from BPO providers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Mortgage Outsourcing Market.- IBM

- Wipro

- Accenture

- Genpact

- Capgemini

- Infosys

- Tata Consultancy Services (TCS)

- Ocwen Financial

- Altisource Portfolio Solutions

- First American Financial Corporation

- Sagen

- Coforge

- EXL

- HCLTech

- Sutherland Global Services

- Conduent

- Mphasis

- WNS

- Concentrix

- CSI

Frequently Asked Questions

Analyze common user questions about the Mortgage Outsourcing market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary drivers of growth in the Mortgage Outsourcing Market?

The primary drivers are the escalating costs associated with maintaining internal compliance expertise, the critical need for lenders to achieve flexible operational scalability during fluctuating interest rate cycles, and the mandate for rapid digital transformation to enhance the borrower experience.

How does AI technology specifically benefit mortgage BPO services?

AI benefits mortgage BPO services by automating document processing through OCR and NLP, significantly improving the accuracy and speed of underwriting data preparation, and enabling sophisticated fraud detection algorithms, thereby moving BPO from manual tasks to cognitive automation.

What are the key risks associated with outsourcing mortgage functions?

The key risks involve data security breaches concerning sensitive borrower information, the potential loss of direct control over core operational processes, and integration challenges when connecting third-party vendor platforms with the lender’s proprietary legacy systems.

Which service type segment currently holds the largest market share?

The Loan Servicing Support segment typically holds the largest market share due to the sustained, long-term nature of these processes, which include complex tasks like payment management, escrow administration, and default servicing, all of which require specialized, ongoing regulatory attention.

Which geographical region is anticipated to demonstrate the fastest growth rate?

The Asia Pacific (APAC) region is anticipated to exhibit the fastest growth rate, propelled by the rising trend of digital lending, the maturity of offshore delivery centers (e.g., India and the Philippines), and increasing domestic demand for financial modernization across emerging economies.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager