Mortuary Facility Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433355 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Mortuary Facility Market Size

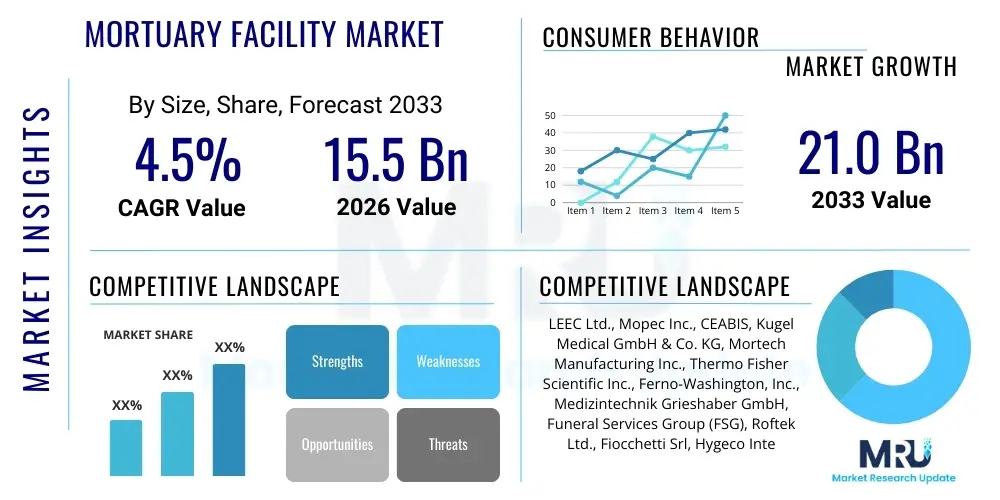

The Mortuary Facility Market is projected to grow at a Compound Annual Growth Rate (CAGR) of [4.5%] between 2026 and 2033. The market is estimated at [USD 15.5 Billion] in 2026 and is projected to reach [USD 21.0 Billion] by the end of the forecast period in 2033.

Mortuary Facility Market introduction

The Mortuary Facility Market encompasses the entire ecosystem of products, equipment, infrastructure, and services dedicated to the short-term and long-term storage, preservation, identification, and examination of human remains. This sector is critical to public health, forensic science, and the bereavement process, servicing hospitals, medical examiners offices, forensic laboratories, government agencies, and private funeral homes. Key products involved range from highly specialized refrigeration units and cold rooms—designed to maintain specific temperature requirements for preservation—to sophisticated autopsy instruments, ventilation systems, viewing rooms, and administrative software solutions for tracking and managing remains efficiently. The demand is fundamentally driven by population growth, global mortality rates, the increasing complexity of legal and forensic investigations requiring thorough post-mortem examinations, and heightened standards for hygiene and dignity in handling the deceased.

A primary function of mortuary facilities is ensuring the integrity and traceability of human remains, which necessitates robust infrastructure capable of adhering to stringent regulatory guidelines regarding biohazard containment and environmental control. Major applications of mortuary facilities include routine hospital morgues for temporary holding, high-capacity centralized forensic centers for complex investigations, and specialized academic institutions utilized for medical education and research. The inherent benefits derived from advanced facilities include improved preservation quality, enhanced safety for staff through better ventilation and pathogen control, streamlined workflows utilizing digital inventory systems, and ensuring respectful and dignified treatment of the deceased, fulfilling both ethical and legal requirements globally. Furthermore, the longevity and reliability of the equipment—such as stainless steel autopsy tables with integrated drainage and ventilation features—are paramount considerations for facility operators seeking long-term investments that minimize maintenance costs and operational downtime.

Driving factors propelling market expansion include infrastructural modernization in developing economies where existing facilities may be outdated or insufficient, alongside continuous technological advancements focusing on automation and digital integration within established markets. For instance, the adoption of specialized tracking systems using RFID technology is improving chain-of-custody management, a critical aspect of forensic integrity. Moreover, public awareness and regulatory pressure regarding the proper management of infectious remains, particularly highlighted by global health crises, necessitate continuous upgrades to biosafety levels (BSL) within mortuary and pathology environments. This collective push towards higher safety standards, combined with an increasing elderly global population contributing to rising mortality figures, firmly establishes the Mortuary Facility Market as a consistently growing sector within the broader healthcare infrastructure landscape.

Mortuary Facility Market Executive Summary

The Mortuary Facility Market is characterized by steady growth, primarily fueled by stringent regulatory environments mandating specialized infrastructure for human remains management and continuous investments in forensic science capabilities globally. Current business trends indicate a strong move toward integrated facility design, emphasizing modular construction for flexibility and scalability, particularly in response to potential surge capacity needs demonstrated by recent pandemics. Furthermore, digitalization is emerging as a critical trend, encompassing everything from digital pathology services for remote diagnosis to sophisticated inventory management software (LIMS) integrated within morgue operations, enhancing efficiency, and minimizing the risk of administrative errors crucial for legal documentation. Key players are increasingly focusing on offering holistic, turnkey solutions that include not only the core refrigeration units and specialized equipment but also comprehensive maintenance and validation services, shifting the competitive landscape toward value-added service provision rather than just hardware sales.

Regional trends reveal significant investment disparity and maturity levels. North America and Europe currently dominate the market due to established healthcare systems, rigorous regulatory frameworks, and early adoption of advanced forensic technologies, including specialized toxicology and DNA analysis labs integrated within mortuary complexes. However, the Asia Pacific (APAC) region is projected to exhibit the highest growth rate, driven by rapid urbanization, expanding healthcare infrastructure development in countries like China and India, and increasing government allocation toward upgrading public health and forensic institutions. The Middle East and Africa (MEA) region also presents growing opportunities, particularly in high-growth economies investing heavily in modernizing hospital facilities and establishing centralized forensic centers to meet rising standards of criminal justice and health safety protocols, often leveraging international partnerships for technology transfer and facility design expertise.

Segmentation trends highlight the Refrigeration Systems segment (specifically high-capacity modular cold rooms and specialized infectious remains storage units) as maintaining the largest market share due to its foundational importance in preservation. Concurrently, the Autopsy and Examination Equipment segment, driven by technological enhancements such as hydraulic or electric autopsy tables with integrated downdraft ventilation systems and advanced microscopic imaging devices, is experiencing the fastest rate of innovation and adoption. The End-User segment remains primarily dominated by Hospitals and Forensic Science Institutes, which require the highest levels of biosafety and complex equipment. There is a perceptible shift toward cloud-based software solutions within the Services segment, enabling better centralized inventory control, seamless data sharing between institutions, and efficient management of large-scale mortuary operations, thus driving operational expenditure (OpEx) growth alongside capital expenditure (CapEx) on physical infrastructure.

AI Impact Analysis on Mortuary Facility Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Mortuary Facility Market primarily revolve around three key areas: enhancing operational efficiency, improving forensic accuracy, and addressing ethical concerns related to data privacy and automated decision-making regarding human remains. Users frequently ask about AI's role in predictive mortality analysis for resource allocation, optimizing cold storage logistics to minimize energy use, and utilizing computer vision in post-mortem diagnostics, such as automated lesion detection or identification validation. A significant theme is the expectation that AI could streamline the administrative burdens associated with chain-of-custody documentation and inventory management, ensuring error-free tracking from arrival to release. Concerns often center on the initial investment required for sophisticated AI-driven pathology tools and the necessary training for existing staff to interact with these advanced systems effectively, alongside ensuring regulatory compliance when sensitive patient and deceased data are processed by algorithms.

The primary area where AI is beginning to demonstrate transformative potential is in the integration of digital pathology systems. AI algorithms can analyze high-resolution whole-slide images (WSI) generated during autopsies or specialized examinations, significantly reducing the time required for pathologists to screen and identify abnormalities, tissue types, or signs of infectious agents. This speed and precision are crucial in forensic cases where rapid, accurate results are paramount. Moreover, AI is being deployed in optimizing facility operations. By analyzing historical occupancy data, seasonal mortality rates, and disaster response scenarios, AI-powered systems can predict required storage capacity, optimize refrigeration unit settings for energy efficiency, and manage complex logistical movements of remains within large centralized facilities, thereby lowering operational costs and increasing preparedness during high-demand periods.

Furthermore, AI is instrumental in enhancing security and traceability within the mortuary environment. AI-driven vision systems can monitor access points and verification protocols, linking biometric data or digital tags of the deceased to physical locations, thereby mitigating the risk of misidentification—a major concern for institutions. In the realm of research and education, machine learning is facilitating large-scale data analysis of post-mortem findings, contributing valuable insights into disease progression, public health trends, and forensic databases. However, the ethical and legal frameworks governing the deployment of AI in handling human remains and sensitive medical data are still evolving, requiring providers to implement robust data governance models and ensure that AI outputs are always subject to human oversight, maintaining the essential role of skilled pathologists and forensic technicians.

- AI enhances digital pathology by automating the analysis of whole-slide images, speeding up post-mortem diagnosis and forensic evidence processing.

- Predictive analytics optimize facility resource management, forecasting storage needs based on mortality patterns and disaster scenarios for improved readiness.

- Machine learning algorithms streamline chain-of-custody documentation, utilizing digital tagging and verification to ensure accurate tracking and minimize administrative errors.

- AI-powered monitoring systems improve facility security and access control, utilizing computer vision to verify identity and movement protocols within sensitive areas.

- Automated environmental control systems leverage AI to optimize refrigeration unit performance, reducing energy consumption while maintaining mandated preservation temperatures.

- AI contributes to forensic toxicology and genetic analysis by accelerating data interpretation and correlation with extensive criminal and medical databases.

DRO & Impact Forces Of Mortuary Facility Market

The Mortuary Facility Market is propelled by several robust dynamics, constrained by significant financial and infrastructural barriers, and holds considerable potential through emerging technologies and regulatory shifts. Driving forces include global population expansion leading to increased overall mortality rates, coupled with increasingly rigorous government mandates for dignified and forensic-standard handling of human remains, particularly in response to complex criminal investigations or mass casualty events. These drivers necessitate continuous investment in high-quality, reliable, and compliant infrastructure. Restraints primarily involve the substantial capital expenditure required for building and maintaining advanced facilities, particularly high-level containment morgues (BSL-3/4), alongside the shortage of highly specialized, trained personnel needed to operate and manage sophisticated equipment like advanced toxicology labs and digital pathology systems. Furthermore, regulatory hurdles related to data privacy and international transfers of forensic evidence can slow down the adoption of global, standardized systems. Opportunities, however, abound in modular and temporary mortuary solutions for disaster preparedness, the integration of IoT for remote monitoring and predictive maintenance of refrigeration units, and the expansion into emerging markets requiring rapid infrastructural upgrades.

Impact forces within this market are predominantly shaped by regulatory enforcement and public health crises. Stringent biohazard regulations, especially post-pandemic, mandate upgrades to air filtration, ventilation systems (downdraft and negative pressure), and specialized storage for infectious remains, compelling facility operators to invest proactively. Technology standardization, particularly concerning data interoperability between forensic labs, police departments, and judicial systems, is another strong force driving the adoption of standardized LIMS and digital platforms. Economic volatility, acting as a constraining force, can delay large-scale public sector construction projects in developing nations, prioritizing immediate healthcare needs over long-term mortuary infrastructure. Conversely, philanthropic initiatives and international aid focused on public health infrastructure in underserved regions act as a positive external force, facilitating the introduction of modern mortuary technologies and training programs, thereby incrementally expanding the global market footprint and driving demand for foundational equipment like cooling systems and basic examination tables.

The inherent sensitivity and ethical nature of the industry mean that societal expectations regarding respect and dignity significantly influence investment decisions, forcing providers to adopt aesthetically appropriate and human-centered design principles for viewing and receiving areas, which impacts construction and fit-out costs. Innovation is increasingly concentrated in traceability, with demand for non-invasive imaging techniques (e.g., post-mortem computed tomography, PMCT) reducing the reliance on traditional autopsy methods in certain jurisdictions, thus driving demand for highly specific imaging equipment suppliers within the facility ecosystem. The convergence of forensic science and public health requirements, requiring integrated facilities capable of handling both routine cases and complex criminal evidence preservation simultaneously, creates a strong impetus for comprehensive system providers capable of delivering customized, multi-functional mortuary solutions that adhere to diverse and often conflicting legal and procedural requirements.

Segmentation Analysis

The Mortuary Facility Market is comprehensively segmented based on the type of Equipment, the specific component of the Facility, the level of Technology utilized, and the ultimate End-User application. This multi-dimensional segmentation allows for a granular understanding of purchasing trends and investment priorities across different global regions and institutional types. Equipment segmentation typically includes high-value capital items such as refrigeration units, advanced autopsy tables, and specialized instruments, which represent the largest expenditure category. Facility component segmentation dissects the market based on required infrastructure, differentiating between storage areas (cold rooms, cabinets), examination suites (autopsy rooms), and administrative/viewing areas, each requiring distinct technological and design inputs. The End-User analysis is critical, distinguishing between high-volume, regulated institutions (Hospitals, Forensic Labs) and smaller, private operators (Funeral Homes), who have fundamentally different needs concerning scale, complexity, and regulatory adherence. The segmentation highlights the growing shift toward digitized systems and modular infrastructure designed for quick deployment and scalable operations.

- By Equipment Type

- Refrigeration Systems (Mortuary Cold Rooms, Mortuary Cabinets, Portable Cooling Units)

- Autopsy and Examination Equipment (Autopsy Tables - Downdraft, Hydraulic, Fixed; Mortuary Saws, Dissection Instruments, Scales)

- Handling and Transfer Equipment (Body Trays, Hydraulic Lifters, Roller Conveyors, Transfer Vehicles)

- Ancillary Equipment (Ventilation and Air Filtration Systems, Chemical Storage, Viewing Room Furniture)

- By Facility Type/Component

- Storage Infrastructure (Temporary Holding Areas, Long-Term Storage Rooms, Infectious Remains Storage)

- Examination and Pathology Suites (Autopsy Rooms, Histology Labs, Toxicology Labs)

- Administrative and Support Areas (Reception, Viewing Rooms, Decontamination Zones)

- By Technology

- Conventional Systems (Standard Refrigeration, Fixed Tables)

- Advanced and Digital Systems (Digital Pathology Integration, PMCT Scanners, RFID Tracking Systems, Laboratory Information Management Systems - LIMS)

- By End-User

- Hospitals and Medical Centers

- Forensic Science and Medical Examiner Offices

- Government Agencies (Military and Public Health Authorities)

- Private Funeral Homes and Crematoriums

- Academic and Research Institutions

Value Chain Analysis For Mortuary Facility Market

The value chain of the Mortuary Facility Market begins with upstream analysis, which is heavily concentrated on the sourcing and manufacturing of highly specialized materials, predominantly medical-grade stainless steel for equipment (tables, body trays) and precision cooling technology components (compressors, insulation materials). Manufacturers must adhere to rigorous quality control standards (ISO certification, medical device directives) due to the critical nature of preservation and hygiene. The complexity in this stage lies in maintaining a balance between durable, long-lasting construction required for intensive use in forensic settings and incorporating advanced features such as antimicrobial surfaces and energy-efficient cooling mechanisms. Key upstream suppliers include specialized metal fabricators, refrigeration component providers, and manufacturers of high-precision diagnostic and imaging instruments used in pathology labs integrated into the facility.

The midstream segment involves the core manufacturing and assembly of the integrated facility components, where specialized firms design, fabricate, and install the complete mortuary solution, often customized to the end-user’s specific architectural and operational requirements. This phase includes the integration of complex systems like negative pressure ventilation for autopsy rooms, sophisticated plumbing for waste management, and the setup of digital inventory tracking hardware. Distribution channels are crucial in ensuring the timely delivery and installation of these often large and sensitive systems. Direct channels, involving manufacturers selling directly to large government forensic institutions or major hospital groups, allow for customized contracting and installation services. Indirect channels utilize specialized medical equipment distributors and construction firms who manage the procurement and integration as part of a larger healthcare or public works project, providing necessary regional warehousing and specialized installation expertise in compliance with local building codes.

Downstream analysis focuses on the end-users—hospitals, forensic centers, and funeral homes—who utilize the facilities and services. The final stage also includes critical after-sales support, maintenance contracts, and validation services, which are significant revenue streams for market players. Given that equipment failure, especially refrigeration, can have severe legal and ethical repercussions, predictive maintenance and rapid response service agreements are highly valued. Potential customers frequently prioritize providers offering comprehensive service packages and long-term warranties. The entire value chain is heavily regulated; adherence to international forensic standards, health and safety regulations, and proper disposal protocols (e.g., chemical waste, biohazardous materials) adds significant complexity and cost, but also validates the necessity for high-quality, specialized providers throughout the chain.

Mortuary Facility Market Potential Customers

The primary customers and end-users of mortuary facility infrastructure and associated services span the public and private sectors, driven by legal mandates for handling the deceased and public health necessity. Hospitals and large medical centers represent a foundational customer base, requiring facilities for temporary holding, infection control, and supporting hospital-based pathology and medical training programs. Their needs focus heavily on efficient, medium-to-high capacity refrigeration systems and integrated morgue protocols that comply strictly with accreditation standards. Forensic Science Institutes and Medical Examiner Offices constitute the most technically demanding segment, requiring state-of-the-art facilities equipped with advanced autopsy tables, integrated imaging equipment (CT/X-ray), specialized toxicology labs, and highly secure chain-of-custody tracking systems, reflecting their critical role in the justice system and requiring substantial capital investment and continuous technology upgrades.

Government agencies, including military establishments, public health authorities, and disaster management bodies, are also significant buyers, particularly seeking solutions for mass casualty preparedness, rapid deployment, and high-volume, secure long-term storage capabilities, often necessitating modular or mobile mortuary solutions. This segment’s procurement decisions are heavily influenced by national security protocols, emergency planning budgets, and international cooperation standards. Private funeral homes and crematoriums represent a large, distributed customer segment whose needs are centered on smaller-scale, aesthetically pleasing, and dignified facilities, emphasizing viewing room quality, efficient cold storage cabinets, and user-friendly handling equipment tailored for the bereavement process, where customer service and operational efficiency are key purchasing drivers.

Additionally, Academic and Research Institutions, particularly those involved in anatomy, forensic anthropology, and medical research, require specialized facilities that accommodate instructional needs and ethical research protocols, often including features like dedicated dissection halls, advanced ventilation, and flexible body storage solutions that can cater to varying preservation methods beyond standard refrigeration. These diverse customer groups all share the need for reliable, compliant, and durable infrastructure, driving the demand for specialized vendors capable of meeting the stringent health, safety, and legal requirements specific to the management and examination of human remains across all operational scales and environments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | [USD 15.5 Billion] |

| Market Forecast in 2033 | [USD 21.0 Billion] |

| Growth Rate | [4.5% CAGR] |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | LEEC Ltd., Mopec Inc., CEABIS, Kugel Medical GmbH & Co. KG, Mortech Manufacturing Inc., Thermo Fisher Scientific Inc., Ferno-Washington, Inc., Medizintechnik Grieshaber GmbH, Funeral Services Group (FSG), Roftek Ltd., Fiocchetti Srl, Hygeco International, Afos LTD, Mortuary Equipment Sales, Nor-Lake Inc., Polarteknik, C.F.N. Medical Instruments Srl, Scientek, Mortuary Solutions UK, Cold Storage Technology (CST) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Mortuary Facility Market Key Technology Landscape

The technological landscape of the Mortuary Facility Market is rapidly evolving, driven primarily by the need for enhanced safety, improved preservation techniques, and digital integration for seamless data management and forensic integrity. The foundation of this landscape remains highly reliable refrigeration technology, but modern innovations include modular cold rooms with redundancy features, allowing for rapid expansion and preventing catastrophic failures. Advanced refrigeration systems now often incorporate IoT sensors for continuous temperature monitoring, logging, and remote diagnostics, crucial for maintaining preservation quality and complying with stringent legal evidence standards. Beyond cooling, infrastructure technology has advanced significantly in ventilation, with downdraft and negative pressure systems becoming standard in autopsy suites to protect personnel from aerosolized pathogens and harmful chemical fumes, such as formaldehyde, ensuring compliance with occupational safety regulations.

Digitalization represents the most transformative technological shift. Laboratory Information Management Systems (LIMS) and specialized mortuary management software are now integrated, providing digital tracking of human remains using RFID tags or barcodes from the moment of arrival until release, thereby automating the chain-of-custody process and significantly reducing human error in identification and documentation. Furthermore, the adoption of post-mortem computed tomography (PMCT) and magnetic resonance imaging (PMMRI) is becoming increasingly common in high-tier forensic facilities. These non-invasive imaging techniques offer detailed internal views, often supplementing or replacing traditional invasive autopsies, speeding up investigations, and providing three-dimensional data critical for complex forensic reconstructions, thereby driving demand for specialized radiological equipment designed for mortuary use.

Innovation also focuses on the equipment itself. Autopsy tables are now highly ergonomic, featuring hydraulic lift mechanisms, integrated sophisticated waste disposal systems (pulpers and biological waste treatment), and localized ventilation manifolds. Sustainable technology is an emerging priority, with facilities increasingly implementing energy-efficient building materials, heat recovery systems for cold rooms, and utilizing eco-friendly preservation chemicals where possible. The growing demand for digital pathology involves high-throughput slide scanners and cloud-based image analysis platforms, enabling remote collaboration between geographically distant pathologists and forensic experts, which improves case turnaround times and accessibility to specialized expertise, making technology a central determinant of facility quality and efficiency.

Regional Highlights

Regional dynamics play a crucial role in shaping the Mortuary Facility Market, with significant variances in regulatory stringency, technological maturity, and investment priorities across geographical areas. North America, specifically the United States and Canada, stands as a mature market leader, characterized by high penetration of advanced technologies such as PMCT scanners, integrated LIMS, and specialized BSL-3 standard forensic facilities. The market here is driven by continuous replacement cycles, stringent accreditation standards (e.g., NAME accreditation for medical examiner offices), and a strong emphasis on forensic science research and investment, sustaining high demand for complex, high-value equipment and sophisticated software solutions.

Europe represents another key region, exhibiting robust market growth driven by modernization efforts across national health services (NHS in the UK, centralized forensic services in Germany and France). European demand is characterized by a strong focus on energy efficiency, adherence to strict EU health and safety directives, and the adoption of dignified design principles for facilities. Western European countries maintain high technology standards, while Eastern European nations are actively investing in upgrades to align their infrastructure with broader EU regulations, often procuring integrated, modular solutions that balance cost-effectiveness with compliance requirements.

The Asia Pacific (APAC) region is forecasted to be the fastest-growing market globally. This exponential growth is underpinned by massive infrastructural development in countries like China, India, and Southeast Asian nations, where rapid urbanization and increasing public health expenditure necessitate the construction of new, large-scale hospitals and centralized government morgues. The APAC market is characterized by a dual demand structure: high-end equipment procurement by major metropolitan centers and a substantial need for reliable, cost-effective basic refrigeration and preservation infrastructure in rural and secondary urban areas, making scalability and local manufacturing capabilities vital competitive factors.

- North America: Dominance in high-tech solutions, driven by rigorous forensic standards and continuous hospital infrastructure renewal, strong adoption of digital tracking and PMCT.

- Europe: Focus on energy efficiency, stringent EU regulatory compliance, and modernization of public health morgue facilities, steady growth in integrated systems.

- Asia Pacific (APAC): Highest projected growth due to extensive hospital and government facility construction, significant demand for scalable, high-capacity cold storage solutions in densely populated areas.

- Latin America (LATAM): Growth driven by governmental efforts to improve forensic capabilities and justice system infrastructure, leading to targeted investments in standardized autopsy and storage equipment.

- Middle East and Africa (MEA): Emerging market opportunities fueled by large-scale infrastructure projects in Gulf Cooperation Council (GCC) countries and increasing focus on establishing modern, centralized public health and forensic institutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Mortuary Facility Market.- LEEC Ltd.

- Mopec Inc.

- CEABIS

- Kugel Medical GmbH & Co. KG

- Mortech Manufacturing Inc.

- Thermo Fisher Scientific Inc.

- Ferno-Washington, Inc.

- Medizintechnik Grieshaber GmbH

- Funeral Services Group (FSG)

- Roftek Ltd.

- Fiocchetti Srl

- Hygeco International

- Afos LTD

- Mortuary Equipment Sales

- Nor-Lake Inc.

- Polarteknik

- C.F.N. Medical Instruments Srl

- Scientek

- Mortuary Solutions UK

- Cold Storage Technology (CST)

- J M Equipment

- Surgical Medical Products

- Mortuary Equipment Company

- Medical & Scientific Equipment Ltd.

Frequently Asked Questions

Analyze common user questions about the Mortuary Facility market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Mortuary Facility Market?

The market growth is primarily driven by rising global mortality rates due to aging populations, increased government regulation mandating high standards for human remains handling and forensic investigation, and continuous investment in modernizing hospital and public health infrastructure worldwide to meet biosafety and dignity requirements.

How is technology impacting operational efficiency within modern mortuary facilities?

Technology significantly boosts efficiency through the implementation of digital solutions, specifically Laboratory Information Management Systems (LIMS) and RFID tracking, which automate chain-of-custody documentation, minimize identification errors, and allow for centralized inventory management of high-volume facilities. Advanced IoT sensors also optimize energy use in refrigeration units.

What are the key biosafety requirements driving investment in autopsy room technology?

Key biosafety requirements center on pathogen containment and chemical safety. This drives investment in advanced ventilation systems, such as downdraft and negative pressure tables, high-efficiency particulate air (HEPA) filtration, and non-porous, antimicrobial surfaces, ensuring maximum protection for morgue personnel during post-mortem examinations.

Which regional market is anticipated to show the highest growth rate during the forecast period?

The Asia Pacific (APAC) region is projected to exhibit the highest growth rate. This is due to extensive urbanization, rapid expansion of healthcare infrastructure, and increased public sector spending on forensic and pathology services in major economies like China and India, creating substantial demand for new facility construction and equipment procurement.

What are the main segmentation categories used to analyze the Mortuary Facility Market?

The market is typically segmented by Equipment Type (e.g., Refrigeration Systems, Autopsy Equipment), Facility Component (e.g., Storage Infrastructure, Examination Suites), Technology (e.g., Conventional vs. Digital Systems), and End-User (e.g., Hospitals, Forensic Science Institutes, Private Funeral Homes).

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager