Mosquito Repellent Ingredients Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433082 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Mosquito Repellent Ingredients Market Size

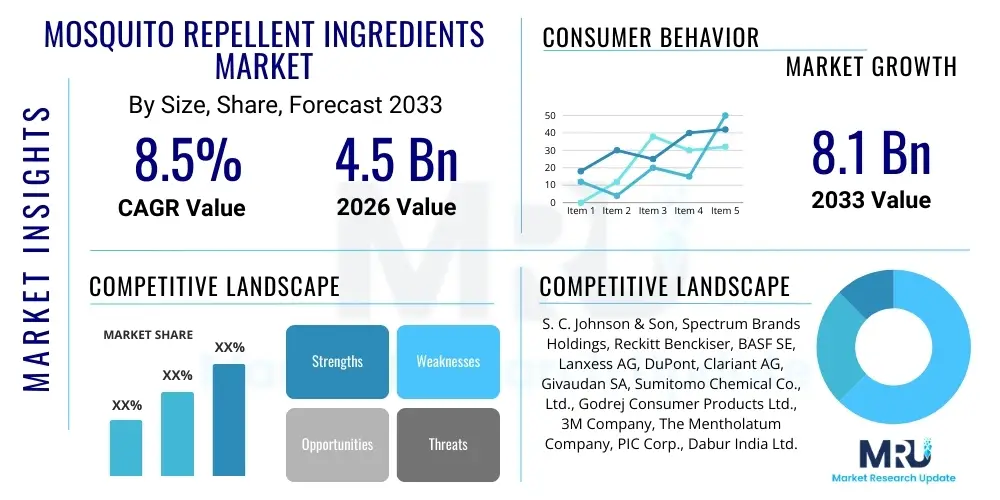

The Mosquito Repellent Ingredients Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 8.1 Billion by the end of the forecast period in 2033.

Mosquito Repellent Ingredients Market introduction

The Mosquito Repellent Ingredients Market encompasses a specialized segment within the broader chemical and consumer goods industry, focusing on the raw materials used to formulate products designed to deter mosquitoes and prevent vector-borne diseases such as Dengue, Malaria, Zika, and Chikungunya. These ingredients are broadly categorized into synthetic compounds, like DEET (Diethyltoluamide), Picaridin (Icaridin), and IR3535, and natural derivatives, including essential oils such as Citronella, Lemon Eucalyptus Oil (OLE/PMD), and Geraniol. The selection of ingredients is paramount, determined by factors such as efficacy duration, toxicity profile, regulatory approval status, and consumer preference for synthetic versus natural formulations. Manufacturers across aerosols, creams, lotions, coils, and wearable patches are the primary consumers of these specialized ingredients, driving continuous innovation in research and development to enhance product safety and performance, especially in highly humid and endemic regions globally.

The product scope of this market extends beyond direct topical applications to include ingredients utilized in space repellents and perimeter protection systems. Major applications center on consumer personal care products, military and outdoor recreation gear, and public health initiatives aimed at mass disease prevention. The key benefit of these ingredients is their critical role in public health protection, offering a primary defense mechanism against debilitating and often fatal mosquito-borne illnesses. Increased public awareness regarding the transmission risks associated with global warming and urbanization further fuels the demand for high-efficacy, long-lasting repellent ingredients, making them indispensable components of household defense and travel preparedness worldwide. The market dynamically responds to seasonal outbreaks and geopolitical shifts, demanding robust supply chains capable of delivering consistent quality and quantity of both established and newly developed active ingredients.

Driving factors for sustained market growth include the escalating prevalence of vector-borne diseases globally, coupled with supportive governmental health initiatives and educational campaigns promoting personal protective measures. Climate change is a significant environmental driver, as expanding mosquito habitats into previously temperate zones increases the global population at risk, necessitating widespread adoption of effective repellency measures. Furthermore, advancements in ingredient science, leading to the creation of microencapsulation technologies and extended-release formulas, enhance user compliance and product longevity. Consumer demand for "clean label" and naturally derived ingredients is pushing innovation toward botanical extracts, while the established efficacy of synthetic ingredients like DEET ensures their continued dominance in professional and high-risk applications, creating a dual trajectory of growth across both segments.

Mosquito Repellent Ingredients Market Executive Summary

The Mosquito Repellent Ingredients Market is characterized by robust growth, primarily driven by increasing global health concerns related to mosquito-borne diseases and the continuous search for high-performance, environmentally conscious formulations. Current business trends indicate a significant polarization between high-efficacy synthetic ingredients, which dominate in terms of market share due to established reliability, and rapidly expanding natural ingredients, favored by consumers seeking sustainable and chemical-free options. Strategic mergers, acquisitions, and partnerships focused on securing botanical sources and proprietary extraction technologies are common among major ingredient suppliers. Furthermore, innovation in delivery mechanisms, such as microencapsulation and polymer matrices, is a key focus, aiming to reduce the volatility of active compounds and extend protection periods, directly impacting raw material specifications and procurement strategies across the industry value chain.

Regional trends highlight the Asia Pacific (APAC) and Africa regions as pivotal growth engines, primarily due to the high endemicity of diseases like Malaria and Dengue, combined with large, rapidly urbanizing populations lacking adequate centralized vector control infrastructure. This necessitates high consumer reliance on personal repellents. North America and Europe, while having lower endemic risk for most major diseases, exhibit high demand for premium, regulated, and specialized ingredients catering to outdoor recreation and pet care segments, emphasizing product safety and environmental biodegradability. Segment trends show that Synthetic Ingredients, specifically DEET and Picaridin, maintain high volume consumption, although the Natural Ingredients segment, particularly essential oil derivatives and PMD, is recording the highest CAGR, reflective of evolving consumer preferences and aggressive marketing of green alternatives.

The market faces concurrent challenges, including stringent regulatory scrutiny regarding long-term ingredient safety and the ongoing issue of mosquito resistance development, which mandates constant R&D investment in novel active agents. Success in this market is intrinsically linked to demonstrating efficacy through rigorous testing and navigating the complex registration requirements across varied international jurisdictions, particularly concerning new botanical actives. The imperative to balance public health needs for effective protection with consumer preference for sustainable and gentle ingredients forms the core strategic challenge for ingredient manufacturers, dictating future investment into novel synthetic structures and advanced plant-based extraction techniques.

AI Impact Analysis on Mosquito Repellent Ingredients Market

User queries regarding AI's impact on the Mosquito Repellent Ingredients Market frequently center on predictive analytics for disease outbreaks, accelerated compound discovery, and optimizing manufacturing efficiency. Users are keenly interested in how machine learning models can forecast the spatial and temporal spread of mosquito populations and associated diseases, allowing ingredient manufacturers to pre-position inventory and adjust production schedules efficiently. Furthermore, there is significant interest in AI-driven drug discovery platforms that can rapidly screen thousands of potential novel repellent compounds, reducing the time and cost associated with traditional laboratory synthesis and testing. Concerns often revolve around the security and integration challenges of linking diverse data sets—climate data, epidemiological data, and chemical property data—necessary for effective predictive modeling and formulation optimization within a highly regulated market environment.

- AI-Powered Epidemiological Forecasting: Utilizing machine learning to predict mosquito migration patterns and disease hotspots, enabling targeted distribution of repellent products and raw materials.

- Accelerated Compound Discovery: Employing AI algorithms to screen virtual chemical libraries for novel, highly effective, and low-toxicity repellent molecules, drastically reducing R&D timelines.

- Supply Chain Optimization: Implementing AI and IoT for real-time tracking of raw material supply (both synthetic chemicals and natural botanicals), mitigating risks associated with climate disruptions and geopolitical instability.

- Precision Formulation: Using computational chemistry models to optimize ingredient ratios and delivery systems (e.g., controlled release polymers) for maximum efficacy and stability, enhancing product performance.

- Quality Control and Compliance: AI vision systems and data analytics ensuring high standards of purity and consistency for active ingredients, simplifying regulatory submissions and adherence to global standards.

DRO & Impact Forces Of Mosquito Repellent Ingredients Market

The Mosquito Repellent Ingredients Market is shaped by a powerful interplay of public health drivers, restrictive environmental regulations, and ongoing technological innovation. The core drivers stem from the unavoidable public health necessity to combat rapidly spreading mosquito-borne diseases, amplified by climatic changes that expand vector habitats and necessitate long-term personal protection strategies. Restraints principally involve the stringent regulatory hurdles imposed on new chemicals, the growing consumer skepticism towards synthetic ingredients (like DEET), and the persistent development of resistance in mosquito populations to established chemical classes, demanding costly and continuous investment in new active compounds. Opportunities arise from the burgeoning consumer demand for natural, sustainable, and biodegradable repellent alternatives, particularly in developed economies, alongside the potential for integrating advanced technology like encapsulation to enhance ingredient performance and lifespan. These factors collectively create a dynamic competitive landscape where scientific superiority, safety profile, and supply chain reliability are the paramount forces impacting market growth and direction.

Segmentation Analysis

The Mosquito Repellent Ingredients Market is primarily segmented based on the ingredient type, which fundamentally determines efficacy, regulatory status, and target consumer group. The two primary segments are Synthetic Ingredients and Natural Ingredients. Synthetic ingredients, including dominant substances like DEET and Picaridin, continue to hold the largest market share due to their proven, robust efficacy and long history of use, particularly crucial for applications in high-risk zones and military settings. Conversely, the Natural Ingredients segment, encompassing essential oils such as Citronella, Lemon Eucalyptus Oil (PMD), and other botanical derivatives, is experiencing rapid growth driven by the clean label movement, consumer aversion to synthetic chemicals, and the perceived safety profile for use with vulnerable populations, such as children and pets. Further segmentation by application (topical, space/indoor, apparel) and formulation type (liquid, solid, aerosol) provides detailed insight into end-user requirements and material handling considerations.

- Ingredient Type

- Synthetic Ingredients (e.g., DEET, Picaridin, IR3535)

- Natural Ingredients (e.g., PMD/OLE, Citronella, Geraniol, Soybean Oil)

- Formulation Type

- Liquid/Lotion/Cream

- Aerosol/Spray

- Coils/Mats/Vaporizers

- Wearables/Patches

- Application

- Topical (Skin Application)

- Space and Area Repellents (Indoor/Outdoor)

- Apparel and Gear Treatment

- End User

- Household/Residential

- Commercial/Industrial (e.g., Agriculture, Construction)

- Military and Defense

Value Chain Analysis For Mosquito Repellent Ingredients Market

The value chain for the Mosquito Repellent Ingredients Market is complex, beginning with the sourcing and synthesis of chemical intermediates or the cultivation and extraction of natural botanicals. Upstream analysis involves key chemical manufacturers specializing in polymerization, amidation, and complex organic synthesis for synthetic actives like DEET and Picaridin. For natural ingredients, the upstream stage is dominated by specialized agricultural firms and extraction companies, often concentrated in tropical or Mediterranean climates, focusing on sustainable sourcing and high-purity essential oil distillation. Consistency in quality and volume is a major concern upstream, as slight variations in chemical purity or botanical extraction efficiency can significantly impact the efficacy and regulatory compliance of the final repellent product. Investments in vertical integration or long-term sourcing contracts are common strategies used to mitigate volatility in raw material availability and pricing, especially for natural oils whose yield is heavily reliant on climate conditions.

The midstream process involves formulation specialists and contract manufacturers who purchase active ingredients and blend them with solvents, carriers, stabilizers, and fragrances to create the final consumer repellent product (e.g., lotions, aerosols, coils). This stage requires rigorous R&D to ensure stability, skin compatibility, and controlled release of the active ingredient. Quality assurance and regulatory compliance testing are critical steps at this juncture. Downstream analysis focuses on the distribution channels, which are bifurcated into direct and indirect routes. Direct channels involve B2B sales to large retail chains, pharmacies, and governmental agencies (e.g., public health programs). Indirect channels rely on wholesale distributors and third-party logistics providers (3PLs) to reach smaller retail outlets, e-commerce platforms, and international markets. The proliferation of e-commerce has significantly impacted the downstream segment, allowing smaller, specialized natural repellent brands to bypass traditional retail barriers and directly access health-conscious consumers, demanding flexible and efficient packaging and fulfillment logistics.

Effective distribution is paramount, particularly for rapid deployment during disease outbreaks or seasonal peaks. Supply chain agility is a crucial competitive factor, requiring sophisticated inventory management systems to balance highly seasonal demand against the shelf-life constraints of certain formulations. Marketing and consumer education also play a vital role downstream, informing consumers about the correct usage and relative efficacy of different ingredient types (synthetic versus natural). The entire chain is heavily influenced by regulatory bodies like the EPA (in the US) or ECHA (in the EU), which regulate ingredient registration, claim substantiation, and packaging safety, adding substantial compliance costs and risk management requirements throughout the value delivery process, from raw material extraction to final product sale.

Mosquito Repellent Ingredients Market Potential Customers

Potential customers for mosquito repellent ingredients primarily consist of manufacturers specializing in consumer protection and personal care products, alongside governmental bodies engaged in public health initiatives. The largest segment includes multinational Fast-Moving Consumer Goods (FMCG) corporations that produce mass-market aerosols, lotions, and creams under established household brands. These customers require large, consistent volumes of active ingredients (both DEET and natural oils) that meet strict safety and dermatological standards for broad consumer use. A secondary, but highly critical, customer base includes specialized chemical and textile companies that manufacture treated apparel, military uniforms, and camping gear, demanding highly durable and encapsulated forms of ingredients that offer protection through fabric contact, focusing heavily on permethrin-based solutions and long-lasting synthetic actives like Picaridin.

Furthermore, smaller, niche market formulators focused on organic, natural, or specialty products (e.g., baby-safe repellents, pet care products) constitute a growing customer group, exhibiting high willingness to pay for certified organic or sustainably sourced botanical extracts, such as specific grades of Citronella or OLE/PMD. Finally, government and non-governmental organizations (NGOs) often procure bulk quantities of ingredients or finished goods for large-scale distribution programs in endemic regions, prioritizing cost-effectiveness, WHO endorsement, and proven, high-efficacy formulations suitable for harsh environmental conditions. These diverse customer profiles necessitate ingredient suppliers to offer a varied product portfolio, supported by robust regulatory documentation and clinical efficacy data tailored to specific end-application requirements and geographical regulatory frameworks, ensuring widespread acceptance and marketability across various channels.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 8.1 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | S. C. Johnson & Son, Spectrum Brands Holdings, Reckitt Benckiser, BASF SE, Lanxess AG, DuPont, Clariant AG, Givaudan SA, Sumitomo Chemical Co., Ltd., Godrej Consumer Products Ltd., 3M Company, The Mentholatum Company, PIC Corp., Dabur India Ltd., Entek Corporation, Vertellus Specialties, Inc., Jiangsu Yangnong Chemical Group Co., Ltd., Kenko Corporation, Kapi Limited, and Aromafloria. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Mosquito Repellent Ingredients Market Key Technology Landscape

The technological landscape of the Mosquito Repellent Ingredients Market is characterized by a strong focus on enhancing efficacy, extending duration, and improving the cosmetic acceptance of formulations. A crucial area of technological innovation is microencapsulation, where active ingredients, both synthetic (like DEET) and natural (like PMD), are encased within microscopic polymer shells. This technology serves multiple purposes: it prevents rapid evaporation of the volatile compound, leading to extended protection times; it minimizes direct skin contact, thereby reducing irritation and improving the sensory profile; and it allows for controlled, slow release of the active agent, which is essential for specialized products like treated fabrics and long-wear patches. Continuous advancements in polymer chemistry are dedicated to creating biodegradable and environmentally friendly encapsulation materials that align with sustainable consumer demands without compromising the required mechanical and barrier properties.

Another significant technological advancement involves the development of novel synergistic blends and green chemistry processes. Research is actively exploring combinations of ingredients that, when used together, offer superior protection compared to individual components (synergism), potentially allowing for lower concentrations of the most potent chemicals, such as DEET, while maintaining high efficacy. Furthermore, green chemistry techniques are transforming the natural ingredients sector, utilizing advanced extraction methods like supercritical CO2 extraction or molecular distillation to isolate highly concentrated, pure active compounds (e.g., p-Menthane-3,8-diol (PMD) from lemon eucalyptus oil). These methods improve yield and purity, minimizing the environmental impact associated with solvent-based extraction and addressing consistency challenges that have historically plagued the adoption of natural repellents in large-scale formulations. Computational toxicology and QSAR (Quantitative Structure-Activity Relationship) modeling are increasingly used to predict the toxicity and efficacy profile of new ingredient candidates digitally, accelerating the research phase before costly in-vivo testing, leading to faster market introduction of safer, innovative repellent solutions.

The integration of advanced formulation science is vital for maintaining market relevance. This includes developing optimized emulsifiers and carriers that allow high concentrations of oil-based repellents to be formulated into light, non-greasy lotions or aqueous sprays, meeting the high standards of modern cosmetic appeal. Furthermore, smart material technology is impacting the wearables segment, with ingredients being embedded into polymer matrices in wristbands and patches designed for sustained, low-dose release over weeks or months. Ingredient manufacturers are increasingly investing in spectroscopic analysis and chromatographic techniques to ensure the absolute purity and stability of their supplies, confirming compliance with rigorous regulatory specifications globally. This technological focus ensures that ingredients not only effectively repel mosquitoes but also perform reliably under diverse climatic conditions while meeting the aesthetic and environmental expectations of the global consumer base, driving product differentiation and value creation across the market spectrum.

Regional Highlights

Regional variations in mosquito species, climate, public health infrastructure, and regulatory environments profoundly shape the demand and consumption patterns for repellent ingredients globally. The Asia Pacific (APAC) region stands out as the dominant market for ingredient consumption. This dominance is attributed to the high population density, tropical and sub-tropical climates supporting multiple breeding cycles, and the endemic status of severe mosquito-borne diseases like Dengue, Zika, and Japanese encephalitis, necessitating widespread use of both personal and space repellents (coils and vaporizers). Countries like India, China, and Indonesia exhibit immense demand, driving high consumption of cost-effective synthetic ingredients and traditional natural options like citronella, alongside an emerging preference for regulated, higher-efficacy synthetic alternatives like Picaridin.

North America and Europe represent mature markets characterized by high regulatory standards, emphasis on ingredient safety, and demand primarily driven by seasonal outdoor recreation and travel concerns. In these regions, the preference leans toward highly researched ingredients like DEET and Picaridin for high-performance applications, complemented by a strong consumer trend favoring PMD and other natural ingredients for daily, low-exposure use, particularly in the premium and specialty retail segments. The regulatory burden, especially under the EU's Biocidal Products Regulation (BPR), significantly influences the pace of new ingredient adoption and market strategy, emphasizing sustainable and biodegradable attributes. The focus here is on product aesthetics, low skin irritation, and advanced formulation technologies, such as microencapsulation, that extend efficacy without residual greasiness or strong odors.

The regions of Latin America and the Middle East and Africa (MEA) are critical growth frontiers, linked directly to ongoing climate variability and poor sanitation infrastructure that exacerbate mosquito proliferation. Latin America, particularly Brazil and Mexico, experiences significant outbreaks of Zika and Dengue, requiring substantial governmental procurement and consumer use of highly efficacious ingredients. Africa remains the primary global focus for malaria prevention, driving consistent, high-volume demand for WHO-recommended ingredients suitable for large-scale distribution programs, often favoring highly effective, albeit sometimes challenging, synthetic options for insecticide-treated nets and topical use. Economic volatility and logistical challenges in MEA require ingredient suppliers to adopt flexible pricing and robust supply chain models, prioritizing immediate effectiveness and affordability in ingredient choice over premium aesthetic considerations prevalent in developed markets.

- Asia Pacific (APAC): Highest volume market, driven by endemic diseases (Dengue, Malaria), dense population, and tropical climates; strong demand for both cost-effective synthetics (DEET) and traditional natural ingredients (Citronella).

- North America: Mature market characterized by high regulatory compliance; demand focused on premium, low-irritation synthetics (Picaridin) and advanced natural derivatives (PMD) for recreational use and personal health.

- Europe: Driven by strict adherence to the Biocidal Products Regulation (BPR); increasing focus on sustainable, biodegradable formulations and sophisticated microencapsulation technology for extended efficacy.

- Latin America (LATAM): High growth potential fueled by recurrent Zika and Dengue outbreaks; significant government involvement in ingredient procurement for public health campaigns.

- Middle East and Africa (MEA): Critical market for global public health initiatives, high demand for cost-effective, high-efficacy ingredients crucial for combating Malaria, often driven by NGO and government purchases.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Mosquito Repellent Ingredients Market.- S. C. Johnson & Son Inc.

- Spectrum Brands Holdings Inc.

- Reckitt Benckiser Group PLC

- BASF SE

- Lanxess AG

- DuPont de Nemours, Inc.

- Clariant AG

- Givaudan SA

- Sumitomo Chemical Co., Ltd.

- Godrej Consumer Products Ltd.

- 3M Company

- The Mentholatum Company

- PIC Corporation

- Dabur India Ltd.

- Entek Corporation

- Vertellus Specialties, Inc.

- Jiangsu Yangnong Chemical Group Co., Ltd.

- Kenko Corporation

- Kapi Limited

- Aromafloria

- Bayer AG

- Dow Chemical Company

- Rallis India Limited

- Isagro S.p.A.

- Zhejiang Core Technology Co., Ltd.

- Henkel AG & Co. KGaA

- Shiseido Company, Limited

- Avon Products, Inc.

- PZ Cussons Plc

- Sanofi S.A.

- ICL Group Ltd.

- Croda International Plc

- Ashland Global Holdings Inc.

- Evonik Industries AG

- FMC Corporation

- Mitsui Chemicals, Inc.

- Nufarm Limited

- Albemarle Corporation

- Akzo Nobel N.V.

- Ajinomoto Co., Inc.

- DSM Nutritional Products AG

- International Flavors & Fragrances Inc. (IFF)

- Symrise AG

- Firmenich International SA

- Kerry Group plc

- Tate & Lyle PLC

- Sensient Technologies Corporation

- Takasago International Corporation

- Wacker Chemie AG

- Lonza Group AG

- Sartomer Company (Arkema Group)

- Cabot Corporation

- Solvay S.A.

- Neste Oyj

- P&G (Procter & Gamble)

- Colgate-Palmolive Company

Frequently Asked Questions

Analyze common user questions about the Mosquito Repellent Ingredients market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary drivers accelerating growth in the Mosquito Repellent Ingredients Market?

The primary drivers include the escalating global prevalence of mosquito-borne diseases such as Dengue and Zika, amplified by climate change extending vector habitats, and increased public health awareness promoting prophylactic personal protection measures.

How are Synthetic and Natural Repellent Ingredients segmented by market share?

Synthetic ingredients, particularly DEET and Picaridin, hold the largest volumetric market share due to their established high efficacy. However, Natural Ingredients, driven by consumer demand for cleaner labels and sustainability, are exhibiting the highest Compound Annual Growth Rate (CAGR).

What role does technology like microencapsulation play in the market?

Microencapsulation technology is critical for improving ingredient performance by enabling controlled, slow release of actives, which extends the product's protective duration, reduces volatility, and minimizes skin irritation, thereby enhancing overall product appeal and compliance.

Which region currently dominates the consumption of Mosquito Repellent Ingredients?

The Asia Pacific (APAC) region dominates consumption due to its large population, tropical climate conducive to year-round mosquito activity, and the high endemic risk associated with severe vector-borne illnesses, necessitating extensive use of repellent products.

What major regulatory challenge faces new ingredient introductions globally?

The major regulatory challenge is navigating the highly stringent and expensive approval processes (e.g., US EPA and EU BPR), requiring extensive data on toxicology, environmental impact (biodegradability), and proven efficacy to achieve registration and market entry, especially for novel synthetic or natural actives.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager