Motion Sensing Lightings Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431725 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Motion Sensing Lightings Market Size

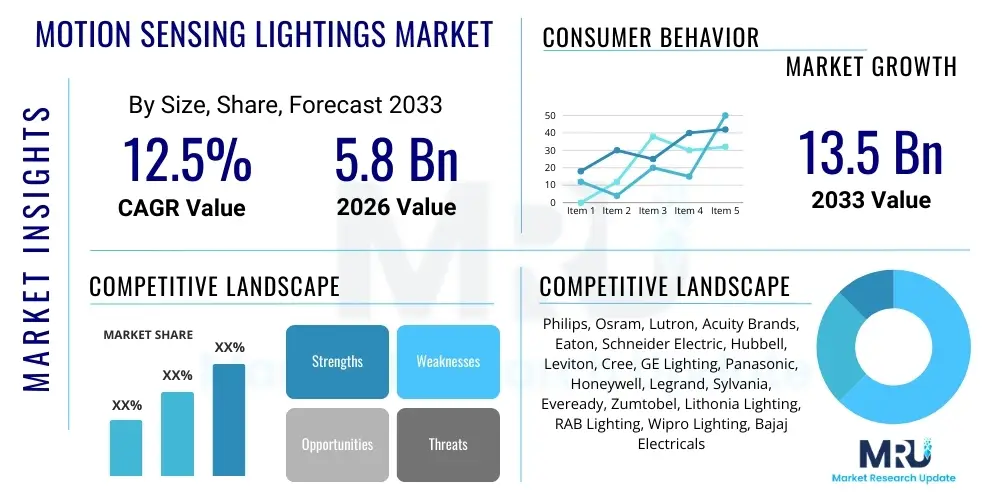

The Motion Sensing Lightings Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at $5.8 Billion in 2026 and is projected to reach $13.5 Billion by the end of the forecast period in 2033.

Motion Sensing Lightings Market introduction

The Motion Sensing Lightings Market encompasses advanced illumination systems integrated with proximity sensors, primarily Passive Infrared (PIR), microwave, and ultrasonic technologies, designed to automatically control lighting output based on the detection of movement within a designated area. These systems are foundational to modern energy conservation strategies, reducing overall electricity consumption by ensuring lights are only active when spaces are occupied. The core product offering includes integrated fixtures, standalone sensors, and networked control units compatible with various lighting sources, predominantly high-efficiency Light Emitting Diodes (LEDs). The evolution of these systems is closely linked to the proliferation of smart building infrastructure and the rising global mandate for sustainable urban development.

Major applications of motion sensing lighting span across residential, commercial, industrial, and public infrastructure sectors. In commercial spaces such as office buildings and retail environments, they are critical for optimizing lighting in common areas, stairwells, and restrooms. Industrial facilities utilize them extensively in warehouses and manufacturing floors to enhance safety and manage substantial energy loads. For residential users, the primary benefits revolve around convenience, security enhancement through automated exterior lighting, and significant savings on utility bills. The technological integration of these sensors with networking protocols like Zigbee and Bluetooth Mesh is further expanding their utility into comprehensive Building Management Systems (BMS).

The principal benefits driving market penetration include unparalleled energy savings, extended lifespan of lighting components due to reduced operational hours, and enhanced security and safety features. Key driving factors accelerating market growth include stringent governmental regulations promoting energy efficiency, rapidly declining costs of sensor and LED components, and the surging global adoption of Internet of Things (IoT) technologies in smart homes and smart cities. Furthermore, growing consumer awareness regarding environmental sustainability and the tangible return on investment (ROI) offered by automated lighting systems are cementing the market's robust upward trajectory.

Motion Sensing Lightings Market Executive Summary

The Motion Sensing Lightings Market is experiencing dynamic growth, characterized by significant technological convergence, primarily driven by the imperative for energy efficiency across all major end-use sectors. Business trends indicate a decisive shift towards wireless connectivity and decentralized control systems, moving away from traditional hardwired installations. Market participants are focusing heavily on developing miniaturized, aesthetically appealing sensor modules that can be seamlessly integrated into modern architectural designs. Furthermore, strategic partnerships between sensor manufacturers and LED fixture producers are streamlining the supply chain and accelerating product innovation, particularly in dual-technology sensors that combine PIR and microwave detection for optimal accuracy and reduced false triggers.

Regional trends reveal that North America and Europe maintain maturity in adopting high-end, networked sensor solutions, fueled by supportive energy codes and high consumer purchasing power for smart home technologies. However, the Asia Pacific region, led by rapidly urbanizing economies like China and India, is projected to exhibit the fastest growth rate. This rapid expansion is attributed to massive investments in commercial and public infrastructure development, coupled with governmental initiatives subsidizing the adoption of energy-efficient lighting solutions in new construction projects. Latin America and the Middle East & Africa are emerging markets, where growth is primarily concentrated in hospitality and large-scale industrial projects requiring efficient energy management.

Segment trends underscore the dominance of the commercial sector in terms of market share due to larger deployment scales and regulatory compliance requirements. Within sensor types, Passive Infrared (PIR) technology remains the most utilized due to its cost-effectiveness, though microwave sensors are gaining traction in high-ceiling environments and areas requiring higher sensitivity through non-obstructive surfaces. The shift from traditional light sources to LED integrated fixtures is nearly complete across all segments, ensuring that future growth is intrinsically linked to smart control features. The fastest-growing segment is expected to be wireless connectivity solutions, specifically those leveraging low-power protocols suitable for massive IoT deployment and robust integration into smart building platforms.

AI Impact Analysis on Motion Sensing Lightings Market

Common user questions regarding AI's impact on motion sensing lighting frequently revolve around how artificial intelligence can move the systems beyond simple on/off functionality to predictive and adaptive lighting control. Users are keen to understand if AI can eliminate false positives (e.g., HVAC movement triggering lights) and optimize energy use by learning complex occupant behavior patterns over time. Key concerns center on data privacy associated with continuous monitoring of movement and the complexity of commissioning and maintaining AI-driven systems. There is also a strong expectation that AI should enable hyper-personalization of lighting environments, adjusting intensity, color temperature, and zone based on learned preferences rather than just presence detection.

The integration of AI algorithms, particularly machine learning (ML), transforms motion sensing lighting into an intelligent system capable of contextual awareness. Instead of merely reacting to motion, AI systems analyze temporal data, spatial patterns, and occupancy density to predict future lighting needs. This transition from reactive control to proactive intelligence drastically improves both energy efficiency and user experience. For instance, an AI-powered system in an office environment can learn that a specific meeting room is typically utilized for two hours every Tuesday morning and pre-adjust the light level and color spectrum minutes before expected arrival, while also intelligently delaying shut-off based on known meeting durations.

Furthermore, AI facilitates predictive maintenance and fault detection within the lighting network. By continuously analyzing performance data from thousands of connected sensors and fixtures, AI can identify anomalies, forecast potential component failures (e.g., sensor calibration drift or LED degradation), and automatically generate maintenance tickets. This capability minimizes system downtime and reduces operational expenses, positioning AI as a critical layer for large-scale, enterprise-level lighting control platforms. The data gathered by these AI systems also provides valuable insights for space utilization and facility management planning, extending the value proposition far beyond simple energy savings.

- AI enables predictive lighting control by learning and forecasting occupancy patterns, optimizing energy consumption beyond simple presence detection.

- Machine learning algorithms enhance sensor accuracy, effectively filtering out noise and environmental disturbances to reduce false light triggers.

- AI drives hyper-personalization, adjusting light intensity, color temperature, and zoning based on individual or group historical preferences.

- Integration with computer vision allows AI systems to analyze occupancy density and flow, dynamically allocating resources in complex environments like airports or hospitals.

- Predictive maintenance analytics, powered by AI, monitor sensor and fixture health, forecasting failures and improving system longevity and reliability.

- AI facilitates deep integration into Smart Building Management Systems (BMS), correlating lighting data with HVAC and security systems for holistic operational efficiency.

DRO & Impact Forces Of Motion Sensing Lightings Market

The growth trajectory of the Motion Sensing Lightings Market is strongly influenced by a robust set of drivers, tempered by specific restraints, while presenting substantial future opportunities, all modulated by pervasive impact forces. The primary driver is the accelerating global focus on energy conservation, underpinned by governmental mandates and high energy tariffs, making the ROI of smart lighting systems compelling. Furthermore, the rapid growth of the smart home and smart city concepts provides a fertile ground for the seamless integration and widespread adoption of these sophisticated lighting controls. However, market penetration is restrained by the relatively high initial installation cost compared to conventional lighting and the perceived complexity of commissioning and networking advanced wireless systems, particularly in existing building retrofits.

Key opportunities exist in the development of sophisticated, dual-technology sensors that offer enhanced reliability and versatility in challenging environments, such as cold storage or outdoor public spaces. The integration of motion sensing capabilities directly into the LED chipsets (on-chip sensing) presents a major technological opportunity, reducing the component count and improving aesthetic integration. Furthermore, emerging markets offer vast, untapped potential for large-scale infrastructure projects requiring optimized energy solutions. The impact forces acting on this market include intense competition leading to rapid price erosion of standard PIR sensors, the influence of global standardization bodies (e.g., DALI, Matter) on connectivity protocols, and the continuous advancement in battery life and low-power wireless communication technologies, enabling truly maintenance-free installations.

Ultimately, the market is defined by the ongoing trade-off between installation complexity and the lifetime energy savings realized. The long-term success of market players hinges on developing user-friendly, plug-and-play solutions that minimize commissioning time and reduce reliance on specialized technical expertise. Addressing consumer concerns about data privacy and system reliability, especially in AI-integrated platforms, will be crucial. The synergistic relationship between the LED lighting market and the IoT infrastructure market ensures that as connectivity becomes cheaper and more ubiquitous, motion sensing lighting will evolve from an optional accessory to a mandatory component of efficient building operation, solidifying its essential status in modern infrastructure planning.

Segmentation Analysis

The Motion Sensing Lightings Market is structurally segmented based on sensor technology utilized, the type of light source, connectivity method employed, and the broad application sector served. This granular segmentation provides critical insights into purchasing patterns and technological preferences across diverse end-user groups. The dominance of LED integration across all segments highlights the market's focus on maximizing efficiency gains. Analyzing the market by connectivity reveals the dynamic shift towards wireless solutions driven by flexibility and scalability requirements in modern smart buildings, contrasting with the robustness and reliability offered by traditional wired systems in industrial environments.

- By Sensor Type: Passive Infrared (PIR), Ultrasonic, Microwave, Dual Technology.

- By Connectivity: Wired, Wireless (Wi-Fi, Zigbee, Bluetooth, LoRaWAN).

- By Application: Residential (Indoor and Outdoor), Commercial (Offices, Retail, Healthcare, Educational Institutions), Industrial (Warehouses, Manufacturing), Public Infrastructure (Street Lighting, Parking Garages).

- By Light Type: LED Integrated Fixtures, Fluorescent, High-Intensity Discharge (HID), Halogen.

Value Chain Analysis For Motion Sensing Lightings Market

The value chain for the Motion Sensing Lightings Market is complex, beginning with upstream activities focused on raw material procurement, semiconductor manufacturing, and specialized sensor component fabrication. Upstream players, including silicon providers and specialized sensor element manufacturers (e.g., pyroelectric sensor makers for PIR), hold significant leverage as their technological advancements dictate the sensitivity, size, and cost base of the final product. Research and development activities at this stage focus on increasing detection accuracy, reducing false triggers, and achieving better integration capabilities with microcontrollers and wireless communication modules. Efficient sourcing and high-quality production of these core components are crucial for maintaining competitiveness in the downstream market.

Midstream activities encompass the manufacturing, assembly, and integration of the sensors into lighting fixtures and control systems. This stage involves LED packaging, driver circuit manufacturing, and the final assembly of the lighting fixture with the integrated sensor module and communication chipsets. Manufacturers must navigate complexities related to system compatibility, ensuring that their products adhere to various regional safety and energy standards (e.g., UL, CE, Energy Star). Distribution channels are bifurcated into direct sales to large corporate clients (BMS integrators, industrial customers) and indirect sales through wholesalers, electrical distributors, and retail channels for residential and smaller commercial projects. The efficiency of the distribution network is vital for market penetration and timely delivery of solutions.

The downstream segment involves installation, system integration, software development, and post-sales maintenance services. System integrators and energy service companies (ESCOs) play a pivotal role here, offering specialized expertise in designing, commissioning, and maintaining large-scale networked lighting systems, particularly those utilizing advanced AI-driven control software. Direct channels are preferred for high-value industrial and commercial projects where customization and long-term service contracts are required. Indirect channels, relying on standard electrical contractors, dominate the residential and small office markets. The ongoing service and software update revenue streams, especially for wireless and networked systems, represent a growing area of value capture in the downstream market, emphasizing the shift towards Lighting-as-a-Service (LaaS) models.

Motion Sensing Lightings Market Potential Customers

The primary target audience for motion sensing lightings systems is broadly diversified but can be categorized into entities prioritizing energy conservation, regulatory compliance, and enhanced safety/security. End-users in the commercial sector, particularly large corporate entities operating expansive office parks, retail chains, and hospitality venues, constitute a significant customer base. These buyers are typically focused on substantial operational cost reduction realized through minimized electricity use and demonstrating compliance with green building certifications like LEED or BREEAM, making the investment highly justifiable through financial savings and corporate social responsibility (CSR) initiatives.

Industrial customers, comprising logistics centers, large-scale warehouses, and manufacturing plants, are characterized by expansive floor spaces and 24/7 operational requirements, making them ideal adopters. For these environments, motion sensing lighting not only yields massive energy savings in low-traffic areas but also significantly contributes to worker safety by ensuring immediate, high-quality illumination when presence is detected, often utilizing ruggedized fixtures and robust microwave sensor technologies suitable for harsh conditions. The purchasing decision in this sector is heavily influenced by total cost of ownership (TCO), durability, and ease of integration with existing industrial automation systems.

Additionally, governmental and municipal authorities represent a high-volume potential customer segment, primarily for public infrastructure applications such as street lighting, tunnels, and public parking facilities. The adoption here is usually mandated by energy efficiency goals set at the federal or local level, driving the need for sophisticated, networked sensor solutions that can operate reliably in outdoor conditions. Residential consumers, while lower in volume per transaction, collectively represent a rapidly growing segment, driven by the convenience and security aspects of smart home integration, preferring simple, wireless, and aesthetically pleasing PIR-based fixtures for both interior and exterior use.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $5.8 Billion |

| Market Forecast in 2033 | $13.5 Billion |

| Growth Rate | CAGR 12.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Philips, Osram, Lutron, Acuity Brands, Eaton, Schneider Electric, Hubbell, Leviton, Cree, GE Lighting, Panasonic, Honeywell, Legrand, Sylvania, Eveready, Zumtobel, Lithonia Lighting, RAB Lighting, Wipro Lighting, Bajaj Electricals |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Motion Sensing Lightings Market Key Technology Landscape

The technology landscape of the Motion Sensing Lightings Market is characterized by the continuous refinement of detection methodologies and the rapid advancement of embedded communication protocols. Passive Infrared (PIR) sensors remain the dominant technology due to their low cost and low power consumption, detecting thermal radiation changes caused by moving objects. However, modern PIR sensors incorporate complex lens arrays and multi-element designs to refine detection fields and minimize false triggers. Microwave sensors, which operate based on the Doppler effect, are growing significantly, offering wider coverage, the ability to penetrate non-metallic obstacles, and higher sensitivity, making them ideal for high-bay industrial applications and outdoor security lighting.

A crucial technological shift involves the transition toward Dual Technology (DT) sensors, which combine PIR and microwave or ultrasonic elements. These DT systems significantly boost detection accuracy and reliability, particularly in large rooms or areas with fluctuating ambient temperatures, by requiring both detection methods to confirm presence before activating or deactivating the lighting. This synergistic approach effectively mitigates common issues like lights turning off prematurely when occupants are still present but stationary. Furthermore, the miniaturization of sensor components allows for deep integration directly within the light fixture, improving aesthetics and ease of installation.

Connectivity standards are equally vital, with wireless protocols defining the market's future. Wi-Fi and Bluetooth Mesh are critical for residential and small commercial sectors due to easy integration with existing consumer electronics. However, in large-scale commercial and industrial deployments, proprietary mesh networks and industry standards like Zigbee, Z-Wave, and the emerging Matter protocol are gaining traction for their robust security, scalability, and long-range, low-power operation. The growing adoption of Power over Ethernet (PoE) technology is also reshaping the landscape, allowing sensors and fixtures to receive both power and data over a single cable, simplifying installation architecture and maximizing data transmission speeds for advanced control algorithms.

Regional Highlights

- North America: This region is characterized by high market maturity and technological sophistication, particularly in the commercial and institutional sectors. Strict energy consumption regulations, like those implemented in California and various state-level energy codes, mandate the use of advanced lighting controls, strongly favoring motion sensing technologies. The robust presence of major technology hubs and high consumer disposable income accelerates the adoption of premium, AI-integrated smart lighting solutions. The market focus is primarily on advanced retrofit solutions for aging building infrastructure and seamless integration within comprehensive building automation systems (BAS). The strong presence of key players and high competition drive continuous innovation in wireless connectivity and cybersecurity features for commercial applications.

- Europe: Driven by ambitious European Union energy efficiency directives (e.g., the Energy Performance of Buildings Directive - EPBD), Europe exhibits strong market growth, particularly in Germany, the UK, and the Nordic countries. The region demonstrates a high preference for DALI (Digital Addressable Lighting Interface) based wired systems for guaranteed reliability in commercial projects, alongside rapidly growing adoption of wireless mesh networks conforming to Zigbee standards. Sustainability concerns and a strong emphasis on smart city initiatives push the demand for high-quality, long-life, and serviceable outdoor motion sensing fixtures used in public spaces and street lighting infrastructure. Government incentives for green renovations further stimulate the replacement of older systems with integrated LED and sensor technology.

- Asia Pacific (APAC): APAC represents the fastest-growing market globally, fueled by rapid urbanization, massive investments in smart city projects (especially in China, India, and Southeast Asia), and burgeoning construction activity in both residential and commercial real estate. While cost sensitivity remains high, the increasing implementation of national energy efficiency standards is boosting demand. China dominates the regional market due to vast manufacturing capabilities and substantial domestic construction, favoring high-volume, cost-effective PIR sensor solutions. The market is evolving rapidly from basic, localized motion detection to sophisticated, centralized control systems necessary for managing large-scale infrastructure developments and sprawling industrial complexes.

- Latin America (LATAM): The LATAM market is nascent but shows strong potential, driven primarily by the need for enhanced security lighting in residential and commercial areas, coupled with high electricity costs that incentivize efficiency measures. Brazil and Mexico are leading the regional adoption due to their larger economies and infrastructure spending. Challenges include fluctuating economic stability and varying regulatory frameworks, but opportunities exist in the industrial and hospitality sectors where energy savings translate directly into significant operational cost reductions. Adoption is typically focused on established, reliable PIR and basic microwave technologies.

- Middle East and Africa (MEA): Growth in the MEA region is heavily concentrated in the Gulf Cooperation Council (GCC) countries, particularly Saudi Arabia and the UAE, driven by mega-infrastructure projects, luxury residential developments, and rapid commercialization. High ambient temperatures necessitate robust sensor technology, often favoring microwave sensors. The region's focus on smart and sustainable building design, often linked to oil revenue diversification strategies, ensures a high demand for premium, integrated lighting control systems. In Africa, adoption is slower but accelerating in commercial buildings and industrial zones seeking immediate energy cost relief.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Motion Sensing Lightings Market.- Philips (Signify)

- Osram (AMS-Osram)

- Lutron Electronics Co., Inc.

- Acuity Brands, Inc.

- Eaton Corporation plc

- Schneider Electric SE

- Hubbell Incorporated

- Leviton Manufacturing Co., Inc.

- Cree Lighting (IDEAL Industries)

- GE Lighting (Savoy Group)

- Panasonic Corporation

- Honeywell International Inc.

- Legrand S.A.

- Sylvania (LEDVANCE)

- Eveready Industries India Ltd.

- Zumtobel Group AG

- Lithonia Lighting

- RAB Lighting Inc.

- Wipro Lighting

- Bajaj Electricals Ltd.

Frequently Asked Questions

Analyze common user questions about the Motion Sensing Lightings market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Motion Sensing Lightings Market?

The predominant driver is the global mandate for energy conservation and sustainability, supported by stringent governmental regulations and rapidly increasing energy costs, making motion sensing systems essential for achieving high energy efficiency and swift return on investment (ROI) in commercial and public infrastructure.

Which sensor technology dominates the market and why are dual-technology sensors gaining popularity?

Passive Infrared (PIR) sensors currently dominate due to their cost-effectiveness and low power draw. Dual-technology (DT) sensors, which combine PIR with microwave or ultrasonic sensing, are gaining popularity because they significantly enhance detection accuracy and system reliability, minimizing false off events and improving user experience in complex environments.

How is AI impacting the functionality of motion sensing lighting systems?

AI integration transforms reactive lighting control into proactive intelligence by enabling systems to learn, predict, and forecast occupancy patterns and user preferences. This leads to optimization far beyond basic motion detection, resulting in personalized environments and superior energy savings through contextual awareness.

What are the key connectivity options utilized in commercial motion sensing lighting installations?

Commercial installations primarily utilize robust, scalable protocols such as Zigbee, Bluetooth Mesh, and Power over Ethernet (PoE). These protocols support large-scale networks, facilitate centralized control through Building Management Systems (BMS), and ensure reliable, secure data transmission across extensive floor plans.

Which geographical region is expected to exhibit the fastest growth rate and why?

The Asia Pacific (APAC) region is projected to register the fastest CAGR, driven by rapid urbanization, massive government investment in smart city infrastructure, and substantial commercial and industrial construction activity across major economies like China and India, where the adoption rate is rapidly accelerating.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager