Motor Controllers Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434112 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Motor Controllers Market Size

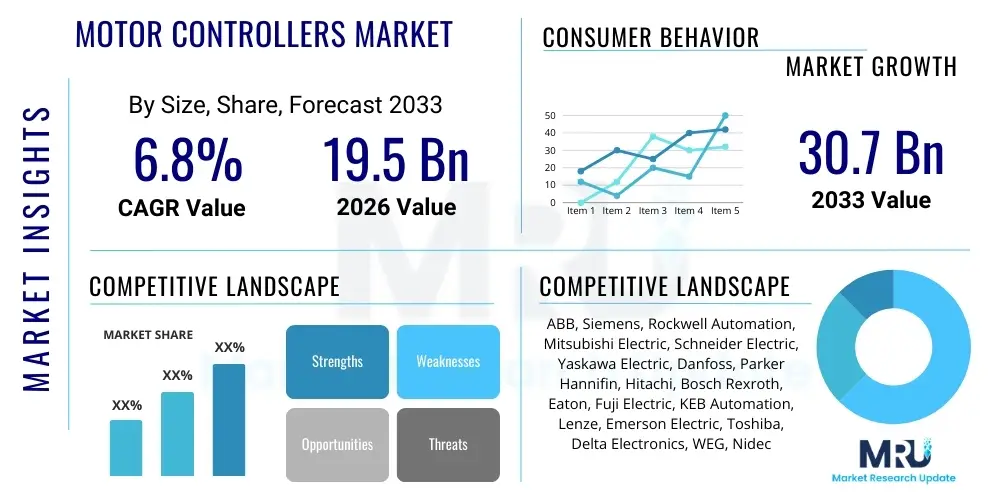

The Motor Controllers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 19.5 Billion in 2026 and is projected to reach USD 30.7 Billion by the end of the forecast period in 2033.

Motor Controllers Market introduction

The Motor Controllers Market encompasses devices designed to manage the performance of electric motors, regulating variables such as speed, torque, position, and direction of rotation. These controllers are essential components in virtually every sector involving mechanical motion, providing crucial functionalities like soft start, overload protection, energy efficiency optimization, and precise operational control. Key products within this market include Variable Frequency Drives (VFDs), servo drives, soft starters, and dedicated motor starters, each tailored for specific operational requirements and motor types, such as AC induction, DC brushed/brushless, and permanent magnet synchronous motors.

Major applications driving the demand for advanced motor controllers include industrial automation, where precise motion control is mandatory for robotics, conveyor systems, and CNC machines. Furthermore, the proliferation of Electric Vehicles (EVs) and Hybrid Electric Vehicles (HEVs) relies heavily on sophisticated motor controllers (inverters) to manage high-voltage battery power delivery to traction motors efficiently. The core benefit provided by modern motor controllers is enhanced operational efficiency, significantly reducing energy consumption and extending the lifespan of the motor systems they manage, aligning with global sustainability initiatives and stricter regulatory standards like IE4 and IE5 efficiency ratings.

Driving factors stimulating market expansion are the global push toward Industry 4.0, which mandates interconnected and highly efficient manufacturing processes, and the increasing adoption of renewable energy infrastructure requiring precise control over pumping and compressor systems. Additionally, advancements in power electronics, particularly the widespread use of Silicon Carbide (SiC) and Gallium Nitride (GaN) semiconductors, are enabling smaller, more powerful, and significantly more efficient motor control solutions. These technological improvements are lowering the total cost of ownership for end-users and facilitating greater integration into space-constrained applications like portable industrial tools and compact HVAC systems.

Motor Controllers Market Executive Summary

The Motor Controllers Market is poised for robust expansion, primarily fueled by accelerated global industrial automation initiatives and significant investment in sustainable transportation and energy systems. Business trends indicate a strong focus on developing integrated motor control solutions that combine drive technology, protective features, and communication capabilities into single, compact units, facilitating easier integration into complex manufacturing environments. There is a perceptible shift toward intelligent drives equipped with embedded diagnostic and predictive maintenance capabilities, leveraging cloud connectivity and edge computing to maximize uptime and minimize operational expenditures for industrial consumers. Competitive pressures are driving innovation in power density and thermal management, pushing manufacturers to utilize cutting-edge semiconductor materials for superior performance.

Regionally, the Asia Pacific (APAC) market, spearheaded by China, India, and Japan, remains the primary growth engine, attributed to large-scale infrastructure projects, rapid expansion of the manufacturing sector, and aggressive adoption of EVs. North America and Europe are characterized by high demand for premium, energy-efficient, and highly connected drives that comply with stringent environmental regulations and support advanced Industry 4.0 applications, focusing particularly on retrofit opportunities in legacy industrial infrastructure. Regulatory environments mandating higher motor and system efficiency standards across all major geographies are providing a fundamental structural impetus for the replacement of older, less efficient motor control systems with state-of-the-art variable speed drives (VSDs).

In terms of segmentation trends, Variable Frequency Drives (VFDs) dominate the market by product type due to their superior energy-saving capabilities and versatility across numerous applications, including pumping, ventilation, and material handling. The high power range segment (above 75 kW) is experiencing accelerated growth, driven by investments in heavy industries such as oil & gas, mining, and large capacity renewable energy generation systems. Application-wise, the automotive sector, specifically the burgeoning EV powertrain market, is demonstrating the fastest growth trajectory, demanding specialized, rugged, and highly responsive controllers. Meanwhile, the industrial automation segment continues its long-term stability and expansion, demanding controllers capable of high synchronization and integration into complex robotic systems.

AI Impact Analysis on Motor Controllers Market

Common user inquiries regarding the impact of Artificial Intelligence (AI) on the Motor Controllers Market generally center on several key themes: how AI can enhance predictive maintenance capabilities, the role of machine learning in optimizing motor efficiency in real-time under fluctuating loads, and the potential for autonomous control systems in complex industrial processes. Users are concerned about the complexity of implementing AI-driven algorithms, the required processing power at the edge, and the cybersecurity implications of integrating smart, networked controllers. Expectations are high, focusing on AI's ability to move motor control beyond simple regulatory tasks toward self-aware, self-optimizing systems that dramatically reduce energy waste and minimize catastrophic failures through advanced anomaly detection.

The integration of AI and Machine Learning (ML) is fundamentally transforming the design and operation of motor controllers, moving them from reactive control elements to proactive, intelligent system components. AI algorithms are increasingly being embedded into high-end VFDs and servo drives to analyze massive amounts of operational data—such as current draw, vibration patterns, and temperature profiles—to establish baseline performance metrics. This deep data analysis allows the controller to predict impending component failures (e.g., bearings, insulation breakdown) with far greater accuracy than traditional statistical methods, enabling timely intervention and maximizing equipment uptime, which is critical in automated production lines.

Beyond diagnostics, AI is crucial for optimizing energy usage. Conventional motor control relies on predetermined operational parameters; however, AI-based controllers can utilize reinforcement learning or adaptive control algorithms to dynamically adjust voltage, frequency, and torque settings in response to real-time changes in load and environmental conditions. This real-time optimization ensures the motor operates at peak efficiency across its entire operational envelope, delivering substantial energy savings, particularly in applications characterized by variable duty cycles like pumping stations or compressor systems. This continuous learning capability positions AI as a core component for achieving true sustainability goals within industrial infrastructure.

- AI facilitates advanced predictive maintenance by analyzing complex sensor data.

- Machine learning algorithms optimize motor efficiency in dynamic, real-time conditions.

- Enables self-calibration and autonomous fault correction in complex drive systems.

- AI supports anomaly detection, preventing catastrophic motor failures.

- Improves power quality management and harmonic mitigation through intelligent control loops.

- Facilitates seamless integration into IIoT platforms via enhanced data processing at the edge.

- Reduces commissioning time by automating parameter tuning and system identification.

- Drives the development of digital twins for accurate simulation and control testing.

- Enhances safety features through AI-driven deviation monitoring.

- Optimizes material handling and robotic path planning based on predicted inertia requirements.

- Increases the precision of torque control and speed regulation in high-demand applications.

- AI deployment requires robust cybersecurity measures for networked controllers.

- Accelerates the adoption of advanced sensor fusion techniques within the control loop.

- Promotes energy recuperation optimization in braking and deceleration phases.

- Simplifies the user interface and configuration process through intelligent guidance systems.

DRO & Impact Forces Of Motor Controllers Market

The dynamics of the Motor Controllers Market are governed by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively shape the market's trajectory and influence investment decisions. A primary driver is the pervasive trend of industrial digitalization and automation globally, encapsulated by Industry 4.0 standards, which necessitates precise, networked, and reliable motion control components. Coupled with this is the escalating global focus on energy conservation, making highly efficient motor controllers, particularly Variable Speed Drives (VSDs), indispensable tools for complying with increasingly stringent governmental and environmental efficiency mandates, such as the IE4 and IE5 standards implemented across major economies.

However, the market faces significant restraints. The initial capital expenditure required for implementing advanced, intelligent motor control systems, especially those utilizing cutting-edge wide-bandgap (WBG) semiconductors like SiC, can be substantial, posing a barrier to entry for Small and Medium-sized Enterprises (SMEs) in developing regions. Furthermore, the complexity associated with integrating highly sophisticated drive systems into legacy industrial infrastructure presents technical challenges, requiring specialized engineering expertise and significant downtime during the transition phase. This technological complexity demands continuous training and investment in human capital, which can slow the rate of advanced technology adoption.

Despite these challenges, substantial opportunities exist, primarily driven by the exponential growth in Electric Vehicle (EV) manufacturing, which requires massive volumes of high-performance traction motor controllers (inverters). The renewable energy sector, including wind turbines and solar tracking systems, also offers a fertile ground for high-reliability controllers. The ongoing development of the Industrial Internet of Things (IIoT) provides a unique opportunity for manufacturers to transition towards service-oriented business models, offering value-added services such as cloud-based diagnostics, predictive maintenance contracts, and over-the-air firmware updates, thereby securing recurring revenue streams and deeper customer engagement.

- Drivers:

- Rapid global industrial automation and implementation of Industry 4.0 initiatives.

- Mandatory governmental regulations promoting energy efficiency (IE4/IE5 standards).

- Exponential growth in the production of electric vehicles (EVs) and hybrid vehicles.

- Technological advancements in power semiconductors (SiC and GaN) increasing controller efficiency.

- Rising demand for precision control in robotics and CNC machining.

- Restraints:

- High initial capital expenditure for advanced, intelligent motor control systems.

- Complexity of integrating new digital controllers into existing legacy infrastructure.

- Susceptibility of networked systems to cybersecurity threats.

- Need for specialized workforce training to manage complex drive systems.

- Market vulnerability to fluctuations in raw material costs (e.g., copper, rare earth magnets).

- Opportunities:

- Integration of controllers with the Industrial Internet of Things (IIoT) and cloud platforms.

- Expansion into the renewable energy sector (solar trackers, wind pitch control).

- Development of modular and standardized motor control solutions for faster deployment.

- Growing demand for decentralized control architectures (motor-mounted drives).

- Untapped market potential in retrofit applications across emerging economies.

- Impact Forces Analysis:

- Supplier Power: Moderate to High, driven by specialization in WBG semiconductor technology and intellectual property surrounding control algorithms.

- Buyer Power: Moderate, as industrial buyers often standardize on specific brands but demand high customization and robust after-sales support.

- Threat of New Entrants: Low to Moderate, due to high R&D investment requirements, regulatory barriers, and established brand loyalty in industrial sectors.

- Threat of Substitutes: Low, as electronic motor control is functionally superior and more efficient than mechanical speed regulation methods.

- Competitive Rivalry: High, characterized by intense competition among global conglomerates offering comprehensive automation portfolios.

Segmentation Analysis

The Motor Controllers Market is systematically segmented based on Product Type, Power Range, Voltage, and End-User Application, providing crucial insights into specific market dynamics and growth areas. The segmentation reflects the diverse operational requirements across industrial, commercial, and mobility sectors, necessitating a tailored approach to drive design and functionality. Analyzing these segments helps stakeholders identify high-growth niches, allocate resources efficiently, and customize product offerings to meet specific industry demands, particularly focusing on optimization for efficiency and communication protocols relevant to Industry 4.0.

The Product Type segmentation is critical, distinguishing between Variable Frequency Drives (VFDs), which offer superior speed control and energy savings, and simpler devices like Soft Starters, which primarily reduce mechanical stress during startup. VFDs are witnessing the strongest growth due to their technological maturity and their necessity in achieving high efficiency ratings. Conversely, the segmentation by Power Range delineates market demand between low-power applications (e.g., small pumps, fans) and high-power industrial machinery (e.g., large compressors, mining equipment), where the latter demands ruggedness, high reliability, and advanced cooling mechanisms.

Furthermore, the End-User Application segment reveals the core consumption centers. Industrial Automation remains the largest consumer, driven by continuous factory upgrades and expansion. However, the Automotive (EV/HEV) segment is rapidly gaining prominence, requiring specialized, compact, and high-density controllers optimized for battery voltage levels and regenerative braking capabilities. Understanding these granular segments allows companies to focus their R&D efforts on areas such as robust sensorless control algorithms for high-speed motors or the development of explosion-proof controllers for hazardous environments in the Oil & Gas sector.

- By Product Type:

- Variable Frequency Drives (VFDs) / Variable Speed Drives (VSDs)

- Servo Drives

- Soft Starters

- Motor Starters (Manual and Electronic)

- DC Motor Controllers

- By Power Range:

- Low Power (Up to 1 kW)

- Medium Power (1 kW to 75 kW)

- High Power (Above 75 kW)

- By Voltage:

- Low Voltage (Below 1,000 V)

- Medium Voltage (1,000 V to 69 kV)

- By End-User Application:

- Industrial Automation and Factory Machinery (Robotics, Conveyors, Pumps, Fans)

- Automotive (Electric Vehicle Traction Inverters, Auxiliary Systems)

- HVAC Systems (Commercial and Industrial Buildings)

- Oil & Gas and Mining

- Water and Wastewater Management

- Power Generation (Renewable and Conventional)

- Consumer Electronics and Appliances

Value Chain Analysis For Motor Controllers Market

The value chain for the Motor Controllers Market begins with upstream activities dominated by component manufacturing, primarily focusing on power electronics and semiconductor fabrication. Critical components include insulated-gate bipolar transistors (IGBTs), MOSFETs, and increasingly, wide-bandgap (WBG) materials like Silicon Carbide (SiC) and Gallium Nitride (GaN). Suppliers in this tier hold significant leverage due to the specialized nature of these components and the high technological barrier to entry, which directly impacts the performance, size, and cost structure of the final motor controller product. Furthermore, the supply of microcontrollers and digital signal processors (DSPs) used for complex control algorithms forms another vital upstream element.

Midstream activities involve the core manufacturing, assembly, and testing of the motor controller units. This phase includes sophisticated PCB design, thermal management integration, proprietary algorithm development, and enclosure ruggedization. Major players often operate integrated facilities to maintain tight control over quality and intellectual property. Distribution channels play a critical role in reaching diverse end-users. Direct distribution is favored for large-scale industrial projects, original equipment manufacturers (OEMs) like automotive companies, and customized high-voltage solutions, allowing for tailored technical support and direct relationship management.

Conversely, indirect distribution, involving specialized industrial distributors, electrical wholesalers, and system integrators, is essential for reaching smaller enterprises, maintenance, repair, and overhaul (MRO) markets, and for standard, off-the-shelf low-voltage VFDs. Downstream activities involve installation, commissioning, software integration, and crucially, post-sales support, including predictive maintenance services and cloud-based diagnostics. System integrators, who bridge the gap between controller technology and specific application requirements (e.g., configuring a drive for a specific type of pump), are vital to the successful deployment of these complex products across various end-user environments.

Motor Controllers Market Potential Customers

The potential customers for the Motor Controllers Market span a wide array of industrial and commercial entities, fundamentally categorized by their need for reliable, efficient, and precise control over electric motors. The primary consumer base consists of Original Equipment Manufacturers (OEMs) who embed motor controllers into their final products, such as industrial machinery manufacturers (producing CNC machines, compressors, and pumps), HVAC system producers, and increasingly, electric vehicle manufacturers who require high-performance traction inverters as core components of their drivetrain systems. These customers prioritize compatibility, power density, robustness, and supply chain reliability.

A second major category includes End-Users who purchase controllers for plant upgrades, maintenance, or new facility construction. This group is dominated by large-scale industrial consumers in sectors like Oil & Gas, Mining, Power Generation, and Water/Wastewater Treatment. Their purchasing decisions are heavily influenced by Total Cost of Ownership (TCO), focusing on energy efficiency savings, durability in harsh environments, and the availability of sophisticated diagnostic features to minimize unplanned downtime. For these consumers, adherence to strict operational standards and safety certifications is paramount, often leading to long-term supplier relationships.

A rapidly expanding customer segment is the Infrastructure and Utility sector, particularly those involved in developing smart cities and sustainable energy systems. This includes utilities investing in modernized grids, requiring controllers for large-scale energy storage battery management, and developers of commercial and residential buildings seeking advanced HVAC controllers to meet green building standards. Furthermore, small to medium-sized enterprises (SMEs) represent a substantial customer base for standard low-voltage drives, driven by the need to meet localized energy efficiency regulations and improve the productivity of their existing machinery through retrofit installations.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 19.5 Billion |

| Market Forecast in 2033 | USD 30.7 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ABB, Siemens, Rockwell Automation, Mitsubishi Electric, Schneider Electric, Yaskawa Electric, Danfoss, Parker Hannifin, Hitachi, Bosch Rexroth, Eaton, Fuji Electric, KEB Automation, Lenze, Emerson Electric, Toshiba, Delta Electronics, WEG, Nidec, TDK Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Motor Controllers Market Key Technology Landscape

The Motor Controllers Market is defined by continuous technological evolution, primarily driven by advancements in power electronics and digital control systems. The shift from traditional Silicon (Si) based IGBTs to wide-bandgap (WBG) semiconductors like Silicon Carbide (SiC) and Gallium Nitride (GaN) represents the most significant trend. SiC and GaN devices offer substantial benefits, including operation at higher switching frequencies, increased power density, reduced switching losses, and superior thermal performance. These characteristics allow manufacturers to design smaller, lighter, and considerably more efficient motor controllers, which is paramount for space-constrained applications such as electric vehicle drivetrains and compact robotic systems.

Another crucial technological development is the implementation of advanced control algorithms, particularly Field-Oriented Control (FOC) and Direct Torque Control (DTC), which provide highly precise and dynamic control over AC induction and Permanent Magnet Synchronous Motors (PMSMs). Modern controllers are increasingly incorporating sensorless vector control capabilities, eliminating the need for expensive and failure-prone motor feedback devices (encoders/resolvers) while maintaining high control accuracy. Furthermore, the integration of Ethernet-based industrial communication protocols, such as EtherCAT, PROFINET, and Ethernet/IP, is standardizing high-speed communication between controllers, PLCs, and supervisory systems, enabling true real-time coordination necessary for complex multi-axis motion control.

The ongoing push towards the Industrial Internet of Things (IIoT) is mandating the integration of sophisticated diagnostics and edge computing capabilities directly into the motor controller hardware. New generations of controllers feature embedded web servers, secure communication modules (e.g., OPC UA), and local processing power to handle advanced data logging and predictive maintenance algorithms before transmitting only essential data to the cloud. This emphasis on connectivity and decentralized intelligence not only improves operational efficiency but also facilitates remote monitoring, commissioning, and firmware updates, significantly enhancing the serviceability and longevity of installed motor control systems globally.

Regional Highlights

The global Motor Controllers Market exhibits varied growth rates and adoption patterns influenced by regional economic development, regulatory environments, and industrial maturity. The Asia Pacific (APAC) region currently holds the largest market share and is projected to maintain the highest growth rate during the forecast period. This dominance is attributed to rapid industrialization, massive infrastructure development, and substantial government investments in manufacturing capabilities, particularly in China and India. Furthermore, APAC is the epicenter of global electric vehicle production, driving unprecedented demand for high-performance traction inverters, positioning the region as central to market expansion.

North America and Europe represent mature markets characterized by high adoption rates of advanced, high-efficiency motor controllers and sophisticated industrial automation technologies (Industry 4.0). Demand here is less about initial capacity building and more focused on retrofitting existing facilities to meet stringent energy efficiency standards and utilizing intelligent drives for predictive maintenance and data-driven operational optimization. European manufacturers, in particular, lead in the deployment of highly connected drives compliant with complex safety standards, such as those governed by functional safety norms (IEC 61508/62061).

Latin America, the Middle East, and Africa (MEA) are emerging markets showing steady, albeit uneven, growth. In the MEA region, investments in the oil and gas sector and water/wastewater management projects are primary drivers, necessitating rugged, high-power controllers capable of operating reliably under extreme environmental conditions. Latin America sees demand driven by the mining and agriculture sectors. While these regions often prioritize cost-effectiveness, growing awareness regarding the long-term energy savings offered by VSDs is gradually accelerating the transition away from mechanical or simpler control methods.

- Asia Pacific (APAC): Market leader driven by industrial expansion, heavy OEM activity (especially automotive and electronics), and significant governmental support for advanced manufacturing.

- Key Growth Drivers: China's vast manufacturing base, India's infrastructure boom, and high EV production volumes in Southeast Asia.

- Focus: High-volume, standardized VFDs and specialized EV inverters.

- North America: Strong demand focused on technological maturity, regulatory compliance (efficiency standards), and advanced features (IIoT connectivity, AI diagnostics).

- Key Growth Drivers: Modernization of existing manufacturing plants, rapid deployment of robotics, and growth in data center infrastructure (requiring precise HVAC control).

- Focus: Premium, highly integrated servo drives and medium-voltage controllers.

- Europe: Characterized by stringent environmental regulations, high adoption of Industry 4.0, and leadership in functional safety standards.

- Key Growth Drivers: Mandatory efficiency requirements (Ecodesign Directive), strong automotive presence, and investment in sustainable energy generation (wind/solar).

- Focus: Energy-efficient drives, decentralized control modules, and integrated safety-rated controllers.

- Latin America (LATAM): Growth tied to commodity cycles, particularly mining, oil and gas, and major public utility projects (water and sanitation).

- Key Growth Drivers: Infrastructure upgrades, necessity for rugged, reliable controllers in resource extraction industries.

- Focus: Low-to-medium voltage standard VFDs prioritizing reliability and durability.

- Middle East & Africa (MEA): Demand concentrated in critical infrastructure, large-scale construction, desalination plants, and petrochemical facilities.

- Key Growth Drivers: Large governmental investments in industrial diversification (e.g., Saudi Vision 2030), and substantial water management projects.

- Focus: High-power, robust controllers designed for harsh operating environments and high-temperature conditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Motor Controllers Market.- ABB Ltd.

- Siemens AG

- Rockwell Automation, Inc.

- Mitsubishi Electric Corporation

- Schneider Electric SE

- Yaskawa Electric Corporation

- Danfoss A/S

- Parker Hannifin Corporation

- Hitachi, Ltd.

- Bosch Rexroth AG

- Eaton Corporation plc

- Fuji Electric Co., Ltd.

- KEB Automation KG

- Lenze SE

- Emerson Electric Co.

- Toshiba International Corporation

- Delta Electronics, Inc.

- WEG S.A.

- Nidec Corporation

- TDK Corporation

Frequently Asked Questions

Analyze common user questions about the Motor Controllers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary advantage of Variable Frequency Drives (VFDs) over traditional motor starters?

The primary advantage of VFDs is their capability to precisely regulate motor speed and torque, which enables substantial energy savings—often 20% to 50%—in variable-torque applications like pumps and fans. VFDs minimize mechanical stress during startup and provide superior process control, unlike simple starters which only turn motors on or off.

How are Silicon Carbide (SiC) semiconductors impacting the design of modern motor controllers?

SiC semiconductors allow motor controllers to operate at significantly higher switching frequencies and temperatures, resulting in much smaller physical dimensions (higher power density) and drastically improved energy efficiency due to reduced switching losses. This is critical for compact, high-performance applications such as electric vehicle traction inverters and aerospace actuators.

What role does Industry 4.0 play in driving the demand for advanced motor controllers?

Industry 4.0 mandates highly connected, interoperable, and intelligent factory floors. Advanced motor controllers, acting as smart edge devices, must support industrial Ethernet protocols (like PROFINET or EtherCAT), provide rich diagnostic data, and integrate predictive maintenance algorithms, making them essential components for automated and self-optimizing manufacturing systems.

Which end-user application segment is experiencing the fastest growth in the Motor Controllers Market?

The Automotive sector, particularly the Electric Vehicle (EV) and Hybrid Electric Vehicle (HEV) segment, is exhibiting the fastest growth. The transition to electric mobility requires massive volumes of sophisticated, highly reliable, and energy-dense traction motor controllers (inverters) to manage high-voltage battery power and facilitate regenerative braking efficiently.

What are the key cybersecurity concerns related to networked motor control systems?

Key cybersecurity concerns involve protecting networked controllers from unauthorized access and manipulation, which could lead to critical operational failures, production disruptions, or physical damage. Ensuring secure communication protocols (e.g., encryption), implementing rigorous authentication mechanisms, and providing regular firmware updates are essential to mitigate risks associated with IIoT integration.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Motor Controllers Market Size Report By Type (Servo Motor Controller, Stepper Motor Controller), By Application (General Industry, Robots, Automotive, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Motor Controllers Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Crane Controls, Crane Drives, Industrial Drives, AC Drives / Variable Speed Drives), By Application (Industrial, Defense segments, Automotive, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager