Motor Vehicle Sensors Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431429 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Motor Vehicle Sensors Market Size

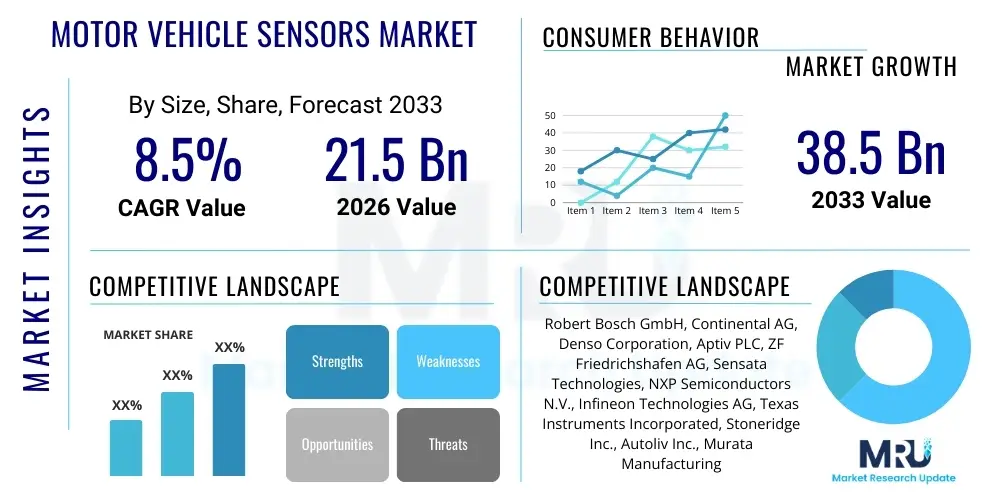

The Motor Vehicle Sensors Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at $21.5 Billion USD in 2026 and is projected to reach $38.5 Billion USD by the end of the forecast period in 2033. This substantial expansion is primarily fueled by the global transition toward electrified vehicles and the accelerating integration of Advanced Driver-Assistance Systems (ADAS), which necessitate a far greater density and sophistication of sensor technology per vehicle compared to traditional internal combustion engine (ICE) models. The increasing demand for enhanced safety features, mandated by governmental regulations across major economies, further solidifies this strong market trajectory throughout the forecast period.

Motor Vehicle Sensors Market introduction

The Motor Vehicle Sensors Market encompasses a diverse array of highly sophisticated electronic components designed to monitor, measure, and report various physical parameters—such as pressure, temperature, position, acceleration, and flow—critical for the safe, efficient, and reliable operation of modern vehicles. These sensors serve as the primary interface between the physical environment (including the road, surrounding traffic, and weather conditions) and the vehicle's electronic control units (ECUs), facilitating crucial functions from basic engine management and emission control to advanced features like autonomous driving and predictive maintenance. The proliferation of sensors is directly tied to regulatory pushes for better fuel economy, reduced emissions, and significantly improved passenger safety, making them indispensable components in modern automotive architecture.

Modern sensors utilize complex technologies, including Micro-Electro-Mechanical Systems (MEMS), Hall-effect, and optical principles, evolving beyond simple monitoring to become highly intelligent, interconnected devices capable of processing data at the edge. Key applications span across powertrain systems (managing fuel injection, transmission shift points, and exhaust gas recirculation), chassis control (ABS, ESC, TPMS), and increasingly, in the perception layer of ADAS and autonomous driving systems (utilizing Radar, Lidar, and high-resolution camera sensors). The performance and reliability of these sensors directly dictate the efficacy of features like Automatic Emergency Braking (AEB), Lane Keep Assist (LKA), and Adaptive Cruise Control (ACC), fundamentally transforming the driving experience and vehicle safety standards globally.

The primary benefits derived from the pervasive use of motor vehicle sensors include optimization of engine performance leading to lower fuel consumption and reduced greenhouse gas emissions, significantly enhanced occupant safety through immediate detection of hazardous conditions, and the foundational enablement of autonomous driving capabilities. Driving factors include the mandate for Tire Pressure Monitoring Systems (TPMS), stringent emission standards (e.g., Euro 6, CAFE standards), and the industry-wide shift towards vehicle electrification (requiring thermal sensors for battery management and high-current sensors for power delivery systems). Furthermore, consumer demand for features that offer convenience, connectivity, and superior passive and active safety measures continues to propel innovation and adoption across all vehicle classes, from entry-level passenger cars to heavy-duty commercial vehicles.

Motor Vehicle Sensors Market Executive Summary

The Motor Vehicle Sensors Market is undergoing a rapid technological transformation, moving from discrete sensor units to highly integrated, multi-functional sensor clusters that enable sophisticated data fusion and centralized processing critical for autonomous operations. Key business trends indicate a strong industry focus on standardizing communication protocols (like Automotive Ethernet) and developing robust cybersecurity measures to protect sensitive sensor data pathways. There is a palpable trend towards supplier consolidation, with major Tier 1 companies heavily investing in solid-state sensor technologies, particularly in the Lidar and advanced Radar space, aiming to drive down manufacturing costs and improve scalability for mass-market deployment. Furthermore, the rise of Software-Defined Vehicles (SDVs) is placing new requirements on sensor manufacturers, demanding greater flexibility and over-the-air update capability for calibration and functionality adjustments.

Regional trends reveal Asia Pacific (APAC) maintaining its position as the largest market, fueled by high volume production in China and India, alongside increasing consumer acceptance of advanced safety packages. However, Europe and North America remain the technological bellwethers, characterized by the highest average sensor content per vehicle, primarily due to rigorous safety regulations (such as mandatory fitment of certain ADAS features) and the early adoption of electric vehicle platforms. Investment in sensor manufacturing and research is disproportionately high in Germany, Japan, and the United States, focusing on developing sensor systems resilient to extreme weather conditions and capable of level 3 and level 4 autonomy. The Middle East and Africa (MEA) and Latin America (LATAM) are emerging rapidly, primarily driven by investments in infrastructure and the introduction of stricter vehicle import safety standards.

Segmentation trends highlight that the fastest growth is observed in the sensor types critical for environmental perception—specifically Radar, Lidar, and ultrasonic sensors—driven exclusively by the transition towards L2+ and L3 automation. Within the traditional segments, pressure and temperature sensors are witnessing significant evolutionary changes, particularly in electric vehicles where thermal management of high-voltage battery packs is crucial for range and longevity. Current and voltage sensors, previously niche components, are becoming high-volume necessities within the Battery Management Systems (BMS) of every electric vehicle, establishing a new, rapidly expanding market sub-segment. Sensor material science is also advancing, with silicon carbide (SiC) and gallium nitride (GaN) substrates becoming prevalent in high-temperature and high-power applications, improving reliability in demanding automotive environments.

AI Impact Analysis on Motor Vehicle Sensors Market

Common user questions regarding AI's influence on the Motor Vehicle Sensors Market frequently revolve around improved decision-making accuracy, the role of AI in overcoming sensor limitations (such as adverse weather performance), and the necessity of high-performance computing (HPC) for real-time sensor fusion. Users are highly interested in how machine learning algorithms minimize false positives in perception systems, particularly concerning pedestrian and object recognition, a common challenge for camera and radar setups. Furthermore, there is significant inquiry into AI’s ability to conduct predictive maintenance, analyzing subtle deviations in sensor outputs to forecast component failures long before they occur, thus enhancing vehicle reliability and uptime.

AI's fundamental impact is transforming raw sensor data into actionable, contextual information. Instead of relying on rigid, pre-programmed logic, AI algorithms, particularly deep learning models, allow the vehicle to interpret complex, unstructured environmental data generated by cameras, lidar, and radar in real-time. This processing power is critical for enabling complex behaviors required for autonomous driving, such as negotiating dense urban traffic, handling unexpected road debris, or making split-second decisions at high speeds. This requires sensors themselves to be smarter, incorporating built-in microcontrollers (edge AI) capable of pre-processing and filtering data before transmitting it to the central domain controller, thereby reducing bandwidth load and latency.

The implementation of AI necessitates a continuous feedback loop that involves over-the-air (OTA) updates for re-training and recalibrating the sensor interpretation models. This level of software integration ensures that the sensor system's performance improves over the vehicle's lifespan. AI also plays a vital role in sensor redundancy and reliability; by fusing data from multiple sensor types (e.g., radar verifying a camera detection), AI ensures that if one sensor fails or is obscured (e.g., a camera blocked by mud), the vehicle can still maintain a reliable perception map, thereby enhancing functional safety and addressing key user concerns about system robustness in real-world driving conditions.

- AI enables highly accurate sensor fusion, combining data from disparate sources (Lidar, Radar, Camera) to create a robust, holistic environmental model.

- Machine learning algorithms significantly reduce false positives and negatives in object detection and classification tasks, enhancing ADAS reliability.

- Edge AI implementation allows for low-latency, real-time data processing directly at the sensor level, optimizing data bandwidth usage.

- AI drives predictive maintenance capabilities by analyzing sensor degradation and output anomalies, forecasting potential component failures.

- Deep learning is crucial for advanced perception tasks such as scene segmentation, behavioral prediction of pedestrians, and trajectory planning in autonomous systems.

DRO & Impact Forces Of Motor Vehicle Sensors Market

The Motor Vehicle Sensors Market is powerfully shaped by three core forces: regulatory mandates pushing for advanced safety features, the consumer-driven electrification trend, and rapid technological advancements in sensing modalities like solid-state Lidar. Drivers include globally intensifying safety ratings (e.g., NCAP requiring mandatory fitment of AEB and LDW) and global emission legislation that necessitates highly accurate engine and exhaust sensors for compliance. Restraints, however, involve the high initial investment cost associated with premium sensors (especially Lidar systems), potential system failures due to software complexity and component vulnerability, and the ever-present threat of cybersecurity breaches targeting vehicle sensor networks and data streams. Opportunities lie in the commercialization of low-cost, high-resolution solid-state sensors and the massive expansion of the electric vehicle segment demanding new thermal and current sensing solutions.

The impact forces within this market are significant and interconnected. Technological acceleration forces manufacturers into a continuous cycle of innovation, necessitating substantial R&D expenditure to keep pace with capabilities in areas such as high-frequency radar and integrated photonics. Economically, the cost of sensors remains a significant factor in vehicle pricing, especially as the sensor count for Level 4 autonomous vehicles could exceed 50 units. Regulatory forces provide a stable baseline demand, guaranteeing market floor volumes for specific sensor types, such such as oxygen sensors and manifold pressure sensors, but also continuously raise the bar for performance requirements, forcing older technologies into obsolescence quickly.

Market sustainability is increasingly dependent on supply chain resilience, particularly concerning semiconductor shortages, which have severely impacted sensor production capabilities globally. Furthermore, the integration complexity of multi-sensor architectures exerts pressure on Tier 1 suppliers to develop standardized, modular platforms that can be easily integrated by diverse OEMs. The overall impact emphasizes a shift from basic electromechanical components to highly sophisticated semiconductor devices, placing the sensor market at the intersection of automotive and advanced electronics industries, governed heavily by semiconductor supply and technological superiority.

Segmentation Analysis

The Motor Vehicle Sensors Market is highly segmented, driven by the diverse functional requirements across different vehicular systems—from powertrain management and body control to advanced driver assistance. Segmentation is typically analyzed based on sensor type (e.g., temperature, pressure, inertial, optical), application area (e.g., safety & control, engine control, telematics), technology utilized (e.g., MEMS, Hall-effect, Piezoelectric), and vehicle type (passenger cars, commercial vehicles). The functional diversity means that no single sensor technology dominates, rather a portfolio approach is required, where high-volume, low-cost sensors (like speed and position) coexist with high-cost, cutting-edge perception sensors (like Lidar).

Analysis by sensor type highlights the rapid growth of non-contact and optical sensors, driven primarily by ADAS requirements. While traditional sensors like temperature, pressure, and position sensors maintain stable demand due to their role in essential vehicle operation and emission control, the value growth is dominated by perception sensors. Pressure sensors, critical for applications like TPMS, common rail systems, and exhaust gas treatment, are evolving toward higher accuracy and extended temperature ranges. Position sensors, essential for steering angle and throttle position, are transitioning towards robust, magnetic-based technologies that offer superior durability and interference resistance compared to potentiometers.

Furthermore, segmentation by application illustrates the largest and most dynamic segment is Safety and Control, which encompasses all ADAS features. This segment dictates high technology investment and adoption rates for Radar and Camera sensors. Conversely, the Engine Control segment, while mature, continues to innovate, particularly within hybrid and electric powertrains, necessitating new sensor types for battery thermal management systems (BTMS) and current sensing to precisely monitor charge and discharge cycles, forming a critical nexus for EV performance and safety assurance.

- By Sensor Type:

- Temperature Sensors (e.g., Coolant, Cabin, Exhaust Gas)

- Pressure Sensors (e.g., Manifold Absolute Pressure (MAP), Tire Pressure Monitoring System (TPMS), Fuel Pressure)

- Speed Sensors (e.g., Wheel Speed, Transmission Speed)

- Position Sensors (e.g., Throttle Position, Crankshaft/Camshaft Position, Steering Angle)

- Inertial Sensors (e.g., Accelerometers, Gyroscopes for ESC/Roll-over detection)

- Gas Sensors (e.g., Oxygen/Lambda, NOx)

- Image/Vision Sensors (Cameras)

- Proximity/Perception Sensors (Radar, Lidar, Ultrasonic)

- Current and Voltage Sensors (Critical for EVs/HEVs)

- By Application:

- Powertrain/Engine Control

- Chassis Control (Braking, Suspension, Steering)

- Safety and Control (ADAS, Airbag, Seatbelt Tension)

- Body Electronics and Comfort

- Telematics and Navigation

- By Vehicle Type:

- Passenger Cars (PC)

- Light Commercial Vehicles (LCV)

- Heavy Commercial Vehicles (HCV)

- By Technology:

- Micro-Electro-Mechanical Systems (MEMS)

- Hall-Effect

- Magnetic Resistance

- Optical (CMOS/CCD)

- Piezoelectric

Value Chain Analysis For Motor Vehicle Sensors Market

The value chain for the Motor Vehicle Sensors Market begins with the upstream segment, dominated by specialized semiconductor manufacturers and materials suppliers. This segment involves the extraction and processing of raw materials—such as silicon wafers, ceramics, and specialized magnetic alloys—and the highly capital-intensive fabrication of sensor dies and ASICs, often relying on advanced MEMS foundries. Key activities at this stage include intellectual property development, chip design, and highly precise micro-manufacturing. Since sensor performance hinges critically on material purity and geometric precision, suppliers in the upstream segment command significant expertise and pricing power, acting as foundational technology providers to the entire automotive ecosystem.

The midstream phase involves Tier 2 and Tier 1 suppliers. Tier 2 companies typically take the raw sensor dies and integrate them into encapsulated modules, providing basic packaging and testing. Tier 1 suppliers (such as Continental, Bosch, and Denso) integrate these modules into complete sensor systems, incorporating necessary hardware (housings, connectors) and complex software algorithms for signal processing, calibration, and fusion. This stage adds substantial value through quality assurance, compliance with stringent automotive safety standards (like ISO 26262), and the delivery of highly reliable, ready-to-install components. These Tier 1 providers act as the primary intermediary, often customizing sensor solutions to meet the unique architectural requirements of various Original Equipment Manufacturers (OEMs).

The downstream distribution channel is bifurcated. The primary channel involves direct, long-term contractual relationships between Tier 1 suppliers and major OEMs (e.g., GM, Volkswagen, Honda) for high-volume supply to vehicle assembly lines (OEM channel). This channel is characterized by stringent quality checks, tight scheduling (Just-In-Time delivery), and competitive pricing based on large volumes. The secondary channel is the aftermarket (independent service workshops and parts distributors), which handles replacement sensors due to failures, wear, or collision damage. While the aftermarket provides high margins, the OEM channel dominates in terms of overall revenue volume and dictates the technological specifications adopted across the industry.

Motor Vehicle Sensors Market Potential Customers

The primary and largest customer segment for motor vehicle sensors consists of Original Equipment Manufacturers (OEMs)—the global producers of passenger vehicles, light commercial vehicles (LCVs), and heavy commercial vehicles (HCVs). These major automotive groups, including multinational giants like Toyota, the Volkswagen Group, Ford, and Tesla, are the ultimate buyers who integrate sensor systems directly into their production lines. Their purchasing decisions are driven by factors such as compliance with regional safety and emission regulations, the need to differentiate their vehicles with advanced ADAS features, platform standardization across multiple vehicle models, and achieving favorable total cost of ownership (TCO) targets. OEMs exert immense influence over design specifications, volumes, and pricing structures in the market.

A crucial secondary segment includes Tier 1 suppliers themselves, particularly those who specialize in large integrated domain controllers or ADAS platforms. While these companies are suppliers to the OEMs, they are simultaneously major buyers of raw sensor chips, MEMS components, and basic sensor modules from Tier 2 and Tier 3 specialized component providers. Companies like ZF, Magna, and Aptiv require vast quantities of components—such as individual lidar lasers, CMOS imaging sensors, and basic pressure dies—to assemble and calibrate the complex sensor clusters and Electronic Control Units (ECUs) they deliver as integrated systems to the final vehicle manufacturers.

Furthermore, the automotive aftermarket forms a consistent, albeit smaller-volume, consumer segment. This includes independent garages, authorized service centers, and specialized parts retailers who purchase replacement sensors for vehicle repairs and maintenance after the initial sale. Essential replacement parts, such as oxygen sensors, TPMS sensors, and ABS wheel speed sensors, create continuous demand in this segment. As vehicles become older and the sensor population on the road increases, the revenue generated from the aftermarket for basic replacement sensors will continue to grow steadily, supporting the long-term profitability of sensor manufacturers and distributors focused on durability and compatibility.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $21.5 Billion USD |

| Market Forecast in 2033 | $38.5 Billion USD |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Robert Bosch GmbH, Continental AG, Denso Corporation, Aptiv PLC, ZF Friedrichshafen AG, Sensata Technologies, NXP Semiconductors N.V., Infineon Technologies AG, Texas Instruments Incorporated, Stoneridge Inc., Autoliv Inc., Murata Manufacturing Co., Ltd., HELLA GmbH & Co. KGaA, Visteon Corporation, Valeo S.A., Velodyne Lidar, Inc., Luminar Technologies, Inc., Melexis NV, TE Connectivity Ltd., Honeywell International Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Motor Vehicle Sensors Market Key Technology Landscape

The contemporary technology landscape for motor vehicle sensors is characterized by significant advances in miniaturization, integration, and communication capability, driven largely by the ubiquity of Micro-Electro-Mechanical Systems (MEMS). MEMS technology forms the backbone for small, low-cost sensors measuring acceleration (for airbags and stability control), pressure (for engine intake and TPMS), and gyroscopic movement. The integration of Application-Specific Integrated Circuits (ASICs) directly into the sensor package transforms these devices into "smart sensors," capable of self-calibration, diagnostic checks, and digital output, minimizing signal noise and reducing latency in data transmission to the main ECUs, which is critical for real-time safety functions.

In the perception layer, technological focus has shifted dramatically towards high-resolution, long-range sensing modalities. Radar technology is evolving from 24 GHz to higher frequency 77 GHz systems, providing superior angular resolution and range accuracy, essential for detecting small objects at a distance and supporting highway driving ADAS functions. Lidar, previously constrained by high cost and mechanical complexity, is rapidly moving towards solid-state architectures (e.g., Flash Lidar and MEMS-based scanning mirrors) that offer greater reliability, smaller form factors, and reduced cost profiles, making them viable for Level 3 and Level 4 autonomous vehicle mass production platforms. Furthermore, CMOS imaging sensors are achieving higher dynamic range and resolution, enabling robust performance in low-light and high-contrast environments.

A pivotal technological trend is the rise of centralized computing and sensor fusion platforms. Rather than having dozens of isolated ECUs processing individual sensor data, modern architectures leverage domain controllers or high-performance computing (HPC) units. This approach uses specialized algorithms to seamlessly merge the data streams from various sensor types (visual, radar, lidar) to create one coherent, highly reliable 3D model of the vehicle's surroundings. This fusion methodology is essential for redundancy, accuracy, and enabling the complex decision-making required for autonomous functions, fundamentally changing how sensor data is collected, validated, and utilized within the vehicle network architecture.

Regional Highlights

- Asia Pacific (APAC) Market Dominance: APAC, led by manufacturing hubs in China, Japan, and South Korea, constitutes the largest segment of the Motor Vehicle Sensors Market, predominantly due to the sheer volume of vehicle production and the accelerating rate of technological adoption, particularly in China's rapidly expanding electric vehicle sector. Government initiatives aimed at promoting local sensor manufacturing and increasing vehicle safety standards in emerging economies like India and Southeast Asian countries are propelling market growth. The region sees high demand for both low-cost, high-volume sensors for basic models and advanced perception sensors for premium and domestically manufactured EVs, maintaining its leadership in production and consumption.

- North America (NA) Focus on Autonomy and Regulation: The North American market is characterized by high sensor content per vehicle, driven by stringent safety regulations imposed by the NHTSA and strong consumer demand for sophisticated ADAS features. NA is a major early adopter of high-end Lidar and advanced Radar systems crucial for Level 3 and 4 autonomy pilots. Furthermore, the massive investment and ramp-up of electric vehicle production by major US automakers necessitate specialized battery management sensors, reinforcing the region's position as a high-value market focused on cutting-edge sensor technology and system integration excellence.

- Europe's Emphasis on Safety and Emissions: Europe remains a technologically mature and highly regulated market. Driven by strict Euro NCAP safety ratings and the world’s most stringent emission standards (Euro 7 forthcoming), demand for highly accurate gas, pressure, and temperature sensors for powertrain optimization remains consistently high. The swift transition towards vehicle electrification, mandated by EU legislation, ensures robust growth in sensors required for high-voltage systems and thermal management, while the region continues to lead in the deployment of sophisticated chassis and stability control sensor systems.

- Latin America (LATAM) and Middle East & Africa (MEA) Growth Trajectories: LATAM and MEA are emerging as high-growth potential regions. Growth is increasingly tied to the harmonization of local safety standards with global benchmarks, leading to rising demand for foundational safety features like ABS, ESC, and TPMS sensors. In the MEA region, investments in smart city infrastructure and high-end automotive imports are gradually increasing the demand for advanced perception sensors, although the market remains highly sensitive to economic volatility and infrastructure limitations, resulting in a primary focus on cost-effective sensor solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Motor Vehicle Sensors Market.- Robert Bosch GmbH

- Continental AG

- Denso Corporation

- Aptiv PLC

- ZF Friedrichshafen AG

- Sensata Technologies

- NXP Semiconductors N.V.

- Infineon Technologies AG

- Texas Instruments Incorporated

- Stoneridge Inc.

- Autoliv Inc.

- Murata Manufacturing Co., Ltd.

- HELLA GmbH & Co. KGaA

- Visteon Corporation

- Valeo S.A.

- Velodyne Lidar, Inc.

- Luminar Technologies, Inc.

- Melexis NV

- TE Connectivity Ltd.

- Honeywell International Inc.

Frequently Asked Questions

Analyze common user questions about the Motor Vehicle Sensors market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Motor Vehicle Sensors Market?

The primary growth factors are the stringent global safety regulations mandating ADAS features (e.g., AEB and ESC), the rapid adoption of electric vehicles requiring complex battery and thermal management sensors (current, voltage, temperature), and the continuous technological push towards higher levels of autonomous driving (L3 and L4) necessitating advanced perception systems like Lidar and 77 GHz Radar for environmental awareness.

How do autonomous driving levels (L3, L4, L5) impact sensor technology requirements?

Higher levels of autonomy require redundancy and diversity, significantly increasing the sensor count and sophistication. L3 demands highly accurate sensor fusion (Lidar, Radar, Camera) for hands-off operation, while L4 and L5 necessitate automotive-grade solid-state sensors that provide 360-degree, high-resolution perception capability and are highly resilient to failure, often incorporating built-in AI for edge processing.

Which sensor technology segment is projected to exhibit the fastest growth rate?

The Perception Sensor segment, encompassing Lidar, high-resolution Camera sensors, and 77 GHz Radar, is projected to show the fastest growth. This acceleration is directly linked to the widespread adoption of ADAS features across mid-range and premium vehicles and the increasing validation of autonomous driving technology platforms by global OEMs, fundamentally raising the average market value per vehicle.

What is the role of MEMS technology in modern vehicle sensors?

MEMS (Micro-Electro-Mechanical Systems) technology is critical for miniaturization and cost reduction, forming the basis for high-volume sensors such as accelerometers, gyroscopes, and pressure sensors (like those used in TPMS and manifold pressure monitoring). MEMS enables precise measurement in a tiny footprint, essential for integration into vehicle control systems like electronic stability control (ESC) and airbag deployment modules.

What challenges currently restrain the overall growth of the sensor market?

Key restraints include the extremely high upfront cost associated with advanced sensor systems, particularly Lidar, which affects mass-market adoption; the inherent complexity of integrating diverse sensor outputs into coherent, fail-safe systems; and rising cybersecurity concerns regarding the vulnerability of networked sensor data, which requires substantial investment in robust, secure hardware and software solutions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager