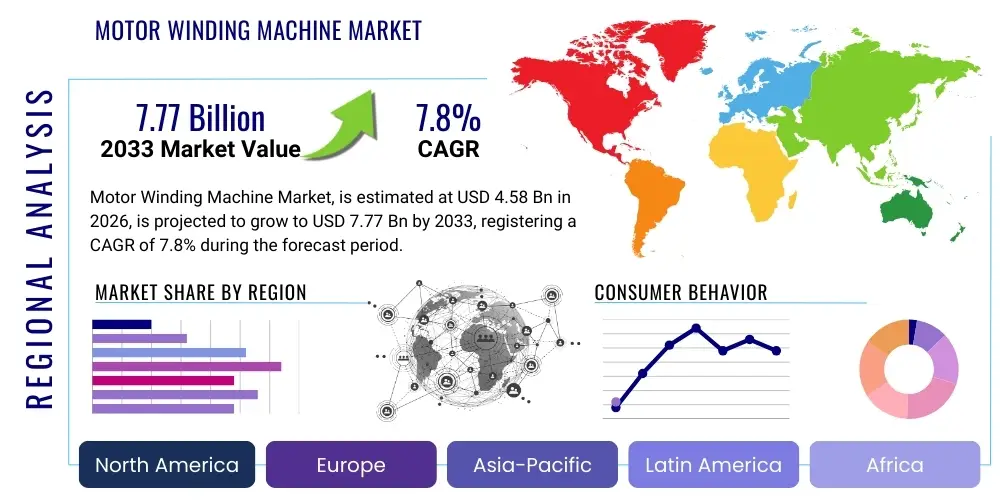

Motor Winding Machine Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437397 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Motor Winding Machine Market Size

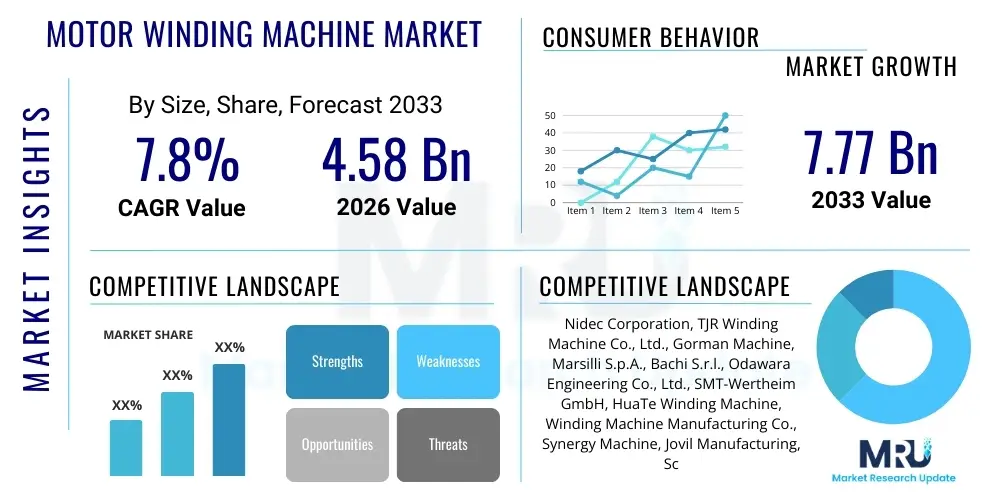

The Motor Winding Machine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 4.58 Billion in 2026 and is projected to reach USD 7.77 Billion by the end of the forecast period in 2033. This robust growth trajectory is primarily fueled by the accelerating global transition towards electric vehicles (EVs), requiring high-precision, automated winding solutions for traction motors. Furthermore, the increasing demand for energy-efficient industrial motors (IE3 and IE4 standards) across manufacturing sectors mandates modern, high-speed winding technology to optimize production yields and quality control, thereby driving significant investment in advanced machinery.

Motor Winding Machine Market introduction

Motor Winding Machines are specialized industrial apparatuses designed for precisely wrapping conductors (usually copper wire) around the cores or stators of electric motors, solenoids, transformers, and generators. This process is fundamental to the functionality of any electromagnetic device, determining the motor's efficiency, torque output, and overall operational lifespan. The evolution of these machines has moved from manual and semi-automatic systems toward fully automated, CNC-controlled, multi-spindle units capable of handling complex winding patterns required by modern, high-density power electronics, particularly in sectors such as electric mobility and high-efficiency heating, ventilation, and air conditioning (HVAC) systems.

Major applications for motor winding machines span the automotive industry (EV propulsion systems), consumer electronics (small precision motors for hard drives, cameras, and drones), heavy industrial machinery (large asynchronous and synchronous motors), and renewable energy generation (wind turbine generators). The primary benefits derived from these advanced systems include vastly improved winding accuracy, reduced cycle times, minimal material waste, and enhanced consistency in mass production environments. These factors collectively address the manufacturing challenges associated with higher pole counts and tighter dimensional tolerances prevalent in contemporary motor designs, especially those employing permanent magnet synchronous motor (PMSM) technology.

The market is predominantly driven by global electrification mandates and stringent energy efficiency regulations, which necessitate the replacement of older, less efficient motors with modern, optimally wound equivalents. Additionally, the rapid expansion of factory automation, particularly in Asia Pacific manufacturing hubs, fuels demand for high-speed, reliable automated winding equipment. Technological advancements, including the integration of servo drives, machine vision systems for quality inspection, and enhanced software for simulating winding patterns, further catalyze market expansion by offering superior operational flexibility and reduced operational expenditures for manufacturers worldwide.

Motor Winding Machine Market Executive Summary

The Motor Winding Machine Market is characterized by significant investment in automation, driven primarily by the global shift towards electric mobility and sustainable industrial practices. Business trends show a strong emphasis on developing highly flexible, modular winding platforms capable of handling diverse motor geometries and wire gauges, essential for manufacturers serving multiple end-user segments. Key manufacturers are focusing on integrating Industry 4.0 capabilities, such as real-time monitoring, predictive maintenance, and seamless integration with Manufacturing Execution Systems (MES), allowing for optimized production scheduling and minimizing unexpected downtime, which is critical in high-volume production lines like those for automotive stators.

Regionally, Asia Pacific (APAC), spearheaded by China, Japan, and South Korea, maintains dominance due to its robust manufacturing base in consumer electronics, traditional automotive components, and the burgeoning EV battery and motor sector. This region benefits from lower manufacturing costs and substantial government support for industrial automation and new energy vehicle development. Conversely, North America and Europe are distinguished by demand for high-end, technologically sophisticated machines capable of extremely tight tolerance windings for specialized applications in aerospace, medical devices, and premium automotive sectors, focusing less on volume and more on precision engineering and rapid prototyping capabilities.

Segment trends highlight the significant growth of the fully automatic segment over semi-automatic machines, reflecting the industry's need for maximum throughput and labor reduction. Within application segments, the automotive sector, specifically driven by electric vehicle motor production (both traction and auxiliary), is the fastest-growing category, demanding high-slot fill factor and precision flat wire (hairpin) winding technologies. Furthermore, the rising adoption of specialized winding types, such as needle winding, which offers superior slot fill characteristics for high-performance motors, indicates a technological maturation and specialization within the market landscape, pushing innovation in machine kinematics and control systems.

AI Impact Analysis on Motor Winding Machine Market

User inquiries regarding AI's influence typically center on three core themes: achieving zero-defect production, optimizing complex winding processes like hairpin insertion, and improving machine utilization through predictive analytics. Users often ask how AI vision systems can guarantee the flawless detection of minor wire insulation damage or winding inconsistencies at high speeds, a critical concern given the cost implications of faulty motor components in EVs. Another major point of interest is the use of machine learning to dynamically adjust winding tension and speed based on real-time material properties (wire temperature, elasticity), aiming for optimal slot fill factor regardless of environmental fluctuations or batch variations. Finally, there is significant curiosity about leveraging AI algorithms for designing novel, more efficient winding patterns that standard computational methods cannot easily achieve, leading to superior motor performance.

The integration of Artificial Intelligence (AI) into motor winding machines is rapidly transforming the market from purely mechanical automation to intelligent manufacturing systems. AI algorithms, particularly those governing computer vision and machine learning (ML), are utilized for enhanced quality control, far surpassing traditional sensor-based inspection. High-definition cameras coupled with deep learning models can analyze minute defects in wire placement, insulation integrity, and coil shape, ensuring extremely high product quality and reducing the need for costly manual inspections or late-stage fault finding, thereby significantly lowering scrap rates in high-precision motor manufacturing. This shift toward AI-driven quality assurance is crucial for sectors like aerospace and automotive where component reliability is paramount.

Furthermore, AI is instrumental in optimizing operational efficiency and predictive maintenance (PdM). Machine learning models analyze vast datasets generated by machine sensors—including vibration, temperature, current draw, and cycle time variations—to predict potential mechanical failures in components like spindles, tensioning systems, or wire guides long before they occur. This transition from time-based or reactive maintenance to predictive scheduling maximizes machine uptime and throughput. Additionally, AI algorithms are being applied in process optimization, dynamically adjusting process parameters (speed, tension, pitch) in real-time to maintain consistent coil characteristics despite variations in raw material quality or ambient temperature, leading to superior winding consistency and overall motor performance optimization.

- AI-Driven Quality Control: Real-time image recognition for zero-defect coil inspection and fault detection.

- Predictive Maintenance (PdM): ML algorithms predict component failure, maximizing machine utilization and reducing unscheduled downtime.

- Process Optimization: Dynamic adjustment of winding parameters (tension, speed) based on material feedback to achieve optimal slot fill.

- Complex Pattern Generation: AI assists in designing and simulating novel, high-efficiency winding topologies, such as advanced hairpin configurations.

- Enhanced Robotics Integration: AI optimizes robot movements for wire handling, insertion, and manipulation, improving overall cycle speed.

DRO & Impact Forces Of Motor Winding Machine Market

The Motor Winding Machine Market is fundamentally shaped by the intersection of technological necessity and global macroeconomic shifts. Key drivers include the overwhelming global policy momentum towards vehicle electrification and the corresponding boom in EV production, which requires specialized, high-volume production machinery. Restraints often revolve around the high initial capital expenditure required for advanced CNC automatic winding systems and the persistent difficulty in standardizing winding processes across diverse motor designs, especially for custom applications. Opportunities lie in developing machines capable of handling new materials like composite insulation and different conductor types (e.g., Litz wire, flat wire), while the primary impact forces are derived from the need for superior motor efficiency and the pressure to reduce manufacturing cycle times to meet booming demand.

Drivers: The most powerful driver is the stringent enforcement of global energy efficiency standards (IE3, IE4, and beyond) for industrial motors, compelling manufacturers to upgrade or replace legacy equipment. The massive global investment in EV battery and motor gigafactories necessitates corresponding investment in highly automated winding and assembly lines capable of 24/7 high-precision operation. Furthermore, the proliferation of specialized motors in robotics, medical pumps, and HVAC systems (utilizing brushless DC motors) increases the demand for flexible, multi-purpose winding equipment. This technological push is supported by the decreasing cost and increasing capability of computerized numerical control (CNC) systems, making advanced automation more accessible.

Restraints: Significant restraints include the substantial initial investment cost associated with high-end, fully automatic winding machines, particularly those employing complex technologies like hairpin forming and insertion systems, which poses a barrier to entry for smaller manufacturers. Furthermore, the global scarcity and high price volatility of key raw materials, such as copper and specialized magnet wire, impact the overall cost structure of both the motors and the machinery required to produce them. Standardization challenges persist, as motor specifications vary widely across industries (from micro-motors to large industrial stators), requiring machine builders to often customize solutions, which slows down deployment and increases engineering costs.

Opportunities: Major opportunities exist in the development of modular and reconfigurable winding platforms that can quickly adapt to shifting production demands and motor design iterations, crucial for agile EV manufacturers. The focus on integrating advanced digital twins and simulation software offers a competitive edge, allowing manufacturers to model and test new winding patterns virtually before costly physical implementation. Additionally, expansion into emerging economies that are industrializing rapidly, particularly in Southeast Asia and Africa, provides untapped market potential for both new and refurbished semi-automatic and automatic winding systems as local manufacturing capacity increases. The shift toward sustainable manufacturing also creates opportunities for developing energy-efficient machine operation itself.

- Drivers:

- Rapid expansion of Electric Vehicle (EV) manufacturing globally.

- Increasing demand for high-efficiency industrial motors (IE4 standards).

- Advancements in automation and CNC control technology.

- Restraints:

- High initial capital investment required for fully automatic systems.

- Complexity and customization requirements for specialized motor designs.

- Supply chain volatility and price fluctuations of essential materials (e.g., copper wire).

- Opportunity:

- Growing adoption of flat wire (hairpin) winding technology.

- Integration of Industry 4.0 features (IoT, predictive maintenance).

- Expansion into emerging applications like surgical robotics and drone technology.

- Impact Forces:

- Need for enhanced motor power density and torque output.

- Pressure to reduce manufacturing cycle times (throughput maximization).

- Stringent quality requirements demanding precise winding tolerance.

Segmentation Analysis

The Motor Winding Machine market is fundamentally segmented by the level of automation (type), the conductor shape, and the application industry, reflecting the diverse requirements of modern motor manufacturing. The automation segment (fully automatic versus semi-automatic) often correlates directly with production volume and required precision, with the automatic segment dominating growth due to large-scale EV and industrial motor production. Conductor shape, particularly the rise of flat wire winding (hairpin technology), necessitates specialized machine designs capable of complex bending, insertion, and welding processes. Analyzing these segments provides critical insights into capital expenditure trends and technological focus areas across different end-user sectors, enabling tailored market strategies.

- By Type:

- Semi-Automatic Winding Machines

- Automatic Winding Machines (CNC controlled)

- By Application:

- Automotive (Traction Motors, Auxiliary Motors)

- Industrial Motors (Generators, Pumps, Fans)

- Consumer Electronics (HDD Spindles, Camera Modules)

- Aerospace & Defense

- Medical Devices

- Home Appliances (HVAC, Washing Machines)

- By Winding Type/Technology:

- Fly Winding

- Needle Winding

- Slot Winding (Conventional)

- Hairpin Winding (Flat Wire)

Value Chain Analysis For Motor Winding Machine Market

The value chain for the Motor Winding Machine market is complex, starting with highly specialized upstream suppliers and culminating in diverse downstream motor manufacturers. Upstream activities involve the sourcing of high-precision components, including advanced CNC controllers (e.g., Siemens, Fanuc), servo motors, vision systems, and specialized metal alloys for machine frames and winding tooling. The quality and reliability of these upstream components directly dictate the performance and longevity of the final winding machine. This stage is crucial as the specialized tooling required for precise wire handling (like nozzles and guides) is often highly customized and requires expert metallurgical and engineering input.

The core of the value chain is the manufacturing and assembly phase, where machine builders integrate these components, develop proprietary software, and perform rigorous calibration. Motor Winding Machine manufacturers often engage in significant R&D to optimize machine kinematics and develop specialized winding heads (e.g., 8-axis needle winding systems) to handle increasingly complex motor designs, focusing on maximizing slot fill and speed. Distribution channels are typically a mix of direct sales for high-value, customized automatic systems (allowing for close interaction and service agreements with major automotive Tier 1 suppliers) and indirect sales through specialized regional distributors for standard or semi-automatic models targeting smaller enterprises or general industrial users. After-sales service, including remote diagnostics and tooling replacement, forms a critical part of the value proposition.

Downstream analysis focuses on the end-users: large original equipment manufacturers (OEMs) and smaller motor repair and service shops. Major OEMs (Automotive, HVAC, Industrial) procure high-throughput automatic machines directly, driven by long-term strategic contracts and the need for seamless integration into fully automated assembly lines (Direct Channel). Conversely, small to medium enterprises (SMEs) and repair shops often purchase semi-automatic or reconditioned equipment via local specialized distributors (Indirect Channel). The entire chain is experiencing pressure to become more agile, driven by the rapid evolution of motor technology, particularly the shift from round wire to flat wire, forcing machine manufacturers to quickly retool their designs and distribution strategies to cater to the accelerating EV market demands.

Motor Winding Machine Market Potential Customers

The primary customers for motor winding machines are electric motor manufacturers spanning a wide spectrum of industries, ranging from global automotive giants setting up gigafactories for EV drivetrain components to niche medical device producers requiring ultra-precise micro-coils. The largest and fastest-growing customer segment is the automotive industry, comprising OEMs and Tier 1 suppliers focused on producing high-performance traction motors (stators and rotors), crucial for meeting range and power requirements in electric and hybrid vehicles. These customers prioritize speed, reliability, and the ability to handle high slot-fill factors using advanced technologies like hairpin winding.

Industrial motor manufacturers constitute a stable and substantial customer base, continuously upgrading machinery to comply with stricter energy efficiency regulations and to meet the demand for high-torque motors used in robotics, heavy machinery, and factory automation systems. Furthermore, manufacturers of consumer appliances, especially in the HVAC segment, are significant buyers, driven by the need for quiet, energy-efficient brushless DC (BLDC) motors for compressors and fans. The demands of these customers emphasize volume production and cost efficiency, often favoring highly standardized, fully automatic multi-spindle machines designed for continuous operation and easy maintenance.

Niche but high-value customer segments include medical device manufacturers requiring miniature winding machines for precise micro-coils used in surgical tools, implantable devices, and diagnostic equipment, where accuracy is paramount, often down to single-turn tolerance. Similarly, aerospace and defense contractors purchase specialized winding equipment for high-reliability components used in actuation systems and generators. These customers typically demand highly customized, low-volume machines with stringent quality assurance and certification processes, often purchasing directly from specialized machine builders to ensure full process control and proprietary technology protection.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.58 Billion |

| Market Forecast in 2033 | USD 7.77 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Nidec Corporation, TJR Winding Machine Co., Ltd., Gorman Machine, Marsilli S.p.A., Bachi S.r.l., Odawara Engineering Co., Ltd., SMT-Wertheim GmbH, HuaTe Winding Machine, Winding Machine Manufacturing Co., Synergy Machine, Jovil Manufacturing, Schirp GmbH, Elite Machinery, Dongguan CIGAL, Shenzhen Sinrad Technology, Haimer Group, ATOP S.r.l., Mikado, Bobinadora Industrial, E. J. Systems. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Motor Winding Machine Market Key Technology Landscape

The current technology landscape of the Motor Winding Machine Market is defined by the convergence of high-precision mechanics, sophisticated computerized numerical control (CNC), and advanced sensor technology, all driven by the relentless pursuit of speed and accuracy. Modern machines heavily rely on multi-axis CNC systems, often leveraging high-speed servo motors and linear drives to achieve micron-level positioning and dynamic acceleration profiles, essential for achieving rapid cycle times while maintaining winding consistency. The move towards highly integrated robotic handling systems is also prominent, automating material loading, wire cutting, and final part removal to minimize human intervention and maximize throughput in production environments demanding hundreds of thousands of stators annually.

A critical technological specialization driving market innovation is the adoption of flat wire (hairpin) winding technology, predominantly in the automotive sector for high-performance EV traction motors. Hairpin machines incorporate complex forming, insertion, twisting, and laser or plasma welding stations integrated into a single high-speed line. This specialization requires significant investment in proprietary tooling and process control systems to manage the deformation and insulation integrity of the rectangular conductors. Furthermore, digitalization via the Industrial Internet of Things (IIoT) is becoming standard, with machines equipped with numerous sensors transmitting real-time operational data (e.g., tension, temperature, vibration) to cloud-based analytics platforms, enabling remote diagnostics, process optimization, and proactive maintenance scheduling, thereby enhancing overall equipment effectiveness (OEE).

Other key technological advancements include the increasing use of machine vision systems, utilizing high-resolution cameras and pattern recognition software to provide inline, non-contact quality assurance. This technology inspects features such as coil alignment, slot presence, and potential copper burrs instantly, ensuring that only compliant stators proceed to subsequent assembly stages. Moreover, software development focuses on simulation and digital twin capabilities, allowing engineers to simulate various winding parameters and motor geometries virtually to optimize performance and manufacturability before committing to costly physical prototypes. This integration of software and hardware enables a faster design-to-production cycle, which is increasingly vital in the competitive and rapidly evolving electric mobility sector.

Regional Highlights

- Asia Pacific (APAC): APAC is the dominant market, driven by its unparalleled concentration of electronics, automotive, and general industrial manufacturing capacity, particularly in China, South Korea, and Japan. China acts as a primary growth engine, fueled by massive domestic investment in EV production and supportive governmental policies promoting industrial automation and smart manufacturing. This region demands both high-volume, cost-efficient automated systems for mass-market motors and specialized, high-precision equipment for advanced component manufacturing, making it the most complex and competitive regional market.

- North America: This region is characterized by high demand for advanced, technologically sophisticated winding machines, particularly driven by new EV startups and the revitalization of domestic manufacturing bases seeking to build secure and localized supply chains. The market prioritizes quality, flexibility, and the integration of advanced IIoT solutions. Demand is strong not only in automotive but also in high-value niche sectors like aerospace, defense, and specialized medical device manufacturing, where regulatory compliance and extreme precision are non-negotiable requirements.

- Europe: Europe is a mature market focusing on technological leadership, particularly in machine precision, energy efficiency, and sustainability. Germany, Italy, and Switzerland host major machine builders and demonstrate robust demand for high-end automation solutions tailored for premium industrial motors and sophisticated EV components. European manufacturers are keen on adopting hybrid winding techniques (combining needle and flyer winding) and stringent quality control systems to maintain their competitive edge in high-quality industrial applications and advanced automotive platforms.

- Latin America (LATAM): The LATAM market represents a developing opportunity, with growth concentrated primarily in countries like Brazil and Mexico, driven by localized automotive production and increasing investment in infrastructure projects requiring industrial motors. Demand is often centered around semi-automatic and basic automatic machines, focusing on efficiency improvements over manual labor, although specialized manufacturing hubs are slowly adopting more advanced CNC solutions.

- Middle East & Africa (MEA): MEA is currently the smallest market, though showing emerging potential due to industrial diversification efforts in the UAE and Saudi Arabia, particularly in petrochemicals and renewable energy infrastructure. The demand profile is highly variable, with some segments requiring high-volume industrial machines and others focused on maintenance and repair services, creating steady demand for rugged and reliable semi-automatic equipment.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Motor Winding Machine Market.- Nidec Corporation

- Marsilli S.p.A.

- Odawara Engineering Co., Ltd.

- Bachi S.r.l.

- SMT-Wertheim GmbH

- Gorman Machine

- TJR Winding Machine Co., Ltd.

- HuaTe Winding Machine

- Winding Machine Manufacturing Co.

- Synergy Machine

- Jovil Manufacturing

- Schirp GmbH

- Elite Machinery

- Dongguan CIGAL

- Shenzhen Sinrad Technology

- ATOP S.r.l.

- Mikado

- Bobinadora Industrial

- Haimer Group

- E. J. Systems

Frequently Asked Questions

Analyze common user questions about the Motor Winding Machine market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary technological driver transforming the Motor Winding Machine Market?

The primary technological driver is the massive adoption of Electric Vehicles (EVs), which necessitates specialized, high-precision Hairpin Winding technology for manufacturing high-slot fill factor stators, driving machine builders to invest heavily in advanced CNC forming and welding systems.

How does the high initial cost of automatic winding machines affect market adoption?

The high initial capital expenditure restrains market adoption primarily among Small and Medium Enterprises (SMEs) and repair shops. However, the superior efficiency, reduced labor costs, and guaranteed precision offered by fully automatic systems justify the investment for large-scale automotive and industrial manufacturers.

Which segment of the Motor Winding Machine Market is expected to exhibit the fastest growth?

The fully Automatic Winding Machine segment, specifically those utilizing Needle Winding and Hairpin/Flat Wire technology, is projected to show the fastest growth rate, fueled by the accelerating global demand for high-performance, energy-efficient motors in the EV and HVAC sectors.

What role does Industry 4.0 play in the evolution of winding machine technology?

Industry 4.0, primarily through IIoT and AI integration, enables real-time monitoring, predictive maintenance, and data-driven process optimization. This integration is crucial for maximizing Overall Equipment Effectiveness (OEE) and ensuring zero-defect production in highly automated motor assembly lines.

Which geographical region dominates the Motor Winding Machine Market and why?

The Asia Pacific (APAC) region currently dominates the market due to its overwhelming manufacturing base in consumer electronics, traditional industrial goods, and its leading role in the establishment of global EV and battery supply chains, particularly driven by investments in China and South Korea.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager