Motorcycle Engine Management System Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436375 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Motorcycle Engine Management System Market Size

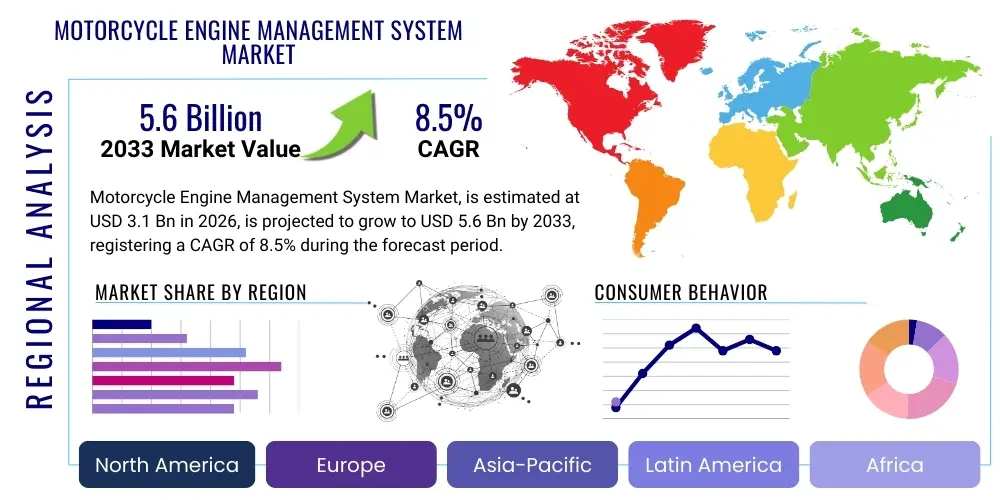

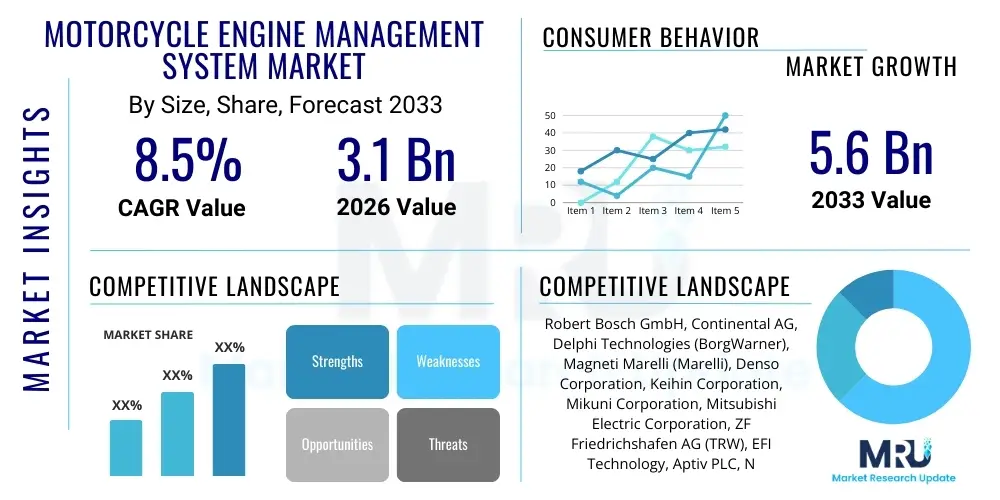

The Motorcycle Engine Management System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 3.1 Billion in 2026 and is projected to reach USD 5.6 Billion by the end of the forecast period in 2033.

Motorcycle Engine Management System Market introduction

The Motorcycle Engine Management System (EMS) Market encompasses the sophisticated electronic control units (ECUs), sensors, and actuators designed to precisely regulate engine performance, optimize fuel efficiency, and minimize harmful emissions in two-wheeled vehicles. These integrated electronic architectures are foundational to modern motorcycle design, offering a vast leap in control precision compared to legacy mechanical systems. The core system architecture includes the ECU, which acts as the brain, collecting real-time operational data from various sensors—such as exhaust gas oxygen sensors, manifold absolute pressure sensors, and engine speed sensors—to calculate and execute optimal control strategies for fuel metering and ignition timing. This technology transition has been significantly accelerated by global environmental policies, forcing OEMs to adopt advanced electronic control to comply with increasingly stringent limits on carbon monoxide, unburnt hydrocarbons, and nitrogen oxides. The adoption of EMS is mandatory for nearly all new motorcycles sold in regulated markets, ensuring uniform and high standards of environmental performance and operational safety.

The diverse product portfolio within the EMS sector includes highly specialized components tailored for different engine requirements and applications. For instance, high-performance motorcycles necessitate ECUs with higher processing power to manage complex variables like variable valve actuation, multiple fuel maps, and integration with advanced rider aids (e.g., lean-angle sensitive traction control). In contrast, the mass-market commuter segment requires robust, cost-effective ECUs optimized primarily for fuel economy and compliance under urban operating cycles. Major applications span across light two-wheelers, heavy-duty motorcycles, and even specialized commercial three-wheelers, all benefiting from the superior diagnostic capabilities and consistent performance afforded by electronic control. Key benefits derived from adopting sophisticated EMS include substantial reductions in lifecycle emissions, improved cold-start capabilities, enhanced responsiveness (throttle-by-wire), and the ability to integrate advanced safety functions that significantly mitigate risks associated with high-speed riding and challenging terrain.

The principal driving factors underpinning the sustained expansion of the EMS market are multi-faceted, rooted deeply in legislative necessity and consumer preference for safety and connectivity. Governmental mandates across Asia, Europe, and North America pertaining to compulsory electronic safety features, such as Anti-lock Braking Systems (ABS), and increasingly strict emission reduction targets (post-Euro V planning) serve as the most powerful market drivers. Beyond regulatory compliance, consumer demand for technologically sophisticated motorcycles offering customizable riding experiences, superior diagnostics, and seamless integration with smart devices further fuels market growth. The ongoing shift toward modular EMS designs that facilitate over-the-air (OTA) updates and remote diagnostics is critical, promising lower lifetime maintenance costs and greater system flexibility, thus appealing to both OEMs seeking efficiency and end-users demanding technological superiority and reduced service downtime. The convergence of conventional powertrain management needs with emerging electrification requirements—often requiring the EMS to interface seamlessly with the Battery Management System (BMS)—is also opening substantial new growth avenues.

Motorcycle Engine Management System Market Executive Summary

The Motorcycle Engine Management System market is experiencing a period of accelerated evolution, characterized by significant investment in software sophistication and component miniaturization, driven overwhelmingly by regulatory convergence across global markets. Current business trends show established automotive Tier 1 suppliers solidifying their market dominance by leveraging their expertise in mass production, functional safety protocols (ISO 26262), and semiconductor supply chain resilience. Competitive advantage is increasingly shifting from hardware cost to software quality and calibration expertise, enabling differentiated performance characteristics even with standardized hardware. A crucial business development involves the increasing integration of diagnostic-over-internet protocols, allowing OEMs to gather vast amounts of real-world data for iterative calibration improvements, enhancing product reliability and minimizing warranty claims. Consolidation of suppliers capable of offering full-stack solutions, from sensor manufacturing to ECU software tuning, is a noticeable trend impacting strategic market positioning.

Regional dynamics clearly delineate the market into volume-driven (Asia Pacific) and value-driven (Europe and North America) segments. Asia Pacific dictates market volume through its enormous commuter segment, demanding cost-optimized, highly durable EMS solutions for mandatory compliance with standards like BS-VI. This region is critical for driving economies of scale. Conversely, Europe continues to lead in technological adoption, requiring high-specification ECUs to manage complex, rider-aid-heavy motorcycles and adhere to stringent environmental and safety regulations. North America maintains a strong demand for performance-focused EMS suitable for large engines and enabling advanced tuning capabilities, reflecting the unique cruiser and touring bike market preferences. Emerging markets in Latin America and the Middle East are transitioning rapidly, presenting opportunities for suppliers offering reliable entry-level EFI conversion kits and localized technical support to facilitate mass adoption in less mature infrastructure environments.

Segmentation analysis underscores the enduring dominance of the Engine Control Unit (ECU) in terms of market value, owing to its computational complexity and intellectual property embedded within its software. However, the Sensors segment, particularly high-accuracy oxygen and position sensors, is witnessing rapid growth in volume due to the necessity for finer control mandated by emission norms. By application, the standard and commuter motorcycle segment drives overall unit volume, although the high-performance Sports and Cruisers categories remain pivotal for revenue growth due to the higher complexity and cost of the integrated EMS and related rider assistance features. The 250cc-500cc displacement segment is emerging as the fastest-growing category globally, reflecting a consumer shift toward premium commuter and entry-level adventure bikes that necessitate sophisticated, yet price-conscious, EMS integration to deliver optimal performance and maintain emissions compliance, requiring suppliers to adapt their product offerings rapidly to meet this surging middle ground demand.

AI Impact Analysis on Motorcycle Engine Management System Market

User inquiries frequently highlight concerns and expectations regarding the practical application of Artificial Intelligence (AI) and Machine Learning (ML) in enhancing motorcycle performance, safety, and operational longevity. Common questions revolve around the transition from fixed, pre-calibrated engine maps to dynamic, self-adjusting control strategies capable of adapting to varying fuel quality, altitude changes, and component degradation over time. A critical area of user interest lies in Predictive Maintenance (PdM): how AI can analyze subtle variances in sensor data (e.g., injector pulse width drift or temperature inconsistencies) to predict component failure well in advance, minimizing unexpected breakdowns and maintenance costs. Furthermore, high-performance riders are keen to understand how AI can optimize power delivery and throttle response instantaneously, maximizing track performance while ensuring the engine operates within safe parameters, essentially demanding an EMS that learns the rider's style and adapts accordingly.

The integration of AI into the Motorcycle Engine Management System marks a paradigm shift from deterministic control theory to adaptive, cognitive management. Advanced AI algorithms are now deployed to process massive multi-sensor data sets, allowing the ECU to develop highly sophisticated, self-learning control loops. For example, machine learning models can continuously monitor the efficiency of the catalytic converter by analyzing lambda sensor data and autonomously adjusting minor fueling trims to maintain peak efficiency throughout the vehicle's lifespan, even accounting for component aging and fuel variations. This capability is paramount for sustained compliance with long-term emission durability requirements. Furthermore, AI is increasingly critical for the effective operation of complex rider assistance systems; by processing IMU data, speed, and braking inputs, AI can instantaneously calculate the optimal intervention level for traction control or stability control in cornering, greatly enhancing safety margins that exceed the limits of pre-programmed, rule-based logic.

Beyond control and safety, the application of Generative AI and ML optimization techniques is revolutionizing the development and calibration cycle itself. OEMs are utilizing AI to rapidly simulate millions of potential engine maps under diverse environmental and load conditions, drastically reducing the physical dyno time required for optimal tuning and certification. This accelerates the time-to-market for new engine variants and allows for precise regional calibration tailored to local fuel standards or altitude variations. The data collected by AI-enabled ECUs also forms the backbone of Prognostic Health Management (PHM) services, providing valuable insights into component stress and expected remaining life, transforming the servicing model from reactive repair to proactive, condition-based maintenance. This advancement solidifies the EMS not merely as a control mechanism but as a sophisticated, connected intelligence platform that continuously optimizes the motorcycle's overall function and safety profile across its operational life.

- AI enables predictive diagnostics and prognostics by analyzing sensor data patterns for early component failure detection, transitioning from reactive to condition-based maintenance.

- Machine learning algorithms facilitate adaptive engine mapping, optimizing fuel efficiency and performance in real-time based on environmental factors (altitude, temperature) and rider input.

- AI enhances sustained compliance with stringent emission standards by continuously adjusting combustion parameters to counteract component aging and fuel quality variations.

- Generative AI tools assist OEMs in rapidly prototyping and validating complex control strategies and software updates, dramatically reducing R&D cycles and calibration costs.

- AI powers advanced sensor fusion, crucial for integrating data from Inertial Measurement Units (IMUs) to manage sophisticated safety features like lean-angle sensitive traction control and cornering ABS.

- Integration of AI-driven anomaly detection enhances cybersecurity, fortifying the EMS against remote intrusion and unauthorized map modifications by recognizing irregular behavior patterns.

- AI supports personalization by learning individual rider characteristics and adjusting throttle response, engine braking, and torque delivery curves for a tailored experience.

DRO & Impact Forces Of Motorcycle Engine Management System Market

The core dynamics of the Motorcycle Engine Management System market are governed by robust drivers, persistent restraints, and transformative opportunities, creating powerful impact forces that shape investment and strategic maneuvering. The predominant driver remains the regulatory imperative, specifically the global harmonization toward stringent emission standards (e.g., Euro V, BS-VI), which mandates the precision control offered exclusively by electronic systems. This regulatory momentum ensures sustained market expansion, particularly in high-volume regions like APAC, where compliance compels mass adoption. Additionally, the increasing consumer desire for sophisticated safety features (ABS, traction control) and connected vehicle functionalities (telematics, remote diagnostics) further amplifies demand for advanced, integrated EMS solutions capable of serving as the central nervous system for these features. These drivers create a non-negotiable requirement for EMS fitment across all new vehicle platforms.

Conversely, market expansion is constrained by several critical factors. The most significant is the substantial increase in the Bill of Materials (BOM) cost incurred by switching from simple carburetor mechanisms to full EMS, making the price point challenging for highly cost-sensitive commuter segments in developing markets. Furthermore, the complexity of EMS requires specialized calibration expertise and diagnostic tools, creating high barriers for small-scale manufacturers and independent repair shops, impacting aftermarket serviceability. Intellectual property disputes related to proprietary control software and the vulnerability of connected systems to cyber threats also present notable restraints. Addressing the cost constraint often involves optimizing ECU hardware for high integration density and leveraging shared software platforms across multiple engine variants to achieve necessary economies of scale without compromising quality or compliance.

The market is rich with transformative opportunities centered around electrification and digitalization. The growing adoption of hybrid and electric motorcycles necessitates the development of integrated powertrain management systems that merge conventional EMS functions with advanced Battery Management Systems (BMS) and motor control logic, offering new product differentiation avenues. Opportunities also exist in refining sensor technology—making them smaller, more durable, and cheaper—to facilitate wider deployment of sophisticated control strategies across mid-range models. The primary impact forces compel Tier 1 suppliers to accelerate technological development, prioritizing functional safety certification (ISO 26262 compliance) and robust cybersecurity over all other features, as these are prerequisites for selling into highly regulated markets. This competitive environment leads to rapid consolidation, favoring large players capable of handling high capital expenditure for R&D and meeting stringent global OEM quality assurance standards.

Segmentation Analysis

The Motorcycle Engine Management System market is meticulously analyzed across three core segmentation dimensions: component, application, and engine displacement, allowing for a detailed understanding of market requirements and expenditure patterns. Component segmentation highlights the critical distinction between the physical hardware (ECU, Sensors, Actuators) and the indispensable software necessary for system functionality, emphasizing the increasing value embedded within proprietary calibration and control algorithms. Application segmentation divides the market based on the end-use type, recognizing that the demands of a high-speed sports bike—requiring complex performance mapping—differ vastly from those of a utilitarian commuter motorcycle, which prioritizes durability and fuel economy. Finally, engine displacement segmentation is vital for understanding volume distribution and technological complexity; smaller engines demand high-volume, cost-effective solutions, while larger engines justify the use of advanced, feature-rich ECUs and sensor suites due to their higher performance requirements and premium positioning.

- By Component:

- Engine Control Unit (ECU): The microprocessor backbone responsible for computational execution and system control.

- Sensors (Oxygen Sensors, Temperature Sensors, Pressure Sensors, Position Sensors): Collect crucial real-time operational data for decision-making.

- Actuators (Fuel Injectors, Throttle Body Actuators, Ignition Coils): Execute the control commands determined by the ECU.

- Software & Calibration Tools: Proprietary algorithms, firmware, and diagnostic tools essential for tuning and maintenance.

- By Application/Motorcycle Type:

- Standard/Commuter Motorcycles: High volume, cost-sensitive segment driven by basic EFI and emissions compliance.

- Sports Motorcycles: High value segment requiring complex ECUs for performance tuning, IMU integration, and advanced rider aids.

- Cruisers and Touring Motorcycles: Focus on torque delivery, fuel range optimization, and integration of comfort features like cruise control.

- Off-Road and Adventure Motorcycles: Demand robust, weather-proof components and specialized mapping for low-traction and variable altitude conditions.

- By Engine Displacement:

- Below 250cc: Largest volume segment globally; highly cost-sensitive; focus on basic EFI reliability and mandatory compliance.

- 250cc - 500cc: Fastest growing segment; balancing performance requirements with cost-efficiency; mid-range sophistication.

- Above 500cc: Premium segment; utilizes highly advanced, feature-rich EMS, including all cutting-edge safety and performance integrations.

Value Chain Analysis For Motorcycle Engine Management System Market

The Value Chain Analysis begins at the upstream level with specialized component manufacturing, primarily semiconductors, microcontrollers, and application-specific integrated circuits (ASICs), which are foundational to the ECU. This stage is dominated by large, global technology providers like NXP, Infineon, and STMicroelectronics. The quality and availability of these electronic components dictate the EMS system's capabilities, processing speed, and cost structure. Tier 2 suppliers focus on producing highly specialized sensor and actuator elements, such as piezoelectric materials for knock sensors or robust ceramic elements for oxygen sensors, requiring deep material science expertise and controlled manufacturing environments. Upstream risks include global chip shortages and fluctuations in commodity prices, necessitating strong contractual relationships and dual-sourcing strategies to maintain production stability for downstream integrators.

Moving midstream, Tier 1 suppliers like Bosch and Continental take on the role of system integrators. They source the electronic components and develop the proprietary hardware architecture and, critically, the complex control software and calibration libraries tailored to specific OEM engine families. This integration phase is highly capital-intensive, requiring extensive R&D facilities for testing, simulation, and functional safety validation (ISO 26262). Distribution from Tier 1 suppliers to OEMs is predominantly direct-to-assembly-line (Direct Channel), optimized for just-in-time delivery and tight quality control alignment. Successful operation at this stage hinges on the ability to customize software while standardizing hardware, allowing for volume scalability while accommodating the nuanced demands of various motorcycle manufacturers, from commuter bikes to high-performance racing platforms.

Downstream market activities focus on vehicle assembly, initial calibration, maintenance, and diagnostics. Motorcycle OEMs integrate the finalized EMS into the motorcycle frame and conduct final calibration checks specific to their vehicle model. The aftermarket (Indirect Channel) involves the distribution of replacement sensors, ignition components, and, increasingly, specialized diagnostic software and authorized tuning kits through certified dealer networks and independent specialized garages. As motorcycles become increasingly connected, the distribution of software updates (Over-The-Air, or OTA) represents a growing part of the downstream value chain, controlled predominantly by the OEM and the Tier 1 software provider. Efficiency in this segment is measured by the speed and reliability of diagnostics and the ease of applying software updates or recalibrations, ensuring that system performance and compliance are maintained throughout the vehicle's operational lifecycle, crucial for long-term customer satisfaction and brand reputation.

Motorcycle Engine Management System Market Potential Customers

The core clientele for Motorcycle Engine Management Systems remains the global community of Original Equipment Manufacturers (OEMs). This category is segmented into high-volume manufacturers (e.g., Hero MotoCorp, Bajaj, Honda in Asia) who prioritize unit cost, robust reliability, and compliance with mass-market emission standards; and premium manufacturers (e.g., BMW Motorrad, Ducati, KTM) who demand cutting-edge EMS platforms that integrate advanced safety and performance technologies, such as IMU integration and personalized rider modes. The mass-market OEMs drive volume and necessitate extreme cost optimization from suppliers, often pushing for highly standardized, modular EMS solutions that can be adapted quickly across a wide range of engine displacements (sub-250cc). In contrast, premium OEMs drive technological advancement, requiring highly specialized software development and deep collaboration to achieve unique performance signatures.

A second major customer cluster includes emerging mobility platforms, specifically electric motorcycle manufacturers, hybrid three-wheeler producers, and specialized last-mile delivery vehicle companies. Although traditional EMS components like injectors are absent, these customers require sophisticated control units that manage the electric motor drive (Motor Control Unit or MCU) and the crucial Battery Management System (BMS). Increasingly, suppliers are offering unified control architectures where traditional EMS expertise in thermal management, sensor processing, and fault diagnostics is adapted to electric vehicle requirements. This customer group is growing rapidly, driven by urbanization and government initiatives promoting zero-emission transport, representing a forward-looking revenue stream for EMS companies capable of pivoting their electronics expertise toward electrification challenges.

Furthermore, independent professional racing teams and authorized high-performance tuning workshops constitute a high-value niche customer base. These entities require ultra-high-specification ECUs that offer open architecture, deep configurability, and advanced data logging capabilities for competitive use. These customers are willing to pay a premium for systems that allow micro-calibration of engine parameters to extract maximum, race-legal performance. Lastly, the expansive global network of wholesale distributors, authorized dealer service centers, and professional repair franchises are crucial indirect customers, reliant on the EMS supplier for replacement components, mandatory diagnostic tools, and ongoing training needed to service the complex electronic systems installed in the rapidly expanding fleet of EMS-equipped motorcycles globally. Their needs focus on logistics efficiency, part availability, and software compatibility.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.1 Billion |

| Market Forecast in 2033 | USD 5.6 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Robert Bosch GmbH, Continental AG, Delphi Technologies (BorgWarner), Magneti Marelli (Marelli), Denso Corporation, Keihin Corporation, Mikuni Corporation, Mitsubishi Electric Corporation, ZF Friedrichshafen AG (TRW), EFI Technology, Aptiv PLC, NXP Semiconductors (Supplier of MCUs), Infineon Technologies AG, Visteon Corporation, Trelleborg AB, Autoliv Inc., S&S Cycle, Lectron Fuel Systems, Dorman Products, Bendix Commercial Vehicle Systems LLC. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Motorcycle Engine Management System Market Key Technology Landscape

The Motorcycle Engine Management System technology landscape is undergoing a radical transformation driven by the increasing need for higher computational capacity and advanced sensing capabilities to support complex control strategies and new safety features. Modern ECUs utilize powerful 32-bit and 64-bit microcontrollers, offering gigahertz-level processing speeds crucial for executing millions of instructions per second, which is necessary to handle simultaneous tasks such as fuel calculation, ignition timing, knock detection, traction control, and communication with the ABS module via the CAN bus. The continuous evolution of semiconductor technology allows for greater integration density, resulting in smaller, lighter ECUs with lower power consumption, which is critical in space and weight-constrained motorcycle environments. Furthermore, robust packaging techniques are increasingly employed to ensure that these sophisticated electronics withstand the intense thermal cycling and vibration inherent to motorcycle powertrains, maintaining reliability across diverse global operating conditions.

Sensor technology development is pivotal, moving toward highly accurate and multi-functional units. Wideband lambda (oxygen) sensors, capable of measuring air-fuel ratios with far greater precision than narrowband sensors, are becoming mandatory for meeting tight emission tolerances, allowing the ECU to maintain stoic conditions much more reliably. The integration of Inertial Measurement Units (IMUs) represents a major technological leap, providing real-time data on the motorcycle’s six degrees of freedom (roll, pitch, yaw, and accelerations). This data, processed by the EMS, enables sophisticated safety features such as Cornering ABS and lean-angle sensitive traction control, which adjust intervention levels based on the motorcycle's dynamic angle. The widespread adoption of IMUs, moving down from premium bikes to mid-range performance models, is significantly reshaping the safety technology benchmark for the entire industry and increasing the complexity requirements placed on the ECU and its software architecture.

Software development and connectivity technologies are defining the future of EMS. The adoption of AUTOSAR (Automotive Open System Architecture) is standardizing software components, enabling greater reusability and faster integration of new features, which is crucial for managing the growing complexity of electronic architectures. Over-the-Air (OTA) update capabilities, allowing remote updates of engine maps and control algorithms, minimize costly dealer visits for software fixes and enable continuous performance improvements post-sale. Cybersecurity is now non-negotiable, with embedded hardware security modules (HSMs) and advanced cryptographic techniques protecting against unauthorized access, malicious map tampering, and denial-of-service attacks, securing both the intellectual property of the engine mapping and the functional safety of the vehicle. These technological advancements ensure that the EMS not only manages the engine but acts as a secure, intelligent gateway for all electronic controls within the modern motorcycle.

Regional Highlights

Asia Pacific (APAC): The Global Volume Leader and Regulatory Compliance Catalyst

The Asia Pacific region commands the largest unit volume share of the global Motorcycle Engine Management System market, primarily due to the massive scale of motorcycle production and consumption in markets like India, China, and Southeast Asian nations. The region’s trajectory is overwhelmingly dictated by regulatory enforcement, specifically the mass adoption of BS-VI in India and equivalent standards elsewhere, which forced a transition from carburetors to electronic fuel injection across the high-volume sub-250cc commuter segment. This created a sudden, immense demand for standardized, low-cost, yet highly reliable EMS solutions. Suppliers focusing on APAC must excel in high-volume, cost-optimized manufacturing and maintain robust supply chains to support the enormous production schedules of regional giants like Hero, Bajaj, and TVS. The focus here is overwhelmingly on achieving compliance and maximizing fuel efficiency in dense urban traffic conditions.

Beyond the core commuter segment, the rapidly expanding middle-class segment in APAC is driving significant growth in the 250cc-500cc category, which necessitates more sophisticated EMS features, including improved throttle control and better performance mapping, while still maintaining aggressive pricing. Localized R&D is gaining importance, with suppliers establishing dedicated centers in India and China to tailor control software to regional fuel specifications and specific riding environments, such as high-altitude operations or varied road quality. The market dynamics are highly competitive, characterized by intense price wars, making operational efficiency and supply chain localization critical factors for success, ensuring that the EMS contribution to the final vehicle price remains within acceptable limits for the price-sensitive consumer base.

Europe: The Pioneer of Safety and High-Performance EMS Integration

The European market is the global benchmark for advanced Motorcycle Engine Management Systems, setting the pace for functional safety integration, performance features, and compliance with the most rigorous emission standards (Euro V and future Euro VI preparations). This region, while lower in volume compared to APAC, represents the highest value per unit sale, driven by the dominance of premium brands and large-displacement motorcycles. European demand is characterized by the mandatory integration of complex rider aids—such as sophisticated traction control systems, electronic suspension management, and engine braking control—all coordinated by a high-specification ECU utilizing IMU data. Suppliers must demonstrate expertise in certified functional safety engineering (ISO 26262), which is a prerequisite for selling into this technologically demanding market, positioning Europe as the lead market for advanced system validation.

The focus on connectivity and sustainability further differentiates the European market. There is a strong uptake of remote diagnostics, telematics, and over-the-air (OTA) update capabilities, leveraging the EMS as the hub for connected services. Furthermore, European regulatory bodies are increasingly focused on reducing real-driving emissions and ensuring long-term system integrity, demanding robust diagnostic capabilities and sophisticated software to manage complex emission control devices like secondary air injection and precise exhaust gas recirculation. OEMs in this region actively collaborate with Tier 1 suppliers on highly customized EMS solutions that deliver unique brand performance characteristics and comply with the extremely detailed technical requirements of the European type-approval process.

North America: Performance, Customization, and Emissions Rigor

North America is predominantly a market for large-displacement V-twins, touring motorcycles, and high-performance sport bikes, influencing the demand for highly configurable and robust EMS platforms. Regulatory standards from the EPA and CARB mandate high precision in emission control, particularly for large engines, requiring complex engine mapping and robust diagnostic capabilities that often integrate with advanced electronic throttle control systems. A unique characteristic of the North American market is the strong aftermarket tuning culture, which creates a niche demand for performance-oriented ECUs and calibration tools that allow authorized modifications while maintaining baseline regulatory compliance. Suppliers must balance the need for strict emissions adherence with the consumer expectation for power and engine auditory characteristics.

Technological trends in North America are increasingly focused on seamless integration of convenience and safety features. Features like integrated GPS, advanced cruise control, and rider information systems rely on the EMS for accurate speed and engine data. The sheer physical size and complex engine configurations of American cruisers and touring bikes often require specialized EMS architectures and heavier-duty components designed to manage the specific thermal and vibration challenges associated with these platforms. Therefore, the market values durability, serviceability, and software flexibility that supports both OEM standards and compliant performance upgrades, creating a specific focus on robust, highly adaptable control modules.

Latin America and Middle East & Africa (MEA): Rapid Transformation and Cost Challenges

Latin America (LATAM) and the Middle East & Africa (MEA) are critical emerging markets characterized by a rapid, yet fragmented, transition from older mechanical systems to electronic control. The primary driver in LATAM, particularly Brazil and Mexico, is government mandates pushing for cleaner air and modernized vehicle fleets, requiring EMS adoption in the high-volume utility and small commuter segments. The challenge here is the extremely high cost sensitivity and the need for systems that can operate reliably with varying fuel qualities and often less regulated maintenance environments. Suppliers must focus on providing highly simplified, functional, and durable EFI systems that minimize cost impact while ensuring minimum compliance thresholds.

The MEA region presents a dual market structure. Gulf Cooperation Council (GCC) countries exhibit high demand for premium, imported motorcycles with advanced EMS features, similar to European demands. However, the majority of the MEA region relies on low-cost, durable motorcycles for essential transportation, where the market is primarily driven by basic EFI introduction for entry-level models. Market success in these regions requires localized distribution networks, accessible training for local technicians, and products tailored for harsh climatic conditions (dust, high heat). The opportunity lies in assisting local manufacturers with the technological transition and capturing the volume growth as more countries enforce their versions of modern emission and safety regulations, progressively phasing out polluting legacy technologies.

- Asia Pacific (APAC): Highest unit volume; driven by regulatory compliance (BS-VI); demands cost-optimized, durable EMS for commuter bikes; fastest growth in 250cc-500cc segment.

- Europe: High-value market; mandates IMU integration, functional safety (ISO 26262), and advanced rider aids; technology leader for complex control systems.

- North America: Focused on large-displacement performance and cruising bikes; requires compliant customization tools and robust systems for high-horsepower engines.

- Latin America & MEA: Emerging transformation markets; highly cost-sensitive; rapid adoption of basic EFI driven by government mandates; significant potential in utility and last-mile vehicles.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Motorcycle Engine Management System Market.- Robert Bosch GmbH

- Continental AG

- Delphi Technologies (BorgWarner)

- Magneti Marelli (Marelli)

- Denso Corporation

- Keihin Corporation

- Mikuni Corporation

- Mitsubishi Electric Corporation

- ZF Friedrichshafen AG (TRW Automotive)

- Aptiv PLC

- Visteon Corporation

- Hitachi Astemo, Ltd.

- NXP Semiconductors N.V. (Key MCU Supplier)

- Infineon Technologies AG (Key Semiconductor Supplier)

- Trelleborg AB

- Autoliv Inc.

- Dana Incorporated

- Stmicroelectronics N.V.

- Bendix Commercial Vehicle Systems LLC

- TVS Supply Chain Solutions (for certain localized markets)

Frequently Asked Questions

Analyze common user questions about the Motorcycle Engine Management System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for Motorcycle Engine Management Systems globally, and how is it impacting the market?

The primary driver is the pervasive and tightening global implementation of vehicular emission standards, such as Euro V and Bharat Stage VI. This regulatory environment makes the precise, electronic control offered by the EMS mandatory for achieving compliance, forcing all manufacturers—especially those in high-volume Asian markets—to shift abruptly from simple mechanical systems to complex electronic fuel injection, thereby guaranteeing sustained high volume demand for EMS components and software.

How does the integration of Artificial Intelligence (AI) specifically influence the performance and reliability aspects of motorcycle EMS?

AI, through machine learning algorithms, enables the EMS to execute adaptive engine mapping, moving beyond fixed calibrations. This allows the system to continuously self-adjust fueling, timing, and other parameters in real-time based on environmental conditions and component aging. This optimization not only maximizes performance and fuel efficiency but also underpins predictive maintenance (PdM) capabilities, significantly enhancing the motorcycle's overall reliability and operational lifespan.

Which component segment holds the largest market share by value, and what makes it so critical?

The Engine Control Unit (ECU) component segment typically commands the largest market share by value. The ECU is the most critical element, hosting high-performance microcontrollers and complex proprietary software that executes all control and safety functions. Its high cost stems from the sophisticated electronic hardware required for computational speed, the extensive R&D invested in its functional safety (ISO 26262 compliance), and the intellectual property embedded within its complex calibration maps.

What are the main restraints hindering the rapid expansion of the EMS market, particularly concerning entry-level vehicles?

The most significant restraint is the substantial increase in the vehicle's Bill of Materials (BOM) due to the high cost of sophisticated EMS hardware (especially sensors and the ECU) compared to older, simpler systems. This cost burden is particularly challenging for high-volume, price-sensitive commuter segments in emerging economies, where minimizing the final retail price is crucial, slowing the complete market penetration of advanced electronic controls.

How are Over-The-Air (OTA) software updates changing the distribution and maintenance model for Motorcycle EMS?

OTA capabilities are revolutionizing the maintenance model by allowing manufacturers to remotely update or recalibrate engine maps and control algorithms without requiring a physical visit to a dealership. This greatly reduces maintenance costs and time, improves system flexibility throughout the vehicle's lifecycle, and strengthens the OEM's control over the vehicle's software performance and emissions compliance over the long term, moving the focus from physical repair to remote software management.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager