Motorcycle Handlebar Control Switches Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435806 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Motorcycle Handlebar Control Switches Market Size

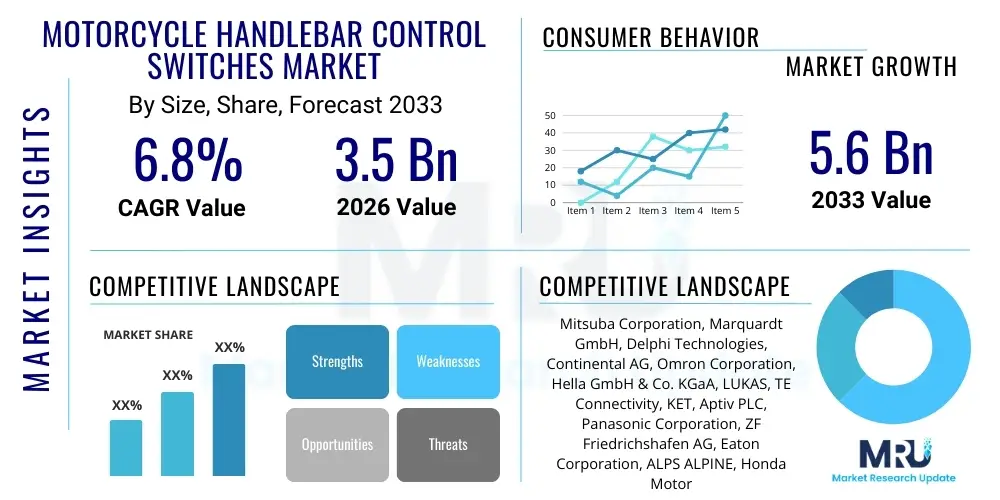

The Motorcycle Handlebar Control Switches Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 5.6 Billion by the end of the forecast period in 2033.

Motorcycle Handlebar Control Switches Market introduction

The Motorcycle Handlebar Control Switches Market encompasses the production, distribution, and sale of electrical and electronic components mounted on motorcycle handlebars designed to manage various functions such as ignition, lighting (headlights, high beams, turn signals), horn, engine kill, and increasingly, sophisticated features like traction control adjustments, ride mode selection, cruise control, and interface controls for integrated digital displays (TFT screens). These switches are essential safety and operational components, acting as the primary interface between the rider and the vehicle's electronic control units (ECUs). Market expansion is intrinsically linked to global motorcycle production volumes, advancements in vehicle electrification, and the growing consumer demand for premium, feature-rich motorcycles equipped with advanced rider assistance systems (ARAS).

The product range includes standard mechanical toggle switches, push buttons, momentary switches, and increasingly complex membrane switches and multi-function joysticks or selectors, especially prevalent in high-end touring and sport bikes. Major applications span across various motorcycle segments, including commuter bikes, scooters, cruisers, off-road bikes, and high-performance superbikes. The integration of advanced features such as heated grips controls, connectivity buttons (for Bluetooth or navigation), and emergency calling functions (e-Call) is driving complexity and value within the component market. The primary benefits of high-quality control switches include enhanced rider safety through reliable operation, improved ergonomics, and greater convenience in controlling complex motorcycle systems quickly and intuitively without distraction.

Driving factors propelling market growth include stringent global safety regulations mandating features like standardized headlight controls and emergency switches, the rapid adoption of electronically controlled fuel injection (EFI) and throttle-by-wire systems which require precise electronic inputs, and the continuous trend towards motorcycle digitalization. Furthermore, rising disposable incomes in emerging economies, particularly in Asia Pacific, fuel demand for both new motorcycles and aftermarket replacements. The shift towards electric motorcycles also requires redesigned, sometimes more durable and weather-sealed, control interfaces tailored for electric powertrain management and regeneration settings, creating new opportunities for component manufacturers specializing in robust electronic switches.

Motorcycle Handlebar Control Switches Market Executive Summary

The Motorcycle Handlebar Control Switches Market is undergoing significant evolution, primarily driven by technological convergence, including digitalization and advanced rider assistance integration. Business trends indicate a strong move toward modular switch assemblies that can be easily customized for different motorcycle platforms and a focus on ruggedized, aesthetically pleasing, and ergonomic designs, particularly those compatible with CAN bus communication protocols for seamless integration with motorcycle ECUs. Furthermore, there is an increasing supplier emphasis on developing switches that minimize cable clutter and maximize signal integrity in harsh operating environments. Key players are investing heavily in material science to produce durable switches resistant to UV exposure, extreme temperatures, and moisture, crucial factors affecting the longevity and reliability of handlebar components.

Regional trends are dominated by the Asia Pacific (APAC) market, which holds the largest volume share due to high production and consumption of commuter motorcycles in countries like India, China, and Indonesia. However, Europe and North America lead in terms of value share and technological adoption, driven by the strong presence of premium and high-performance motorcycle manufacturers who demand sophisticated, multi-function switchgear integrating advanced electronics. The European market, in particular, is witnessing robust growth due to stringent safety standards (like ABS mandates) and a high adoption rate of connected motorcycle technologies, pushing component suppliers to innovate in human-machine interface (HMI) design specifically for two-wheelers.

Segment trends highlight the rapid expansion of multi-functional and electronic control switches over traditional mechanical switches. The shift from analog to digital displays (TFT/LCD) requires complementary handlebar controls, such as joysticks or scroll wheels, for menu navigation and system adjustments. In terms of application, the premium motorcycle segment (sport, touring, adventure) is the fastest-growing segment by value, attributed to the incorporation of features like dynamic suspension control, heated accessories, and complex rider aids managed through handlebar inputs. Manufacturers are also increasingly differentiating products based on IP ratings, ensuring components meet high standards for water and dust resistance, essential for maintaining operational reliability across diverse global riding conditions.

AI Impact Analysis on Motorcycle Handlebar Control Switches Market

Analysis of common user questions reveals a collective interest in how AI and machine learning will influence the physical components of motorcycle controls, particularly concerning safety, customization, and manufacturing efficiency. Users frequently inquire about the role of predictive maintenance algorithms in determining switch failure, the potential for AI to personalize control layouts based on rider habits, and whether advanced diagnostics will be integrated directly into the switchgear. There is a general expectation that while the physical switches themselves will remain, their underlying functionality, manufacturing quality control, and interaction with the motorcycle’s overall system intelligence will be significantly enhanced by AI.

The primary concern revolves around the balance between digital complexity and physical reliability. Riders seek assurance that AI-driven features, such as adaptive cruise control or automatic adjustment of ride modes based on environmental inputs (managed via handlebar buttons), do not compromise the instantaneous and predictable nature of critical controls like the horn or kill switch. Manufacturers are leveraging AI-driven simulations to optimize switch ergonomics and placement, ensuring controls remain intuitive under high-stress riding conditions. Furthermore, AI is crucial in quality control, utilizing vision systems to detect microscopic defects in switch assemblies during high-volume production, significantly reducing the probability of field failures and increasing overall product lifecycle durability, a major concern for both OEM and end-users.

AI’s influence is moving beyond simple diagnostics. Machine learning models are beginning to interpret complex inputs from various motorcycle sensors (e.g., lean angle, speed, acceleration) to provide contextual assistance through handlebar controls. For instance, a sophisticated system could use AI to temporarily adjust the sensitivity or function of a specific switch based on the bike's dynamic state, improving user experience and safety. This requires the switch components themselves to be highly robust and capable of high-speed, multi-channel communication, necessitating higher bandwidth capabilities and better electromagnetic shielding within the handlebar assembly.

- Enhanced Quality Control: AI vision systems analyze manufacturing tolerances, ensuring precise tactile feedback and consistent quality across mass-produced units.

- Predictive Maintenance: Algorithms monitor switch actuation cycles and current draw to predict component degradation and flag potential failures proactively.

- Ergonomic Optimization: AI simulations determine optimal switch size, placement, and required actuation force based on diverse human factors data.

- Adaptive Control Interfaces: Machine learning enables dynamic remapping of non-critical buttons based on riding mode or environmental conditions for superior personalization.

- Supply Chain Efficiency: AI optimizes inventory and logistics for the complex wiring harnesses and numerous switch variants required globally.

- Integrated Diagnostics: Switches themselves may house microprocessors feeding performance data directly into an AI-powered central diagnostic unit.

- Cybersecurity Integration: Ensuring the electronic signals from connected switches are secure against tampering, managed by AI-driven network protection protocols.

DRO & Impact Forces Of Motorcycle Handlebar Control Switches Market

The Motorcycle Handlebar Control Switches Market is shaped by a confluence of driving factors, regulatory constraints, and emerging opportunities, collectively defining the market's trajectory. Key drivers include the global push for motorcycle safety enhancements, exemplified by mandatory ABS and complex electronic stability controls which necessitate greater input from handlebar controls. Furthermore, the rapid expansion of electric vehicle (EV) technology in the two-wheeler sector is creating demand for entirely new, customized switchgear designed for electric power delivery, regeneration braking adjustments, and specialized display navigation, unlike traditional combustion engine controls. This technological transition is accelerating component innovation.

Restraints primarily revolve around the severe operating environment these components face. Motorcycle switches are exposed directly to continuous vibration, extreme weather (rain, snow, intense UV radiation), and corrosive elements, leading to high reliability and durability requirements that translate into higher manufacturing costs. Price sensitivity, particularly in the high-volume commuter segment in APAC, acts as a significant restraint, forcing manufacturers to balance component quality with cost efficiency. Additionally, the risk of counterfeiting and the complexities associated with integrating proprietary communication protocols across diverse OEM platforms pose constant challenges for standardized component suppliers.

Opportunities are largely concentrated in the realms of smart features and ergonomic design. The development of haptic feedback controls, seamless integration with wearable technology (helmets), and the utilization of non-contact switching technology (e.g., Hall effect sensors) for increased longevity represent significant growth avenues. Moreover, the increasing adoption of connected features like telematics and over-the-air (OTA) update capabilities in premium motorcycles necessitates the development of sophisticated, secure, and updateable switch modules capable of managing complex data streams, offering high-margin opportunities for specialized electronic component suppliers. The aftermarket replacement segment also presents consistent opportunities due to component wear and tear, particularly for high-mileage fleet motorcycles.

Impact forces in this market are high, dominated by mandatory safety regulations (R), rapid technological evolution (D), and intense global competition (O). The most immediate force is the drive towards lighter, more compact, and increasingly electronic switch assemblies, driven by weight reduction targets in performance bikes and the need for seamless integration with advanced TFT dashboards. Regulatory mandates, such as specific lighting configuration requirements or the standardization of emergency controls across jurisdictions, force continuous design updates and adherence to high quality assurance standards, maintaining a baseline demand for reliable components.

Segmentation Analysis

The Motorcycle Handlebar Control Switches Market is strategically segmented based on factors such as Switch Type, Application (Motorcycle Type), and Technology. This segmentation is crucial for understanding specific market dynamics, technological uptake, and regional consumption patterns. By Switch Type, the market differentiates between physical mechanical switches (toggle, push button) and increasingly dominant electronic and multi-function switches (rotary selectors, joysticks, capacitive interfaces) necessary for operating modern complex electronic control systems like quick shifters and advanced traction control. Electronic switches are growing faster due to the digitalization trend.

The segmentation by Application (Motorcycle Type) highlights distinct product requirements. High-performance and touring bikes demand highly durable, ergonomic, multi-layered switch assemblies with backlighting and weatherproofing, justifying premium pricing. Conversely, the commuter and standard motorcycle segments emphasize cost-effectiveness, high volume, and basic operational reliability. The emerging electric motorcycle segment requires specialized components focusing on power management interfaces and robust waterproofing due to the often-exposed nature of electric components.

Segmentation by Technology emphasizes the move towards advanced electronic integration. This includes standard wiring harness connections versus advanced CAN bus communication systems. CAN bus integration is preferred by OEMs for premium models as it reduces wiring complexity, improves diagnostic capabilities, and allows for bidirectional communication between the switches and the ECU, enabling dynamic control features. This structural move dictates component design, requiring integrated chipsets within the switch assemblies themselves, transforming them from simple mechanical contacts into sophisticated electronic modules.

- By Switch Type:

- Mechanical Switches (Toggle, Push Button)

- Electronic Switches (Rotary, Multi-function, Membrane)

- Non-Contact Switches (Hall Effect, Capacitive)

- By Application (Motorcycle Type):

- Standard/Commuter Motorcycles

- Scooters/Mopeds

- Cruiser Motorcycles

- Sport/Performance Motorcycles

- Touring/Adventure Motorcycles

- Electric Motorcycles

- By Function:

- Ignition and Engine Kill

- Lighting Controls (Headlight, Turn Signal)

- Horn and Auxiliary Functions

- Advanced Rider Assistance Systems (ARAS) Controls

- By Sales Channel:

- OEM (Original Equipment Manufacturer)

- Aftermarket

Value Chain Analysis For Motorcycle Handlebar Control Switches Market

The Value Chain for motorcycle handlebar control switches begins with upstream analysis involving raw material providers, primarily supplying specialized plastics, high-grade metals (for contacts and housing), and advanced electronic components like microcontrollers and wiring harnesses. Material science suppliers focus on providing materials that offer optimal resistance to thermal stress, UV degradation, and chemical exposure, ensuring the switch housing maintains integrity. Key activities upstream involve precision molding, stamping, and the sourcing of highly reliable micro-electronic components, crucial for the long-term functioning of modern electronic switches.

Midstream activities are characterized by component manufacturing, assembly, and integration. Manufacturers specialize in intricate assembly processes, including soldering, encapsulation, and rigorous testing for waterproof ratings (IP standards) and operational reliability (cycle testing). This stage often involves significant R&D investment in ergonomic design and proprietary connectivity solutions. OEM suppliers maintain tight quality control processes to meet the exact specifications, including customized tactile feedback and specific electrical loads required by various motorcycle platforms. Standardization of modular designs is a key efficiency metric at this stage.

Downstream analysis involves distribution channels, which are segmented into Direct and Indirect sales. Direct sales dominate the Original Equipment Manufacturer (OEM) channel, where control switch suppliers establish long-term contracts with major motorcycle manufacturers (e.g., Honda, Yamaha, BMW, KTM). This channel requires high-volume capacity and adherence to strict manufacturing schedules and quality audits. Indirect channels, primarily serving the Aftermarket segment, utilize established networks of authorized distributors, independent garages, and increasingly, specialized e-commerce platforms focused on motorcycle parts and accessories. The aftermarket focuses on replacement parts, customization kits, and upgrades, often requiring universal or standardized fitment solutions.

Motorcycle Handlebar Control Switches Market Potential Customers

The primary potential customers and buyers in the Motorcycle Handlebar Control Switches Market are broadly categorized into Original Equipment Manufacturers (OEMs) and the vast Aftermarket segment. OEMs represent the highest volume buyers and include major global motorcycle and scooter manufacturers ranging from mass-market producers in Asia (e.g., Hero MotoCorp, Bajaj Auto, TVS Motor, Zongshen) to premium and performance bike builders in Europe and North America (e.g., BMW Motorrad, Ducati, Harley-Davidson, Triumph). These buyers are driven by factors such as guaranteed long-term supply, component reliability, seamless integration capabilities (especially CAN bus compatibility), and competitive pricing aligned with vehicle production cost targets. Their procurement decisions often involve multi-year contracts and collaboration on new model design.

The Aftermarket potential customers consist of independent workshops, authorized dealer service centers, and individual motorcycle owners seeking replacement parts, repairs, or performance/aesthetic upgrades. These customers prioritize availability, ease of installation, and adherence to OEM quality standards, often favoring established brands known for durability. Furthermore, specialized custom bike builders and modification enthusiasts form a niche but high-value customer base, seeking unique or premium components, including custom-machined switch housings or simplified racing switch configurations. The shift towards DIY maintenance, facilitated by online tutorials and readily available component information, is also expanding the reach of the aftermarket segment globally.

A growing segment of potential customers includes electric motorcycle manufacturers (e.g., Zero Motorcycles, Gogoro, Ola Electric). These emerging OEMs require switchgear solutions optimized for electric drivetrains, often integrating features like regenerative braking controls and battery management system indicators directly into the handlebar assembly. Their demand focuses heavily on compact design, weight savings, extreme weather protection, and integration with advanced digital dashboards, setting them apart from traditional ICE motorcycle manufacturers in terms of technical specifications required from switch suppliers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 5.6 Billion |

| Growth Rate | CAGR 6.8 % |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Mitsuba Corporation, Marquardt GmbH, Delphi Technologies, Continental AG, Omron Corporation, Hella GmbH & Co. KGaA, LUKAS, TE Connectivity, KET, Aptiv PLC, Panasonic Corporation, ZF Friedrichshafen AG, Eaton Corporation, ALPS ALPINE, Honda Motors (internal supplier division), Yamaha (internal supplier division), KTM, Ducati, BMW Motorrad. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Motorcycle Handlebar Control Switches Market Key Technology Landscape

The technological landscape of the Motorcycle Handlebar Control Switches Market is shifting rapidly from purely mechanical actuation to sophisticated electronic modules integrating sensors and microprocessors. A critical development is the widespread adoption of Controller Area Network (CAN) bus technology. The CAN bus allows the handlebar switch assembly to communicate complex digital signals efficiently with the motorcycle's Electronic Control Units (ECUs) using minimal wiring, significantly reducing component weight and installation complexity. This integration is essential for managing advanced systems like ride-by-wire throttles, dynamic traction control, and semi-active suspension adjustments, all commonly controlled via handlebar inputs.

Another pivotal technology involves the implementation of non-contact sensing, primarily using Hall effect sensors, to replace traditional mechanical contact switches in high-wear applications, such as turn signal indicators or rotary selectors. Hall effect switches eliminate physical wear and tear associated with constant metal contact, dramatically increasing component lifespan and reliability under high vibration. Furthermore, the focus on Human-Machine Interface (HMI) optimization has led to the development of ergonomic, multi-axis joysticks and scroll wheels, often featuring backlighting (LED technology) and integrated haptic feedback, allowing riders to navigate complex digital dashboards without diverting their attention from the road.

Water and dust protection technology remains fundamental. Component manufacturers are leveraging advanced material encapsulation techniques and high IP (Ingress Protection) rated designs, ensuring switches function flawlessly after prolonged exposure to harsh environmental elements. Materials innovation includes using specialized thermoplastic elastomers and advanced sealing compounds. Lastly, there is a rising trend in modular design and standardization, allowing OEMs to utilize common switch platforms across various motorcycle models, only requiring software-based functional remapping, which simplifies inventory management and speeds up product development cycles significantly.

Regional Highlights

The global Motorcycle Handlebar Control Switches Market exhibits distinct regional consumption patterns and technological maturity levels. Asia Pacific (APAC) stands as the dominant market, driven by sheer volume of motorcycle production and sales, particularly in the commuter and scooter segments across countries like India, China, and Southeast Asia. While APAC focuses heavily on cost-effective and highly reliable mechanical switches for mass-market vehicles, the growing luxury and performance bike segments in Japan and Korea are rapidly adopting sophisticated electronic switchgear. Government initiatives promoting domestic manufacturing and the strong presence of global component suppliers establishing production hubs in the region further solidify APAC's leading position, primarily serving the OEM segment.

Europe represents a high-value market characterized by early adoption of advanced electronic controls and stringent regulatory standards. European motorcycle manufacturers, including BMW Motorrad and Ducati, are pioneers in integrating features such as advanced ARAS controls, integrated navigation systems, and sophisticated multi-function handlebar switches utilizing CAN bus communication. This region demands premium quality, superior ergonomics, and high IP ratings, as components must endure varied weather conditions typical of European touring. The market in Europe is driven less by volume and more by the content and complexity per unit, focusing on high-margin, electronically dense switch assemblies necessary for sophisticated rider aids and connectivity features.

North America maintains a strong position, driven by significant demand for heavy cruisers, touring bikes (Harley-Davidson, Indian), and high-performance sportbikes. This market shows a blend of traditional mechanical switch technology (especially in the cruiser segment where classic aesthetics are valued) and cutting-edge electronic controls in the sport and touring segments. The aftermarket segment in North America is particularly robust, reflecting a high tendency for customization and performance upgrades, leading to strong demand for specialized, often bespoke, switchgear solutions. Growth in this region is also supported by increasing recreational riding activity and the rising adoption of electric motorcycles which require new control interfaces.

- Asia Pacific (APAC): Dominates market volume; growth fueled by mass-market and increasing electric scooter adoption; focus on cost-efficiency and basic reliability.

- Europe: Leads in value and technological sophistication; high adoption of ARAS, CAN bus systems, and premium, ergonomic multi-function switches driven by high-end OEMs.

- North America: Strong aftermarket demand and customization trends; significant presence of large cruiser and touring bike segments requiring durable, sometimes large-format, controls.

- Latin America & MEA (LAMEA): Growing adoption, driven primarily by commuter motorcycle segments; market sensitive to economic stability and focused on durable, low-maintenance components.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Motorcycle Handlebar Control Switches Market.- Mitsuba Corporation

- Marquardt GmbH

- Delphi Technologies

- Continental AG

- Omron Corporation

- Hella GmbH & Co. KGaA

- LUKAS

- TE Connectivity

- KET

- Aptiv PLC

- Panasonic Corporation

- ZF Friedrichshafen AG

- Eaton Corporation

- ALPS ALPINE

- Honda Motors (internal supplier division)

- Yamaha (internal supplier division)

- KTM

- Ducati

- BMW Motorrad

- Sensata Technologies

Frequently Asked Questions

Analyze common user questions about the Motorcycle Handlebar Control Switches market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the Motorcycle Handlebar Control Switches Market?

The market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033, driven by increasing motorcycle production and the integration of advanced electronic features.

How is the shift to electric motorcycles impacting demand for control switches?

The shift to electric motorcycles is driving demand for specialized electronic control switches that can manage electric powertrain functions, regeneration settings, and require higher IP ratings for robust weather protection.

Which technology is crucial for integrating advanced safety features via handlebar controls?

Controller Area Network (CAN) bus technology is crucial as it allows seamless, high-speed digital communication between multi-function handlebar controls and the motorcycle's ECUs, essential for managing advanced rider assistance systems (ARAS).

What are the primary challenges faced by manufacturers in this market?

Primary challenges include meeting stringent requirements for durability and reliability against environmental factors (vibration, moisture, UV exposure), and balancing high R&D costs for complex electronic switchgear with competitive pricing demands, especially in high-volume segments.

Which geographical region holds the largest market share by volume?

Asia Pacific (APAC) holds the largest market share by volume due to high production and consumption of commuter motorcycles and scooters in countries like China, India, and Indonesia.

What role does AI play in the future of handlebar control switches?

AI is primarily used for enhanced quality control during manufacturing, predictive maintenance of component wear, and optimizing ergonomic design, ensuring switch reliability and user personalization.

What is the difference between OEM and Aftermarket segments?

The OEM segment involves direct sales to motorcycle manufacturers for new vehicle assembly, focusing on high volume and proprietary specifications, while the Aftermarket segment serves distributors and individual riders seeking replacement, repair, or upgrade components.

Are non-contact switches gaining traction in the market?

Yes, non-contact technologies like Hall effect sensors are increasingly adopted to replace mechanical contacts, specifically in high-wear functions, significantly enhancing component lifespan and reliability by eliminating physical friction.

Which segments are showing the fastest growth rate by value?

The premium and performance motorcycle segment (Sport, Touring, Adventure) is experiencing the fastest growth by value, driven by the integration of complex, high-cost electronic and multi-functional switch modules necessary for advanced rider aids.

What are the typical functions controlled by handlebar switches?

Typical functions include ignition, engine kill, various lighting modes (headlight, high beam, turn signals), horn, and increasingly, complex functions such as traction control adjustment, ride mode selection, and navigation through digital displays.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager