Motorcycle Immobilizers Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439796 | Date : Jan, 2026 | Pages : 245 | Region : Global | Publisher : MRU

Motorcycle Immobilizers Market Size

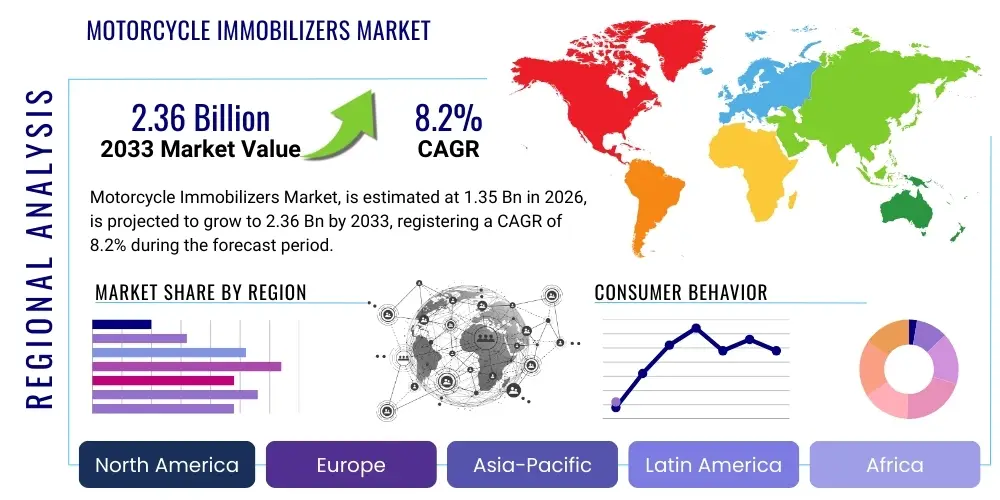

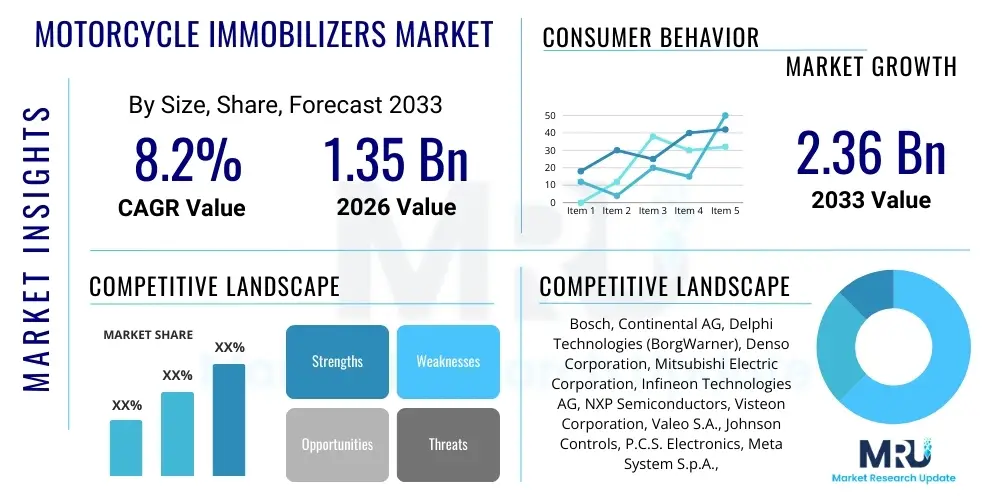

The Motorcycle Immobilizers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.2% between 2026 and 2033. The market is estimated at USD 1.35 Billion in 2026 and is projected to reach USD 2.36 Billion by the end of the forecast period in 2033.

Motorcycle Immobilizers Market introduction

The Motorcycle Immobilizers Market encompasses the global industry dedicated to the development, manufacturing, and distribution of electronic security systems designed to prevent unauthorized operation and theft of motorcycles. These sophisticated devices, whether integrated during manufacturing as OEM parts or installed aftermarket, work by disabling critical vehicle functions, such as the engine ignition, fuel supply, or starter motor, making it impossible for a thief to hotwire the motorcycle. The primary purpose of an immobilizer is to enhance vehicle security, offering a significantly higher level of protection compared to traditional alarms alone by rendering the vehicle inoperable without the correct electronic key or authentication method. The market is characterized by continuous innovation aimed at improving anti-theft capabilities and user convenience, addressing the persistent challenge of motorcycle theft worldwide.

Product descriptions within this market range from basic transponder-based systems, which utilize an RFID chip in the ignition key to communicate with the engine control unit (ECU), to more advanced solutions incorporating GPS tracking, remote disablement features, and integration with smartphone applications. Major applications of motorcycle immobilizers span across various motorcycle segments, including standard bikes, sport bikes, cruisers, scooters, and electric motorcycles, serving both individual consumers and commercial fleet operators. The fundamental benefit provided by these systems is enhanced security, significantly reducing the risk of theft and offering peace of mind to owners, which can also translate into lower insurance premiums due to reduced risk exposure. Furthermore, modern immobilizers often feature tamper alerts and diagnostic capabilities, providing comprehensive security monitoring.

Several driving factors are propelling the growth of the Motorcycle Immobilizers Market. A significant driver is the increasing global incidence of motorcycle theft, which compels owners and manufacturers to adopt more robust security measures. The rising sales of premium and high-performance motorcycles, which represent substantial investments for their owners, further amplify the demand for sophisticated anti-theft systems. Additionally, evolving consumer awareness regarding vehicle security, coupled with growing disposable incomes in emerging economies, allows for greater investment in protective technologies. Technological advancements, particularly in areas like IoT connectivity, biometric authentication, and artificial intelligence, are leading to the development of more effective and user-friendly immobilizer systems, continually pushing market expansion and innovation.

Motorcycle Immobilizers Market Executive Summary

The Motorcycle Immobilizers Market is experiencing robust growth, driven by an escalating need for enhanced vehicle security amid rising global motorcycle theft rates and increasing demand for premium two-wheelers. Key business trends indicate a strong shift towards intelligent, connected immobilizer systems that integrate seamlessly with broader vehicle security ecosystems, including GPS tracking and telematics. Original Equipment Manufacturers (OEMs) are increasingly incorporating advanced immobilizers as standard features, while the aftermarket segment continues to thrive with innovative solutions offering enhanced functionalities and customization. The competitive landscape is characterized by both established automotive security players and specialized technology firms vying for market share through product differentiation and technological leadership, focusing on miniaturization, power efficiency, and user-friendly interfaces. Strategic alliances between technology providers and motorcycle manufacturers are becoming more prevalent to develop integrated security platforms, addressing the complex demands of modern vehicle protection.

Regional trends reveal Asia Pacific as the dominant and fastest-growing market, primarily due to the vast volume of motorcycle sales, particularly in countries like India, China, and Southeast Asian nations, where motorcycle ownership is high and theft remains a significant concern. North America and Europe, while more mature markets, exhibit steady growth fueled by the increasing adoption of high-value motorcycles and stringent insurance regulations that often mandate the installation of immobilizer systems. These regions also lead in the integration of cutting-edge technologies such as GPS and smart connectivity into immobilizers. Latin America and the Middle East & Africa are emerging as promising markets, driven by urbanization, expanding middle-class populations, and a growing awareness of vehicle security needs, although market penetration levels for advanced immobilizers are still lower compared to developed regions, presenting substantial growth opportunities.

Segmentation trends highlight a pronounced shift towards advanced technology-based immobilizers, with GPS-enabled and wireless systems gaining significant traction due to their enhanced functionalities like remote engine cut-off and location tracking. Transponder-based immobilizers continue to hold a substantial market share owing to their reliability and cost-effectiveness, especially in entry-level and mid-range motorcycles. The aftermarket segment is projected to maintain strong growth as a significant portion of older motorcycles are not equipped with modern immobilizers, creating continuous demand for upgrades and standalone solutions. Furthermore, there has been a notable rise in demand for immobilizers compatible with electric motorcycles, reflecting the global transition towards electric mobility and the need for secure solutions for these increasingly valuable vehicles, driving innovation in power-efficient and integrated security systems tailored for electric powertrains.

AI Impact Analysis on Motorcycle Immobilizers Market

The integration of Artificial Intelligence (AI) into the Motorcycle Immobilizers Market represents a transformative shift, addressing critical user questions around enhanced security, predictive capabilities, and seamless integration with smart vehicle systems. Users are increasingly curious about how AI can move beyond basic theft prevention to offer proactive security measures, such as anticipating potential theft attempts based on behavioral patterns or environmental factors. There is a strong expectation that AI will minimize false positives often associated with traditional alarms, thereby improving user experience and reducing unnecessary alerts. Furthermore, consumers are keen to understand how AI can facilitate more sophisticated user authentication, distinguishing between legitimate owners and potential threats with greater accuracy, ultimately making immobilizers more intelligent, adaptive, and reliable in an increasingly connected world.

The key themes emerging from user inquiries regarding AI's influence in this domain revolve around the promise of predictive analytics, intelligent threat detection, and personalized security protocols. Users anticipate AI-powered systems that can learn from their riding habits and common parking locations to identify unusual activities, sending targeted alerts rather than generic ones. There is also a significant interest in how AI can integrate with other Internet of Things (IoT) devices and smart home ecosystems, creating a holistic security environment that extends beyond the motorcycle itself. Concerns primarily focus on data privacy, the potential for AI systems to be bypassed or hacked, and the overall cost implications of such advanced technologies. However, the overarching expectation is for AI to deliver a new paradigm of adaptive, self-learning security that continuously evolves to counter emerging theft techniques.

In essence, the market anticipates AI to significantly elevate the capabilities of motorcycle immobilizers, moving them from reactive security devices to proactive, intelligent guardians. This includes leveraging machine learning algorithms to analyze vast amounts of data related to theft patterns, user behavior, and environmental context, enabling the system to make real-time, informed decisions. AI is poised to revolutionize not only how immobilizers detect and prevent theft but also how they interact with the user, providing a more intuitive and highly personalized security experience. This will necessitate robust cybersecurity measures to protect AI algorithms and collected data, ensuring the integrity and trustworthiness of these advanced systems as they become more central to motorcycle security.

- Predictive Theft Analytics: AI algorithms analyze historical theft data, geographical hotspots, and user behavior patterns to predict potential theft risks, enabling proactive alerts and enhanced security modes.

- Adaptive Security Protocols: Immobilizer systems can learn and adapt to normal user routines, distinguishing unusual activity from genuine use, thereby reducing false alarms and optimizing security responses.

- Enhanced User Authentication: AI powers advanced biometric authentication methods (e.g., facial recognition, voice recognition) and behavioral biometrics, making unauthorized access significantly more difficult.

- Anomaly Detection: Machine learning identifies subtle deviations from normal operational parameters or environmental conditions that might indicate a theft attempt, such as unusual vibrations or unauthorized movement.

- Integrated Decision Making: AI facilitates seamless integration with other vehicle systems (GPS, telematics, ADAS) to create a comprehensive security network that can coordinate responses and share intelligence.

- Remote Diagnostics & Self-Healing: AI can monitor the immobilizer's own health, detect potential malfunctions, and in some cases, perform self-diagnostics or suggest maintenance, ensuring continuous operation.

- Personalized Security Settings: AI enables customizable security zones, time-based arming/disarming, and dynamic sensitivity adjustments based on owner preferences and environmental context.

- Voice Command Integration: AI-powered voice assistants can allow for hands-free arming, disarming, and status checks of the immobilizer system, enhancing convenience and accessibility.

- Data-Driven Security Updates: AI facilitates over-the-air (OTA) updates for security software, allowing systems to learn from new threats and update their defense mechanisms without manual intervention.

DRO & Impact Forces Of Motorcycle Immobilizers Market

The Motorcycle Immobilizers Market is profoundly shaped by a complex interplay of drivers, restraints, and opportunities, alongside significant impact forces that define its competitive dynamics. A primary driver is the pervasive and increasing threat of motorcycle theft globally, which serves as a constant impetus for both consumers and manufacturers to invest in robust security solutions. This is further amplified by the rising average cost of motorcycles, particularly premium and electric models, making owners more inclined to protect their assets. Stringent insurance policies and regulatory requirements in many regions, which often mandate the installation of approved immobilizer systems, also significantly boost market demand. Moreover, continuous technological advancements, including the integration of IoT, GPS, and AI, are leading to more sophisticated, effective, and user-friendly immobilizers, expanding their appeal and market penetration.

However, several restraints challenge the market's growth trajectory. The relatively high initial installation costs, especially for advanced OEM-integrated systems, can be a deterrent for budget-conscious consumers or those owning lower-value motorcycles. The technical complexity associated with some advanced immobilizer systems, including the potential for false alarms or system malfunctions, can lead to user frustration and skepticism. Furthermore, a lack of universal standardization across different motorcycle brands and models can complicate aftermarket installations and repairs, increasing costs and reducing compatibility. Another restraint is the potential for skilled thieves to bypass even advanced systems, prompting a continuous, expensive cycle of innovation to stay ahead of illicit methods, which can impact profitability and consumer confidence.

Despite these challenges, substantial opportunities exist for market expansion and innovation. The burgeoning adoption of electric motorcycles worldwide presents a significant untapped market, as these vehicles, often premium-priced, require specialized immobilizer solutions tailored to their unique electrical architecture. The aftermarket segment offers immense growth potential, catering to the vast installed base of older motorcycles lacking modern security features, especially in emerging economies. Integration with smart city infrastructures and broader IoT ecosystems, allowing for networked security solutions, represents a future growth avenue. Furthermore, strategic partnerships between immobilizer manufacturers, telematics providers, and insurance companies can create bundled service offerings that add value and drive adoption. The development of more affordable and easily installable solutions for mass-market motorcycles also remains a key opportunity.

The market is also influenced by several impact forces. The bargaining power of buyers is moderate, as consumers have a range of choices from basic to advanced systems, and aftermarket options provide alternatives to OEM solutions. However, for high-end motorcycles, buyers may have limited alternatives if certain immobilizers are factory-integrated. The bargaining power of suppliers is relatively high, particularly for specialized electronic components and semiconductor manufacturers, as these are critical to the functionality of advanced immobilizers. The threat of new entrants is moderate; while the security industry requires significant R&D investment and regulatory compliance, technological advancements and unmet market needs can still attract innovative startups. The threat of substitutes, such as traditional alarms or mechanical locks, is decreasing as immobilizers offer superior protection. Competitive rivalry within the market is high, with numerous players constantly innovating to offer more secure, convenient, and cost-effective solutions, leading to intense competition in both OEM and aftermarket segments, driving down prices and enhancing features.

Segmentation Analysis

The Motorcycle Immobilizers Market is comprehensively segmented to provide a detailed understanding of its diverse components and growth dynamics. These segmentations allow for a granular analysis of market trends, consumer preferences, technological adoptions, and regional variations, enabling stakeholders to identify key growth areas and tailor their strategies effectively. The market can be dissected based on various criteria, including the type of immobilizer technology employed, the specific application or end-user segment, the distribution channel through which products reach consumers, and the geographical regions driving demand. Understanding these segments is crucial for identifying opportunities, navigating competitive pressures, and developing targeted product offerings that resonate with specific market needs and preferences.

Each segment within the motorcycle immobilizers market exhibits unique characteristics and growth drivers. For instance, the distinction between OEM (Original Equipment Manufacturer) and aftermarket products highlights different sales strategies and consumer bases, with OEM often focusing on integrated, factory-fitted solutions for new vehicles, while aftermarket caters to existing motorcycles seeking upgrades or replacements. Similarly, segmenting by technology type, such as transponder-based, GPS-enabled, or biometric systems, reflects the evolving landscape of security features and innovation. The distribution channel segmentation, encompassing direct sales, retail, and online platforms, illustrates the varied routes to market. Furthermore, geographical segmentation is essential, as factors like theft rates, motorcycle ownership levels, and regulatory environments differ significantly across regions, influencing both demand and the types of immobilizers prevalent in those areas. This multi-faceted segmentation offers a robust framework for market analysis and strategic planning.

- By Type:

- Transponder-Based Immobilizers: Standard systems using RFID chips in keys.

- GPS-Enabled Immobilizers: Integrated with GPS for tracking and remote disablement.

- Wireless Immobilizers: Utilizing Bluetooth or other wireless protocols for proximity-based control.

- Alarm-Integrated Immobilizers: Systems combining immobilizer functions with an audible alarm.

- Mechanical Immobilizers (e.g., disc locks with alarms): While not purely electronic, some advanced mechanical locks integrate electronic deterrents.

- By Technology:

- RFID (Radio-Frequency Identification): Core technology for transponder keys.

- Bluetooth Low Energy (BLE): For wireless pairing with smartphones or fobs.

- Cellular (GSM/GPRS): For remote communication, tracking, and commands.

- CAN Bus Integration: For seamless communication with the motorcycle's electronic control units.

- Biometric Authentication: Fingerprint or facial recognition for advanced security.

- Advanced Sensor Technology: Vibration sensors, tilt sensors, motion sensors for anomaly detection.

- By Application:

- OEM (Original Equipment Manufacturer): Immobilizers factory-fitted in new motorcycles.

- Aftermarket: Standalone immobilizer systems installed post-purchase.

- By Motorcycle Type:

- Standard Motorcycles

- Sport Motorcycles

- Cruiser Motorcycles

- Scooters

- Electric Motorcycles

- Off-Road/Adventure Bikes

- By Distribution Channel:

- OEM Channel

- Aftermarket Retail Stores

- Online Sales Channels

- Authorized Dealerships & Service Centers

- Specialized Security Installers

- By Region:

- North America (U.S., Canada, Mexico)

- Europe (Germany, UK, France, Italy, Spain, Rest of Europe)

- Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East & Africa (UAE, Saudi Arabia, South Africa, Rest of MEA)

Value Chain Analysis For Motorcycle Immobilizers Market

The value chain for the Motorcycle Immobilizers Market begins with robust upstream activities, encompassing the sourcing of raw materials and the manufacturing of critical electronic components. This initial phase involves suppliers of semiconductors, microcontrollers, sensors (e.g., accelerometers, GPS modules), wiring harnesses, antenna components, and specialized plastics and metals for housing. Key players in this segment are often large electronics manufacturers and specialized component providers who supply to multiple industries, benefiting from economies of scale. The quality and reliability of these upstream components are paramount, as they directly impact the performance and durability of the final immobilizer product. Innovation in this stage, particularly in miniaturization, power efficiency, and advanced sensor technology, is critical for competitive advantage downstream.

Moving downstream, the value chain encompasses the assembly and integration of these components into complete immobilizer systems, followed by their distribution and eventual sale to end-users. Manufacturers of motorcycle immobilizers either produce proprietary systems or assemble solutions from various component suppliers. These products then reach the market through distinct distribution channels. The OEM channel involves direct sales and integration of immobilizer systems into new motorcycles during the manufacturing process. This often requires close collaboration between the immobilizer supplier and the motorcycle manufacturer, ensuring seamless integration with the bike's electrical architecture and control units. The aftermarket channel, in contrast, relies on a broader network of distributors, wholesalers, and retailers, including specialized automotive security shops, motorcycle accessory stores, and online platforms.

Both direct and indirect distribution play crucial roles. Direct distribution is predominantly seen in the OEM segment, where immobilizer manufacturers supply directly to motorcycle assembly plants. This direct relationship allows for greater customization, technical support, and quality control. Indirect distribution characterizes the aftermarket segment, where a network of intermediaries ensures broad market reach. This includes national and regional distributors who supply to thousands of retail outlets and independent installers. Online sales platforms have emerged as a powerful indirect channel, offering consumers convenience and a wider selection of aftermarket immobilizers. Furthermore, authorized dealerships and service centers often act as both OEM service providers and aftermarket installers, bridging the gap between direct and indirect channels and offering expertise in system installation and maintenance, completing the comprehensive value delivery process.

Motorcycle Immobilizers Market Potential Customers

The Motorcycle Immobilizers Market targets a diverse range of potential customers, each driven by specific motivations and needs related to vehicle security. The largest segment of end-users comprises individual motorcycle owners, who are primarily concerned with protecting their personal investment from theft. This group includes owners of various types of motorcycles, from daily commuters and scooters to high-performance sport bikes and luxury cruisers. Their purchasing decisions are influenced by factors such as the perceived risk of theft in their area, the value of their motorcycle, insurance requirements, and a desire for peace of mind. As motorcycle prices continue to rise and theft rates remain a concern, the demand from individual owners for effective immobilizer solutions is consistently strong, driving innovation in both OEM and aftermarket offerings.

Beyond individual consumers, commercial entities represent a significant and growing customer base for motorcycle immobilizers. This includes motorcycle rental companies, delivery services, and fleet operators who manage a large number of two-wheelers. For these businesses, the security of their fleet is critical not only to prevent financial losses from theft but also to ensure operational continuity and protect their assets' resale value. Implementing advanced immobilizer systems, often integrated with GPS tracking and fleet management software, allows these businesses to monitor their vehicles, deter theft, and recover stolen assets more efficiently. The robust nature and remote management capabilities of modern immobilizers make them particularly attractive to this segment, where downtime due to theft can have substantial economic repercussions.

Another key set of potential customers includes motorcycle dealerships and manufacturers, who often act as intermediaries. Dealerships frequently offer immobilizers as an upsell option or as part of premium security packages for new bikes, catering to customer demand for enhanced protection right from the point of purchase. Motorcycle manufacturers, as OEMs, are direct consumers of immobilizer technology, integrating these systems into their production lines to provide factory-fitted security features, which can be a strong selling point for their brands. Furthermore, insurance companies, while not direct buyers of the product, play a pivotal role as influencers. Many insurers offer reduced premiums for motorcycles equipped with approved immobilizer systems, indirectly driving demand by incentivizing owners to invest in these security devices. This symbiotic relationship within the ecosystem ensures a broad and continuous demand for immobilizer solutions across various stakeholders.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.35 Billion |

| Market Forecast in 2033 | USD 2.36 Billion |

| Growth Rate | 8.2% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bosch, Continental AG, Delphi Technologies (BorgWarner), Denso Corporation, Mitsubishi Electric Corporation, Infineon Technologies AG, NXP Semiconductors, Visteon Corporation, Valeo S.A., Johnson Controls, P.C.S. Electronics, Meta System S.p.A., Datatool (Scorpion Automotive), Autowatch, SPY Alarm & Immobilizer, Steelmate, Minda Corporation, Harison, Omron Corporation, Hella GmbH & Co. KGaA. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Motorcycle Immobilizers Market Key Technology Landscape

The Motorcycle Immobilizers Market is characterized by a rapidly evolving technological landscape, driven by the continuous pursuit of enhanced security, greater convenience, and seamless integration with modern vehicle architectures. At its core, the most widespread technology remains RFID (Radio-Frequency Identification) for transponder-based systems, where a microchip in the ignition key communicates with the motorcycle's engine control unit (ECU). This foundational technology provides a robust layer of security by ensuring that the engine can only start when the correct, electronically matched key is present. However, contemporary immobilizers are increasingly incorporating advanced functionalities that move beyond this basic principle, leveraging a blend of diverse technologies to create comprehensive anti-theft solutions.

Further advancements include the integration of GPS (Global Positioning System) technology, which adds location tracking capabilities to the immobilizer. This allows owners to remotely monitor their motorcycle's position in real-time and, crucially, to remotely disable the engine in case of theft, significantly increasing recovery rates. Bluetooth Low Energy (BLE) is gaining traction for wireless, proximity-based keyless entry and ignition systems, enabling convenient arming and disarming through smartphone applications or compact fobs. Cellular communication technologies (GSM/GPRS) facilitate remote alerts, diagnostics, and control over long distances, connecting the immobilizer to cloud-based platforms and user smartphones. The direct integration with the motorcycle's CAN (Controller Area Network) bus system is also becoming standard, allowing immobilizers to communicate directly and securely with various electronic control units, enhancing both functionality and tamper resistance.

Looking ahead, emerging technologies such as biometric authentication, including fingerprint or facial recognition, are being explored to provide an even higher level of personalized security, eliminating the need for physical keys entirely. IoT (Internet of Things) connectivity is transforming immobilizers into smart devices that can integrate with wider smart home and smart city ecosystems, enabling advanced features like geofencing and predictive theft analytics powered by Artificial Intelligence (AI) and machine learning algorithms. Cloud-based platforms are crucial for data storage, remote management, and over-the-air (OTA) software updates, ensuring that immobilizer systems remain updated against evolving theft techniques. These technological convergences are not only making motorcycles more secure but also more intelligent and connected, providing a multi-layered defense against theft while improving the overall ownership experience.

Regional Highlights

- North America: This region showcases a mature market with high adoption rates of advanced immobilizer systems, driven by a strong consumer focus on vehicle security for high-value motorcycles and increasingly stringent insurance requirements. The U.S. and Canada are leaders in integrating GPS tracking and smart connectivity features, with significant aftermarket demand for premium solutions. Innovation in telematics and AI integration is also prominent.

- Europe: Characterized by diverse regulatory landscapes, European markets such as Germany, the UK, and France exhibit a strong demand for immobilizers due to high motorcycle ownership and established anti-theft standards. OEM integration is substantial, with a growing trend towards compact, aesthetically integrated solutions. Strict type approval regulations often dictate the features and reliability standards for immobilizer systems.

- Asia Pacific (APAC): The largest and fastest-growing market globally, APAC is fueled by the immense volume of motorcycle sales, particularly in populous countries like India, China, and Indonesia, where two-wheelers are primary modes of transport and theft rates are significant. While cost-effective solutions dominate the mass market, there is a rapidly expanding demand for advanced GPS-enabled and smart immobilizers for premium and electric motorcycles.

- Latin America: This region presents a burgeoning market with substantial growth potential, primarily driven by increasing motorcycle sales and elevated theft rates in countries like Brazil and Mexico. There is a strong demand for robust and reliable anti-theft solutions, with a growing interest in GPS-enabled immobilizers for tracking and recovery, catering to both individual owners and commercial fleets.

- Middle East & Africa (MEA): An emerging market, MEA is experiencing increasing adoption of motorcycle immobilizers alongside economic growth and rising motorcycle ownership. While market penetration is currently lower compared to other regions, rising security awareness and a growing preference for technologically advanced products are expected to drive significant growth in the forecast period, especially in urban centers and for commercial applications.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Motorcycle Immobilizers Market.- Bosch

- Continental AG

- Delphi Technologies (BorgWarner)

- Denso Corporation

- Mitsubishi Electric Corporation

- Infineon Technologies AG

- NXP Semiconductors

- Visteon Corporation

- Valeo S.A.

- Johnson Controls

- P.C.S. Electronics

- Meta System S.p.A.

- Datatool (Scorpion Automotive)

- Autowatch

- SPY Alarm & Immobilizer

- Steelmate

- Minda Corporation

- Harison

- Omron Corporation

- Hella GmbH & Co. KGaA

Frequently Asked Questions

Analyze common user questions about the Motorcycle Immobilizers market and generate a concise list of summarized FAQs reflecting key topics and concerns.How do motorcycle immobilizers effectively prevent theft?

Motorcycle immobilizers prevent theft by disabling critical engine functions, such as the ignition, fuel supply, or starter motor. They typically use a transponder chip in the key that communicates with the motorcycle's engine control unit (ECU). If the correct electronic code from the key is not detected, the ECU will not allow the engine to start, rendering hotwiring ineffective and preventing unauthorized operation.

Are immobilizers a better security solution than traditional motorcycle alarms?

Immobilizers are generally considered a superior security solution compared to traditional alarms alone because they prevent the motorcycle from being started and ridden away. While alarms deter thieves with noise, an immobilizer physically prevents the vehicle from being operated. For comprehensive security, many experts recommend using both an immobilizer and an alarm, often combined with GPS tracking, to offer both deterrence and prevention.

Can an immobilizer be bypassed by professional thieves, and how can I ensure maximum security?

While no security system is absolutely impenetrable, modern, advanced immobilizers are highly difficult to bypass without specialized equipment and significant time, making them a strong deterrent. To ensure maximum security, use a multi-layered approach: combine a factory-fitted or high-quality aftermarket immobilizer with a physical lock (e.g., disc lock, chain), an audible alarm, and GPS tracking. Regularly update any software-based systems and park in well-lit, secure areas.

What is the difference between an OEM (Original Equipment Manufacturer) and an aftermarket immobilizer?

An OEM immobilizer is factory-fitted by the motorcycle manufacturer as a standard or optional feature, designed to integrate seamlessly with the bike's existing electronics and warranty. Aftermarket immobilizers are purchased and installed separately after the motorcycle has been manufactured, offering a wide range of features and price points, suitable for enhancing security on older bikes or adding specific functionalities not available as OEM options.

How is AI expected to transform the future of motorcycle immobilizers and enhance security?

AI is set to revolutionize motorcycle immobilizers by introducing predictive theft analytics, adaptive security protocols, and enhanced user authentication. AI-powered systems can analyze patterns to anticipate theft risks, learn user behavior to reduce false alarms, and enable advanced biometric authentication (e.g., fingerprint). This will lead to more intelligent, proactive, and personalized security solutions, constantly evolving to counter new threats and offering a more integrated user experience.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager