Motorcycle Navigation Systems Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431963 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Motorcycle Navigation Systems Market Size

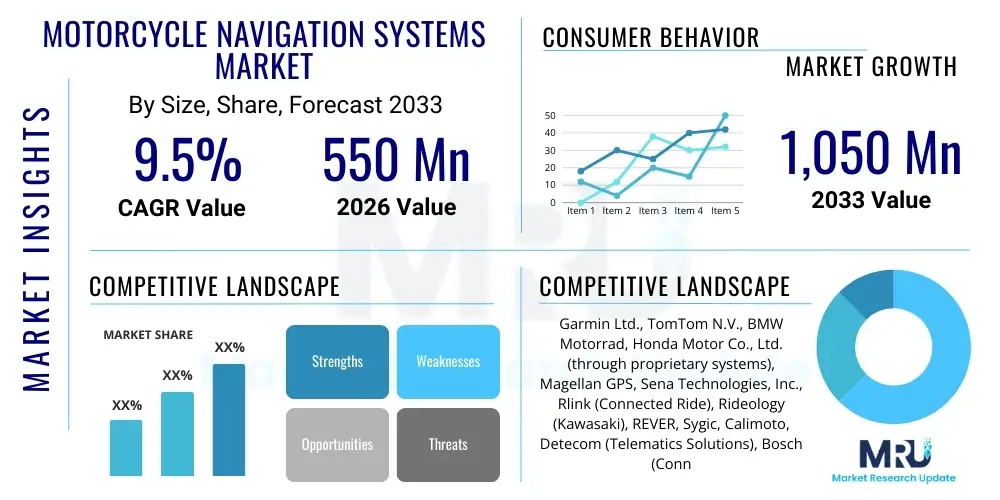

The Motorcycle Navigation Systems Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at $550 Million in 2026 and is projected to reach $1,050 Million by the end of the forecast period in 2033.

Motorcycle Navigation Systems Market introduction

The Motorcycle Navigation Systems Market encompasses dedicated Global Positioning System (GPS) devices, advanced smartphone-based applications, and fully integrated dashboard solutions engineered specifically for the unique environment of motorcycle riding. These systems are characterized by their superior durability, requiring robust waterproofing (often meeting IPX standards), resistance to intense vibration, and specialized anti-glare, high-brightness displays to ensure readability under direct sunlight and severe weather conditions. Crucially, these navigation tools offer motorcyclist-specific features such as scenic route planning algorithms, waypoint management optimized for group riding, and connectivity standards compatible with helmet communication systems, prioritizing rider safety and an enhanced touring experience over purely utilitarian transit metrics.

The primary applications for these systems span recreational touring, professional off-road exploration, daily urban commuting, and high-precision event participation such as rallies and track day training where accurate telemetry and location tracking are non-negotiable. The core benefit provided to the end-user is a substantial increase in riding safety and convenience; by delivering clear, audible, and visual turn-by-turn directions, these systems significantly minimize the need for the rider to divert attention from the road, mitigating a major source of accidents. Furthermore, advanced units often integrate features like fuel monitoring, nearest points of interest (POIs) suitable for motorcyclists, and real-time connectivity to emergency services, solidifying their role as essential rider aids rather than mere map providers.

Market growth is predominantly driven by the accelerating global sales of adventure and touring class motorcycles, particularly in rapidly developing economies where disposable income is rising and long-distance recreational travel is gaining popularity. Complementing this trend is the technological imperative for safety, with increasing mandates for telematics and rider assistance systems in major vehicle markets, pushing OEMs to integrate sophisticated navigation platforms directly into new models. The ongoing technological evolution in display capabilities, including the potential for helmet-based Head-Up Displays (HUDs), and the deployment of advanced connectivity solutions like Vehicle-to-Everything (V2X) communication promise to further expand the market's value proposition by offering dynamic, hazard-aware routing capabilities.

Motorcycle Navigation Systems Market Executive Summary

The global Motorcycle Navigation Systems Market is undergoing a rapid transition characterized by the rising prominence of OEM-installed systems that offer deep integration with the motorcycle's electronics, challenging the traditional dominance of aftermarket dedicated GPS devices. Key business trends show a strategic shift toward recurring revenue models based on software subscriptions for premium mapping updates, personalized routing services, and cloud-based features like group tracking. Manufacturers are heavily investing in specialized user interfaces (UI) and user experiences (UX) that allow for intuitive, voice-activated, and minimal-touch operation, recognizing that complexity is a significant deterrent for safety-conscious riders.

Regional market dynamics reveal that Europe and North America remain the revenue centers, benefiting from a high density of established touring markets and consumer willingness to pay a premium for specialized, rugged hardware. However, the Asia Pacific (APAC) region is projected to register the fastest CAGR throughout the forecast period. This rapid growth is attributed to the soaring production and adoption of two-wheelers across India, China, and Southeast Asia, coupled with increasing infrastructure investment that makes high-quality navigation essential for both commercial and personal use. Regional disparities exist, with APAC favoring low-cost, smartphone-tethered solutions, while Western markets maintain a strong preference for high-reliability dedicated units for long-haul travel.

In terms of segmentation, the Aftermarket distribution channel currently holds the largest share due to the vast installed base of existing motorcycles requiring navigation upgrades, but the OEM segment is quickly catching up driven by luxury and high-performance bike manufacturers integrating proprietary systems. Product type analysis indicates that while dedicated GPS units provide the highest unit revenue due to their hardware cost, the software-as-a-service (SaaS) model associated with smartphone applications is capturing the largest share of new user growth. The market is increasingly segmented by application, with highly differentiated products catering to the extreme ruggedness demands of adventure riding versus the real-time traffic requirements of urban commuting.

AI Impact Analysis on Motorcycle Navigation Systems Market

User queries frequently focus on how Artificial Intelligence will translate into tangible safety benefits and superior ride quality specific to motorcycling. Common topics include the reliability of AI-driven route suggestions for technical riding (e.g., maximizing curves while maintaining safety), the ability of systems to learn and adapt to individual riding styles, and the effectiveness of predictive hazard alerts in real-time scenarios. Users expect AI to reduce cognitive load by filtering non-essential information and providing only the most critical, context-relevant safety data. The central expectation is a move from passive navigation to an active, intelligent co-pilot that enhances the intuitive flow of riding.

The influence of AI is revolutionizing motorcycle navigation by introducing true predictive routing and enhancing situational awareness far beyond conventional algorithms. Machine learning models analyze historical and real-time data inputs—including road surface conditions, weather changes, rider speed profiles, and recorded incident hotspots—to dynamically modify routes and issue highly personalized warnings. For instance, an AI system can prioritize a route that features appealing curves while simultaneously factoring in the rider’s known cornering speeds and flagging sharp turns where local accident frequency is high, thus balancing excitement with safety, a critical distinction for the motorcycling consumer.

Furthermore, AI is instrumental in developing robust, hands-free interfaces. Advanced Natural Language Processing (NLP) enables riders to issue complex voice commands even amid high-speed wind noise, ensuring seamless interaction without manual input. In integrated OEM systems, AI aggregates data from the bike’s ECU (Engine Control Unit) and external sensors to monitor system health and even infer rider fatigue based on subtle changes in input patterns, offering timely suggestions for rest or fuel stops. This technological convergence positions AI as the core engine for moving navigation systems from simple directional tools to comprehensive, rider-centric intelligent safety platforms.

- Enhanced Predictive Routing: Utilizing machine learning to optimize routes based on real-time traffic, historical rider preferences, and road quality assessment.

- Contextual Safety Alerts: AI analyzes speed, lean angle, and road conditions to issue proactive warnings regarding potential risks like slippery patches or aggressive cornering requirements.

- Natural Language Processing (NLP): Significant improvement in voice command accuracy and complexity for hands-free system interaction.

- Personalized User Profiles: Creation of AI-driven rider profiles influencing map display, alert frequency, and recommended stops (fuel, rest, points of interest).

- Fatigue Detection Integration: Future potential for AI systems to analyze riding patterns and integrate with helmet sensors to suggest mandatory rest stops.

- Dynamic System Optimization: AI manages power consumption and resource allocation within dedicated hardware for extended reliability on long journeys.

- Intelligent Group Riding: Automated sharing of rider status, location, and speed within a touring group, managed and optimized by a centralized AI platform.

- Map Data Augmentation: Machine learning rapidly processes crowdsourced data to verify and update map accuracy, particularly concerning temporary road hazards or closures.

DRO & Impact Forces Of Motorcycle Navigation Systems Market

The Motorcycle Navigation Systems Market is powerfully shaped by the increasing demand for advanced rider safety features (Driver) and the parallel challenge posed by the fierce competition from highly accessible, feature-rich smartphone applications (Restraint). The core Opportunity lies in integrating navigation capabilities into motorcycle-specific wearables and Head-Up Displays (HUDs), moving away from handlebar-mounted devices. The combined Impact Forces indicate a high degree of technological substitution pressure, necessitating continuous innovation in rugged design and specialized motorcycle-centric functionality to maintain hardware market relevance against free or low-cost software alternatives.

Primary drivers include the expanding global market for high-value touring and adventure motorcycles, particularly among affluent consumers who prioritize safety accessories. The regulatory landscape, especially in regions like the European Union, increasingly mandates enhanced vehicle connectivity and rapid emergency response systems (e.g., automatic crash detection and eCall functionality), which are built upon sophisticated GPS and telematics platforms. Furthermore, the rising appeal of social and recreational group riding fuels demand for navigation systems capable of advanced group tracking and communication integration, functionalities that are often superior in purpose-built devices compared to general consumer electronics.

Key market restraints largely center on the powerful competitive pressure exerted by well-established, constantly evolving smartphone navigation applications, many of which are offered at no cost to the consumer and feature near-real-time traffic data, which diminishes the perceived value proposition of expensive dedicated hardware. Additionally, the technical complexity and high cost associated with the initial installation and integration of premium OEM navigation systems can act as a barrier to market penetration, especially in emerging markets sensitive to price. Opportunities, however, abound in developing highly specialized software services, such as specialized geo-fencing for motorcycle rental companies, and robust, enterprise-grade solutions for commercial fleet management, requiring features beyond typical consumer needs.

Segmentation Analysis

The Motorcycle Navigation Systems Market is meticulously segmented based on product type (dedicated GPS hardware versus smartphone applications), distribution channel (OEM vs. Aftermarket), display type (standard LCD/TFT versus Head-Up Display/Integrated Dashboard), and application (on-road vs. off-road). This structure allows for a detailed analysis of distinct customer needs, ranging from the casual commuter utilizing app-based solutions to the dedicated adventure rider relying on high-durability, offline mapping GPS units. The segmentation highlights the bifurcation of the market between cost-effective software solutions catering to the mass market and premium hardware solutions dominating the high-end touring and adventure segments.

The product type segmentation is critical as it reflects the primary competitive dynamic in the industry: the struggle between mature, purpose-built hardware and rapidly evolving software. Dedicated GPS units, while pricier, offer superior resilience, anti-glare screens, and often longer battery life independent of the bike’s power, making them the preferred choice for long-distance, unsupported travel where reliability is paramount. Conversely, smartphone applications leverage the ubiquity and processing power of mobile devices, focusing on real-time updates and seamless integration with other mobile services, achieving high penetration due to their low barrier to entry and familiar interface.

Furthermore, the segmentation by distribution channel is becoming increasingly vital. While the aftermarket channel continues to serve the large existing motorcycle fleet, the OEM channel is rapidly gaining share, driven by premium manufacturers who integrate navigation hardware and proprietary software directly into the motorcycle’s digital cockpit. This OEM integration provides a cleaner aesthetic, better power management, and deeper functional interplay with the motorcycle’s internal diagnostics, appealing to high-end buyers seeking a premium, factory-backed experience. The application segment delineates market focus, requiring dedicated hardware developers to focus on ruggedness for the off-road segment and connectivity/traffic awareness for the on-road segment.

- By Product Type:

- Dedicated GPS Devices (e.g., Zumo, Rider Series)

- Smartphone-Based Applications (Subscription and Free Models)

- Integrated OEM Systems (Proprietary Dashboards)

- By Display Type:

- LCD/TFT Screens (Standard/High Brightness)

- Head-Up Displays (HUD)

- Integrated Dashboard Displays

- Helmet-Based Projection Systems (Emerging)

- By Application:

- On-Road Touring and Commuting (Real-time traffic focus)

- Off-Road/Adventure Riding (Offline mapping, ruggedness focus)

- Track and Racing (Telemetry and Lap Timing Integration)

- By Distribution Channel:

- Original Equipment Manufacturer (OEM)

- Aftermarket (Retail, E-commerce, Specialty Stores)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Motorcycle Navigation Systems Market

The value chain begins in the upstream segment with core component sourcing, requiring specialized procurement of high-performance GNSS chipsets capable of multi-constellation tracking (GPS, GLONASS, Galileo) for global reliability. This stage also involves securing high-specification electronic components such as waterproof sensors, vibration-dampening mounting hardware, and sophisticated microprocessor units designed for demanding environments. Key strategic decisions involve licensing mapping data from major providers (e.g., HERE, TomTom Maps) and developing proprietary routing software, which is essential for differentiation in the competitive hardware market. Manufacturers must also establish robust quality control measures tailored to automotive and motorcycle industry standards.

The midstream phase encompasses the manufacturing and assembly process, where dedicated hardware units are produced and software solutions are developed and integrated. For dedicated units, this involves rigorous stress testing against vibration, temperature extremes, and water ingress. For OEM systems, this phase includes complex integration protocols with the motorcycle’s electrical and CAN bus systems. Distribution channels are bifurcated: Direct distribution is characteristic of OEM supply to assembly lines and authorized dealerships, guaranteeing professional installation and warranty. Indirect distribution is managed through a vast network of aftermarket retailers, authorized accessory distributors, and specialized online platforms, which handle the majority of consumer-purchased GPS devices and software application sales.

The downstream segment focuses heavily on customer acquisition, maintenance, and service delivery, critical for long-term revenue generation, especially through software. Post-sale activities include providing continuous Over-The-Air (OTA) updates for maps and firmware, which address security vulnerabilities and introduce new features. Subscription services for premium features (e.g., live weather overlays, advanced scenic routing) are crucial for establishing recurring revenue streams. Effective customer service, capable of troubleshooting both hardware failures and software issues, is vital, as system failure on a long-distance trip severely damages brand reputation and user trust in the device’s reliability.

Motorcycle Navigation Systems Market Potential Customers

The core customer base for high-end dedicated motorcycle navigation systems comprises long-distance touring riders and adventure motorcyclists who require maximum reliability, offline functionality, and extreme durability for extended journeys in remote areas. These individuals often own premium motorcycles and view the navigation system as a crucial safety and investment component, prioritizing features like external antenna connectivity, extensive battery backup, and gloved usability over price. This segment also includes professional users such as overland tour guides, who rely on the accuracy and robustness of these devices for their livelihood and client safety.

A second major customer segment includes daily commuters and urban riders, who prioritize real-time traffic updates, quick re-routing, and integration with helmet audio systems. This segment is highly cost-sensitive and often opts for feature-rich smartphone-based navigation apps, utilizing aftermarket mounts and charging solutions. Motorcycle OEMs represent significant B2B customers, integrating white-label or proprietary navigation software and hardware into their production models, targeting consumers who prefer seamless, factory-fitted technology that maintains the vehicle’s aesthetic and warranty integrity.

Emerging and specialized customer groups include commercial motorcycle fleets (delivery, police, emergency medical services), which require highly customized telematics solutions for tracking, efficiency monitoring, and secure communication. These enterprise customers prioritize fleet management features, secure data logging, and centralized map updating capabilities that general consumer products cannot offer. Motorcycle racing teams and track day enthusiasts also form a niche market, focusing on systems integrated with telemetry that provide lap times, lean angle metrics, and performance data overlaid onto map recordings for post-ride analysis and improvement.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $550 Million |

| Market Forecast in 2033 | $1,050 Million |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Garmin Ltd., TomTom N.V., BMW Motorrad, Honda Motor Co., Ltd. (through proprietary systems), Magellan GPS, Sena Technologies, Inc., Rlink (Connected Ride), Rideology (Kawasaki), REVER, Sygic, Calimoto, Detecom (Telematics Solutions), Bosch (Connectivity Division), Interphone, CoPilot GPS |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Motorcycle Navigation Systems Market Key Technology Landscape

The contemporary technology landscape is defined by the necessity for maximum accuracy and rugged operational resilience. Core positioning technology relies on advanced multi-constellation Global Navigation Satellite Systems (GNSS) receivers, which simultaneously track signals from GPS, GLONASS, Galileo, and BeiDou. This redundancy is critical for maintaining location accuracy and stability in signal-denied environments, such as urban canyons or dense forests, vital for the adventure riding segment. Hardware design features high-nit, high-definition capacitive screens specifically engineered to repel moisture and be fully operational while the rider is wearing thick gloves, often supported by specialized processors optimized for fast map rendering and low power consumption.

Connectivity standards are rapidly evolving, shifting from simple Bluetooth integration for audio alerts to embedded 4G/5G modems that facilitate continuous real-time traffic (RTT) data flow, over-the-air (OTA) software updates, and cloud-based features like live group tracking and emergency calls (eCall). A crucial technological innovation is the integration of Inertial Measurement Units (IMUs) within the navigation hardware. IMUs use accelerometers and gyroscopes to calculate position via dead reckoning when satellite signals are momentarily lost (e.g., in long tunnels), ensuring uninterrupted navigation and high integrity data for safety functions, significantly enhancing overall system dependability.

Furthermore, specialized software algorithms represent a major competitive advantage, particularly those focused on motorcycle-specific route generation, such as curvature and elevation optimization algorithms that appeal to leisure riders seeking aesthetically pleasing journeys rather than the shortest path. Looking forward, the most transformative technologies include Augmented Reality (AR) navigation interfaces, which project directional prompts onto a Head-Up Display (HUD) integrated either into the helmet or the motorcycle dashboard, minimizing rider eye movement and cognitive load. The gradual integration of V2X (Vehicle-to-Everything) communication technology will enable navigation units to receive and process decentralized data on localized hazards, further leveraging connectivity for proactive safety management.

Regional Highlights

- Europe: This region maintains the largest market share, predominantly driven by high ownership rates of premium touring motorcycles (BMW, KTM, Ducati) and a deeply entrenched culture of long-distance motorcycle travel across borders. Strict safety regulations and the established presence of key market players like TomTom and Garmin contribute significantly. Western Europe, particularly Germany, France, and the UK, shows high adoption rates of both aftermarket and integrated OEM systems, benefiting from high consumer spending on specialized touring accessories and advanced safety features.

- North America (US and Canada): Characterized by vast distances and a strong demand for high-performance off-road and adventure touring (ADV) systems. The market here is highly competitive in the aftermarket segment, with consumers often favoring robust, shock-resistant units offering satellite communication capabilities essential for remote area travel. The increasing trend of motorcycle rentals and shared economy platforms also boosts the demand for easily interchangeable, durable navigation solutions for diverse recreational activities across various states.

- Asia Pacific (APAC): The fastest-growing region, fueled by rising disposable incomes in countries like India, China, and Southeast Asian nations, leading to increased purchasing power for mid-range and premium motorcycles. While cost-sensitive, the urban populations highly demand efficient, real-time traffic navigation software due to severe congestion. Localized manufacturing is key, focusing on integrating navigation into mass-market motorcycle displays, particularly in two-wheeler dominant countries, with smartphone tethering dominating the volume market due to cost effectiveness.

- Latin America (LATAM): Growth is steady, driven by the need for reliable anti-theft tracking and navigation in complex urban environments and cross-country transport logistics. The market leans heavily toward affordable smartphone application solutions, though rugged hardware is gaining traction among adventure riders exploring diverse geographical landscapes, such as in Brazil and Argentina. Demand is also influenced by the need for robust fleet management solutions for commercial motorcycle operations in large metropolitan areas.

- Middle East and Africa (MEA): This region is primarily focused on utility and commercial motorcycle applications, though leisure riding is slowly increasing in specific Gulf Cooperation Council (GCC) countries where luxury motorcycle imports are growing. The market requires systems capable of withstanding extreme heat and dust, favoring highly durable hardware with strong cooling properties and localized mapping content that accounts for rapidly changing infrastructure and desert terrain navigation challenges.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Motorcycle Navigation Systems Market.- Garmin Ltd.

- TomTom N.V.

- BMW Motorrad

- Honda Motor Co., Ltd. (Connectivity Solutions)

- Sena Technologies, Inc.

- Magellan GPS

- COYOTE System

- REVER (Segmented Software Provider)

- Sygic a.s.

- Calimoto GmbH

- Rlink/Rider Link

- Interphone (Cellularline S.p.A.)

- Cardo Systems, Inc. (Integration Partner)

- Bosch (Automotive Electronics Division)

- Continental AG (V2X and Telematics)

- Kawasaki Heavy Industries (Rideology App)

- Yamaha Motor Co., Ltd. (Y-Connect)

- Triumph Motorcycles (Integrated Navigation)

- Harley-Davidson (Boom! Box Systems)

Frequently Asked Questions

Analyze common user questions about the Motorcycle Navigation Systems market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between dedicated motorcycle GPS and smartphone navigation apps?

Dedicated motorcycle GPS units offer superior ruggedness (waterproof, vibration-resistant), anti-glare screens operable with gloves, specialized offline mapping capabilities, and unique winding road algorithms, making them safer and more reliable than standard consumer smartphone apps, especially for long-distance touring.

How is AI impacting the future safety features of motorcycle navigation?

AI is crucial for enhancing predictive safety by analyzing real-time data, rider behavior, and road conditions to offer context-aware warnings, dynamic route modifications, and personalized alerts that preemptively address hazards specific to motorcycle riding dynamics and environment, minimizing response time.

Which segment of the Motorcycle Navigation Systems market is expected to show the highest growth?

The software and services segment, particularly smartphone-based applications and subscription services for premium mapping, is projected to exhibit the highest CAGR, driven by their accessibility, low cost, continuous, rapid feature updates, and the increasing global penetration of connected mobile devices.

Are Original Equipment Manufacturer (OEM) navigation systems better than aftermarket products?

OEM systems typically offer seamless deep integration with the motorcycle's onboard computer (ECU), power management, and existing dashboard displays, providing a cleaner look and factory warranty. Aftermarket units, conversely, offer greater portability, application flexibility, and often superior ruggedness for niche demands like extreme adventure riding.

What are the key technological advancements driving innovation in this market?

Key advancements include the use of multi-constellation GNSS for higher accuracy, the development of robust, glove-friendly anti-glare display technology, the implementation of advanced V2X communication standards for real-time hazard sharing, and the integration of augmented reality (AR) overlays for distraction-free directional guidance projected onto HUDs.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager