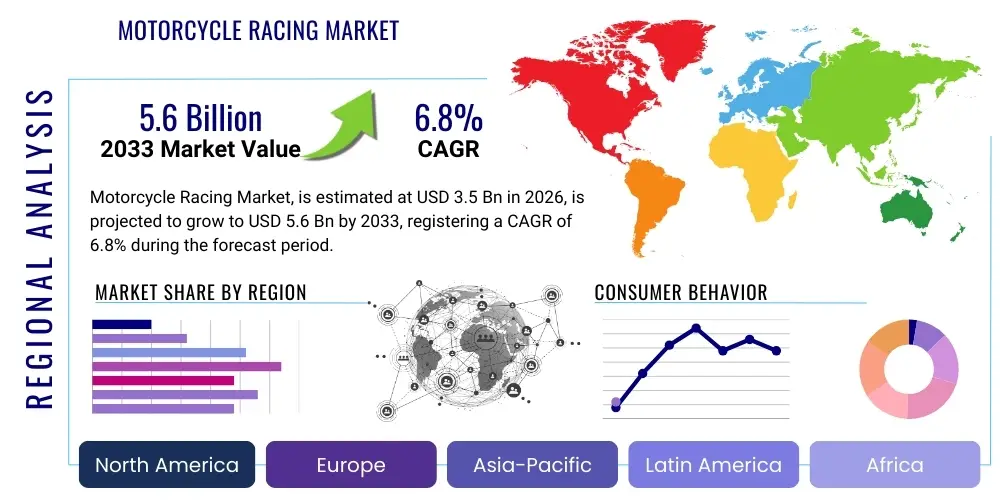

Motorcycle Racing Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437544 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Motorcycle Racing Market Size

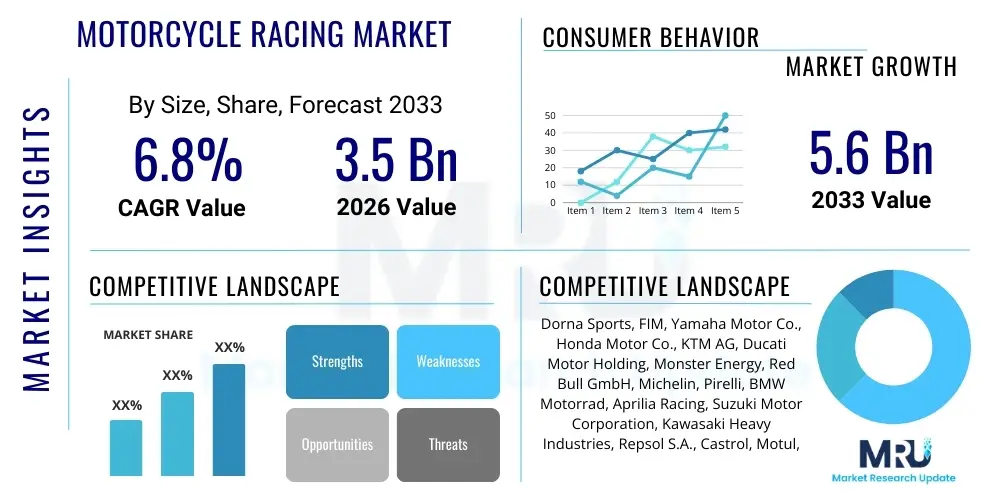

The Motorcycle Racing Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 5.6 Billion by the end of the forecast period in 2033. This growth trajectory is fundamentally driven by the escalating global appeal of high-speed motorsports, coupled with significant investments in digital broadcasting rights and fan engagement technologies. Emerging economies, particularly across Asia Pacific, are witnessing a surge in motorsport participation and spectatorship, positioning them as pivotal growth engines. Furthermore, continuous technological advancements in motorcycle engineering, safety gear, and track infrastructure contribute significantly to the market expansion, making professional racing increasingly accessible and globally televised, thereby amplifying commercial revenues.

Motorcycle Racing Market introduction

The Motorcycle Racing Market encompasses all professional and semi-professional activities related to competitive motorcycle events, including organizational rights, team operations, sponsorship revenues, media broadcasting, and ancillary merchandise sales. The core product of this market is the racing spectacle itself, which provides entertainment, technological testing grounds, and brand visibility for manufacturers and sponsors alike. Major applications span across various formats, such as MotoGP, Superbike World Championship (WSBK), Motocross (MXGP), and specialized endurance races, each catering to distinct fan demographics and technological requirements. These events serve as crucial platforms for motorcycle manufacturers to test new engine components, aerodynamic designs, and sustainable fuel solutions under extreme conditions, validating innovations before consumer release. The market’s primary benefits include generating substantial media value, driving technological innovation in safety and performance, and fostering a global community of enthusiasts and consumers.

Driving factors for the market's robust growth include the increasing digitalization of content distribution, which allows global access to live races via streaming platforms, significantly expanding the audience base beyond traditional television viewership. High-profile corporate sponsorships, particularly from energy drink brands, automotive lubricants, and technology firms, inject crucial financial resources into teams and organizing bodies, improving event quality and prize money. Moreover, stringent safety regulations enforced by governing bodies like the Fédération Internationale de Motocyclisme (FIM) enhance rider protection and professional standards, making the sport more appealing to a wider range of investors and participants. The development of electric motorcycle racing formats (e.g., MotoE) also represents a forward-looking driver, addressing sustainability concerns and attracting a new segment of environmentally conscious fans and technological partners.

Motorcycle Racing Market Executive Summary

The Motorcycle Racing Market is characterized by intense competition among major manufacturers and highly consolidated organizational control by rights holders like Dorna Sports (for MotoGP and WSBK). Current business trends indicate a significant shift towards hybrid revenue models, where traditional sources like ticket sales and trackside advertising are complemented by high-value digital media rights and exclusive content subscriptions. Regional trends highlight Europe as the historical stronghold due to the prevalence of major circuits and manufacturer headquarters (Italy, Germany, Spain), yet the Asia Pacific region is rapidly gaining prominence, driven by rising disposable incomes, aggressive marketing campaigns in countries like Indonesia and Thailand, and the integration of local riders into global championships. Segment trends show that the Sponsorships category remains the dominant revenue stream, but the Media Rights segment exhibits the highest CAGR, propelled by global streaming deals and the demand for 4K broadcast quality. Furthermore, the segmentation by Vehicle Class demonstrates that the premier classes (MotoGP and Superbike) command disproportionately higher commercial valuations due to superior global visibility and star power, necessitating continuous investment in high-performance infrastructure and talent development to maintain market dominance.

Key strategic activities within the market currently focus on global expansion and diversification of racing formats. Major organizations are actively seeking new host nations in the Middle East and Latin America to extend the racing calendar and tap into new fan bases, balancing the reliance on traditional European circuits. From a competitive standpoint, Original Equipment Manufacturers (OEMs) are locked in a continuous technological arms race, viewing success on the racetrack as essential for brand perception and consumer sales of their street models. This competitive dynamic ensures a steady flow of investment into R&D. The long-term stability of the market depends heavily on maintaining strong relationships with global broadcasters and attracting younger demographics through interactive digital experiences, esports integration, and increased social media engagement, ensuring the sustainability of fan interest across generations.

AI Impact Analysis on Motorcycle Racing Market

Common user questions regarding AI in the Motorcycle Racing Market often revolve around its application in enhancing safety, optimizing performance analytics, and revolutionizing fan experience. Users frequently ask: "How can AI prevent accidents in real-time?" "Will AI-driven simulations replace human testing?" and "How will personalized AI content change race viewership?" Based on this analysis, the key themes summarize the expectation that AI will move beyond basic data processing to become an embedded, prescriptive tool. Users anticipate AI transforming rider training through personalized feedback systems, significantly improving vehicle setup optimization based on predictive modeling of track conditions and tire wear, and creating deeply engaging, customized content feeds for viewers, ensuring maximum viewer retention and monetization opportunities across diverse media channels. Concerns primarily focus on the ethical use of AI in potentially blurring the lines between human skill and machine optimization, and the risk of algorithmic bias in judging performance or predicting outcomes.

- AI-powered predictive maintenance models optimize engine life and reduce mechanical failures during critical races by analyzing telemetry data in real-time.

- Advanced simulation platforms utilizing machine learning enhance rider training and tactical decision-making, replicating real-world track conditions with unprecedented accuracy.

- Generative AI tools are employed to create hyper-personalized fan content, tailoring highlight reels, commentary styles, and statistical overlays based on individual viewer preferences and engagement history (AEO focus).

- AI-driven aerodynamics and chassis setup optimization allow engineering teams to fine-tune bike configurations faster and more accurately than traditional methods, providing a competitive edge.

- Computer vision and deep learning algorithms enhance safety systems, providing real-time hazard detection, flag status monitoring, and precise analysis of near-miss incidents for post-race review and regulatory action.

- Automated commentary and data visualization systems provide instantaneous, complex statistical insights during live broadcasts, significantly enriching the viewing experience and improving content delivery speed.

DRO & Impact Forces Of Motorcycle Racing Market

The Motorcycle Racing Market is governed by a dynamic interplay of Drivers, Restraints, and Opportunities, collectively forming the Impact Forces that shape its trajectory. Key drivers include the robust increase in global sports viewership, particularly in Asian markets, coupled with relentless technological innovation driven by manufacturers seeking a performance edge that translates into consumer product sales. Restraints primarily involve the high operational costs associated with maintaining competitive teams, stringent environmental regulations requiring shifts towards expensive sustainable fuels or electric powertrains, and the inherent risk of severe injuries, which occasionally impacts public perception and sponsorship interest. Opportunities lie in the expansion of esports racing simulations to engage younger audiences, the development of new, commercially viable racing circuits in untapped regions, and the monetization of exclusive digital assets and Non-Fungible Tokens (NFTs) related to riders and teams. These forces create a high-stakes competitive environment where financial stability, technological superiority, and global brand visibility are paramount for market success.

The impact forces operate on several levels: economically, the reliance on mega-sponsorship deals means market stability is tied to the health of global corporate marketing budgets. Technologically, the mandate for continuous performance enhancement drives rapid technological obsolescence, favoring well-funded organizations capable of rapid R&D cycles. Socially, the market benefits from the sustained cultural excitement surrounding speed and extreme sports, although it must continuously manage the negative public relations resulting from high-profile incidents. The primary impact force accelerating growth is the convergence of high-quality digital broadcasting with increased consumer demand for live, premium sports content, allowing rights holders to command escalating media fees globally. Conversely, the rising regulatory burden, specifically regarding noise pollution and sustainability mandates, acts as a decelerating force, requiring substantial capital investment to ensure compliance and maintain social license to operate.

Segmentation Analysis

The Motorcycle Racing Market is segmented across several dimensions, reflecting the diverse nature of racing formats, vehicle types, and monetization strategies. Understanding these segments is crucial for stakeholders to target investment, tailor sponsorship strategies, and allocate resources effectively for technological development. The segmentation by type typically differentiates between track-based activities (Road Racing, Speedway) and off-road events (Motocross, Enduro), each requiring specialized equipment, venues, and fan engagement strategies. Revenue source segmentation highlights the critical financial dependency on large-scale corporate partnerships and the growing importance of media consumption models. Furthermore, vehicle class provides a clear hierarchy of prestige and technological expenditure, with MotoGP representing the pinnacle of prototype technology and cost, while supporting classes serve as crucial feeders for talent and more standardized machinery.

- By Type:

- Road Racing (e.g., MotoGP, WSBK)

- Off-Road Racing (e.g., Motocross, Supercross, Rally Raid)

- Speedway and Flat Track Racing

- By Vehicle Class:

- Grand Prix Racing (MotoGP, Moto2, Moto3)

- Superbike and Supersport (WSBK)

- Motocross and Enduro Classes

- Electric Motorcycle Racing (e.g., MotoE)

- By Revenue Source:

- Sponsorships and Advertising

- Media Rights and Broadcasting

- Ticket Sales and Hospitality

- Merchandising and Licensing

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Motorcycle Racing Market

The value chain of the Motorcycle Racing Market is complex and highly specialized, beginning with the upstream supply side, which involves the key manufacturers (OEMs) providing high-performance motorcycles, specialized components (e.g., tires from Michelin, Pirelli), and advanced electronics. This upstream phase is characterized by intense R&D investment and proprietary technology development, crucial for achieving competitive parity. Midstream activities encompass the organizational structure: sanctioning bodies (FIM), event promoters (Dorna Sports), race teams (factory and private), and professional riders. These entities coordinate the logistics, safety, and competition rules, transforming technical components into a marketable spectacle. Financial stability at this stage is heavily reliant on securing lucrative sponsorship contracts and media distribution deals, which form the primary commercial engine of the sport.

The downstream analysis focuses on distribution channels, primarily the massive global media network. Direct distribution includes ticket sales at physical circuits and team-specific merchandise sales via e-commerce platforms. Indirect distribution, which generates the vast majority of market revenue, involves broadcasting rights sold to global television networks (e.g., Sky Sports, DAZN) and increasingly, digital streaming platforms. The effectiveness of this downstream channel is contingent upon high production quality and robust content delivery systems, ensuring worldwide fan access. The final value component lies in fan engagement and data monetization, where detailed audience data is collected and leveraged for targeted advertising and customized content delivery, maximizing return for corporate sponsors and rights holders. Efficiency across this value chain—from R&D to digital distribution—is critical for maintaining the market’s premium valuation and global visibility.

Motorcycle Racing Market Potential Customers

The potential customers for the Motorcycle Racing Market are diverse, falling into two primary categories: commercial buyers and end-users (fans). Commercial buyers, the most financially critical segment, include Original Equipment Manufacturers (OEMs) such as Honda, Yamaha, and Ducati, who use racing as a high-stakes marketing and R&D platform. These manufacturers are the primary buyers of team services and technology. Equally important are corporate sponsors (e.g., energy drinks, telecommunications, financial services) who purchase visibility and association rights, aiming to leverage the sport's demographic reach and excitement to enhance their brand equity. These corporate entities are seeking high-impact, global platforms to reach specific, often male, technologically interested, and affluent consumer groups, making race organizations strategic partners rather than simple vendors.

End-users or fans constitute the massive audience base that directly purchases tickets, merchandise, and, most importantly, pays for content consumption through subscription services or through viewership which is monetized by advertisers. This segment can be further broken down into core enthusiasts (high frequency attendance, high spending on licensed products) and casual observers (digital viewers). Core enthusiasts often purchase high-value items like specialized apparel and hospitality packages, while casual observers drive the volume needed for high media rights valuations. Targeted marketing must therefore address both the corporate buyer's need for high-ROI visibility and the end-user's desire for immersive, high-quality entertainment and emotional connection to riders and brands. The growth of esports spectatorship has also introduced a younger, digitally native consumer base, broadening the overall demographic reach.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 5.6 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Dorna Sports, FIM, Yamaha Motor Co., Honda Motor Co., KTM AG, Ducati Motor Holding, Monster Energy, Red Bull GmbH, Michelin, Pirelli, BMW Motorrad, Aprilia Racing, Suzuki Motor Corporation, Kawasaki Heavy Industries, Repsol S.A., Castrol, Motul, Alpinestars, Dainese S.p.A., Go Pro, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Motorcycle Racing Market Key Technology Landscape

The Motorcycle Racing Market relies on a cutting-edge technological landscape focused on maximizing speed, ensuring rider safety, and enhancing data acquisition capabilities. Core technologies include sophisticated telemetry systems, which capture hundreds of data points per second—ranging from suspension travel and tire temperature to lean angles and braking force—enabling engineering teams to make millisecond-level adjustments. Aerodynamic advancements, derived often from aerospace engineering, play a crucial role, particularly in premier classes like MotoGP, where winglets and sophisticated fairings are designed to increase downforce and improve stability at speeds exceeding 350 km/h. Furthermore, the development of high-performance materials, such as carbon fiber composites and specialized alloys, is essential for reducing weight while increasing structural rigidity and safety cage integrity. This technological arms race demands significant annual investment, driving innovation that eventually trickles down to consumer motorcycles.

Beyond vehicle performance, safety technology has seen transformative growth. Advanced airbag suits, mandatory in many professional series, utilize sophisticated sensor packages to detect impending high-side or low-side crashes, inflating protective bags around the rider’s neck and torso within milliseconds. Helmet technology continuously evolves, focusing on enhanced energy absorption liners and optimized shell structures derived from finite element analysis. In terms of track operations, advanced digital signaling systems are replacing traditional flag marshals in certain zones, providing instantaneous, clear safety information directly to the rider’s dashboard. The integration of sensor technology with centralized race control ensures regulatory adherence and immediate response to on-track incidents, maintaining the integrity and safety profile of the competition.

Looking forward, the adoption of sustainable technologies is rapidly becoming central to the market’s technological landscape. This includes the mandated use of renewable fuels in some series and the increasing prominence of electric motorcycle racing, which drives battery technology, power management systems, and specialized thermal regulation solutions. Data analytics and machine learning remain foundational, utilized for everything from predicting optimal tire usage strategies based on changing track temperatures to simulating complex race scenarios for strategic planning. These data-driven tools ensure that technological superiority remains a critical determinant of competitive success across all classes of motorcycle racing.

Regional Highlights

- Europe: Historical Dominance and Technological Hub

Europe continues to be the stronghold of the Motorcycle Racing Market, anchored by its rich motorsport heritage, the concentration of major OEM headquarters (e.g., Ducati, KTM, Aprilia), and the location of several iconic circuits (Assen, Mugello, Jerez). The region benefits from highly organized and well-funded national championships that feed talent directly into global series like MotoGP and WSBK. Spain and Italy, in particular, serve as critical commercial and operational centers, hosting a disproportionate number of races and housing the critical support infrastructure, including advanced testing facilities and top-tier team bases. The European consumer base possesses a high affinity for motorsport, ensuring strong ticket sales and consistent viewership, which in turn justifies premium media rights values. This established ecosystem, backed by strong regulatory bodies like the FIM based in Switzerland, provides structural stability and dictates many of the global technological standards adopted worldwide. Continuous strategic focus is placed on maintaining sponsorship relationships with large multinational corporations headquartered within the continent, crucial for financing the high cost of competitive racing.

- Asia Pacific (APAC): The Growth Engine and Future Market Potential

The APAC region is identified as the fastest-growing market for motorcycle racing, driven by massive population density, expanding middle classes, and a deeply ingrained cultural reliance on two-wheeled transportation. Countries such as Indonesia, Thailand, Malaysia, and Vietnam boast tremendous enthusiasm for the sport, often resulting in sell-out crowds for international events. This fan base is highly desirable for manufacturers, as racing success directly translates into increased sales volumes for consumer-grade motorcycles. Key market strategies in APAC revolve around expanding the race calendar into new territories (e.g., India, Kazakhstan) and developing local rider talent to create regional heroes, thereby maximizing domestic engagement and media interest. Media consumption in APAC is heavily skewed towards digital and mobile platforms, making the success of streaming partnerships vital for market penetration and commercial growth. The sheer size of the potential audience guarantees that investments in infrastructure and local promotion will continue at an aggressive pace throughout the forecast period.

- North America: Niche Enthusiasm and Focus on Off-Road/Supercross

North America, while possessing massive spending power, historically focuses more intensely on specialized segments like Motocross and Supercross, which enjoy significant commercial success and high visibility (e.g., AMA Supercross). Road racing, while present, holds a slightly more niche status compared to Europe. The market dynamics here are often driven by robust, localized sponsorship deals and high-quality television production focused on domestic consumption. There is significant opportunity to bridge the gap between niche interest and mainstream sports engagement, particularly through integrating competitive digital engagement (esports) and improving accessibility of international series like MotoGP. Investment in North America is strategically focused on leveraging the large corporate marketing budgets available and capitalizing on the region's strong heritage in automotive motorsports to cross-promote two-wheeled racing. Key growth strategies include enhancing US rider representation in global series to boost patriotic viewership.

- Latin America (LATAM): Recovering Markets and Passionate Fan Base

Latin America represents a market with high volatility but an immensely passionate fan base, particularly in countries like Brazil and Argentina, which have strong motorsport traditions. Economic fluctuations often restrain large-scale infrastructural investment required for hosting premier international events consistently, yet the fan interest remains high. The primary value drivers in LATAM are media rights and affordable event ticketing, appealing to large crowds. Opportunities involve long-term governmental and corporate partnerships to stabilize event hosting and team operations. The region serves as an important talent pool for riders, often requiring successful integration into European-based teams for professional development. Strategic focus involves improving the stability and frequency of hosting international-level competitions to capitalize on deep-seated national enthusiasm and unlock regional sponsorship revenues.

- Middle East and Africa (MEA): Strategic Investment and High-Profile Venues

The MEA region is characterized by high-profile, state-of-the-art racing venues, particularly in the Gulf states (e.g., Qatar, Saudi Arabia), which actively seek to host global sporting events to boost international profile and tourism. These markets provide significant capital for event organization and often feature long-term hosting agreements, offering stable revenue streams for rights holders. The climate and infrastructure allow races to be held during seasons unsuitable for European tracks, diversifying the global calendar. While the local consumer base for racing is still developing compared to APAC or Europe, the strategic importance lies in the capacity for major infrastructure investment and the provision of unique, high-value hospitality experiences. Growth strategies focus on using these high-profile events to serve as a gateway for marketing and media consumption across the wider Asian and African continents.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Motorcycle Racing Market.- Dorna Sports S.L. (Rights Holder of MotoGP & WSBK)

- Fédération Internationale de Motocyclisme (FIM)

- Yamaha Motor Co., Ltd.

- Honda Motor Co., Ltd.

- KTM AG

- Ducati Motor Holding S.p.A.

- Aprilia Racing (Piaggio Group)

- Suzuki Motor Corporation (Historical Participant and Technology Provider)

- Kawasaki Heavy Industries, Ltd.

- Monster Energy Company (Major Sponsor)

- Red Bull GmbH (Major Sponsor and Team Owner)

- Michelin Group (Official Tire Supplier)

- Pirelli & C. S.p.A. (Official Tire Supplier for WSBK)

- BMW Motorrad (WSBK participant and technology provider)

- Repsol S.A. (Major Lubricant/Energy Sponsor)

- Castrol (Lubricant Provider and Sponsor)

- Motul S.A. (Lubricant Provider and Sponsor)

- Alpinestars S.p.A. (Safety Gear and Apparel)

- Dainese S.p.A. (Safety Gear and Apparel)

- Go Pro, Inc. (Technology Partner and Content Provider)

Frequently Asked Questions

Analyze common user questions about the Motorcycle Racing market and generate a concise list of summarized FAQs reflecting key topics and concerns.What factors are driving the projected 6.8% CAGR growth in the Motorcycle Racing Market through 2033?

The primary drivers sustaining the robust 6.8% Compound Annual Growth Rate are multifaceted, centering on technological advancement and global accessibility. Firstly, the exponential increase in media rights value, specifically driven by the shift towards global streaming and high-definition broadcast technologies, allows rights holders to reach vastly larger, monetizable audiences, particularly in the highly populous and economically expanding Asia Pacific (APAC) region. Secondly, continuous, large-scale investment from corporate sponsors, notably in the energy, finance, and technology sectors, provides essential capital for team operations, event quality, and technological research and development, treating racing success as a crucial element of global brand building and validation. Thirdly, mandated safety and performance regulations implemented by governing bodies foster trust and encourage manufacturer participation, leading to a constant cycle of innovation in areas such as engine efficiency, aerodynamics, and rider protection gear. This combination of digital market expansion, stable corporate investment, and innovation pipeline assures sustained revenue growth and market dynamism across the forecast period, positioning the sport favorably against other global sporting franchises.

How significant is the shift towards electric racing (MotoE) and what is its long-term impact on OEM investment?

The shift towards electric motorcycle racing, exemplified by series like MotoE, is highly significant, acting as a crucial technological proving ground and a key strategic pivot for Original Equipment Manufacturers (OEMs) focused on future sustainability mandates. While currently smaller in commercial scale compared to premier fossil-fuel classes like MotoGP, MotoE forces manufacturers to rapidly innovate in battery technology, thermal management, electric drivetrain efficiency, and energy regeneration systems. This forced innovation is invaluable because the technologies developed under extreme racing conditions directly inform the design and capabilities of future consumer electric motorcycles, fulfilling regulatory compliance goals and meeting increasing consumer demand for sustainable mobility solutions. Long-term OEM investment is expected to increasingly allocate R&D budgets towards electric powertrains, viewing participation in electric racing not merely as a sporting endeavor but as a necessary and high-visibility marketing platform to demonstrate leadership in the transition to electric vehicles. This integration ensures that the market remains relevant and aligned with global environmental objectives, attracting new partnerships focused on green technology and clean energy provision.

Which segments are generating the highest revenue and demonstrating the fastest growth rate within the global market?

The highest absolute revenue generation within the Motorcycle Racing Market is historically attributed to the Sponsorships and Advertising segment. Large, multi-year contracts with global brands (such as energy drink companies, tire manufacturers, and lubricant providers) form the financial backbone of teams and event operations, reflecting the massive global visibility afforded by premier races. However, the fastest growth rate is demonstrably occurring within the Media Rights and Broadcasting segment. This rapid acceleration is fueled by the aggressive bidding wars among global streaming platforms and traditional broadcasters for exclusive content distribution rights, especially as consumption shifts globally toward premium, on-demand digital experiences. Rights holders are successfully partitioning and selling these rights geographically and digitally, unlocking unprecedented value. The Superbike (WSBK) and MotoGP Vehicle Class segments command the highest commercial value due to their global reach and elite technology status, ensuring they remain the dominant forces in both sponsorship attraction and media monetization, driving overall market value upward through premium pricing strategies.

What are the primary restraints hindering faster market growth, especially concerning operational sustainability?

The primary restraints hindering faster market growth largely revolve around escalating operational costs and stringent environmental mandates. The cost of maintaining a competitive factory race team, encompassing specialized R&D, advanced material procurement, logistics, and personnel salaries, has soared, creating significant barriers to entry for smaller teams and increasing financial pressure on private outfits. Furthermore, the mandatory transition towards more sustainable operational practices, including the use of renewable or low-carbon fuels and addressing the carbon footprint of global logistics (freight and travel), requires substantial, non-revenue generating capital investment. These environmental regulations, while necessary for long-term viability, add complexity and cost in the short term. Additionally, the inherent risks associated with high-speed racing remain a continuous restraint, occasionally impacting public image and potentially deterring risk-averse corporate sponsors, necessitating ongoing, high-cost investment in sophisticated safety technologies and regulatory enforcement to mitigate these inherent dangers and maintain market confidence among stakeholders and the general public.

How is AI specifically enhancing rider safety and technological performance analysis in contemporary motorcycle racing?

AI is fundamentally transforming rider safety and performance analysis by moving beyond basic data logging to provide predictive and prescriptive insights in real-time. For safety, AI systems analyze complex telemetry data and bio-feedback from the rider (via smart suits and helmets) to detect patterns indicative of fatigue or impending component failure before human perception can register the danger. More critically, AI-driven computer vision systems monitor track conditions, flag status, and rider separation in real-time, providing race control with instantaneous, objective hazard assessments, thereby speeding up intervention times following an incident. On the performance front, machine learning algorithms process massive datasets relating to tire wear, suspension kinematics, and atmospheric conditions to recommend optimal bike setups for changing race scenarios with unparalleled precision. This eliminates much of the guesswork previously reliant on subjective rider feedback, allowing engineering teams to implement precise, data-validated adjustments to aerodynamics, engine mapping, and chassis geometry between sessions, guaranteeing maximum competitive performance and pushing the technological limits of the machinery within regulatory constraints, thus creating a tangible competitive advantage for technologically proficient teams.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager