Motorcycle Safety Gear Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438177 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Motorcycle Safety Gear Market Size

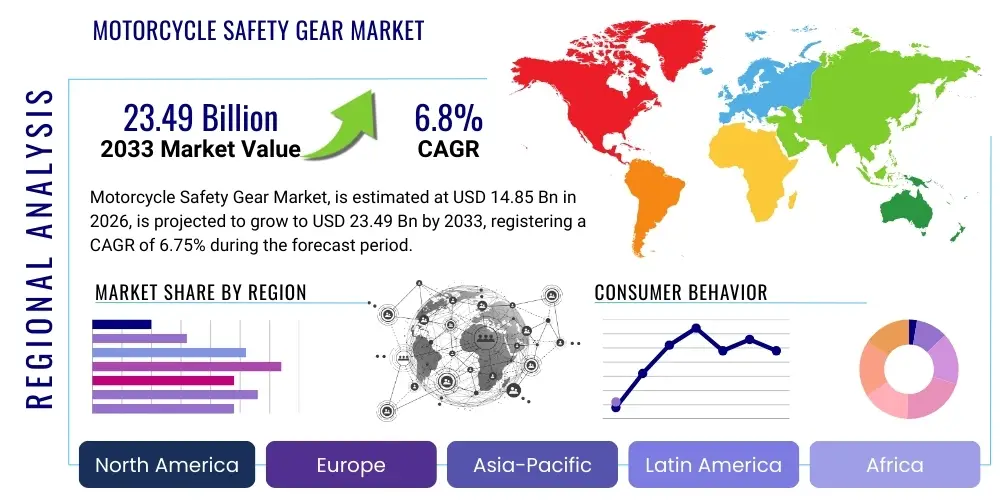

The Motorcycle Safety Gear Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.75% between 2026 and 2033. The market is estimated at USD 14.85 Billion in 2026 and is projected to reach USD 23.49 Billion by the end of the forecast period in 2033.

Motorcycle Safety Gear Market introduction

The Motorcycle Safety Gear Market encompasses a diverse range of specialized protective equipment designed to safeguard riders from injuries during accidents, falls, or exposure to harsh environmental conditions. This category primarily includes helmets, protective jackets, pants, gloves, boots, and specialized armor systems, all manufactured using advanced materials such as high-impact composites, durable textiles (Kevlar, Cordura), and premium leather. The primary function of this gear is to absorb impact energy, reduce abrasion, and provide thermal protection, thereby enhancing rider safety and comfort, which is crucial for both daily commuting and competitive motorsports.

The core products within this market, particularly helmets, are subject to stringent regulatory standards set by organizations like DOT, ECE, and Snell, ensuring that they meet minimum safety performance criteria. Key applications span across various segments of motorcycling, including casual riding, touring, off-roading (motocross), and professional racing. The market growth is fundamentally driven by increasing global motorcycle sales, especially in developing economies, coupled with a rising awareness among consumers regarding the critical importance of high-quality protective wear. Furthermore, the burgeoning trend of motorcycle tourism and recreational riding fuels demand for comfortable, stylish, and technologically integrated gear.

The major benefits associated with adopting quality safety gear include significant reduction in head injuries (up to 70% with helmet use), prevention of severe skin abrasions (road rash), and improved joint protection. Driving factors include governmental mandates making safety gear compulsory, advancements in material science leading to lighter and stronger products (e.g., carbon fiber helmets), and consumer preference shifting towards premium, feature-rich products that integrate communication systems, ventilation mechanisms, and smart technology for enhanced safety and connectivity on the road.

Motorcycle Safety Gear Market Executive Summary

The Motorcycle Safety Gear Market is characterized by robust growth, propelled by evolving safety regulations across North America and Europe and explosive demand from the Asia Pacific region, particularly India and China, which are dominant in terms of two-wheeler adoption. Business trends indicate a strong move toward innovation, with manufacturers heavily investing in R&D to develop protective equipment that offers superior impact absorption without compromising comfort or aesthetics. Key strategic shifts include the integration of electronics, such as Bluetooth communication systems and MIPS (Multi-directional Impact Protection System) technology, standardizing safety features across mid-range and premium product lines. The market structure remains fragmented but is seeing consolidation through strategic mergers and acquisitions among major global players seeking to expand their geographical footprint and diversify their product portfolios, focusing particularly on advanced textiles and air-bag vests.

Regionally, Asia Pacific is anticipated to exhibit the fastest growth, largely due to high population density, rising disposable incomes facilitating motorcycle ownership, and increasing government efforts to enforce road safety laws, which mandate the use of certified protective gear. Europe maintains its position as a key market for high-end, technologically advanced gear, driven by a strong touring culture and strict certification requirements (e.g., ECE 22.06). North America focuses on premium products, driven by consumer demand for brand recognition, specialized protective clothing for diverse climates, and a high uptake of off-road gear like motocross helmets and armored suits. The competitive landscape is intensely focused on material science, with composite materials (carbon fiber and fiberglass) gaining traction over traditional thermoplastics in performance-oriented helmet segments.

Segment trends reveal that the Helmet category maintains the largest market share due to universal mandatory usage laws, though the fastest-growing segment is Protective Clothing, specifically jackets and pants incorporating advanced abrasion-resistant materials and embedded armor. The distribution channel analysis shows a continuing shift towards online retail platforms, offering greater product variety, detailed user reviews, and competitive pricing, complementing the traditional motorcycle dealerships and specialty stores. Furthermore, the market is benefiting from consumer segmentation, targeting specific end-users such as professional racers, adventure tourists, and daily commuters, each requiring distinct sets of protective features, materials, and price points, thereby driving specialized product development and market expansion across all segments.

AI Impact Analysis on Motorcycle Safety Gear Market

Common user questions regarding AI's impact on motorcycle safety gear frequently revolve around how artificial intelligence can prevent accidents rather than just mitigate injuries, the feasibility of integrating complex sensors into lightweight gear, and concerns about the cost and reliability of 'smart' features. Users are keen to understand the role of AI in real-time collision warning systems, the potential for predictive maintenance alerts built into gear, and how personalized fitting, driven by AI algorithms and 3D scanning, could enhance comfort and protection simultaneously. A central theme is the expectation that AI should move safety gear beyond passive protection into active safety systems, making riding inherently safer. Users also inquire about data privacy implications arising from gear constantly monitoring the rider’s health, performance, and surroundings.

Based on these expectations, AI integration is primarily summarizing the shift toward active safety and personalization. AI algorithms are crucial for developing advanced sensor fusion capabilities in smart helmets, allowing for real-time risk assessment based on speed, lean angle, and proximity to other vehicles. This summarized intelligence is driving the next generation of collision detection and avoidance systems, providing auditory or haptic feedback to the rider before an impending threat materializes. Furthermore, AI is revolutionizing manufacturing processes by analyzing vast datasets of impact testing, enabling manufacturers to optimize material thickness and placement in critical areas like helmet shells and armor inserts, ensuring maximum protection with minimal weight increase, thereby offering performance benefits.

The impact extends significantly into the commercial domain through personalized retail and fit optimization. AI-powered recommendation engines analyze rider profiles, geographic riding conditions, and previous purchase behavior to suggest the most appropriate gear (e.g., thermal lining versus mesh ventilation). More fundamentally, AI-driven 3D body scanning technologies are being implemented in premium gear manufacturing to ensure perfect fit—a critical element for maximizing the effectiveness of protective armor. Ultimately, AI’s influence is pushing the market toward predictive safety, customized products, and enhanced manufacturing precision, addressing the core consumer need for seamless integration of high-level protection and technological convenience.

- AI-driven sensor fusion in smart helmets for real-time collision detection and warning systems.

- Predictive modeling and generative design optimizing helmet structure for superior energy dissipation during impact.

- Machine learning algorithms providing personalized gear recommendations based on rider biometrics and environmental conditions.

- AI analysis of riding data to offer performance feedback and fatigue monitoring for professional and enthusiast riders.

- Automated quality control systems (visual inspection using AI) ensuring flawless manufacturing standards for protective components.

DRO & Impact Forces Of Motorcycle Safety Gear Market

The Motorcycle Safety Gear Market is significantly influenced by a combination of key drivers (D), compelling restraints (R), and substantial opportunities (O), all molded by several critical impact forces. Drivers prominently include the relentless increase in global road accidents involving two-wheelers, which raises immediate public and governmental concern, leading to stricter enforcement of safety mandates worldwide. The escalating disposable income in fast-growing economies, particularly in the APAC region, facilitates the purchase of not just motorcycles but also premium, higher-quality safety gear. Furthermore, aggressive marketing campaigns by manufacturers emphasizing safety, coupled with the increasing popularity of motorcycling as a lifestyle and recreational pursuit, fuel demand across all product categories, from helmets to specialized protective suits.

Conversely, the market faces significant restraints. A primary concern is the high cost of advanced, certified safety equipment (especially gear incorporating high-performance materials like Kevlar, carbon fiber, and integrated airbags), which often deters cost-sensitive consumers in emerging markets who might opt for cheaper, uncertified alternatives, posing a safety risk and dampening premium market penetration. The prevalence of counterfeit products remains a persistent challenge, diluting brand value and posing a substantial safety threat to consumers, requiring continuous effort in supply chain protection and consumer education. Additionally, comfort issues, particularly in hot and humid climates where riders may choose to forgo protective jackets or pants due to heat discomfort, represent a significant usage restraint that technology is actively attempting to mitigate through advanced ventilation and cooling fabrics.

Opportunities for growth are vast, centered on technological advancements and market expansion. The development of connected gear (IoT integration) that communicates with motorcycles or smartphones offers novel safety features like automatic emergency calls post-accident (eCall systems). There is a burgeoning opportunity in catering to specialized motorcycling segments, such as adventure touring (requiring versatile, all-weather gear) and electric motorcycle users (who often demand lightweight, aesthetically modern equipment). Furthermore, the regulatory landscape, particularly the phased introduction of ECE 22.06 across Europe and its adoption globally, creates a compulsory replacement cycle for older helmets, providing a major sales boost. The impact forces acting on the market are intense competitive rivalry focused on material innovation, high barriers to entry due to regulatory compliance and necessary R&D investment, and strong bargaining power from institutional buyers (police, military, fleet operators) seeking volume discounts on reliable gear.

Segmentation Analysis

The Motorcycle Safety Gear Market is comprehensively segmented based on product type, material, distribution channel, and end-user, providing a multifaceted view of consumer preferences and market dynamics. This detailed segmentation allows manufacturers to target specific demographic and geographic groups effectively, aligning product development with distinct protective needs and budget constraints. The product segmentation, for example, highlights the proportional importance of helmets, while the material segmentation showcases the shift toward lighter, stronger composites for performance gear and highly durable textiles for daily protective clothing. Understanding these segments is crucial for predicting future market trends, especially concerning regulatory shifts and the integration of smart technologies across different gear types.

Key drivers within segmentation include the global proliferation of different motorcycle categories—from street bikes to dirt bikes—which necessitate specialized protective equipment. For instance, off-road gear requires different ventilation and impact absorption characteristics compared to street gear. The distribution channel breakdown reflects the ongoing digitalization of retail, with e-commerce platforms increasingly challenging traditional brick-and-mortar stores by offering expansive inventories and personalized shopping experiences, although specialty dealers remain vital for professional fittings and personalized service, particularly for premium gear. The end-user split differentiates between individual consumers, who prioritize aesthetics and comfort, and commercial or institutional buyers, who focus on durability, compliance, and bulk pricing.

Future growth within segmentation is expected to be driven by innovation in materials, particularly in the textile segment where advanced polymers and smart fabrics are being integrated to offer temperature regulation and greater abrasion resistance without added bulk. Furthermore, the rising awareness of peripheral safety (e.g., dedicated back protectors and armored vests, categorized under protective clothing) is driving faster growth in accessory segments compared to the more saturated helmet category. This nuanced segmentation analysis provides stakeholders with the necessary granularity to optimize their supply chain, marketing strategies, and R&D pipelines for maximum market capture and compliance with evolving global safety standards.

- By Product Type:

- Helmets (Full-Face, Modular, Open-Face, Off-Road)

- Protective Clothing (Jackets, Pants, Suits, Vests)

- Gloves

- Boots

- Armored Pads and Accessories

- By Material:

- Leather

- Textile (Synthetic Fibers, Kevlar, Cordura)

- Composite Materials (Fiberglass, Carbon Fiber, Polycarbonate)

- By Distribution Channel:

- Online (E-commerce Stores, Company Websites)

- Offline (Specialty Stores, Authorized Dealers, Supermarkets)

- By End User:

- Individual Riders

- Commercial Users (Fleet Operators, Delivery Services)

- Government/Institutional (Police, Military)

Value Chain Analysis For Motorcycle Safety Gear Market

The value chain for the Motorcycle Safety Gear Market begins with the Upstream activities, focused heavily on raw material procurement and advanced material science research. This involves securing high-grade components such as specialized resins, composites (carbon fiber, aramid fibers), high-impact plastics (polycarbonate), premium leathers, and high-performance technical textiles (e.g., Kevlar, Cordura). Manufacturers must forge strong, often long-term, relationships with specialized suppliers who can guarantee material quality, compliance with toxicological standards, and timely delivery, as material properties are paramount to the final product's safety certification and performance. Research and development in this stage are concentrated on reducing weight while maintaining or increasing impact resistance and improving ergonomic design, often involving complex simulation and testing protocols.

The Midstream phase involves manufacturing, assembly, and rigorous testing. This stage includes sophisticated processes like injection molding for thermoplastic shells, complex layering for composite helmets, precision sewing for protective apparel, and the integration of electronic components in smart gear. Quality control is exceptionally critical here, as regulatory compliance (DOT, ECE, Snell, etc.) necessitates stringent adherence to manufacturing tolerances and consistent material deployment. Leading companies often maintain in-house testing facilities or partner closely with external certification bodies to ensure every product line meets or exceeds mandated safety performance thresholds. Efficiency in manufacturing and optimizing labor costs are key competitive factors, driving many large-scale production facilities toward regions offering lower operational expenses, particularly in Asia.

The Downstream activities involve distribution and final sales, utilizing both Direct and Indirect channels. Direct sales occur through company-owned flagship stores and manufacturer e-commerce sites, allowing for greater control over branding, pricing, and customer relationship management. Indirect distribution, the dominant method, relies on authorized specialty dealers, multi-brand sporting goods retailers, and third-party e-commerce giants (like Amazon or regional equivalents). Specialty stores play a vital role, especially for helmets and protective clothing, as they provide necessary expert fitting services and product advice, which is crucial for safety-critical gear. Logistics and inventory management must be highly responsive to seasonal demand fluctuations and regional regulatory changes, ensuring the certified gear reaches the end consumer efficiently and with accurate safety information.

Motorcycle Safety Gear Market Potential Customers

The potential customer base for the Motorcycle Safety Gear Market is highly segmented, ranging from daily commuters and recreational enthusiasts to professional racers and institutional buyers. Individual riders constitute the largest segment; this group is highly sensitive to product aesthetics, brand reputation, comfort for extended use, and balancing cost with safety features. Within this segment, young riders often prioritize style and connectivity (integrated communication systems), while experienced riders and touring enthusiasts seek premium features like advanced ventilation, waterproof membranes, and high-tech composite materials for maximum protection during long journeys in varied weather conditions.

Another significant customer group comprises institutional and commercial buyers, including police forces, military units, and fleet operators (such as food delivery services and courier companies). These end-users prioritize durability, compliance with specific operational requirements (e.g., high visibility, robust communication integration), and bulk purchase value. Their purchasing decisions are primarily driven by regulatory compliance and return on investment calculated through product longevity and safety track records, often leading them to prefer established brands with proven reliability and ease of maintenance. These buyers represent a stable demand stream for specialized, often bespoke, protective gear tailored to unique professional hazards.

The rapidly expanding segment of adventure touring and off-road riders represents a high-growth opportunity. These customers require specialized, highly durable gear capable of handling extreme conditions—heavy impacts, mud, water, and intense heat. They are willing to pay a premium for specialized features like reinforced armor, modular components, and superior ventilation systems. Furthermore, the growing adoption of electric motorcycles is creating a niche market for customers demanding lightweight, aerodynamically optimized, and tech-forward gear that aligns with the sustainable and modern image of electric mobility, influencing material choices and design aesthetics in premium product lines.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 14.85 Billion |

| Market Forecast in 2033 | USD 23.49 Billion |

| Growth Rate | 6.75% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Schuberth GmbH, Dainese S.p.A., Alpinestars S.p.A., Kido Industrial Co., Ltd., Fox Racing, Inc., Acerbis S.p.A., Leatt Corporation, Sena Technologies, Inc., Shark Helmets, Shoei Co., Ltd., HJC Helmets, Arai Helmet, Ltd., AGV S.p.A., Bell Sports, Inc., REV'IT! Sport International B.V., KLIM Technical Riding Gear, Troy Lee Designs, Ruroc Ltd., Suomy S.p.A., Held GmbH. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Motorcycle Safety Gear Market Key Technology Landscape

The technological landscape of the Motorcycle Safety Gear Market is rapidly evolving, driven by the demand for enhanced protection, reduced weight, and improved connectivity. A central area of innovation is in impact management, where technologies such as Multi-directional Impact Protection System (MIPS) and proprietary energy-absorbing liners (e.g., EPS varying densities) are becoming standard, particularly in premium helmets, to address rotational forces during oblique impacts, moving beyond simple linear impact absorption. Furthermore, the use of advanced composite materials like carbon fiber and aramid fibers has allowed manufacturers to create significantly lighter yet stronger helmet shells, which reduces rider fatigue and maximizes passive safety performance, directly influencing consumer adoption rates in the high-end segment.

Another major technological trend involves the increasing integration of electronics, transforming passive gear into active safety devices. This includes the proliferation of "smart helmets" equipped with integrated Bluetooth communication systems, heads-up displays (HUDs) projecting vital information onto the visor, and GPS tracking capabilities. Crucially, active protective systems, notably integrated airbag vests and jackets, are gaining substantial traction. These systems, utilizing complex algorithms and accelerometers, deploy within milliseconds upon detecting an inevitable crash or loss of control, offering critical protection to the chest, back, and neck, thereby significantly mitigating severe torso injuries, which were previously inadequately addressed by traditional armor.

In the realm of protective apparel, innovation is centered on material science and textile engineering. The development of high-performance technical fabrics, such as those featuring high molecular weight polyethylene (HMPE) fibers, provides superior cut and abrasion resistance compared to traditional textiles, often achieving comparable protection to leather but with significantly reduced weight and improved breathability. Furthermore, phase change materials (PCMs) and advanced ventilation membranes are being embedded into jackets and pants to enhance thermal regulation, addressing the comfort constraint that often leads riders to compromise safety in hot weather. These textile advancements ensure year-round usability, expanding the appeal of high-end protective clothing across diverse global climates and maximizing compliance with safety recommendations.

Regional Highlights

Regional dynamics play a crucial role in shaping the Motorcycle Safety Gear Market, with distinct consumption patterns, regulatory environments, and market maturity levels across major geographic areas. The Asia Pacific (APAC) region stands out as the primary engine for market volume and growth. Countries like India, China, Indonesia, and Vietnam are characterized by extremely high two-wheeler penetration rates, primarily for daily commuting. While historically dominated by price-sensitive purchases, rising disposable incomes, and increasingly stringent government mandates regarding helmet certification and usage are rapidly pushing demand toward higher quality, compliant products. This region sees immense potential for growth in the protective apparel and certified helmet segments, driven by rapid urbanization and the emerging class of motorcycling enthusiasts.

Europe represents a mature market characterized by a strong culture of touring, high consumer awareness regarding safety standards, and strict adherence to certification requirements, particularly the ECE standards. Western European countries like Germany, Italy, and the UK are major consumers of premium and technologically advanced gear, including smart helmets, integrated airbag systems, and high-performance textile and leather suits. The demand here is driven not just by mandatory compliance but by performance and aesthetics, leading manufacturers to continually innovate in terms of design, fit, and integration of cutting-edge materials. Europe also serves as a crucial hub for motorsports, generating consistent demand for specialized racing equipment.

North America (NA), primarily led by the United States and Canada, is defined by a significant enthusiast base and a preference for high-end, branded products, especially in the leisure and recreational motorcycling segments (cruisers, touring, and off-road). While helmet laws vary by state in the US, the overall market demands products that offer both safety and comfort for long-distance riding. This region is a major early adopter of new technologies, such as advanced air-bag vests and communication-integrated gear. The substantial motocross and off-road community also drives strong demand for specialized, highly protective, yet lightweight gear designed to withstand extreme environments, making it a critical market for specialized protective equipment manufacturers.

- Asia Pacific (APAC): Dominates market volume; driven by high two-wheeler ownership, rising incomes, and mandatory helmet laws (India, China). Fastest growth region for mid-range and certified safety gear.

- Europe: Mature market characterized by strict ECE standards and high adoption of premium, technology-integrated gear (Airbag vests, MIPS helmets). Strong touring and motorsports culture dictates demand for high-performance apparel.

- North America: Focuses on high-end, brand-loyal consumption, particularly in the touring and off-road segments. Key adopter of smart helmet technology and specialized, climate-specific protective clothing.

- Latin America (LATAM): Growing market influenced by increasing urbanization and the necessity of two-wheelers for transport, leading to rising demand for affordable, compliant helmets and basic protective clothing.

- Middle East and Africa (MEA): Emerging market characterized by fragmented demand, with growth concentrated in high-income Gulf countries adopting premium gear, while African markets focus on essential, low-cost protection.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Motorcycle Safety Gear Market.- Schuberth GmbH

- Dainese S.p.A.

- Alpinestars S.p.A.

- Kido Industrial Co., Ltd. (HJC Helmets)

- Fox Racing, Inc.

- Acerbis S.p.A.

- Leatt Corporation

- Sena Technologies, Inc.

- Shark Helmets

- Shoei Co., Ltd.

- Arai Helmet, Ltd.

- AGV S.p.A.

- Bell Sports, Inc.

- REV'IT! Sport International B.V.

- KLIM Technical Riding Gear

- Troy Lee Designs

- Ruroc Ltd.

- Suomy S.p.A.

- Held GmbH

- Cardo Systems Ltd.

- Triumph Motorcycles Ltd. (via apparel division)

- 3M Company (via material supply for composites)

Frequently Asked Questions

Analyze common user questions about the Motorcycle Safety Gear market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Motorcycle Safety Gear Market?

The market growth is primarily driven by increasingly stringent government regulations globally mandating the use of certified protective gear (especially helmets) and rising consumer awareness regarding road safety, particularly in fast-growing Asian economies with high motorcycle adoption rates.

Which product segment holds the largest share in the Motorcycle Safety Gear Market?

The Helmets segment consistently holds the largest market share due to universal legal requirements for their use. However, the Protective Clothing segment (jackets, pants, airbag vests) is projected to exhibit the fastest Compound Annual Growth Rate (CAGR) due to technological advancements and improved material science.

How is technology influencing the future design of motorcycle safety gear?

Technology is shifting gear from passive to active protection. Key advancements include the integration of AI-driven collision warning systems in smart helmets, rapid deployment of sophisticated airbag vests, and the use of advanced composites (like carbon fiber) to significantly reduce weight while enhancing impact protection.

Which region is expected to demonstrate the highest growth rate during the forecast period?

The Asia Pacific (APAC) region is projected to register the highest growth rate. This is attributed to massive two-wheeler populations, economic development leading to higher disposable incomes, and governmental efforts to enforce road safety compliance across major nations like India and China.

What are the main challenges faced by manufacturers in this market?

Manufacturers primarily face challenges related to the high cost of compliance with global safety standards (like ECE 22.06), the constant threat of counterfeit products entering the supply chain, and the need to develop comfortable, highly ventilated gear that encourages usage in diverse and often challenging climate conditions globally.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager