Motorcycle Side Box Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433672 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Motorcycle Side Box Market Size

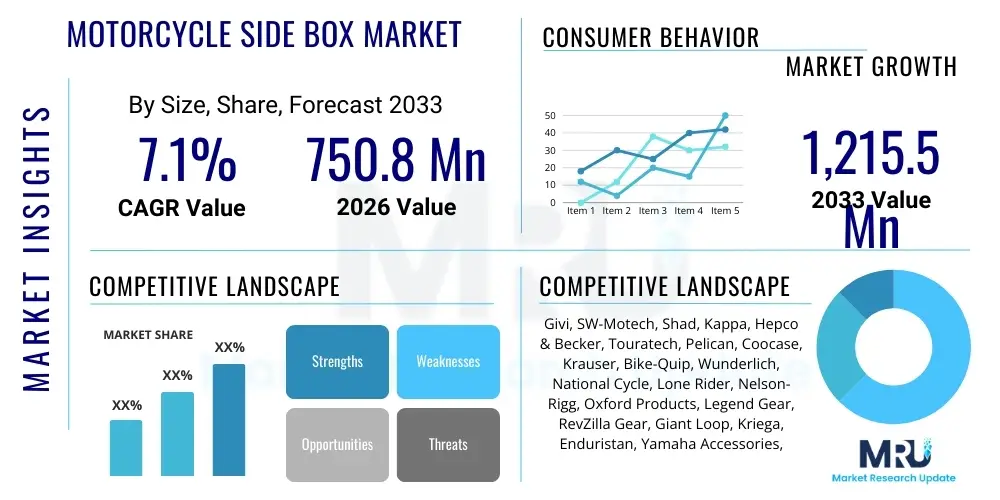

The Motorcycle Side Box Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.1% between 2026 and 2033. The market is estimated at USD 750.8 million in 2026 and is projected to reach USD 1,215.5 million by the end of the forecast period in 2033.

Motorcycle Side Box Market introduction

The Motorcycle Side Box Market encompasses the global landscape concerning the design, manufacturing, distribution, and sale of lateral luggage systems, commonly referred to as panniers or saddlebags, utilized for enhancing the storage capacity and utility of two-wheeled vehicles. These critical accessories are fundamental for riders engaging in extended touring, adventure motorcycling, and heavy commuting, providing secure, weather-resistant containment for personal belongings, safety gear, and supplies. The market segmentation is inherently complex, defined by material composition—ranging from premium, impact-resistant aluminum alloys favored by adventure riders to lightweight, cost-effective plastics such as polypropylene (PP) and high-density polyethylene (HDPE) preferred for urban applications—and further differentiated by sophisticated quick-release mounting systems which are proprietary to leading accessory brands. The consistent requirement for aerodynamic efficiency, robust security features, and absolute waterproofing drives continuous innovation and technological refinement within this highly specialized segment of the motorcycle accessories industry.

Major applications of motorcycle side boxes span across multiple riding disciplines. In the recreational sector, side boxes are indispensable for long-haul motorcycle tourism and camping trips, where maximizing carrying capacity without compromising motorcycle stability or safety is paramount. For this application, large-capacity, robustly sealed aluminum boxes with integrated tie-down points are the industry standard, ensuring gear remains protected from extreme weather and rough terrain. Conversely, in the commercial and daily commuting spheres, particularly prevalent in densely populated emerging economies, side boxes offer essential utility for transporting work materials, groceries, or delivery items securely. These applications favor medium-to-small capacity plastic boxes designed for quick access and narrow profiles to facilitate urban maneuverability. The inherent benefit provided by high-quality side boxes transcends mere storage; it significantly contributes to the overall safety profile of the ride by allowing riders to centrally and securely stow items that might otherwise shift unsafely in soft bags or backpacks, thereby maintaining optimal vehicle dynamics.

Market expansion is principally stimulated by several powerful secular trends. Firstly, the global surge in interest in adventure touring and off-road motorcycling, fueled by aspirational travel content and the proliferation of high-performance adventure bikes from OEMs, necessitates the purchase of heavy-duty luggage systems. Secondly, rising disposable incomes across Asia Pacific, coupled with the increasing adoption of motorcycles as primary transportation, boost demand for functional accessories that enhance daily utility. Furthermore, advancements in material science are enabling manufacturers to produce side boxes that are simultaneously lighter, more durable, and aesthetically superior, offering improved fuel efficiency and a more integrated look that appeals to modern consumers. Regulatory environments in certain jurisdictions, which increasingly emphasize secure storage for transporting commercial goods on two-wheelers, further solidify the foundational growth drivers supporting the market's trajectory towards substantial value accumulation over the forecast period, positioning side boxes as essential components of modern motorcycling infrastructure.

Motorcycle Side Box Market Executive Summary

The Motorcycle Side Box Market is undergoing significant evolution, characterized by pronounced shifts towards high-durability, premium product offerings, coupled with aggressive competitive maneuvering in the volume-driven aftermarket segment. Key business trends highlight a strong emphasis on standardized mounting interfaces and modular systems that offer compatibility across a wide range of motorcycle makes and models, reducing inventory complexity for retailers and enhancing user flexibility. Manufacturers are increasingly differentiating their products through advanced manufacturing techniques, such as roto-molding for plastic components to achieve seamless construction and advanced surface finishing processes like specialized anodization for aluminum boxes, which improves resistance to corrosion and UV degradation. The rising consumer demand for visually integrated luggage solutions that seamlessly match the aesthetics of the motorcycle model is also driving closer collaboration between leading accessory producers and Original Equipment Manufacturers (OEMs) during the design phase, targeting exclusivity and guaranteed fitment.

Geographically, market dynamics are sharply polarized, illustrating a clear dichotomy between volume and value markets. The Asia Pacific region commands the largest unit sales volume, predominantly focused on mid-to-low capacity plastic boxes catering to the vast population of daily commuters and small-scale commercial operators, where purchasing decisions are highly sensitive to unit price and local availability. In stark contrast, North America and Europe represent the core of the high-value market, where sales are concentrated in large-capacity, premium-priced aluminum panniers designed to withstand the rigors of transnational and off-road adventure touring. European markets, in particular, set the global benchmarks for quality and design, often demanding certification from bodies like TÜV, driving manufacturers to invest heavily in rigorous stress testing and long-term performance guarantees. This regional segmentation dictates global supply chain strategies, requiring manufacturers to maintain diversified production facilities capable of meeting both high-precision, low-volume European demands and high-volume, standardized APAC needs.

Segmentation analysis reveals the continued dominance of the Aftermarket distribution channel, which accounts for the vast majority of revenue, offering consumers extensive choice beyond initial motorcycle purchase constraints and providing avenues for specialized upgrades. Material trends confirm the growing revenue significance of Aluminum, propelled by the enduring popularity of the Adventure Bike segment, which requires unmatched structural integrity and security. Furthermore, analysis by capacity indicates that the medium (25L-45L) range is optimal for balancing load requirements with vehicle maneuverability, making it the most popular capacity choice across diverse geographical markets and rider demographics, excluding only the most dedicated long-haul expedition riders. Strategic focus for market players involves leveraging e-commerce platforms to directly engage the increasingly informed consumer base and utilizing targeted marketing that emphasizes proprietary security features and quick-mounting ease, thereby transforming a simple storage accessory into an integrated riding safety and convenience solution.

AI Impact Analysis on Motorcycle Side Box Market

User engagement and common search queries concerning the interface between Artificial Intelligence (AI) and the Motorcycle Side Box Market reveal a focused interest in how AI can transition these passive accessories into active, smart components of the motorcycle ecosystem. Key analytical themes revolve around the potential for AI-driven manufacturing optimization, specifically in achieving unparalleled structural efficiency and minimizing material costs without compromising safety standards. Consumers are increasingly curious about "smart panniers" that incorporate autonomous locking, integrated navigation feedback systems, or dynamic load sensors capable of communicating stability data back to the rider. The underlying concern for both manufacturers and end-users is ensuring that the integration of electronic components does not compromise the fundamental requirements of side boxes, which are ruggedness, weatherproofing, and reliability in extreme conditions, necessitating a sophisticated deployment of AI for passive design improvements rather than complex active operations.

In the short to medium term, AI's most profound impact resides within the manufacturing and supply chain segments. Generative Design (GD) platforms, utilizing sophisticated machine learning algorithms, are employed to simulate countless structural variations of aluminum and plastic side box shells. This allows engineers to identify the optimal geometry that provides maximum stiffness and energy absorption during impact, concurrently using the least amount of raw material, leading to significantly lighter components and reduced manufacturing waste. This data-driven optimization is crucial for premium aluminum models, where material reduction translates directly into weight savings—a paramount concern for riders—and higher profit margins for producers. Additionally, AI-powered predictive maintenance models are being integrated into manufacturing plant floor operations, monitoring robotic welding and injection molding machines to prevent failures, thereby ensuring consistent quality control and high-precision outputs necessary for seamless fitment with proprietary mounting hardware.

Future iterations of side box technology will leverage AI for integrated smart functionalities, moving beyond simple passive storage. Although currently nascent, the development pathway involves integrating ultra-low power sensor packages within the side box structure. These sensors, managed by embedded AI algorithms, could monitor internal temperature and humidity (crucial for sensitive electronics or food transport), detect unauthorized entry attempts with higher accuracy than traditional mechanical locks, and even analyze the gravitational center of the loaded box. Furthermore, in the realm of safety, AI could potentially optimize the placement and strength parameters of side box mounting racks to better manage crash forces, minimizing the risk of secondary injury to the rider by ensuring controlled deformation patterns. This computational optimization approach, driven by extensive AI simulation, represents a fundamental shift from traditional physical testing, making products safer, lighter, and more intelligently integrated into the overall vehicle safety architecture.

- AI-powered generative design software achieves optimal material distribution, creating lighter and structurally stronger side box shells.

- Machine learning algorithms enhance production efficiency and quality control by monitoring robotic precision during welding and molding processes.

- Predictive analytics in the supply chain optimize inventory management and demand forecasting based on dynamic regional motorcycle sales patterns.

- Future integration of AI-managed sensors for intelligent anti-theft systems and monitoring of internal environmental conditions (temperature, humidity).

- AI simulations accelerate R&D by enabling virtual crash testing and optimizing mounting rack design for improved energy absorption during impacts.

DRO & Impact Forces Of Motorcycle Side Box Market

The fundamental market dynamic for Motorcycle Side Boxes is characterized by powerful drivers rooted in lifestyle and utility, constrained by economic and design trade-offs, and shaped by significant long-term technological opportunities. The primary driver is the exponentially increasing global engagement in motorcycle adventure touring, necessitating robust, large-capacity, and reliable storage systems capable of enduring harsh environmental conditions and high-mileage abuse. This consumer demand is amplified by the continuous stream of new, highly capable Adventure Touring (ADV) models released by major OEMs, which inherently require sophisticated luggage solutions. Conversely, the market faces significant restraints, chiefly stemming from the high cost of raw materials—specifically aerospace-grade aluminum—required for the premium touring segment, which can render top-tier products unaffordable for mass-market consumers. Furthermore, the inherent design challenge of adding side boxes involves mitigating their negative impact on vehicle aerodynamics, handling stability, and overall vehicle width, particularly in congested traffic environments where regulations strictly govern physical dimensions.

A second crucial driving factor is the essential utility provided to the large commuter market, particularly prevalent across Asian and Latin American geographies. In these regions, side boxes transform motorcycles from mere transportation into critical workhorses for daily commerce and personal errands, creating a persistent, high-volume demand for cost-effective, weather-resistant plastic options. The rising middle class in these areas views durable storage accessories as a critical investment in their mobility infrastructure. Opportunities for growth are strongly concentrated in the emerging electric motorcycle segment; these vehicles offer a platform for radical redesigns of luggage systems, free from the constraints of hot exhaust routing, allowing for optimized weight distribution and innovative battery-integrated storage solutions. Moreover, the opportunity to develop truly modular luggage ecosystems—where hard side boxes, soft saddlebags, and top boxes seamlessly integrate and share common mounting points—presents a substantial commercial avenue for dominating the high-end accessory space by maximizing versatility and customer lifetime value.

The market is subjected to several critical impact forces. The bargaining power of buyers remains high, driven by the longevity and expected performance of premium side boxes; consumers demand extensive warranties and proven reliability before committing to high-priced purchases. The threat of substitutes, particularly high-quality textile and soft luggage options (like waterproof roll-top dry bags), is substantial, as these alternatives are significantly lighter, cheaper, and present a lower aerodynamic penalty, often appealing to weight-conscious or budget-sensitive riders. However, soft luggage lacks the security and rigidity of hard boxes. Competitive rivalry is fierce, concentrated among a handful of major international brands (Givi, SW-Motech, Shad) that compete aggressively on proprietary mounting technology, material innovation, and aesthetic integration with popular motorcycle models. The overall impact of these forces suggests a competitive landscape where sustained differentiation through intellectual property protection on mounting systems and superior material performance is crucial for long-term market leadership and pricing power.

Segmentation Analysis

The comprehensive segmentation of the Motorcycle Side Box Market provides an indispensable framework for understanding diverse consumer needs and strategic market positioning, analyzing product differentiation across material type, storage capacity, intended vehicle platform, and sales distribution channel. This granular approach clarifies that the market is not homogeneous, but rather a collection of specialized niches, each driven by distinct end-user priorities—whether it be the absolute structural integrity sought by trans-continental adventure riders or the aesthetic appeal and urban practicality demanded by cruiser motorcycle owners. The fundamental trade-offs among the segments, particularly cost versus durability and weight versus capacity, are the primary determinants influencing product design and retail pricing strategies globally. Analyzing these segments rigorously allows stakeholders to pinpoint high-potential areas, such as the increasing commercial viability of lightweight, high-capacity hybrid material boxes designed specifically for the rapidly expanding electric two-wheeler fleet.

Detailed analysis of the Material segment confirms that while the premium Aluminum category (often utilizing 5000 or 6000 series alloys) commands the highest average selling price and revenue per unit, the Plastic category, incorporating advanced polypropylene and ABS formulations, accounts for the highest volume of units sold due to its widespread adoption in the commuter and scooter markets. Aluminum’s enduring preference in touring is attributed to its weldable structure, repairability, and high inherent resistance to severe impacts, often featuring complex internal reinforcements and advanced anodization for maximum corrosion resistance. Conversely, the Capacity segment, delineated into Small (<25L), Medium (25L-45L), and Large (>45L), directly reflects usage patterns; the medium segment provides the most versatile solution for weekend trips and daily hauling, avoiding the excessive width concerns associated with large boxes while offering significantly more utility than small, city-focused panniers. Manufacturers continuously strive to maximize internal volume efficiency while adhering to strict external dimension limits set by ergonomic and aerodynamic constraints.

Furthermore, the segmentation by Vehicle Type dictates specific design requirements, with Adventure Bikes and Touring Motorcycles necessitating specialized asymmetrical designs to accommodate high exhaust pipes without sacrificing total capacity, and demanding mounting systems optimized for vibration damping and high load stress. In contrast, the market for Cruisers and Sport Bikes requires sleek, low-profile designs that minimize visual disruption, often favoring aesthetically integrated plastic or fiberglass construction. The Distribution Channel segmentation underscores a powerful market structure where the Aftermarket dominates by offering innovation, variety, and competitive pricing through global e-commerce and specialized retail networks, far surpassing the often standardized and limited options available directly from Original Equipment Manufacturers (OEMs). Effective penetration requires manufacturers to maintain excellent relationships across the independent dealer network while aggressively optimizing their online presence for global direct-to-consumer sales, leveraging high-quality digital assets and detailed fitment guides to assure compatibility.

- By Material:

- Aluminum (High-impact resistance, premium segment, often anodized or powder-coated)

- Plastic (Polypropylene, ABS, Roto-molded options; lightweight, volume-driven)

- Others (Fiberglass, Soft Luggage/Textile reinforced with rigid internal structures)

- By Capacity:

- Small (Less than 25 Liters; urban use, minimal load)

- Medium (25 Liters to 45 Liters; optimal balance for commuting and weekend touring)

- Large (Greater than 45 Liters; expedition/long-distance touring, maximum capacity)

- By Vehicle Type:

- Cruisers (Aesthetic integration, moderate capacity)

- Sport Bikes (Aerodynamic design, smaller profile)

- Touring Bikes (High-capacity, robust mounting)

- Adventure Bikes (ADV) (Maximum durability, asymmetrical design necessity)

- Scooters/Commuter Bikes (Utility focused, cost-effective plastic)

- By Distribution Channel:

- Original Equipment Manufacturers (OEM) (Bundled accessories, guaranteed fitment)

- Aftermarket (Specialized retail, e-commerce; dominant revenue channel)

Value Chain Analysis For Motorcycle Side Box Market

The Motorcycle Side Box value chain initiates with the sophisticated procurement of specialized raw materials, a phase critical for determining the final product's quality, weight, and market price. Upstream activities involve sourcing high-strength aluminum alloys (e.g., AlMg3 or 6061 T6) requiring meticulous quality assurance for welding integrity, high-grade polymers such as impact-modified polypropylene and ABS resins suitable for UV exposure and temperature extremes, and proprietary locking mechanism components (often involving zinc or stainless steel castings). Strategic supplier relationships are paramount for managing commodity price volatility and ensuring the steady flow of certified materials necessary for manufacturing complex, stress-resistant components. Effective supply chain management at this stage minimizes upstream risk and maximizes the competitiveness of the final manufactured good, directly influencing the product's lifespan and warranty guarantees offered to the end-user.

The midstream phase encompasses advanced manufacturing and assembly, transforming raw materials into finished, market-ready side boxes. This stage includes precision processes like robotic laser cutting and TIG welding for aluminum boxes to achieve structural uniformity, high-pressure injection molding for plastic panniers, and the subsequent application of specialized coatings such as anodization or powder-coating for corrosion protection and aesthetic finish. A significant portion of value is added through the design and integration of proprietary quick-release mounting hardware—the patented component that locks the box to the motorcycle’s frame. This hardware requires meticulous engineering to ensure zero-play attachment, vibration resistance, and seamless interface functionality. Manufacturing efficiency, adherence to ISO standards, and rigorous quality control testing (including impact and water ingress tests, often exceeding IP67 ratings) are non-negotiable determinants of product acceptance and brand reputation in the demanding touring segment.

Downstream activities focus on efficient distribution and market access, bifurcating into OEM sales and the dominant aftermarket channel. OEM distribution is direct, highly controlled, and focuses on motorcycle dealerships, leveraging the motorcycle brand’s warranty and financing options. Conversely, the aftermarket relies on an extensive, multi-layered indirect distribution network comprising global accessory wholesalers, specialized regional retailers, and large-scale global e-commerce platforms. This indirect channel is highly reliant on sophisticated digital marketing, optimized logistics for bulky item shipping, and detailed technical support to address fitment questions across thousands of motorcycle models. Success in the aftermarket hinges on retail margin management, rapid inventory replenishment, and highly visible online product presence, making digital asset management and SEO crucial for connecting product innovation with the geographically dispersed and technologically savvy global rider community.

Motorcycle Side Box Market Potential Customers

The core customer segment for the Motorcycle Side Box Market is the affluent and dedicated Adventure Touring (ADV) and long-distance Touring rider, representing the highest revenue generators due to their unequivocal need for premium, large-capacity, high-durability luggage solutions. These individuals, typically aged 35 to 65 with high disposable incomes, invest heavily in their motorcycle accessories, prioritizing features such as bomb-proof aluminum construction, advanced weather sealing, key-matched security systems, and compatibility with proprietary rack systems (like asymmetrical cutouts for high exhausts). Their purchasing rationale is driven by reliability in extreme conditions, necessitating boxes that can survive prolonged exposure to dust, water, and repeated off-road impacts. Brand loyalty within this segment is extremely high, favoring established names known for proven quality and extensive post-sale support, viewing the side box as a long-term investment integral to their expedition safety and logistics.

A second major customer demographic encompasses institutional and commercial end-users, including fleet operators, logistics companies specializing in last-mile delivery, and various government agencies (police, emergency services). These buyers require utilitarian, standardized, and extremely robust side boxes optimized for operational efficiency rather than recreational aesthetics. Procurement decisions are influenced by bulk pricing, standardization across fleet vehicles for simplified maintenance, and specific regulatory compliance for transporting commercial goods securely. This segment often prefers heavy-duty plastic or reinforced composite boxes that balance impact resistance with lower maintenance costs, frequently customized with internal dividers, specific lighting, or communications equipment, representing a stable, recurring demand stream for high-volume manufacturers capable of managing large B2B contracts.

Finally, the largest volume segment consists of daily commuters and scooter riders, predominantly in urban and peri-urban areas across APAC and Latin America. These customers are highly price-sensitive and primarily seek practical, secure storage for helmets, groceries, or small work items. They gravitate towards smaller, lighter, and more economical plastic side boxes that offer rapid attachment/detachment for daily convenience and minimize the overall width of the motorcycle for easier filtering through traffic. While unit revenue is lower, the sheer size of this market segment necessitates focused product development on low-cost manufacturing processes and wide retail availability. The purchasing decision here is guided by basic utility, value for money, and ease of installation, making the accessible aftermarket distribution channel the key point of purchase for this massive consumer base.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 750.8 Million |

| Market Forecast in 2033 | USD 1,215.5 Million |

| Growth Rate | 7.1% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Givi, SW-Motech, Shad, Kappa, Hepco & Becker, Touratech, Pelican, Coocase, Krauser, Bike-Quip, Wunderlich, National Cycle, Lone Rider, Nelson-Rigg, Oxford Products, Legend Gear, RevZilla Gear, Giant Loop, Kriega, Enduristan, Yamaha Accessories, BMW Motorrad Accessories, Honda Accessories |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Motorcycle Side Box Market Key Technology Landscape

The technological sophistication of the Motorcycle Side Box Market is primarily defined by continuous advancements in material science, focusing on achieving superior strength-to-weight ratios, alongside proprietary innovations in mounting and security systems crucial for consumer adoption and safety. For the premium segment, the use of specialized 5000 and 6000 series aluminum alloys is standard, often requiring sophisticated, high-precision robotic welding techniques to ensure seamless, structurally rigid, and absolutely watertight constructions capable of meeting extreme IP ratings (e.g., IP68 against dust and continuous submersion). Surface treatment technologies, particularly hard anodization processes and durable powder coatings, are essential for resisting corrosion from road salts and prolonged UV exposure, simultaneously contributing to the aesthetic appeal and longevity of the product, thereby justifying the premium price point and high consumer expectations for touring gear reliability.

A second major technological cornerstone is the development and patent protection of quick-release and secure mounting systems. Brands invest heavily in R&D to create proprietary rack systems (like Givi's Monokey or SW-Motech's EVO) that minimize installation complexity for the user while guaranteeing stable attachment at high speeds and under heavy loads. These systems integrate complex mechanical components designed for zero tolerance, preventing rattling or movement that could compromise handling. Modern technological advancements in this area include key-matched systems, where the ignition key, top box, and side boxes can all operate on a single key cylinder, significantly enhancing rider convenience. Furthermore, the integration of specialized vibration-dampening elastomers within the mounting plate ensures that high-frequency vibrations from the motorcycle engine and road are mitigated, protecting the contents of the box and extending the life of the mounting hardware itself, a critical feature for long-distance durability.

Looking ahead, the market is gradually embracing the integration of active electronics, moving towards a smart accessories ecosystem. Although still niche, technological innovation is focusing on lightweight, low-power technologies such as Bluetooth-enabled smart locks for keyless entry and remote status monitoring via a mobile application, allowing riders to confirm the locked status of their panniers remotely. Further research is dedicated to incorporating internal motion sensors that can trigger an alarm or send notifications if tampering is detected, offering enhanced security features beyond traditional mechanical locks. Manufacturing technology is also advancing rapidly, with increasing adoption of 3D printing and advanced computational fluid dynamics (CFD) software during the design phase to optimize box shape for minimal aerodynamic drag and maximize fuel efficiency, ensuring that future side box designs contribute positively to the overall performance envelope of the modern motorcycle.

Regional Highlights

The Asia Pacific (APAC) market represents the quantitative powerhouse of the global Motorcycle Side Box industry, driven by unparalleled unit sales volume resulting from the region's massive two-wheeler population and its integral role in daily transportation and regional commerce. Countries like India, China, Indonesia, and Vietnam exhibit staggering demand for functional, durable, and affordable storage, fueling the dominance of the plastic and mid-to-small capacity segments, primarily distributed through vast aftermarket networks. Economic growth and rising disposable incomes are transitioning a segment of these consumers from basic utility needs to seeking higher quality, medium-capacity solutions suitable for family travel and weekend excursions. This regional dynamic necessitates highly scalable, cost-efficient manufacturing and complex logistics management to serve geographically diverse and price-sensitive consumer bases effectively.

Europe stands as the undisputed center for premium quality and high-value transactions, where the market is saturated with experienced touring riders demanding the highest specification aluminum side boxes. This market is characterized by high brand consciousness, rigorous quality expectations—often exceeding global standards—and a strong preference for integrated designs that complement high-end European adventure motorcycles (like those produced by BMW, KTM, and Ducati). The region's extensive infrastructure for long-distance travel and the cultural importance of motorcycle touring sustain demand for large-capacity, robust, and highly secure luggage systems, with sales predominantly concentrated in Western European nations. Innovation is heavily influenced by competitive pressures among established European accessory manufacturers (like Givi, Hepco & Becker, and SW-Motech) vying for dominance in proprietary mounting technology and aesthetic superiority.

North America maintains a robust, high-value market focused heavily on the Adventure and large Cruiser segments, driven by consumers undertaking extended cross-country road trips, necessitating maximum capacity and reliability. The U.S. market, specifically, shows a high correlation between premium motorcycle sales and accessory attachment rates, leading to significant revenue generation in the OEM and high-end aftermarket channels. Latin America and the Middle East and Africa (MEA) are characterized by their emerging market status, exhibiting rapid growth potential. Latin America’s demand is primarily driven by urban necessity and security concerns, favoring utility-focused panniers, while the MEA region sees niche, high-end growth focused on specialized, durable equipment purchased by affluent riders for desert touring and adventure expeditions, demanding exceptional resistance to sand, dust, and high temperatures, further demonstrating the market’s responsiveness to specific climatic and operational demands.

- Asia Pacific (APAC): Highest volume market; driven by commuter utility; dominated by plastic/polypropylene materials and aftermarket distribution in India, China, and Southeast Asia.

- Europe: High-value revenue center; strong demand for premium, large-capacity aluminum boxes; technology and quality leadership due to extensive touring culture and high regulatory standards.

- North America: Stable, high-value demand focused on robust, large-capacity systems for touring and adventure riding across vast distances; significant OEM accessory penetration.

- Latin America (LATAM): Emerging market growth; demand driven by secure urban transport needs and utilitarian applications in populous cities.

- Middle East & Africa (MEA): Niche, high-growth luxury segment; demand for specialized, weather-resistant touring accessories catering to adventure riders in challenging arid environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Motorcycle Side Box Market.- Givi S.r.l.

- SW-Motech GmbH & Co. KG

- Shad (NAD, S.L.)

- Kappa (Givi Group)

- Hepco & Becker GmbH

- Touratech AG (Now part of Happich Group)

- Pelican Products Inc. (Known for rugged adapted cases)

- Coocase

- Krauser GmbH

- Bike-Quip

- Wunderlich GmbH

- National Cycle Inc.

- Lone Rider

- Nelson-Rigg USA, Inc.

- Oxford Products Ltd.

- Legend Gear (Brand under SW-Motech)

- RevZilla Gear

- Giant Loop

- Kriega

- Enduristan AG

Frequently Asked Questions

Analyze common user questions about the Motorcycle Side Box market and generate a concise list of summarized FAQs reflecting key topics and concerns.What criteria should be used when selecting side boxes for long-distance adventure touring?

For adventure touring, selection criteria must prioritize materials like robust aluminum for maximum impact resistance and reparability, a high IP rating (IP67 or higher) for absolute waterproofing, large capacity (>45L), and a proven, vibration-damped quick-release mounting system for reliable performance on rough terrain and at high speeds.

How do technological advancements in materials affect the performance and pricing of side boxes?

Technological advancements, such as the use of lightweight aluminum alloys and advanced polymer injection molding, allow manufacturers to reduce product weight while enhancing structural integrity and durability. These innovations, coupled with specialized surface treatments (anodization), generally increase manufacturing costs, driving premium pricing in the high-end touring segments.

Is the market growth trajectory stronger in the OEM or the independent Aftermarket distribution channel?

Market growth is significantly stronger in the independent Aftermarket distribution channel. This segment thrives on offering greater product diversity, specialized solutions (e.g., asymmetrical designs), continuous innovation in mounting technology, and competitive pricing, providing consumers with highly customizable options post-purchase, which is essential for serious riders.

What are the key differences between side boxes designed for Cruisers versus Adventure Bikes?

Side boxes for Adventure Bikes emphasize ruggedness, maximum capacity, and off-road survivability, often utilizing robust aluminum construction. Boxes for Cruisers prioritize sleek aesthetic integration, chrome accents, and lower profiles to match the vehicle's classic styling, often favoring composite materials or streamlined plastic designs with moderate capacity.

What regulatory factors currently restrain the widespread adoption of large-capacity side boxes in urban areas?

Regulatory restraints often center on limitations concerning the maximum allowable vehicle width, particularly in dense urban environments where excessive width compromises maneuverability and safety. These regulations compel manufacturers to innovate narrower, streamlined designs, particularly for commuter and scooter side boxes, balancing storage utility with legal compliance and urban practicality.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager