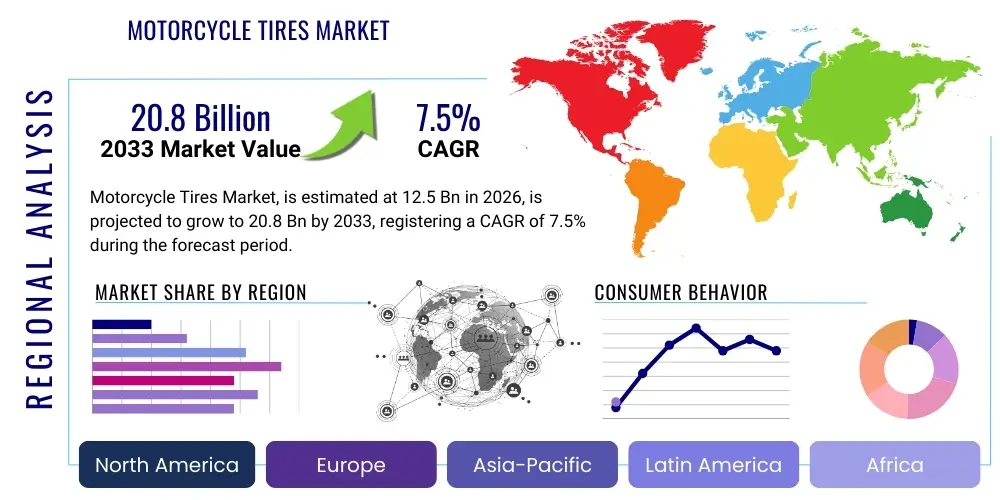

Motorcycle Tires Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440267 | Date : Jan, 2026 | Pages : 249 | Region : Global | Publisher : MRU

Motorcycle Tires Market Size

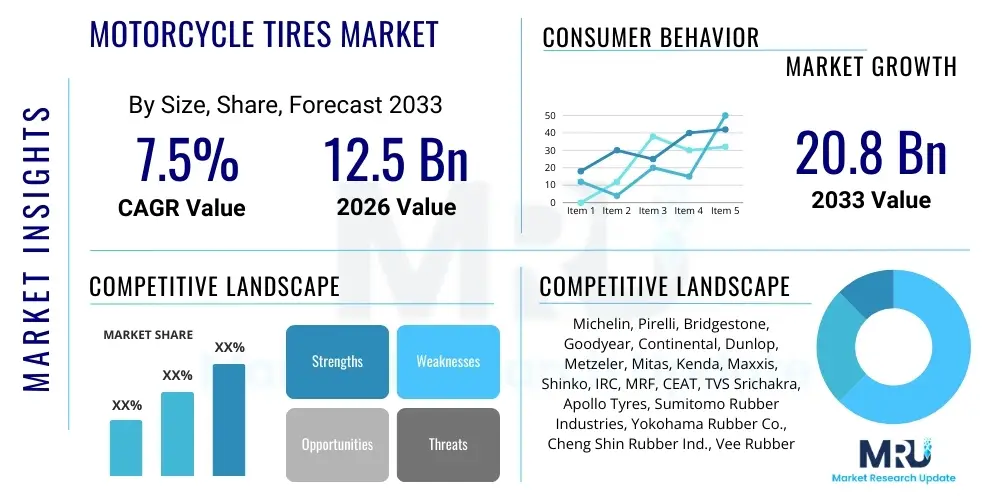

The Motorcycle Tires Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 12.5 Billion in 2026 and is projected to reach USD 20.8 Billion by the end of the forecast period in 2033.

Motorcycle Tires Market introduction

The global motorcycle tires market encompasses the manufacturing, distribution, and sale of tires specifically designed for various types of motorcycles. These products are critical components, directly influencing a motorcycle's safety, performance, and handling characteristics. The market is driven by the robust growth in motorcycle sales worldwide, particularly in emerging economies where two-wheelers serve as primary modes of transportation, alongside increasing demand for recreational and performance-oriented motorcycles in developed regions. Product offerings span a wide range, including tires optimized for on-road, off-road, racing, touring, and specific vehicle types such as cruisers and scooters, each engineered with distinct tread patterns, rubber compounds, and construction to meet diverse rider needs and operational conditions.

Major applications for motorcycle tires extend across daily commuting, long-distance touring, high-performance sport riding, competitive racing, and adventurous off-road exploration. The inherent benefits derived from advanced motorcycle tire technology are numerous, contributing significantly to rider safety through enhanced grip in varying weather conditions, improved braking performance, and superior cornering stability. Beyond safety, specialized tires offer benefits such as extended mileage, reduced rolling resistance for better fuel efficiency, and optimized comfort, making them indispensable for different riding experiences. The continuous evolution of motorcycle technology, including the rise of electric motorcycles, further drives innovation in tire design and materials, demanding tires that can handle new performance profiles and vehicle weights.

Driving factors propelling the motorcycle tires market include rising disposable incomes, particularly in Asia Pacific, which fuels increased purchasing power for motorcycles and their aftermarket components. A burgeoning interest in motorsports and adventure biking activities globally also contributes significantly to the demand for specialized, high-performance tires. Furthermore, technological advancements in tire manufacturing, such as the development of multi-compound technologies, silica-enhanced rubber, and advanced carcass constructions, are enabling manufacturers to offer tires with superior grip, durability, and handling, thereby attracting a larger consumer base. Urbanization and traffic congestion in many cities worldwide also make motorcycles an attractive mode of transport, consistently bolstering tire sales.

Motorcycle Tires Market Executive Summary

The motorcycle tires market is experiencing dynamic shifts, characterized by several key business, regional, and segment trends. Business trends highlight a strong emphasis on research and development, with manufacturers investing heavily in developing advanced rubber compounds and construction techniques to enhance tire performance, durability, and sustainability. Strategic partnerships between tire manufacturers and motorcycle OEMs are becoming more prevalent, aimed at developing bespoke tire solutions for new motorcycle models, including the rapidly expanding electric motorcycle segment. The growth of e-commerce platforms is also transforming distribution channels, making it easier for consumers to access a wider range of aftermarket tires and accessories, driving competitive pricing and expanding market reach globally. Sustainability initiatives, focusing on eco-friendly materials and manufacturing processes, are gaining traction as environmental regulations tighten and consumer awareness rises.

AI Impact Analysis on Motorcycle Tires Market

Common user questions regarding AI's impact on the Motorcycle Tires Market frequently revolve around how artificial intelligence will enhance safety, performance, and the manufacturing process. Users are keen to understand if AI can lead to "smarter" tires that offer real-time feedback, optimize wear patterns, or even adapt to different riding conditions. There's also significant interest in AI's role in accelerating the design and testing phases, reducing development costs, and personalizing tire characteristics to individual rider preferences or motorcycle types. Concerns often touch upon data privacy implications for smart tires, the accessibility of such advanced technologies to all market segments, and potential job displacement within traditional manufacturing roles. Users expect AI to usher in a new era of highly efficient, predictive, and intelligent tire solutions.

- AI-driven predictive analytics will optimize tire maintenance schedules, forecasting wear and tear based on riding style and conditions, thereby extending tire lifespan and enhancing safety.

- Generative design and simulation tools powered by AI will drastically reduce the time and cost associated with developing new tire prototypes, enabling rapid innovation in tread patterns, compound formulations, and structural integrity.

- AI will facilitate smart manufacturing processes by optimizing production lines, improving quality control through real-time defect detection, and ensuring consistency in tire characteristics, leading to higher product reliability.

- Supply chain management within the motorcycle tire industry will leverage AI for demand forecasting, inventory optimization, and logistics planning, making operations more efficient and resilient to market fluctuations.

- The integration of AI with embedded sensors in "smart tires" can provide riders with real-time data on tire pressure, temperature, and grip levels, offering unprecedented levels of insight for performance optimization and immediate safety alerts.

- AI algorithms will be instrumental in analyzing vast datasets from various riding conditions, helping engineers fine-tune tire designs for specific motorcycle models and riding applications, delivering highly specialized performance.

- Customization and personalization of tire compounds and characteristics for individual rider preferences or specific competitive scenarios could become more accessible through AI-powered manufacturing and design platforms.

DRO & Impact Forces Of Motorcycle Tires Market

The Motorcycle Tires Market is significantly shaped by a confluence of drivers, restraints, opportunities, and powerful market forces. Key drivers include the consistent global growth in motorcycle sales, fueled by urbanization, increasing disposable incomes, and the rising popularity of motorcycling as a recreational activity and mode of transport, especially in developing economies. The surging demand for high-performance and specialized tires across various segments like sport bikes, adventure tourers, and off-road vehicles further stimulates market growth. Technological advancements in tire manufacturing, such as the introduction of multi-compound technologies, silica-enhanced rubber, and advanced carcass constructions that offer superior grip, durability, and handling characteristics, are also crucial drivers attracting consumers and fostering innovation within the industry. Furthermore, stringent safety regulations and evolving consumer awareness regarding tire quality contribute to the demand for premium and technically advanced tires.

Despite these growth drivers, the market faces several restraints. Volatile raw material prices, particularly for natural rubber and petrochemical-derived synthetic rubbers, directly impact production costs and profit margins for manufacturers. Intense competition among a large number of global and regional players leads to pricing pressures, challenging smaller enterprises and potentially limiting investment in R&D for some companies. Stringent environmental regulations concerning tire manufacturing processes and disposal also pose challenges, requiring significant investments in compliance and sustainable practices. The aftermarket segment is particularly susceptible to counterfeit products, which can erode brand value and pose safety risks to consumers, hindering market integrity and consumer trust. Economic downturns or geopolitical instabilities can also dampen consumer spending on discretionary items like motorcycles and premium tires.

Opportunities within the motorcycle tires market are abundant, especially with the rapid emergence of electric motorcycles, which require specialized tires optimized for higher torque, heavier battery weights, and different wear patterns. The development of "smart tires" integrated with sensors for real-time data on pressure, temperature, and wear offers significant growth potential, enhancing rider safety and tire performance. Expanding into untapped or rapidly growing emerging markets provides significant avenues for market penetration and revenue generation. Furthermore, innovation in sustainable materials and manufacturing processes, such as using recycled content or bio-based polymers, presents opportunities for companies to differentiate themselves, meet evolving consumer preferences, and comply with future environmental standards. The growing trend of adventure tourism and off-road motorcycling also opens up a niche for highly durable and specialized adventure tires.

The market is also influenced by several impact forces. Competitive rivalry is high due to the presence of numerous established global brands and aggressive regional players, leading to continuous product innovation and marketing efforts. The bargaining power of buyers is moderate to high, as consumers have access to a wide range of products and price points, especially in the aftermarket. This forces manufacturers to offer competitive pricing and high-quality products. The bargaining power of suppliers is moderate, as key raw materials like rubber are subject to global commodity markets, but long-term contracts and diversified sourcing strategies help mitigate risks. The threat of new entrants is relatively low due to the high capital investment required for manufacturing, extensive R&D, and established brand loyalties. However, specialized niche players can emerge. The threat of substitutes is low, as there are no direct substitutes for motorcycle tires; however, advancements in tire repair technology or extreme durability advancements could slightly alter replacement cycles.

Segmentation Analysis

The motorcycle tires market is comprehensively segmented to cater to the diverse needs of riders, vehicle types, and distribution channels across the globe. Understanding these segments is crucial for market participants to tailor their strategies, optimize product offerings, and identify specific growth opportunities. The segmentation primarily considers tire construction, the application or riding style, the type of motorcycle vehicle, and the sales channel through which tires reach the end-user. Each segment represents a distinct customer base with unique requirements regarding performance, durability, safety features, and price points, influencing manufacturing and marketing efforts. For instance, racing tires prioritize maximum grip and performance over longevity, while touring tires focus on comfort, mileage, and stability over long distances and varying loads, highlighting the bespoke nature of product development within each category. This granular segmentation allows for a detailed analysis of market dynamics and consumer preferences.

- By Type

- Radial Tires: Known for superior grip, stability, and high-speed performance, favored by sport and touring motorcycles.

- Bias-Ply Tires: Characterized by durability, comfort, and load-carrying capacity, commonly used in cruisers, standard bikes, and scooters.

- By Application

- On-Road Tires: Designed for paved surfaces, including sport, touring, street, and cruiser tires, balancing grip, mileage, and comfort.

- Off-Road Tires: Engineered for dirt, mud, and uneven terrain, offering aggressive tread patterns for maximum traction and durability.

- Racing Tires: Optimized for track performance, providing exceptional grip and handling at high speeds, often with short lifespans.

- Scooter/Moped Tires: Specifically designed for urban commuting, prioritizing maneuverability, wet grip, and moderate mileage.

- By Vehicle Type

- Standard/Naked Motorcycles: Versatile tires balancing everyday performance with comfort.

- Sport/Supersport Motorcycles: High-performance tires for aggressive riding and track use, emphasizing grip and cornering stability.

- Cruiser Motorcycles: Designed for stability, comfort, and mileage, often with aesthetic considerations to match the motorcycle style.

- Touring Motorcycles: Engineered for long-distance comfort, load-carrying capacity, and durability across varied weather conditions.

- Off-Road/Dirt Bikes: Robust tires with deep treads for superior traction on unpaved surfaces.

- Scooters/Mopeds: Small-diameter tires focused on urban agility, wet performance, and value.

- Electric Motorcycles: Emerging segment requiring tires optimized for immediate torque delivery, heavier battery weight, and regenerative braking.

- By Distribution Channel

- OEM (Original Equipment Manufacturer): Tires supplied directly to motorcycle manufacturers for installation on new vehicles.

- Aftermarket: Tires sold to consumers through dealerships, independent tire retailers, online platforms, and service centers for replacement.

Value Chain Analysis For Motorcycle Tires Market

A comprehensive value chain analysis for the Motorcycle Tires Market commences with the upstream activities involving the sourcing and procurement of raw materials. This critical phase includes acquiring natural rubber, synthetic rubbers (such as styrene-butadiene rubber and butyl rubber), carbon black, silica, steel wire, textile fabrics (like nylon and rayon), and various chemicals and additives crucial for tire compound formulation. The global nature of raw material markets necessitates robust supply chain management, often involving long-term contracts with suppliers to ensure consistent quality and mitigate price volatility. Manufacturers may also engage in research and development with raw material suppliers to innovate new compounds that enhance tire performance or sustainability, highlighting the interdependence within this initial stage.

Following raw material procurement, the value chain moves into the core manufacturing processes. This stage involves sophisticated machinery and highly specialized techniques for mixing rubber compounds, calendering rubber sheets, building the tire carcass, applying tread and sidewall components, and ultimately curing the tire through vulcanization. Quality control is paramount at every step to ensure the tires meet stringent performance, safety, and durability standards. Post-manufacturing, tires undergo rigorous testing, including laboratory simulations and real-world road tests, before being packaged. Manufacturers often employ advanced automation and robotics to enhance efficiency and precision, investing significantly in production technology to optimize output and reduce defects, thereby adding substantial value through transformation of raw materials into finished products.

The downstream activities involve the distribution channel, which is bifurcated into OEM (Original Equipment Manufacturer) and aftermarket sales. In the OEM channel, tires are supplied directly to motorcycle manufacturers for assembly onto new bikes, often requiring close collaboration in design and testing. The aftermarket channel is more diverse, encompassing sales through authorized dealerships, independent tire retailers, specialized motorcycle shops, and a growing segment of online e-commerce platforms. Direct and indirect distribution plays a significant role; direct sales might involve manufacturers selling through their own branded stores or online portals, while indirect sales rely on a network of wholesalers, distributors, and retailers. Effective logistics, inventory management, and marketing strategies are essential in the downstream segment to ensure timely delivery, broad market reach, and strong brand presence, ultimately connecting the product with the end-user and completing the value chain.

Motorcycle Tires Market Potential Customers

The potential customer base for the motorcycle tires market is highly diverse, encompassing a broad spectrum of end-users and buyers each with distinct needs and purchasing behaviors. At the core, individual riders represent the largest segment of end-users. This group includes daily commuters who prioritize durability, mileage, and wet-weather performance; sport bike enthusiasts and racers seeking maximum grip, precise handling, and high-speed stability; touring riders who demand comfort, longevity, and load-carrying capacity for long journeys; and off-road adventurers requiring aggressive tread patterns and puncture resistance for challenging terrains. Each sub-segment of individual riders often exhibits strong brand loyalty based on personal experience, peer recommendations, and specialized tire characteristics tailored to their specific riding style and motorcycle type. Understanding these varied demands is crucial for manufacturers to develop and market appropriate tire solutions effectively.

Beyond individual riders, motorcycle manufacturers (OEMs) constitute a significant segment of potential customers. These companies purchase tires in bulk for factory installation on their new motorcycle models. OEM relationships are strategic, often involving collaborative design and testing to ensure optimal tire performance integrated with the motorcycle's overall dynamics and safety features. Establishing strong OEM partnerships provides tire manufacturers with consistent sales volumes, brand exposure on new vehicles, and the opportunity to showcase their technological capabilities. Dealers and independent workshops also form a vital part of the customer ecosystem, purchasing tires from distributors to stock for replacement services and direct sales to their clientele. These entities value a wide product range, competitive pricing, reliable supply, and technical support from tire manufacturers.

Furthermore, specialized segments such as motorcycle fleet operators, custom bike builders, and racing teams represent niche but important potential customers. Fleet operators, including police forces, delivery services, and rental companies, require durable and reliable tires that can withstand heavy use and contribute to operational efficiency. Custom builders often seek unique sizes, vintage styles, or specific performance attributes to complement their bespoke creations. Racing teams, whether professional or amateur, demand cutting-edge racing compounds and constructions that deliver peak performance under extreme conditions, often forming close technical partnerships with tire brands. These varied customer groups underscore the necessity for a flexible product portfolio, diverse distribution strategies, and targeted marketing efforts within the dynamic motorcycle tires market to maximize market penetration and customer satisfaction.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 12.5 Billion |

| Market Forecast in 2033 | USD 20.8 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Michelin, Pirelli, Bridgestone, Goodyear, Continental, Dunlop, Metzeler, Mitas, Kenda, Maxxis, Shinko, IRC, MRF, CEAT, TVS Srichakra, Apollo Tyres, Sumitomo Rubber Industries, Yokohama Rubber Co., Cheng Shin Rubber Ind., Vee Rubber |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Motorcycle Tires Market Key Technology Landscape

The motorcycle tires market is characterized by a rapidly evolving technological landscape, where continuous innovation is paramount for enhancing performance, safety, and durability. A cornerstone of this advancement lies in the development of advanced rubber compounds. Manufacturers are increasingly utilizing sophisticated blends of synthetic and natural rubbers, incorporating additives like high-dispersion silica and specialized carbon black. These innovations allow for multi-compound tire constructions, where different rubber formulations are used across the tire's tread, such as harder compounds in the center for mileage and softer compounds on the shoulders for improved grip at lean angles. This technological approach optimizes tires for various aspects like wet grip, dry grip, mileage, and heat management, pushing the boundaries of what a single tire can achieve across diverse riding conditions and performance requirements, thereby directly addressing complex rider demands for versatile performance.

Beyond material science, tire construction methods represent another critical area of technological advancement. The shift from traditional bias-ply to radial construction has significantly impacted performance, with radial tires offering superior high-speed stability, better handling, and a larger contact patch under load. Further refinements include the integration of aramid belts and other high-tensile strength fibers within the tire carcass, which enhance structural integrity, reduce weight, and improve resistance to deformation at high speeds. Advanced tread pattern design, often developed through computational fluid dynamics (CFD) simulations, plays a vital role in optimizing water dispersion for wet weather performance, maximizing dry grip, and minimizing tire noise. These designs are meticulously engineered to balance aesthetics with crucial functional attributes, ensuring both visual appeal and paramount safety and performance characteristics for riders across all segments, from daily commuters to professional racers, continually elevating the overall riding experience.

The integration of smart technologies is emerging as a significant trend in the motorcycle tires market. Tire Pressure Monitoring Systems (TPMS) are becoming more common, either as standard equipment or aftermarket accessories, providing riders with real-time pressure data to prevent unsafe riding conditions and optimize tire longevity. Looking ahead, the development of fully "smart tires" with embedded sensors capable of monitoring not just pressure and temperature, but also wear levels, grip characteristics, and even road conditions, is on the horizon. These innovations leverage Internet of Things (IoT) connectivity and artificial intelligence to provide predictive maintenance alerts and potentially even adaptive performance adjustments. Furthermore, sustainable manufacturing processes and the development of eco-friendly materials, such as bio-based rubbers and recycled content, are gaining traction, driven by environmental regulations and consumer demand for greener products, demonstrating a commitment to both performance and ecological responsibility within the industry's technological evolution.

Regional Highlights

The global motorcycle tires market exhibits distinct regional dynamics, influenced by varying levels of motorcycle ownership, economic development, riding cultures, and regulatory frameworks. Each major region contributes uniquely to the market's overall growth and trends, presenting different opportunities and challenges for manufacturers and distributors. Asia Pacific, for instance, stands out as the largest and fastest-growing market, driven by its massive population, high density of two-wheelers for daily commuting, and burgeoning middle class with increasing disposable incomes. This region not only serves as a significant consumption hub but also as a major manufacturing base for motorcycle tires. In contrast, regions like North America and Europe, while having lower overall motorcycle sales volumes compared to APAC, are key markets for premium, high-performance, and specialized tires, reflecting a stronger emphasis on recreational riding, sport, and touring segments. Understanding these regional nuances is critical for developing targeted market strategies and optimizing resource allocation on a global scale.

- Asia Pacific (APAC): Dominates the market due to high motorcycle penetration for commuting, especially in countries like India, China, and Southeast Asian nations (Indonesia, Vietnam, Thailand). This region also houses major manufacturing hubs and is experiencing rapid growth in discretionary spending, fueling demand for both economy and mid-range tires. The rise of adventure tourism and motorsport in countries like Australia and Japan further contributes to the demand for specialized tires.

- Europe: A mature market characterized by strong demand for premium and performance-oriented tires, driven by a robust culture of sport riding, touring, and classic motorcycle ownership. Countries such as Germany, Italy, France, and the UK are key markets, with a focus on innovation, safety standards, and environmental regulations influencing product development. The growth of electric motorcycles is also a notable trend here.

- North America: Known for its significant cruiser, touring, and adventure motorcycle segments, driving demand for durable, high-mileage, and off-road capable tires. The market also has a strong emphasis on performance tires for sport bikes and track use. The US and Canada are key contributors, with evolving consumer preferences leaning towards technologically advanced and specialized tire solutions.

- Latin America: An emerging market with growing motorcycle sales, particularly for commuter and utility bikes. Countries like Brazil, Mexico, and Argentina offer substantial growth potential. The market is price-sensitive but is gradually transitioning towards better quality and performance tires as economic conditions improve and awareness increases.

- Middle East & Africa (MEA): A developing market with increasing infrastructure development and disposable incomes driving motorcycle sales. Demand is primarily for standard and commuter motorcycle tires, with an emerging interest in leisure and adventure biking in select regions. Geopolitical factors and economic stability can significantly influence market growth in this diverse region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Motorcycle Tires Market.- Michelin (France)

- Pirelli (Italy)

- Bridgestone (Japan)

- Goodyear Tire & Rubber Company (USA)

- Continental AG (Germany)

- Dunlop Motorcycle Tires (USA/Japan, under Goodyear/Sumitomo)

- Metzeler (Germany, under Pirelli)

- Mitas Tires (Czech Republic, under Trelleborg Group)

- Kenda Rubber Industrial Co. Ltd. (Taiwan)

- Maxxis International (Taiwan, under Cheng Shin Rubber Ind. Co. Ltd.)

- Shinko Tire (South Korea)

- IRC Tire (Inoue Rubber Co. Ltd.) (Japan)

- MRF Tyres (India)

- CEAT Ltd. (India)

- TVS Srichakra Ltd. (India)

- Apollo Tyres Ltd. (India)

- Sumitomo Rubber Industries, Ltd. (Japan)

- The Yokohama Rubber Co., Ltd. (Japan)

- Cheng Shin Rubber Ind. Co. Ltd. (Taiwan)

- Vee Rubber Group (Thailand)

Frequently Asked Questions

Analyze common user questions about the Motorcycle Tires market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth trajectory for the global Motorcycle Tires Market?

The global Motorcycle Tires Market is projected to experience robust growth, with a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. This growth is anticipated to elevate the market's valuation from USD 12.5 Billion in 2026 to an estimated USD 20.8 Billion by the end of 2033, driven by increasing motorcycle adoption and technological advancements.

Which key factors are primarily driving the demand and expansion of the motorcycle tire industry?

Demand for motorcycle tires is primarily driven by the consistent global increase in motorcycle sales, especially in emerging economies, alongside a rising interest in recreational and high-performance riding. Key contributing factors include technological advancements in tire compounds and construction, increasing disposable incomes, and the growing popularity of adventure tourism and motorsports, all of which necessitate specialized and high-quality tire solutions.

How is technological innovation influencing the development and future of motorcycle tires?

Technological innovation is profoundly shaping the motorcycle tire market through advancements in rubber compounds (e.g., multi-compound and silica-enhanced formulations), refined radial construction methods, and sophisticated tread pattern designs for optimal performance. Emerging trends include the integration of "smart tire" technologies with embedded sensors for real-time data, and the use of AI in design and manufacturing processes, leading to more durable, safer, and performance-optimized tires.

What are the main segmentation categories within the Motorcycle Tires Market, and why are they important?

The Motorcycle Tires Market is segmented by Type (Radial, Bias-Ply), Application (On-Road, Off-Road, Racing, Scooter/Moped), Vehicle Type (Standard, Sport, Cruiser, Touring, Off-Road/Dirt, Scooter, Electric), and Distribution Channel (OEM, Aftermarket). These segmentations are crucial as they allow manufacturers to tailor products and marketing strategies to specific rider needs, motorcycle types, and purchasing preferences, optimizing market reach and product relevance across diverse consumer bases.

Which geographical regions are currently leading the Motorcycle Tires Market, and what are their defining characteristics?

The Asia Pacific region currently leads the Motorcycle Tires Market due to its vast motorcycle ownership for daily commuting and rising disposable incomes, alongside robust manufacturing capabilities. Europe and North America are significant markets for premium, high-performance, and specialized tires, driven by strong recreational and sport riding cultures and a focus on technological innovation and stringent safety standards. Latin America and MEA are emerging markets with growing potential.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager