Motorcycle Top Box Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435908 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Motorcycle Top Box Market Size

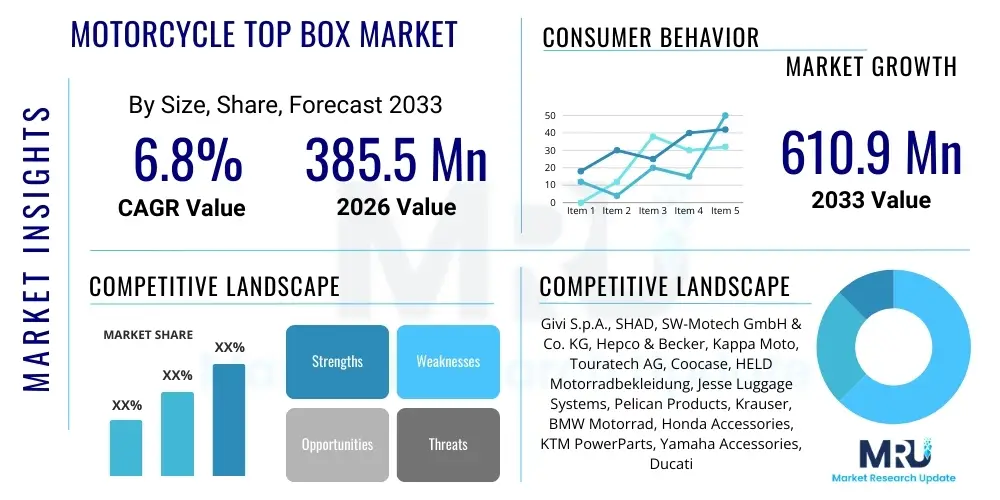

The Motorcycle Top Box Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $385.5 Million in 2026 and is projected to reach $610.9 Million by the end of the forecast period in 2033. This growth trajectory is significantly influenced by the escalating global demand for motorcycle touring and adventure riding, coupled with the increasing adoption of motorcycles and scooters for daily commuting in densely populated urban environments. The integration of advanced locking mechanisms and lightweight, durable materials further enhances the market's value proposition, driving sustained consumer interest across various end-user segments.

Motorcycle Top Box Market introduction

The Motorcycle Top Box Market encompasses the manufacturing and distribution of secure, hard-shell storage containers designed to be mounted primarily on the rear rack of motorcycles and scooters. These accessories, often referred to as tail cases or top cases, provide essential, lockable storage capacity for helmets, luggage, and personal items, significantly enhancing the utility and practicality of two-wheeled vehicles. Top boxes are crucial components, particularly for long-distance touring, adventure motorcycling, and urban delivery services, offering superior weather resistance and security compared to soft luggage solutions. They are typically constructed from robust materials such as high-grade plastic polymers (ABS, Polypropylene) or durable metals (Aluminum).

The product functionality is centered on providing convenience and safety. Modern top boxes feature quick-release mounting systems, integrated backrests for pillion comfort, and sophisticated waterproofing seals. Major applications include daily commuting where carrying essential documents or shopping is required, long-haul touring where substantial luggage capacity is mandatory, and last-mile delivery fleets where secure transportation of goods is paramount. The increasing trend of motorcycle customization and the rising population of motorcycle enthusiasts globally serve as foundational driving factors for continuous market expansion. Furthermore, stringent regulations in some regions requiring secure storage for certain items while riding also contribute to the adoption rate of these products.

Key benefits derived from utilizing top boxes include enhanced rider convenience, improved safety through better weight distribution (when properly loaded), and significant deterrence against theft due to robust locking systems. Market growth is primarily driven by the rising disposable incomes in emerging economies, leading to increased purchasing power for premium motorcycle accessories, and the technological evolution of materials that offer lighter yet stronger storage solutions. Moreover, the integration of smart features, such as remote locking capabilities and integrated lighting, represents a forward-looking trend shaping consumer expectations and driving new product development strategies among leading manufacturers.

Motorcycle Top Box Market Executive Summary

The Motorcycle Top Box Market exhibits robust growth, propelled by strong business trends focusing on material innovation, particularly the shift toward high-strength aluminum cases for the adventure segment and lightweight, aerodynamically optimized polymer cases for urban commuting. Key manufacturers are focusing on modular designs that allow riders to easily swap between different storage capacities and styles, catering to diversified user needs. Regional trends indicate that Asia Pacific (APAC) dominates in terms of volume due to the massive two-wheeler population, driven primarily by commuter demand, while Europe and North America lead in value due to the high penetration of premium touring and adventure motorcycle brands, favoring high-end aluminum top boxes with advanced features and rugged construction. The aftermarket segment remains the primary revenue driver, although Original Equipment Manufacturers (OEMs) are increasingly bundling top boxes with higher-end models, standardizing fittings, and ensuring seamless integration with motorcycle aesthetics and electronic systems.

Segment trends highlight the dominance of the Polypropylene/ABS Plastic material segment owing to its cost-effectiveness and suitability for mass-market scooters and commuter bikes. However, the Aluminum segment is experiencing the fastest growth rate, fueled by the booming adventure touring subculture and the perceived durability and rugged appeal associated with metal construction. In terms of capacity, the 30-45 Liter range represents the sweet spot, balancing sufficient storage for two full-face helmets or medium-sized luggage with maintaining motorcycle maneuverability and stability. E-commerce platforms are revolutionizing the sales channels, providing riders with easy access to a vast array of aftermarket options, technical specifications, and user reviews, thereby accelerating global market penetration and facilitating cross-border sales, especially for specialized and niche manufacturers.

Overall, the market is characterized by moderate fragmentation, with several global leaders setting benchmarks for quality and design, while numerous regional players focus on competitive pricing and localized product adaptations. Sustained investment in research and development aimed at improving mounting system reliability, reducing overall weight without compromising structural integrity, and enhancing aesthetics will be critical success factors. The market trajectory is intrinsically linked to global motorcycle sales and the continuous expansion of motorcycle leisure activities, ensuring a stable and expanding demand base through the forecast period. The convergence of safety standards and customization demands further solidifies the essential role of top boxes in the modern motorcycling ecosystem.

AI Impact Analysis on Motorcycle Top Box Market

Common user questions regarding the influence of Artificial Intelligence (AI) on the Motorcycle Top Box Market typically revolve around integrating smart locking mechanisms, predictive maintenance of mounting hardware, and optimizing supply chain logistics. Users are concerned about whether AI could lead to self-adjusting top boxes that alter aerodynamics based on speed or whether smart sensors could be incorporated to detect intrusions or unauthorized access, thereby enhancing security. The primary expectation is that AI will move beyond simple manufacturing automation and permeate the product itself, offering features like integration with onboard motorcycle navigation systems for optimized weight distribution warnings or utilizing machine learning algorithms to predict failure points in quick-release mechanisms based on usage patterns and environmental stress factors. These advanced capabilities, while nascent, define the direction for future premium accessory development, aiming to transform a static storage unit into an active, intelligent part of the motorcycle ecosystem.

- AI-driven Predictive Maintenance: Utilizing sensor data within the mounting plate to predict wear and tear on locking pins or brackets, providing riders with advance replacement alerts.

- Smart Inventory and Logistics: AI algorithms optimizing inventory levels for different top box models based on real-time sales data and regional motorcycle registration trends, significantly reducing warehousing costs.

- Enhanced Security Systems: Integrating AI-powered facial recognition or behavioral biometrics into the locking mechanism, replacing traditional key systems with highly secure, personalized access control.

- Generative Design Optimization: Employing AI tools to design lightweight, structurally sound top boxes that minimize aerodynamic drag while maximizing internal volume, leading to more efficient manufacturing processes.

- Automated Quality Control: AI vision systems inspecting finished products for minute defects in sealing, paint finish, or structural integrity during the production line, ensuring zero-defect output.

- Rider Assistance Integration: Linking top box status (locked, attached, load distribution) with the motorcycle’s onboard display using AI to provide contextual safety warnings and notifications.

DRO & Impact Forces Of Motorcycle Top Box Market

The Motorcycle Top Box Market is influenced by a dynamic interplay of Drivers, Restraints, and Opportunities (DRO), which collectively define the impact forces shaping its long-term trajectory. Key drivers include the exponential increase in recreational and adventure motorcycling activities globally, particularly the growth in long-distance touring where substantial, secure luggage is indispensable. Furthermore, the rising reliance on two-wheelers for urban mobility and last-mile delivery services in heavily congested cities directly fuels demand for functional storage solutions. These drivers are fundamentally linked to demographic shifts and consumer spending habits, emphasizing convenience and utility in daily life. However, these driving factors are moderated by significant restraints, primarily centered around concerns regarding motorcycle stability and handling when accessories are improperly installed or overloaded, potentially leading to safety risks. High manufacturing costs associated with premium materials like carbon fiber and high-grade aluminum also restrain mass-market adoption in price-sensitive regions.

Opportunities in the market primarily reside in the development of lightweight, integrated, and highly aesthetic top boxes that blend seamlessly with motorcycle design, moving away from bulky, utilitarian aesthetics. There is a substantial opportunity for manufacturers to collaborate more closely with OEMs during the motorcycle design phase to standardize mounting points and electrical integration, enhancing the overall user experience. Moreover, the burgeoning e-commerce segment provides an opportunity for direct-to-consumer sales, allowing niche players to reach a global audience without extensive physical distribution networks. The core impact forces include technological advancements in polymer science, leading to lighter and more impact-resistant plastics, and the regulatory environment regarding motorcycle safety standards and accessory installation guidelines. These forces dictate product innovation cycles and market entry barriers, rewarding companies that prioritize durability, security, and adherence to established safety benchmarks.

The continuous innovation in quick-release systems, enhancing both security and ease of use, represents another critical market driver. Consumers demand accessories that can be mounted and removed swiftly and securely, adapting the motorcycle for different uses (commuting versus weekend riding). Conversely, market restraints are often amplified by counterfeit products that fail to meet safety and quality standards, potentially eroding consumer trust in the overall product category. The competitive force is high, requiring significant differentiation through proprietary design patents and superior material performance. Ultimately, the successful navigation of these forces hinges on balancing cost-effectiveness for the mass commuter segment with premium engineering and ruggedness demanded by the rapidly expanding adventure tourism sector, ensuring market resilience against economic fluctuations and changing consumer preferences.

Segmentation Analysis

The Motorcycle Top Box Market is comprehensively segmented based on material composition, storage capacity, sales channel, and application, providing a granular view of market dynamics and consumer preferences across different usage scenarios. This segmentation is crucial for stakeholders to tailor product development and marketing strategies effectively. The differentiation based on material, ranging from high-volume, cost-effective plastics to premium, robust aluminum, directly correlates with end-user applications, dictating price points and target demographics. The structural design and capacity segmentation reflects the primary need of the rider, whether it is minimal storage for daily commuting or extensive capacity required for multi-week international touring expeditions.

Capacity segmentation is particularly insightful, distinguishing between small cases necessary for a single helmet or minimal documents, medium cases suitable for standard touring luggage, and large boxes specifically designed for heavy-duty adventure use or carrying two large helmets simultaneously. The division by sales channel highlights the enduring influence of the aftermarket segment, which offers greater flexibility and choice, contrasting with the standardized, quality-assured integration provided by OEM channels. Finally, application segmentation underscores the shift from purely utilitarian usage (commuting) to leisure-driven activities (touring and recreation), each demanding distinct features such as integrated backrests, aesthetic finishes, or extreme weather sealing.

- By Material:

- ABS Plastic

- Polypropylene (PP)

- Aluminum

- Fiberglass

- Carbon Fiber Composites

- By Capacity:

- Less than 30 Liters

- 30 to 45 Liters

- More than 45 Liters

- By Sales Channel:

- OEM (Original Equipment Manufacturer)

- Aftermarket (Retail Stores, E-commerce Platforms, Specialty Distributors)

- By Application:

- Commuting and Daily Use

- Touring and Adventure Riding

- Recreation and Sport Use

- Commercial Fleet Use (Delivery Services)

Value Chain Analysis For Motorcycle Top Box Market

The value chain for the Motorcycle Top Box Market commences with upstream activities focusing on raw material procurement, primarily high-density polymers (PP, ABS) and specialized metals (aircraft-grade aluminum sheets). Key upstream suppliers include chemical manufacturers and metal processing units specializing in lightweight alloys and advanced composites. Efficiency in this stage is dependent on securing favorable pricing for materials and ensuring consistent quality, particularly for materials used in injection molding processes which form the backbone of mass-produced top boxes. Innovation in material science, focusing on increased rigidity and reduced weight, holds significant leverage at this initial stage, influencing the final product's performance and cost structure. Successful manufacturers establish strong, long-term relationships with material suppliers to ensure supply chain stability and compliance with global safety standards related to material toxicity and durability under extreme weather conditions.

Midstream activities involve core manufacturing, including design, tooling, injection molding, welding (for aluminum boxes), assembly, and quality control. This stage adds the most value, transforming raw materials into sophisticated, functional storage systems. Manufacturers invest heavily in automated production lines, precision machining for mounting systems, and rigorous testing protocols (e.g., vibration testing, water resistance testing, lock mechanism endurance). Downstream analysis focuses on distribution and sales. The distribution channel is bifurcated: direct supply to OEMs for factory installation or authorized accessory sales, and supply to the robust aftermarket through specialized motorcycle accessory distributors, large retail chains, and, increasingly, dedicated global e-commerce platforms. E-commerce platforms act as a powerful indirect channel, providing wider market reach and lower overheads compared to traditional retail, particularly beneficial for smaller, innovative accessory makers seeking rapid global scaling.

The effective management of the distribution logistics, ensuring timely delivery and minimal damage during transit, is crucial given the product's size. Direct channels involve manufacturers selling high volumes directly to major motorcycle brands (OEMs), typically under exclusive agreements, ensuring perfect product fitment and brand synergy. Indirect channels, which dominate the aftermarket, rely on regional distributors who manage inventory and provide localized customer support and installation services. The shift toward digital retailing demands strong content marketing, clear installation guides, and visual demonstrations to overcome the lack of physical product inspection, driving optimization efforts in digital presentation and customer relationship management throughout the entire value delivery process.

Motorcycle Top Box Market Potential Customers

The primary end-users and buyers of Motorcycle Top Box products are highly diversified, ranging from individual commuters seeking practical storage solutions to professional delivery fleets requiring rugged, high-capacity containers. The largest segment comprises individual motorcycle owners who use their bikes for recreational purposes, specifically adventure touring and long-distance travel. These customers prioritize durability, weather sealing, large capacity (typically >45 Liters), and seamless integration with high-end adventure or touring motorcycles. They represent the premium end of the market, often favoring aluminum or high-grade composite boxes from established, reputable brands, viewing the top box as a critical, long-term investment that contributes significantly to their riding experience and safety on prolonged journeys.

The second major customer segment consists of urban commuters who rely on motorcycles and scooters for daily transportation in densely populated areas. This group focuses on affordability, ease of use (quick-release systems), and sufficient capacity for one or two full-face helmets or light shopping bags (typically 30-45 Liters). Polypropylene or ABS plastic models are highly preferred by this segment due to their lower cost, lighter weight, and ample protection against routine urban wear and tear. Market penetration in this segment is strongly correlated with scooter sales in Asian and Latin American countries, where two-wheelers are the predominant mode of personal transport, highlighting the importance of value engineering and high-volume production efficiency.

A rapidly expanding customer base includes commercial delivery services and professional courier fleets. With the rise of e-commerce and fast food delivery platforms, businesses require highly reliable, theft-resistant, and sometimes temperature-controlled storage solutions mounted on their fleet of two-wheelers. These commercial customers demand exceptional robustness, industrial-grade locks, and high visibility features, often purchasing through OEM channels or specialized fleet distributors who offer bulk pricing and maintenance agreements. Furthermore, police, emergency medical services, and other governmental agencies utilizing motorcycles for patrol or rapid response also form a niche, high-value customer group demanding customized, highly secure, and integrated top box systems designed for specialized equipment transport and rugged operational requirements.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $385.5 Million |

| Market Forecast in 2033 | $610.9 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Givi S.p.A., SHAD, SW-Motech GmbH & Co. KG, Hepco & Becker, Kappa Moto, Touratech AG, Coocase, HELD Motorradbekleidung, Jesse Luggage Systems, Pelican Products, Krauser, BMW Motorrad, Honda Accessories, KTM PowerParts, Yamaha Accessories, Ducati Performance, K-Max Moto, Eklipes, T-Rex Racing, Metal Mule. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Motorcycle Top Box Market Key Technology Landscape

The technological landscape of the Motorcycle Top Box Market is characterized by continuous refinements in material science, mounting systems, and electronic integration aimed at optimizing security, aerodynamics, and user convenience. A primary focus is the evolution of polymers used in plastic cases, with manufacturers adopting advanced engineering plastics that offer superior impact absorption and scratch resistance while minimizing weight, addressing the critical safety constraint associated with added mass high up on the motorcycle chassis. Furthermore, proprietary injection molding techniques are being employed to create seamless, monolithic case bodies, vastly improving water resistance and overall structural integrity compared to older, multi-piece construction methods. In the premium metal segment, hydroforming and precision welding technologies are utilized to produce robust, yet lightweight aluminum boxes with enhanced aesthetic appeal and streamlined profiles, essential for high-performance adventure bikes.

Innovation in mounting and locking mechanisms represents another crucial technological area. Modern top boxes predominantly utilize quick-release mounting systems that allow attachment or detachment in seconds, using a single key operation. Keyless locking mechanisms, often featuring electromagnetic locks that integrate with the motorcycle’s existing central locking or proximity key systems, are becoming standard features in the high-end segment, significantly boosting anti-theft capabilities and convenience. Additionally, vibration damping technologies are integrated into the mounting racks and base plates to mitigate the effects of continuous road input, which prolongs the lifespan of both the box contents and the box structure itself, crucial for heavy-duty touring and off-road applications.

The integration of smart technology is defining the future of the top box market. This includes embedded LED brake and running lights that enhance visibility and safety, wirelessly connecting to the motorcycle's electrical system, often utilizing low-power Bluetooth or proprietary transmission protocols. Further advanced models are experimenting with internal sensor systems that monitor temperature, humidity, and location tracking (GPS integration), especially relevant for commercial applications transporting sensitive goods. These technological advancements not only justify higher price points but also fundamentally shift the product perception from a simple container to a highly engineered component that actively contributes to the motorcycle's safety and utility profile, demanding expertise in both mechanical and electronic engineering.

Regional Highlights

- Asia Pacific (APAC): APAC dominates the global market in terms of volume consumption, driven by countries like China, India, and Southeast Asian nations where motorcycles and scooters are the primary modes of transportation for a massive population. Demand is predominantly concentrated in the cost-effective Polypropylene and ABS plastic segments, catering primarily to the commuting and commercial fleet application sectors. Rapid urbanization and the expansion of the gig economy utilizing two-wheelers for delivery services further solidify APAC's leading position, demanding robust, high-volume manufacturing capabilities and competitive pricing strategies.

- Europe: Europe is the largest market in terms of value, characterized by a strong consumer preference for premium, high-quality products, particularly in Germany, Italy, and the UK. The market here is heavily influenced by the robust touring and adventure motorcycling culture, leading to high adoption rates of large-capacity aluminum and high-end composite top boxes. Strict safety regulations and a high concentration of established premium motorcycle manufacturers drive demand for integrated OEM and specialized aftermarket accessories that offer superior engineering and compliance.

- North America: The North American market, led by the United States, demonstrates significant demand in both the touring (Harley-Davidson, BMW, Honda Goldwing) and adventure segments. Consumers prioritize large capacity and extreme durability, often choosing aluminum cases or rugged plastic variants designed to withstand varied climate conditions and extended highway travel. The aftermarket channel is highly developed, offering customization options and focusing heavily on quick installation features and brand-specific aesthetic compatibility.

- Latin America: The market in Latin America is growing steadily, mirroring APAC trends but with smaller volumes. Key drivers include increasing motorcycle ownership for daily use in densely populated cities (e.g., Brazil, Mexico). The price sensitivity is high, favoring standard ABS plastic cases. Opportunities lie in expanding organized retail and improving quality standards to differentiate against lower-cost, unbranded imports, particularly in the mid-range commuter segment.

- Middle East and Africa (MEA): MEA represents a nascent but rapidly developing market, fueled by infrastructure investment and growing interest in recreational motorcycling in the wealthier Gulf Cooperation Council (GCC) countries. High temperatures and abrasive environments drive demand for highly durable, UV-resistant materials and robust locking systems. Commercial adoption, though currently limited, is expected to expand with infrastructure development and the increasing reliance on localized logistics solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Motorcycle Top Box Market.- Givi S.p.A.

- SHAD

- SW-Motech GmbH & Co. KG

- Hepco & Becker

- Kappa Moto

- Touratech AG

- Coocase

- HELD Motorradbekleidung

- Jesse Luggage Systems

- Pelican Products

- Krauser

- BMW Motorrad

- Honda Accessories

- KTM PowerParts

- Yamaha Accessories

- Ducati Performance

- K-Max Moto

- Eklipes

- T-Rex Racing

- Metal Mule

Frequently Asked Questions

Analyze common user questions about the Motorcycle Top Box market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected Compound Annual Growth Rate (CAGR) for the Motorcycle Top Box Market?

The Motorcycle Top Box Market is anticipated to exhibit a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033, driven primarily by the rising global popularity of adventure touring and the expanded use of two-wheelers for urban commuting and delivery services globally.

Which material segment dominates the Motorcycle Top Box market?

The Polypropylene and ABS Plastic material segment currently dominates the market by volume due to its cost-effectiveness, lightweight properties, and suitability for the high-volume commuter and scooter market, particularly in the Asia Pacific region. However, Aluminum is the fastest growing segment by value.

How does the integration of smart technology impact the safety features of top boxes?

Smart technology, including electromagnetic keyless locking systems, integrated LED lighting, and GPS tracking, significantly enhances safety by providing superior anti-theft security, improving the motorcycle's visibility in low light, and allowing riders to monitor load distribution and box status via onboard systems.

Which regional market offers the highest value opportunity for premium Motorcycle Top Boxes?

Europe offers the highest value opportunity, particularly for premium top boxes, due to a strong culture of long-distance touring and the high penetration of large-displacement adventure motorcycles. European consumers prioritize durable aluminum construction, sophisticated design, and seamless integration with high-end OEM brands.

What are the primary factors restraining the growth of the Motorcycle Top Box Market?

The primary restraints include rider concerns regarding the potential negative impact on motorcycle handling and stability when a top box is overloaded or improperly mounted. Additionally, the high initial cost associated with premium, rugged materials like specialized aluminum and carbon fiber acts as a barrier to entry for budget-conscious consumers.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager