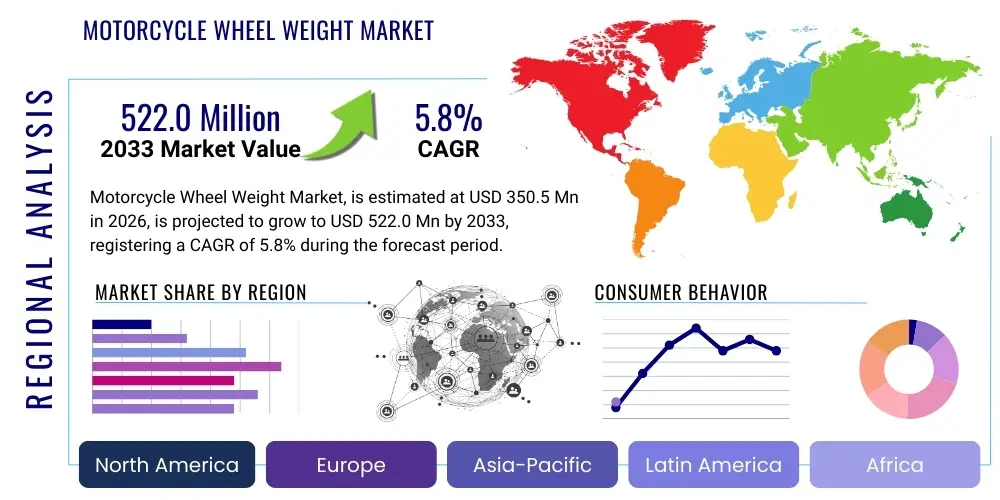

Motorcycle Wheel Weight Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439117 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Motorcycle Wheel Weight Market Size

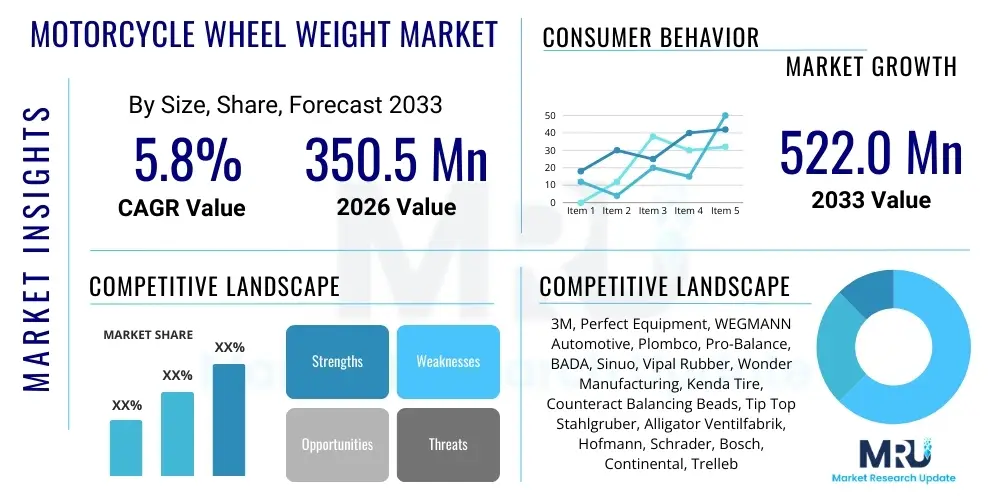

The Motorcycle Wheel Weight Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 350.5 Million in 2026 and is projected to reach USD 522.0 Million by the end of the forecast period in 2033.

This projected expansion is fundamentally driven by the robust growth in global motorcycle production and sales, particularly across emerging economies in the Asia Pacific region. Furthermore, increasing regulatory emphasis on vehicle safety and stability necessitates the use of high-quality wheel weights to ensure proper tire balance, which is critical for high-speed performance and longevity of both tires and suspension components. The transition from traditional lead weights to environmentally friendly alternatives like steel and zinc also contributes to market dynamism, requiring manufacturers to invest in new production technologies and offering premium-priced, compliant products.

Motorcycle Wheel Weight Market introduction

The Motorcycle Wheel Weight Market encompasses the manufacturing, distribution, and sale of small, calibrated weights used to counteract minor imbalances in motorcycle wheel-tire assemblies. These imbalances, whether resulting from tire manufacturing tolerances or uneven distribution of mass in the wheel itself, can cause vibrations, premature wear, and instability at speed. Proper balancing using these weights is essential for enhancing ride comfort, improving handling precision, and extending the operational life of the motorcycle components, thereby serving as a foundational element of vehicular maintenance and safety standards globally.

The primary products within this market are categorized based on their material composition, such as lead, zinc, and steel, and their application method, predominantly clip-on or adhesive (stick-on) weights. Major applications span the Original Equipment Manufacturer (OEM) segment, where weights are factory-installed on new motorcycles, and the robust Aftermarket segment, driven by routine tire replacement and maintenance procedures. Key driving factors include increasing global motorcycle ownership, stringent safety regulations mandating dynamic wheel balancing, and the continuous technological evolution in tire and rim design requiring precise counterbalancing solutions.

The core benefit of these products lies in mitigating radial and lateral run-out issues, ensuring a smooth and safe riding experience. As environmental concerns escalate, the market is rapidly moving toward non-lead weights, fueled by legislative mandates in regions like Europe and North America. This shift presents both a challenge for material substitution and an opportunity for innovation in adhesive technologies and specialized non-toxic alloys that maintain optimal density and durability for the demanding conditions of motorcycle operation.

Motorcycle Wheel Weight Market Executive Summary

The Motorcycle Wheel Weight Market is characterized by a strong shift toward sustainable materials and advanced mounting technologies, positioning it for steady growth through 2033. Business trends indicate consolidation among major global suppliers who are investing heavily in automated manufacturing processes to improve precision and reduce costs, particularly in the production of zinc and steel weights. The Aftermarket segment remains the dominant revenue driver, fueled by high volumes of tire changes and repair services globally, whereas the OEM segment focuses on integrating advanced, corrosion-resistant, and aesthetically discreet adhesive weights into high-performance motorcycle models. Regulatory pressure concerning lead usage is forcing a complete overhaul of product portfolios, leading to higher average selling prices (ASPs) for compliant, modern balancing solutions.

Regionally, the Asia Pacific (APAC) stands as the primary engine of volume growth, driven by massive production bases in countries like China and India, coupled with high consumption due to large motorcycle populations. North America and Europe, while slower in volume, lead in value adoption, characterized by a preference for premium, high-quality, non-lead adhesive weights that meet strict environmental directives (e.g., REACH). These developed markets are also pioneering the adoption of dynamic balancing solutions and specialized weights for high-performance and touring motorcycles, where subtle imbalances are more keenly felt and potentially dangerous.

Segment trends reveal that adhesive weights are rapidly gaining market share over traditional clip-on variants, especially in OEM applications and wheels with complex or alloy rim designs where clip-on attachments might cause damage or fail to seat correctly. Material-wise, steel and zinc are dominating new product launches, effectively replacing lead which faces imminent phase-outs globally. The increasing popularity of specialized vehicle types, such as electric motorcycles and adventure touring bikes, also necessitates tailored weight designs to handle unique performance envelopes and environmental exposure.

AI Impact Analysis on Motorcycle Wheel Weight Market

User queries regarding AI in the Motorcycle Wheel Weight Market typically center on how artificial intelligence can optimize the balancing process, improve weight placement precision, and enhance supply chain efficiency. Key themes include the implementation of AI-driven vision systems in manufacturing for quality control, the role of machine learning algorithms in predicting optimal balancing requirements based on tire and rim data (Digital Twin concept), and how smart inventory management systems can reduce waste in distribution. Concerns often revolve around the initial capital investment required for integrating such advanced systems into existing balancing equipment used in service shops and the need for skilled technicians capable of maintaining this sophisticated machinery. Users anticipate AI will lead to 'perfect balance' solutions, minimizing reliance on trial-and-error manual placement.

The primary impact of AI is observed in two major domains: manufacturing precision and service optimization. In manufacturing, AI-powered systems can analyze high-resolution images of wheel weights during production, detecting microscopic defects or variances in mass distribution far exceeding human capability. This ensures that the weights themselves are flawlessly calibrated before distribution. Secondly, in the aftermarket and OEM service bays, diagnostic balancing machines are starting to incorporate machine learning algorithms. These systems can analyze thousands of historical balancing procedures, considering factors like ambient temperature, tire pressure, and specific rim geometry, to recommend the exact weight, material, and precise location instantly, drastically reducing the time spent on balancing and improving accuracy beyond conventional methods.

Furthermore, AI-enabled predictive maintenance strategies are being explored. Motorcycle fleet operators, particularly in delivery or law enforcement sectors, can utilize telematics data combined with AI models to predict when wheel balancing is likely to drift out of tolerance due to road conditions or wear patterns, scheduling preventive maintenance rather than reactive repairs. This integration of sensor data and AI analytics transforms wheel balancing from a simple repair activity into a sophisticated, data-driven preventative measure, enhancing safety and operational uptime across commercial and high-performance applications globally.

- AI-driven vision systems enhance quality control in weight manufacturing, ensuring precise mass calibration.

- Machine learning algorithms optimize balancing machine outputs, reducing balancing time and increasing accuracy in service bays.

- Predictive analytics, utilizing telematics, forecast optimal maintenance schedules for dynamic wheel balance correction.

- AI improves supply chain logistics by predicting demand for specific weight types (e.g., steel vs. zinc) across different regional markets.

- Robotics integrated with AI facilitates highly accurate, automated placement of adhesive weights during the OEM assembly line process.

DRO & Impact Forces Of Motorcycle Wheel Weight Market

The dynamics of the Motorcycle Wheel Weight Market are significantly influenced by a complex interplay of regulatory drivers, material substitution challenges, and continuous expansion of the global motorcycle fleet. The main driver is the mandatory requirement for dynamic wheel balancing to meet vehicle safety standards worldwide, directly correlating market demand with vehicle usage and maintenance cycles. Restraints primarily involve the regulatory bans on lead weights, forcing manufacturers into higher-cost materials like steel and zinc, which can sometimes pose challenges in achieving the same density and ease of shaping as lead. Opportunities are abundant in the development of innovative, sustainable adhesive technologies that offer superior durability and compliance, alongside expansion into fast-growing electric motorcycle segments that require specialized balancing solutions due to their higher torque and unique weight distribution profiles. These forces collectively shape the market landscape, pushing for innovation in material science and application methodology while guaranteeing a baseline demand driven by safety regulations.

Drivers: Growing sales of motorcycles globally, especially in high-volume markets like Asia and Latin America, inherently drive demand for both OEM installation and aftermarket maintenance. Furthermore, consumer awareness regarding the critical role of wheel balance in vehicle handling, tire longevity, and fuel efficiency compels regular inspection and balancing services. The proliferation of tubeless tires and alloy wheels, particularly in premium and sports segments, favors the adoption of adhesive weights, supporting market value growth. Stringent road safety regulations, frequently updated by regional transportation authorities, continually reinforce the necessity of accurate and effective wheel balancing practices.

Restraints: The most significant restraint is the global legislative shift banning or restricting the use of lead in automotive and motorcycle components due to environmental toxicity. This necessitates the use of alternatives (zinc, steel) that are often less dense, requiring larger weight dimensions, which can affect aerodynamics and aesthetics, or are more expensive to produce. Additionally, the proliferation of counterfeit or low-quality wheel weights, primarily distributed in price-sensitive markets, poses a threat to established manufacturers, undermining quality standards and potentially compromising vehicle safety. High volatility in raw material costs, particularly for zinc and steel, also introduces complexity in long-term pricing strategies and profitability margins.

Opportunity: The market benefits from substantial opportunities in the realm of material innovation and application technology. Developing highly dense, non-toxic alternatives (e.g., composite materials or specialized tungsten alloys) that overcome the density limitations of zinc and steel presents a significant competitive advantage. The rise of the electric vehicle (EV) segment, including electric motorcycles and scooters, provides a niche market for specialized weights that account for unique battery placement and higher instantaneous torque. Moreover, advancing the performance and durability of adhesive weights, making them more resistant to harsh weather and high-speed forces, ensures continued growth in the high-value aftermarket segment, complemented by the expansion of professional maintenance networks globally.

Impact Forces: The market is under constant pressure from technological shifts and regulatory mandates. Technological change, particularly the move towards advanced digital balancing equipment in service centers, influences the demand for highly precise and standardized weights. Regulatory impact, such as the EU's ELV Directive (though primarily focused on vehicles, related restrictions influence component materials) and region-specific mandates on lead, directly dictates material choice and manufacturing complexity. Supplier power is moderate, as production requires specialized stamping and coating equipment, but buyer power is high in the large-volume aftermarket where price sensitivity prevails, forcing manufacturers to optimize their cost structures while maintaining regulatory compliance.

Segmentation Analysis

The Motorcycle Wheel Weight Market is systematically segmented based on material composition, application method, end-user type, and geographic regions to provide comprehensive market visibility. Understanding these segments is crucial as different segments face unique regulatory pressures and demand characteristics. For instance, the segmentation by material reflects the ongoing transition from lead to eco-friendly options, directly impacting cost structures and supply chain requirements globally. Similarly, the method of attachment—clip-on versus adhesive—delineates product choice based on rim aesthetics, speed requirements, and ease of installation, significantly differentiating the OEM and Aftermarket segments.

The segmentation based on Application (OEM vs. Aftermarket) is foundational, illustrating the volume-driven maintenance cycle versus the value-driven initial installation phase. OEM demand is stable and focuses on quality assurance and integration efficiency, while the Aftermarket segment is cyclical, responding to tire wear rates and consumer service intervals. Further segmentation by Vehicle Type, including road motorcycles, off-road variants, and scooters/mopeds, highlights the diverse requirements for weight resilience and specific balancing precision needed for different riding conditions, from high-speed touring to rugged trail use.

Geographic segmentation is vital, as market growth rates and material preferences vary dramatically; APAC dominates in volume for basic weights, while North America and Europe lead the adoption of premium, non-lead, adhesive products. This multi-dimensional segmentation allows market players to tailor production, pricing strategies, and distribution channels to target specific, high-growth, and high-value niches within the global balancing solutions ecosystem, ensuring optimized market penetration and regulatory adherence across diverse operational environments.

- By Type: Clip-On Weights, Adhesive Weights, Spoke Weights

- By Material: Lead, Zinc, Steel, Others (Tungsten, Composites)

- By Application: Original Equipment Manufacturer (OEM), Aftermarket

- By Vehicle Type: Road Motorcycles (Standard, Sport, Cruiser, Touring), Off-Road Motorcycles (Dirt Bikes, Enduro), Scooters & Mopeds

- By Distribution Channel: Direct Sales (OEM), Distributor Networks, Online Retailers, Independent Service Garages

Value Chain Analysis For Motorcycle Wheel Weight Market

The value chain for the Motorcycle Wheel Weight Market begins with upstream activities focused on raw material procurement, primarily sourcing high-purity metals such as lead (in restricted markets), zinc, and steel, along with specialized adhesive components for stick-on weights. Manufacturers in this segment maintain close relationships with metal suppliers to mitigate price volatility and ensure compliance with chemical and environmental standards, particularly regarding heavy metals and coating durability. The transformation stage involves specialized casting, stamping, or injection molding processes to achieve precise weight tolerances and shapes, often utilizing automated quality control to certify mass accuracy before packaging.

Midstream activities involve sophisticated manufacturing processes, including surface treatment (e.g., powder coating or vinyl lamination for corrosion resistance) and the application of high-strength adhesive tapes for the stick-on variants. This stage requires significant investment in specialized machinery and adherence to high dimensional precision standards. The finished products then move into the distribution phase, which is segmented into direct channels for OEMs and indirect channels for the Aftermarket. Direct sales involve long-term contractual agreements and Just-in-Time (JIT) delivery to motorcycle assembly plants globally, demanding reliable logistics and zero-defect quality assurance.

Downstream activities are dominated by the aftermarket segment, where distribution relies heavily on global and regional distributors, large automotive retail chains, and independent service garages. Online retail is also increasingly important, particularly for specialized or branded premium weights purchased directly by consumers or small service shops. The end-user, comprising both motorcycle manufacturers and riders seeking maintenance, is highly sensitive to product quality, ease of installation, and adherence to regulatory standards, completing the value chain loop where demand dictates both product specifications and distribution network efficiency.

Motorcycle Wheel Weight Market Potential Customers

Potential customers for the Motorcycle Wheel Weight Market are broadly categorized into two major groups: Original Equipment Manufacturers (OEMs) and the vast Aftermarket network that serves the end-consumer. OEMs, including global motorcycle manufacturers such as Honda, Yamaha, BMW, Harley-Davidson, and Bajaj Auto, represent a high-volume, quality-critical customer base that integrates these weights directly into the factory assembly of new vehicles. These buyers prioritize consistent supply, technical compliance (especially dimensional accuracy), and long-term corrosion resistance, often demanding customized adhesive solutions for their proprietary wheel designs.

The Aftermarket segment represents a significantly larger pool of customers, driven by the necessity of replacing weights whenever tires are serviced or replaced—a frequent occurrence over the life of a motorcycle. This group includes wholesale distributors specializing in automotive parts, large-scale tire repair franchises, independent motorcycle repair shops and garages, and increasingly, direct-to-consumer online platforms. Aftermarket customers often exhibit higher price sensitivity but still demand reliability and compatibility across a wide range of wheel types (spoke, alloy, cast).

A specialized, growing customer segment includes high-performance racing teams and motorcycle modification enthusiasts. These buyers require ultra-precise balancing solutions, often involving premium materials like tungsten or highly calibrated steel, where even minute imbalances can affect competitive performance. This niche prioritizes advanced material science and application ease, often purchasing smaller quantities of specialized products through dedicated performance parts distributors, reflecting a high-value segment focusing on dynamic stability improvements.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 350.5 Million |

| Market Forecast in 2033 | USD 522.0 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | 3M, Perfect Equipment, WEGMANN Automotive, Plombco, Pro-Balance, BADA, Sinuo, Vipal Rubber, Wonder Manufacturing, Kenda Tire, Counteract Balancing Beads, Tip Top Stahlgruber, Alligator Ventilfabrik, Hofmann, Schrader, Bosch, Continental, Trelleborg, Michelin, Bridgestone |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Motorcycle Wheel Weight Market Key Technology Landscape

The technological landscape of the Motorcycle Wheel Weight Market is rapidly evolving, moving away from simple casting towards advanced material science and precision manufacturing. A crucial area of development is the transition to high-density, non-lead materials. While zinc and steel are standard replacements, researchers are exploring composites and specialized alloys (such as tungsten compounds) that can mimic the high mass density of lead within smaller physical footprints. This material innovation is essential for maintaining the aesthetic and aerodynamic profiles of modern motorcycle wheels, particularly those used in high-performance and premium segments, where minimizing external components is a design priority.

Another significant technological focus is on enhancing adhesive technology for stick-on weights. Manufacturers are developing multi-layer adhesive tapes that offer superior shear strength, improved weather resistance (especially against water, heat, and road salts), and residues that are easier to remove during wheel maintenance. This is crucial as adhesive weights gain dominance, particularly on polished or powder-coated alloy rims. Furthermore, the geometric design of the weights is being optimized using CAD and simulation software to ensure minimal impact on airflow and a more contoured fit to specific rim profiles, enhancing both reliability and visual integration.

In manufacturing, the integration of robotics and advanced metrology is paramount. Automated stamping and coating processes ensure uniformity and prevent corrosion, while laser measurement systems verify the weight and dimensional accuracy of every single piece with sub-milligram precision. This shift towards Industry 4.0 principles, including the use of IoT sensors for production monitoring and automated packaging, ensures the high level of reliability and regulatory compliance demanded by OEM clients and professional service centers, ultimately driving efficiency and reducing the incidence of manufacturing defects that could compromise balancing accuracy.

The adoption of advanced balancing machinery in the downstream sector also dictates product technology. Modern wheel balancers utilize high-speed sensors and software that can accurately differentiate between static and dynamic imbalance. This capability creates demand for standardized, finely granulated weights that allow technicians to achieve highly precise correction values, often requiring fractional weight increments (e.g., 5g, 10g). The convergence of smart balancing equipment and high-precision weights is defining the new standard for vehicle safety and comfort, influencing purchasing decisions across the global aftermarket network.

Regional Highlights

- Asia Pacific (APAC): APAC is the dominant market globally in terms of volume consumption and manufacturing base, driven primarily by high motorcycle penetration in countries like India, China, Indonesia, and Vietnam. This region is characterized by a high demand for cost-effective solutions, leading to the prevalence of basic clip-on weights, though regulatory modernization is gradually forcing a shift towards zinc and steel variants. The rapid expansion of local OEM production for both conventional and electric scooters guarantees sustained demand. India, in particular, due to its massive two-wheeler population and frequent tire replacement cycles, remains a critical consumer hub for aftermarket products. Investment in balancing equipment is increasing, driving demand for higher quality, standardized weights.

- North America: North America is a high-value market focused heavily on compliance and premium products. Due to strict environmental regulations regarding lead, the market relies almost exclusively on zinc and steel adhesive weights. Demand is concentrated in the aftermarket segment, serving large, cruiser, and touring motorcycles which require specific, durable balancing solutions to maintain stability during long-distance, high-speed travel. Key drivers include rigorous vehicle inspection standards and a consumer base willing to pay a premium for high-quality, branded products that minimize environmental impact and maximize performance stability.

- Europe: Europe is a leader in adopting non-lead materials, driven by stringent directives such as REACH and national legislation (e.g., in Germany and the UK). This region exhibits a strong preference for aesthetic and discreet solutions, favoring high-quality, specialized adhesive steel weights, especially for high-end sport bikes and premium touring models. The European market benefits from a well-established and sophisticated distribution network of garages and service centers that prioritize precision balancing. Regulatory consistency across the European Union further streamlines the supply chain for compliant, non-toxic weights, reinforcing value growth over volume.

- Latin America (LATAM): LATAM represents a burgeoning market where the two-wheeler population is growing rapidly, particularly for commuting and utility purposes. Demand is currently characterized by a mix of affordable clip-on weights and growing adoption of basic adhesive types. Brazil and Mexico are the regional hubs for both manufacturing and consumption. The market is increasingly professionalizing, moving away from low-quality materials as consumer awareness of safety implications improves, presenting a clear opportunity for manufacturers of medium-to-high quality zinc and steel balancing solutions.

- Middle East and Africa (MEA): This region is highly fragmented, with demand driven by varying import dynamics and infrastructure conditions. The Middle Eastern segment, particularly the Gulf Cooperation Council (GCC) countries, demonstrates a higher demand for premium weights for imported high-performance motorcycles, similar to European preferences. In Africa, the market is volume-driven, primarily focusing on affordable, robust solutions for utility motorcycles and scooters operating under challenging road conditions. Growth here is contingent on economic development and the formalization of vehicle maintenance sectors.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Motorcycle Wheel Weight Market.- WEGMANN Automotive (Perfect Equipment)

- 3M Company

- Plombco Inc.

- BADA Company

- Wonder Manufacturing Co., Ltd.

- Sinuo Industrial Co., Ltd.

- Pro-Balance Wheel Weights

- Tip Top Stahlgruber

- Vipal Rubber

- Alligator Ventilfabrik GmbH

- Counteract Balancing Beads

- Hofmann E. W. GmbH

- Schrader International

- Bosch (Automotive Aftermarket)

- Continental AG

- Trelleborg Group

- Michelin Group

- Bridgestone Corporation

- Kenda Tire

- Fujian Nanan Yihui Hardware Industrial Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Motorcycle Wheel Weight market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary drivers for the shift from lead to steel and zinc motorcycle wheel weights?

The primary driver is stringent environmental regulation, particularly in North America and Europe, banning lead components due to toxicity concerns (e.g., disposal and environmental contamination). Steel and zinc offer compliant, eco-friendly alternatives, despite challenges in matching lead's density for compact weight designs.

How do adhesive wheel weights compare to traditional clip-on weights in terms of market adoption?

Adhesive (stick-on) weights are rapidly gaining market share over clip-on weights, especially in the OEM segment and for modern alloy rims. Adhesives offer greater aesthetic appeal, prevent rim scratching, and provide more precise placement, though clip-ons remain prevalent in the cost-sensitive aftermarket and for traditional spoke wheels.

Which geographical region dominates the consumption volume in the Motorcycle Wheel Weight Market?

The Asia Pacific (APAC) region dominates the consumption volume, driven by the immense size of the motorcycle and scooter populations in countries like India, China, and Indonesia, which necessitate high volumes of basic and functional aftermarket wheel balancing products.

What is the main challenge facing manufacturers in developing high-performance non-lead wheel weights?

The main challenge is achieving sufficient mass density with environmentally compliant materials. Lead is exceptionally dense; alternatives like steel or zinc require a larger physical weight to achieve the same balance correction, posing difficulties in aerodynamic design and aesthetic integration, especially for high-speed sport bikes.

What role does the electric motorcycle segment play in the future demand for wheel weights?

The electric motorcycle segment presents a significant opportunity, as these bikes often feature unique weight distribution (due to battery packs) and higher instantaneous torque, demanding highly precise, specialized, and durable wheel weights to maintain stability and prevent vibration, thereby driving value growth in the market.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager