Motorsport Flour Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438499 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Motorsport Flour Market Size

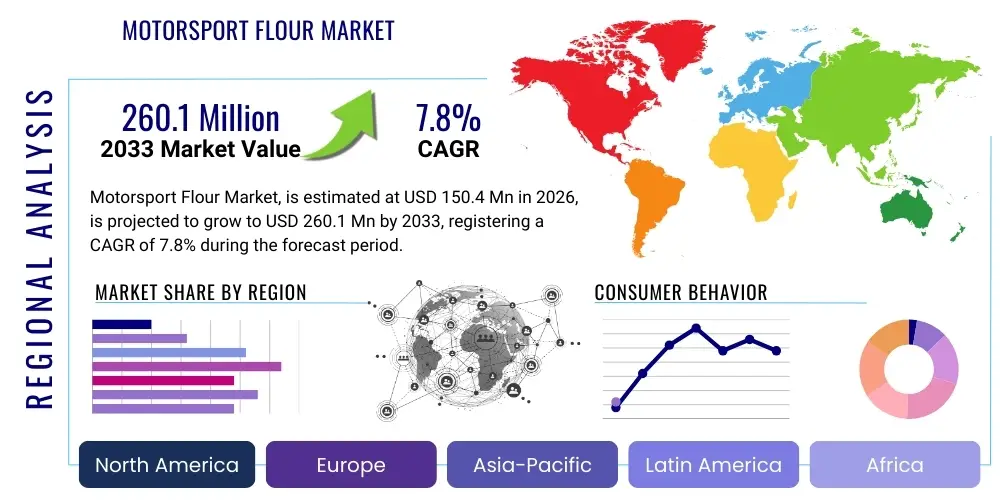

The Motorsport Flour Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 150.4 Million in 2026 and is projected to reach USD 260.1 Million by the end of the forecast period in 2033.

Motorsport Flour Market introduction

The Motorsport Flour Market encompasses highly specialized, finely powdered chemical or composite materials designed exclusively for extreme performance applications within professional motor racing circuits. These materials, often proprietary blends of nano-ceramics, advanced polymers, or metal oxides, are crucial components used primarily to enhance friction management, improve thermal stability, and reduce the overall weight of critical vehicle parts. Defined by their unique particulate structure, these "Flours" function as high-performance fillers or coatings in manufacturing processes like additive manufacturing, specialized composite molding, and high-tolerance surface treatments for engine components and braking systems.

Key applications of Motorsport Flour include the manufacturing of high-heat resistant engine seals, lightweight chassis components, enhanced friction pads for clutch systems, and thermal barrier coatings for exhaust manifolds. The unique benefits derived from utilizing these materials involve substantial performance gains, such as superior wear resistance under intense stress, significantly reduced operational temperatures, and improved power-to-weight ratios for racing vehicles. This specialization mandates rigorous quality control and customization for specific racing disciplines, ranging from Formula 1 to endurance challenges and high-speed rally events.

The principal driving factors accelerating this market include the relentless pursuit of marginal gains in professional motorsport, where even a fraction of a second can determine success. Regulatory shifts demanding greater efficiency, coupled with intense technological competition among racing teams, necessitate continuous innovation in material science. Furthermore, the increasing integration of additive manufacturing techniques, which rely heavily on precise, high-quality powdered inputs, is broadening the application scope and demand for specialized Motorsport Flours, ensuring sustained market expansion throughout the forecast period.

Motorsport Flour Market Executive Summary

The global Motorsport Flour Market is poised for significant expansion, driven primarily by escalating demand for ultralight, highly durable components that can withstand extreme mechanical and thermal stress inherent in competitive racing. Current business trends indicate a strong pivot towards sustainability and efficiency, compelling manufacturers to develop bio-based or recycled composite flours without compromising structural integrity or performance characteristics. Major material suppliers are increasingly forging exclusive partnerships with elite racing teams and original equipment manufacturers (OEMs) to tailor formulations, ensuring intellectual property protection and early market access for groundbreaking material science innovations.

Regionally, Europe, anchored by robust Formula 1 and major endurance racing infrastructure, maintains its dominance as the leading consumption and innovation hub. However, the Asia Pacific region, specifically Japan and China, is projected to register the fastest growth rate, fueled by expanding local racing circuits, increasing motorsport investment, and the establishment of advanced material production facilities catering to the burgeoning domestic automotive performance sector. North America continues to represent a mature market focused on NASCAR and IndyCar series, emphasizing materials that offer longevity and cost-effectiveness alongside high performance.

Segment trends reveal that the Polymer-based and Nanoparticle-infused Flours are experiencing high growth, primarily due to their superior versatility and compatibility with advanced manufacturing technologies like 3D printing. Application-wise, the demand for Motorsport Flour in Engine Components, especially those requiring precise thermal management and wear resistance, remains the largest segment. The increasing adoption across diverse vehicle types, particularly in the rapidly evolving electric vehicle (EV) racing categories, promises new avenues for growth, requiring specialized non-conductive and battery-friendly composite flours.

AI Impact Analysis on Motorsport Flour Market

Common user inquiries concerning AI's impact on the Motorsport Flour Market often revolve around predictive material failure analysis, optimization of composite recipes, and efficiency gains in manufacturing processes. Users are keenly interested in how Artificial Intelligence can accelerate the discovery of novel ‘flour’ compositions that meet impossible performance criteria, thereby reducing long and expensive R&D cycles. Furthermore, significant user concern relates to the integration of AI-driven quality control systems capable of analyzing micro-structural defects in the powdered materials and final composite parts, ensuring flawless performance under racing conditions where failure is catastrophic. The consensus expectation is that AI will transform the industry from a trial-and-error approach to a data-driven, highly predictive scientific domain.

AI is fundamentally reshaping the materials research pipeline within the Motorsport Flour sector. Machine learning algorithms are now utilized to simulate the interaction of various composite elements—such as ceramic particles, polymer binders, and metallic fillers—under extreme stress, temperature, and cyclic loading scenarios before any physical synthesis occurs. This computational approach drastically narrows down the pool of potential material candidates, focusing R&D efforts solely on compositions with the highest probability of success. Furthermore, AI helps in optimizing particle size distribution and morphology during the milling and compounding phases, critical factors that dictate the final performance of the ‘flour’ in high-precision additive manufacturing.

The manufacturing floor also leverages AI for enhanced operational efficiency. Predictive maintenance systems analyze sensor data from grinding and sieving equipment to ensure consistent particle quality, minimizing batch variations which are detrimental in precision racing applications. In supply chain logistics, AI algorithms forecast demand volatility based on race schedules and team inventory requirements, ensuring just-in-time delivery of these expensive and specialized materials. Ultimately, the integration of AI standardizes quality, reduces material wastage, and significantly accelerates the speed at which innovative Motorsport Flour compositions transition from the laboratory to the racetrack.

- AI-driven optimization of composite flour compositions for specific thermal and mechanical properties.

- Predictive modeling of material wear and failure rates under simulated racing conditions.

- Enhanced quality control systems utilizing computer vision for micro-structural defect analysis in powdered materials.

- Optimization of particle size distribution during manufacturing using real-time machine learning feedback.

- Accelerated R&D cycles through computational material design and virtual screening of components.

- Improved supply chain efficiency and inventory forecasting tailored to competitive racing schedules.

DRO & Impact Forces Of Motorsport Flour Market

The Motorsport Flour Market is subject to a complex interplay of Drivers, Restraints, and Opportunities (DRO), all intensified by significant Impact Forces unique to the highly competitive racing environment. The primary driver is the absolute necessity for performance superiority, pushing material science to its limits to achieve lighter weight, higher durability, and better thermal regulation. This is countered by major restraints, including the exorbitant research and development costs associated with creating nano-engineered materials and the stringent, often proprietary, quality assurance demanded by top-tier racing bodies. Opportunities arise from integrating these materials into electric motorsport platforms and leveraging advanced manufacturing techniques like hybrid additive processes. These forces collectively dictate the market dynamics, requiring manufacturers to maintain a delicate balance between innovation, cost, and compliance.

Key drivers include the global appeal and investment in competitive racing, which consistently raises the stakes for technological innovation. Furthermore, stringent safety regulations imposed by organizations like the FIA (Fédération Internationale de l'Automobile) often mandate the use of advanced, flame-retardant, and highly resilient materials, indirectly boosting demand for specialized flours used in safety structures and cockpit assemblies. Another significant driver is the continuous evolution of engine and chassis designs, which demand materials capable of maintaining structural integrity at temperatures and pressures previously considered impossible, cementing the market's growth trajectory.

Conversely, the market faces hurdles due to the highly fragmented nature of demand, where each racing team or OEM often requires a slightly customized formulation, preventing large-scale mass production and increasing unit costs. Intellectual property risks are also high, as proprietary formulas are susceptible to reverse engineering. The primary impact forces shaping the market include rapid technological obsolescence—where a breakthrough material in one season may be outdated by the next—and intense competitive rivalry among material suppliers, compelling continuous, high-risk capital expenditure in material science innovation and testing facilities.

- Drivers: Relentless demand for performance optimization; stringent safety and thermal management regulations; increasing investment in electric motorsport R&D; expansion of additive manufacturing in racing.

- Restraints: Exceptionally high material development and testing costs; reliance on highly specialized manufacturing infrastructure; small volume production leading to high unit prices; strict intellectual property protection requirements.

- Opportunities: Integration into emerging EV racing circuits (Formula E); development of sustainable and bio-composite flour alternatives; expansion into niche high-performance industrial applications; adoption of hybrid manufacturing techniques.

- Impact Forces: Rapid technological cycling; high capital barriers to entry for new suppliers; significant influence of major racing bodies (FIA, NASCAR) on material specifications; risk of material failure leading to catastrophic competitive consequences.

Segmentation Analysis

The Motorsport Flour Market is comprehensively segmented based on material composition (Type), the specific component or system it is applied to (Application), and the category of competitive vehicle utilizing the material (Vehicle Type). This structured segmentation allows market participants to precisely target specialized demands within the high-performance material supply chain. Material composition is crucial, differentiating between organic polymer bases, high-temperature ceramics, and cutting-edge nanoparticle formulations, each serving distinct functional requirements in terms of heat resistance, flexibility, and strength-to-weight ratio. The complexity of racing necessitates this detailed categorization to ensure optimal material selection for components operating under vastly different mechanical loads and thermal environments.

Segmentation by application identifies the most significant revenue streams, such as those derived from engine component manufacturing, where thermal stability is paramount, versus chassis composites, which prioritize extreme lightness and impact resilience. Understanding these application needs guides R&D investment towards the most critical performance deficiencies that need addressing. Furthermore, the segmentation based on vehicle type—ranging from the high-downforce requirements of Formula series cars to the rigorous durability needed for Rally racing—highlights the regional and regulatory variances in material demand, ensuring that material suppliers can align their product portfolios with specific racing disciplines globally.

The strategic analysis of these segments reveals that while traditional ceramic flours maintain stability due to their established reliability in braking systems, the emerging nanoparticle-infused flours are exhibiting the highest growth due to their ability to enhance multiple material properties simultaneously, particularly when used in sophisticated composite matrices. This dynamic shift necessitates that market participants continuously monitor segment performance to adapt their production capabilities and commercial strategies effectively, focusing on areas offering the highest potential for innovation and revenue growth within the competitive motorsport landscape.

- By Type:

- Polymer-based Motorsport Flour (e.g., PEEK, Carbon Nanotube-infused Polymers)

- Ceramic-based Motorsport Flour (e.g., Zirconia, Alumina Oxide powders)

- Nanoparticle-infused Motorsport Flour (e.g., Graphene, Nano-diamond composites)

- Metallic Alloy Powders (Specialized for Additive Manufacturing)

- By Application:

- Engine Components (Pistons, Seals, Valve Train)

- Chassis and Aerodynamic Composites

- Braking Systems (Friction Enhancement)

- Thermal and Acoustic Barrier Coatings

- By Vehicle Type:

- Formula Series Racing (F1, F2, F3)

- Endurance Racing (WEC, Le Mans)

- Rally and Off-Road Racing

- Stock Car Racing (NASCAR)

- Electric Vehicle Racing (Formula E)

Value Chain Analysis For Motorsport Flour Market

The value chain for the Motorsport Flour Market begins with highly specialized upstream activities involving the sourcing and refinement of ultra-pure raw materials, such as rare earth metals, industrial polymers, and synthetic ceramics. This stage requires significant technological expertise in precision synthesis, milling, and particle size classification to ensure the fundamental consistency and quality demanded by motorsport applications. The primary raw material suppliers operate in a high-barrier-to-entry environment, emphasizing patented processes and stringent quality control protocols, which ultimately determines the performance characteristics of the final 'flour' product.

Midstream activities involve the complex process of material compounding, functionalization, and formulation, where the basic ingredients are mixed, coated, or chemically bonded to create the final proprietary Motorsport Flour. This stage often includes custom tailoring of the powder’s morphology and surface chemistry to optimize its interaction with binding agents or 3D printing equipment. Following formulation, the distribution channel is bifurcated into direct sales to major racing teams, who require immediate, secure supply of custom batches, and indirect sales through specialized high-performance material distributors who serve smaller racing outfits or broader high-performance automotive tuning markets.

Downstream analysis focuses on the end-users: the high-performance material manufacturers, composite specialists, and the racing teams themselves, who incorporate the flour into final components such as engine blocks, brake discs, or chassis structures. Direct distribution is preferred for mission-critical, highly secret formulations, minimizing external handling and ensuring confidentiality. Indirect channels, while broader, typically handle more standard, high-volume inputs. The ultimate value delivery is realized when the material performs flawlessly under extreme competitive pressure, providing a measurable performance advantage to the end-user team.

Motorsport Flour Market Potential Customers

The potential customer base for Motorsport Flour is highly specialized and characterized by organizations with critical needs for advanced material performance under extreme operating conditions. The primary customers are high-tier professional racing teams across Formula 1, WEC, IndyCar, and Formula E, whose competitive success hinges directly on utilizing the lightest, strongest, and most thermally resilient components. These teams procure the materials directly from specialized suppliers, often under exclusive non-disclosure agreements, using the flour in both internally manufactured components and specifications provided to their external parts suppliers.

Secondary customer segments include high-performance Original Equipment Manufacturers (OEMs) who supply specialized parts directly to racing series, such as manufacturers of specialized engine components (e.g., piston or valve train producers) and braking systems (e.g., specialized pad and rotor manufacturers). These firms require large, consistent batches of Motorsport Flour tailored to specific production processes, such as sintering or advanced injection molding. Furthermore, high-end automotive tuning companies and hypercar manufacturers, who incorporate racing technology into limited-edition road vehicles, also represent a valuable niche customer segment, emphasizing materials for durability and exclusivity.

The rapidly expanding segment of Electric Vehicle (EV) racing teams and associated battery and motor component developers are becoming increasingly vital potential customers. EV racing requires specialized flours that offer superior electrical insulation properties, thermal runaway prevention, and structural resilience for battery casings and high-speed motor components. These customers prioritize materials that balance high performance with rigorous safety standards related to electrical components, marking a significant growth area for specialized non-conductive and fire-retardant Motorsport Flours.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 150.4 Million |

| Market Forecast in 2033 | USD 260.1 Million |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | High-Performance Materials Inc., Racin-Chem Solutions, Advanced Composites Global, AeroTech Powders, Friction Dynamics GmbH, NanoSpec Racing, Apex Material Science, Velocity Compounds, MotoChem R&D, Trackside Technologies, GigaMaterials Corp., Synthex Innovations, Precision Racing Products, Carbon Fiber Solutions, E-Drive Polymers, Motorsport Chemistry Labs, Specialized Powder Technologies, Extreme Performance Composites, Thermal Dynamics Corp., Wear Resistant Solutions. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Motorsport Flour Market Key Technology Landscape

The Motorsport Flour Market is deeply rooted in advanced material synthesis technologies, requiring highly sophisticated manufacturing processes to achieve the requisite purity, particle size uniformity, and functional performance. Key technologies include plasma atomization and chemical vapor deposition (CVD) for generating ultra-fine, spherical metallic and ceramic powders, essential for high-precision additive manufacturing applications in racing. Furthermore, proprietary surface functionalization techniques, such as micro-encapsulation or specialized surface coatings, are routinely employed to enhance the bonding capabilities of the flour particles with various polymer or metal matrix materials, thereby maximizing the final composite’s mechanical properties and resistance to hostile operating conditions.

Crucially, high-energy ball milling and jet milling technologies are utilized to achieve nanometer-scale particle sizes, which are pivotal for producing high-dispersion, homogeneous composite structures that minimize defects and maximize material strength and lightness. These milling techniques must be meticulously controlled to maintain the desired particle morphology, as deviations can significantly compromise the performance gains. Beyond synthesis, the landscape relies heavily on advanced characterization tools, including Scanning Electron Microscopy (SEM) and X-ray Diffraction (XRD), to ensure every batch of Motorsport Flour meets the strict microstructural and chemical specifications demanded by racing teams, reinforcing the technology-intensive nature of this market.

The fastest emerging technological area involves the seamless integration of Motorsport Flours with Additive Manufacturing (AM), specifically Selective Laser Sintering (SLS) and Binder Jetting. This requires flours to possess excellent flowability and packing density characteristics. Suppliers are focusing on creating hybrid flours—combining ceramics and polymers—that can be processed by these technologies to produce complex, lightweight geometries impossible with traditional machining. The continual refinement of these hybrid materials and their associated 3D printing parameters constitutes a core technological driver ensuring the future competitive advantage in material supply within the motorsport ecosystem.

Regional Highlights

Europe: Dominance in Innovation and Consumption

Europe stands as the undisputed epicenter of the Motorsport Flour Market, primarily driven by the concentration of premier racing series, including Formula 1, World Endurance Championship (WEC), and a dense network of major automotive OEMs and high-performance material science research institutions. The region benefits from stringent performance regulations imposed by bodies like the FIA, forcing continuous innovation in material lightweighting and thermal resistance, directly stimulating demand for specialized flours. Countries such as Germany, the UK (Motor Sport Valley), and Italy house the leading R&D centers and manufacturing facilities, specializing in high-end ceramic and carbon-based flours for engine and aerodynamic applications. European market maturity allows for high price tolerance for superior performance materials, sustaining its revenue dominance.

The competitive rivalry among European suppliers is extremely high, prompting significant investment in proprietary synthesis techniques and exclusive supply agreements with top racing teams. This localized expertise allows for rapid prototyping and deployment of newly developed materials into active competition. The shift towards sustainable racing, particularly in Formula E, is further encouraging European manufacturers to pioneer bio-composite flours and materials derived from recycled carbon fiber, ensuring the region remains at the forefront of both performance and environmental compliance.

North America: Focus on Durability and Cost Efficiency

The North American market, centered around NASCAR, IndyCar, and drag racing, emphasizes durability and standardized performance requirements due to the nature of their racing formats which often involve high wear and long seasons. While innovation is present, the demand profile tends to favor established, reliable composite flours, particularly in stock car racing where cost control and standardized parts are more critical than in European Formula series. The U.S. is a major consumer of metallic and specialized polymer flours used in robust engine internals and chassis structures built to withstand high-impact loads.

The presence of major aerospace and defense material suppliers in the U.S. provides a strong technological backbone for the Motorsport Flour industry, often leading to cross-application transfers of advanced powder metallurgy and high-temperature composite technologies. Growth in this region is also increasingly linked to the developing electric off-road and rally segments, which are creating new demand for rugged, high-performance battery housing and motor protection materials utilizing specialized flours for enhanced structural integrity and fire suppression.

Asia Pacific (APAC): High Growth Trajectory

The APAC region is projected to be the fastest-growing market segment, driven by soaring motorsport participation, increased disposable income leading to greater investment in racing infrastructure (especially in China, Japan, and India), and the rapid expansion of high-performance domestic automotive industries. Japan remains a powerhouse in material science, contributing significantly to nano-ceramic and metal-alloy flours, while emerging markets like China are rapidly establishing high-volume manufacturing capabilities for polymer-based composites.

Government initiatives supporting advanced manufacturing and technological self-sufficiency in countries like South Korea and China are accelerating local R&D in specialized powder materials. This allows domestic racing teams and high-performance component manufacturers to source innovative Motorsport Flours regionally, reducing reliance on expensive European imports. The growth is particularly pronounced in motorcycle racing and local touring car series, demanding versatile flours for engine tuning and lightweight chassis construction.

Latin America and Middle East & Africa (MEA): Emerging Markets

These regions, while smaller in market size, offer niche growth opportunities. Latin America, particularly Brazil and Argentina, possesses a passionate motorsport culture and localized racing circuits that drive demand for imported performance materials, though often constrained by economic volatility. The MEA region, highlighted by significant F1 investment (e.g., UAE, Saudi Arabia) and the establishment of high-tech manufacturing zones, represents a promising future market. Material consumption in MEA is currently heavily focused on high-end components imported for prestigious, state-backed racing teams and events, emphasizing the absolute highest quality and performance regardless of cost.

Investment in major racing venues is stimulating localized material logistics and maintenance operations. As these regions develop their own high-performance engineering capabilities, the demand for direct sourcing of specialized flours for repair, testing, and eventual localized manufacturing of components is expected to increase steadily. The presence of large international material suppliers is essential for these emerging markets, providing technical expertise and assured quality supply chains necessary for competitive participation on the global motorsport stage.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Motorsport Flour Market. These companies are pivotal in driving innovation, setting performance standards, and influencing the global supply chain dynamics through proprietary formulas and strategic partnerships with racing organizations.- High-Performance Materials Inc.

- Racin-Chem Solutions

- Advanced Composites Global

- AeroTech Powders

- Friction Dynamics GmbH

- NanoSpec Racing

- Apex Material Science

- Velocity Compounds

- MotoChem R&D

- Trackside Technologies

- GigaMaterials Corp.

- Synthex Innovations

- Precision Racing Products

- Carbon Fiber Solutions

- E-Drive Polymers

- Motorsport Chemistry Labs

- Specialized Powder Technologies

- Extreme Performance Composites

- Thermal Dynamics Corp.

- Wear Resistant Solutions

Frequently Asked Questions

Analyze common user questions about the Motorsport Flour market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary functional benefits of using Nanoparticle-infused Motorsport Flours in racing components?

Nanoparticle-infused Motorsport Flours, typically utilizing materials like graphene or nano-ceramics, deliver multi-faceted performance enhancements crucial for competitive advantage. The primary benefit is a drastic improvement in the material's strength-to-weight ratio, allowing for significantly lighter components without compromising structural integrity. Secondly, these flours provide superior thermal conductivity or insulation, depending on the application; for example, they can efficiently dissipate heat in brake systems or act as thermal barriers in engine manifolds. Finally, the extremely fine particulate structure leads to highly uniform composites with enhanced friction reduction capabilities and vastly improved wear resistance under sustained high-stress operation, extending component lifespan and reliability on the track.

The unique size and surface area of nanoparticles enable them to integrate seamlessly into polymer or metal matrices, eliminating common stress risers found in conventional fillers. This homogeneity is essential for components undergoing high cyclic loading, preventing microscopic crack initiation and propagation. Furthermore, the use of these advanced flours allows racing teams to push operational limits, such as higher engine temperatures or increased downforce pressures, knowing the material integrity is maintained. This technological edge is why they are rapidly becoming the material of choice for highly critical systems like internal combustion engine seals and lightweight structural nodes.

For prospective buyers and material scientists, understanding the role of the particle morphology is critical. The superior flowability of nano-flours is also a key factor driving their adoption in additive manufacturing, allowing for the 3D printing of complex geometries with excellent surface finish and high density, ensuring zero porosity—a fatal flaw in racing components. This shift towards ultra-precision materials underscores the high-value nature and technological complexity of this market segment.

How is the growth of Electric Vehicle (EV) racing impacting the demand profile for Motorsport Flour?

The rapid expansion of electric vehicle racing series, such as Formula E, Extreme E, and various EV endurance challenges, has fundamentally altered the demand profile for Motorsport Flour by introducing stringent requirements related to electrical management and fire safety. Traditional motorsport flours focused on mitigating high mechanical friction and extreme combustion heat; EV racing, conversely, requires specialized, non-conductive ceramic and polymer flours primarily utilized for battery casing protection, thermal management of high-voltage components, and structural insulation. These materials must effectively manage the significant heat generated by battery discharge and charging cycles while preventing thermal runaway, a critical safety concern.

The shift necessitates R&D investment into dielectric-strength enhanced flours that can withstand high electrical potential differences while maintaining structural lightness. For instance, specialized magnesium oxide or high-grade polymer flours are now employed in the manufacture of composite battery housings to offer robust protection against impact while ensuring electrical isolation. This new focus moves the market away from purely friction-and-combustion-based applications toward materials designed for power management, insulation, and fire suppression, opening up entirely new segmentation opportunities for suppliers capable of meeting these unique specifications.

Furthermore, EV motorsport components, including motor stators and power inverters, benefit from flours that enhance cooling efficiency without adding prohibitive weight. The market is witnessing increased demand for composite flours that can be integrated into liquid cooling channels or used as high-efficiency heat sinks. This dual requirement for structural integrity and advanced electrical/thermal management confirms EV racing as a significant, high-growth vertical that demands bespoke material solutions distinct from conventional internal combustion engine (ICE) racing needs.

What regulatory and certification challenges do manufacturers face in the Motorsport Flour Market?

Manufacturers in the Motorsport Flour Market navigate a complex web of regulatory and certification challenges dictated by global racing bodies such as the FIA and regional authorities like NASCAR. The most significant challenge is compliance with safety standards, especially concerning fire resistance and structural integrity under catastrophic failure scenarios. Materials used in safety-critical areas, such as cockpit assemblies or driver protection structures, must pass rigorous, often proprietary, crash testing protocols that go beyond standard industrial material certifications, demanding extensive and costly pre-race validation procedures.

In addition to safety, there are often strict "homologation" rules which limit what materials can be used in certain series to ensure fair competition and control costs. For instance, some series might mandate the use of a standard alloy or composite base, restricting material innovation to minute improvements in proprietary coatings or fillers—i.e., the specialized flour itself. This requires material suppliers to develop highly adaptable formulas that can enhance performance within a tightly regulated framework. The constant revision of these technical regulations means that compliance is an ongoing, high-priority operational cost, demanding rapid material formulation changes often on a seasonal basis.

A final challenge pertains to supply chain transparency and traceability. Due to the high-stakes environment, racing teams demand certified material purity and batch consistency to guarantee component performance. Manufacturers must implement meticulous quality assurance systems, often including digital tracking of the raw materials, processing parameters, and final material properties for every single batch of Motorsport Flour. Failure to provide complete traceability can lead to component disqualification or, worse, safety issues, thereby requiring manufacturers to invest heavily in advanced monitoring and documentation technologies that satisfy the rigorous demands of competitive motorsport engineering.

How does the integration of Additive Manufacturing (AM) influence the demand and properties required for Motorsport Flours?

The widespread adoption of Additive Manufacturing (AM), particularly in prototype creation and final component production for racing, has significantly altered the specifications and increased the demand for highly specialized Motorsport Flours. AM technologies like Selective Laser Sintering (SLS) and Binder Jetting rely entirely on powdered materials, making the particle size distribution, morphology (shape), and flowability of the flour paramount. Unlike traditional methods, AM demands spherical or near-spherical particles with exceptional purity and tight size tolerance to ensure uniform powder bed density and optimal laser absorption, which is critical for producing defect-free, high-strength parts.

AM enables racing teams to iterate designs rapidly, demanding material suppliers to be equally agile in developing bespoke flours for unique applications, such as lightweight cooling ducts or highly complex, integrated engine components. This has led to an increase in demand for hybrid flours—materials combining polymers and fine ceramic fillers—specifically engineered to sinter or melt efficiently under controlled AM parameters. This technological marriage allows for the creation of geometries that are impossible to achieve through traditional subtractive manufacturing, maximizing lightweighting and aerodynamic efficiency, which are non-negotiable competitive advantages in racing.

Furthermore, the ability of AM to utilize high-performance metallic alloy flours (like specialized titanium or nickel-based powders) is growing, especially for critical structural parts like suspension linkages and bespoke engine mounts. This requires material suppliers to master plasma atomization techniques to produce contamination-free, reactive metal powders suitable for high-energy laser processes. Consequently, the success of AM in motorsport directly correlates with the quality, versatility, and precise engineering of the specialty Motorsport Flours available in the market, making AM a primary technological driver for volume and innovation.

Which geographical region leads in R&D and consumption, and what factors contribute to this dominance in the Motorsport Flour Market?

Europe is the definitive leader in both the research and development (R&D) and overall consumption of specialized Motorsport Flours globally. This dominance is primarily attributed to the historical and structural concentration of the world's most prestigious and technologically demanding racing series, including Formula 1 (F1) and the World Endurance Championship (WEC), within the continent. The presence of 'Motor Sport Valley' in the UK and key high-performance automotive manufacturing clusters in Germany and Italy creates a localized ecosystem where material science suppliers, racing teams, and component manufacturers collaborate intensely, leading to accelerated material innovation cycles.

The factors contributing to this dominance include substantial financial investment in top-tier motorsport, which mandates the use of cutting-edge, often prohibitively expensive, materials to achieve competitive marginal gains. European R&D institutions and material companies benefit from decades of accumulated expertise in high-performance composites, ceramics, and advanced polymer engineering, allowing them to rapidly prototype and test new flour formulations under live racing conditions. Furthermore, the stringent technical regulations enforced by European-based governing bodies (like the FIA) continually push material boundaries regarding safety, strength, and thermal management, directly stimulating demand for customized, ultra-high-specification flours.

While the Asia Pacific market is growing quickly in terms of volume, Europe maintains its technological edge by focusing on bespoke, high-value, low-volume batches of the most advanced flours—such as proprietary nanoparticle-infused ceramics and bio-based high-performance polymers. This focus on performance exclusivity and rapid technological deployment ensures that European suppliers retain leadership in setting industry benchmarks and controlling the intellectual property surrounding the most transformative Motorsport Flour compositions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager