Mountain Bike Footwear and Socks Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438392 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Mountain Bike Footwear and Socks Market Size

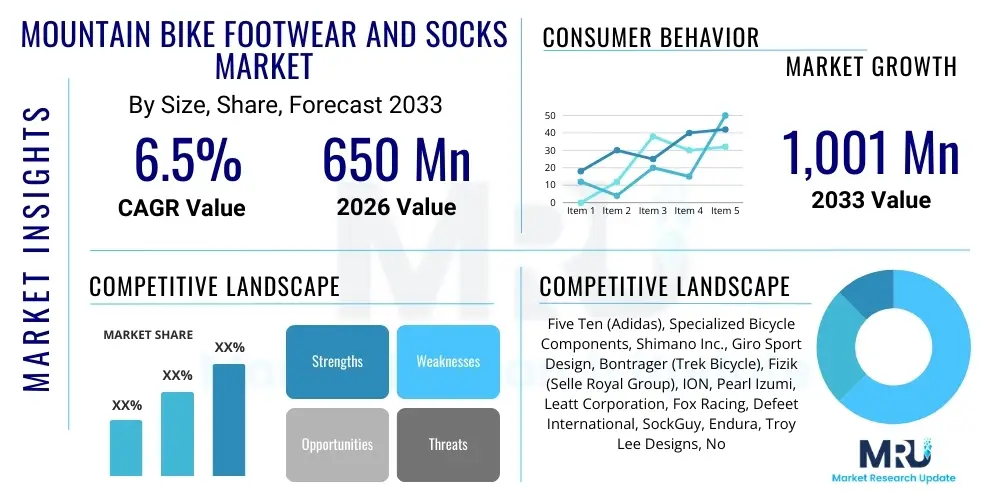

The Mountain Bike Footwear and Socks Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 650 Million in 2026 and is projected to reach USD 1,001 Million by the end of the forecast period in 2033.

Mountain Bike Footwear and Socks Market introduction

The Mountain Bike Footwear and Socks Market encompasses specialized gear designed to enhance performance, comfort, and safety for mountain cyclists across various disciplines, including cross-country (XC), trail riding, enduro, and downhill (DH). Mountain bike footwear is fundamentally distinct from standard athletic shoes, featuring robust construction, stiff soles for efficient power transfer, and aggressive tread patterns for off-bike traction in challenging, muddy, or uneven terrains. These shoes often incorporate reinforced toe boxes and water-resistant materials to withstand harsh environmental conditions specific to mountain biking. The continuous evolution of mountain biking technology, coupled with rising consumer participation globally, drives the demand for high-performance accessories that directly impact rider experience and biomechanics. The market scope includes clipless (SPD-compatible) shoes, which maximize pedaling efficiency, and flat pedal shoes, which prioritize grip and feel via proprietary rubber compounds like stealth rubber, catering to different rider preferences and technical requirements. This market is characterized by rapid innovation in materials science, focusing on reducing weight while maintaining structural integrity and protection.

Mountain bike socks, while seemingly ancillary, play a critical role in moisture management, temperature regulation, and blister prevention, complementing the sophisticated technology integrated into the footwear. Specialized socks are designed with strategic padding, compression zones, and breathable fabrics such such as merino wool blends or advanced synthetic fibers that wick moisture effectively, essential during prolonged, intense physical activity. Major applications of this gear span professional racing, amateur competitive events, recreational trail use, and increasingly, the growing segment of e-mountain biking, where reliable foot retention and comfort remain paramount. The primary benefit of specialized mountain bike footwear and socks is the optimization of the rider-to-bike interface, ensuring maximum power transmission from the legs to the pedals, reducing fatigue, and protecting the feet from impact and abrasion risks inherent to off-road riding. The integration of durable materials like TPU and carbon fiber in high-end shoes further solidifies their value proposition in terms of longevity and performance gain.

Driving factors propelling market expansion include the substantial growth in outdoor sports tourism and the adoption of cycling as a core recreational activity post-pandemic, leading to a burgeoning population of new and dedicated mountain bikers. Increased disposable income in developed economies and the strategic marketing efforts by major brands focusing on safety and performance benefits also contribute significantly to sales growth. Furthermore, the trend toward customization and specialized gear tailored for specific riding disciplines—such as stiffer soles for XC racing versus more protective, flexible designs for DH riding—encourages consumers to invest in multiple pairs, boosting market volume. The sustainability movement is also influencing product development, with brands exploring recycled and environmentally conscious materials, appealing to the modern, eco-aware consumer base.

Mountain Bike Footwear and Socks Market Executive Summary

The Mountain Bike Footwear and Socks Market is positioned for robust growth, underpinned by favorable macroeconomic conditions, sustained consumer interest in adventure sports, and continuous technological refinements aimed at enhancing rider performance and safety. Key business trends indicate a strong focus on direct-to-consumer (D2C) channels by niche and established brands, leveraging digital platforms to offer personalized fitting guides and exclusive product launches, bypassing traditional retail intermediaries and capturing higher profit margins. There is a palpable shift towards premiumization, where consumers are willing to invest in high-durability, technologically advanced products featuring BOA closure systems, carbon composite soles, and highly breathable, technical sock materials. Furthermore, collaborative partnerships between footwear manufacturers and professional athletes are driving product credibility and market visibility, translating into increased sales of signature and race-proven models. The competitive landscape is characterized by aggressive patent protection for proprietary sole technologies and grip compounds, essential differentiators in both clipless and flat pedal segments.

Regionally, North America and Europe remain the dominant markets, attributed to their established mountain biking infrastructure, high penetration of outdoor sports, and strong purchasing power. However, the Asia Pacific (APAC) region, particularly China, Australia, and select Southeast Asian nations, is emerging as the fastest-growing market segment. This accelerated growth is fueled by increasing urbanization leading to a demand for leisure activities, rapid development of dedicated trail parks, and the rising popularity of professional cycling events that inspire consumer purchases. Regulatory trends, although minimal for footwear and socks, influence manufacturing standards, particularly concerning chemical use and worker safety, prompting global brands to adhere to stringent international compliance frameworks. The increasing accessibility and affordability of high-quality entry-level mountain bikes are also expanding the consumer base globally, creating a larger target demographic for associated apparel and accessories.

Segmentation trends highlight the increasing dominance of clipless shoes in the performance-oriented XC and Trail categories, while flat pedal shoes maintain strong traction in the Enduro and Downhill markets, favored for quick dismounting capabilities and tactical freedom. Material segmentation indicates a growing preference for synthetic leather and durable textiles over traditional leather due to lower weight, better water resistance, and easier maintenance. In the socks segment, the shift is towards ultra-durable, quick-drying synthetic blends and merino wool for thermal regulation, often featuring anti-odor treatments. Retail channel analysis suggests that specialized sports retailers continue to be vital for expert advice and fitting, but e-commerce platforms are increasingly preferred for repeat purchases and niche brand access, necessitating hybrid retail strategies by major market players. Sustainability concerns are driving the demand for recycled polyester and bio-based materials in both footwear components and sock manufacturing, creating a new axis of competition centered on environmental responsibility.

AI Impact Analysis on Mountain Bike Footwear and Socks Market

User queries regarding AI's influence in the mountain bike footwear and socks sector primarily revolve around personalized product recommendations, optimizing manufacturing processes, and creating truly customized performance gear. Consumers are keenly interested in how AI can analyze their riding style, foot biomechanics, and environmental data (like expected temperature and terrain) to recommend the ideal combination of shoe stiffness, fit, and sock material composition, ensuring maximum efficiency and injury prevention. Manufacturers are concerned with using AI for predictive maintenance of machinery, optimizing material sourcing to reduce waste (a core sustainability goal), and leveraging computer vision systems for real-time quality control checks on complex bonding and stitching processes. Another critical theme is the use of generative design AI to create innovative new sole patterns and shoe shapes that maximize grip and durability while minimizing material usage, fundamentally altering traditional R&D cycles and accelerating time-to-market for performance innovations. These themes collectively suggest that while AI won't change the physical product dramatically overnight, it will revolutionize the customer experience, product development pipeline, and manufacturing efficiency.

- AI-driven personalized recommendation engines optimize e-commerce conversion rates by matching specific shoe features (e.g., stiffness index, sole material) to rider profiles (discipline, skill level, pedal type).

- Generative design algorithms are used to simulate complex force distribution, creating lighter, stronger, and more energy-efficient carbon fiber sole plates and optimized rubber tread patterns.

- Predictive analytics enhance supply chain management, forecasting demand fluctuations for specific sizes and regional trends, minimizing inventory holding costs and reducing stockouts.

- AI-powered virtual fitting tools utilize 3D scanning and machine learning to recommend perfect sizing and fit characteristics, reducing returns linked to poor initial fit, a significant e-commerce challenge.

- Real-time monitoring using IoT sensors and AI in manufacturing facilities ensures quality control and detects defects in material bonding or stitching with greater precision than manual inspection.

- AI analyzes telemetry and biomechanical data collected during pro rider testing, providing granular insights that inform iterative improvements in shoe geometry and sock compression zones.

DRO & Impact Forces Of Mountain Bike Footwear and Socks Market

The market dynamics for Mountain Bike Footwear and Socks are shaped by a complex interplay of internal and external forces, creating opportunities for specialized growth while simultaneously presenting constraints related to material costs and consumer durability expectations. The primary drivers fueling growth include the proliferation of purpose-built mountain biking trails globally, investment in cycling infrastructure, and the persistent trend of health and wellness consciousness promoting outdoor activities. These factors increase participation rates across all demographics, from casual weekend riders to dedicated athletes requiring high-end gear. Furthermore, consistent product innovation, such as the adoption of advanced closure systems like BOA, integration of durable, lightweight composites, and the specialization of footwear for niche riding segments (e.g., highly breathable shoes for hot climates or waterproof options for wet environments), keeps the product category fresh and encourages frequent upgrades.

However, the market faces significant restraints. A major challenge is the high initial cost associated with premium mountain bike footwear, particularly models utilizing carbon fiber soles or proprietary grip technologies, which can deter entry-level consumers. Furthermore, the specialized nature of the product limits its utility outside the specific cycling context, unlike cross-training shoes, narrowing the total addressable market. Market growth is also occasionally hampered by fluctuations in the global supply chain, affecting the sourcing of specialized rubber compounds and technical textiles, often leading to increased production costs and longer lead times. Counterfeit products, particularly prevalent in rapidly expanding APAC regions, pose a threat to brand credibility and profit margins, forcing companies to invest heavily in brand protection and authentication technologies.

Opportunities for expansion lie significantly in geographical penetration into emerging markets where mountain biking is gaining traction, coupled with the development of entry-to-mid-level product lines that offer high value without the premium price tag. The trend towards sustainable and eco-friendly manufacturing offers a unique opportunity for brands to capture market share among environmentally conscious consumers by utilizing recycled, durable materials and minimizing manufacturing waste. The impact forces acting on the market are substantial. Regulatory requirements for material safety, particularly concerning specialized adhesives and chemical treatments for water resistance and durability, exert continuous pressure on R&D. Furthermore, the strong influence of social media and professional athlete endorsements acts as a powerful marketing impact force, dictating style trends and rapidly accelerating the adoption cycles of new product features. Economic volatility impacts consumer discretionary spending, yet the robust nature of the dedicated cycling community often ensures stable demand for essential, performance-enhancing equipment.

Segmentation Analysis

The Mountain Bike Footwear and Socks Market is highly segmented based on product type, application, distribution channel, and material, allowing companies to target distinct rider needs and price points effectively. Product segmentation separates the market into Footwear (clipless shoes and flat pedal shoes) and Socks (performance socks, compression socks, and casual cycling socks). Clipless shoes, which physically connect the shoe to the pedal, dominate segments where power efficiency is paramount, such as cross-country racing. Conversely, flat pedal shoes, favored for downhill and enduro, are defined by their proprietary rubber outsole compounds that maximize pin-to-sole friction. Application segmentation is crucial, differentiating products tailored for Enduro, Downhill, Cross-Country (XC), and General Trail Riding, each requiring unique characteristics concerning sole stiffness, weight, and level of protection. The increasing sophistication in product design across these segments reflects the maturation of the market.

Material segmentation reveals a strong correlation between performance and the use of advanced materials. High-end footwear utilizes carbon fiber reinforced soles for rigidity, synthetic leather for durability and water resistance, and advanced mesh for breathability, often coupled with complex TPU reinforcements for impact protection. Socks are primarily segmented by material composition, with merino wool gaining popularity for its thermal regulating and anti-odor properties, while synthetic blends (nylon, polyester, spandex) remain the mainstay for high-compression, quick-drying performance socks. The choice of material directly dictates the product's price point and its suitability for specific weather conditions or riding intensity. Retail segmentation is bifurcated between offline channels—predominantly specialty sporting goods stores offering personalized fitting and expert advice—and online channels, including D2C websites and third-party e-commerce giants, which offer broader selection and competitive pricing.

Geographical segmentation identifies the concentration of sales and growth potential. Developed markets like North America and Europe prioritize premium, feature-rich products and account for the largest revenue share due to high cycling participation rates and affluent consumer bases. Conversely, the high growth potential in the Asia Pacific region is driven by expanding middle classes, increasing access to cycling infrastructure, and growing awareness of specialized sports equipment. Understanding these segmentations allows market participants to tailor their marketing strategies, inventory allocation, and research and development focus to address the precise demands of each target consumer group, optimizing both market penetration and profitability across the product lifecycle.

- By Product Type:

- Mountain Bike Footwear

- Clipless Shoes (SPD, etc.)

- Flat Pedal Shoes

- Mountain Bike Socks

- Performance Socks

- Compression Socks

- Casual Cycling Socks

- Mountain Bike Footwear

- By Application/Discipline:

- Cross-Country (XC)

- Trail Riding

- Enduro/All-Mountain

- Downhill (DH)

- By Material (Footwear):

- Synthetic Leather

- Carbon Composite/TPU

- Advanced Textile Mesh

- By Material (Socks):

- Merino Wool Blends

- Synthetic Fibers (Nylon, Polyester)

- Blended Fabrics

- By Distribution Channel:

- Online Retail (E-commerce, D2C Websites)

- Offline Retail (Specialty Stores, Sporting Goods Chains)

Value Chain Analysis For Mountain Bike Footwear and Socks Market

The value chain for the Mountain Bike Footwear and Socks Market begins with upstream activities, focusing heavily on raw material procurement, particularly specialized technical textiles, proprietary rubber compounds, and advanced composite materials such as carbon fiber and TPU. Key upstream partners include chemical companies supplying specialized adhesives, textile manufacturers producing moisture-wicking and durable sock materials (like merino wool suppliers or synthetic fiber producers), and component manufacturers providing specialized closure systems (e.g., BOA dials or high-strength velcro). The quality and consistency of these inputs are critical, as they directly determine the performance characteristics—such as sole stiffness, grip reliability, and sock longevity—that define premium products. Successful management of upstream logistics involves establishing long-term contracts with reliable, certified suppliers, often utilizing global networks to optimize cost and ensure ethical sourcing, which is increasingly scrutinized by end-consumers.

Midstream activities involve the core manufacturing processes, including design, prototyping, testing, assembly, and quality control. Footwear manufacturing is particularly labor-intensive, requiring specialized machinery for molding rigid soles, precision cutting of upper materials, and complex bonding processes to ensure water resistance and structural integrity. Socks manufacturing utilizes sophisticated knitting technology to create seamless designs with targeted compression zones and anatomical fits. Post-manufacturing, the focus shifts to branding, packaging, and compliance testing (ensuring products meet safety and performance standards). Efficiency in this stage is driven by lean manufacturing principles and the utilization of automation for repetitive tasks, although customization and high-end models still require significant skilled manual assembly, especially for final finishing and quality assurance checks before the products are prepared for distribution.

Downstream activities center on distribution and retail. The distribution channel is multifaceted, relying on both direct and indirect routes. Indirect distribution predominantly utilizes major global logistics providers and regional distributors to move finished goods from manufacturing hubs (often in Asia) to regional warehouses and then to specialty bike shops and large sporting goods retailers across North America and Europe. Direct distribution involves the manufacturer selling directly to the consumer (D2C) via proprietary e-commerce platforms. This channel offers brands greater control over pricing, messaging, and customer data, fostering a stronger brand-consumer relationship. Specialty retailers remain vital as they provide crucial services like fitting, expert product comparison, and after-sales support, adding significant value to the purchasing experience, especially for high-value footwear. The selection of the optimal channel mix is crucial for maximizing market reach while maintaining brand identity and profit margins.

Mountain Bike Footwear and Socks Market Potential Customers

Potential customers for the Mountain Bike Footwear and Socks Market are highly diversified, ranging from professional athletes and competitive racers to recreational trail enthusiasts and commuter cyclists who occasionally venture off-road. The core demographic consists of dedicated mountain biking enthusiasts, typically aged 25 to 55, possessing above-average disposable income, and actively participating in the sport weekly or bi-weekly. These buyers prioritize performance, durability, and technological features such as stiff carbon soles for efficiency in clipless models, or specialized high-friction rubber outsoles for flat pedal users. They are highly brand-aware, seek product validation through peer reviews and professional endorsements, and often invest in multiple pairs of footwear tailored for different riding conditions or disciplines (e.g., one pair for XC and one for DH). The critical factor for this group is how the gear directly contributes to marginal gains in performance and protection on technical terrain.

A rapidly expanding customer segment includes the casual trail rider and the e-mountain bike (E-MTB) user. These individuals often prioritize comfort, durability, and a blend of walking performance and cycling efficiency, rather than pure stiffness. E-MTB riders, due to the sustained high torque output of electric motors, require highly durable footwear with exceptional foot retention, driving demand for specialized, reinforced models. This group is often less brand-loyal than elite racers but highly sensitive to value propositions that combine comfort and longevity. Socks for this segment focus heavily on moisture-wicking properties and robust construction, mitigating the risk of blisters and foot fatigue during longer, less intense rides. Marketing towards this segment emphasizes product versatility, ease of use, and overall rider enjoyment rather than race pedigree.

Furthermore, a distinct but lucrative segment comprises institutional buyers, such as mountain bike rental operations, cycling tour companies, and outdoor adventure camps. These customers require durable, easily maintainable, and highly resilient footwear and socks that can withstand constant use and washing. Their purchasing decisions are driven primarily by cost-per-use, repairability, and wide availability of sizing, favoring mid-range models built for maximum longevity over cutting-edge performance features. Addressing the needs of this B2B segment requires manufacturers to focus on robust material specifications, streamlined inventory management, and bulk pricing structures, providing a stable revenue stream less dependent on seasonal consumer trends. The diverse needs of these end-users mandate a broad product portfolio covering entry-level durability to professional-grade performance optimization.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 650 Million |

| Market Forecast in 2033 | USD 1,001 Million |

| Growth Rate | CAGR 6.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Five Ten (Adidas), Specialized Bicycle Components, Shimano Inc., Giro Sport Design, Bontrager (Trek Bicycle), Fizik (Selle Royal Group), ION, Pearl Izumi, Leatt Corporation, Fox Racing, Defeet International, SockGuy, Endura, Troy Lee Designs, Northwave, Mavic, Scott Sports SA, DMT, Vaude Sport, Ride Concepts. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Mountain Bike Footwear and Socks Market Key Technology Landscape

The technological landscape of the Mountain Bike Footwear and Socks Market is dynamic, centered on enhancing the interface between the rider, the pedal, and the terrain. A cornerstone technology in footwear is the continuous refinement of outsole compounds, exemplified by proprietary rubber formulas like Five Ten's Stealth rubber, which maximizes friction for flat pedals, and highly durable TPU/nylon mixes for clipless shoes that balance grip for hike-a-bike sections with required sole stiffness. Furthermore, the integration of advanced closure systems, notably the BOA Fit System, has become a standard feature in high-performance models, offering micro-adjustability and secure, even pressure distribution across the foot, significantly enhancing power transfer and eliminating hot spots. Material science innovation is driving the adoption of lighter, thinner, yet structurally robust materials for shoe uppers, increasing protection without adding unnecessary bulk, often utilizing sophisticated welding or seamless bonding techniques instead of traditional stitching to improve water resistance and durability in mud-prone environments.

In the performance footwear category, the utilization of carbon fiber composite plates is a key technological differentiator, particularly in Cross-Country and aggressive Trail shoes, where the stiffness-to-weight ratio is crucial. These composites are strategically layered to provide maximum power transfer efficiency while still allowing for a small degree of flex near the toe box to facilitate comfortable walking when dismounted. This engineering precision requires advanced simulation and material testing technologies. For socks, technological advances focus on knitting complexity and fiber treatment. Seamless toe closures, targeted compression zones (to enhance blood circulation and reduce muscle fatigue), and the strategic placement of padding are achieved through high-precision 3D knitting machines. Furthermore, permanent anti-microbial treatments, often based on silver or zinc technology, are infused into the fibers to combat odor and improve hygiene, contributing significantly to the product's lifespan and consumer appeal during multi-day trips.

Beyond material and construction, connectivity and integration are emerging trends. While not mainstream, some manufacturers are experimenting with integrating small RFID or NFC tags into high-end footwear for authenticity verification or integrating micro-sensors for tracking foot pressure distribution, although the latter is currently reserved primarily for professional testing environments. The overarching technological trajectory is towards customization and protective reinforcement. For instance, the use of proprietary D3O or other non-Newtonian materials in strategic protective areas of the shoes (like ankle cuffs or reinforced toe boxes) offers flexibility during normal use but instantly hardens upon impact, providing superior protection against rock strikes and pedal impacts. This blend of mechanical, material, and digital innovation ensures that footwear and socks are viewed as essential performance equipment rather than mere accessories.

Regional Highlights

- North America: This region is characterized by a mature and highly competitive market, dominated by key players like Specialized, Trek, and Shimano, alongside strong market penetration by specialized brands such as Five Ten and Ride Concepts. The US and Canada boast extensive trail networks and high consumer engagement in mountain biking culture, driving demand for premium, technologically advanced footwear (e.g., BOA-equipped clipless shoes) and high-end merino wool socks suitable for diverse climates. Growth is stable, driven primarily by replacement cycles, performance upgrades, and the increasing adoption of E-MTBs which require robust, durable gear.

- Europe: Europe represents a significant revenue base, driven by strong cycling traditions in countries like Germany, Switzerland, and the UK. The market is highly segmented, with varying preferences between Central European regions prioritizing XC and trail riding (demanding stiff, efficient footwear) and regions in the Alps focusing heavily on Enduro and Downhill (driving demand for protective flat pedal shoes and compression socks). European consumers show a higher propensity towards sustainable and ethically sourced products, pressuring brands to adopt eco-friendly materials and transparent supply chains, often reflected in certifications and material choices.

- Asia Pacific (APAC): APAC is the fastest-growing regional market, fueled by rising disposable incomes, rapid urbanization, and significant governmental investment in outdoor recreational infrastructure, particularly in China, Japan, and Australia. While the market is currently mid-tier focused, the increasing exposure to international cycling events is creating a burgeoning demand for high-performance gear. Manufacturing presence in countries like Vietnam and China also makes this region critical for supply chain logistics, but brands face challenges related to intense local competition and the prevalence of counterfeits.

- Latin America (LATAM): The LATAM market is nascent but shows strong growth potential, particularly in countries like Brazil, Colombia, and Chile, which have favorable geographies for mountain biking. Economic volatility often restricts consumer spending to value-oriented products, meaning the mid-range and entry-level segments of durable, multi-purpose footwear dominate. E-commerce penetration is rising, facilitating access to international brands that were previously difficult to source, slowly introducing premium models.

- Middle East and Africa (MEA): This region is currently the smallest in terms of market share, focused mainly on expatriate communities and high-net-worth individuals, particularly in the UAE and Saudi Arabia, where cycling sports are gaining governmental support. The extreme heat necessitates specialized products, focusing on maximum breathability, lightweight construction, and rapid moisture-wicking technology in both footwear and socks, influencing local inventory stocking decisions toward specific technical textile requirements.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Mountain Bike Footwear and Socks Market.- Five Ten (Adidas)

- Specialized Bicycle Components

- Shimano Inc.

- Giro Sport Design

- Bontrager (Trek Bicycle)

- Fizik (Selle Royal Group)

- ION

- Pearl Izumi

- Leatt Corporation

- Fox Racing

- Defeet International

- SockGuy

- Endura

- Troy Lee Designs

- Northwave

- Mavic

- Scott Sports SA

- DMT

- Vaude Sport

- Ride Concepts

Frequently Asked Questions

Analyze common user questions about the Mountain Bike Footwear and Socks market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected CAGR for the Mountain Bike Footwear and Socks Market between 2026 and 2033?

The Mountain Bike Footwear and Socks Market is projected to experience a Compound Annual Growth Rate (CAGR) of 6.5% during the forecast period from 2026 to 2033, driven by increasing global cycling participation and performance gear upgrades.

What is the primary difference between clipless and flat pedal mountain bike shoes?

Clipless shoes (such as SPD compatible) feature a stiff sole and a cleat attachment point for mechanical connection to the pedal, maximizing power transfer, while flat pedal shoes prioritize an ultra-grippy rubber outsole for secure pin engagement and quick foot removal, essential for technical downhill riding.

How is technological innovation affecting mountain bike footwear design?

Innovation is primarily focused on integrating advanced materials like carbon fiber for enhanced sole stiffness and power efficiency, utilizing proprietary high-friction rubber compounds for superior grip, and adopting micro-adjustable closure systems, such as BOA, for optimized fit and security.

Which geographical region is expected to show the fastest growth in this market?

The Asia Pacific (APAC) region is forecasted to exhibit the fastest growth rate, fueled by expanding middle classes, increasing investment in cycling infrastructure, and rising consumer awareness of specialized outdoor sports equipment in countries like China and Australia.

What role do specialized socks play in mountain biking performance?

Specialized mountain bike socks are crucial for moisture management, temperature regulation, and injury prevention, often featuring compression zones, strategic padding, and technical materials (like merino wool or advanced synthetics) to enhance comfort and prevent blisters during sustained intense activity.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager