Mountain Bike Suspension Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436430 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Mountain Bike Suspension Market Size

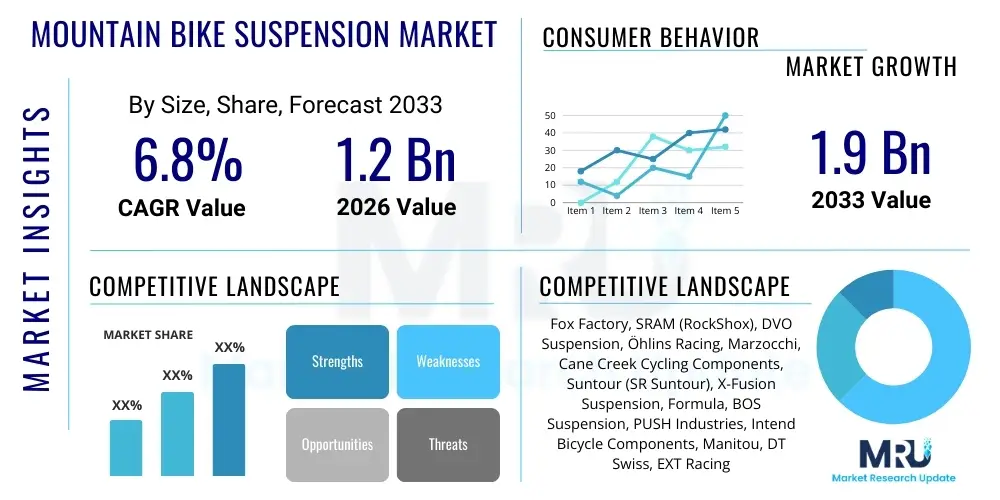

The Mountain Bike Suspension Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.2 Billion in 2026 and is projected to reach USD 1.9 Billion by the end of the forecast period in 2033. This growth trajectory reflects increasing global participation in cycling sports, significant technological advancements in damping systems, and rising consumer demand for high-performance, specialized components tailored for extreme terrain and diverse riding disciplines.

Mountain Bike Suspension Market introduction

The Mountain Bike Suspension Market encompasses the design, manufacturing, and distribution of components critical for shock absorption and wheel control on off-road bicycles. These systems primarily include front fork suspensions and rear shock absorbers, essential for maximizing traction, improving rider comfort, and ensuring safety across varied terrains such as cross-country trails, enduro stages, and technical downhill tracks. The market is defined by innovation, particularly in areas like hydraulic damping circuits, air spring architecture, and material science, aiming to deliver highly tunable and lightweight products. Major applications span competitive racing, recreational trail riding, and utility-focused electric mountain biking (e-MTB), where specialized suspension is required to manage increased speed and mass.

The primary benefits derived from advanced mountain bike suspension include enhanced control during high-speed impacts, reduced rider fatigue due to vibration absorption, and improved climbing efficiency through lockout mechanisms or platform damping technologies. Modern suspension systems utilize sophisticated technologies, such as micro-adjustments for low-speed and high-speed compression and rebound, allowing riders to precisely tailor performance to specific terrain and riding styles. This customization capability drives premium component sales, especially among enthusiast and professional segments who demand peak performance and reliability from their equipment under rigorous conditions. Furthermore, the integration of electronic components, facilitating on-the-fly adjustment and data logging, represents a key technological frontier influencing market dynamics.

Key driving factors accelerating the market growth include the global surge in outdoor recreational activities, often exacerbated by shifts in consumer preferences towards health and wellness activities, especially following recent global events. The continuous evolution of mountain bike standards—such as larger wheel sizes, boost spacing, and increasingly aggressive geometry—necessitates corresponding advancements in suspension component strength, stiffness, and travel length. Moreover, the rapid expansion of the e-MTB segment is profoundly impacting suspension design, requiring manufacturers to develop robust solutions capable of handling the extra weight and sustained higher speeds of electric-assist bicycles. Product differentiation, often achieved through patented damping technologies and weight optimization strategies, remains a crucial competitive element among leading market participants.

Mountain Bike Suspension Market Executive Summary

The Mountain Bike Suspension Market is poised for robust expansion, driven primarily by favorable business trends emphasizing lightweight component design, electronic integration, and specialization across distinct biking disciplines. Business trends indicate a strong focus on direct-to-consumer models alongside traditional OEM supply chains, allowing niche manufacturers to capture market share through specialized, high-end tuning services and customized products. Strategic mergers and acquisitions, such as those observed among major groups like SRAM and Fox Factory, continue to consolidate market leadership, driving economies of scale while accelerating technological deployment. Investment in advanced materials, including specialized aluminum alloys and carbon fiber reinforced polymers, is crucial for meeting the stringent weight-to-strength requirements demanded by modern, aggressive riding standards.

Regional trends highlight the prominence of North America and Europe as the primary revenue generators, characterized by high disposable incomes, deeply established mountain biking cultures, and extensive trail infrastructure. Asia Pacific, particularly countries like China and emerging Southeast Asian markets, is projected to exhibit the highest growth CAGR, fueled by rapid urbanization, increasing accessibility to entry-level and mid-range mountain bikes, and government initiatives promoting cycling. These emerging regions offer significant opportunities for manufacturers targeting the mass-market segment, necessitating the development of cost-effective, durable suspension solutions that still incorporate fundamental performance technologies. Furthermore, competitive regional dynamics often revolve around intellectual property protection related to patented damping mechanisms and air spring designs.

Segmentation trends reveal that the Air Suspension segment dominates the market by revenue, favored for its adjustability, lightweight nature, and broad applicability across Cross-Country (XC) and Trail riding. However, the Coil Suspension segment is experiencing a resurgence in specialized areas like Downhill (DH) and Enduro, driven by the perceived superior consistency, sensitivity, and reliability under continuous heavy usage. In terms of application, the Trail and Enduro segments represent the fastest-growing categories, reflecting the increasing popularity of versatile bikes capable of both climbing and aggressive descending. Manufacturers are consequently focusing R&D efforts on developing longer-travel, highly efficient forks (150mm–180mm) and advanced rear shocks that incorporate sophisticated hydraulic bottom-out control and position-sensitive damping to cater effectively to these high-demand disciplines.

AI Impact Analysis on Mountain Bike Suspension Market

User queries regarding the impact of Artificial Intelligence on the Mountain Bike Suspension Market primarily center on performance optimization, predictive maintenance, and customization. Consumers and industry professionals frequently ask: "How can AI automatically tune my suspension for different terrain?" and "Will AI reduce the need for manual setup and adjustment?" The core concerns revolve around data privacy related to ride metrics collected by smart suspension systems and the cost-effectiveness of integrating complex electronic and AI-driven components. Expectations are high, anticipating personalized damping curves, real-time adjustments based on rider input and terrain recognition (often utilizing accelerometers and GPS data), and diagnostics that alert riders to component wear before failure occurs, thereby enhancing safety and performance repeatability across challenging environments.

AI's influence is transforming suspension systems from purely mechanical devices into sophisticated electro-mechanical platforms capable of instantaneous adaptation. By integrating machine learning algorithms, manufacturers can process vast datasets—including speed, impact forces, pedal input, and fork/shock position—to generate optimized damping adjustments in milliseconds. This capability moves suspension technology beyond conventional platform valves and manual adjustments, offering true dynamic control. Furthermore, AI contributes significantly to the manufacturing pipeline through advanced simulation and Finite Element Analysis (FEA), allowing engineers to optimize material usage and stress resistance, resulting in lighter, stronger, and more reliable suspension components tailored to specific demands of competitive and recreational riders.

- AI enables real-time dynamic damping adjustment based on terrain and riding inputs (Smart Suspension Systems).

- Predictive maintenance analytics monitor component wear (e.g., seal friction, oil degradation), scheduling optimal service intervals.

- Machine learning algorithms optimize manufacturing tolerances and material structure through advanced simulation.

- Automated setup guides utilize rider weight and bike geometry data to establish optimal baseline pressure and volume settings.

- Integration of sensor data (accelerometers, gyroscope) feeds ML models for enhanced traction control and anti-squat performance.

DRO & Impact Forces Of Mountain Bike Suspension Market

The dynamics of the Mountain Bike Suspension Market are shaped by powerful Drivers promoting growth, specific Restraints limiting expansion, and lucrative Opportunities that promise future innovation, all interacting under various Impact Forces. The primary drivers include the escalating global interest in adventure sports and mountain biking participation, supported by continuous product innovation that makes higher performance accessible to a broader consumer base. Restraints predominantly involve the high complexity and corresponding premium pricing associated with professional-grade components, which limits uptake in price-sensitive markets, alongside maintenance challenges requiring specialized tools and knowledge. Opportunities lie significantly in the expanding e-MTB segment and the commercialization of smart, electronically controlled suspension systems, promising superior riding experiences and ease of tuning for consumers.

Market growth is strongly driven by the relentless pursuit of performance improvement among enthusiast and professional riders, fueling demand for technologically superior products. Furthermore, advancements in trail development and the proliferation of accessible bike parks globally contribute directly to higher utilization rates of mountain bikes, accelerating the wear and tear on components and thus increasing replacement market demand. Regulatory requirements related to product safety and environmental sustainability, particularly concerning hydraulic fluids and manufacturing processes, also subtly influence market offerings, pushing manufacturers toward eco-friendlier and more reliable designs. The perceived status associated with owning high-end suspension brands also acts as a socio-economic driver, particularly in established markets where brand loyalty is high.

The market faces inherent constraints, primarily revolving around the economic barrier to entry for high-performance suspension components. Specialized damping technologies require precision engineering and complex assembly, driving up manufacturing costs. Furthermore, the reliance on proprietary technologies and specialized service intervals can create consumer reluctance due to the perceived long-term ownership cost and reliance on authorized service centers. Analyzing the impact forces reveals that the Bargaining Power of Suppliers is moderately high, particularly for unique raw materials (like high-grade aluminum, titanium springs, or specialized seals) and patented hydraulic technologies. The Threat of New Entrants is relatively low due to the high R&D investment required and the necessity of establishing deep trust and brand recognition within the niche cycling community. Buyer power is moderate; while volume buyers (OEMs) exert significant pressure, individual consumer purchasing power is often constrained by brand preference and product specialization.

Segmentation Analysis

The Mountain Bike Suspension Market is comprehensively segmented based on product type, damping technology, application, and distribution channel, providing a granular view of market dynamics and consumer preferences. Product segmentation differentiates between front fork suspension, which manages steering and front wheel impact, and rear shock suspension, which controls the main pivot of the bicycle frame. Damping technology distinguishes between the widely popular air-sprung systems, favored for adjustability and low weight, and coil-sprung systems, preferred for their sensitivity and superior consistency under heavy load. Understanding these segment dynamics is crucial for manufacturers to tailor their product lines and marketing strategies to specific rider needs and financial profiles across diverse global regions.

Application-based segmentation is critical, reflecting the highly specialized nature of modern mountain biking. Cross-Country (XC) suspension requires extreme efficiency and lightweight construction, often incorporating extensive lockout mechanisms to optimize climbing performance. Conversely, Downhill (DH) suspension systems demand maximum travel, exceptional heat dissipation, and robust structural integrity to handle successive, high-energy impacts. The growing Trail and Enduro segments necessitate hybrid solutions, often featuring mid-to-long travel (130mm to 180mm) with advanced mid-stroke support and tunability, reflecting the requirement for components that can perform equally well on climbs and aggressive descents. This specialization dictates material choice, hydraulic circuit design, and overall component architecture.

The distribution channel analysis, covering OEM (Original Equipment Manufacturer) sales and the aftermarket, highlights differing profit margins and volume strategies. OEM sales represent high volume but generally lower margin sales, where suspension units are integrated into new bicycle builds. The aftermarket, comprising replacement and upgrade components sold through retailers, bike shops, and online platforms, represents higher-margin opportunities driven by enthusiast spending on performance enhancements. The robust aftermarket segment confirms the high engagement level of core mountain biking consumers who frequently seek to upgrade or customize their bike’s performance attributes beyond the stock configuration.

- By Product Type:

- Fork Suspension

- Rear Suspension (Shock)

- By Damping Technology:

- Air Suspension

- Coil Suspension

- By Application:

- Cross-Country (XC)

- Trail/All-Mountain

- Enduro

- Downhill (DH)

- By Distribution Channel:

- Original Equipment Manufacturer (OEM)

- Aftermarket

Value Chain Analysis For Mountain Bike Suspension Market

The Value Chain for the Mountain Bike Suspension Market is characterized by highly technical input stages, precision manufacturing, and strategic distribution networks. Upstream activities involve sourcing specialized raw materials such as high-grade aluminum alloys (7000 series), chromium-plated steel, carbon fiber composites, and proprietary elastomers and seals. Research and Development (R&D) forms a critical upstream component, requiring substantial investment in fluid dynamics, mechanical testing, and software development for electronic systems. Suppliers of patented damping cartridges, highly precise CNC machining services, and specialized coatings (like Kashima or DLC coatings) wield significant influence, determining component quality, durability, and cost structure early in the chain.

Midstream activities focus on the actual manufacturing, assembly, and quality control of the suspension units. This stage demands extreme precision (often involving micron-level tolerances) to ensure the smooth operation of telescoping tubes and the consistent performance of hydraulic circuits. Assembly requires specialized cleanroom environments, particularly for high-end shocks and forks, to prevent contamination that could compromise damping performance. Efficient supply chain management and inventory control are crucial here, balancing the need for quick turnaround times for OEM partners against the specialized, lower-volume requirements of the aftermarket segment. The integration of advanced manufacturing technologies, such as robotic assembly and automated testing rigs, is becoming standard practice to ensure product consistency and meet stringent quality standards.

Downstream analysis focuses on distribution and sales channels, categorized into direct and indirect paths. Direct distribution often involves sales to major bicycle manufacturers (OEMs) like Specialized, Trek, or Giant, where large volumes of components are integrated into new bike models. Indirect distribution primarily serves the aftermarket through a network of specialized bicycle distributors, physical retailers, and e-commerce platforms. High-value, specialized components often rely on expert advice provided by local bike shops for selection, installation, and tuning, making these shops critical touchpoints. Service centers and authorized tuners also form a crucial part of the downstream value chain, providing maintenance and custom tuning services that extend the product lifecycle and enhance consumer satisfaction, differentiating premium brands from mass-market offerings.

Mountain Bike Suspension Market Potential Customers

Potential customers for the Mountain Bike Suspension Market span a broad range, segmented primarily by skill level, riding discipline, and frequency of use, but fundamentally revolve around entities involved in bicycle manufacturing, retail, and end-user riding. The largest volume customer segment is Original Equipment Manufacturers (OEMs)—global bicycle brands that purchase suspension components in bulk for factory assembly onto new bicycles across various price points, from entry-level trail bikes to professional-grade downhill machines. OEMs prioritize supply consistency, bulk pricing discounts, and components that meet specific design parameters (e.g., axle spacing, steering tube standards) mandated by their frame designs. Partnerships with leading suspension suppliers are strategic for OEMs, as component quality significantly impacts the overall perceived value and performance of the bicycle.

The second major category involves the diverse array of end-users or individual riders, who are further segmented into recreational riders, dedicated enthusiasts, and professional athletes. Recreational riders typically seek durable, low-maintenance, and cost-effective solutions for occasional riding. Dedicated enthusiasts and racers represent the high-value aftermarket segment, constantly seeking performance upgrades, custom tuning services, and the latest technological advancements to gain a competitive edge or enhance their riding experience. These consumers are highly educated about suspension kinematics and damping technologies, often relying on specialized retailers and online communities for detailed product reviews and specifications before making significant investment decisions in performance components.

Furthermore, specialized service centers, custom builders, and tuning workshops constitute a significant segment of indirect customers. These entities purchase replacement parts, proprietary tools, fluids, and specialized upgrade kits (e.g., air spring volumes, damper cartridges) to service and modify existing suspension units for their clientele. This segment is highly influential in driving brand perception and specialized demand, particularly for niche, high-performance tuning solutions offered by boutique suspension companies. The emergence of the electric mountain bike (e-MTB) consumer also represents a rapidly growing buyer profile, characterized by the need for robust, heavy-duty suspension units designed to withstand the unique forces and sustained speeds associated with assisted riding, often prioritizing durability and predictable handling over minimal weight.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 1.9 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Fox Factory, SRAM (RockShox), DVO Suspension, Öhlins Racing, Marzocchi, Cane Creek Cycling Components, Suntour (SR Suntour), X-Fusion Suspension, Formula, BOS Suspension, PUSH Industries, Intend Bicycle Components, Manitou, DT Swiss, EXT Racing Shox, Specialized, Trek, WP Suspension, Fast Suspension, MRP. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Mountain Bike Suspension Market Key Technology Landscape

The technology landscape of the Mountain Bike Suspension Market is rapidly evolving, moving beyond simple mechanical springs and oil dampers toward highly sophisticated electro-hydraulic systems and advanced material compositions. A primary technological focus remains on hydraulic damping circuits, specifically developing proprietary valves that manage low-speed and high-speed compression and rebound independently (LSC, HSC, LSR, HSR). Technologies such as position-sensitive damping, utilized in shocks like Fox’s Live Valve or specialized Öhlins components, allow the damping force to change dynamically based on the shock’s travel position, offering firmer support in the middle stroke for pedaling efficiency and plushness deeper into the travel for absorbing major impacts. Air spring technology is advancing through volume spacers and self-equalizing positive/negative chambers, enabling riders to precisely adjust the spring curve (linearity/progressiveness) without invasive internal modifications.

Another significant area of technological investment is electronic and smart suspension systems. These systems incorporate internal sensors (accelerometers and position sensors) that collect data on impacts, terrain gradients, and pedaling forces hundreds of times per second. Microprocessors then instantaneously adjust the damping settings via electronically controlled solenoids or motor-driven valves. This technology, exemplified by products like RockShox’s Flight Attendant or specialized OEM electronic integrations, removes the need for manual tuning and maximizes efficiency by automatically locking out the suspension for climbing or firming it up for sprints, providing a competitive edge in racing and enhancing the versatility of trail bikes. The integration of Bluetooth connectivity and companion apps allows riders to monitor performance metrics and download over-the-air firmware updates for further optimization.

Material science and surface treatments also play a crucial role in performance and durability. Manufacturers utilize sophisticated surface coatings—such as hard anodization, proprietary low-friction coatings (like Kashima Coat or black Diamond Like Carbon/DLC coating), and specialized low-stiction seals—to minimize friction between moving parts (stanchions and seals). Reduced friction enhances small-bump sensitivity, which is critical for maintaining traction and rider comfort. Furthermore, advancements in chassis design focus on increasing stiffness-to-weight ratios, achieved through highly optimized hollow-crown forks and carbon fiber components in both the upper structure and sometimes the inner parts of the damper cartridge. These structural enhancements are essential to manage the immense bending and torsional forces encountered during aggressive riding and high-speed cornering, ensuring steering precision and component longevity.

Regional Highlights

- North America: North America, particularly the United States and Canada, represents a mature and dominant market segment for high-end and aftermarket suspension components. The region is characterized by a strong enthusiasm for technical mountain biking disciplines (Enduro and Downhill) and high consumer disposable income, fostering demand for premium, electronically controlled, and customized suspension products. Key market drivers include extensive trail networks, high frequency of recreational riding, and the presence of numerous industry-leading manufacturers and technology innovators, ensuring rapid adoption of new standards and performance features. The strong OEM presence of major global bike brands also stabilizes demand for mass-market components.

- Europe: Europe holds a substantial market share, driven by strong cycling culture, widespread accessibility to organized cycling events, and diverse topography supporting all mountain bike disciplines, from Alpine downhill to Cross-Country marathons. Germany, the UK, and Switzerland are key markets, showing robust demand for both performance-oriented components and reliable, durable suspension tailored for e-MTBs, which have experienced exponential growth across the continent. European consumers often prioritize robust build quality and adherence to strict manufacturing and environmental standards, influencing design choices toward long-lasting, serviceable components.

- Asia Pacific (APAC): The APAC region is the fastest-growing market, primarily fueled by increasing urbanization, rising disposable incomes in developing economies like China, India, and Southeast Asia, and infrastructural development supporting cycling tourism and recreation. While the region currently exhibits high demand for entry-to-mid-level suspension units (OEM segment), the rapid emergence of a high-net-worth consumer class is boosting the aftermarket for premium components. Japan and Australia are established high-value markets, mirroring North American and European trends in performance and technology adoption, positioning the region as a critical future growth engine.

- Latin America & Middle East/Africa (MEA): These regions represent emerging opportunities characterized by infrastructural limitations but a growing enthusiasm for cycling. Latin America, particularly Brazil and Colombia, shows potential for recreational cycling markets. The MEA region remains nascent, with demand focused on durable, lower-maintenance components suitable for varied and often harsh climates. Growth in these regions is dependent on improved economic stability, greater access to recreational infrastructure, and effective distribution networks to combat counterfeit products.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Mountain Bike Suspension Market.- Fox Factory Inc.

- SRAM LLC (RockShox)

- Öhlins Racing AB

- DVO Suspension

- Manitou (Haynes Bicycle Group)

- SR Suntour

- Marzocchi (owned by Fox Factory)

- Cane Creek Cycling Components

- X-Fusion Suspension

- Formula S.p.A

- BOS Suspension

- PUSH Industries

- Intend Bicycle Components

- DT Swiss

- EXT Racing Shox

- Fast Suspension

- MRP

- WP Suspension

- Specialized Bicycle Components

- Trek Bicycle Corporation

Frequently Asked Questions

Analyze common user questions about the Mountain Bike Suspension market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between air suspension and coil suspension in mountain bikes?

Air suspension uses pressurized air as the spring medium, offering significant weight savings, high adjustability of the spring rate via air pressure, and tunable progressiveness using volume spacers. Coil suspension uses a physical steel or titanium spring, known for its superior small-bump sensitivity, linear spring rate, and exceptional consistency over long, rough descents, but it is typically heavier and requires changing the physical spring for major adjustments.

How is the growth of the E-MTB segment impacting mountain bike suspension design?

E-MTBs are heavier and typically generate higher sustained speeds than traditional mountain bikes, requiring suspension components to be significantly more robust, durable, and capable of dissipating more heat. Manufacturers are developing specific e-MTB rated forks and shocks with reinforced chassis, increased damping control, and heavier-duty air springs or coil rates to manage the added mass and forces effectively, focusing on longevity and safety.

What is 'smart suspension' and how does it optimize performance?

Smart suspension, or electronic suspension, utilizes integrated sensors (accelerometers, position sensors) and machine learning algorithms to monitor terrain and rider input in real-time. This system automatically adjusts the internal damping circuits (compression and rebound) instantaneously, optimizing traction, eliminating unwanted suspension movement during pedaling (bob), and maximizing efficiency without requiring the rider to manually flip lockout levers.

Which geographical region leads the demand for high-performance aftermarket suspension components?

North America and Europe consistently lead the demand for high-performance, aftermarket mountain bike suspension components. This dominance is driven by high disposable income among enthusiasts, deeply entrenched mountain biking cultures, extensive network of challenging trails, and a strong preference for performance customization and technological upgrades over stock components.

What are the main technological drivers pushing innovation in mountain bike shocks and forks?

The main technological drivers include the integration of AI and electronic damping systems for real-time adjustment, advancements in proprietary hydraulic circuits offering independent high and low-speed tuning, and continuous material science innovation focusing on lightweight, high-strength chassis components and specialized low-friction coatings (like Kashima and DLC) to enhance sensitivity and durability.

Why is tuning complexity considered a restraint in the mass adoption of premium suspension?

Premium suspension components offer highly sophisticated adjustments (multiple compression/rebound circuits, air volume adjustments, hydraulic bottom-out). This complexity requires specialized knowledge and tools for proper setup and maintenance, which can be intimidating for casual riders. This acts as a barrier, often leading mass-market consumers to prefer simpler, less tunable, but more straightforward suspension systems.

How do manufacturers ensure the reliability and longevity of their suspension seals and materials?

Manufacturers invest heavily in proprietary seal materials (elastomers and plastics) designed for minimal friction (stiction) and maximum durability against contaminants like dirt and moisture. They utilize advanced surface treatments, such as hard anodization and low-friction coatings on stanchions, to reduce wear and maintain smooth operation under extreme temperature and pressure variations, crucial for long-term reliability.

What is the significance of the OEM segment versus the Aftermarket segment in terms of revenue?

The OEM (Original Equipment Manufacturer) segment accounts for the highest volume of units sold, providing components for new bike assembly, but often operates at lower profit margins due to bulk purchasing. The Aftermarket segment, consisting of replacements and upgrades sold to consumers, generates higher profit margins per unit due to the focus on high-performance, specialized components purchased by dedicated enthusiasts seeking customization and superior features.

How does suspension travel length relate to mountain bike application segments?

Suspension travel length is directly correlated with application: Cross-Country (XC) bikes typically use 100mm–120mm for efficiency and climbing speed; Trail/All-Mountain bikes use 130mm–150mm for versatility; Enduro bikes use 160mm–180mm for aggressive descending capability; and Downhill (DH) bikes use 180mm–200mm+ for maximum impact absorption and control on severe terrain.

What role does Finite Element Analysis (FEA) play in the development process?

FEA is a critical upstream R&D tool used to simulate the stresses and strains on suspension components under realistic riding conditions. It allows engineers to optimize material distribution, identify potential failure points, and refine the geometry of forks and shocks. This process ensures components meet stringent strength, stiffness, and weight requirements before expensive physical prototyping begins, significantly speeding up the product development cycle.

Beyond performance, what environmental factors are influencing suspension manufacturing?

Environmental considerations are leading manufacturers to focus on sustainable practices, including minimizing waste from CNC machining, utilizing environmentally safer hydraulic fluids (biodegradable oils), and ensuring that packaging materials are recyclable. Furthermore, product design is increasingly centered on serviceability and component longevity to reduce the overall consumption lifecycle.

What is the market impact of proprietary damping systems (e.g., specific cartridges or valves)?

Proprietary damping systems are a key differentiator and source of competitive advantage. They create brand loyalty and technological lock-in, as riders seeking specific performance characteristics must adhere to a particular brand's component ecosystem for service and upgrades. This drives premium pricing and protects market share for technology leaders.

How are advancements in carbon fiber technology affecting fork and shock design?

Carbon fiber is increasingly utilized in fork crowns and sometimes shock bodies due to its exceptional stiffness-to-weight ratio. This material allows manufacturers to reduce overall component weight while improving steering precision and torsional stiffness, critical features for competitive racing and high-performance trail riding, where weight savings directly translate into performance gains.

What challenges do manufacturers face regarding international regulatory standards?

Manufacturers must adhere to varying safety and import regulations across regions (e.g., EU, US, China). Challenges include compliance with specific material restrictions (REACH regulations in Europe), mandatory safety testing standards (like CEN standards), and varying customs duties and tariffs, which complicate global distribution and add layers of administrative cost.

How does the complexity of the supply chain affect manufacturing timelines in the suspension market?

The supply chain is complex due to the reliance on specialized global suppliers for patented seals, highly specific aluminum extrusions, and advanced coatings. Geopolitical instability, logistics disruptions, and global events can severely impact the lead times for these high-precision components, causing delays in OEM bicycle production and aftermarket availability, necessitating robust inventory strategies.

What defines the emerging growth potential of the APAC region for suspension components?

The APAC region's growth potential is defined by rapidly expanding middle-class populations, increased investment in urban and recreational infrastructure supporting cycling, and the shift of manufacturing operations closer to end-markets. While price sensitivity remains, the increasing sophistication of riders in countries like China and South Korea drives up demand for quality components.

How significant is rider weight and input in suspension performance and why is it personalized?

Rider weight, riding style (aggressive vs. passive), and pedaling input fundamentally dictate the required spring rate and damping settings. Suspension must be personalized to match the rider’s sag (static compression) and prevent excessive bottom-out. Personalized tuning ensures maximum traction and efficiency, making customizable air springs and precise hydraulic adjustments essential for high performance.

In the aftermarket, what factors drive consumer decisions between upgrading and servicing their current suspension?

Consumers often choose to service their current suspension for cost-effectiveness, especially if the unit is high-quality. However, they opt for an upgrade when significant technological advancements (e.g., electronic integration, new damping architecture) offer performance benefits unavailable in their current model, or when the unit has reached the end of its functional life or is incompatible with new bike standards (e.g., axle boost spacing).

What is the concept of 'Anti-Squat' and how does suspension engineering address it?

Anti-squat is the suspension system’s inherent ability to resist compression caused by pedaling forces (chain tension). Engineers design suspension kinematics and damping systems (often using platform or inertia valves) to counteract squat during acceleration, ensuring that pedaling energy propels the bike forward efficiently rather than being wasted by compressing the rear shock, particularly crucial in XC and Trail riding.

How does predictive maintenance technology reduce long-term ownership costs?

Predictive maintenance uses sensor data and AI to analyze the performance degradation of components (like seals or damping oil) and accurately forecast when service is required, preventing catastrophic failures that often result in expensive repairs or complete replacement. By optimizing service intervals, it minimizes unexpected downtime and ensures components operate at peak efficiency throughout their lifespan, reducing overall ownership cost.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager