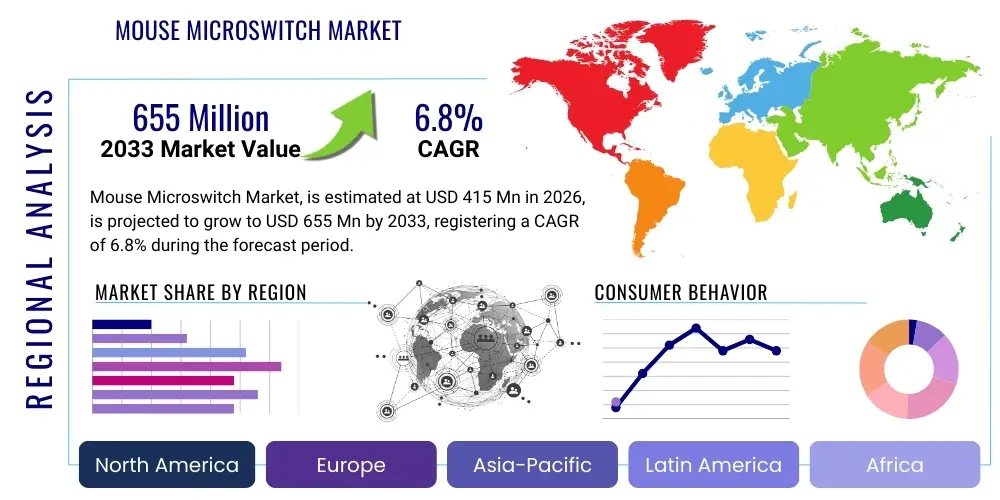

Mouse Microswitch Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435147 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Mouse Microswitch Market Size

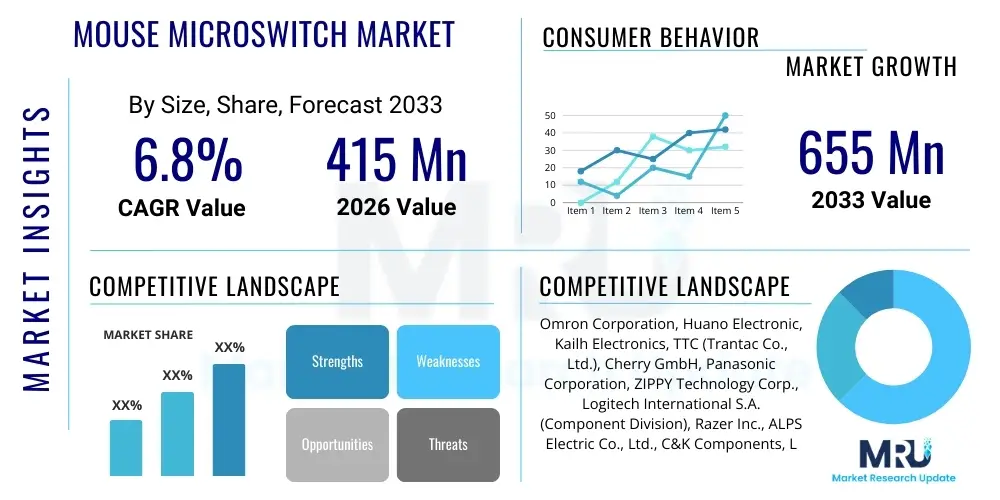

The Mouse Microswitch Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 415 Million in 2026 and is projected to reach USD 655 Million by the end of the forecast period in 2033.

Mouse Microswitch Market introduction

The Mouse Microswitch Market encompasses the manufacturing, distribution, and sales of miniature, high-reliability snap-action switches specifically designed for integration into computer mouse peripherals. These components are fundamental to the functionality of modern input devices, dictating the tactile feedback, click force, and overall lifespan of the mouse. A microswitch operates on a highly precise mechanism that involves minimal movement to initiate a circuit closure, offering rapid actuation and consistent performance critical for both casual and high-demand applications, such as professional gaming and industrial control interfaces. Market growth is fundamentally tied to the global demand for computing hardware and the continuous innovation within the peripheral electronics sector, particularly the drive towards higher durability and lower latency.

Product descriptions within this market segment revolve around key technical specifications including operational cycles (ranging from 5 million to 100 million clicks), contact material composition (e.g., gold alloys or silver contacts for enhanced conductivity), and actuation force measured in grams. Major applications span across consumer electronics, including standard office mice, advanced ergonomic input devices, and professional-grade gaming mice, which constitute a significant demand driver due to their stringent requirements for reliability and responsiveness. The benefits derived from high-quality microswitches include improved user experience through consistent tactile feedback, extended product life, and minimized mechanical failure, directly enhancing customer satisfaction and brand loyalty in the competitive mouse manufacturing space. Furthermore, the selection of an appropriate microswitch is vital for achieving specific ergonomic and performance targets in premium peripherals.

Key driving factors accelerating market expansion include the explosive growth of the eSports industry globally, which demands specialized, ultra-durable gaming peripherals capable of enduring intense use. Technological advancements in switch design, such as the transition from traditional mechanical contacts to optical-based actuation mechanisms, are significantly reducing debounce time and further extending lifespan, attracting premium segment buyers. Moreover, the steady increase in remote work and digital interaction across corporate and educational sectors sustains the baseline demand for reliable office peripherals. These factors, combined with intense competition among peripheral manufacturers who seek differentiation through superior components, ensure continued investment and innovation within the Mouse Microswitch Market, particularly focusing on optimizing the balance between cost, performance, and durability.

Mouse Microswitch Market Executive Summary

The Mouse Microswitch Market executive summary highlights a robust trajectory driven primarily by the escalating demand for high-performance computing peripherals, especially within the gaming sector. Business trends indicate a strategic shift towards vertical integration among larger component suppliers, aiming to secure long-term contracts with major original equipment manufacturers (OEMs). Furthermore, intense focus on material science advancements is creating opportunities for non-traditional switch technologies, such as optical and magnetic switches, which offer competitive advantages in longevity and speed over conventional mechanical designs. The market is characterized by a high volume of production concentrated in East Asia, reflecting global supply chain dynamics. Key stakeholders are investing heavily in automation to achieve tighter manufacturing tolerances and improved quality control, thereby enhancing the perceived value of their components in the premium segments.

Regionally, the Asia Pacific (APAC) continues its dominance, serving as both the principal manufacturing hub and the largest consumer market, fueled by the region's massive population base, high penetration of internet cafes, and strong eSports culture. North America and Europe demonstrate mature market characteristics, with demand focusing heavily on premium, high-cycle-life switches and ergonomic designs suitable for professional use and content creation. These developed markets show a strong inclination towards branded switches known for guaranteed quality and consistency, impacting regional pricing dynamics. Emerging markets in Latin America and the Middle East & Africa are displaying accelerating growth, correlated with rising PC penetration rates and improving digital infrastructure, suggesting future expansion opportunities, particularly in the entry-level and mid-range segments.

Segment trends reveal that the mechanical microswitch category, while facing competition, maintains the largest market share due to its cost-effectiveness and proven reliability, dominating standard consumer and office peripherals. However, the optical microswitch segment is experiencing the fastest growth, primarily adopted by high-end gaming mouse manufacturers who require zero debounce and unparalleled durability, often reaching 100 million clicks or more. Segmentation by operating force also indicates increasing demand for customized solutions, catering to the nuanced preferences of professional gamers and users seeking personalized ergonomic comfort. The shift towards higher durability ratings across all segments underscores a major consumer expectation: that premium peripherals must withstand extensive, long-term use, pushing manufacturers to continuously improve material quality and component resilience.

AI Impact Analysis on Mouse Microswitch Market

Analysis of common user questions regarding the impact of Artificial Intelligence (AI) on the Mouse Microswitch Market reveals key themes centered on design optimization, predictive failure analysis, and personalized user experience. Users frequently ask if AI algorithms can design switches with optimal acoustic profiles and tactile feedback specific to user cohorts, transcending traditional trial-and-error R&D methods. Concerns also emerge about whether the integration of AI-driven peripheral software, capable of compensating for microswitch wear and tear (e.g., drift calibration), might reduce the perceived necessity for ultra-high durability hardware, thereby impacting demand for premium components. A critical area of inquiry involves using AI in quality control during manufacturing, particularly for automated visual inspection and performance testing, ensuring that millions of switches meet incredibly tight specifications before assembly.

The consensus among market observers and technical users is that AI will primarily serve as an accelerant for component innovation and quality assurance rather than a direct threat to hardware demand. AI-driven simulation tools allow engineers to rapidly test millions of design variations related to spring stiffness, pivot points, and contact geometry, significantly shortening the development cycle for next-generation microswitches. This accelerated design capability enables companies to respond faster to evolving ergonomic and performance requirements dictated by the eSports community and professional users. Furthermore, applying machine learning models to analyze failure data from field returns and stress testing helps manufacturers pinpoint subtle design flaws or material weaknesses that traditional analytical methods might overlook, leading to vastly improved Mean Time Between Failures (MTBF) and overall product reliability.

Crucially, AI is being leveraged to optimize manufacturing yield and consistency. In highly automated production lines, AI systems monitor sensor data in real-time, adjusting machinery parameters to maintain stringent micron-level tolerances required for high-performance microswitches. This level of precision is vital for maintaining the homogeneous click feel across mass-produced units—a key factor for OEM consistency. Additionally, AI-powered personalization software embedded in mice allows users to customize actuation profiles, often requiring the switch itself to provide precise, repeatable electrical signals that AI can interpret and adjust. This symbiotic relationship ensures that hardware quality remains paramount, as software-based personalization relies heavily on the underlying precision and responsiveness of the microswitch hardware, thereby sustaining the demand for high-fidelity components.

- AI-driven generative design optimizes switch acoustics and tactile feedback profiles.

- Machine learning enhances manufacturing quality control and defect prediction, boosting yield.

- AI algorithms facilitate predictive failure analysis, extending product warranty periods.

- Real-time data processing through AI software compensates for minor switch degradation, enhancing user longevity.

- AI assists in analyzing competitive performance data, identifying optimal material selections for durability.

DRO & Impact Forces Of Mouse Microswitch Market

The dynamics of the Mouse Microswitch Market are governed by a complex interplay of Drivers, Restraints, and Opportunities (DRO), collectively forming the Impact Forces shaping industry growth. Key drivers include the exponential expansion of the professional gaming and eSports ecosystem, necessitating switches with exceptionally high durability (50 million to 100 million clicks) and minimal latency. This high-performance requirement pushes continuous technological investment. Opportunities are significant in emerging markets where PC and peripheral adoption is surging, and in the niche market for specialized ergonomic and accessibility mice. Conversely, primary restraints involve intense pricing pressure from low-cost Asian manufacturers and the ongoing challenge of maintaining supply chain stability for specialized contact materials like gold alloys, which are crucial for premium switch longevity and conductivity. The aggregate impact forces suggest a market moving towards specialization, where high-volume, low-margin products coexist alongside low-volume, high-margin specialized components.

A major driving force is the relentless pursuit of speed and responsiveness in competitive gaming. Peripheral manufacturers differentiate their products by touting superior component performance, making the microswitch a critical marketing point. This necessitates continuous R&D into optical and magnetic actuation technologies that inherently eliminate mechanical wear and debounce delay, thereby raising the performance ceiling. Furthermore, the trend toward customizable and modular peripherals means that microswitches must be designed for easy hot-swapping, adding complexity to component design but expanding market appeal. Another significant driver is the increasing regulatory focus on electronic waste and component longevity, pushing OEMs to select switches that guarantee a longer product lifespan, indirectly boosting demand for high-cycle rated units and discouraging the use of lower-quality alternatives.

However, the market faces notable restraints, particularly the risk of commoditization in the standard segment. The high entry barrier regarding precision manufacturing and IP protection is countered by the ease with which basic switch designs can be replicated, leading to severe price competition for mid-range products. Another crucial restraint is the inherent technological limitation of mechanical switches, which suffer from metal fatigue and contact bounce over time, encouraging a search for alternative, non-mechanical solutions that are often costlier to implement. Despite these challenges, vast opportunities exist in integrating microswitches into broader industrial and medical Human-Machine Interface (HMI) applications beyond traditional PC peripherals, leveraging their reliability and small form factor. Developing environmentally sustainable and lead-free microswitch production processes also presents a strategic opportunity for differentiation and compliance in environmentally conscious markets like Europe, influencing future design material selection.

Segmentation Analysis

The Mouse Microswitch Market is comprehensively segmented based on technology type, life cycle rating, operating force, and end-use application, providing a granular view of market dynamics and consumer preferences. Understanding these segments is crucial for manufacturers to tailor their product offerings and strategic investments. The primary segmentation by technology type distinguishes between mechanical, optical, and emerging non-contact switches, reflecting the performance tiers and cost structures within the industry. Further segmentation by durability (e.g., 10 million cycles vs. 50 million cycles) directly correlates with the target application, determining whether the switch is destined for budget office mice or professional-grade gaming equipment. This layered analysis allows stakeholders to identify high-growth niches, such as the segment demanding ultra-low operating force switches for competitive first-person shooter (FPS) games.

Detailed analysis of the market by life cycle rating reveals a strong polarization in demand. The high-volume, standard market primarily consumes switches rated between 5 million and 20 million clicks, balancing cost efficiency with adequate longevity for typical office environments. Conversely, the high-end gaming and professional segment disproportionately drives demand for switches rated 50 million clicks and above, where component failure is unacceptable and premium pricing is often tolerated. This segmentation highlights the importance of materials science, as achieving higher cycle ratings requires specialized, often proprietary, contact alloys and rigorous manufacturing quality controls. The operating force segment reflects a critical ergonomic preference, with forces generally ranging from 50 grams to 90 grams. Gaming often prefers lighter actuation for faster clicking, while industrial applications might prefer heavier actuation for reduced accidental clicks, necessitating a diverse product portfolio from suppliers.

Segmentation by end-use application clearly delineates the largest consumption sectors. Gaming peripherals constitute the fastest-growing and most innovation-driven segment, continuously pushing the boundaries of required performance. General computing peripherals (office and home use) represent the largest volume segment, focusing on cost-effective reliability. Industrial and specialized input devices, while smaller in volume, demand extremely high reliability and often operate under harsh conditions, leading to unique technical requirements (e.g., sealed or dust-proof switches). The strategic importance of understanding end-use behavior allows component suppliers to align their production capabilities, ensuring they meet the specific performance criteria, regulatory compliance, and volume demands of diverse OEM clients, thereby maximizing market penetration and profitability across the entire product spectrum.

- Technology Type:

- Mechanical Microswitches (Standard, Silent)

- Optical Microswitches

- Magnetic (Hall Effect) Microswitches

- Life Cycle Rating (Durability):

- Under 20 Million Clicks

- 20 Million to 50 Million Clicks

- Above 50 Million Clicks (High-End Gaming)

- Operating Force:

- Light Force (50gf - 65gf)

- Medium Force (65gf - 75gf)

- Heavy Force (75gf and Above)

- End-Use Application:

- Gaming Peripherals

- General Computing (Office & Home)

- Industrial and Specialized Input Devices

Value Chain Analysis For Mouse Microswitch Market

The value chain for the Mouse Microswitch Market begins with the upstream suppliers of raw materials, primarily focusing on specialized metals and polymers. Upstream analysis involves sourcing critical components such as copper alloys (for terminals and moving contacts), precious metals like gold and silver (for contact surfaces to ensure low resistance and high cycle life), and various engineering plastics (for the housing and plungers). The precision required for these materials is extremely high, as tolerances directly impact the switch’s tactile feel and durability. Suppliers capable of providing high-purity, consistent materials are crucial strategic partners for microswitch manufacturers. The upstream costs are subject to global commodity price fluctuations, which significantly influence the final component price, making long-term procurement contracts essential for maintaining stable margins for switch producers.

The manufacturing stage, which includes highly automated stamping, molding, assembly, and rigorous quality testing, represents the core value-added activity. Leading microswitch manufacturers invest heavily in proprietary assembly technologies and testing apparatus to ensure consistent tactile and electrical characteristics across high volumes. Direct distribution channels are typically employed when dealing with large Original Equipment Manufacturers (OEMs) like Logitech, Razer, or Corsair, where customized specifications and volume pricing agreements are negotiated directly between the switch manufacturer and the peripheral brand. This direct model ensures rapid feedback loops regarding performance and supply adjustments. The complexity of managing these direct relationships requires specialized sales and technical support teams capable of integrating the switch design seamlessly into the client’s final mouse architecture.

Downstream analysis involves the final peripheral assembly manufacturers and the various distribution channels leading to the end-user. Indirect distribution often utilizes electronic component distributors (both global and regional specialized suppliers) who aggregate smaller orders from smaller peripheral makers or provide replacement parts for repair centers. The final layer of the value chain involves retail distribution, including e-commerce platforms, specialized electronics stores, and gaming outlets, which significantly influence brand perception and product accessibility. The efficiency of the downstream distribution channel, particularly its ability to rapidly deliver the finished mouse product to global consumers, directly impacts the derived demand for microswitches. Maintaining strong relationships across the entire value chain, from raw material sourcing to end-user feedback, is paramount for sustained competitive advantage and market responsiveness.

Mouse Microswitch Market Potential Customers

Potential customers in the Mouse Microswitch Market primarily consist of Original Equipment Manufacturers (OEMs) and Original Design Manufacturers (ODMs) specializing in computer peripherals and related input devices. These are the direct buyers who integrate the microswitches into their final products. Major customers fall into three distinct categories: high-end gaming peripheral manufacturers (who demand the highest cycle ratings and proprietary actuation technologies), mass-market consumer electronics brands (who prioritize cost efficiency and reliable performance for general use), and specialized industrial equipment producers (who require robust, sealed switches for harsh operating environments). The purchasing decisions of these customers are driven by a blend of technical specifications, reliability data, unit cost, and the supplier's capacity to handle massive production volumes with consistent quality.

The second tier of potential customers includes specialized system integrators and custom peripheral builders, particularly those serving the professional eSports scene or niche ergonomic markets. These buyers often require smaller, highly customized batches of switches, sometimes demanding unique tactile or acoustic profiles. While their volume is lower than tier-one OEMs, they represent a high-margin opportunity for suppliers capable of flexible manufacturing and rapid prototyping. Furthermore, the after-market and repair industry also constitutes a substantial customer base, comprising independent repair shops, professional modders, and individual enthusiasts who purchase switches directly through distributors for replacement and upgrade purposes. This segment is highly sensitive to brand reputation and component availability, favoring switches known for their modding community support and documentation.

Ultimately, the actual end-users—professional gamers, office workers, graphic designers, and industrial operators—act as indirect, yet highly influential, customers. Their evolving preferences for click responsiveness, durability, and ergonomic feel dictate the design parameters adopted by the direct OEM customers. For example, a shift in professional gaming preference towards "lighter click" switches immediately translates into purchasing specifications issued by major gaming mouse brands to microswitch suppliers. Therefore, suppliers must not only satisfy the technical requirements of the OEMs but also anticipate and react to the macro-trends driven by millions of end-user interactions, using comprehensive market research to inform future product roadmaps and investment in specific operational force and durability segments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 415 Million |

| Market Forecast in 2033 | USD 655 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Omron Corporation, Huano Electronic, Kailh Electronics, TTC (Trantac Co., Ltd.), Cherry GmbH, Panasonic Corporation, ZIPPY Technology Corp., Logitech International S.A. (Component Division), Razer Inc., ALPS Electric Co., Ltd., C&K Components, Ltd., Honeywell International Inc., TE Connectivity, Saia-Burgess Controls AG, Marathon Special Products, Eaton Corporation, Siemens AG, ZF Electronics (Now CHERRY), Microswitch Technology (China), D2M Company. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Mouse Microswitch Market Key Technology Landscape

The technological landscape of the Mouse Microswitch Market is undergoing a rapid evolution, primarily driven by the need to surpass the inherent limitations of traditional mechanical switches, specifically contact bounce (debounce delay) and finite mechanical lifespan due to metal fatigue. Traditional mechanical switches rely on physical contact between metal plates, necessitating software-based debounce algorithms that introduce latency, albeit minimal. The focus of innovation centers on contact material science, optimizing the alloy compositions (e.g., gold-plated contacts) to enhance electrical conductivity, minimize oxidation, and maximize elasticity, thereby extending the switch's rated cycle life significantly from standard 10 million to premium 80 million clicks. Furthermore, the development of quieter, "silent" mechanical switches, achieved through modified internal damping structures and unique plunger designs, caters to professional and office environments where acoustic performance is paramount.

The most transformative technology disrupting the segment is the adoption of optical microswitches. These switches eliminate physical contact entirely by utilizing an infrared light beam and a phototransistor. When the user presses the click button, the plunger interrupts the light beam, instantly sending a signal without mechanical rebound. This non-contact actuation virtually eliminates debounce delay, achieving near-zero latency—a critical feature for competitive gaming—and allows manufacturers to rate switches for extreme lifespans, often exceeding 100 million cycles, as there is no physical wear on the electrical contacts. Though initially more expensive to produce and integrate, the superior performance characteristics of optical technology are driving its rapid adoption across the premium peripheral market, forcing traditional mechanical switch suppliers to innovate rapidly to remain competitive, particularly regarding cost parity and tactile consistency.

Another emerging technology is the use of magnetic or Hall Effect microswitches, which rely on the movement of a magnet relative to a Hall sensor to generate a signal. Similar to optical switches, these are non-contact and offer exceptional durability. However, magnetic switches provide unique benefits, specifically allowing for adjustable actuation points. This level of customization, often managed via integrated software, permits users to fine-tune the switch response to their preferred depth of press, enhancing the personalized gaming experience. This technological shift towards customizable and non-mechanical components signals a move away from static hardware specifications towards dynamic, user-adjustable input mechanisms. Future technological breakthroughs are expected to center on integrating these non-contact technologies more seamlessly and cost-effectively into mass-market devices, further accelerating the displacement of basic mechanical switch designs within the mainstream mouse market, contingent on reducing the manufacturing complexity and component cost associated with these advanced sensors.

Regional Highlights

- Asia Pacific (APAC)

- North America

- Europe

- Latin America (LATAM)

- Middle East and Africa (MEA)

The Asia Pacific (APAC) region dominates the Mouse Microswitch Market both in terms of manufacturing capacity and consumption volume, positioning it as the undisputed market leader. This dominance is attributable to the concentration of major PC, laptop, and peripheral Original Equipment Manufacturers (OEMs) in countries like China, Taiwan, and South Korea, which drives colossal demand for components. Furthermore, APAC houses the largest and fastest-growing eSports and gaming communities globally. Countries such as China, Japan, and India exhibit a high adoption rate of professional-grade gaming mice, directly translating into exponential demand for high-durability (50M+ cycle) and low-latency microswitches. Competitive pricing and established, scalable supply chains further solidify the region's position, making it the primary sourcing destination for global peripheral brands.

North America holds a substantial market share, characterized by high spending power and a strong preference for premium, branded peripheral devices. Consumers in the US and Canada focus heavily on product reliability, advanced features, and ergonomic design, driving demand for switches utilizing cutting-edge technologies like optical and magnetic actuation. The region is home to major professional gaming leagues and a significant population of affluent PC enthusiasts and content creators, who require uncompromising performance. The market here is less sensitive to marginal price increases compared to APAC, placing greater emphasis on verified component quality and brand recognition (e.g., switches manufactured by established Western or highly reputable Japanese firms). This maturity favors suppliers who can offer innovation alongside robust quality assurance and localized technical support.

Europe represents another mature and technologically demanding market. Western European countries, particularly Germany, the UK, and France, exhibit strong demand for specialized ergonomic and professional-use peripherals suitable for prolonged office and creative work. Environmental and safety regulations (such as RoHS compliance) are stringent in Europe, influencing material choices and manufacturing processes for microswitch suppliers seeking market entry or expansion. While the volume is lower than in APAC, the European market commands high average selling prices due to the preference for certified, high-quality, and long-lasting components. The continued growth of localized eSports scenes across Eastern and Western Europe also ensures a steady, expanding need for high-performance gaming microswitches, ensuring consistent market progression driven by quality specifications rather than just volume.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Mouse Microswitch Market.- Omron Corporation

- Huano Electronic Co., Ltd.

- Kailh Electronics (Kaihua Electronics)

- TTC (Trantac Co., Ltd.)

- Cherry GmbH

- Panasonic Corporation

- ZIPPY Technology Corp.

- Logitech International S.A. (Peripheral Design and Integration)

- Razer Inc. (Proprietary Switch Development)

- ALPS Electric Co., Ltd.

- C&K Components, Ltd.

- Honeywell International Inc.

- TE Connectivity

- Saia-Burgess Controls AG

- Marathon Special Products

- Eaton Corporation

- ZF Electronics (CHERRY)

- D2M Company

- Defond Electronic Co., Ltd.

- Electro-Mech Components, Inc.

Frequently Asked Questions

Analyze common user questions about the Mouse Microswitch market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between mechanical and optical mouse microswitches?

Mechanical switches rely on physical metallic contact, leading to contact bounce, latency (debounce time), and wear over time, typically lasting up to 80 million clicks. Optical switches use an infrared light beam for actuation, eliminating physical contact, resulting in zero debounce delay, faster response times, and greatly extended lifespans, often exceeding 100 million clicks.

How does the cycle life rating of a microswitch affect its cost and application?

Switches with higher cycle life ratings (e.g., 50 million+ clicks) are significantly more expensive because they require specialized precious metal contacts (like gold alloy) and extremely high-precision manufacturing. They are predominantly used in premium gaming and professional mice where durability is critical. Lower-rated switches (10–20 million clicks) use standard materials and dominate the cost-sensitive general computing market.

Which region dominates the global production and consumption of mouse microswitches?

The Asia Pacific (APAC) region, particularly China and Taiwan, dominates both production due to established electronic manufacturing supply chains, and consumption, driven by the massive market size and the burgeoning eSports industry across Asia.

Are silent microswitches sacrificing performance or durability for quiet operation?

Silent microswitches typically incorporate rubberized or unique damping mechanisms to minimize acoustic output. While earlier models sometimes experienced a slight reduction in tactile feedback or durability, modern high-end silent switches are engineered to maintain high cycle life (20M+ clicks) and consistent performance, catering specifically to users in shared office or quiet environments.

How is AI influencing the design and quality control of microswitches?

AI is accelerating R&D by enabling generative design simulations to optimize tactile feel and acoustic properties. In manufacturing, AI-powered systems perform real-time visual inspection and performance testing, ensuring tighter tolerances and predicting component failure rates, thereby drastically improving overall quality consistency and reducing manufacturing defects.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager