Mouthguard Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439833 | Date : Jan, 2026 | Pages : 249 | Region : Global | Publisher : MRU

Mouthguard Market Size

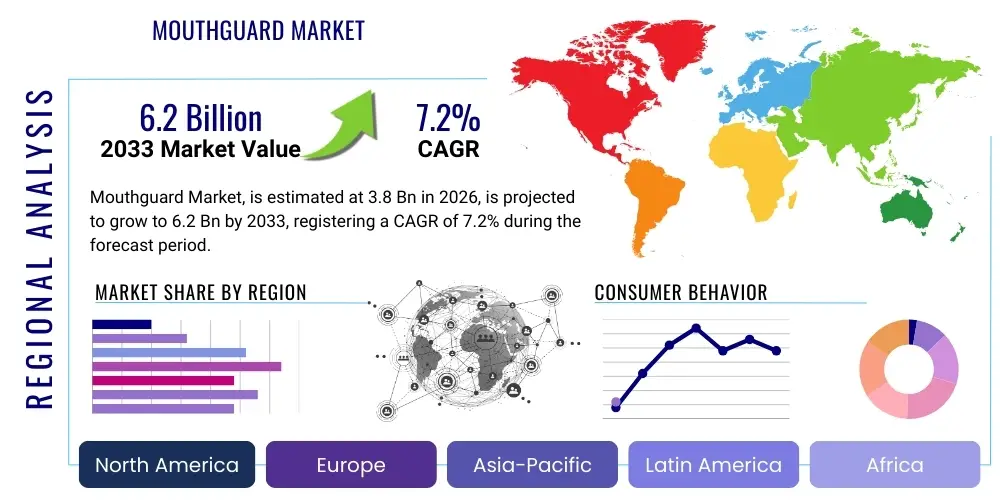

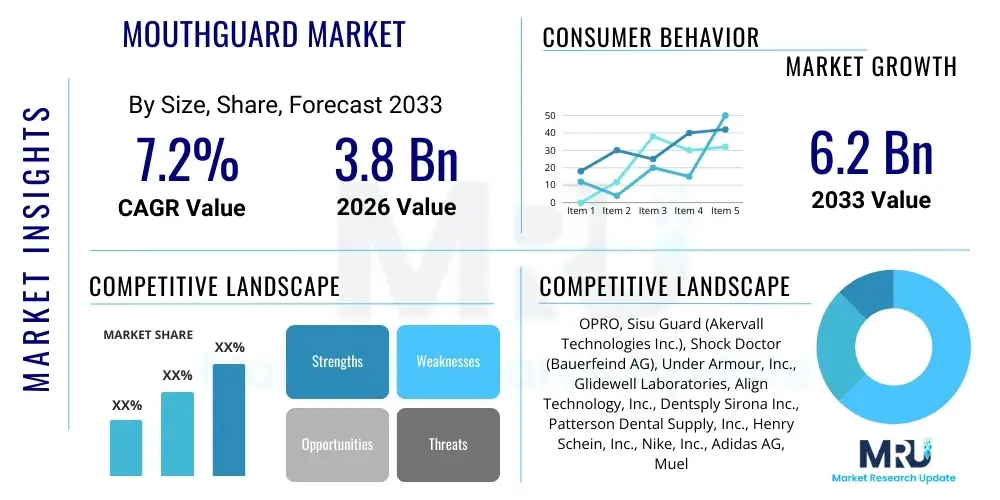

The Mouthguard Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.2% between 2026 and 2033. This robust growth trajectory is underpinned by increasing global sports participation, heightened awareness regarding oral health and injury prevention, and advancements in dental technology. The market is estimated at USD 3.8 Billion in 2026, reflecting a solid foundation built upon a diverse range of applications and product offerings, from protective sports equipment to therapeutic dental devices. Projections indicate a significant expansion, with the market expected to reach USD 6.2 Billion by the end of the forecast period in 2033. This growth is not merely volumetric but also encompasses qualitative improvements in product design, material innovation, and personalized fitting solutions, catering to an ever-widening consumer base across various demographic and geographic segments. The consistent upward trend signifies a strong and evolving demand for effective oral protection and health management solutions.

Mouthguard Market introduction

The Mouthguard Market encompasses a specialized segment within the broader healthcare and sports equipment industries, dedicated to the design, manufacturing, and distribution of protective oral appliances. These devices, commonly known as mouthguards, gum shields, or sports protectors, are custom-designed or pre-formed shields worn over the teeth and gums. Their primary function is multifaceted: to prevent traumatic dental injuries during contact and non-contact sports, including fractures, dislocations, and soft tissue damage; to mitigate the effects of bruxism (involuntary teeth grinding and clenching), which can lead to tooth wear, jaw pain, and headaches; and to serve as an integral component in the management of temporomandibular joint (TMJ) disorders and mild to moderate obstructive sleep apnea, by promoting proper jaw alignment and maintaining open airways. The market offers a spectrum of products, ranging from readily available stock mouthguards and semi-customizable boil-and-bite options to highly personalized, custom-fabricated devices crafted by dental professionals using advanced materials such as Ethylene-vinyl Acetate (EVA), various thermoplastics, acrylics, and specialized silicone compounds. This variety ensures that solutions are available for different levels of protection, comfort, and budgetary considerations, making mouthguards accessible to a broad demographic of users, from children to elite athletes and individuals seeking therapeutic relief.

The major applications of mouthguards span across diverse sectors. In sports, they are indispensable for participants in high-impact activities like football, rugby, boxing, hockey, and martial arts, where direct facial trauma is common. However, their utility extends to non-contact sports such as basketball, cycling, and gymnastics, where accidental falls or collisions can still result in significant dental damage. Beyond athletic endeavors, a substantial portion of the market is dedicated to clinical dentistry, where mouthguards, often referred to as nightguards or splints, are prescribed to patients suffering from chronic bruxism to protect tooth surfaces and alleviate jaw muscle strain. Similarly, oral appliances play a crucial role in treating TMJ dysfunction by repositioning the jaw and reducing pressure on the joint, and in managing sleep apnea by preventing airway collapse. The benefits are profound, including superior dental and oral tissue protection, a potential reduction in the severity of concussions through impact dispersion, significant pain relief for bruxism and TMJ patients, and improved sleep quality for those with sleep apnea. These pervasive advantages act as strong driving factors for market growth. Other significant drivers include the escalating global participation rates in organized and recreational sports, increasing public awareness campaigns about the importance of oral injury prevention, a rising prevalence and diagnosis of bruxism and sleep apnea facilitated by enhanced diagnostic tools, continuous technological advancements in materials and manufacturing processes enabling more comfortable and effective designs, and supportive regulatory frameworks promoting safety in sports. These interwoven factors collectively stimulate consistent demand and innovation within the Mouthguard Market, positioning it for sustained expansion over the coming years as both protective and therapeutic applications become more widely recognized and adopted.

Mouthguard Market Executive Summary

The Mouthguard Market is currently experiencing a transformative period characterized by several prominent business and technological trends. A significant business trend involves the shift towards personalized and digital dentistry solutions. Manufacturers are increasingly leveraging 3D scanning and printing technologies to offer custom-fitted mouthguards that provide unparalleled comfort, protection, and fit, thereby commanding premium pricing. The proliferation of direct-to-consumer (D2C) channels, particularly online platforms, is democratizing access to custom and semi-custom options, allowing brands to bypass traditional distribution layers and engage directly with consumers. Furthermore, there's a growing emphasis on material innovation, with R&D efforts focused on developing multi-layered composites, antimicrobial coatings, and eco-friendly, biocompatible polymers that enhance product durability, hygiene, and user acceptance. Strategic collaborations between mouthguard manufacturers, dental laboratories, sports organizations, and even technology firms are becoming crucial for market expansion, co-branding, and the integration of advanced features. Sustainability initiatives, including the use of recyclable materials and reduced manufacturing waste, are also emerging as competitive differentiators, resonating with environmentally conscious consumers.

Regional trends reveal distinct growth patterns and market maturities. North America and Europe remain the largest and most established markets, benefiting from high rates of organized sports participation, strong dental health awareness, and well-developed healthcare infrastructures that support the prescription and fitting of therapeutic mouthguards. These regions are also at the forefront of adopting advanced digital dentistry solutions. The Asia Pacific (APAC) region, however, is emerging as the fastest-growing market, driven by rapidly increasing disposable incomes, a burgeoning sports culture, particularly in countries like China, India, and Australia, and a rising awareness of oral hygiene and injury prevention. Governments and sports bodies in APAC are investing heavily in sports infrastructure, further stimulating demand. Latin America and the Middle East & Africa (MEA) are also showing promising growth, albeit from a smaller base, fueled by improving access to dental care, increasing urbanization, and growing engagement in various sports activities. Each region presents unique opportunities and challenges, requiring localized marketing and distribution strategies.

Segment-wise, the market exhibits dynamic shifts. The custom-fit mouthguard segment is anticipated to witness the highest growth rate, primarily due to their superior protective qualities, enhanced comfort, and perfect fit, which collectively lead to better user compliance. While initially more expensive, the long-term benefits and increased effectiveness justify the investment for many users. The application segment for bruxism and sleep apnea is also experiencing robust expansion. This growth is attributed to a higher prevalence and diagnosis rate of these conditions, coupled with a preference for non-invasive, custom-fitted oral appliances as an effective treatment alternative to more complex medical interventions. In the sports application segment, while traditional contact sports continue to drive demand, there's an increasing recognition of the need for mouthguards in non-contact sports, broadening the potential customer base. Online retail and direct-to-consumer channels are gaining significant traction as distribution methods, offering convenience and a wider selection, especially for boil-and-bite and general-purpose sports mouthguards, while dental clinics remain paramount for custom and therapeutic solutions.

AI Impact Analysis on Mouthguard Market

Common user questions regarding the profound impact of Artificial Intelligence (AI) on the Mouthguard Market often center on the potential for hyper-personalization, enhanced protective capabilities, and streamlined manufacturing processes. Users are keenly interested in understanding how AI can facilitate the creation of mouthguards that offer an unprecedented level of comfort and effectiveness, precisely tailored to their unique dental anatomy and specific activity requirements. Queries frequently arise about AI's role in reducing the typically high cost and lengthy turnaround times associated with custom-fit solutions, making advanced protection more accessible. Furthermore, there is significant curiosity regarding the integration of AI with smart mouthguards, particularly concerning their ability to provide real-time feedback on impact forces, monitor physiological data, or even predict potential injury risks. Concerns, however, often touch upon the privacy and security of sensitive biometric data collected by AI-enabled devices, the potential for technology to become overly complex or cost-prohibitive for the average consumer, and the ethical implications of using AI in healthcare and sports safety. Overall, users hold high expectations for AI to revolutionize the design, functionality, and intelligence of future mouthguard generations, promising superior protection, greater convenience, and personalized health insights, thereby transforming both the user experience and the industry’s operational paradigms.

- AI-driven personalized design and fit optimization: Utilizing advanced algorithms to process 3D intraoral scans and facial kinematics, AI can generate highly precise mouthguard designs. This allows for optimal material distribution, thickness variation, and anatomical contouring, ensuring a perfect, comfortable, and protective fit tailored to the individual's unique dental structure and bite, significantly reducing the discomfort and bulkiness often associated with generic mouthguards.

- Predictive analytics for material wear and tear: AI can analyze usage patterns, impact data, and material properties to predict when a mouthguard's protective effectiveness might degrade. This enables timely replacement recommendations, ensuring continuous optimal protection and enhancing product lifespan management for both consumers and manufacturers.

- Integration of smart sensors with AI algorithms for real-time impact monitoring and data analysis: AI-powered sensors embedded within mouthguards can detect, measure, and analyze impact forces, acceleration, and rotational kinematics experienced by the wearer. These systems can provide immediate alerts for potentially dangerous impacts, assist in concussion assessment protocols, and offer valuable data for training optimization and injury prevention strategies in sports, moving beyond passive protection to active monitoring.

- Automated manufacturing processes (e.g., 3D printing) guided by AI for improved precision and speed: AI optimizes 3D printing parameters, such as print speed, layer thickness, and material deposition, to enhance the precision and efficiency of mouthguard fabrication. This automation reduces human error, accelerates production cycles for custom devices, and lowers manufacturing costs, making bespoke solutions more scalable and economically viable.

- Development of advanced materials with AI-simulated properties for enhanced shock absorption: AI algorithms can simulate the mechanical behavior of new material compositions and structural designs under various impact scenarios. This allows researchers to rapidly iterate and discover novel materials or multi-layered structures that offer superior energy dissipation and shock absorption capabilities, leading to lighter yet more protective mouthguards without extensive physical prototyping.

- AI-powered diagnostic support for dentists in identifying bruxism patterns and treatment planning: AI tools can analyze sensor data from nightguards worn by patients to identify specific patterns of teeth grinding, clenching, and jaw movements during sleep. This data-driven insight helps dentists to more accurately diagnose the severity and type of bruxism, track treatment efficacy, and personalize therapeutic mouthguard designs or interventions.

- Customization at scale, making personalized mouthguards more accessible and affordable: By automating design and manufacturing workflows, AI enables the mass customization of mouthguards. This reduces the labor intensity and specialized expertise traditionally required for bespoke dental appliances, making high-quality, personalized mouthguards more accessible and affordable to a broader market segment, including recreational athletes and individuals in developing regions.

DRO & Impact Forces Of Mouthguard Market

The Mouthguard Market operates within a complex framework influenced by a dynamic interplay of driving factors, persistent restraints, emerging opportunities, and competitive impact forces. A primary driver is the accelerating global participation in organized and recreational sports across all age groups. As more individuals engage in contact and non-contact sports, the inherent risk of dental injuries escalates, directly increasing the demand for effective oral protection. This trend is amplified by a heightened awareness among athletes, coaches, parents, and healthcare professionals regarding the critical importance of preventing dental trauma, leading to wider adoption of mouthguards as standard protective gear. Concurrently, the rising global prevalence and diagnosis of dental conditions such as bruxism, characterized by involuntary teeth grinding and clenching, and temporomandibular joint (TMJ) disorders, significantly boost the demand for therapeutic nightguards and splints. Furthermore, an increasing understanding and diagnosis of obstructive sleep apnea have expanded the market for specialized oral appliances designed to manage this condition. Technological advancements in material science, including the development of multi-layered polymers and biocompatible compounds, alongside innovations in digital dentistry such as 3D scanning and printing, have enabled the creation of more comfortable, durable, and highly effective custom-fit mouthguards, thus stimulating market growth by improving product appeal and efficacy.

Despite these robust drivers, the Mouthguard Market faces several significant restraints that temper its growth potential. The comparatively high cost associated with custom-fitted mouthguards, particularly those fabricated by dental professionals using advanced techniques, remains a substantial barrier for many consumers, especially in price-sensitive markets or for recreational users who may opt for cheaper, less effective alternatives. Issues related to discomfort, bulkiness, and interference with speech or breathing, though continuously addressed through product innovation, still represent concerns for some users, potentially leading to lower compliance rates. Moreover, a persistent lack of comprehensive awareness about the specific benefits, proper selection, and consistent usage of mouthguards, particularly in developing economies or among certain demographic groups, continues to limit market penetration. The market is also challenged by the proliferation of low-quality, often unregulated, generic mouthguards that may not offer adequate protection, potentially eroding consumer trust in the overall efficacy of mouthguard products and increasing the risk of injury despite usage.

Opportunities for considerable market expansion are prevalent within the Mouthguard Market, promising future growth and innovation. Untapped emerging markets, particularly in regions with expanding economies, improving healthcare infrastructure, and growing sports participation rates in Asia Pacific, Latin America, and the Middle East & Africa, offer substantial potential for new market entrants and established players alike. The continuous evolution of smart mouthguard technology, incorporating advanced sensors for real-time impact monitoring, concussion detection, performance analytics, and even physiological tracking, represents a high-growth segment. These intelligent devices move beyond passive protection to active data collection and analysis, adding significant value for athletes and medical professionals. Furthermore, diversifying the application of mouthguards into new domains, such as for general stress relief, improved posture, or specialized orthodontic protection beyond traditional athletic or bruxism uses, can unlock new consumer segments. The integration of telehealth and direct-to-consumer (D2C) models, leveraging digital impressions and online customization tools, also enhances accessibility, reduces geographical barriers, and offers personalized solutions at greater convenience. These innovations, coupled with strategic partnerships between manufacturers, sports bodies, and dental organizations, are poised to redefine market landscapes.

The Mouthguard Market is also influenced by several key impact forces that shape its competitive dynamics and overall structure. The intense competitive rivalry is a dominant force, characterized by a diverse landscape of manufacturers ranging from global sports brands to specialized dental product companies, all vying for market share. This competition drives continuous innovation, aggressive marketing, and strategic pricing, benefiting consumers with a wider array of choices. The bargaining power of buyers, comprising individual consumers, athletes, dental clinics, and sports organizations, is moderate. While individual buyers have choices, professional recommendations from dentists and coaches often influence purchasing decisions for higher-value, custom solutions. Large institutional buyers can exert more pressure on pricing. The bargaining power of suppliers, specifically raw material providers for polymers and specialized components, is relatively low to moderate due, to the availability of multiple suppliers and alternative materials, although niche smart components could increase this. The threat of new entrants is moderate; while manufacturing basic mouthguards has low barriers, developing advanced, custom, or smart mouthguards requires significant R&D, specialized equipment, and regulatory compliance. Finally, the threat of substitute products is relatively low for essential protective and therapeutic applications, as no direct alternative offers the same level of specific oral protection. However, non-compliance due to discomfort or perceived lack of necessity can act as an indirect substitute by negating usage.

Segmentation Analysis

A comprehensive segmentation analysis of the Mouthguard Market is critical for understanding its multifaceted nature, identifying key growth drivers within specific niches, and formulating effective market strategies. This process involves categorizing the market based on various attributes, enabling stakeholders to gain granular insights into consumer preferences, technological adoption rates, and competitive landscapes across different segments. By dissecting the market along dimensions such as product type, the materials utilized in manufacturing, the primary application areas, the channels through which products are distributed, and the end-user demographics, a clearer picture emerges of where demand is strongest and where opportunities for innovation and expansion lie. This detailed breakdown highlights not only the current state of the market but also its potential evolutionary paths, allowing businesses to tailor their product offerings, marketing messages, and distribution networks to effectively reach distinct target groups. For instance, the needs of a professional athlete requiring maximum impact protection differ significantly from those of an individual seeking relief from bruxism, necessitating distinct product designs and marketing approaches. Therefore, understanding these segmentations is paramount for market participants to optimize their strategic planning, resource allocation, and product development efforts, ensuring sustained growth and competitive advantage in a dynamic market environment.

- By Product Type:

- Stock Mouthguards: Ready-to-wear, pre-formed, and offer the least customization. They are inexpensive but often uncomfortable and provide minimal protection.

- Boil-and-Bite Mouthguards: Made from thermoplastic material, softened in hot water, then molded to the teeth by biting down. They offer a better fit than stock options but less than custom.

- Custom-Fit Mouthguards: Individually fabricated by a dentist from a precise impression of the user's teeth. They offer superior fit, comfort, protection, and allow for optimal speech and breathing.

- By Material:

- Ethylene-vinyl Acetate (EVA): Most common material due to its flexibility, shock absorption, and ease of molding.

- Thermoplastics: Used in boil-and-bite mouthguards, becoming pliable when heated and rigid upon cooling.

- Acrylic: Often used for nightguards due to its rigidity and durability, especially for severe bruxism.

- Silicone: Offers softness and flexibility, sometimes used in layers for comfort.

- Polyurethane: Known for excellent impact resistance and durability, used in high-performance sports mouthguards.

- Other Advanced Polymers: Including multi-layered laminates and specialized resins for enhanced properties like antimicrobial action or lighter weight.

- By Application:

- Sports:

- Contact Sports: Football, rugby, boxing, martial arts, hockey, lacrosse, where direct physical contact and high impact are prevalent.

- Non-Contact Sports: Basketball, soccer, baseball, gymnastics, skateboarding, cycling, where accidental falls, collisions, or equipment impacts can cause injury.

- Bruxism: Nightguards to protect teeth from grinding and clenching, preventing wear and alleviating jaw pain.

- TMJ Disorders: Splints or oral appliances to alleviate symptoms of temporomandibular joint dysfunction by repositioning the jaw and reducing pressure.

- Sleep Apnea: Mandibular advancement devices (MADs) or oral appliances to keep the airway open during sleep, treating mild to moderate obstructive sleep apnea.

- Orthodontic Protection: Mouthguards designed to protect braces and other orthodontic appliances from damage during sports or bruxism.

- Sports:

- By Distribution Channel:

- Dental Clinics & Hospitals: Primary channel for custom-fit and therapeutic mouthguards, offering professional fitting and medical guidance.

- Sporting Goods Stores: Major retail channel for stock and boil-and-bite sports mouthguards, offering convenience and immediate purchase.

- Pharmacies & Drug Stores: Provide accessible options for boil-and-bite and general protective mouthguards, often alongside other oral care products.

- Online Retail: E-commerce platforms, including major marketplaces and specialized dental/sports retailers, offer a vast selection, competitive pricing, and direct-to-consumer options, driving convenience and global reach.

- Direct-to-Consumer (D2C): Brands selling directly to customers through their own websites, often leveraging digital impression kits for semi-custom solutions.

- By End-User:

- Adults: Encompassing professional athletes, recreational sports enthusiasts, and individuals suffering from bruxism or sleep apnea.

- Children & Adolescents: A crucial segment driven by increasing participation in youth sports and the necessity for protecting developing dentition.

- Professional Athletes: Require high-performance, custom-fit mouthguards for optimal protection and comfort, often sponsored or provided by teams.

- Recreational Athletes: Seek effective yet affordable mouthguard solutions for casual sports activities, balancing cost with protection.

Value Chain Analysis For Mouthguard Market

The value chain for the Mouthguard Market is a complex and interconnected network of activities, starting from the procurement of raw materials and culminating in the delivery of finished products to end-users. Upstream activities are foundational, involving the sourcing and processing of various polymers and specialized components. This critical stage includes suppliers of Ethylene-vinyl Acetate (EVA), a widely used material due to its thermoplastic properties and shock-absorbing capabilities, as well as suppliers of other thermoplastics, acrylic resins, silicone, and polyurethane, which offer different levels of rigidity, flexibility, and durability. Research and development departments play an essential role upstream, focusing on material science innovations, biocompatibility testing, and the design of new mouthguard architectures. These efforts aim to enhance protective qualities, comfort, and the integration of advanced features like antimicrobial agents or smart sensors. The quality and cost-effectiveness of these raw materials directly impact the final product's performance and market price, making strong supplier relationships and efficient procurement strategies vital for manufacturers. Furthermore, compliance with health and safety standards for raw materials is paramount, especially for products coming into direct contact with oral tissues, necessitating stringent quality control measures from the outset.

Midstream activities encompass the manufacturing and assembly processes, where raw materials are transformed into various types of mouthguards. This stage involves sophisticated machinery and technical expertise. For stock and boil-and-bite mouthguards, processes such as injection molding, compression molding, and vacuum forming are common, allowing for mass production. However, for custom-fit mouthguards, the manufacturing process is more intricate, often involving digital impressions from intraoral scanners, Computer-Aided Design (CAD) software for precise modeling, and Computer-Aided Manufacturing (CAM) techniques, including advanced 3D printing or milling. These digital workflows ensure an exact fit and optimized design for individual users. Quality control at this stage is crucial to ensure that each mouthguard meets specified protection levels, comfort standards, and regulatory requirements. Manufacturers continuously invest in process optimization and automation to enhance efficiency, reduce production costs, and accelerate time-to-market. Packaging and sterilization are also integral parts of midstream activities, ensuring products are ready for safe distribution and use.

Downstream activities focus on the distribution, sales, and post-sales support that bring mouthguards to the end-consumer. The distribution channels are diverse, catering to different product types and customer segments. Direct distribution includes manufacturers selling directly to consumers through their own e-commerce websites (D2C models), often offering customization options that involve users taking their own impressions or uploading digital scans. This channel allows for greater brand control and direct customer engagement. Indirect distribution is more prevalent and involves a network of intermediaries. Dental clinics and hospitals are crucial for custom-fit and therapeutic mouthguards, where dentists provide professional fitting, education, and follow-up care. Sporting goods stores and large retail chains serve as major outlets for stock and boil-and-bite sports mouthguards, offering convenience and immediate availability. Pharmacies and drug stores also carry a range of general-purpose mouthguards. Online retailers, including major e-commerce platforms, have become increasingly important, providing vast product selections, competitive pricing, and global reach. Effective marketing and sales strategies are vital at this stage to educate consumers about product benefits, drive brand awareness, and encourage adoption. Post-sales support, including customer service and warranty provisions, contributes significantly to customer satisfaction and brand loyalty, completing the value chain by ensuring a positive user experience.

Mouthguard Market Potential Customers

The Mouthguard Market serves a broad and heterogeneous base of potential customers, each driven by distinct needs related to oral protection, therapeutic intervention, or performance enhancement. A significant segment comprises athletes across all age groups and competitive levels, ranging from professional sports participants in high-impact disciplines like football, rugby, boxing, and martial arts, to recreational enthusiasts involved in a wide array of physical activities including basketball, soccer, cycling, and even weightlifting. For this group, the primary motivation is the prevention of traumatic dental and oral injuries, which can range from chipped teeth and lacerated soft tissues to more severe jaw fractures and concussions. Parents of children and adolescents engaged in youth sports represent a particularly critical demographic, as they are often the primary decision-makers for purchasing protective gear, prioritizing safety and long-term dental health for their developing children. These athletic customers seek mouthguards that offer superior impact absorption, a secure and comfortable fit that doesn't impede breathing or speech, and durability to withstand rigorous use, sometimes even looking for customization options that align with team colors or personal preferences.

Beyond the realm of sports, another substantial customer segment includes individuals suffering from various dental and medical conditions. Chief among these are patients diagnosed with bruxism, a common condition characterized by involuntary teeth grinding or clenching, predominantly during sleep. For these individuals, mouthguards, often referred to as nightguards or occlusal splints, are essential therapeutic devices designed to protect tooth surfaces from excessive wear, alleviate jaw pain, reduce headaches, and mitigate muscle fatigue associated with chronic clenching. Dentists and orthodontists play a pivotal role in identifying these patients and prescribing custom-fitted nightguards, making them key influencers and direct providers. Similarly, patients experiencing temporomandibular joint (TMJ) disorders benefit from specialized oral appliances that help to reposition the jaw, reduce stress on the joint, and alleviate pain and dysfunction. A rapidly growing segment involves patients with mild to moderate obstructive sleep apnea (OSA). For these individuals, mandibular advancement devices (MADs) or other custom oral appliances are prescribed to hold the lower jaw and tongue forward during sleep, thereby preventing airway collapse and improving breathing. The demand from these therapeutic end-users underscores the critical role of mouthguards not just as protective equipment but also as vital medical devices that enhance quality of life by addressing chronic health issues, driving continuous innovation in design and functionality to meet specialized clinical requirements.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.8 Billion |

| Market Forecast in 2033 | USD 6.2 Billion |

| Growth Rate | 7.2% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | OPRO, Sisu Guard (Akervall Technologies Inc.), Shock Doctor (Bauerfeind AG), Under Armour, Inc., Glidewell Laboratories, Align Technology, Inc., Dentsply Sirona Inc., Patterson Dental Supply, Inc., Henry Schein, Inc., Nike, Inc., Adidas AG, Mueller Sports Medicine, Inc., Makura Sport, SafeJawz, PlaySafe, Vettec, Inc., DMG America LLC, Dentamerica, Inc., Cynova, Inc., Custom Protectives. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Mouthguard Market Key Technology Landscape

The Mouthguard Market's technological landscape is rapidly evolving, driven by innovations aimed at enhancing customization, protection, and user experience. A foundational shift has been the widespread adoption of digital dentistry techniques, particularly 3D intraoral scanning and Computer-Aided Design (CAD) software. This technology revolutionizes the impression-taking process, replacing traditional, often uncomfortable, physical molds with highly accurate digital models of a patient's dental arch. CAD software then enables dental professionals and manufacturers to design mouthguards with exceptional precision, optimizing for fit, material thickness in critical areas, and overall anatomical contouring. This digital workflow not only significantly improves the accuracy and comfort of custom-fit mouthguards but also streamlines the entire production process, reducing turnaround times and enhancing operational efficiency, which is crucial for delivering bespoke solutions at scale. The ability to store digital models also facilitates easy reordering or adjustments, further enhancing customer convenience.

Complementing digital design, advanced manufacturing techniques, most notably 3D printing (additive manufacturing), are transforming how mouthguards are produced. 3D printing allows for the fabrication of complex geometries and multi-layered structures that are difficult or impossible to achieve with traditional methods. This enables the creation of mouthguards with varying zones of rigidity and flexibility, tailored precisely to the areas requiring maximum impact absorption versus those needing comfort or breathability. Specialized biocompatible resins and polymers are employed in 3D printing, ensuring safety and durability. Furthermore, material science continues to be a key area of innovation, with ongoing research into developing next-generation polymers that offer superior energy dissipation, lighter weight, and enhanced comfort. Efforts are also focused on integrating antimicrobial properties into mouthguard materials to improve hygiene and reduce bacterial build-up, addressing a common user concern. These material advancements contribute significantly to extending the lifespan of mouthguards and ensuring consistent protective performance under diverse conditions, from high-impact sports to long-term therapeutic use.

The integration of smart technology represents another significant frontier in the mouthguard market. Smart mouthguards embed miniature sensors, such as accelerometers, gyroscopes, and pressure sensors, directly into the device. These sensors are capable of collecting real-time data on impact forces, head kinematics (e.g., angular and linear acceleration), and even physiological parameters like heart rate or core body temperature. This data is then transmitted wirelessly to connected devices (e.g., smartphones or tablets) for analysis, often leveraging artificial intelligence (AI) algorithms to interpret the information. For athletes, this offers unprecedented insights into head impacts, helping to identify potential concussions, monitor training loads, and inform injury prevention strategies. For therapeutic applications, smart mouthguards can track bruxism patterns, provide biofeedback, or monitor sleep apnea effectiveness. While still evolving, this technology is moving mouthguards from passive protective devices to active data-gathering and analytical tools, offering a paradigm shift in oral protection, sports safety, and personalized health management. Challenges remain in miniaturization, battery life, data security, and cost-effectiveness, but the potential for these intelligent devices to enhance safety and performance is immense.

Regional Highlights

- North America: This region stands as a dominant force in the Mouthguard Market, characterized by high rates of participation in organized sports, particularly football, hockey, and basketball, where mouthguard usage is often mandated or strongly encouraged. A strong emphasis on athlete safety, coupled with a highly developed dental healthcare infrastructure and high disposable incomes, drives significant demand for premium custom-fit and advanced technological mouthguards. The United States and Canada are key contributors, leading in both consumption and product innovation, including the early adoption of smart mouthguard technologies. Rigorous regulatory standards for sports safety and increasing awareness campaigns further bolster market growth.

- Europe: The European market demonstrates robust growth, propelled by a deep-rooted sports culture, especially in countries like the UK, Germany, France, and Italy, with popular sports such as rugby, football (soccer), and ice hockey. Increasing health consciousness and government initiatives promoting sports safety across the continent have led to broader mouthguard adoption. Regulatory bodies and sports federations are also increasingly implementing guidelines for protective gear, fostering a consistent demand. While custom-fit mouthguards are prevalent through dental channels, the market also sees strong sales of boil-and-bite options through sporting goods retailers.

- Asia Pacific (APAC): Positioned as the fastest-growing market globally for mouthguards, the APAC region is experiencing an unprecedented surge in sports participation, particularly in developing economies like China, India, and Southeast Asian nations. Rising disposable incomes, coupled with expanding sports infrastructure and Westernization of sports culture, are key drivers. Awareness regarding oral health and injury prevention is also growing steadily, though it still lags behind Western markets, indicating significant untapped potential. Australia and New Zealand, with their strong rugby and contact sports cultures, represent mature sub-markets within APAC, often leading in the adoption of advanced mouthguard technologies.

- Latin America: This region is exhibiting steady growth, primarily fueled by the immense popularity of sports like football (soccer) and combat sports. Improvements in dental healthcare access and increasing public health initiatives focused on injury prevention are gradually expanding the consumer base for both protective and therapeutic mouthguards. Brazil and Mexico are leading markets within the region, characterized by a growing middle class and increasing investments in sports development. Challenges include lower awareness levels and economic disparities that can limit access to higher-priced custom solutions, making affordable boil-and-bite options popular.

- Middle East & Africa (MEA): Representing an emerging market with substantial future growth potential, the MEA region is benefiting from increasing government investments in sports infrastructure and events, alongside a rising health consciousness among its population. Countries like the UAE, Saudi Arabia, and South Africa are witnessing growing participation in various sports, from traditional martial arts to modern team sports. While market penetration for mouthguards is currently lower compared to developed regions, increasing awareness campaigns and improving access to dental services are expected to drive significant expansion over the forecast period. Economic diversification and a young demographic also contribute to the long-term growth prospects in this region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Mouthguard Market. These companies are at the forefront of innovation, manufacturing, and distribution, contributing significantly to market growth through their diverse product portfolios, strategic initiatives, and global presence. Their activities span from developing advanced materials and digital customization techniques to expanding distribution networks and engaging in targeted marketing campaigns.- OPRO Group Ltd.

- Sisu Guard (Akervall Technologies Inc.)

- Shock Doctor (Bauerfeind AG)

- Under Armour, Inc.

- Glidewell Laboratories

- Align Technology, Inc.

- Dentsply Sirona Inc.

- Patterson Dental Supply, Inc.

- Henry Schein, Inc.

- Nike, Inc.

- Adidas AG

- Mueller Sports Medicine, Inc.

- Makura Sport

- SafeJawz

- PlaySafe (Danville Materials)

- Vettec, Inc.

- DMG America LLC

- Dentamerica, Inc.

- Cynova, Inc.

- Custom Protectives

Frequently Asked Questions

Analyze common user questions about the Mouthguard market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary benefits of using a mouthguard for sports?

Mouthguards offer essential protection for teeth, gums, lips, and tongue from impacts during sports, significantly reducing the risk of dental fractures, dislocations, and soft tissue injuries. They can also aid in distributing impact forces, potentially lessening the severity of concussions.

How do custom-fit mouthguards compare to boil-and-bite or stock options in terms of effectiveness?

Custom-fit mouthguards, made from precise dental impressions, offer superior protection, comfort, and fit compared to boil-and-bite (semi-custom) or stock (off-the-shelf) options. Their tailored design ensures optimal retention, breathability, and allows for unimpeded speech, leading to better compliance and more effective injury prevention.

What are the key applications of mouthguards beyond sports protection?

Beyond sports, mouthguards are widely used as therapeutic devices. They effectively treat bruxism (teeth grinding and clenching) by protecting teeth from wear and reducing jaw pain. Specialized oral appliances also manage temporomandibular joint (TMJ) disorders and mild to moderate obstructive sleep apnea by repositioning the jaw and maintaining open airways during sleep.

What advanced technologies are shaping the future of mouthguards?

Advanced technologies driving the mouthguard market include 3D scanning and printing for highly personalized and precise designs, advanced material science for enhanced shock absorption and durability, and smart sensor integration. These smart mouthguards can monitor real-time impact forces, head kinematics, and even physiological data for improved safety and performance analytics.

How should I properly care for my mouthguard to ensure hygiene and longevity?

Proper mouthguard care involves rinsing it with cold water after each use, cleaning it gently with a soft toothbrush and mild soap or non-abrasive toothpaste, and storing it in a well-ventilated, protective case. Avoid hot water, which can distort the material, and periodically use a denture or mouthguard cleaning solution for deeper sanitization.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager