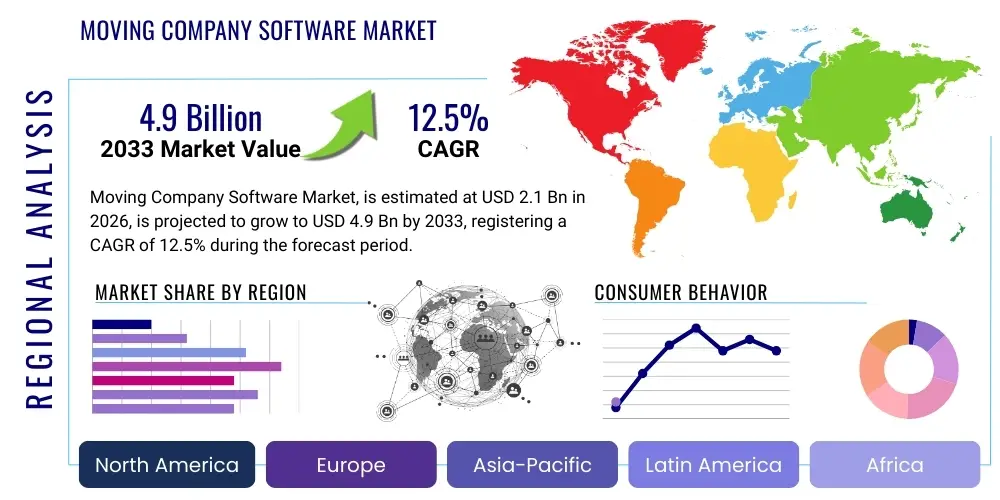

Moving Company Software Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436042 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Moving Company Software Market Size

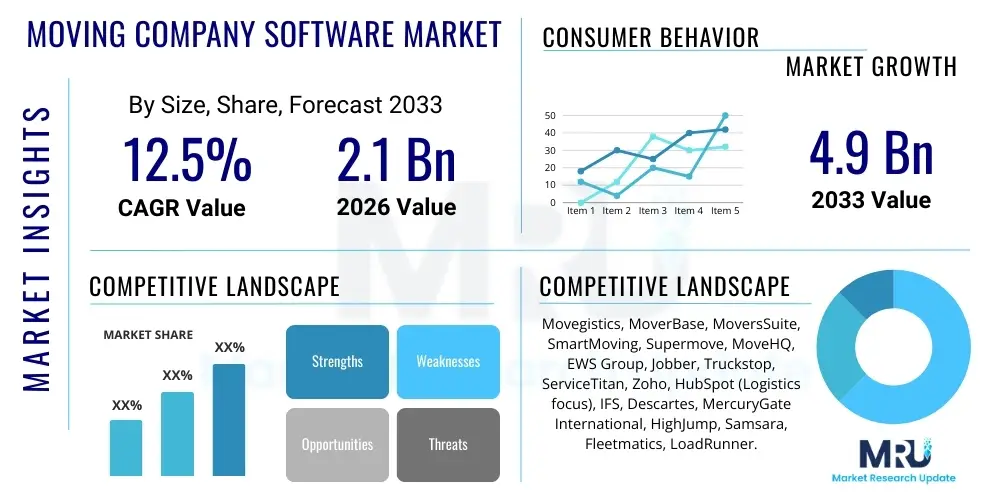

The Moving Company Software Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at USD 2.1 Billion in 2026 and is projected to reach USD 4.9 Billion by the end of the forecast period in 2033.

Moving Company Software Market introduction

The Moving Company Software Market encompasses specialized technology solutions designed to streamline and automate the complex operational processes inherent to the relocation industry. These sophisticated platforms provide movers with tools for lead management, accurate job quoting, scheduling and dispatch, fleet management, inventory tracking, and critical customer relationship management (CRM). The core function of this software is to transition traditional, often manual or paper-based moving logistics into integrated digital workflows, significantly enhancing efficiency and reducing the likelihood of human error during high-stress moving events. Product offerings range from modular components addressing specific business needs, such as route optimization or electronic paperwork, to comprehensive, enterprise-level suites providing end-to-end operational visibility.

Major applications of moving company software include robust logistics planning, which optimizes truck utilization and routing to minimize fuel costs and travel time, and dynamic pricing engines that generate rapid and precise quotes based on volume, distance, and service complexity. Furthermore, these platforms facilitate regulatory compliance by maintaining digital records and managing necessary permits. The primary benefits realized by adopting this technology include improved customer satisfaction due due to transparent communication and reliable service delivery, substantial reductions in operational overhead, and enhanced scalability, allowing moving companies to handle increased volume without proportionally expanding administrative staff. The centralization of data is a crucial advantage, enabling superior decision-making through analytics.

The market growth is fundamentally driven by the escalating demand for operational digitization across the logistics sector, coupled with the increasing complexity of cross-border and regional relocation services. Key driving factors also include the necessity for precise real-time tracking capabilities mandated by modern customers, the proliferation of cloud-computing models that make sophisticated software accessible to small and medium-sized enterprises (SMEs), and the competitive pressure within the moving industry, which forces companies to adopt technology to differentiate services and improve service speed. Furthermore, the integration with external ecosystems, such as payment gateways and accounting software, accelerates adoption rates across various geographical regions.

Moving Company Software Market Executive Summary

The Moving Company Software Market is experiencing rapid transformation, driven primarily by favorable business trends emphasizing digitalization and customer experience optimization. A major business trend is the shift towards Software-as-a-Service (SaaS) models, offering flexibility and lower upfront capital expenditure, which significantly lowers the barrier to entry for smaller moving firms seeking advanced operational tools. The industry is also witnessing strong merger and acquisition activity among technology providers aiming to consolidate specialized features, such as advanced AI-driven estimation tools or integrated electronic bill of lading capabilities, thereby creating more comprehensive platforms for end-users. Enterprise-level movers are increasingly investing in proprietary systems or heavily customized solutions to integrate seamlessly with existing ERP infrastructure, focusing on predictive analytics for seasonal demand forecasting and resource allocation efficiency.

Regionally, North America remains the dominant market, characterized by high technological adoption rates, a large concentration of established moving enterprises, and robust regulatory frameworks requiring digitized documentation. However, the Asia Pacific (APAC) region is demonstrating the highest growth trajectory, fueled by rapid urbanization, significant infrastructure development, and the burgeoning adoption of mobile-first business solutions, particularly in emerging economies where logistics operations are rapidly modernizing. Europe presents a mature market focused on compliance with data privacy regulations (like GDPR) and prioritizing software solutions that facilitate complex inter-European cross-border moves, emphasizing multi-language and multi-currency support.

Segment trends highlight the strong performance of the Cloud-based segment due to its inherent scalability and ease of deployment, overshadowing the traditional On-Premise deployments. In terms of application, the Logistics and Fleet Management module maintains the largest share, reflecting the core necessity of efficient physical operations. Nevertheless, the Quotation and Estimation segment is projected to exhibit the fastest growth, largely due to the integration of machine learning algorithms and augmented reality (AR) tools that dramatically improve the accuracy and speed of pre-move surveys and quoting processes, directly addressing a primary customer pain point related to inaccurate initial estimates. The SME end-user segment is crucial, as vendor solutions become more modular and affordable, democratizing access to enterprise-grade functionality.

AI Impact Analysis on Moving Company Software Market

User inquiries regarding the influence of Artificial Intelligence (AI) on the Moving Company Software Market predominantly center on the potential for autonomous decision-making, predictive accuracy enhancement, and labor displacement. Common questions revolve around "How accurately can AI predict moving volume and time based on video assessments?" "What are the tangible cost savings associated with AI-driven route optimization versus traditional methods?" and "Will AI integration reduce the need for in-person sales surveyors?" These queries underscore user expectations that AI must deliver verifiable improvements in operational efficiency and customer experience while simultaneously navigating concerns about the initial investment cost and the complexity of integrating sophisticated AI models with legacy systems. The key thematic summary is that users expect AI to transition moving services from reactive scheduling to proactive, high-precision planning, making the entire relocation process smoother and more predictable for both the company and the customer.

The integration of AI is fundamentally transforming key moving company workflows, moving beyond simple automation to genuine intelligent assistance. For instance, AI algorithms are now capable of analyzing historical move data, customer review sentiments, local traffic patterns, and weather forecasts simultaneously to generate highly optimized scheduling and resource allocation plans that minimize delays and maximize team utilization. This level of predictive analytics is critical in mitigating risks associated with logistics. Moreover, AI powers sophisticated chatbot interfaces and virtual assistants that can handle a significant percentage of routine customer inquiries, from initial pricing checks to tracking updates, freeing up human staff to focus on complex service issues and personalized sales efforts.

Furthermore, the visual estimation segment is perhaps the most dramatically affected. By employing computer vision and machine learning (ML) models, smartphone videos or virtual reality tours of a customer’s premises can be instantly analyzed to accurately catalog inventory, calculate volume (cubic feet or meters), and estimate required packing materials and labor hours. This capability replaces the traditional, time-consuming, and subjective in-person survey with an objective, scalable, and faster digital process. The long-term impact of AI is the creation of a 'Dynamic Moving Management' ecosystem where pricing, scheduling, and labor deployment adjust autonomously in real-time based on fluctuating market conditions and operational capacities, ensuring maximum profitability and service quality.

- AI-driven Predictive Scheduling: Utilizes historical data and external factors (traffic, weather) to forecast demand and optimize crew allocation, reducing idle time and minimizing logistical conflicts.

- Automated Visual Inventory Assessment: Uses computer vision technology to analyze images or videos of household goods, accurately calculating volume and weight for precise quoting without physical surveys.

- Enhanced Dynamic Pricing: Machine learning models analyze competitors' pricing, service demand elasticity, and internal cost structures in real time to generate optimized, variable quotes.

- Intelligent Lead Scoring and CRM: AI ranks incoming leads based on conversion probability and potential value, allowing sales teams to prioritize high-potential customers and customize communication strategies.

- Optimized Route Planning and Geofencing: Utilizes reinforcement learning to continuously improve routes based on real-world feedback loops, incorporating constraints like vehicle size restrictions and delivery window accuracy.

- Proactive Risk Management: Identifies potential delays or operational bottlenecks (e.g., high-risk loading locations, unexpected traffic jams) before they occur and suggests alternative courses of action to dispatchers.

- Natural Language Processing (NLP) for Customer Support: Implements sophisticated chatbots to manage frequently asked questions, update status inquiries, and initiate booking processes 24/7, improving customer responsiveness.

DRO & Impact Forces Of Moving Company Software Market

The market trajectory for Moving Company Software is shaped by a powerful interplay of drivers, restraints, and opportunities, culminating in defining impact forces. A primary driver is the accelerating pressure on moving companies to improve profitability by minimizing operational waste—a goal readily achieved through software-driven route optimization, precise inventory tracking, and electronic documentation, which collectively reduce costly errors and administrative overhead. This is significantly compounded by customer expectations for transparency; modern consumers demand real-time visibility into the status of their belongings, necessitating cloud-based tracking and immediate communication tools integrated within the software platform. Furthermore, the global proliferation of affordable mobile devices acts as a substantial enabler, allowing field crews to access and update critical job information instantly, irrespective of their physical location.

Despite these robust drivers, the market faces notable restraints. The significant initial capital expenditure required for implementing advanced Enterprise Resource Planning (ERP)-integrated software solutions can be prohibitive, particularly for smaller, independent moving operators operating on thin margins. Coupled with this is the inherent resistance to change within traditionally analog businesses; convincing long-established companies to abandon entrenched, familiar paper-based processes for new, complex digital workflows requires substantial training and cultural transformation. Data security and privacy concerns also pose a restraint, especially as these systems handle sensitive customer information and proprietary operational data, necessitating high investment in robust cybersecurity features, which further increases the cost of deployment and maintenance.

Opportunities within the market are vast and centered on specialization and technological convergence. A key opportunity lies in developing highly specialized software catering specifically to niche moving segments, such as fine art transportation, medical equipment relocation, or complex industrial moves, which require unique regulatory compliance and handling protocols. Furthermore, the integration of cutting-edge technologies like the Internet of Things (IoT)—through connected vehicle sensors and smart inventory tags—offers opportunities for unprecedented real-time operational oversight and condition monitoring during transit. The increasing global regulatory requirements around carbon emissions and sustainability also create an opportunity for software providers to incorporate environmental impact tracking and optimization tools, appealing to environmentally conscious corporate clients. These drivers, restraints, and opportunities converge to create potent impact forces, primarily compelling companies toward digital transformation to remain competitive, while simultaneously raising the technological sophistication requirements for new market entrants.

Segmentation Analysis

The Moving Company Software Market is comprehensively segmented based on deployment model, the functionality of the application, and the size of the end-user organization. This multidimensional segmentation allows vendors to tailor their offerings to precise market needs, ranging from simple, accessible cloud-based solutions for small movers requiring basic quoting tools to complex, integrated on-premise solutions managing vast, international fleets for large corporations. Understanding these segments is crucial for strategic market positioning, particularly as the demand for specialized features, such as advanced data analytics and mobile workforce management, continues to grow across all enterprise sizes. The segmentation highlights the market's evolving architecture from monolithic software packages to modular, API-driven components that can be flexibly combined to meet specific operational requirements.

The most significant segment shift is the overwhelming preference for Cloud-based (SaaS) solutions, driven by their lower total cost of ownership (TCO), automatic updates, and inherent accessibility from any location, which is vital for mobile workforces. Conversely, the smaller On-Premise segment still serves specific large enterprises that require maximum control over proprietary data or operate in environments with stringent security mandates or limited internet connectivity. Application-wise, logistics and fleet management remains foundational, but the accelerating adoption of integrated Customer Relationship Management (CRM) tools and dedicated estimation software reflects the industry's pivot toward customer experience and sales efficiency as key differentiators, often exceeding the growth rates of traditional operational modules. The dichotomy between large enterprises demanding highly customized integration and SMEs seeking plug-and-play affordability dictates product feature roadmaps.

- Deployment Model:

- Cloud-based (SaaS)

- On-Premise

- Application:

- Logistics and Fleet Management (Scheduling, Dispatch, Route Optimization)

- Customer Relationship Management (CRM)

- Quotation and Estimation (Volume Calculation, Dynamic Pricing)

- Inventory Management and Tracking

- Billing and Invoicing

- Workforce Management (Crew Scheduling, Time Tracking)

- End-User:

- Large Enterprises (International and National Moving Chains)

- Small and Medium-sized Enterprises (SMEs) (Local and Regional Movers)

- Component:

- Software

- Services (Implementation, Training, Support)

Value Chain Analysis For Moving Company Software Market

The value chain for the Moving Company Software Market begins with the Upstream Analysis, which focuses on the core suppliers of foundational technological components. This includes cloud infrastructure providers (such as AWS, Microsoft Azure, and Google Cloud), who supply the scalable architecture for SaaS deployment. Additionally, independent software vendors (ISVs) supply specialized application programming interfaces (APIs) and third-party modules—such as mapping services (e.g., Google Maps API for routing), payment gateway integrations (e.g., Stripe, PayPal), and proprietary AI algorithms for computer vision and pricing optimization. The quality and reliability of these upstream inputs directly influence the functionality, security, and scalability of the final moving software product. Strong relationships with reliable cloud providers are essential for ensuring high uptime and global accessibility, critical features for geographically dispersed moving operations.

Mid-chain activities involve the Software Developers and System Integrators. Developers engage in the design, coding, testing, and continuous updating of the core software platform, focusing on user experience (UX) design, robustness, and regulatory compliance features. System integrators play a vital role, particularly for large enterprise clients, by customizing the software to fit specific workflows, ensuring seamless integration with existing ERP, accounting, and HR systems, and providing specialized data migration services. Distribution channels represent the mechanism by which the software reaches the end-user. Direct channels involve vendors selling their proprietary software subscription services directly to moving companies through their internal sales teams, often providing highly specialized training and long-term support contracts.

Indirect channels utilize third-party resellers, value-added resellers (VARs), and strategic channel partners, particularly in fragmented international markets, to distribute the software. This approach leverages local market expertise and existing customer relationships to accelerate adoption. Downstream Analysis centers on the end-user applications and feedback loop. Moving companies utilize the software to deliver tangible services (e.g., efficient quotes, timely moves). The feedback gathered from these end-users—in terms of usability, feature requests, and performance issues—is crucial for the continuous product improvement cycle (DevOps). The efficiency of this feedback loop, from the moving company back to the software developer, significantly impacts the vendor's ability to remain competitive and responsive to evolving industry needs, particularly concerning regulatory changes and emerging technologies like autonomous logistics.

Moving Company Software Market Potential Customers

Potential customers for Moving Company Software span the entire spectrum of the relocation industry, categorized primarily by size and operational scope. The primary end-users are professional moving companies, ranging from small, family-owned local operators specializing in residential moves to massive, multinational logistics giants handling complex corporate relocations, military contracts, and specialized freight. For smaller operators (SMEs), the appeal of moving software lies in its ability to professionalize their operations quickly and affordably, often utilizing subscription-based SaaS models focused on automating basic functions like online booking, simple invoicing, and basic route planning. They seek solutions that require minimal IT overhead and offer rapid deployment to immediately enhance their competitive edge against larger firms.

Large enterprises, encompassing global moving networks and specialized freight forwarders, represent another critical customer segment. These organizations demand highly sophisticated, modular software capable of managing thousands of jobs concurrently across multiple international jurisdictions. Their focus is on deep system integration, advanced predictive analytics for resource management across large fleets, and robust compliance features for cross-border taxation and customs documentation. Customization is a key requirement for this segment, ensuring the software adheres to strict internal protocols and existing technology stacks, often necessitating lengthy implementation and substantial ongoing service contracts from the software vendor.

Beyond traditional movers, the customer base is expanding to include adjacent logistical service providers. This includes temporary storage and warehousing companies that require integrated inventory management features, corporate relocation service agencies that manage third-party vendors and demand real-time visibility into the moving process, and apartment management groups that partner with moving software providers to offer seamless tenant transition services. This diversification of the end-user base underscores the increasing relevance of specialized APIs and flexible integration capabilities, allowing the software to interface effectively with a broader logistics ecosystem. Ultimately, any organization whose core business relies heavily on accurate scheduling, precise inventory handling, and effective resource deployment across geographical distances is a potential buyer of modern moving software solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.1 Billion |

| Market Forecast in 2033 | USD 4.9 Billion |

| Growth Rate | CAGR 12.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Movegistics, MoverBase, MoversSuite, SmartMoving, Supermove, MoveHQ, EWS Group, Jobber, Truckstop, ServiceTitan, Zoho, HubSpot (Logistics focus), IFS, Descartes, MercuryGate International, HighJump, Samsara, Fleetmatics, LoadRunner. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Moving Company Software Market Key Technology Landscape

The technological architecture underpinning the Moving Company Software market is rapidly evolving, driven by the shift from legacy desktop applications to highly integrated, mobile-first cloud platforms. The primary technological foundation is Software-as-a-Service (SaaS), which allows for multi-tenant architecture, enabling vendors to deploy updates and new features instantly across their entire user base while significantly reducing the maintenance burden on moving companies. Critical technologies include robust Application Programming Interfaces (APIs) that facilitate seamless integration with external ecosystems, such as third-party accounting software (e.g., QuickBooks), payment processing systems, and specialized industry platforms for background checks or insurance underwriting. The effectiveness of these APIs determines the software's ability to operate as a central nervous system for the moving business, connecting operational processes with financial and customer-facing functions.

The second pillar of the technology landscape involves advanced data processing and connectivity solutions. Mobile technology, specifically dedicated mobile applications for field crews, is indispensable for real-time data capture, electronic proof of delivery (e-POD), and communication with dispatchers. These apps leverage geo-location services (GPS) and telematics to provide granular data on vehicle location, driver behavior, and estimated time of arrival (ETA), which are crucial inputs for optimizing routes and managing customer expectations. Furthermore, the increasing adoption of 5G networks is enhancing the speed and reliability of data transmission from remote locations, minimizing latency issues that historically plagued field operations, ensuring that dispatchers always work with current, accurate operational status information.

The third and most disruptive technological trend is the pervasive integration of Artificial Intelligence (AI) and Machine Learning (ML). AI algorithms are employed not only for sophisticated route optimization but also for improving the accuracy of initial quotes through computer vision models that estimate item volume from visual inputs, reducing the reliance on manual estimates that are often sources of discrepancy and customer dissatisfaction. Blockchain technology is also beginning to emerge, particularly for secure and immutable record-keeping of high-value inventories, cross-border documentation, and electronic contracts (smart contracts), promising enhanced transparency and reduced fraud across the complex logistics chains managed by large moving organizations. The confluence of cloud scalability, deep mobile functionality, and intelligent automation defines the modern competitive edge in this market.

Regional Highlights

- North America: This region holds the largest market share, characterized by high disposable incomes, significant consumer mobility, and a mature, highly competitive moving industry structure. The early and rapid adoption of cloud-based SaaS solutions and advanced telematics for fleet management defines this market. Regulatory compliance software, especially related to commercial driver hours and weight restrictions, is a strong growth driver. The U.S. and Canada are technology pioneers, demanding feature sets that include integrated virtual survey capabilities and sophisticated AI for demand forecasting. Investment in digital infrastructure is robust, enabling small and large movers alike to implement high-end software solutions.

- Europe: The European market is fragmented yet sophisticated, driven heavily by regulatory compliance, particularly GDPR (data protection) and complex cross-border logistics requirements among EU member states. Solutions must offer multi-lingual support, multi-currency processing, and highly adaptable taxation modules. The market growth is focused on optimizing inter-country moves and developing seamless digital workflows that reduce bureaucratic hurdles. Countries such as Germany, the UK, and France show high adoption rates, concentrating on utilizing software for carbon footprint reduction and efficient use of existing dense road networks.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region due to explosive urbanization, rapid infrastructure investment, and the mass digitization of logistics operations across nations like China, India, and Southeast Asian countries. The market here is characterized by a high preference for mobile-first solutions, reflecting the widespread use of smartphones in daily business operations. While SMEs dominate, growth is fueled by large international moving companies establishing a presence, necessitating robust software for complex port logistics and high-volume residential moves. Price sensitivity is a key factor, pushing demand toward affordable, subscription-based micro-services rather than large, integrated suites.

- Latin America: This region presents a market with significant potential but faces challenges related to economic volatility and infrastructure limitations in certain areas. Market growth is gradually accelerating, driven by the need to formalize and professionalize logistics operations. Key software requirements include reliable offline capabilities for areas with inconsistent connectivity, robust anti-theft tracking, and solutions adapted for specific localized regulatory frameworks related to labor and transportation. Brazil and Mexico are leading the adoption, primarily focusing on route optimization to combat high fuel costs and traffic congestion.

- Middle East and Africa (MEA): The MEA region is witnessing growing software adoption, primarily centered around major economic hubs like the UAE, Saudi Arabia, and South Africa. Growth is driven by large-scale infrastructure projects, high expatriate mobility (especially in the Gulf Cooperation Council nations), and governmental initiatives promoting digital transformation in logistics. Solutions demanded here often prioritize stringent security features, robust Arabic language support, and modules capable of managing international air freight and complex customs documentation processes efficiently. The market is slowly maturing, moving from basic operational software to advanced planning and forecasting tools.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Moving Company Software Market.- Movegistics

- MoverBase

- MoversSuite (EWS Group)

- SmartMoving

- Supermove

- MoveHQ

- Jobber

- ServiceTitan

- Zoho Corporation (CRM integration)

- Descartes Systems Group

- MercuryGate International

- HighJump (Körber Supply Chain)

- Samsara (Fleet Management focus)

- Fleetmatics (Verizon Connect)

- LoadRunner

- TrueLogic

- SoftMove

- Book-A-Move

- Vana Moving Software

- ReadySetMove

Frequently Asked Questions

Analyze common user questions about the Moving Company Software market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary benefit of migrating from on-premise moving software to a cloud-based SaaS solution?

The primary benefit of transitioning to a cloud-based SaaS model is significantly reduced operational expenditure, coupled with enhanced scalability and superior accessibility. SaaS solutions eliminate the need for costly local server maintenance and manual software updates, providing automatic security patches and feature upgrades. This ensures that field crews and administrative staff can access real-time job data securely from any location, improving collaboration and service responsiveness immediately.

How does AI integration specifically improve the accuracy of moving quotes and estimations?

AI improves quote accuracy by employing machine learning and computer vision to objectively analyze visual data (photos, videos) of the items to be moved, instantly calculating precise volume, weight, and material requirements. This automated process replaces subjective, error-prone manual estimates, leading to dynamic pricing that minimizes disputes, enhances customer trust, and ensures accurate resource allocation for the moving company.

Which geographical region exhibits the highest growth potential for moving company software adoption?

The Asia Pacific (APAC) region is forecasted to exhibit the highest growth potential. This accelerated growth is driven by substantial digital transformation initiatives, rapid urbanization, and a burgeoning logistics sector across emerging economies. Increased internet penetration and the high adoption rate of mobile-first business tools are enabling rapid software deployment even among small and medium-sized enterprises (SMEs) in this region.

What core functional modules are essential for small and medium-sized moving enterprises (SMEs)?

SMEs typically require core modules focused on immediate return on investment and operational basics, including a robust Customer Relationship Management (CRM) system for lead tracking, accurate Quotation and Estimation tools, efficient Dispatch and Scheduling capabilities, and simplified Billing and Invoicing functionality. Cloud deployment is essential for minimizing IT investment and maximizing flexibility for a small team.

What is the key technological restraint currently challenging the widespread adoption of advanced moving software?

The key restraint is the persistent organizational inertia and resistance to change within traditionally manual moving businesses. While the cost of entry for SaaS has decreased, the reluctance of existing operators, particularly those utilizing outdated paper-based systems, to invest in training, overcome system integration complexity, and implement new digital workflows remains a significant hurdle to market expansion.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Moving Company Software Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Cloud-based, On-premise), By Application (SMEs, Large companies), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

- Moving Company Software Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Cloud based, On premise), By Application (SMEs, Large companies), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager