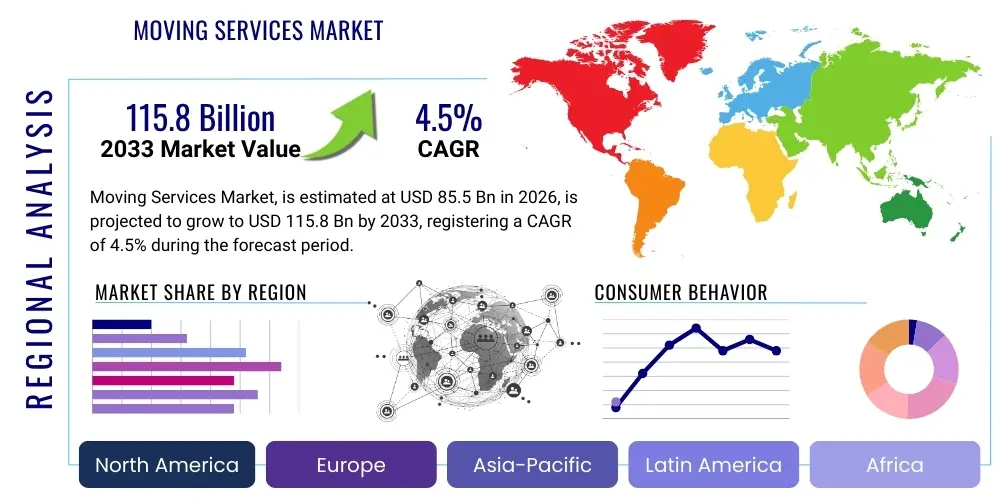

Moving Services Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435693 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Moving Services Market Size

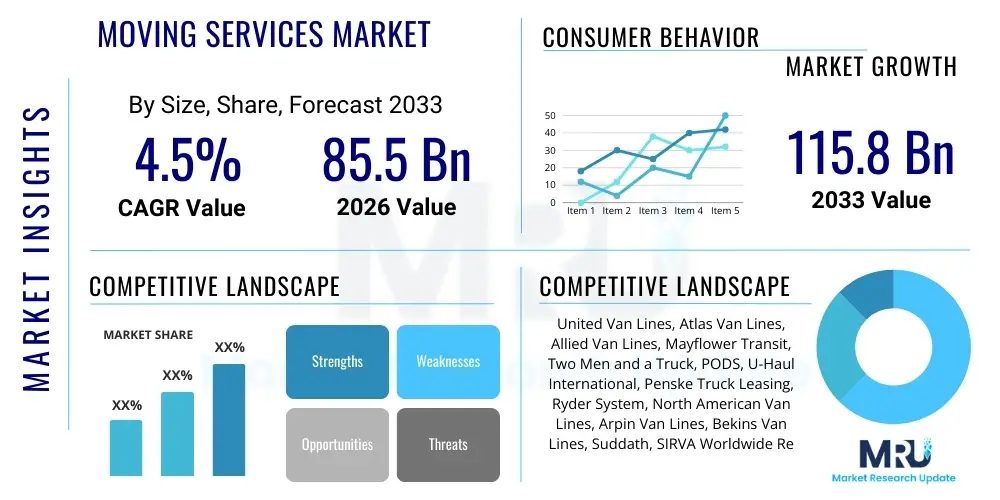

The Moving Services Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at USD 85.5 Billion in 2026 and is projected to reach USD 115.8 Billion by the end of the forecast period in 2033.

Moving Services Market introduction

The Moving Services Market encompasses the professional provision of logistics, transportation, packing, loading, unloading, and storage solutions for individuals, families, and businesses relocating their possessions across various distances, ranging from local intrastate moves to complex international relocations. This industry is fundamentally driven by housing market volatility, corporate relocation policies, economic migration patterns, and the increasing demand for specialized, secure handling of personal and commercial assets. The services offered are highly diverse, including full-service options where professionals manage every stage of the move, partial services focused primarily on transportation, and self-service models utilizing rental trucks or portable storage containers.

Major applications of moving services span residential transfers, where families require efficient transition to new homes, and commercial or corporate relocations, often involving the complex logistical maneuvering of office equipment, IT infrastructure, and specialized inventory. The principal benefit derived from utilizing professional moving services is the substantial reduction in physical labor, time commitment, and the minimization of risk associated with potential damage during transit. Furthermore, professional providers offer specialized insurance coverage and expert regulatory compliance, particularly critical for long-distance and cross-border moves, ensuring a streamlined and predictable moving experience for the client.

Driving factors stimulating market growth include robust economic recovery in developed nations leading to higher employment mobility, the sustained trend of urbanization and suburbanization necessitating frequent residential moves, and technological advancements enhancing operational efficiency, such as advanced route optimization software and digitized inventory management systems. Additionally, the growing complexity of large-scale commercial relocations, often requiring specialized rigging and sophisticated project management, further solidifies the need for expert third-party logistics providers within the moving services ecosystem.

Moving Services Market Executive Summary

The Moving Services Market is characterized by resilient growth, primarily fueled by global labor mobility, robust residential real estate activity, and the sustained outsourcing trend of corporate logistics to specialized vendors. Current business trends indicate a strong bifurcation in consumer preference: a continued demand for premium, full-service, white-glove moving experiences among affluent demographics and corporate clients, contrasted with rapid growth in the self-service and containerized moving segments driven by cost-consciousness and digital accessibility. Key competitive dynamics revolve around maximizing operational efficiency through advanced logistics software and ensuring stringent quality control measures, particularly concerning timeliness and damage prevention, which are paramount consumer trust factors.

Regional trends highlight North America as the dominant market, largely due to high internal migration rates and substantial corporate relocation activity, particularly within the technology and finance sectors. Asia Pacific is emerging as the fastest-growing region, stimulated by rapid urbanization, infrastructure development, and increasing international trade necessitating cross-border movement of expatriate professionals and commercial assets. Meanwhile, regulatory standardization and the adoption of eco-friendly moving practices, such as using sustainable packing materials and transitioning to low-emission vehicle fleets, are becoming significant differentiating factors, particularly in environmentally conscious European markets.

Segment trends underscore the enduring importance of the Residential segment, specifically long-distance and international residential moves, which typically yield higher average transaction values. Within the service type, the self-service moving sector (truck rentals and portable storage) is experiencing accelerating adoption, appealing to do-it-yourself movers seeking flexibility and affordability. Technology integration is profoundly impacting segmentation, with digital platforms and mobile applications becoming essential tools for instant quoting, virtual surveys, and real-time tracking, thereby blurring traditional segment boundaries and emphasizing service transparency across all market tiers.

AI Impact Analysis on Moving Services Market

Analysis of common user questions regarding the impact of Artificial Intelligence (AI) on the Moving Services Market reveals significant interest centered on enhanced efficiency, pricing transparency, and the potential displacement of human labor. Users frequently inquire about how AI can provide highly accurate, instantaneous quotes without in-person surveys, focusing on the use of computer vision for automated volume estimation and predictive analytics for demand forecasting. Key concerns often revolve around data privacy when utilizing AI-driven tools that analyze personal inventory data, and the expected reliability of machine-generated logistical plans compared to experienced human coordinators. Expectations are generally high, anticipating AI will eliminate scheduling bottlenecks, optimize complex multi-stop routes instantly, and significantly reduce the administrative overhead currently associated with relocation planning.

The introduction of AI is fundamentally restructuring the operational backbone of moving companies, moving beyond simple automation to genuine intelligent orchestration. AI-powered dynamic pricing models analyze historical demand, seasonality, fuel costs, and real-time competitor rates to provide optimized, profitable quotes instantly, improving conversion rates while maximizing truck utilization. Furthermore, conversational AI and advanced chatbots are increasingly handling routine customer service inquiries, managing booking confirmations, and providing updates, thus freeing up human staff to focus on complex problem resolution and personalized client relationship management, leading to improved service quality metrics.

The long-term impact of AI will materialize through fully integrated predictive supply chain management systems. These systems utilize machine learning to predict potential disruptions, such as weather delays or regulatory hold-ups, and proactively adjust routing and scheduling. This predictive capability translates directly into higher customer satisfaction through improved adherence to promised timelines. For instance, sophisticated AI algorithms can analyze satellite imagery and floor plans to determine optimal loading and unloading strategies, enhancing crew productivity and minimizing the duration of physical labor, thereby driving down overall operational costs for providers.

- AI-driven real-time dynamic pricing and quotation based on visual inventory analysis (computer vision).

- Optimized route planning and logistics orchestration, minimizing fuel consumption and travel time.

- Predictive analytics for demand forecasting, enabling efficient resource allocation and staffing.

- Automated scheduling and workload balancing for moving crews and vehicle fleets.

- Enhanced customer interaction via conversational AI for booking, tracking, and basic support.

- Fraud detection and risk assessment improvements in insurance and valuation services.

- Streamlined documentation generation and automated compliance checks for international moves.

DRO & Impact Forces Of Moving Services Market

The Moving Services Market is shaped by a confluence of powerful Drivers, Restraints, and Opportunities (DRO), all contributing to its overall trajectory and strategic direction. Primary market drivers include macroeconomic stability fostering high housing turnover and increased corporate mobility, coupled with globalizing labor forces necessitating complex international relocation services. The sheer volume of annual relocations globally ensures a stable baseline demand for professional services. Conversely, major restraints involve intense price competition from unlicensed operators and the inherent vulnerability of the industry to economic downturns and fluctuations in fuel prices, which directly impact operational expenditures. Opportunities predominantly lie in leveraging technology for efficiency gains, expanding specialized services (e.g., fine art or medical equipment moving), and penetrating rapidly developing urban centers in emerging economies.

Key drivers include demographic shifts, such as the increasing mobility of millennials and Gen Z seeking job changes or affordable housing, and the aging population requiring assistance with downsizing and complex logistics management. Furthermore, the sustained investment in residential real estate across major metropolitan areas acts as a constant catalyst for demand. The professionalism offered by established firms, including specialized packaging materials, standardized training protocols, and comprehensive insurance coverage, serves as a significant pull factor, differentiating legitimate providers from informal competitors and assuring service quality, which justifies higher pricing tiers for full-service moves.

Restraints are often operational and economic. High liability risk inherent in handling valuable possessions mandates expensive insurance and rigorous training, constraining profit margins. Moreover, market entry barriers remain relatively low for small, local movers, leading to fragmented competition and downward pressure on pricing, especially in the local segment. The most critical opportunity, however, resides in utilizing digital platforms—not just for booking, but for creating end-to-end customer journeys that offer high levels of transparency, communication, and control, effectively turning a typically stressful event into a manageable, digitally-assisted process. The expansion of portable storage solutions also presents a growth opportunity by integrating short-term storage into the long-distance moving lifecycle.

Segmentation Analysis

The Moving Services Market segmentation provides a granular view of service differentiation based on the complexity, scale, and specific requirements of the relocation project. The primary axes of segmentation include the Type of Service (defining the level of professional involvement), the End-User (identifying the client base as residential or commercial), and the Distance covered (categorizing moves as local, long-distance, or international). This structure allows providers to tailor their marketing, resource allocation, and pricing strategies to specific high-value or high-volume sub-markets. For instance, commercial relocation demands specialized project management skills not required in standard residential moves, while international moves necessitate expert knowledge of customs regulations and global logistics networks, defining distinct operational segments.

Analyzing segmentation highlights the growing importance of hybrid models, where customers mix and match professional services (like packing or loading) with self-service transportation elements. The Residential End-User segment remains the largest volume driver, though the Commercial/Corporate Relocation segment offers superior average revenue per contract due to the complexity and volume of assets involved, often incorporating warehousing and specialized IT decommission/recommission services. Furthermore, the distance segmentation dictates the level of logistical complexity; local moves are primarily time-and-labor-based, while international moves introduce significant variable costs related to freight forwarding, customs brokerage, and multi-modal transportation planning.

Strategic growth opportunities are highly concentrated within segments demanding high specialization. The market for moving high-value items, such as fine art, laboratory equipment, or sensitive governmental archives, requires certified personnel, climate-controlled environments, and specialized security protocols, fetching premium prices. Service providers are increasingly focusing on technology adoption to improve efficiency across segments—for example, using digital inventory tagging to streamline residential packing processes or integrating AI to optimize container loading configurations for long-distance commercial freight. The self-service segment, including portable storage containers, continues to challenge traditional full-service models by offering significant cost savings and flexibility, particularly appealing to younger, budget-conscious consumers.

- By Type: Full-Service Moving, Partial Service Moving, Self-Service Moving, Truck Rental, Portable Storage/Containerized Moving.

- By End-User: Residential (Local, Long-Distance, International), Commercial/Corporate Relocation (Office, Industrial, Retail), Military/Government.

- By Distance: Local (Intra-city), Interstate/Long-Distance, International (Cross-border, Intercontinental).

Value Chain Analysis For Moving Services Market

The value chain for the Moving Services Market begins with upstream activities focused on securing essential resources and assets. This upstream segment involves the procurement of highly specialized assets, including a diverse fleet of moving vehicles (ranging from small vans to large tractor-trailers), procurement of advanced packing materials (such as customizable crates, archival boxes, and protective wraps), and investment in advanced logistics software for scheduling and route optimization. Key players in this stage are truck manufacturers, packaging suppliers, and third-party technology developers providing SaaS solutions for fleet management and virtual surveying. Effective upstream management ensures cost control and the availability of high-quality resources necessary for executing diverse moving projects efficiently.

Midstream activities represent the core service delivery process: sales, inventory surveying (often utilizing virtual or AI tools), planning, packing, loading, transportation, unloading, and setting up at the destination. This stage is heavily labor-intensive and quality-dependent, requiring highly trained crews and stringent adherence to safety and handling protocols. The midstream stage is where the provider generates the most value by transforming logistical complexity into a seamless customer experience. Successful firms differentiate themselves here through specialized handling (e.g., piano moving, fine art crating) and proactive communication, minimizing damages and delays which are critical metrics for customer satisfaction.

Downstream activities focus on the post-move service components and market reach. This includes temporary or long-term storage solutions, debris removal, post-move damage claims processing, and managing the overall distribution channel. Distribution is often direct-to-consumer or direct-to-corporate clients, though strategic partnerships with real estate agencies, corporate HR departments (for employee relocation benefits), and third-party relocation management firms act as indirect channels. The downstream phase is crucial for brand reputation and securing repeat business, necessitating efficient claims management and robust customer feedback mechanisms to continuously improve service quality and sustain a competitive advantage in a high-touch service industry.

Moving Services Market Potential Customers

The potential customer base for the Moving Services Market is remarkably broad, spanning all demographics and organizational sizes globally, fundamentally driven by the necessity of physical relocation. The largest and most frequent end-users are Residential Movers, including first-time homeowners, renters transitioning between apartments, and families undertaking inter-city or cross-country moves due to lifestyle changes or job opportunities. Within the residential segment, high-net-worth individuals requiring white-glove, insured handling of large, complex estates represent a high-value niche demanding tailored service agreements and exceptional discretion.

The Commercial Sector constitutes the other major customer segment, encompassing Corporate Relocation, Office Moves, and Industrial Transfers. Corporate clients, particularly large multinational companies, are crucial buyers as they frequently relocate personnel, require specialized services for moving entire departments, and often maintain ongoing contracts for executive transfers, valuing reliability, speed, and minimal business interruption above cost. Additionally, niche commercial sectors like healthcare, education, and manufacturing require providers capable of handling sensitive, expensive equipment, such as laboratory instruments or heavy machinery, demanding compliance with strict industry regulations and specialized rigging services.

Finally, government and military organizations represent a steady, high-volume customer base, particularly in countries with significant military presence and frequent personnel rotations. These institutional clients demand providers who can adhere to strict federal contracting guidelines, security clearances, and detailed logistical reporting requirements. Ultimately, any individual or entity undertaking a physical move—whether driven by economic necessity, professional opportunity, or personal preference—who values time savings, risk mitigation, and professional execution over purely minimizing cost, represents a high-potential customer for professional moving service providers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 85.5 Billion |

| Market Forecast in 2033 | USD 115.8 Billion |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | United Van Lines, Atlas Van Lines, Allied Van Lines, Mayflower Transit, Two Men and a Truck, PODS, U-Haul International, Penske Truck Leasing, Ryder System, North American Van Lines, Arpin Van Lines, Bekins Van Lines, Suddath, SIRVA Worldwide Relocation & Moving, National Van Lines, Graebel Companies, UniGroup, Stevens Van Lines, Wheaton World Wide Moving, Taylor Moving and Storage |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Moving Services Market Key Technology Landscape

The technological landscape of the Moving Services Market is undergoing rapid digital transformation, moving away from manual, paper-based processes toward integrated, data-driven platforms. Central to this transformation is the widespread adoption of advanced Fleet Management Systems (FMS) utilizing GPS tracking and telematics data. FMS technology provides real-time location and diagnostics of vehicles, enabling managers to optimize routes for fuel efficiency, monitor driver behavior for safety compliance, and provide accurate, up-to-the-minute estimated arrival times (ETAs) to customers, significantly enhancing operational transparency and reliability, which are paramount in customer satisfaction metrics.

Another crucial technological development is the implementation of digital sales and inventory tools. Virtual survey capabilities, often powered by smartphone cameras and augmented reality (AR) or AI, allow sales consultants to accurately estimate the volume and weight of belongings remotely, eliminating the need for costly and time-consuming in-person visits. This not only speeds up the quotation process but also dramatically increases the accuracy of estimates, reducing disputes and unexpected charges upon moving day. Furthermore, mobile applications are becoming the standard interface for customers, offering features like digital documentation signing, inventory photo logs for insurance purposes, and two-way communication with the moving coordinator.

The future technology landscape is heavily invested in robotics and advanced automation, particularly in warehousing and storage solutions. Automated storage and retrieval systems (AS/RS) are being deployed to manage containerized storage efficiently, minimizing labor costs and optimizing warehouse footprint. Furthermore, blockchain technology is being explored to create immutable, transparent records of inventory handling and customs documentation for international moves, addressing persistent issues of chain-of-custody verification and ensuring regulatory compliance. This comprehensive technological stack ensures that modern moving companies function as sophisticated logistics firms rather than simple transportation providers.

Regional Highlights

- North America: Dominates the global moving services market, primarily due to high internal migration rates within the United States and Canada, driven by economic opportunities and housing market volatility. The region is characterized by advanced technological adoption, high competition among major van lines, and strong demand for full-service, long-distance moving solutions. The robust corporate relocation sector, especially within the finance, tech, and energy industries, significantly contributes to market value.

- Europe: The European market shows steady growth, driven by intra-European Union labor mobility and a strong focus on sustainability. Regulatory environments, particularly regarding international haulage and customs within the EU/non-EU borders, necessitate highly specialized service providers. Germany, France, and the UK are key markets, where demand is focused on high-quality specialized moves and containerized logistics, often prioritizing environmentally friendly moving practices.

- Asia Pacific (APAC): Positioned as the fastest-growing region, APAC benefits from rapid urbanization, industrialization, and significant foreign direct investment leading to expatriate relocations. Countries like China, India, and Australia are seeing surging demand for both residential and commercial moves. The market is highly fragmented but offers vast opportunity for Western firms to introduce standardized, technologically advanced moving solutions to meet growing demand from the burgeoning middle class and expanding multinational corporations.

- Latin America: Growth is moderate, largely constrained by economic volatility in some countries, yet demonstrating increasing adoption of professional moving services, particularly in major economic hubs like Brazil and Mexico. The market is primarily driven by local and regional relocation, with increasing interest in affordable, containerized moving options offering better security for possessions during transit.

- Middle East and Africa (MEA): This region is heavily influenced by large-scale infrastructure projects and expatriate movements, especially within the Gulf Cooperation Council (GCC) countries. High demand for international moving services catering to transient, highly skilled workers characterizes this market. The focus is on secure, temperature-controlled storage and efficient customs clearance processes, given the region’s unique regulatory and climatic challenges.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Moving Services Market.- United Van Lines

- Atlas Van Lines

- Allied Van Lines

- Mayflower Transit

- Two Men and a Truck

- PODS

- U-Haul International

- Penske Truck Leasing

- Ryder System

- North American Van Lines

- Arpin Van Lines

- Bekins Van Lines

- Suddath

- SIRVA Worldwide Relocation & Moving

- National Van Lines

- Graebel Companies

- UniGroup

- Stevens Van Lines

- Wheaton World Wide Moving

- Taylor Moving and Storage

Frequently Asked Questions

Analyze common user questions about the Moving Services market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the growth in the Moving Services Market?

Market growth is primarily driven by sustained global economic stability fostering increased corporate and labor mobility, high turnover rates in residential real estate markets, and accelerating adoption of self-service and containerized moving solutions driven by technology and cost efficiency. Demographic shifts and urbanization trends further stimulate consistent demand for professional relocation assistance.

How is technology impacting the pricing structure for moving services?

Technology, particularly AI and virtual surveying tools, is enabling dynamic, real-time pricing models. These tools analyze inventory volume, distance, seasonality, and resource availability instantly, leading to highly accurate, personalized quotes that promote greater pricing transparency and reduce the historical margin for error and hidden costs.

Which segment holds the largest market share in moving services?

The Residential End-User segment consistently holds the largest volume share of the Moving Services Market due to the high frequency of household moves. However, the Commercial/Corporate Relocation segment often generates the highest average contract value due to the complexity and specialization required for moving office infrastructure and personnel.

What are the primary challenges facing professional moving companies?

Key challenges include navigating intense price competition from both established large van lines and smaller, local operators; managing high operational costs related to fuel price volatility and labor shortages; and mitigating high liability risks associated with cargo damage and transportation delays, which necessitate substantial insurance coverage.

What role do portable storage containers play in the market?

Portable storage containers, offered by companies like PODS and U-Haul, represent a rapidly growing sub-segment providing flexible, self-service moving solutions. They appeal to consumers seeking cost-effective alternatives to full-service movers and offer integrated temporary storage solutions, bridging the gap between traditional moving and long-term storage needs.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager