MRI Metal Detector Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433029 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

MRI Metal Detector Market Size

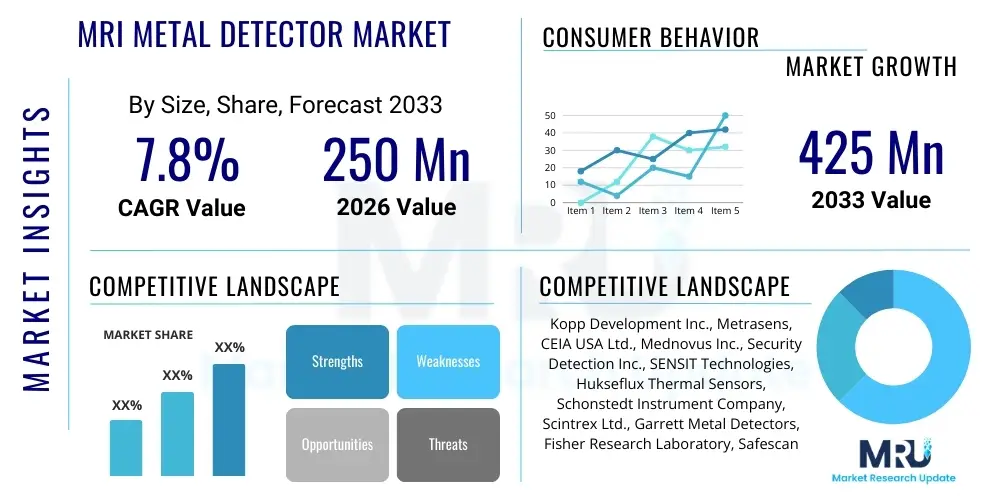

The MRI Metal Detector Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 250 Million in 2026 and is projected to reach USD 425 Million by the end of the forecast period in 2033.

MRI Metal Detector Market introduction

The MRI Metal Detector Market encompasses specialized safety devices designed to identify ferromagnetic materials carried by patients or staff before they enter the controlled environment of a Magnetic Resonance Imaging (MRI) suite. These sophisticated detection systems are crucial for preventing serious accidents, patient injury, and expensive equipment damage resulting from the projectile effect, commonly known as the 'missile effect.' As MRI technology progresses towards higher field strengths (3.0T and beyond), the risks associated with undetected ferromagnetic objects escalate significantly, thereby mandating the increased deployment of advanced detection systems. These devices often utilize proprietary sensing technology, such as fluxgate magnetometers or specialized sensor arrays, optimized to operate without interfering with ambient hospital electronics while maintaining high sensitivity to small metallic items.

Product offerings in this market range from stationary, walk-through portals designed for comprehensive screening at the entrance of Zone IV to handheld devices used for rapid, targeted scanning of patients or specific areas. The primary application of these detectors is enhancing patient safety during the pre-screening process, ensuring compliance with global regulatory guidelines (such as those established by the FDA and various European bodies), and maintaining optimal clinical workflow efficiency by minimizing delays caused by unexpected ferromagnetic incidents. Furthermore, the increasing complexity of patient populations, including those with previously undisclosed or forgotten metallic implants, necessitates reliable detection tools that can integrate seamlessly into the clinical workflow without causing undue anxiety or lengthy screening procedures.

The market’s expansion is robustly driven by the rising global volume of MRI procedures, particularly in oncology, neurology, and orthopedics, coupled with an increasing awareness among healthcare providers regarding stringent MRI safety protocols. The benefit of these systems extends beyond simple safety; they contribute significantly to risk mitigation, reducing potential liability for healthcare institutions. Key driving factors include mandatory accreditation standards requiring pre-screening measures, continuous innovation leading to improved detection accuracy and reduced false-positive rates, and the global trend toward replacing older, lower-field MRI units with modern, high-field scanners that intensify magnetic hazards. The need for specialized detection that can differentiate between safe, weakly magnetic materials (like some titanium implants) and hazardous ferromagnetic materials is also pushing technological development forward.

- Product Description: Specialized ferromagnetic detection systems (FDS) used to screen individuals entering high-magnetic field environments like MRI suites.

- Major Applications: Pre-screening for patient safety, staff screening, clinical risk management, and regulatory compliance verification in MRI Zone IV access points.

- Benefits: Prevents missile effect accidents, protects expensive MRI machinery, enhances patient and staff safety, streamlines pre-procedure workflow, and ensures adherence to global safety standards.

- Driving Factors: Rising volume of MRI procedures, stricter regulatory enforcement of MRI safety standards, and increasing deployment of high-field (3.0T+) MRI systems globally.

MRI Metal Detector Market Executive Summary

The MRI Metal Detector Market is characterized by steady growth, primarily fueled by global mandates prioritizing patient safety within high-strength magnetic environments. Business trends indicate a strong shift towards integrated safety solutions, where detection systems are networked with patient information systems and access control mechanisms, moving beyond standalone screening tools. Key players are focusing heavily on developing sophisticated algorithms that minimize false alarms, which historically have been a major impediment to workflow efficiency. There is a palpable trend of mergers and acquisitions aimed at consolidating specialized detector technology with broader hospital safety and imaging informatics portfolios. Furthermore, sustainable business models are emerging, emphasizing preventative maintenance and recurring software update subscriptions to maintain calibration and compliance with evolving imaging standards.

Regionally, North America remains the dominant market, driven by high healthcare expenditure, stringent safety guidelines established by organizations like the American College of Radiology (ACR), and early adoption of advanced high-field MRI technology. However, the Asia Pacific (APAC) region is demonstrating the highest growth trajectory. This acceleration is attributed to rapidly expanding healthcare infrastructure in countries such as China and India, increasing governmental investments in diagnostic imaging facilities, and a growing middle class demanding higher quality medical care, which necessitates adherence to international safety standards. Europe maintains a mature market position, driven by EU Medical Device Regulation (MDR) compliance requirements and a high installed base of advanced imaging equipment, where replacement cycles and technological upgrades sustain market demand.

Segment trends reveal that the fixed/walk-through detector segment commands the largest market share due to its mandatory deployment in high-volume imaging centers and its superior ability to provide non-intrusive, continuous screening. Conversely, the portable/handheld segment is expected to exhibit the fastest growth, largely driven by its flexibility in screening non-ambulatory patients, conducting focused spot checks, and performing emergency rapid response scans. Segmentation by end-user highlights hospitals and diagnostic imaging centers as the primary revenue generators, although specialized research institutions and university medical centers represent a high-value niche market demanding the most sensitive and technologically advanced systems for ultra-high-field research applications. The prevailing trend across all segments is the increasing integration of Internet of Things (IoT) capabilities for remote monitoring, diagnostics, and data logging for compliance reporting.

- Business Trends: Shift towards integrated safety platforms; high investment in algorithms for false alarm reduction; focus on preventative maintenance contracts and subscription services for calibration.

- Regional Trends: North America dominates due to established safety protocols; APAC exhibits the fastest CAGR driven by infrastructure expansion and regulatory harmonization; Europe maintains stability through regulatory adherence (MDR).

- Segments Trends: Fixed (Walk-through) detectors hold the largest share for routine screening; Portable/Handheld devices show the fastest growth rate due to workflow flexibility and specific patient needs (e.g., non-ambulatory).

AI Impact Analysis on MRI Metal Detector Market

Common user questions regarding AI's impact on the MRI Metal Detector Market often center on whether AI can entirely replace physical detection hardware, how AI can improve existing detection accuracy, and its role in workflow automation and false positive reduction. Users frequently inquire about the feasibility of AI-driven predictive modeling to assess patient risk based on electronic health records (EHRs) versus relying solely on physical screening. There are also concerns about regulatory approval timelines for AI-enhanced detection systems and the cost implications of integrating such sophisticated software. The overriding expectation is that AI should significantly enhance the reliability and speed of the pre-MRI screening process, making it less dependent on human interpretation and more resilient to operator error.

The immediate influence of Artificial Intelligence (AI) in this market is not centered on replacing the core ferromagnetic detection hardware but rather on optimizing the operational efficiency and diagnostic performance of existing systems. AI algorithms are being deployed primarily for sophisticated signal processing. This involves analyzing the subtle magnetic signatures generated by potential ferromagnetic objects detected by the sensors. Traditional systems might flag a weakly magnetic object and a highly dangerous object similarly; AI, specifically machine learning models trained on vast datasets of magnetic profiles, can potentially differentiate between a benign item (like a small hair clip or certain dental fillings) and a hazardous projectile (like a key or loose tool). This advanced classification dramatically reduces the incidence of false positive alarms, which currently cause significant bottlenecks and delays in imaging center schedules.

Furthermore, AI plays a pivotal role in workflow automation and data integration. By linking the metal detection data directly with the patient scheduling system and the MRI machine console, AI ensures that no procedure commences until the mandatory safety clearance is logged and verified, thereby providing a robust, auditable safety layer. Predictive maintenance is another critical application; AI models analyze the performance metrics, environmental factors (like temperature fluctuations or electrical interference), and calibration history of the detectors to predict potential failures or drifts in sensitivity before they compromise safety. This shift from reactive maintenance to predictive maintenance ensures continuous high-level operation and regulatory compliance. The long-term impact involves exploring AI-enhanced sensors capable of identifying the precise location and material composition of embedded objects more effectively than current technologies, especially relevant for patients with complex medical histories involving numerous implants.

- Enhanced Signal Classification: AI algorithms differentiate between safe and hazardous ferromagnetic signatures, minimizing unnecessary workflow interruptions.

- Reduction of False Positives: Machine learning models dramatically improve accuracy, addressing the primary complaint regarding current FDS systems.

- Automated Workflow Integration: AI facilitates mandatory safety clearance logging and synchronization with MRI scheduling and access control systems (AEO/GEO focus on integration).

- Predictive Maintenance: AI analyzes performance data to forecast calibration needs or component failures, ensuring regulatory uptime and optimal safety function.

- Risk Assessment Augmentation: Potential for integrating screening data with EHRs to create real-time, dynamic patient risk profiles before entry into Zone IV.

DRO & Impact Forces Of MRI Metal Detector Market

The market is predominantly driven by the non-negotiable imperative of patient safety in MRI environments, underscored by global regulatory tightening and standardization efforts. Major drivers include the increasing global adoption of high-field (3T and 7T) MRI systems, which inherently amplify the ‘missile effect’ hazard, making robust ferromagnetic detection essential rather than optional. Restraints are primarily linked to the high capital expenditure required for installing advanced walk-through detectors and the recurring operational challenge posed by high false-positive rates, which can lead to staff fatigue, diminished trust in the system, and operational delays. Opportunities abound in developing multi-modality screening systems that combine metal detection with radio frequency identification (RFID) or near-field communication (NFC) technologies to track patient accessories and ensure all personnel entering the zone are accounted for and cleared.

The immediate impact forces are dominated by technological innovation, specifically the development of detectors offering superior differentiation capabilities—the ability to distinguish between benign implants and truly hazardous external objects. Regulatory pressure exerts a sustained, high-level impact; as accreditation bodies enforce stricter compliance with MRI safety standards, investment in certified detection equipment becomes mandatory for hospitals seeking to maintain their operating licenses and professional reputation. Economically, the cost-benefit analysis favors adoption, as the potential liability and cost associated with a single major MRI accident (equipment damage and patient injury) vastly outweigh the initial investment in a reliable detection system. This powerful economic deterrent against non-compliance forces market growth.

A significant long-term opportunity lies in standardizing data output and communication protocols (e.g., HL7, DICOM integration) for ferromagnetic detection systems, allowing seamless integration into hospital information systems (HIS) and radiology information systems (RIS). This integration would transform the screening process from an isolated physical check into an integral, traceable part of the digital patient record, crucial for medico-legal documentation and quality assurance. However, resistance to change in established clinical workflows and the lack of standardization among different detector manufacturers remain formidable restraints that suppress growth potential in fragmented healthcare markets. Successful market penetration relies on demonstrating a compelling blend of high sensitivity, low false-positive rates, and minimal disruption to the fast-paced radiology environment.

- Drivers (D): Increased installation of high-field MRI scanners (3T+); rising awareness and enforcement of stringent MRI safety protocols (e.g., ACR guidelines); heightened liability concerns among healthcare providers.

- Restraints (R): High initial acquisition costs for advanced systems; operational friction caused by persistent false-positive alarms; lack of universal standardization in magnetic detection thresholds.

- Opportunity (O): Integration with hospital digital infrastructure (HIS/RIS); development of next-generation sensors using superconducting quantum interference devices (SQUIDs) or similar highly sensitive technology; expansion into emerging markets (APAC, MEA).

- Impact Forces: Technological advancement (High); Regulatory mandates (High); Economic risk mitigation (High); Operational efficiency requirements (Medium).

Segmentation Analysis

The MRI Metal Detector Market is comprehensively segmented based on product type, technology, end-user, and field strength compatibility. Analyzing these segments provides a nuanced understanding of market dynamics and adoption trends. Product segmentation is crucial, differentiating between the high-throughput walk-through systems (fixed) and the versatile handheld/portable devices required for spot checks and non-ambulatory patient screening. Technology segmentation reveals the competitive edge, primarily distinguishing between highly sensitive passive systems (like advanced fluxgate magnetometers) and those incorporating active magnetic field generation. The end-user analysis confirms that primary demand originates from institutions managing high volumes of critical imaging procedures, while compatibility segmentation reflects the growing need for specialized detectors engineered to function optimally in the intense magnetic environments of 3.0T and 7.0T scanners without generating electrical noise.

The largest contributing segment by Product Type remains the fixed/walk-through portal detectors. These units offer standardized, consistent screening capabilities and are typically mandated for installation at the access point of MRI Zone IV in all accredited imaging centers. Their market dominance is secure due to their non-negotiable role in controlling access and preventing accidental entry of large ferromagnetic objects. However, the fastest growth is observed in the handheld detector segment, driven by their use in secondary screening, especially in scenarios where a patient's history is complex, or when an alarm is triggered, requiring precise localization of the metallic object without removing the patient from the gurney or trolley. This efficiency benefit, coupled with decreasing hardware costs, propels its adoption rate.

From an End-User perspective, Hospitals and large diagnostic imaging centers collectively account for the overwhelming majority of market revenue. These facilities house multiple high-field MRI units and conduct procedures 24/7, making the investment in robust safety infrastructure a core operational requirement. Specialized segments, such as academic research institutions utilizing ultra-high-field MRI (e.g., 7T and above) for cutting-edge neuroimaging, represent a smaller but highly lucrative market demanding custom-calibrated, extremely sensitive detection systems optimized for specific research protocols. This demand drives innovation, pushing manufacturers to refine their detection algorithms to handle the unique challenges posed by ultra-high magnetic gradients and sophisticated shielding techniques often employed in research settings.

- By Product Type:

- Fixed/Walk-Through Detectors

- Handheld/Portable Detectors

- By Technology:

- Passive Detection Systems (Fluxgate Magnetometers, etc.)

- Active Detection Systems (Less common in primary MRI screening)

- Hybrid Systems (Integrating magnetic detection with visual/metal mass analysis)

- By Field Strength Compatibility:

- 1.5 Tesla Compatible

- 3.0 Tesla Compatible

- Ultra-High Field (7.0 Tesla and above) Compatible

- By End-User:

- Hospitals

- Diagnostic Imaging Centers

- Ambulatory Surgical Centers

- Academic & Research Institutions

Value Chain Analysis For MRI Metal Detector Market

The value chain for the MRI Metal Detector Market begins with sophisticated upstream activities focused on the procurement of high-performance electronic components, particularly magnetic sensors, advanced microprocessors, and shielding materials critical for reliable operation near intense magnetic fields. Key suppliers include specialized sensor manufacturers (often specializing in fluxgate or specialized hall effect technologies) and embedded system developers. Manufacturing processes are highly specialized, requiring cleanroom environments and meticulous calibration procedures to ensure the final product meets stringent regulatory standards for electromagnetic compatibility (EMC) and detection sensitivity. Intellectual property regarding proprietary noise cancellation algorithms and filtering techniques represents a significant value-add during this stage, differentiating premium products from standard offerings.

The downstream distribution channel is critical and typically involves a dual approach. Direct sales are common for high-value installations, particularly when dealing with major hospital networks or large equipment procurement projects where technical consultation and customization are necessary. Manufacturers often maintain in-house sales teams and technical support specialists to manage these complex relationships. Conversely, indirect channels leverage authorized medical device distributors and value-added resellers (VARs) who possess established relationships with smaller diagnostic centers and regional healthcare providers. These indirect partners provide essential services such as local installation, initial operator training, and localized maintenance, crucial components that extend the manufacturer’s reach, especially in geographically dispersed or emerging markets.

Service and maintenance form a high-margin segment in the latter part of the value chain. Due to the critical safety function of these detectors, periodic calibration and regulatory compliance checks are mandatory. This generates consistent, recurring revenue for manufacturers through long-term service contracts. Technological integration with MRI equipment manufacturers (OEMs) is also a crucial aspect, as partnerships ensure the seamless operation and certification of the detection system within the broader imaging suite ecosystem. The movement is toward digitally managed systems, where remote diagnostics and predictive maintenance (enabled by IoT connectivity) further enhance the post-sale value proposition, ensuring maximum uptime and minimizing workflow interruptions caused by system recalibration or failure.

MRI Metal Detector Market Potential Customers

The primary end-users and buyers of MRI Metal Detector products are healthcare facilities that operate high-field MRI scanners, where the risk of the projectile effect is highest and regulatory compliance is paramount. This includes large, multi-specialty hospitals, both public and private, which typically require multiple fixed walk-through units for each MRI suite entrance and a stock of handheld units for secondary screening. These institutions prioritize systems that offer superior reliability, seamless integration with existing access control systems, and comprehensive data logging capabilities for accreditation and medico-legal purposes. Investment decisions are often driven by centralized capital planning committees focused on minimizing institutional risk and ensuring adherence to national safety guidelines, such as those published by the FDA or the European Medicines Agency (EMA).

Diagnostic imaging centers constitute another high-volume customer segment. Unlike large hospitals, these centers often specialize solely in outpatient radiology services and are highly sensitive to workflow efficiency. Their purchasing decisions are strongly influenced by the detector's ability to minimize false positives, thereby accelerating patient throughput without compromising safety. Smaller, private imaging centers may prefer more cost-effective, modular solutions or opt for high-quality handheld devices initially, before scaling up to fixed systems as their patient volume and regulatory scrutiny increase. Their requirements focus heavily on ease of use and minimal required staff training, making user-friendly interfaces a significant competitive advantage for manufacturers targeting this segment.

A niche but growing customer base includes specialty clinical facilities, such as neurological research centers, sports medicine clinics, and correctional facilities requiring specialized imaging. Additionally, academic and university medical centers, often operating advanced research MRI units (e.g., 7T and 9T systems), require the most technically sensitive detectors capable of identifying sub-millimeter metallic debris or weakly magnetic objects that could skew research results or pose a hazard in ultra-high magnetic fields. These research customers often drive early adoption of prototype technologies and customized detection parameters, demonstrating a strong willingness to invest heavily in systems that offer documented, verifiable improvements in detection threshold and object differentiation capabilities, thereby validating the manufacturer's technological leadership.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 250 Million |

| Market Forecast in 2033 | USD 425 Million |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Kopp Development Inc., Metrasens, CEIA USA Ltd., Mednovus Inc., Security Detection Inc., SENSIT Technologies, Hukseflux Thermal Sensors, Schonstedt Instrument Company, Scintrex Ltd., Garrett Metal Detectors, Fisher Research Laboratory, Safescan Global, Steris Corporation, Invivo Corporation (Philips), GE Healthcare, Siemens Healthineers, Bruker Corporation, Sumitomo Heavy Industries, Aspire Systems, Acoma Medical Industry |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

MRI Metal Detector Market Key Technology Landscape

The technological landscape of the MRI Metal Detector Market is predominantly defined by the necessity of high sensitivity combined with immunity to the strong static and gradient magnetic fields generated by the MRI scanner itself. The leading technology relies heavily on advanced fluxgate magnetometers. These passive systems measure disturbances in the ambient magnetic field caused by the presence of a ferromagnetic object. Manufacturers employ proprietary shielding techniques and sophisticated filtering algorithms to ensure the detectors can distinguish between the extremely weak signature of a small metallic object and the vast, omnipresent magnetic field of the MRI unit. Continuous innovation focuses on enhancing the sensor array architecture, allowing for three-dimensional localization of the detected object, which greatly aids staff in identifying the source of the alarm and expediting the screening process, a critical factor for AEO optimization.

A secondary, rapidly growing technological area involves integrating sensing technology with advanced software for object differentiation. Traditional detectors often trigger alarms indiscriminately, leading to the aforementioned high false-positive rates. Modern systems utilize advanced signal processing, often incorporating deep learning techniques (as highlighted in the AI analysis), to analyze the temporal and spatial characteristics of the magnetic disturbance. This permits the system to classify the object's likely material (e.g., highly ferromagnetic steel versus weakly magnetic alloys) and size, providing the operator with actionable intelligence rather than a simple 'go/no-go' decision. This intelligent classification is essential for navigating the safety complexities of patients with approved, but slightly magnetic, internal hardware.

Future technological advancements are trending towards highly sensitive, perhaps non-ferromagnetic-based detection methods, though current market penetration remains low. Research is exploring the use of technologies like specialized low-noise, high-bandwidth sensors that might offer improved sensitivity without the constraints of fluxgate technology. Furthermore, the integration of secure networking protocols and cloud-based data management is a key technology driver. Systems are now expected to be networked, providing central reporting on screening throughput, incident logging, and automatic software updates, enhancing overall compliance management across large hospital networks. Cybersecurity for these networked safety systems is also becoming a crucial technological focus, ensuring the integrity and reliability of the mandatory safety clearance data.

Regional Highlights

- North America (Dominant Market Share): The largest market due to high adoption rates of advanced imaging technology, the presence of major key players, and extremely stringent safety and accreditation standards enforced by bodies like the ACR. High litigation potential in the US mandates robust safety infrastructure, accelerating capital investment in certified MRI detection equipment.

- Europe (Mature and Regulatory-Driven): Characterized by mandatory compliance with EU Medical Device Regulations (MDR) and established healthcare systems. Growth is steady, driven by replacement cycles, technological upgrades, and the expansion of private diagnostic services requiring certified safety solutions. Germany, the UK, and France are the major revenue contributors.

- Asia Pacific (Fastest Growing Region): Exhibits the highest CAGR, primarily fueled by massive infrastructure investment in China, India, and Southeast Asia. Rapid growth in the middle class is driving demand for high-quality diagnostic services, leading to the construction of new imaging centers and the adoption of international safety protocols, thus spurring detector sales.

- Latin America (Emerging Market Potential): Growth is moderate but accelerating, particularly in Brazil and Mexico, driven by increasing government spending on public healthcare facilities and the gradual adoption of international safety standards. Price sensitivity remains a key factor, favoring cost-effective solutions and reliable handheld devices.

- Middle East and Africa (Niche High-Value Market): Focused growth in GCC countries (UAE, Saudi Arabia) due to high per capita healthcare spending and investment in cutting-edge medical tourism facilities that adhere strictly to international safety standards, often surpassing those in Europe or North America.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the MRI Metal Detector Market.- Kopp Development Inc.

- Metrasens

- CEIA USA Ltd.

- Mednovus Inc.

- Security Detection Inc.

- SENSIT Technologies

- Schonstedt Instrument Company

- Garrett Metal Detectors

- Fisher Research Laboratory

- Safescan Global

- Steris Corporation

- Invivo Corporation (Philips)

- GE Healthcare (Provider of Integrated MRI Suite Solutions)

- Siemens Healthineers (Provider of Integrated MRI Suite Solutions)

- Bruker Corporation (Focus on Ultra-High Field Systems)

- Sumitomo Heavy Industries

- Aspire Systems

- Acoma Medical Industry

- Tinsley Instruments Ltd.

- Foerster Instruments

Frequently Asked Questions

Analyze common user questions about the MRI Metal Detector market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of an MRI metal detector in a clinical setting?

The primary function is to detect and identify ferromagnetic objects (metal items attracted to a magnet) on patients or staff before they enter the strong magnetic field (Zone IV) of an MRI scanner. This action prevents the 'missile effect,' mitigating severe patient injury and catastrophic damage to the expensive MRI equipment, ensuring compliance with mandated safety protocols.

How do advanced MRI metal detectors differentiate between safe and hazardous metallic items?

Advanced detectors utilize sophisticated sensor arrays and AI-driven signal processing algorithms. By analyzing the magnetic signature's intensity and spatial characteristics, the system can often differentiate harmless, weakly magnetic materials (like some approved titanium implants) from highly ferromagnetic, dangerous projectile hazards (like steel keys or oxygen tanks), thereby reducing false alarms and improving workflow efficiency.

Which technology is most commonly used in high-sensitivity MRI ferromagnetic detection systems (FDS)?

The most commonly employed core technology in specialized fixed MRI FDS units is the fluxgate magnetometer. This passive sensing technology provides the required high sensitivity to detect small ferromagnetic disturbances without introducing electrical noise that would interfere with the operation of the MRI scanner or other critical life support equipment within the controlled zone.

What major factors are driving the growth of the MRI Metal Detector Market?

Market growth is predominantly driven by three factors: the increasing global installation and utilization of high-field MRI scanners (3.0T and above), heightened regulatory requirements and accreditation standards mandating advanced safety protocols, and the escalating cost of potential liability and equipment replacement following an avoidable magnetic incident.

What are the key differences between fixed (walk-through) and portable (handheld) MRI metal detectors?

Fixed detectors provide comprehensive, standardized screening at the access point of the MRI suite (Zone IV) for all entering personnel and patients, holding the largest market share. Portable detectors offer flexibility, used primarily for targeted secondary screening, localizing specific metallic objects on non-ambulatory patients, or quickly checking objects intended for the MRI room, addressing diverse workflow needs.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager