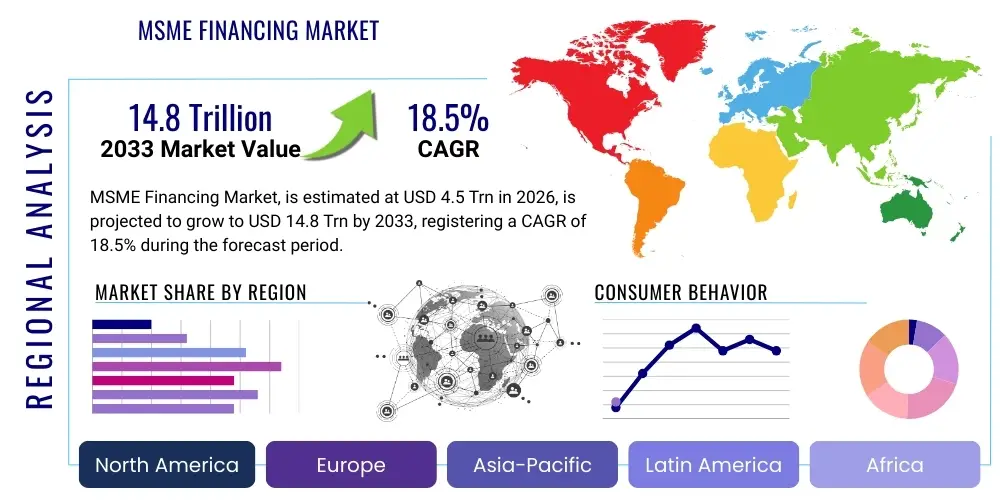

MSME Financing Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438233 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

MSME Financing Market Size

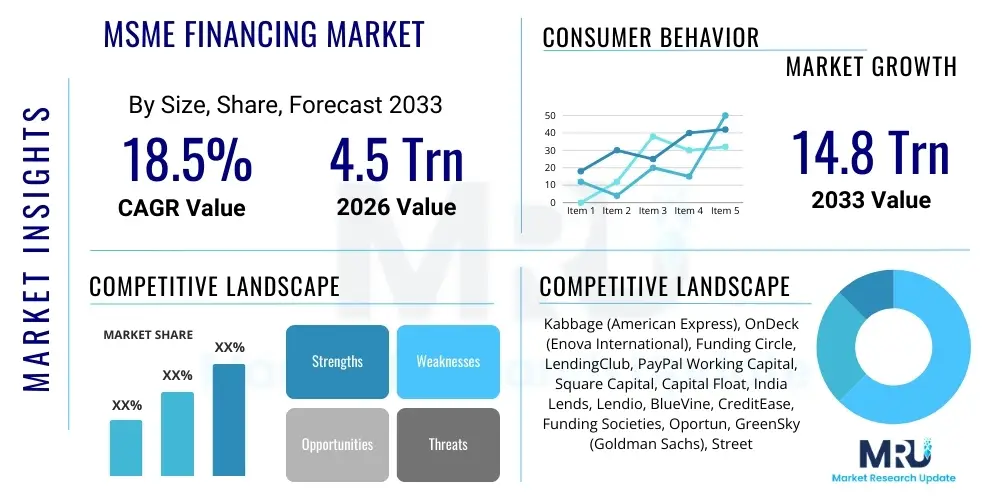

The MSME Financing Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at USD 4.5 Trillion in 2026 and is projected to reach USD 14.8 Trillion by the end of the forecast period in 2033.

This substantial growth is primarily fueled by the increasing formalization of small businesses globally, coupled with massive technological shifts that are reducing the friction in accessing credit. Traditional banking models often struggle to serve the diverse and volatile needs of Micro, Small, and Medium Enterprises (MSMEs) due to insufficient collateral or complex documentation requirements. The emergence of specialized FinTech lenders, utilizing alternative data and sophisticated credit scoring models, is bridging this historical financing gap, thereby unlocking significant market potential across developing and developed economies.

Furthermore, government initiatives across major economies, such as digitalization mandates and dedicated credit guarantee schemes, actively encourage the flow of capital to MSMEs, recognizing their critical role as primary engines of employment and Gross Domestic Product (GDP) growth. The integration of financing solutions directly into e-commerce platforms and supply chain ecosystems creates embedded finance opportunities, which drastically increases the accessibility and convenience of capital, propelling the market valuation upward during the forecast period.

MSME Financing Market introduction

The MSME Financing Market encompasses the provision of various financial products—including term loans, working capital loans, invoice factoring, line of credit, and supply chain finance—to enterprises typically employing fewer than 250 individuals. This market addresses the persistent 'missing middle' problem where conventional banking systems fail to meet the diverse and immediate capital requirements of this vital economic sector. The recent market landscape is defined by rapid digitization, shifting the delivery mechanism from purely brick-and-mortar branches to digital-first platforms, improving speed, transparency, and tailored risk assessment for businesses previously deemed unbankable.

The primary applications of MSME financing include capital expenditure for machinery and expansion, operational needs such as inventory management and payroll, and specific funding for export/import activities. The core benefit of adequate financing is enhanced business resilience and accelerated growth potential for small businesses, allowing them to compete effectively in global markets and scale operations efficiently. When MSMEs secure timely and appropriate financing, it directly translates into job creation and regional economic stability, positioning MSME financing as a high-impact financial sector.

Key driving factors accelerating the market include the explosive growth of digital payment infrastructure, enabling real-time data flow for underwriting; the increasing regulatory focus on financial inclusion, particularly in high-growth emerging economies; and the technological maturity of specialized lending platforms. These platforms leverage artificial intelligence (AI) and machine learning (ML) to process diverse data points—from transaction history to social media presence—to generate holistic and dynamic credit profiles, thereby lowering default rates while expanding the eligible borrower base.

MSME Financing Market Executive Summary

The MSME Financing Market is experiencing profound structural transformation, driven by the convergence of business trends focused on embedded finance, regional shifts emphasizing financial inclusion in Asia Pacific (APAC) and Latin America (LATAM), and segmentation trends highlighting the dominance of digital lending platforms over traditional bank lending. Key business trends include the proliferation of strategic partnerships between large financial institutions and agile FinTech firms, aiming to combine the former's capital strength with the latter's technological superiority. This collaborative ecosystem is crucial for scaling personalized financing solutions and reducing customer acquisition costs across geographies.

Regionally, APAC stands out as the primary growth engine, fueled by the massive unserved MSME population, rapid mobile penetration, and supportive government policies in countries like India, China, and Indonesia, which actively promote digital lending. While North America and Europe maintain higher average ticket sizes and focus on advanced analytics for risk management, the sheer volume of enterprises and the urgency for financial access in APAC ensure its unparalleled market expansion rate. This trend necessitates global providers to localize their products, accommodating diverse regulatory environments and varied data availability standards.

In terms of segmentation, the digital lending channel (non-bank FinTechs and online platforms) is projected to outpace traditional bank loans significantly, particularly in the micro and small enterprise categories where speed and minimal collateral are paramount requirements. Furthermore, sector-specific financing, especially for technology services and e-commerce-focused MSMEs, is witnessing accelerated growth. Investors are increasingly pivoting towards platforms offering integrated financial services, moving beyond simple credit provision to include treasury management, business analytics, and insurance within a single digital ecosystem.

AI Impact Analysis on MSME Financing Market

Common user questions regarding the impact of AI on MSME financing center around how AI improves credit risk assessment for businesses lacking traditional financial history, the potential for algorithmic bias in lending decisions, and the efficiency gains realized through automation of the loan origination process. Users frequently inquire about the feasibility of real-time loan approval and how machine learning models utilize unstructured data, such as utility payments, social media sentiment, or inventory turnover, to build comprehensive borrower profiles. A significant underlying concern revolves around balancing the speed and scalability offered by AI with the necessity of maintaining ethical and fair lending practices, particularly for vulnerable small businesses.

AI's primary influence is the fundamental reshaping of the underwriting process, moving away from static, backward-looking financial statements to dynamic, forward-predictive models. By analyzing thousands of data points instantaneously, AI algorithms can identify subtle patterns indicative of creditworthiness or distress, which are often overlooked by human underwriters. This enhanced predictive capability significantly lowers the perceived risk of lending to smaller firms, encouraging financiers to extend credit to segments previously categorized as too high-risk, thus expanding the overall market reach and enhancing financial inclusion.

Furthermore, AI tools drive massive operational efficiencies across the entire financing lifecycle. Natural Language Processing (NLP) is used to rapidly digitize and verify documentation, reducing turnaround times from weeks to hours. Machine learning algorithms optimize pricing strategies based on granular risk segmentation, ensuring competitive interest rates tailored to individual firm performance. For MSMEs, this translates to faster access to capital and customized financing products, while lenders benefit from reduced operational costs, higher throughput, and minimized fraud risk through sophisticated pattern recognition.

The long-term strategic impact of AI lies in its ability to facilitate true embedded finance. By integrating AI-driven lending decisions directly into the software that MSMEs use daily (e.g., accounting systems, POS terminals, ERPs), financing becomes context-aware and instantaneous. This shift transforms financing from a separate transaction into a seamless component of doing business, enhancing customer experience and reinforcing loyalty to the provider offering integrated digital solutions. However, continuous monitoring and ethical governance of these AI models are essential to prevent biased outcomes and ensure robust regulatory compliance.

- Enhanced Credit Scoring: Utilization of alternative data for highly accurate, dynamic risk assessment, crucial for collateral-light MSMEs.

- Automated Underwriting: Rapid processing and approval of loan applications, drastically reducing turnaround time and lowering operating expenses.

- Fraud Detection and Prevention: AI algorithms monitor transaction patterns in real-time to identify and flag suspicious activities with high precision.

- Personalized Product Offering: ML models segment MSMEs based on sector, geography, and lifecycle stage to offer customized financing instruments.

- Chatbot and Customer Service: AI-powered interfaces provide 24/7 support and initial qualification assessment, improving borrower experience.

- Optimized Portfolio Management: Predictive analytics identify potential defaults early, allowing lenders to proactively manage non-performing assets (NPAs).

DRO & Impact Forces Of MSME Financing Market

The dynamics of the MSME Financing Market are governed by a complex interplay of Drivers (D), Restraints (R), and Opportunities (O), which collectively shape the Impact Forces. The market is primarily driven by global digitalization and the substantial credit gap faced by MSMEs, while regulatory complexity and intense competition from non-traditional lenders act as key restraints. The major opportunity lies in leveraging specialized technology like blockchain for transparent supply chain finance and AI for deeper financial inclusion, with overall market growth heavily impacted by macroeconomic stability and technological adoption rates.

Drivers: A paramount driver is the immense global credit demand from MSMEs, often exceeding supply, estimated at several trillion dollars globally. This demand is further amplified by the rapid integration of MSMEs into global supply chains and the necessity for digital working capital solutions. Secondly, governmental focus on boosting the MSME sector through mandated priority sector lending and fiscal incentives, particularly in emerging markets, channels substantial institutional funds into this segment. Finally, the success and scalability of digital lending infrastructure have proven that alternative financing models are viable, instilling confidence among investors and spurring innovation.

Restraints: Significant restraints include the inherent risk associated with MSME lending, characterized by high failure rates and financial volatility, often leading to elevated Non-Performing Asset (NPA) levels for lenders. Regulatory fragmentation across different jurisdictions creates hurdles for global FinTechs seeking cross-border expansion, requiring costly compliance efforts. Furthermore, the lack of standardized, high-quality financial data for many micro and small enterprises, particularly in developing countries, limits the effectiveness of advanced credit scoring models, maintaining a barrier to entry for streamlined digital processes.

Opportunities: Key opportunities are centered around technological disruption and market penetration. The adoption of Open Banking principles globally provides an opportunity for lenders to access richer, more holistic data, enhancing underwriting accuracy. There is a massive untapped potential in vertical-specific financing (e.g., agricultural MSMEs, healthcare tech MSMEs) where specialized platforms can tailor their risk assessment to industry-specific data. Moreover, the integration of distributed ledger technology (DLT) offers a chance to revolutionize supply chain finance by tokenizing invoices and ensuring instantaneous, verifiable settlements, minimizing fraud and financing costs.

Impact Forces: The main impact forces include technological acceleration, macroeconomic stability, and regulatory responsiveness. Technological advancements, especially in AI and mobile internet, exert a continuous upward force on market efficiency and outreach. Conversely, global economic downturns or geopolitical instability significantly impact MSME revenues and loan repayment capabilities, acting as a strong mitigating force. Regulatory bodies' decisions regarding data privacy, licensing requirements for digital lenders, and consumer protection ultimately determine the speed and structure of market evolution.

Segmentation Analysis

The MSME Financing Market is broadly segmented based on the type of enterprise (Micro, Small, Medium), the type of financing product (Term Loans, Working Capital, Invoice Financing), the financing channel (Bank vs. Non-Bank/Digital), and regional geography. Understanding these segments is critical for stakeholders to tailor their product offerings and distribution strategies effectively. The digital channel is rapidly gaining market share due to its flexibility and efficiency, particularly appealing to the Micro and Small enterprise categories which often require smaller, shorter-duration loans that traditional banks find uneconomical to process.

The product segmentation reveals a strong demand for working capital solutions, reflecting the operational volatility and cash flow management needs typical of MSMEs. While traditional term loans remain crucial for capital expenditure, innovative products like revenue-based financing and merchant cash advances are seeing exponential growth, especially among businesses with high digital transaction volumes. This shift indicates a market preference for financing aligned with actual business performance rather than relying solely on fixed collateral.

Geographically, the market segmentation highlights a dichotomy between established markets (North America, Europe), which focus on optimizing existing credit models and risk mitigation, and emerging markets (APAC, LATAM), which prioritize basic financial inclusion and building scalable digital infrastructure. Within the enterprise size segment, Micro enterprises present the largest volume of potential clients, driving the need for micro-loans and pay-as-you-go financing schemes, often delivered exclusively through mobile platforms or integrated digital wallets.

Segmentation by channel is perhaps the most dynamic area, separating the market into traditional institutions leveraging their balance sheets and high-touch customer service, versus FinTech lenders and marketplaces utilizing superior technology and alternative data for rapid execution. The future growth trajectory is heavily weighted towards the digital channel, forcing banks to either acquire technology firms or rapidly modernize their legacy systems to remain competitive in the fast-paced MSME lending environment.

- By Enterprise Size:

- Micro Enterprises

- Small Enterprises

- Medium Enterprises

- By Product Type:

- Term Loans

- Working Capital Loans (Cash Credit, Overdrafts)

- Invoice/Receivable Financing

- Supply Chain Finance (Reverse Factoring)

- Equipment Financing

- Trade Finance

- By Channel:

- Banks (Traditional Financial Institutions)

- Non-Banking Financial Companies (NBFCs)

- FinTech/Digital Lenders (Marketplace Lending)

- Credit Unions and Cooperative Banks

- By End-Use Industry:

- Retail and E-commerce

- Manufacturing and Industrial

- Services (IT, Consulting)

- Construction

- Agriculture and Food Processing

Value Chain Analysis For MSME Financing Market

The value chain for MSME financing is undergoing significant disaggregation and reassembly, shifting away from a monolithic banking structure towards a modular ecosystem involving data providers, platform developers, and capital sources. Upstream activities involve technology development, data aggregation (including public records, utility data, and transaction histories), and proprietary risk modeling tool creation. FinTech companies typically excel in the upstream, utilizing advanced analytics and cloud infrastructure to create highly efficient origination and servicing tools that banks often license or integrate into their existing systems.

The core of the value chain is the intermediation and delivery phase, encompassing marketing, client acquisition, underwriting, disbursement, and servicing. Distribution channels, both direct (through lender platforms) and indirect (through financial marketplaces or strategic partners like accounting software vendors), play a crucial role. Direct channels offer greater control over the user experience but require higher marketing spend, whereas indirect channels allow lenders to tap into established user bases cheaply but often involve revenue sharing and reduced brand visibility. Strategic partnerships with non-financial entities, such as large e-commerce platforms, are increasingly vital indirect distribution channels, facilitating embedded finance at the point of sale.

Downstream activities focus on risk management, collection, and capital recovery. This stage relies heavily on predictive analytics for early warning signs of default, automated communication strategies for collections, and secondary market mechanisms for securitizing MSME loan portfolios. Successful financiers optimize their downstream processes through efficient servicing platforms and robust legal frameworks that minimize losses while maintaining borrower relationships. The entire chain is heavily dependent on secure, scalable IT infrastructure to ensure compliance and transactional transparency.

MSME Financing Market Potential Customers

The primary customers in the MSME Financing Market are the millions of Micro, Small, and Medium Enterprises globally, spanning all major economic sectors. Micro enterprises represent the largest volume of potential borrowers, typically seeking small, unsecured loans (less than USD 10,000) for inventory or immediate cash flow needs. These businesses are highly sensitive to processing time and documentation requirements, making them the prime target for fully automated digital lending platforms which emphasize speed and minimal paperwork based on transaction data.

Small enterprises constitute the 'missing middle' and are crucial customers, often requiring larger working capital lines or medium-term asset finance (USD 10,000 to USD 500,000). They typically possess some formal operational history but may lack the fixed assets or comprehensive financial statements demanded by traditional banks. FinTechs targeting this group leverage alternative data such as utility bills, tax returns, and supply chain invoices to bridge the collateral gap, providing tailored solutions that facilitate moderate expansion and operational stability.

Medium enterprises represent the most financially sophisticated customer segment, often requiring structured products such as syndicated loans, factoring services, or complex trade finance facilities (above USD 500,000). While traditional banks retain a strong relationship with this segment due to the large capital commitment involved, digital platforms are increasingly competing by offering specialized products, such as API-driven treasury management or embedded B2B payment financing solutions, which streamline complex financial operations and reduce transaction costs, adding significant value beyond mere credit provision.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Trillion |

| Market Forecast in 2033 | USD 14.8 Trillion |

| Growth Rate | CAGR 18.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Kabbage (American Express), OnDeck (Enova International), Funding Circle, LendingClub, PayPal Working Capital, Square Capital, Capital Float, India Lends, Lendio, BlueVine, CreditEase, Funding Societies, Oportun, GreenSky (Goldman Sachs), StreetShares, OakNorth, Biz2Credit, Zopa, iwoca, Atom Bank |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

MSME Financing Market Key Technology Landscape

The technology landscape within the MSME financing sector is characterized by intense innovation centered around data aggregation, automation, and security. Cloud computing forms the foundational infrastructure, enabling FinTechs to scale rapidly without heavy upfront capital investment in hardware. This scalability is essential for handling the high volume of smaller transactions typical of micro and small enterprises. Furthermore, API (Application Programming Interface) connectivity is crucial, facilitating seamless integration between lenders' proprietary platforms and third-party data sources, such as accounting software (e.g., QuickBooks, Xero), bank accounts, and e-commerce platforms, which is the backbone of the embedded finance movement.

Artificial Intelligence (AI) and Machine Learning (ML) constitute the most impactful technologies, moving beyond simple credit scoring to encompass deep behavioral analysis. ML models are used for real-time risk pricing, automated documentation verification using computer vision and NLP, and personalized client engagement. For instance, sophisticated algorithms can predict an MSME's future cash flow based on seasonal industry trends, macro indicators, and micro transactional data, offering pre-approved, flexible credit limits. This reliance on advanced analytics differentiates leading digital lenders from traditional institutions relying on rigid, backward-looking appraisal processes.

Another critical area is the adoption of Distributed Ledger Technology (DLT), commonly known as blockchain, particularly within Supply Chain Finance (SCF). DLT provides an immutable, transparent record of transactions between buyers and suppliers, significantly mitigating the risk of invoice fraud and double financing. By tokenizing verified trade documents, DLT platforms offer instantaneous settlement and lower financing costs, making SCF more accessible to smaller suppliers who previously struggled with complex paperwork and long settlement cycles. Concurrently, enhanced cybersecurity protocols, including advanced encryption and multi-factor authentication, are constantly being deployed to protect sensitive MSME financial data against rising cyber threats.

Regional Highlights

The regional dynamics of the MSME Financing Market are characterized by disparate growth rates and differing levels of technological maturity. Asia Pacific (APAC) dominates the market in terms of volume and growth potential, driven by the sheer scale of its unbanked or underbanked MSME population and government policies explicitly pushing digital financial inclusion. Countries such as India, China, and Indonesia are witnessing rapid adoption of mobile-first lending solutions, where FinTechs leverage high mobile penetration rates to bypass traditional banking infrastructure constraints. The concentration of manufacturing and retail MSMEs in these regions further amplifies the demand for working capital and trade finance solutions, positioning APAC as the undisputed engine of global market growth.

North America (NA), led by the US and Canada, represents the largest segment in terms of transaction value and technological sophistication. The market here is mature, characterized by high competition between established banks and specialized FinTech lenders like Kabbage and BlueVine. NA focuses heavily on utilizing open banking data access (though less regulated than Europe) and advanced AI for granular credit risk segmentation, catering particularly to small businesses seeking rapid, online funding solutions to manage short-term cash flow gaps. Regulations tend to favor innovation, leading to a dynamic environment where rapid deployment of new product features is common, particularly in the e-commerce lending space.

Europe, driven by strict regulatory frameworks like PSD2 (Payment Services Directive 2) and favorable Open Banking mandates, exhibits strong growth primarily in Western Europe. The regulatory environment encourages data sharing, which benefits FinTech lenders like Funding Circle and iwoca by providing access to richer transactional data for underwriting. The market is highly diverse, with the UK and Germany leading in digital lending adoption, while Southern and Eastern European markets are still playing catch-up, relying more heavily on traditional bank financing but rapidly transitioning towards digital solutions spurred by EU-wide harmonization efforts and government incentives aimed at economic recovery and small business support post-pandemic.

Latin America (LATAM) and the Middle East & Africa (MEA) are emerging as high-potential regions, though currently constrained by economic volatility and infrastructural challenges. In LATAM, countries like Brazil and Mexico show strong growth in digital lending, addressing high interest rates and complicated processes historically imposed by traditional banks. FinTechs are focusing on utilizing non-traditional data—often leveraging the high usage of social media and mobile wallets—to assess creditworthiness. In MEA, specifically in the UAE, Saudi Arabia, and parts of Sub-Saharan Africa, governmental diversification efforts and initiatives to modernize financial sectors are creating fertile ground for digital lending platforms, often focused on mobile money integration and bridging the significant credit gap faced by small enterprises across the continent.

- North America: Focus on sophisticated AI underwriting, high transaction value, and embedded finance integration, led by the US.

- Asia Pacific (APAC): Highest growth rate and volume, driven by financial inclusion initiatives, high mobile adoption, and massive unserved micro-enterprise segments (India, China, Indonesia).

- Europe: Strong adoption driven by Open Banking regulations (PSD2), emphasis on data security, and specialized SME lending platforms (UK, Germany).

- Latin America (LATAM): Rapid FinTech expansion targeting high interest rates and inefficient traditional banking systems, high potential in Brazil and Mexico.

- Middle East and Africa (MEA): Emerging market potential, driven by digitalization strategies and governmental pushes for economic diversification and financial access (UAE, South Africa).

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the MSME Financing Market.- Kabbage (American Express)

- OnDeck (Enova International)

- Funding Circle

- LendingClub

- PayPal Working Capital

- Square Capital

- Capital Float

- India Lends

- Lendio

- BlueVine

- CreditEase

- Funding Societies

- Oportun

- GreenSky (Goldman Sachs)

- StreetShares

- OakNorth

- Biz2Credit

- Zopa

- iwoca

- Atom Bank

Frequently Asked Questions

Analyze common user questions about the MSME Financing market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driver of growth in the MSME Financing Market?

The primary driver is the massive global credit gap faced by Micro, Small, and Medium Enterprises, which is now being efficiently addressed by technological advancements, specifically digital lending platforms utilizing Artificial Intelligence and alternative data for rapid credit assessment.

How is digital lending changing the competitive landscape for MSME financing?

Digital lending introduces speed, accessibility, and lower operational costs, shifting market share from traditional banks to FinTechs. This forces banks to adopt digitization and form strategic partnerships to compete, particularly in the micro and small enterprise segments where traditional collateral requirements are often prohibitive.

Which geographical region holds the highest growth potential for MSME financing?

Asia Pacific (APAC) holds the highest growth potential, driven by large volumes of previously underserved MSMEs, increasing mobile penetration, and strong governmental backing for digital financial inclusion initiatives across key economies like India and Indonesia.

What role does Artificial Intelligence (AI) play in MSME credit assessment?

AI revolutionizes credit assessment by analyzing vast amounts of alternative and unstructured data (e.g., utility payments, e-commerce sales data) in real-time. This enables more accurate, dynamic risk pricing and rapid loan approval for MSMEs that lack traditional financial documentation.

What are the key products preferred by MSMEs in the current market?

While term loans for capital expenditure remain important, there is a dominant preference for flexible working capital solutions, invoice financing, and specialized supply chain finance instruments, reflecting the MSMEs' need for short-term liquidity and cash flow management flexibility.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager