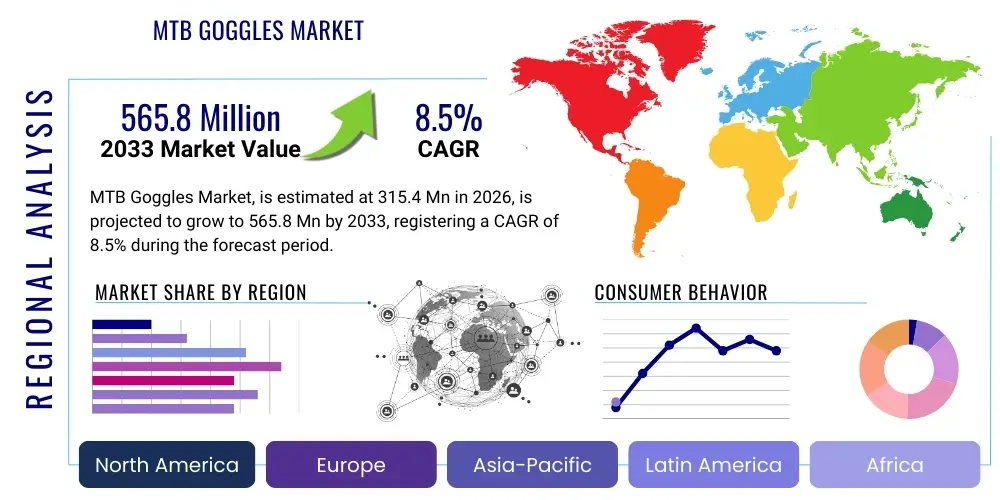

MTB Goggles Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439826 | Date : Jan, 2026 | Pages : 255 | Region : Global | Publisher : MRU

MTB Goggles Market Size

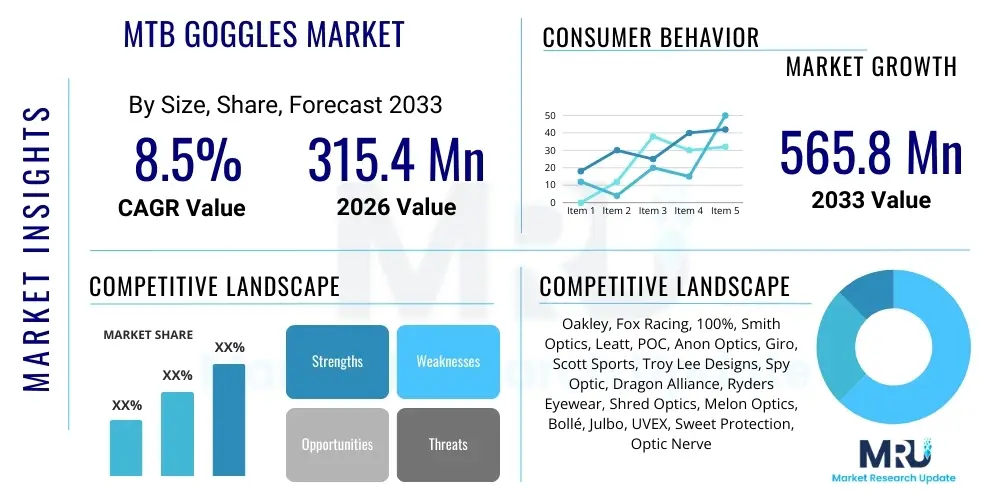

The MTB Goggles Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 315.4 Million in 2026 and is projected to reach USD 565.8 Million by the end of the forecast period in 2033.

MTB Goggles Market introduction

The MTB Goggles Market is an integral component of the broader cycling accessories industry, specifically catering to the rigorous demands of mountain biking enthusiasts and professional athletes alike. These specialized eyewear products are meticulously engineered to offer paramount protection, enhanced visual clarity, and optimal comfort across diverse and often challenging off-road terrains. Product descriptions typically highlight features such as impact-resistant polycarbonate lenses, anti-fog and scratch-resistant coatings, wide peripheral vision, and robust frame constructions designed for durability and a secure fit even during aggressive maneuvers. The frames are often designed with flexible materials to conform to various face shapes and integrate seamlessly with a wide range of mountain bike helmets, providing a cohesive and protective system for the rider.

Major applications span various disciplines of mountain biking, including but not limited to downhill racing where high speeds and numerous obstacles necessitate superior protection and a wide field of view; enduro riding which demands versatility across demanding ascents and high-speed, technical descents, requiring lenses that perform well in varied light conditions; and trail riding where comfort and sustained clarity over extended periods are crucial for recreational riders. Other emerging applications include cross-country mountain biking, particularly in technical sections, and the rapidly growing electric mountain biking (E-MTB) segment, where riders may achieve higher sustained speeds, increasing the need for consistent eye protection. The primary benefits derived by users encompass comprehensive eye safety against debris, dust, mud, UV radiation, wind, and direct impact, alongside significantly improved visual acuity through specialized lens tints that enhance contrast and reduce glare in varying light conditions, from bright sun to dense forest canopy. Furthermore, the ergonomic designs ensure robust compatibility with helmets, highly effective ventilation systems to prevent lens fogging during strenuous activity, and moisture-wicking foam to manage perspiration, all contributing to a more focused, safer, and ultimately more enjoyable riding experience across diverse environments and intensities.

The market is primarily driven by the escalating global participation in mountain biking, spurred by increasing awareness of outdoor recreational health benefits, the proliferation of purpose-built bike parks and extensive trail networks across continents, and continuous technological advancements in materials science and lens technology that consistently deliver superior product performance, durability, and rider satisfaction. As more individuals adopt mountain biking as a leisure activity, a fitness pursuit, or a competitive sport, the demand for high-quality, specialized protective gear like MTB goggles naturally expands. Environmental factors such as unpredictable weather conditions, dust, and potential impacts from trailside elements further solidify the necessity of these specialized goggles, driving their adoption among both amateur and professional riders. Moreover, the aspirational element associated with premium mountain biking gear, often influenced by professional athletes and social media trends, also plays a significant role in market expansion, encouraging consumers to invest in advanced eyewear solutions that promise enhanced performance and safety.

MTB Goggles Market Executive Summary

The MTB Goggles Market is currently experiencing robust growth, propelled by several convergent business trends, dynamic regional market shifts, and evolving consumer segment preferences. From a business perspective, manufacturers are increasingly focusing on product innovation, incorporating advanced lens technologies such as photochromic and polarized options, alongside enhanced anti-fog and anti-scratch coatings, to meet the sophisticated demands of modern riders. There's a notable trend towards customization and personalization, with brands offering a wider array of frame colors, strap designs, and interchangeable lens systems. Strategic partnerships between goggle manufacturers and helmet brands are also becoming more common, aiming to provide seamlessly integrated protective solutions and enhanced comfort. Furthermore, sustainable manufacturing practices and the use of recycled materials are emerging as key differentiators, responding to a growing environmental consciousness among consumers and regulatory pressures. Direct-to-consumer (DTC) sales channels, particularly online, are gaining prominence, allowing brands to establish closer relationships with their customer base and control their brand messaging more effectively, while traditional retail channels like specialty bike shops continue to offer expert advice and fitting services.

Regionally, North America and Europe currently represent the largest market shares, driven by a well-established mountain biking culture, extensive trail infrastructure, high disposable incomes, and a strong presence of key market players and events. However, the Asia Pacific region is rapidly emerging as a significant growth hub, fueled by increasing urbanization, rising middle-class populations, growing awareness of adventure sports, and substantial investments in outdoor recreational facilities, particularly in countries like China, Japan, Australia, and India. Latin America and the Middle East & Africa also demonstrate considerable potential, albeit from a smaller base, as mountain biking gains traction and accessible trails develop. Each region presents unique consumer preferences and purchasing behaviors, necessitating tailored marketing and distribution strategies from global brands. For instance, in colder climates, anti-fog performance is paramount, while in sunnier regions, superior UV protection and glare reduction are often prioritized, influencing product development and regional sales efforts.

Segment-wise, the market is witnessing shifts influenced by rider discipline, price point, and distribution channel. The premium segment continues to thrive, driven by professional riders and affluent enthusiasts seeking cutting-edge technology and superior performance. However, the mid-range segment is also expanding significantly, as more casual riders seek a balance between quality and affordability, leading to increased competition among brands. In terms of distribution, online retail is experiencing accelerated growth, offering convenience, wider product selection, and competitive pricing, especially appealing to younger demographics. Despite this, brick-and-mortar specialty stores maintain their importance, particularly for riders who prefer to physically try on goggles and receive expert advice, ensuring proper fit and compatibility with their helmets. The trend towards electric mountain biking (E-MTB) is also creating a new niche within the market, as E-MTB riders may require goggles optimized for different speed profiles or extended ride durations. Moreover, there is an increasing demand for goggles that offer robust prescription lens compatibility, addressing the needs of a growing demographic of riders who require vision correction without compromising on protection or field of view.

AI Impact Analysis on MTB Goggles Market

User questions related to AI's impact on MTB goggles primarily revolve around enhanced safety features, personalized user experiences, and potential performance improvements. Riders are keenly interested in whether AI could integrate into goggles for real-time hazard detection, intelligent anti-fog systems that adapt to environmental conditions, or even offer data overlays for navigation and performance metrics without obstructing vision. There's also curiosity about AI's role in optimizing goggle fit and comfort through advanced scanning and design, and how it might influence lens technology for dynamic light adaptation. Overall, users expect AI to elevate both the protective and functional aspects of MTB goggles, making riding safer, more comfortable, and more data-rich.

- AI-powered Smart Lenses: Development of lenses that dynamically adjust tint and polarization based on real-time light conditions and terrain, optimizing visibility without manual intervention.

- Integrated Safety Features: AI algorithms could be embedded to detect potential hazards (e.g., upcoming obstacles, changes in trail surface) and provide subtle visual or auditory cues to the rider, enhancing proactive safety.

- Personalized Fit and Ergonomics: Utilization of AI in design software to analyze facial scan data, creating custom-fit goggle frames and foam padding for unparalleled comfort and helmet integration, reducing pressure points.

- Performance Tracking and Feedback: AI could process eye-tracking data to monitor rider focus and fatigue, or integrate with other sensors to overlay essential performance metrics (speed, elevation, heart rate) directly onto the lens in a non-distracting manner.

- Predictive Maintenance and Material Science: AI algorithms analyzing usage patterns and environmental stressors to predict component wear, informing riders about optimal replacement times, and guiding R&D for more durable, high-performance materials.

- Enhanced Anti-Fog and Ventilation Systems: AI-driven sensors could monitor humidity and temperature inside the goggle, intelligently activating micro-fans or adjusting vents to maintain optimal airflow and prevent fogging under varying exertion levels and external conditions.

- Augmented Reality (AR) Overlays: Future integration of AR capabilities for navigation, trail mapping, or communication with riding partners, presenting information seamlessly within the rider's field of view without impeding vision.

- Supply Chain Optimization: AI-driven analytics to optimize inventory management, demand forecasting, and logistics for MTB goggle manufacturers and retailers, improving efficiency and reducing waste.

- Customer Service and Personalization: AI chatbots and recommendation engines on e-commerce platforms could provide highly personalized product suggestions based on rider profile, preferences, and past purchases, enhancing the shopping experience.

DRO & Impact Forces Of MTB Goggles Market

The MTB Goggles Market is profoundly shaped by a confluence of Drivers, Restraints, and Opportunities, collectively forming the Impact Forces that dictate its trajectory. A primary driver is the significant and sustained global growth in mountain biking participation, fueled by increasing interest in outdoor recreational activities, health and wellness trends, and the expansion of dedicated trail networks and bike parks worldwide. This rising engagement directly translates into higher demand for specialized protective gear, including high-performance goggles. Additionally, continuous innovation in lens technology, such as the development of photochromic, polarized, and high-definition lenses, along with improved anti-fog and anti-scratch coatings, significantly enhances the user experience and justifies premium pricing, acting as a strong market accelerator. The growing emphasis on rider safety and injury prevention, often spurred by industry standards and awareness campaigns, further boosts the adoption of quality goggles. The influence of professional athletes and social media content creators, showcasing advanced gear, also plays a pivotal role in shaping consumer preferences and driving purchasing decisions, particularly for aesthetically appealing and technologically superior products.

However, the market also faces notable restraints. The relatively high cost associated with premium MTB goggles can be a barrier to entry for budget-conscious consumers, potentially leading them to opt for less specialized or lower-quality alternatives. Intense competition from a multitude of established brands and new entrants, alongside the availability of cheaper generic alternatives, can exert downward pressure on prices and profit margins. Furthermore, the seasonal nature of mountain biking in many regions can lead to fluctuations in demand, impacting sales volumes and inventory management for manufacturers and retailers. A lack of standardized regulations for goggle performance and safety across different regions can also create market fragmentation and confusion for consumers. Moreover, economic downturns or uncertainties can reduce discretionary spending on recreational equipment, affecting market growth. The challenge of achieving universal helmet compatibility while maintaining optimal fit and comfort also presents a consistent design hurdle for manufacturers, as ill-fitting goggles can detract from the riding experience and pose safety risks.

Despite these challenges, substantial opportunities exist for market expansion and innovation. The burgeoning popularity of electric mountain bikes (E-MTBs) represents a significant growth avenue, as these riders often cover more ground and achieve higher average speeds, necessitating reliable and comfortable eye protection for longer durations. Untapped potential in emerging markets, particularly in Asia Pacific and Latin America, where mountain biking is gaining traction and disposable incomes are rising, offers fertile ground for market penetration and expansion. Customization and personalization trends, allowing riders to tailor goggle frames, straps, and lenses to their specific preferences and visual needs, present a strong opportunity for premium product offerings and brand differentiation. Additionally, the integration of smart technologies, such as embedded sensors for environmental data or augmented reality overlays for navigation, could revolutionize the functionality of MTB goggles, opening up entirely new product categories and consumer segments. Further opportunities lie in the development of eco-friendly and sustainably produced goggles, appealing to an increasingly environmentally conscious consumer base and aligning with broader industry shifts towards responsible manufacturing. Continuous advancements in material science also offer avenues for creating lighter, more durable, and more comfortable goggles with enhanced protective qualities, further cementing their essential role in mountain biking.

Segmentation Analysis

The MTB Goggles Market is comprehensively segmented to provide granular insights into consumer preferences, product characteristics, distribution strategies, and pricing dynamics. This detailed segmentation helps market players understand diverse demand patterns and tailor their offerings to specific rider needs and market niches. The primary segmentation criteria typically include lens type, application or riding discipline, distribution channel, and price range, each revealing distinct market behaviors and growth opportunities. Analyzing these segments allows manufacturers to refine their product portfolios, optimize their marketing campaigns, and identify underserved markets, ensuring that product development aligns closely with the evolving demands of the mountain biking community. This strategic approach enables companies to differentiate their products in a competitive landscape and capture specific consumer groups, from casual trail riders to elite downhill racers.

- By Type:

- Cylindrical Lens: Known for their flat, uniform curve, offering a wide horizontal field of view with good optical clarity. Typically more affordable.

- Spherical Lens: Curved both horizontally and vertically, mimicking the shape of the human eye. Provides superior peripheral vision, reduced distortion, and less glare.

- Toric Lens: A hybrid design combining elements of both cylindrical and spherical lenses, offering advanced optical performance with a less bulky profile than full spherical lenses.

- By Application:

- Downhill Mountain Biking: Requires maximum protection, wide field of view, and robust anti-fog capabilities for high-speed descents.

- Enduro Mountain Biking: Demands versatility, good ventilation for climbs, and clear vision for varied terrain and light conditions during descents.

- Trail Mountain Biking: Focus on comfort, long-term wearability, and clear vision for general recreational riding.

- Cross-Country Mountain Biking: Often less aggressive, but still benefits from eye protection, especially in dusty or wooded areas.

- Electric Mountain Biking (E-MTB): Growing segment, often requires goggles suitable for extended rides and potentially higher sustained speeds.

- By Distribution Channel:

- Online Retail: E-commerce platforms, brand websites, and specialized online bike shops offer convenience and wider product selection.

- Specialty Stores: Bike shops and outdoor sports retailers provide expert advice, fitting services, and immediate product availability.

- Department Stores: Larger retail chains that may carry a selection of sports equipment, including basic MTB goggles.

- Direct Sales: Manufacturers selling directly to consumers, often through their own websites or events.

- By Price Range:

- Premium: High-end goggles featuring advanced lens technologies, superior materials, and sophisticated designs, targeting professional and serious enthusiasts.

- Mid-Range: Offers a balance of quality, features, and affordability, appealing to a broad segment of recreational riders.

- Economy: Entry-level goggles focusing on basic protection and functionality, primarily targeting new riders or those on a strict budget.

Value Chain Analysis For MTB Goggles Market

The Value Chain Analysis for the MTB Goggles Market illustrates the sequential processes involved in bringing a product from raw materials to the end-consumer, highlighting opportunities for value creation and optimization at each stage. It commences with upstream activities, primarily involving the sourcing and processing of specialized raw materials. This includes high-grade polycarbonate or Trivex for lenses, flexible thermoplastic polyurethanes (TPU) or other polymers for frames, various foams for facial interfaces, and silicone-backed elastic straps. Manufacturers often collaborate with chemical companies and material science innovators to develop lighter, more durable, and optically superior materials, focusing on properties like impact resistance, anti-fog capabilities, and UV protection. The quality and cost-effectiveness of these raw materials significantly influence the final product's performance and market price, making strong supplier relationships crucial for consistency and innovation. Research and development activities, including optical engineering, ergonomic design, and material testing, are integral parts of the upstream phase, driving product differentiation and technological advancements.

Moving downstream, the value chain encompasses manufacturing, assembly, and quality control. This stage involves precision molding of frames, advanced lens coating techniques (e.g., anti-scratch, anti-fog, mirror, photochromic applications), cutting and sewing of straps, and meticulous assembly of all components. Strict quality assurance protocols are implemented to ensure that each goggle meets specified safety standards, optical clarity requirements, and design tolerances. Post-manufacturing, the products enter the distribution channels, which can be broadly categorized into direct and indirect routes. Direct distribution involves manufacturers selling directly to consumers through their own e-commerce websites, flagship stores, or at events and races. This channel offers higher profit margins, greater control over brand image, and direct customer feedback, enabling agile product development and marketing adjustments. Conversely, indirect distribution relies on a network of intermediaries to reach the end-user.

Indirect distribution channels are typically more expansive and include a variety of retail outlets. This often involves selling to wholesalers, who then distribute to a wide array of retailers such as specialized bicycle shops, outdoor sports stores, large department stores, and online marketplaces (e.g., Amazon, specialty cycling e-retailers). These intermediaries play a crucial role in market penetration, providing geographic reach, logistics capabilities, and localized marketing efforts. Specialty bike shops are particularly important as they offer expert advice, product demonstrations, and fitting services, which are highly valued by mountain biking enthusiasts who often require specific knowledge about helmet compatibility and lens performance. Online retailers, both general and specialized, offer convenience, broader product selections, and competitive pricing, appealing to a growing segment of tech-savvy consumers. Effective supply chain management, encompassing warehousing, inventory control, and efficient logistics, is critical across all distribution channels to ensure timely delivery and minimize costs. Post-sale services, including warranty provisions, repair services, and customer support, also form a vital part of the value chain, contributing to brand loyalty and customer satisfaction, ultimately reinforcing the brand's reputation and long-term market position.

MTB Goggles Market Potential Customers

The potential customers for MTB goggles represent a diverse and expanding demographic within the broader cycling and outdoor sports community. Primarily, this includes professional mountain bikers and competitive athletes across disciplines like downhill, enduro, and cross-country, who require the highest level of performance, protection, and optical clarity to gain a competitive edge and ensure safety during intense races and training. These individuals prioritize features such as wide peripheral vision, advanced anti-fog technologies, robust impact resistance, and seamless integration with high-performance helmets. They are often willing to invest in premium-priced goggles that offer cutting-edge innovations and are endorsed by other professionals or leading brands. Their purchasing decisions are heavily influenced by performance metrics, durability under extreme conditions, and brand reputation for quality and reliability.

Beyond the professional realm, a significant portion of potential customers consists of recreational mountain biking enthusiasts, ranging from frequent weekend warriors to casual trail riders. This group seeks a balance of comfort, reliable protection, and good value. They are motivated by the desire to enhance their riding experience, protect their eyes from dust, debris, UV rays, and wind, and improve visibility on various terrains. Their purchasing criteria often include effective anti-fogging, scratch-resistant lenses, comfortable fit, and a choice of lens tints suitable for different light conditions. As mountain biking continues to grow in popularity as a leisure activity and a means of staying fit, this segment is expanding rapidly, including a growing number of new riders who may start with entry-level goggles and progressively upgrade as their skills and commitment to the sport develop. Furthermore, the increasing adoption of electric mountain bikes (E-MTBs) is creating a new segment of riders who often cover longer distances and maintain higher average speeds, thereby increasing their need for consistent and comfortable eye protection.

Lastly, an emerging segment of potential customers includes individuals interested in adventure sports and outdoor activities that share similar demands for protective eyewear, even if mountain biking is not their sole pursuit. This could encompass gravel bikers tackling more aggressive terrain, or even participants in other action sports who find the robust design and protective features of MTB goggles suitable for their specific needs. Demographic shifts, such as an aging population that remains active and seeks comfortable, protective gear, or younger generations entering outdoor sports, also contribute to the expanding customer base. Retailers, rental services for bike parks, and tour operators catering to mountain biking tourism also represent indirect customers, as they purchase goggles in bulk to equip their clients, further driving market demand. Ultimately, anyone who seeks enhanced eye protection, improved vision, and greater comfort while engaging in dynamic outdoor activities where speed, environmental elements, and potential impacts are factors is a potential customer for MTB goggles.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 315.4 Million |

| Market Forecast in 2033 | USD 565.8 Million |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Oakley, Fox Racing, 100%, Smith Optics, Leatt, POC, Anon Optics, Giro, Scott Sports, Troy Lee Designs, Spy Optic, Dragon Alliance, Ryders Eyewear, Shred Optics, Melon Optics, Bollé, Julbo, UVEX, Sweet Protection, Optic Nerve |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

MTB Goggles Market Key Technology Landscape

The MTB Goggles market is characterized by a dynamic and evolving technology landscape, where innovation drives enhanced performance, safety, and user experience. At the forefront are advancements in lens technology, which include specialized coatings and material compositions. Photochromic lenses, for instance, automatically adjust their tint based on UV light intensity, providing optimal vision across varying light conditions without the need for manual lens changes. Polarized lenses are crucial for reducing glare from reflective surfaces like water, wet trails, or metallic elements, significantly improving visual comfort and clarity. High-definition (HD) or contrast-enhancing lenses utilize specific spectral filters to boost color perception and depth, making it easier to spot trail features and obstacles. Anti-fog coatings and treatments are continually being refined, often incorporating hydrophilic properties or advanced chemical compositions to prevent condensation, maintaining clear vision during strenuous activity and in humid conditions. Similarly, robust anti-scratch coatings are essential to withstand the harsh environment of mountain biking, protecting the optical integrity of the lens from debris and minor impacts. The development of interchangeable lens systems, often using magnetic or quick-release mechanisms, allows riders to easily swap lenses to match specific light conditions or preferences, adding versatility and value to the product.

Frame technology also plays a critical role in the overall performance and comfort of MTB goggles. Manufacturers are increasingly utilizing advanced thermoplastic polyurethanes (TPU) and other flexible polymer composites that offer exceptional durability, impact resistance, and the ability to maintain flexibility in varying temperatures. These materials allow frames to conform better to different face shapes and integrate seamlessly with a wide range of helmets, preventing pressure points and ensuring a secure fit. Ventilation systems within the frames are meticulously engineered to promote airflow and exhaust warm, moist air, working in conjunction with anti-fog lens technologies to prevent condensation. This often involves strategic placement of vents, sometimes covered with fine mesh to prevent debris ingress. The design of multi-layer face foams, incorporating moisture-wicking materials and varying densities, enhances comfort, absorbs sweat, and creates an effective seal against dust and wind while minimizing pressure on the face. Furthermore, advancements in strap technology include silicone-backed straps that prevent slippage on helmets, and adjustable mechanisms that ensure a custom, secure fit for all head sizes, even with gloves on. Some goggles also feature outrigger systems, which are pivot points where the strap connects to the frame, allowing for better articulation and compatibility with a broader range of helmet designs, distributing pressure more evenly across the face.

Emerging technologies are also beginning to influence the MTB goggle market, hinting at future innovations. This includes the potential integration of smart technologies, such as micro-sensors to monitor environmental conditions or rider biometrics, feeding data to an external device or even providing subtle feedback within the goggle itself. Concepts for augmented reality (AR) overlays are being explored, which could project navigation cues, speed, or other performance data directly onto the lens, enhancing the rider's situational awareness without requiring them to look away from the trail. Manufacturing processes are also leveraging technology, with advanced CAD/CAM software for precise design and prototyping, and potentially 3D printing for customized frame components or specialized parts. The application of sustainable and recycled materials in both frames and straps is also a growing technological trend, driven by environmental concerns and consumer demand for eco-conscious products. These technological advancements collectively aim to deliver MTB goggles that are not only highly protective but also supremely comfortable, adaptable, and integrated with the rider's overall experience, pushing the boundaries of what eyewear can achieve in demanding off-road environments.

Regional Highlights

- North America: Dominant market share due to a mature mountain biking culture, extensive trail networks (e.g., Whistler Bike Park in Canada, numerous trails across the US), high disposable incomes, and the strong presence of major goggle brands. Strong demand for premium products and advanced lens technologies.

- Europe: Second largest market, driven by widespread participation in cycling sports, numerous professional events (UCI Mountain Bike World Cup), and diverse geographical terrains suitable for various MTB disciplines. Countries like Germany, France, Switzerland, and the UK are key contributors. High demand for performance-oriented and aesthetically pleasing goggles.

- Asia Pacific (APAC): Fastest-growing market, propelled by increasing awareness of outdoor sports, rising disposable incomes, rapid development of urban bike parks and trails, particularly in China, Japan, Australia, and New Zealand. Emerging markets like India and Southeast Asian nations are showing significant growth potential.

- Latin America: Emerging market with increasing interest in mountain biking, particularly in countries like Brazil, Colombia, and Mexico. Development of local events and trail infrastructure is fostering market growth. Price sensitivity is a key factor, with demand for both mid-range and economy products.

- Middle East and Africa (MEA): Nascent but growing market, with developing outdoor sports scenes and an increasing focus on adventure tourism. Growth is primarily concentrated in urban centers and regions with suitable terrain for mountain biking, albeit from a smaller base.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the MTB Goggles Market.- Oakley

- Fox Racing

- 100%

- Smith Optics

- Leatt

- POC

- Anon Optics

- Giro

- Scott Sports

- Troy Lee Designs

- Spy Optic

- Dragon Alliance

- Ryders Eyewear

- Shred Optics

- Melon Optics

- Bollé

- Julbo

- UVEX

- Sweet Protection

- Optic Nerve

Frequently Asked Questions

What is the projected growth rate for the MTB Goggles Market?

The MTB Goggles Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033.

What are the key factors driving the MTB Goggles Market?

Key drivers include the global increase in mountain biking participation, continuous technological advancements in lens and frame materials, and a growing emphasis on rider safety and protection.

Which regions are leading the MTB Goggles Market?

North America and Europe currently hold the largest market shares, driven by established mountain biking cultures and extensive trail infrastructure. However, the Asia Pacific region is rapidly emerging as a significant growth area.

How is AI expected to impact MTB Goggles?

AI is anticipated to bring innovations such as dynamically adjusting smart lenses, integrated safety features like hazard detection, personalized fit and ergonomics, and potential augmented reality overlays for performance data or navigation.

What are the primary segmentation categories for MTB Goggles?

The market is primarily segmented by lens type (cylindrical, spherical, toric), application (downhill, enduro, trail, XC, E-MTB), distribution channel (online, specialty stores), and price range (premium, mid-range, economy).

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager