Muffin Pan Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431455 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Muffin Pan Market Size

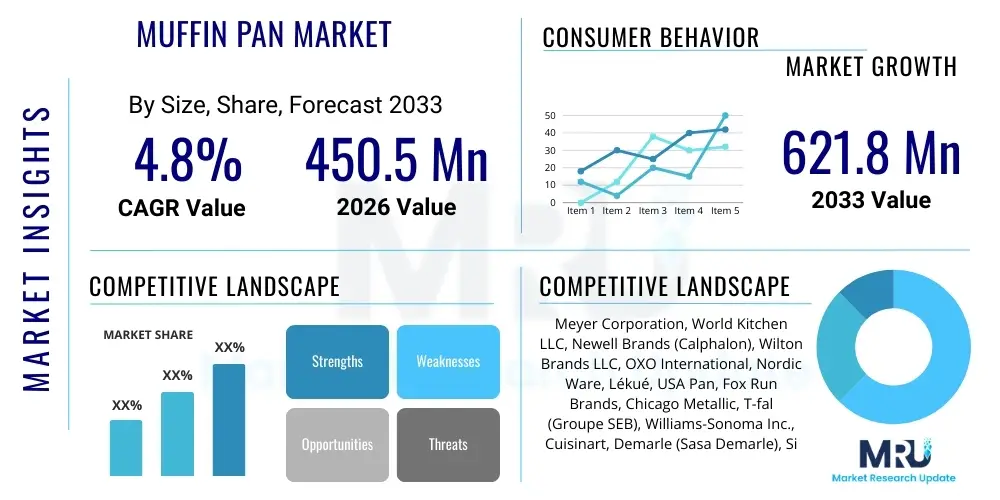

The Muffin Pan Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 450.5 Million in 2026 and is projected to reach USD 621.8 Million by the end of the forecast period in 2033. This consistent expansion is largely attributable to the enduring global interest in home-based culinary activities and the sustained growth of the commercial baking sector. The resilience of the market, even amidst economic fluctuations, highlights the muffin pan's status as a fundamental, non-discretionary item in both residential kitchens and professional food preparation facilities. Market valuation is heavily influenced by the raw material costs, especially fluctuations in global steel and silicone prices, which impact the final consumer pricing for premium and professional-grade products, but overall demand elasticity remains relatively low due to the essential nature of the product.

Muffin Pan Market introduction

The Muffin Pan Market encompasses the manufacturing, distribution, and retail sale of specialized bakeware engineered for standardized production of individual, portion-controlled baked goods such as muffins, cupcakes, and savory mini-quiches. This highly fragmented yet essential segment of the kitchenware industry serves a dual role, catering to the burgeoning needs of the professional culinary sector—including high-volume industrial bakeries and niche artisan cafes—as well as the massive global demographic of home baking enthusiasts. Products are critically differentiated by key performance attributes determined by material composition, specifically including high-grade carbon steel, durable aluminized steel, flexible platinum-cured silicone, and aesthetic ceramic options. These materials dictate crucial elements like thermal conductivity, non-stick release effectiveness, resistance to warping, and overall product longevity, forming the basis of competitive differentiation among manufacturers. The market's stability is underpinned by the essential function of the product, requiring continuous innovation primarily in material science and ergonomic design rather than revolutionary technological leaps.

Major applications of muffin pans span across the entire food preparation spectrum. In the residential domain, their use is fueled by the continuing trend of Do-It-Yourself (DIY) food preparation, driven by consumer desires for ingredient transparency, healthier alternatives to store-bought items, and engagement with culinary social media content. This segment demands pans that are visually appealing and easy to clean. Commercially, they are mission-critical equipment within automated and semi-automated production lines where consistency and rapid turnaround are paramount. Industrial applications leverage heavy-duty, stackable, and often customized pan configurations designed to integrate seamlessly with large-scale conveyor ovens and robotic demolding systems, prioritizing durability and heat uniformity above all else. The fundamental benefit derived from using dedicated muffin pans is achieving uniform size, shape, and consistent baking quality across large batches, a requirement essential for brand consistency in packaged food and efficiency in food service operations globally, directly impacting profitability.

The Muffin Pan Market expansion is principally driven by several macroeconomic and technological factors. Firstly, the global economic recovery, coupled with rising disposable incomes in emerging economies, allows consumers to upgrade from basic bakeware to premium, specialized, and often aesthetically pleasing models, often leading to purchases based on brand reputation and material quality. Secondly, continuous innovation in coatings, particularly the industry's shift towards sustainable, non-toxic, and ultra-durable non-stick technologies (like ceramic and specialized silicone treatments), encourages consumers to replace older, less safe equipment, driving the market replacement cycle and offering a clear path for market revenue growth. Thirdly, the infrastructural development of organized retail and the accelerated penetration of sophisticated e-commerce platforms worldwide have drastically improved accessibility, allowing niche, high-quality international brands to reach consumers even in previously underserved geographical areas, thereby sustaining market momentum and widening the consumer base for advanced bakeware while simultaneously introducing price transparency.

Muffin Pan Market Executive Summary

Current business trends within the Muffin Pan Market show a polarized consumer demand: high-end market segments prioritize premiumization, focusing on heavy-gauge construction and advanced non-stick formulations ensuring extreme durability, primarily targeting experienced home bakers and small commercial entities willing to invest in superior tools. Simultaneously, the mass market continues to emphasize affordability and novelty, boosting the demand for flexible, brightly colored silicone pans and entry-level carbon steel options through large retail channels. Key competitive strategies involve leveraging digital channels for direct-to-consumer (D2C) sales, utilizing compelling visual content and user-generated social proof to establish brand credibility and trust, particularly targeting younger demographics who rely heavily on online reviews. Furthermore, regulatory alignment, especially concerning the removal of PFOA and the transparency regarding material sourcing, has become a non-negotiable factor for securing retailer partnerships and consumer trust, influencing market leadership positioning and brand differentiation efforts.

Geographically, market growth forecasts indicate a decisive shift toward Asia Pacific (APAC) as the primary growth engine, where evolving dietary habits, increased exposure to Western culinary concepts, and the rapid expansion of organized food retail are creating unprecedented demand for both residential and commercial bakeware. While North America and Europe retain high per capita consumption and purchasing power, their growth remains constrained by market maturity and defined replacement cycles, forcing innovation within existing product lines rather than capturing new users. Manufacturers are strategically adapting their supply chains to the APAC region, often establishing local production or assembly facilities to mitigate high logistics costs and circumvent complex import tariffs. Regional trends also reflect specialized product needs; for instance, smaller, space-saving designs are essential for high-density urban areas in East Asia, whereas robust, oversized commercial pans are standard in established European and North American bakeries due to differing operational requirements.

In terms of segmentation, the material category is dominated by metal pans (carbon steel and aluminized steel) due to their superior performance in controlled commercial settings, offering longevity and predictable thermal results. However, silicone is rapidly gaining ground as the fastest-growing residential segment due to its user-friendly features—flexibility, ease of cleaning, and reduced need for greasing—strongly appealing to novice bakers. Application-wise, the residential sector holds the dominant market share by volume, driven by frequency of purchase and low unit price, but the commercial segment contributes disproportionately to value, demanding higher quality, higher-priced, and longer-lasting equipment designed for continuous duty. The online distribution segment continues its aggressive growth trajectory, leveraging optimized search ranking algorithms and fast fulfillment capabilities to capture market share previously held by traditional brick-and-mortar specialty retailers, fundamentally reshaping consumer access to niche and international bakeware brands.

AI Impact Analysis on Muffin Pan Market

The integration of Artificial Intelligence (AI) and Machine Learning (ML) technologies within the seemingly traditional Muffin Pan Market primarily focuses on optimizing the intricate, capital-intensive aspects of manufacturing and the complex dynamics of consumer interaction and supply chain efficiency. User inquiries frequently explore how AI can move beyond simple automation to enable hyper-personalized product recommendations (e.g., suggesting specific pan materials based on a user's favorite recipes and oven type) and how AI can ensure the structural integrity and optimal thermal performance of new pan designs before expensive, physical prototyping begins. A core user expectation is that AI will stabilize raw material procurement costs and predict sudden demand spikes caused by viral recipe trends on social media platforms, thereby preventing costly stockouts and ensuring seamless, timely supply chain responsiveness, particularly during high-demand holidays.

Specific AI applications are emerging across the operational ecosystem. In manufacturing, AI-powered image recognition and computer vision systems are deployed on production lines to inspect the quality and uniformity of non-stick coating application with microscopic precision, far surpassing human capabilities in speed and accuracy. This rigorous, automated quality control minimizes cosmetic defects and ensures that every pan cavity releases perfectly, dramatically reducing consumer complaints and costly warranty claims. Furthermore, ML algorithms analyze millions of data points related to pan usage, heat stress cycles, and historical material failure rates to inform R&D, enabling the development of next-generation pans with superior durability and optimized heat profiles suitable for modern high-efficiency and induction ovens. This rapid, data-driven product iteration cycle reduces time-to-market for innovative, high-performance bakeware designs.

On the consumer and commercial engagement front, AI is fundamentally changing market engagement and logistics. Predictive analytics models are used to forecast highly localized seasonal demand fluctuations for specific product types—for example, anticipating higher demand for holiday-themed silicone molds in specific geographic areas or large-volume industrial pans for summer catering peaks—allowing companies to adjust production runs, optimize warehousing space, and allocate shipping resources strategically. For e-commerce sales, sophisticated AI recommendation engines leverage collaborative filtering and natural language processing (NLP) of customer reviews to cross-sell complementary bakeware accessories (e.g., parchment liners, specialized cleaning tools) and provide highly relevant, context-specific suggestions during the browsing session, significantly boosting average order values and fostering deeper customer loyalty within this specialized consumer durable goods segment by simplifying the purchasing journey.

- AI-driven Predictive Maintenance: Utilizing machine learning algorithms to monitor manufacturing equipment performance, predicting potential failures in stamping or coating lines, thus reducing unplanned downtime and maintaining consistent production quality for metal pans, ensuring uniform metal gauge thickness and consistent thermal properties.

- Demand Forecasting Optimization: Implementing sophisticated AI models to analyze sales data, seasonal trends, social media sentiment, and external economic indicators to accurately forecast granular demand for different pan sizes and materials, optimizing inventory levels across regional warehouses and strategically minimizing expensive safety stock requirements.

- Generative Design for Ergonomics: Applying AI tools to rapidly iterate on handle designs, pan structural geometry, and cavity spacing, ensuring optimal air circulation, maximizing energy efficiency during baking, and enhancing handling ease for both commercial operators and residential users, based on virtual stress testing.

- Supply Chain Resilience: AI analyzing global supply chain risks, raw material price fluctuations (silicone, steel), and logistical bottlenecks, recommending alternative sourcing strategies, optimizing transportation routes, and implementing just-in-time inventory systems to maintain cost stability and meet fluctuating, time-sensitive production schedules.

- Personalized Consumer Recommendations: Using AI to analyze individual user baking habits, recipe interests, and purchasing history on e-commerce platforms to recommend the most suitable pan material, non-stick coating type, and cavity count, optimizing product discovery and enhancing conversion rates through highly accurate, context-specific product targeting.

- Quality Control Automation: Deployment of advanced machine vision systems powered by AI to automatically inspect the consistency of non-stick coatings, detect subtle microscopic imperfections in mold casting, surface scratches, and ensure absolute dimensional uniformity across all production batches, vastly exceeding the precision capabilities of manual human inspection.

- Sentiment Analysis and Product Feedback: Employing Natural Language Processing (NLP) to rapidly process and categorize thousands of online customer reviews and social media mentions, immediately identifying recurring pain points (e.g., pans warping, coating failure) related to specific models, providing instantaneous, actionable feedback to R&D teams for rapid, iterative product improvement cycles and proactive damage control.

- Optimized Pricing Strategies: AI algorithms continuously analyze competitor pricing, inventory levels, promotional elasticity, and localized demand to dynamically adjust pricing strategies across different retail and e-commerce channels, maximizing margin while remaining competitively positioned in highly saturated sub-segments.

DRO & Impact Forces Of Muffin Pan Market

The Muffin Pan Market is dynamically shaped by powerful drivers that primarily stem from global cultural shifts and ongoing material science improvements. A principal driver is the widespread acceleration of the 'culinary lifestyle' trend, where consumers, particularly younger demographics, view baking and complex home cooking not just as a necessity but as a valued leisure activity and a form of creative expression, fueling robust demand for specialty and premium bakeware. This trend is significantly amplified by the proliferation of digital content—from professionally produced cooking shows to interactive online tutorials and viral social media challenges—which continuously introduces new, complex recipes requiring specific, high-quality baking tools, thereby driving product specificity. Technological drivers, especially the breakthroughs in developing eco-friendly and ultra-durable non-stick surfaces that are certified free of harmful chemicals (PFOA/PTFE), actively encourage health-conscious consumers to discard older, potentially unsafe equipment and invest in new, validated products, sustaining the crucial replacement market demand and supporting higher pricing tiers for technologically advanced products.

Significant restraints pose persistent challenges to market expansion and overall profitability within the bakeware sector. The most critical constraint is the substantial volatility in the global pricing of key raw materials, primarily steel (carbon and aluminized) and high-grade silicone polymers, which are susceptible to geopolitical shifts, energy cost spikes, and commodity market speculation. This fluctuation makes accurate, long-term cost planning extremely difficult for manufacturers, often forcing sudden, unplanned price increases that can suppress demand, particularly in the price-sensitive mass market where consumers expect stable, low pricing. Furthermore, the inherent maturity and high saturation of basic muffin pan categories in established Western markets mean that growth is heavily reliant on expensive incremental upgrades, innovative niche products (like specialty shapes), or promotional replacement sales, rather than capturing entirely new household customers, leading to fierce competition based primarily on marginal pricing and heavy discounting strategies which erode overall segment profitability.

Opportunities for exponential growth are concentrated in product diversification and aggressive geographic expansion into high-potential, underserved territories. The potential to introduce truly multi-functional baking tools—pans designed to handle multiple tasks beyond standard muffins, such as specialized bread puddings, individual frozen desserts, or savory entree portions in the same mold—captures the modern consumer’s need for kitchen efficiency and space saving, justifying a higher average selling price. Geographically, establishing robust supply and distribution networks in high-growth, underserved markets like Southeast Asia, India, and parts of Latin America, where disposable income is steadily rising and Western-style baking is rapidly gaining popularity, presents a massive, relatively untapped consumer base. The overall impact forces currently tilt towards positive long-term expansion, primarily due to the continuous technological refinement in materials ensuring safety and performance, which provides a tangible, compelling incentive for consumers to upgrade, effectively offsetting the cyclical challenges posed by commodity market variability and the relentless price competition in the basic product segments.

Segmentation Analysis

The detailed segmentation of the Muffin Pan Market provides crucial insights into manufacturing priorities, material trends, and consumer purchasing behavior across various demographics. The segmentation by material—spanning high-conductivity metals (carbon steel, aluminized steel), flexible silicones, and heat-retentive ceramics—is essential for differentiating product lines based on target application and desired thermal outcome. For instance, high-volume commercial bakeries rarely utilize consumer-grade silicone due to its lower heat retention and lack of structural rigidity, instead relying on robust, perforated aluminized steel trays that maximize air circulation and ensure rapid cooling for high-throughput efficiency and stackability. Conversely, residential consumers increasingly favor the sheer convenience, flexibility, and anti-adherence properties of platinum-cured silicone, making material choice the most influential purchasing criteria outside of initial unit cost.

Segmentation by coating type highlights the industry's strategic response to global health consciousness and evolving regulatory standards. The steady decline in public trust regarding traditional PTFE non-stick coatings, driven by increased awareness regarding PFOA use in manufacturing, has spurred major capital investment in developing advanced ceramic-based and proprietary hybrid polymer coatings. Ceramic coatings, while sometimes possessing lesser long-term durability than premium fluoropolymers, are actively promoted based on their non-toxic, chemical-free attributes (often marketed as "Green" or "Eco-friendly"), resonating particularly strongly with millennial and Gen Z consumers concerned about food safety and long-term environmental sustainability. Furthermore, the segmentation by cavity size (Standard, Mini, Jumbo) reflects changing dietary and lifestyle patterns, with Mini pans seeing a significant surge in popularity driven by the increased need for controlled portion sizes suitable for calorie counting, specialized dietary regimes (keto, paleo), and the efficiency required by professional caterers, indicating a sophisticated market response to highly specific consumer demands.

Distribution channel analysis reveals a critical, ongoing evolution in how market access is managed and consumer relationships are built. The Online segment is far more than just a retail outlet; it functions as a powerful market validator and brand-building ecosystem, where aggregated consumer reviews and influencer endorsements directly dictate purchasing decisions for specialized, higher-priced bakeware items. Traditional Offline channels, including mass-market supermarkets and dedicated kitchenware specialty stores, continue to anchor the market by offering crucial benefits like immediate product availability and the opportunity for consumers to physically assess product attributes—such as weight, gauge thickness, and handle ergonomics—factors often critical for evaluating the long-term quality of commercial-grade metal pans. The interplay between these channels mandates that leading manufacturers adopt sophisticated omnichannel strategies, ensuring strict pricing consistency, unified promotional messaging, and seamless inventory management across all physical and digital consumer touchpoints for optimal market penetration and brand continuity.

- By Material:

- Silicone: High flexibility, superior release, non-reactive, freezer-safe, favored by residential users for convenience and efficient storage.

- Metal:

- Carbon Steel: Excellent thermal conductivity and durability, economical for mid-range market, staple for basic bakeware.

- Aluminized Steel: Premium commercial standard, resists rust and corrosion, offers superior, consistent heat distribution, essential for high-volume industrial operations.

- Aluminum: Lightweight, rapid heating and cooling, ideal for specialized professional, high-volume baking setups requiring quick turnaround.

- Glass: Used primarily for aesthetic oven-to-table presentation and superior heat retention, occupying a niche residential market for specialty items.

- Ceramic: Highly non-reactive, visually appealing colors, strong niche market positioning focused on premium, non-toxic, chemical-free attributes.

- Others (e.g., Paper/Foil Inserts, Composites): Primarily used for disposable commercial applications, catering, and novelty shapes where cleanup is avoided.

- By Coating:

- Non-stick:

- PTFE (Fluoropolymer): Highest performance in release and durability, standard for heavy-duty professional use, but facing regulatory scrutiny.

- Ceramic: PFOA/PTFE-free, non-toxic marketing focus, highly aesthetic, strong residential demand driver due to health concerns.

- Hybrid/Proprietary: Advanced technological formulations offering improved scratch resistance, superior non-stick longevity, and high-temperature thresholds suitable for robust domestic use.

- Standard/No Coating: Typically heavy-gauge, often seasoned steel or traditional cast aluminum, utilized in specialized, extremely high-heat commercial environments where seasoning provides natural non-stick properties.

- Non-stick:

- By Cavity Size:

- Standard (typically 12-cup): The core household size, offering balanced utility for everyday baking needs.

- Jumbo (typically 6-cup): Used for large format muffins or specialized desserts, commanding a premium price point per unit due to material use.

- Mini (typically 24-cup): High growth segment catering to dietary trends, sampling, portion control, and professional catering requirements.

- By Application:

- Residential (Home Use): Volume-dominant segment, driven by cultural trends, seasonal baking, and replacement cycles of existing equipment.

- Commercial (Bakeries, Cafes, Food Services): Value-dominant segment, driven by non-negotiable requirements for durability, consistency, and thermal stability.

- Industrial (Large-Scale Food Production): Niche, customized segment requiring highly specialized pans for automation compatibility and extreme longevity under continuous stress.

- By Distribution Channel:

- Offline:

- Supermarkets/Hypermarkets: Primary channel for mass-market accessibility and price-sensitive, basic bakeware purchases.

- Specialty Stores: Focus on premium brands, personalized expert advice, and providing the tactile experience essential for quality evaluation.

- Online: E-commerce Platforms, Direct-to-Consumer Websites: Fastest growing channel, crucial for niche products, brand-building, and leveraging advanced digital marketing and logistics strategies.

- Offline:

Value Chain Analysis For Muffin Pan Market

The Muffin Pan value chain is characterized by a high degree of integration for major players, stretching from initial material sourcing to final consumer engagement, with rigorous quality checkpoints at every stage. Upstream activities begin with the strategic procurement of primary raw materials: high-quality steel sheets (which must meet specific gauge and metallurgical composition requirements for thermal stability), specialized food-grade silicone polymers, and highly regulated non-stick chemical formulations. The consistency, quality, and cost stability of these inputs are absolutely critical, often accounting for a substantial portion of the total manufacturing cost. Leading manufacturers frequently engage in strategic vertical integration or secure long-term, preferential supply contracts to effectively manage the pronounced volatility inherent in global commodity markets. Any geopolitical disruption or logistical constraint affecting the supply of core materials like steel or specialized polymers can immediately inflate manufacturing costs and compromise delivery timelines across all product tiers, necessitating proactive risk management.

Midstream transformation processes involve advanced industrial operations that utilize sophisticated, high-precision equipment. For metal pans, this includes high-tonnage stamping, specialized edging, and hydroforming processes, ensuring uniform cavity shapes, precise dimensional accuracy, and necessary structural rigidity to effectively prevent warping under high oven temperatures. For silicone products, the midstream phase involves complex injection molding and highly regulated platinum-curing processes to achieve guaranteed food-grade purity and optimal functional flexibility. Crucially, the application of advanced non-stick coatings is highly technological, requiring precisely controlled environmental chambers and advanced electrostatic deposition techniques to ensure perfectly uniform layer adherence and optimal thermal curing, which directly correlates with the pan’s long-term performance, abrasion resistance, and ultimately, consumer satisfaction. Manufacturers who invest heavily in superior coating technology gain a significant competitive edge through superior product longevity and predictable release characteristics, justifying a necessary premium in the final market price.

Downstream activities center on efficient logistics management, inventory optimization, and multifaceted distribution strategies that directly engage the end-user. The distribution channel is strategically bifurcated into direct and indirect routes. Direct sales (D2C channels and B2B industrial contracts) offer manufacturers the highest control over brand message, pricing, and critical customer relationship management, which is essential for specialized, high-volume commercial sales that require tailored specifications and dedicated maintenance support. Indirect channels, which heavily utilize wholesalers, large-scale retailers, and massive e-commerce aggregators, maximize geographic market reach and accessibility. The accelerated growth of e-commerce has necessitated significant investment in digital content optimization, regional warehouse automation, and robust last-mile delivery solutions specifically tailored for handling both fragile and bulky kitchenware. Retailers and e-commerce platforms also play an indispensable role in consumer education and high-impact promotion, leveraging detailed product imagery and verified consumer reviews to powerfully influence purchasing decisions, particularly within the rapidly expanding residential and niche specialty segments.

Muffin Pan Market Potential Customers

The Muffin Pan Market identifies three core customer cohorts: the Residential Home Baker, the Specialized Commercial Food Service Provider, and the Large Industrial Food Manufacturer, each exhibiting distinct purchasing behaviors, volume requirements, and non-negotiable product expectations. The Residential Customer segment is characterized by high volume, low frequency (driven by replacement rather than first-time purchase), and moderate price elasticity, valuing features such as aesthetic appeal, easy cleanup (preferably dishwasher safe), and high-quality non-stick surfaces, often strongly influenced by visual content and online culinary trends. This segment's purchasing behavior is highly cyclical, spiking significantly during major holidays and driven heavily by major retail promotions and the limited-edition availability of novelty items (e.g., specific seasonal silicone molds), necessitating manufacturers to maintain diverse, visually compelling, and cost-effective inventory lines to capture impulse purchases.

The Commercial Food Service segment represents a critical value driver for the market, encompassing independent and small chain bakeries, specialized cafes, large-scale catering operations, and institutional kitchens (e.g., hotels, hospitals). These dedicated buyers exhibit lower price elasticity but demand non-negotiable standards of rugged performance, specifically requiring extreme durability, consistent resistance to corrosive industrial cleaning chemicals, and superior, predictable thermal properties (such as those offered by heavy-gauge aluminized steel). Their purchasing decisions involve rigorous internal testing and are fundamentally based on criteria such as the quantifiable return on investment (ROI), proven pan lifespan, precise compatibility with high-capacity rack ovens, and strict standardization to minimize operational complexity, making them highly strategic, reliable long-term customers for premium industrial bakeware suppliers who can guarantee consistency and longevity.

The Industrial segment, though smallest in terms of the number of buyers, is the most technologically demanding in terms of specialized engineering and customization requirements. These customers, including major packaged food corporations and large frozen food processors, require highly customized, multi-piece modular pans designed to interface with extreme precision with automated conveyor systems, cooling tunnels, and robotic handling units operating continuously. Product specifications often include non-standard, proprietary coatings optimized for specific, complex batters and ultra-high-temperature resistance coatings suitable for exceptionally rapid industrial baking cycles. Purchasing decisions are highly strategic, involving multi-year contracts, focusing entirely on minimizing costly production downtime, maximizing high-speed throughput efficiency, and requiring dedicated technical support from the supplier for ongoing maintenance and precise system integration, often making customization, technical consultancy, and guaranteed reliability the key competitive differentiators in this highly specialized and capital-intensive segment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 Million |

| Market Forecast in 2033 | USD 621.8 Million |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Meyer Corporation, World Kitchen LLC, Newell Brands (Calphalon), Wilton Brands LLC, OXO International, Nordic Ware, Lékué, USA Pan, Fox Run Brands, Chicago Metallic, T-fal (Groupe SEB), Williams-Sonoma Inc., Cuisinart, Demarle (Sasa Demarle), Silikomart, Rosti Mepal, Pyrex (Corelle Brands), KitchenAid (Whirlpool Corporation), Tramontina, Farberware (Meyer Corporation), Prestige (TTK Prestige Limited), MasterClass (Cookware Company), IKEA Systems B.V., Kaiser Bakeware (WMF Group), Anolon (Meyer Corporation) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Muffin Pan Market Key Technology Landscape

The current technology landscape of the Muffin Pan Market is primarily centered on enhancing material performance through specialized surface treatments, advanced structural engineering, and rigorous adherence to increasingly strict global food safety standards dictated by evolving material science research. The dominant technological innovation continues to be the industry-wide transition to next-generation non-stick systems. This involves significant and continuous research and development focused on creating highly durable, ceramic-reinforced hybrid coatings that offer superior release qualities while being entirely free of legacy perfluorinated chemicals like PFOA and PFOS, which are increasingly restricted by global regulatory bodies. Manufacturers are utilizing advanced processes such as plasma deposition techniques and high-heat curing methods to apply these coatings, ensuring superior molecular adherence and significantly extending the pan's functional longevity compared to older, traditional spray application methods. This heavy technological investment allows leading brands to effectively command a substantial premium price point, positioning their products as high-performance, long-lasting, and health-conscious alternatives to basic, low-cost bakeware available through mass retail.

Furthermore, structural technology applied to metal pans, particularly crucial in the rigorous commercial and industrial segments, involves complex material lamination and proprietary structural rigidity enhancements. Aluminized steel, currently the most favored commercial material globally, utilizes a proprietary layered composition that effectively maximizes heat reflection and dramatically prevents long-term oxidation, significantly extending the pan's lifespan even under harsh, continuous, high-temperature use environments. Key manufacturers are also implementing advanced geometric design principles, such as incorporating micro-textured bases or optimizing specific cavity angles, which are engineered to intentionally optimize crucial airflow and heat distribution dynamics within modern convection and impinging airflow ovens, leading directly to faster, more consistent baking times and quantifiable energy savings for large commercial operators. For silicone bakeware, the technology focus is overwhelmingly on achieving higher platinum cure purity, ensuring the base material remains completely non-reactive, odorless, and structurally stable, capable of withstanding extreme temperature differentials without any degradation, which is a critical feature for products frequently used across both industrial freezing and high-heat baking environments.

An emerging technological frontier involves integrating digital readiness and advanced material resilience into the product itself. While direct electronics are rare in bakeware, this includes the application of specialized, ultra-hardened coatings that effectively prevent surface scratching and abrasion under harsh automated scrubbing systems widely used in industrial bakeries, often utilizing nano-level material hardening techniques. Moreover, the implementation of permanent, laser-etched identifiers (such as high-contrast barcodes or unique serial numbers) directly onto commercial trays facilitates accurate, real-time inventory tracking, precise batch tracing, and robust quality control management within highly automated food processing facilities, seamlessly integrating the physical pan asset into the wider digital Manufacturing Execution Systems (MES). This integration of durable identification technology is crucial for achieving stringent quality control, efficiently managing massive asset inventories across multiple facilities, and complying with stringent traceability regulations within the highly competitive professional food production supply chain, fundamentally transforming the muffin pan from a simple tool into an integrated component of a sophisticated, intelligent production system.

Regional Highlights

North America maintains its status as a market leader, characterized by high consumer spending power on household items, frequent product replacement cycles (driven by consumer trends), and a strong cultural affinity for home baking heavily influenced by media-driven culinary trends. The US market, in particular, drives significant innovation in specialized niche segments, showing very strong adoption rates for highly specific products like the 24-cup mini muffin pans and innovative silicone/metal hybrid models designed for convenience. Key market activity revolves around intense, data-driven digital marketing campaigns and leveraging the massive reach of major e-commerce platforms. European markets, led by Germany, the UK, and France, prioritize uncompromising quality, environmental sustainability, and strict regulatory compliance. The demand here is heavily influenced by stringent EU standards for food-contact materials, actively promoting the rapid adoption of ceramic-coated and locally sourced, high-quality steel pans, with strong, established commercial demand from traditional artisan bakeries maintaining high average selling prices in the professional segment.

Asia Pacific (APAC) is projected to record the highest growth trajectory through the forecast period, fundamentally driven by two powerful macro-trends: rapid socioeconomic development across the region and accelerating cultural integration of Western dietary habits. As disposable incomes consistently rise across powerhouse economies like China, India, and various Southeast Asian nations, there is an increasing shift from traditional cooking to experimental Western-style baking at home, driving residential demand for accessible, mid-range metal and silicone pans. Simultaneously, the massive and ongoing expansion of the region's packaged food industry necessitates substantial infrastructural investment in industrial-grade, large-volume pans and highly specialized equipment, making APAC a critical strategic focus for all global bakeware manufacturers seeking scale and future market leadership. Competition in this region is exceptionally intense, often involving a complex blend of large international brands aggressively competing against agile local manufacturers who compete fiercely on price and highly localized product design adaptations.

Latin America shows steady, yet geographically fragmented, growth, highly concentrated around the major urban population centers in Brazil, Mexico, and Argentina. Market penetration is closely tied to the accelerating expansion of organized modern retail chains and the improvement of national logistics infrastructure, making product accessibility a key determinant of market success. Consumers in this region are often sensitive to price but increasingly seek branded products that promise reliable quality, prioritizing functional versatility and multi-functionality due to generally smaller household kitchen spaces. The Middle East and Africa (MEA) market, while currently smallest in scale, shows significant future promise, particularly within the affluent Gulf Cooperation Council (GCC) countries. High growth in the dedicated hospitality and catering sectors, fueled by massive tourism and urban development projects, drives consistent commercial demand for durable, professional-grade bakeware. However, complex import duties, fragmented supply chains, and underdeveloped distribution networks in some African regions present persistent logistical challenges that continue to restrain overall consumer market potential, requiring localized sales partnerships and strategic distributor alliances to effectively overcome existing entry barriers.

- North America: Dominant market share and high product replacement rates; primary focus on premium, certified PFOA-free bakeware and specialty sizes driven by active DIY food and health trends. Key global hub for digital marketing and high-value e-commerce-driven sales.

- Europe: Strong regulatory environment and consumer preference for ethical, sustainable, high-quality, and safety-certified materials. High value contribution from the robust traditional and industrial commercial bakery sectors, especially in Central and Western Europe.

- Asia Pacific (APAC): Fastest growing regional market globally; fueled by rapid urbanization, rising middle-class income levels, and the massive expansion of industrial food processing and packaged goods production. Strategic focus on balancing verifiable quality with cost-effectiveness for mass-market penetration.

- Latin America: Moderate, incremental growth tied closely to retail modernization and infrastructure development; consumer demand concentrated in key urban centers; focus on durable, multi-functional metal pans suitable for standard household use; characterized by high regional price sensitivity.

- Middle East & Africa (MEA): Emerging growth segment primarily driven by the rapid expansion of the hospitality (HoReCa) and food service sectors; primary demand centered on heavy-duty, commercial equipment; faces significant logistical challenges related to high shipping costs and complex import duties.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Muffin Pan Market.- Meyer Corporation

- World Kitchen LLC

- Newell Brands (Calphalon)

- Wilton Brands LLC

- OXO International

- Nordic Ware

- Lékué

- USA Pan

- Fox Run Brands

- Chicago Metallic

- T-fal (Groupe SEB)

- Williams-Sonoma Inc.

- Cuisinart

- Demarle (Sasa Demarle)

- Silikomart

- Rosti Mepal

- Pyrex (Corelle Brands)

- KitchenAid (Whirlpool Corporation)

- Tramontina

- Farberware (Meyer Corporation)

- Prestige (TTK Prestige Limited)

- MasterClass (Cookware Company)

- IKEA Systems B.V.

- Kaiser Bakeware (WMF Group)

- Anolon (Meyer Corporation)

- Fissler GmbH

- Le Creuset S.A.S.

Frequently Asked Questions

Analyze common user questions about the Muffin Pan market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the key benefits of silicone muffin pans compared to metal pans for residential use?

Silicone muffin pans are highly valued for their exceptional flexibility, which allows for effortless release of baked goods without sticking, significantly minimizing breakage. They are also oven, microwave, and freezer safe, offering greater thermal versatility, and are generally easier to store due to their pliable nature, appealing particularly to home bakers with limited kitchen space. Their ease of cleaning is a primary residential benefit.

Is the use of PFOA and PTFE non-stick coatings in modern muffin pans still safe or environmentally preferred?

The majority of modern, branded non-stick muffin pans, particularly those sold in North America and Europe, are manufactured without PFOA (Perfluorooctanoic Acid), due to strict regulatory oversight. While PTFE remains highly effective, consumer concern over chemical usage drives a major shift towards alternative ceramic-based non-stick coatings, which are actively marketed as healthier, more non-toxic, and environmentally responsible alternatives in the residential bakeware market segment.

How does the thickness (gauge) of a metal muffin pan affect baking performance and commercial viability?

The gauge, or thickness, of a metal muffin pan significantly influences performance, particularly in commercial environments. Thicker, heavy-gauge pans (aluminized or carbon steel) heat slower but distribute thermal energy more evenly, preventing hot spots and ensuring consistent browning across high-volume batches, which minimizes product waste and maximizes operational efficiency crucial for professional bakeries and industrial use.

Which distribution channel is experiencing the fastest growth for specialized muffin pan sales globally?

The online distribution channel, encompassing global e-commerce platforms and niche direct-to-consumer websites, is rapidly gaining dominance and experiencing the fastest growth. This channel offers consumers unparalleled access to specialty sizes (Mini, Jumbo) and international premium brands, leveraging search engine optimization and verified customer reviews to influence purchasing decisions far more effectively than traditional brick-and-mortar stores.

What is driving the increased demand for mini muffin pans (24-cup capacity) in the current market?

The surging demand for mini muffin pans is primarily driven by current consumer trends favoring strict portion control, catering services requiring uniform small-scale products, and the popularity of specialized diets (like keto or gluten-free baking) where controlled serving sizes are essential for nutritional compliance. Their utility also extends to diverse savory preparations like miniature quiches and appetizers.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager