Muffle Furnaces Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433257 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Muffle Furnaces Market Size

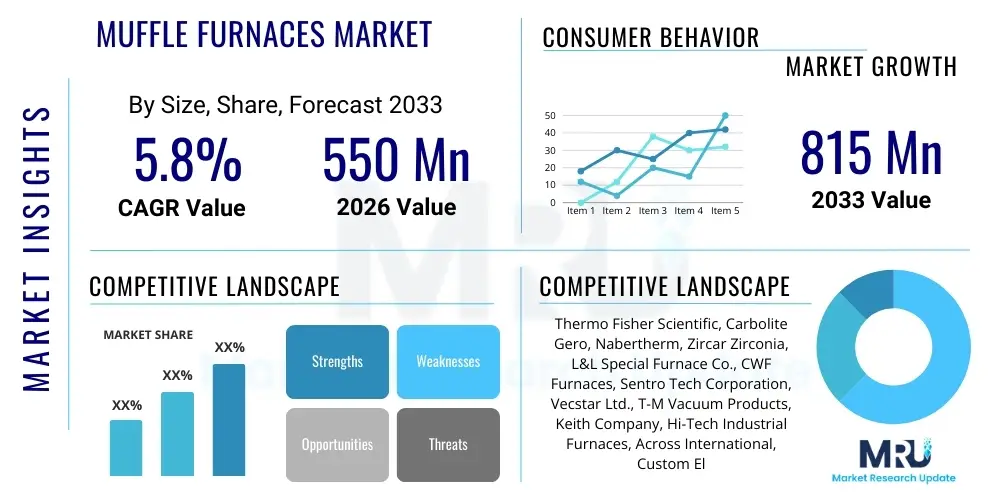

The Muffle Furnaces Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 550 million in 2026 and is projected to reach USD 815 million by the end of the forecast period in 2033.

Muffle Furnaces Market introduction

Muffle furnaces are indispensable laboratory and industrial heating devices characterized by an insulated heating chamber, or muffle, which separates the heated material from the heating elements and combustion gases. This separation is critical for applications demanding high purity, controlled atmosphere, and precise temperature uniformity, such as ashing, sintering, heat treating, and annealing of materials. The fundamental design allows for operating temperatures typically ranging from 100°C up to 1800°C, making them versatile tools across various scientific and manufacturing disciplines. The market encompasses a range of designs, including box furnaces for high volume and tube furnaces for controlled atmosphere experimentation.

Product sophistication has increased significantly, driven by demand for enhanced thermal efficiency, improved temperature control accuracy via PID controllers, and integration of advanced refractory materials like alumina, zirconia, and silicon carbide to achieve ultra-high temperatures and longevity. Major applications span quality control in materials science, gravimetric analysis in environmental testing, ceramic and metal component processing, and pharmaceutical raw material analysis. The reliability and precision offered by modern muffle furnaces position them as standard equipment in R&D labs, academic institutions, and specialized manufacturing sectors.

The primary driving factors propelling the Muffle Furnaces Market include the substantial increase in global research and development expenditure, particularly in emerging economies focused on advanced materials and biotechnology. Furthermore, stringent quality control standards in industries such as pharmaceuticals and metallurgy necessitate the reliable, controlled thermal processing capabilities that muffle furnaces provide. The continuous evolution of materials science, requiring high-temperature synthesis and precise thermal cycling, further cements the market’s growth trajectory, supported by technological advancements in insulation and heating element design.

Muffle Furnaces Market Executive Summary

The Muffle Furnaces Market is currently witnessing robust expansion driven by global investment in specialized laboratories and the accelerating pace of materials science research. Business trends indicate a shift towards energy-efficient designs, integrating vacuum or inert gas capabilities, and incorporating sophisticated digital control systems for remote monitoring and data logging. Key market players are focusing on developing high-temperature models (1700°C+) to cater to emerging applications in aerospace ceramics and specialized metallurgy. Mergers and acquisitions, alongside strategic partnerships between equipment manufacturers and specialized material suppliers, are defining the competitive landscape, aiming to broaden product portfolios and geographic reach.

Regionally, Asia Pacific (APAC) stands out as the fastest-growing market, primarily fueled by massive industrialization, government backing for scientific research in countries like China and India, and the burgeoning pharmaceutical and semiconductor manufacturing sectors. North America and Europe, while mature, maintain their dominance in terms of technological innovation and high-value applications, particularly in advanced R&D and quality assurance, where demand for regulatory-compliant, validated equipment is paramount. Growth in Latin America and MEA is steady, driven by infrastructure development and increasing investments in local academic and mining sectors requiring reliable thermal analysis tools.

Segment-wise, high-temperature muffle furnaces (above 1200°C) are experiencing the highest growth due to their essential role in developing advanced ceramics, composites, and high-performance alloys. The R&D Laboratories end-user segment remains the largest revenue contributor, consistently purchasing specialized and customized units. Furthermore, the rising adoption of tube furnaces, which offer superior atmospheric control compared to standard box furnaces, reflects the increasing complexity of modern scientific experiments focusing on specific material phase transitions and controlled environment synthesis.

AI Impact Analysis on Muffle Furnaces Market

Common user questions regarding AI's impact on muffle furnaces revolve around improving process optimization, predictive maintenance, and integrating laboratory automation. Users frequently inquire if AI can reduce energy consumption by dynamically adjusting heating cycles, predict the failure of expensive heating elements or refractory linings, and streamline complex thermal treatment protocols. There is significant interest in using machine learning (ML) algorithms to analyze real-time temperature, atmosphere, and energy data to achieve unprecedented uniformity and repeatability, especially crucial in high-precision material synthesis where slight thermal variance can ruin a batch. The consensus expects AI to transition muffle furnaces from static, programmed devices to intelligent, self-optimizing thermal processing units, enhancing both throughput and reliability.

- AI-driven predictive maintenance forecasts heating element lifespan and chamber lining wear, minimizing unscheduled downtime.

- Machine learning algorithms optimize temperature ramp-up and soak times, significantly reducing overall energy consumption and cycle duration.

- Integration of AI with spectroscopy tools allows for real-time monitoring of material changes within the furnace, leading to automated parameter adjustments.

- Automated fault detection and diagnostics using sensor data enhance operational safety and compliance in regulated environments.

- AI facilitates complex, multi-step thermal profiles required for advanced material research, ensuring highly repeatable experimental conditions.

DRO & Impact Forces Of Muffle Furnaces Market

The Muffle Furnaces Market is primarily driven by the escalating demand for advanced materials requiring precise thermal processing, coupled with substantial governmental and private sector investments in laboratory infrastructure globally. Restraints predominantly center on the high initial investment cost associated with high-temperature and highly specialized units, along with the increasing operational costs related to high energy consumption. Opportunities emerge from the development of green, energy-efficient furnaces and the rapid expansion of niche applications in fields such as battery material production and specialized metallurgy. These forces collectively shape the market's evolution, demanding manufacturers balance high performance with sustainability and affordability to maintain competitive advantage.

Drivers: A key driver is the relentless pursuit of high-performance materials in the aerospace, automotive, and energy sectors, where components must withstand extreme thermal and mechanical stresses. The development of lithium-ion batteries and fuel cells requires specialized, controlled atmosphere muffle furnaces for precursor synthesis and heat treatment of electrode materials, creating a constant demand surge. Furthermore, global regulatory frameworks for quality assurance in pharmaceutical and chemical testing mandate the use of highly calibrated and reliable thermal analysis equipment, compelling organizations to upgrade or purchase new furnace technology.

Restraints: The most significant restraint is the substantial capital expenditure required for sophisticated, high-temperature muffle furnaces, often exceeding budgets for smaller research institutions or startups. Additionally, the operational expenses, chiefly energy consumption, can be prohibitive, especially for processes requiring extended soak times at very high temperatures. Technical restraints include the limitations of refractory materials and heating elements at ultra-high temperatures (above 1800°C), where wear and tear significantly reduce equipment longevity and increase maintenance frequency. Market growth is also occasionally hampered by long procurement cycles in highly bureaucratic sectors, such as government R&D labs.

Opportunities: Major market opportunities exist in the development of next-generation, smart furnaces featuring IoT connectivity, allowing for remote diagnostics, operational optimization, and integration into laboratory information management systems (LIMS). The transition towards electric vehicle (EV) technology presents a massive opportunity, as muffle furnaces are crucial for producing battery components, coatings, and structural materials. Developing cost-effective, modular furnace systems tailored for localized, smaller-scale industrial applications in developing regions also presents a viable route for market penetration. Furthermore, focus on sustainable furnace design, leveraging insulation technologies to minimize heat loss and maximize energy efficiency, aligns with global green manufacturing initiatives.

- Drivers: Increased R&D spending, growth in advanced materials sector, stringent quality control standards, expansion of battery technology manufacturing.

- Restraints: High initial investment cost, significant energy consumption, limitations of materials at ultra-high temperatures, long replacement cycles.

- Opportunities: Integration of IoT and smart features, rising demand from electric vehicle (EV) supply chain, focus on energy-efficient designs, customization for niche industrial processes.

- Impact Forces: The rapid technological adoption in APAC shifts the market's production and consumption center, while environmental mandates in Europe drive innovation toward sustainable thermal solutions.

Segmentation Analysis

The Muffle Furnaces Market is comprehensively segmented based on product type, temperature range, application, and end-user, reflecting the diverse requirements across research and industrial environments. Segmentation by type differentiates between standard box furnaces, which are highly versatile, and tube furnaces, which offer superior gas atmosphere control for specific chemical reactions or material treatments. Temperature range categorization is crucial as it dictates the required heating element material and refractory lining, thereby influencing cost and performance. Analyzing these segments helps manufacturers tailor products to specific vertical market needs, such as ultra-high temperature sintering in ceramics or precise ashing in pharmaceutical QA/QC laboratories.

- By Type:

- Box Muffle Furnaces (Standard and Heavy-Duty)

- Tube Muffle Furnaces (Horizontal and Vertical)

- Chamber Furnaces (Large Volume)

- By Temperature Range:

- Low Temperature (Up to 1200°C)

- Medium Temperature (1200°C to 1700°C)

- High Temperature (Above 1700°C)

- By Application:

- Ashing and Calcination

- Heat Treatment (Annealing, Hardening, Tempering)

- Gravimetric Analysis

- Ceramic Sintering and Firing

- Material Testing and Research

- By End-User:

- R&D Laboratories and Academic Institutions

- Pharmaceutical and Biotechnology Companies

- Materials Science and Metallurgy

- Industrial Manufacturing (Automotive, Aerospace, Electronics)

- Environmental Testing Laboratories

Value Chain Analysis For Muffle Furnaces Market

The value chain for muffle furnaces begins with the upstream suppliers of critical raw materials, primarily focusing on high-purity refractory ceramics (alumina, zirconia), specialized heating elements (Kanthal, MoSi2, SiC), and advanced insulation materials. The efficiency and quality of the final product are highly dependent on the reliability and thermal properties of these input materials. Manufacturers often engage in long-term contracts with specialized material producers to ensure consistency and cost optimization, as the performance requirements for high-temperature applications are extremely demanding.

Midstream activities involve core manufacturing, including precision casting and fabrication of the furnace shell, winding and integration of heating elements, and the complex engineering of control systems and safety features. This phase is characterized by intensive R&D to improve thermal uniformity, reduce energy consumption, and enhance connectivity features (IoT). Distribution channels are diverse, utilizing both direct sales teams for customized industrial units and indirect channels, such as specialized laboratory equipment distributors and regional resellers, who often provide critical installation, calibration, and localized maintenance services.

Downstream analysis focuses on the end-users—R&D facilities, industrial plants, and academic labs—where the furnace is integrated into specific workflows. Direct sales are preferred for high-value, highly customized industrial furnaces where technical consultation and post-sales support are essential. Indirect distribution channels dominate sales of standardized, bench-top laboratory models, leveraging the established logistics networks of major lab supply houses. Post-sales service, including periodic recalibration, element replacement, and software updates, constitutes a significant part of the downstream value, ensuring equipment longevity and user satisfaction.

Muffle Furnaces Market Potential Customers

The primary customers for muffle furnaces are institutions and enterprises requiring precise, high-temperature thermal processing under controlled conditions. This includes the massive global network of academic research laboratories and government-funded R&D centers, which require a variety of furnace types—from small benchtop units for basic research to larger, specialized tube furnaces for advanced material synthesis under specific gas atmospheres. These customers prioritize temperature accuracy, reliability, and data logging capabilities to ensure research repeatability and integrity for publications and patent applications.

The industrial sector, particularly metallurgy and advanced materials manufacturing, constitutes another core customer segment. Companies involved in producing high-performance ceramics for aerospace, specialized alloys for medical implants, or coatings for automotive components rely heavily on large-capacity muffle furnaces for sintering, tempering, and firing processes. For these industrial users, throughput, energy efficiency, and long-term durability are critical purchasing criteria, often requiring customized solutions integrated directly into automated production lines.

Furthermore, the pharmaceutical, biotechnology, and environmental testing industries are significant purchasers, utilizing muffle furnaces mainly for quality control (QC) and regulatory compliance. Pharmaceutical companies use them extensively for residue on ignition (ROI) tests, gravimetric analysis, and ashing of raw materials and final products. Environmental laboratories use them for sample preparation, such as determining the ash content of organic matter. These segments demand furnaces that meet stringent regulatory standards (e.g., ISO, GMP), emphasizing validation protocols and robust temperature uniformity mapping.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 550 Million |

| Market Forecast in 2033 | USD 815 Million |

| Growth Rate | CAGR 5.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Thermo Fisher Scientific, Carbolite Gero, Nabertherm, Zircar Zirconia, L&L Special Furnace Co., CWF Furnaces, Sentro Tech Corporation, Vecstar Ltd., T-M Vacuum Products, Keith Company, Hi-Tech Industrial Furnaces, Across International, Custom Electric, PCE Instruments, K.H. Huppert Co., Furnace Finders Inc., Mellen Company, Vulcan Electric, CM Furnaces, HTM Furnaces |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Muffle Furnaces Market Key Technology Landscape

The technological landscape of the Muffle Furnaces Market is defined by continuous innovation in three core areas: heating element materials, thermal insulation, and control system sophistication. Advanced heating elements, such as molybdenum disilicide (MoSi2) and silicon carbide (SiC), are replacing traditional resistive wires, enabling furnaces to consistently reach and sustain temperatures well above 1700°C while offering longer operational life and faster ramp rates. The selection of the heating element is crucial, as it directly impacts the furnace's maximum temperature capability and the atmospheric compatibility—MoSi2, for instance, is oxidation-resistant but sensitive to reducing atmospheres.

Insulation technology is undergoing significant evolution, moving from traditional fiberboards to multi-layer, high-density refractory ceramics and vacuum-formed insulation assemblies. The use of micro-porous insulation materials and advanced reflection shields dramatically reduces heat loss to the exterior, improving energy efficiency, decreasing outer casing temperatures for enhanced safety, and allowing for extremely rapid cooling cycles. This focus on energy efficiency aligns with global sustainability mandates and reduces the total cost of ownership, driving adoption across cost-conscious research and industrial users.

Furthermore, the integration of advanced digital control systems is paramount. Modern muffle furnaces utilize sophisticated PID (Proportional-Integral-Derivative) controllers with multi-segment programming capabilities, allowing users to define complex thermal profiles with extreme precision. The burgeoning adoption of Internet of Things (IoT) technologies enables remote monitoring, data acquisition, and integration with LIMS systems. This connectivity supports features like automated self-calibration, predictive failure warnings, and secure data storage, transitioning the muffle furnace from a simple heating apparatus to a smart thermal processing workstation essential for modern, automated laboratories.

Specialized gas management systems, particularly for tube furnaces, represent a vital technological area. These systems ensure precise control over inert, reducing, or oxidizing atmospheres, critical for applications like CVD (Chemical Vapor Deposition), material purification, and specific sintering protocols. Manufacturers are incorporating advanced flow meters and vacuum pumps to achieve ultra-high purity environments, essential for synthesizing sensitive materials like advanced semiconductors or specialty powders. The convergence of precise temperature control with stringent atmospheric regulation dictates the premium segment of the market.

Finally, safety and ergonomics are driving features like integrated fume extraction systems and over-temperature protection mechanisms that rely on independent control circuits. Touchscreen interfaces and intuitive software allow users to manage complex thermal cycles with minimal training, enhancing operational safety and reducing the risk of material damage. The trend is toward compact, ergonomic designs that maximize usable workspace in increasingly crowded laboratory environments while adhering to rigorous international safety standards (e.g., CE marking, UL listing).

The continuous improvement in furnace lining and chamber architecture, moving towards monolithic refractory structures, minimizes structural failure points and enhances temperature uniformity across the working volume. This is especially important in large box furnaces where temperature gradients can affect the quality of batch processing. The use of specialized ceramic cements and precision-machined components ensures that even at extreme temperatures, the internal environment remains stable and contaminant-free, crucial for high-purity applications.

The future technology trajectory points toward integrating more advanced sensing technologies, such as non-contact infrared thermometry, to provide internal material temperature readings rather than just chamber temperature, offering a higher degree of process control. Furthermore, modular design allows end-users to easily swap out muffles or specialized components, increasing the versatility of a single furnace platform to accommodate diverse research requirements, thus justifying higher initial capital investment through multi-functionality.

Regional Highlights

- Asia Pacific (APAC): APAC is projected to be the engine of growth for the Muffle Furnaces Market, driven by rapid industrial expansion in manufacturing sectors, particularly electronics, automotive, and construction materials. China and India are major contributors due to substantial government investments in R&D infrastructure and the massive scale of their pharmaceutical and biotechnology industries. The increasing need for localized quality control and material testing, combined with lower operational costs compared to Western nations, positions APAC as a high-volume market.

- North America: North America holds a commanding share in terms of advanced and high-value equipment adoption. The market here is characterized by high R&D spending, stringent regulatory requirements (especially in pharma and aerospace), and a demand for highly customized, technologically sophisticated furnaces featuring advanced automation and IoT capabilities. The presence of leading research institutions and key market players drives innovation in ultra-high temperature and vacuum furnace technologies.

- Europe: Europe represents a mature market focusing heavily on sustainability and precision. Regulations regarding energy efficiency (mandating lower power consumption and superior insulation) drive the market towards highly efficient, certified equipment. Germany, the UK, and France are leaders, primarily serving the advanced metallurgy, specialized chemical, and academic research sectors. The adoption of advanced atmospheric control systems for intricate materials research is particularly high in this region.

- Latin America (LATAM): The LATAM market is in an emerging phase, with growth linked to infrastructure development, mining activities, and increasing local pharmaceutical production. Countries like Brazil and Mexico are primary consumers, focusing on robust, reliable, and mid-range temperature furnaces for educational and industrial quality testing. Market penetration relies heavily on imports and localized distribution networks capable of providing technical support.

- Middle East and Africa (MEA): Growth in MEA is highly concentrated around energy (oil & gas), metallurgy, and expanding academic sectors, especially in the UAE and Saudi Arabia. Investment in materials science related to construction and petrochemicals fuels demand. The region often imports standard box furnaces for quality assurance purposes, with specialized purchases driven by newly established research universities and government initiatives aimed at diversifying economic reliance.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Muffle Furnaces Market.- Thermo Fisher Scientific

- Carbolite Gero

- Nabertherm

- Zircar Zirconia

- L&L Special Furnace Co.

- CWF Furnaces

- Sentro Tech Corporation

- Vecstar Ltd.

- T-M Vacuum Products

- Keith Company

- Hi-Tech Industrial Furnaces

- Across International

- Custom Electric

- PCE Instruments

- K.H. Huppert Co.

- Furnace Finders Inc.

- Mellen Company

- Vulcan Electric

- CM Furnaces

- HTM Furnaces

Frequently Asked Questions

Analyze common user questions about the Muffle Furnaces market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between box muffle furnaces and tube muffle furnaces?

Box muffle furnaces offer a large, open chamber ideal for batch processing, ashing, and general heat treatment, providing versatility. Tube muffle furnaces, conversely, utilize a cylindrical tube running through the heating zone, which allows for superior atmospheric control, including vacuum or inert gas environments, crucial for high-purity material synthesis and thermal gradient testing.

Which factors significantly influence the lifespan of a muffle furnace?

The lifespan is primarily influenced by the maximum operating temperature, the frequency of thermal cycling, and the chemical environment within the chamber. Regular operation near the furnace's temperature limit, rapid heating/cooling cycles, and exposure to corrosive vapors significantly accelerate the degradation of refractory linings and heating elements, particularly silicon carbide or MoSi2 elements.

How does the Muffle Furnaces Market address the need for energy efficiency?

Manufacturers address energy efficiency through advanced insulation techniques, primarily utilizing multilayer, high-density refractory fiber materials and vacuum-formed ceramics to minimize thermal transfer. Furthermore, sophisticated PID control systems optimize power consumption during the soak time, and rapid heating elements reduce overall process duration, lowering cumulative energy usage.

What role does the pharmaceutical industry play in driving Muffle Furnace demand?

The pharmaceutical industry is a major driver, utilizing muffle furnaces for mandatory quality control procedures such as determining the ash content, residue on ignition (ROI) of excipients and raw materials, and gravimetric analysis. This demand is sustained by strict global regulatory standards (GMP/GLP) requiring validated and highly precise thermal processing equipment.

Which technology trends are anticipated to revolutionize muffle furnace design?

Future designs will be revolutionized by the integration of IoT connectivity for remote diagnostics and predictive maintenance, coupled with AI-driven process optimization to autonomously adjust heating profiles for maximum efficiency and material purity. Furthermore, enhanced safety features and the development of cost-effective, durable heating elements for ultra-high temperature applications are key trends.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager