MulteFire technology Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433744 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

MulteFire technology Market Size

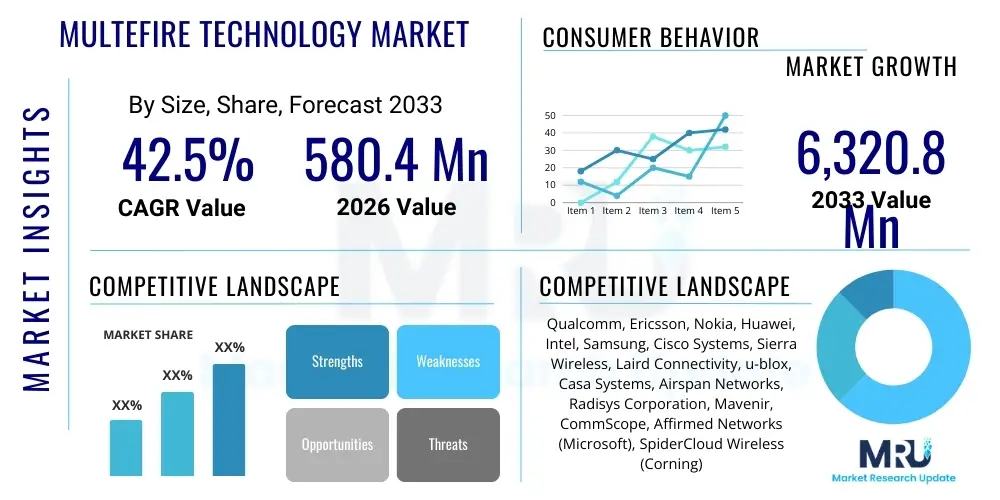

The MulteFire technology Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 42.5% between 2026 and 2033. The market is estimated at $580.4 Million in 2026 and is projected to reach $6,320.8 Million by the end of the forecast period in 2033.

MulteFire technology Market introduction

The MulteFire technology market encompasses the deployment and utilization of the MulteFire standard, which enables Long-Term Evolution (LTE) operations exclusively in unlicensed spectrum, primarily the 5 GHz Industrial, Scientific, and Medical (ISM) band. This technology, standardized by the MulteFire Alliance, addresses the growing demand for dedicated, secure, and high-performance wireless connectivity solutions in environments where licensed spectrum is unavailable, scarce, or cost-prohibitive. MulteFire operates on a Listen-Before-Talk (LBT) protocol, ensuring fair co-existence with Wi-Fi and other unlicensed spectrum users, making it particularly attractive for enterprise private networks, industrial IoT (IIoT), and dense indoor deployments where seamless mobility and carrier-grade reliability are crucial.

MulteFire's product portfolio includes small cells, core network components (EPC/vEPC), integrated chipset solutions, and specialized user equipment (UE). Major applications span across industrial automation, smart cities, large venues, transit systems, and enterprise connectivity. For industrial settings, MulteFire provides reliable, low-latency links necessary for robotic control and real-time sensor data aggregation. In commercial environments, it enhances indoor coverage and capacity, offering a consistent mobile experience superior to standard Wi-Fi under high-density loads. The technology is essentially designed to bring the performance and security benefits of cellular LTE networks into the unlicensed domain without requiring spectrum licenses.

The primary benefits driving market adoption include enhanced spectral efficiency, robust security features derived from the LTE standard, reliable Quality of Service (QoS) guarantees, and seamless mobility across access points—attributes often lacking in standard Wi-Fi deployments. Driving factors involve the explosive growth of connected IoT devices, the escalating need for private LTE networks by enterprises seeking ownership and control over their wireless infrastructure, and global regulatory harmonization supporting unlicensed LTE access. Furthermore, the inherent scalability and superior coverage provided by MulteFire solutions compared to traditional Wi-Fi in large-scale installations are accelerating its penetration, especially in manufacturing and logistics sectors demanding operational continuity and secure data transmission.

MulteFire technology Market Executive Summary

The MulteFire technology market is characterized by robust growth, propelled significantly by the global shift toward private networking solutions and the convergence of cellular reliability with unlicensed spectrum flexibility. Business trends indicate a strong move by telecommunication equipment vendors and chipset manufacturers toward developing integrated MulteFire-5G Non-Standalone (NSA) and Standalone (SA) solutions, ensuring future-proofing and interoperability. The market is witnessing increasing strategic collaborations between mobile network operators (MNOs) and industrial integrators to offer customized private LTE solutions, often leveraging MulteFire in combination with licensed spectrum. Technological advancements, particularly in small cell densification and improved LBT algorithms, are key contributors to market maturation and expansion into niche industrial use cases requiring ultra-reliable low-latency communication (URLLC). The economic viability of deploying MulteFire, bypassing expensive spectrum license fees, makes it highly attractive to non-traditional telecom players such as large enterprises and campus operators.

Regional trends highlight North America and Europe as leading adopters, primarily due to the early proliferation of private LTE initiatives, mature regulatory frameworks, and significant investment in industrial automation (Industry 4.0). The Asia Pacific (APAC) region, however, is projected to register the fastest growth rate, driven by massive urbanization, burgeoning smart city projects in countries like China and India, and rapid deployment of connected manufacturing facilities. In Latin America and the Middle East & Africa (MEA), growth is spurred by the need for cost-effective, high-capacity wireless backhaul and enterprise connectivity in areas with limited fiber infrastructure. Regulatory clarity regarding the use of the 5 GHz band for LTE technologies remains a critical determinant of regional success.

Segmentation trends reveal that the component segment is dominated by infrastructure, specifically small cells and access points, reflecting the foundational requirement for network build-out. Among application segments, Industrial IoT and Enterprise Connectivity hold the largest share, driven by the immediate demand for secure, dedicated networks in factories, warehouses, and corporate campuses. The Services segment, particularly managed services and system integration, is anticipated to exhibit rapid growth, reflecting the complexity of deploying and maintaining carrier-grade networks within enterprise environments. Furthermore, vertical segmentation shows significant traction in the manufacturing, logistics, and healthcare sectors, where mission-critical applications rely heavily on the guaranteed performance characteristics offered by MulteFire, distinguishing it from traditional Wi-Fi alternatives.

AI Impact Analysis on MulteFire technology Market

User queries regarding AI's influence on the MulteFire market often center on how Artificial Intelligence (AI) can enhance network performance, optimize spectrum utilization, and automate complex deployment and maintenance tasks in private LTE environments. Key user concerns revolve around the potential for AI algorithms to dynamically manage the Listen-Before-Talk (LBT) mechanism to further improve co-existence with Wi-Fi, the feasibility of using machine learning (ML) for predictive fault detection in dense small cell deployments, and how AI can aid in optimizing radio resource management (RRM) to ensure stringent Quality of Service (QoS) requirements for industrial applications. Users are highly interested in AI’s role in automating network slicing and security protocol management within a MulteFire ecosystem, particularly in high-mobility scenarios where seamless handovers are essential.

AI is poised to transform the operational efficiency and reliability of MulteFire networks by introducing sophisticated automation capabilities. Specifically, ML algorithms can analyze massive datasets generated by user equipment and network infrastructure to predict traffic loads, dynamically adjust power levels, and optimize resource allocation in real-time. This level of granular control is crucial in unlicensed spectrum, where interference management is paramount. AI-driven network optimization minimizes latency fluctuations and maximizes throughput, thereby fulfilling the stringent performance criteria required by Industry 4.0 applications such as autonomous guided vehicles (AGVs) and remote machinery control.

Furthermore, the integration of AI simplifies the deployment lifecycle, addressing one of the primary hurdles in adopting complex cellular technologies. AI-powered tools can automate site planning, interference modeling, and self-configuration of MulteFire small cells. Post-deployment, AI enhances cybersecurity by detecting anomalous behavior indicative of intrusion attempts or jamming, providing a proactive defense layer that leverages the native security framework of LTE. This automation is vital for reducing the operational expenditure (OPEX) for enterprises deploying private networks, making MulteFire a more scalable and economically feasible connectivity option against competing technologies.

- AI enhances dynamic spectrum sharing by optimizing LBT parameters in real-time, improving co-existence with Wi-Fi.

- Machine learning algorithms enable predictive maintenance and fault detection in small cell infrastructure, minimizing downtime.

- AI drives Radio Resource Management (RRM) optimization, ensuring guaranteed Quality of Service (QoS) for mission-critical applications.

- Automation of network configuration and self-healing mechanisms reduces operational complexity and costs for enterprise deployment.

- AI-powered cybersecurity improves intrusion detection and anomaly identification within the private MulteFire core network.

- Intelligent traffic steering and load balancing across dense small cell clusters maximize network throughput and capacity.

- Optimization of mobility management (handover procedures) using ML ensures seamless connectivity for moving assets like AGVs.

DRO & Impact Forces Of MulteFire technology Market

The MulteFire technology market is fundamentally driven by the escalating demand for private, high-performance wireless networks that offer the robustness of LTE without the substantial capital expense of licensed spectrum acquisition. Key drivers include the rapid adoption of Industry 4.0 paradigms, necessitating reliable low-latency communication for real-time factory floor operations, and the saturation and performance limitations of Wi-Fi in high-density enterprise and public venue environments. Opportunities are significant in addressing connectivity gaps in emerging markets and through the integration of MulteFire with 5G technologies (MulteFire 5G NR U), which promises even higher spectral efficiency and expanded use cases. However, market expansion is restrained primarily by the continued dominance and ubiquity of Wi-Fi 6/7 standards, which are constantly evolving to close the performance gap, alongside the persistent challenge of ensuring strict co-existence rules and managing regulatory uncertainty across different global regions regarding unlicensed LTE use. These combined forces shape the investment decisions and deployment strategies within the ecosystem.

One primary driver is the necessity for dedicated network capacity and control in critical sectors. Unlike public MNO networks or shared Wi-Fi, MulteFire allows enterprises to manage their data traffic locally, ensuring strict data sovereignty and reducing reliance on external providers. This control is paramount in sensitive environments such as military bases, ports, and healthcare facilities. The low total cost of ownership (TCO), stemming from the avoidance of spectrum licensing fees, further fuels adoption, particularly among small and medium enterprises (SMEs) that require enterprise-grade connectivity but operate on constrained capital expenditure budgets. Furthermore, the inherent security benefits of the LTE protocol stack are becoming increasingly valued by organizations seeking to mitigate growing cyber threats targeting industrial control systems.

The principal restraint remains the high competitive pressure from established and evolving unlicensed technologies. Wi-Fi 6E and the upcoming Wi-Fi 7 standards offer multi-gigabit speeds and enhanced efficiency, often requiring less proprietary hardware integration than MulteFire. Enterprises frequently prefer the familiarity and lower barrier to entry of Wi-Fi. Another significant hurdle is the ecosystem maturity; while major vendors support MulteFire, the overall availability and variety of compatible user equipment (UE) compared to Wi-Fi remain limited. Regulatory harmonization also acts as a restraint; inconsistent or delayed adoption of LBT requirements across different geographical regions creates fragmentation and complicates international deployment strategies for multinational companies, requiring tailored solutions for each jurisdiction.

- Drivers: Demand for secure, private LTE networks; necessity for low-latency communication in Industry 4.0; avoidance of expensive licensed spectrum fees; inherent security and mobility of LTE standard.

- Restraints: Strong competition from evolving Wi-Fi 6/7 standards; limited availability and diversity of MulteFire-enabled user equipment (UE); regulatory fragmentation regarding unlicensed LTE spectrum use.

- Opportunities: Integration with 5G Non-Standalone (NSA) and Standalone (SA) architectures (MulteFire 5G NR U); untapped potential in smart city infrastructure and rural broadband access; growth of managed private network services.

- Impact Forces: Technological innovation (development of highly efficient LBT algorithms); Competitive Intensity (pricing pressure from Wi-Fi vendors); Regulatory Environment (global standardization of unlicensed LTE protocols); Consumer/Enterprise Demand (shift toward self-managed network infrastructure).

Segmentation Analysis

The MulteFire technology market segmentation provides a granular view of deployment patterns, technological preferences, and end-user adoption across various vertical markets. The market is primarily segmented by Component, Application, and End-User Industry. Analyzing these segments helps stakeholders understand which parts of the value chain are driving revenue and where future investment should be directed. The infrastructure component segment, encompassing small cells, access points, and core network elements, forms the backbone of the market, essential for any new deployment. The application breakdown highlights the critical role MulteFire plays in addressing connectivity challenges in industrial environments and large public venues where high capacity and reliability are non-negotiable.

The segmentation by Component reveals that hardware infrastructure, particularly MulteFire-enabled small cells and distributed antenna systems (DAS), holds the largest market share, driven by the requirement for high-density, localized coverage. Software components, including network management systems and advanced LBT algorithms, are witnessing rapid growth due to increasing complexity in network orchestration and the need for optimized spectral efficiency. Services, including system integration, professional consulting, and managed network services, are critical for enterprises lacking in-house cellular expertise, contributing significantly to the operational expenditure (OPEX) segment of the market and ensuring the effective deployment and ongoing performance of the sophisticated technology.

In terms of Application, Industrial IoT (IIoT) consistently dominates, as manufacturing and logistics sectors require the guaranteed QoS and reliability that Wi-Fi often cannot deliver under critical operational loads. Enterprise connectivity, covering corporate offices, campus networks, and large venue installations (stadiums, shopping malls), represents the second major application, capitalizing on MulteFire's superior capacity and mobility features. Emerging applications, such as fixed wireless access (FWA) and smart city deployments utilizing unlicensed backhaul, present substantial growth opportunities, indicating a diversification of MulteFire's utility beyond traditional closed enterprise environments.

- By Component: Infrastructure (Small Cells/Access Points, Core Network Elements), Software (Network Management, Security), Services (Managed Services, System Integration, Consulting).

- By Application: Industrial IoT (Manufacturing, Logistics), Enterprise Connectivity (Corporate Campus, Office Buildings), Public Venues (Stadiums, Shopping Malls), Fixed Wireless Access (FWA), Smart City Applications.

- By End-User Industry: Manufacturing, Transportation & Logistics, Healthcare, Utilities, Retail, Government & Public Safety.

Value Chain Analysis For MulteFire technology Market

The MulteFire technology value chain begins with upstream activities involving chipset and component manufacturing, dominated by major semiconductor firms and intellectual property (IP) providers. These firms are responsible for designing and fabricating the specialized radio frequency (RF) components and baseband processors necessary for implementing the LBT protocol and the full LTE stack in the unlicensed spectrum. Research and development (R&D) in this segment focus heavily on increasing energy efficiency and enhancing the performance of LBT algorithms to ensure seamless co-existence and regulatory compliance. Success in the upstream segment relies heavily on patent portfolios and strategic partnerships with 3GPP standardization bodies and the MulteFire Alliance.

The midstream section of the value chain involves Original Equipment Manufacturers (OEMs) and infrastructure providers who integrate the chipsets into commercial products, primarily small cells, network gateways, and core network software solutions. This stage includes critical processes such as hardware manufacturing, software development for network management, and ensuring device interoperability. Key players in this segment are major telecommunications equipment vendors who leverage their existing expertise in licensed LTE infrastructure to develop and market MulteFire-specific offerings. System integrators also play a crucial role here, customizing off-the-shelf equipment for specific enterprise environments and integrating MulteFire networks with existing IT infrastructure.

Downstream activities focus on deployment, distribution, and end-user services. Distribution channels are bifurcated into direct sales to large enterprises (often involving system integrators for tailored private network deployment) and indirect channels utilizing channel partners, specialized value-added resellers (VARs), and dedicated managed service providers (MSPs). MSPs are increasingly important as they provide the ongoing operational support, monitoring, and maintenance required for complex, carrier-grade private networks. The final layer of the value chain is the end-user, such as manufacturing plants or logistical hubs, which utilize the technology to improve operational efficiency, secure their data transmission, and enable advanced automation capabilities.

MulteFire technology Market Potential Customers

Potential customers for MulteFire technology are diverse organizations requiring dedicated, secure, high-capacity wireless connectivity that traditional Wi-Fi cannot reliably provide, particularly those operating mission-critical applications where network failure carries severe operational or safety risks. The primary end-users fall within the manufacturing and logistics sectors (Industry 4.0), which deploy MulteFire for automated systems, real-time sensor monitoring, and mobile asset tracking across vast factory floors or complex warehouse environments. These buyers prioritize guaranteed Quality of Service (QoS) and low latency over pure bandwidth, making LTE-based solutions highly attractive. Large enterprises and corporate campuses also represent a significant customer base, seeking to enhance indoor connectivity, manage high user density, and ensure better mobility across their premises than traditional Wi-Fi infrastructure allows.

Other key buyers include organizations managing large public venues such as stadiums, airports, and convention centers, where capacity demands peak during specific events, requiring robust and scalable connectivity for both users and operational systems (e.g., security, ticketing). Furthermore, government entities and public safety agencies are emerging customers, utilizing MulteFire for dedicated private networks that offer enhanced security and reliability for critical communications, often preferring to utilize available unlicensed spectrum for non-mission-critical data services to conserve licensed frequencies. Healthcare facilities, specifically large hospitals, also constitute important customers, leveraging MulteFire for reliable connection of mobile medical devices, patient monitoring systems, and secure transmission of electronic health records (EHRs), where network integrity is directly linked to patient care outcomes.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $580.4 Million |

| Market Forecast in 2033 | $6,320.8 Million |

| Growth Rate | 42.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Qualcomm, Ericsson, Nokia, Huawei, Intel, Samsung, Cisco Systems, Sierra Wireless, Laird Connectivity, u-blox, Casa Systems, Airspan Networks, Radisys Corporation, Mavenir, CommScope, Affirmed Networks (Microsoft), SpiderCloud Wireless (Corning), Baicells Technologies, ASOCS, Athonet |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

MulteFire technology Market Key Technology Landscape

The foundational technology underpinning the MulteFire market is the standardized implementation of LTE in unlicensed spectrum bands, specifically utilizing the Listen-Before-Talk (LBT) mechanism. LBT is mandatory for operating in the 5 GHz unlicensed band in many jurisdictions, including Europe (ETSI regulations), ensuring fair sharing of the medium with incumbent technologies like Wi-Fi. This mechanism requires the MulteFire device to sense the channel and transmit only if the channel is idle for a predefined duration. Technological advancements in this area focus on developing highly sophisticated, software-defined LBT algorithms that can minimize sensing overhead and maximize channel utilization, thereby improving overall network capacity and reducing potential interference with Wi-Fi networks in shared environments.

Another pivotal element is the reliance on small cell architectures. Due to the inherent power limitations and shorter range associated with operation in unlicensed bands, MulteFire deployments necessitate a dense arrangement of small cells to ensure continuous coverage and high capacity across large areas, such as factory floors or stadiums. These small cells are typically deployed independently of licensed spectrum infrastructure, although increasing interest surrounds integrated solutions. The technology leverages standardized 3GPP interfaces and core network components, including the Evolved Packet Core (EPC) or Virtualized EPC (vEPC), providing carrier-grade features like robust security (using SIM/USIM authentication) and seamless mobility management (handover processes) crucial for industrial mobile assets.

Current technological evolution is concentrated on integrating MulteFire capabilities with 5G New Radio (NR) standards, often referred to as MulteFire 5G NR U. This integration aims to bring the substantial performance benefits of 5G—ultra-low latency, massive connectivity, and enhanced throughput—to the unlicensed spectrum domain while retaining the core principle of spectrum sharing via LBT. The shift towards cloud-native and virtualized network functions (NFV) and software-defined networking (SDN) also plays a key role, allowing enterprises to deploy MulteFire core networks (vEPC) on commodity hardware or in the cloud, significantly reducing hardware footprints and accelerating deployment flexibility. The use of specialized chipsets capable of supporting concurrent Wi-Fi and MulteFire operations further enhances versatility in complex enterprise environments.

Regional Highlights

North America is a dominant force in the MulteFire technology market, characterized by early adoption of private LTE networks and high levels of investment in industrial automation, particularly in the manufacturing, energy, and defense sectors. The region benefits from a generally favorable regulatory environment, particularly the availability of the 5 GHz band for unlicensed use, which aligns with MulteFire’s core operational requirements. Enterprises here are quickly migrating from proprietary industrial wireless standards to standardized cellular solutions to leverage the scalability and robust security protocols provided by LTE. Key growth factors include strong partnerships between major telecom vendors and specialized system integrators focusing on tailored enterprise deployments. The maturity of the regional ecosystem facilitates quicker deployment cycles and broader availability of compatible user equipment. Furthermore, the push for 5G innovation includes exploration of MulteFire 5G NR U to extend high-speed coverage indoors and across large campuses.

Europe represents a substantial and rapidly growing market, driven largely by rigorous Industry 4.0 initiatives in Germany, France, and the UK. European regulatory bodies (like ETSI) have established clear guidelines regarding LBT protocols in the 5 GHz band, fostering confidence among enterprises to deploy unlicensed LTE technologies. The region’s growth is strongly influenced by its dense urban centers and robust logistics infrastructure, demanding high-capacity indoor and outdoor coverage for smart warehousing and transportation systems. Furthermore, European telecom operators and large industrial corporations are actively testing and implementing MulteFire solutions to enhance site-specific efficiency and overcome the saturation issues often encountered with enterprise Wi-Fi. The emphasis on localized data processing and security inherent in European data regulations (GDPR) makes the private, self-contained nature of MulteFire networks highly appealing.

Asia Pacific (APAC) is forecasted to be the fastest-growing region, owing to massive infrastructure investments in smart cities, widespread industrial expansion, and high mobile device density. Countries such as China, Japan, South Korea, and India are prioritizing digital transformation across manufacturing and public utilities. While regulatory landscapes vary, the high demand for connectivity in underserved areas and the desire to circumvent expensive spectrum licensing fees drive interest in MulteFire, particularly for Fixed Wireless Access (FWA) applications and connecting large industrial complexes. The sheer scale of potential deployments in APAC—covering thousands of factories, ports, and transit systems—provides a significant opportunity for vendors specializing in high-volume MulteFire small cell production. Competition in this region is intense, requiring competitive pricing and localized feature sets, often focused on integration with specific regional IoT platforms.

Latin America (LATAM) and Middle East & Africa (MEA) are emerging markets where MulteFire adoption is primarily driven by the need for cost-effective capacity expansion and robust network solutions in environments lacking comprehensive licensed spectrum or wired infrastructure. In MEA, major oil and gas installations, mining operations, and large public venues are exploring MulteFire for critical asset monitoring and workforce connectivity where traditional infrastructure is challenging to deploy. LATAM sees potential in providing enhanced connectivity for large university campuses and facilitating enterprise networking solutions in rapidly industrializing economies. While growth in these regions faces hurdles related to limited capital investment and ongoing regulatory complexities, the low TCO of MulteFire compared to licensed alternatives positions it as a viable long-term strategy for bridging digital connectivity gaps.

- North America: Market leader; driven by mature private LTE market, robust industrial automation sectors (aerospace, defense), and clear regulatory environment for 5 GHz usage. High investment in MulteFire-5G integration.

- Europe: Strong growth market; propelled by Industry 4.0 initiatives (especially in Germany), strict LBT compliance (ETSI), and high density of logistics and manufacturing hubs. Focus on secure enterprise networks.

- Asia Pacific (APAC): Fastest-growing market; fueled by vast smart city projects, rapid industrialization, high mobile traffic density, and use cases in FWA for underserved areas. Price competitiveness is a key factor.

- Latin America (LATAM): Emerging market; adoption focused on large corporate campuses, mining, and oil & gas, prioritizing cost efficiency and superior mobility features over Wi-Fi.

- Middle East & Africa (MEA): Niche adoption in critical infrastructure (energy, ports) and large public venues, driven by the requirement for reliable, dedicated network solutions and circumventing high licensed spectrum costs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the MulteFire technology Market.- Qualcomm

- Ericsson

- Nokia

- Huawei

- Intel

- Samsung

- Cisco Systems

- Sierra Wireless

- Laird Connectivity

- u-blox

- Casa Systems

- Airspan Networks

- Radisys Corporation

- Mavenir

- CommScope

- Affirmed Networks (Microsoft)

- SpiderCloud Wireless (Corning)

- Baicells Technologies

- ASOCS

- Athonet

Frequently Asked Questions

Analyze common user questions about the MulteFire technology market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is MulteFire technology and how does it differ from Wi-Fi?

MulteFire is a technology standard that enables LTE (4G/5G) operation exclusively in unlicensed spectrum bands, most commonly the 5 GHz band, without requiring a licensed anchor carrier. It differs from Wi-Fi by utilizing the core LTE protocol stack, providing superior security, carrier-grade mobility (seamless handovers), and guaranteed Quality of Service (QoS), which is essential for mission-critical industrial applications where Wi-Fi can suffer from congestion and unreliable performance due to its best-effort nature. MulteFire mandates the Listen-Before-Talk (LBT) mechanism to ensure fair co-existence with existing Wi-Fi networks in the shared spectrum.

Is MulteFire compatible with 5G technology, and what are the primary use cases?

Yes, the technology is evolving into MulteFire 5G NR U (New Radio in Unlicensed spectrum), ensuring compatibility with 5G Non-Standalone (NSA) and Standalone (SA) architectures. This integration allows enterprises to leverage 5G benefits—such as ultra-low latency and massive machine-type communication (mMTC)—in unlicensed bands. Primary use cases include Industrial IoT (IIoT) for factory automation and robotics, high-density enterprise connectivity, public venue coverage (stadiums), and providing robust private networks for logistics and utilities where traditional licensed cellular or Wi-Fi solutions are insufficient or too costly.

What are the main advantages of deploying a private MulteFire network over standard Wi-Fi 6E/7?

The main advantages of MulteFire lie in its inherent cellular architecture: superior signal propagation and range, enabling wider area coverage with fewer access points; robust security built on SIM-based authentication; enhanced reliability and predictable performance due to guaranteed QoS; and professional mobility management, crucial for moving assets like automated guided vehicles (AGVs). While Wi-Fi 6E/7 offers higher peak bandwidth, MulteFire excels in maintaining consistent, low-latency performance under high-density and interference-prone conditions, offering true carrier-grade reliability without the expense of licensed spectrum.

What are the regulatory hurdles affecting the global adoption of MulteFire?

Regulatory hurdles primarily revolve around the varying implementation and enforcement of the Listen-Before-Talk (LBT) mechanism across different geographies. MulteFire requires LBT in many regions (like Europe and parts of APAC) to operate in the 5 GHz band, ensuring non-interference with Wi-Fi. Lack of consistent LBT technical specifications or delayed governmental approvals in certain emerging markets creates fragmentation, complicating the international deployment strategy for multinational enterprises. Furthermore, ongoing evolution and clarity regarding the use of 6 GHz and other unlicensed bands for MulteFire 5G NR U require continued regulatory harmonization.

Which industry verticals are the biggest consumers of MulteFire solutions?

The Manufacturing and Logistics industries are the biggest consumers of MulteFire solutions globally. These sectors require reliable, dedicated, and secure wireless networks to support mission-critical Industry 4.0 applications, including robotic control, real-time machine telemetry, predictive maintenance systems, and massive sensor networks. Other significant verticals include Transportation (ports, railways, airports) requiring consistent coverage for mobile operations, and large Healthcare facilities needing reliable connectivity for patient monitoring and critical mobile medical devices, valuing the enhanced security and QoS guarantees of MulteFire.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager