Multi-access Laser Micromachining Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433396 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Multi-access Laser Micromachining Market Size

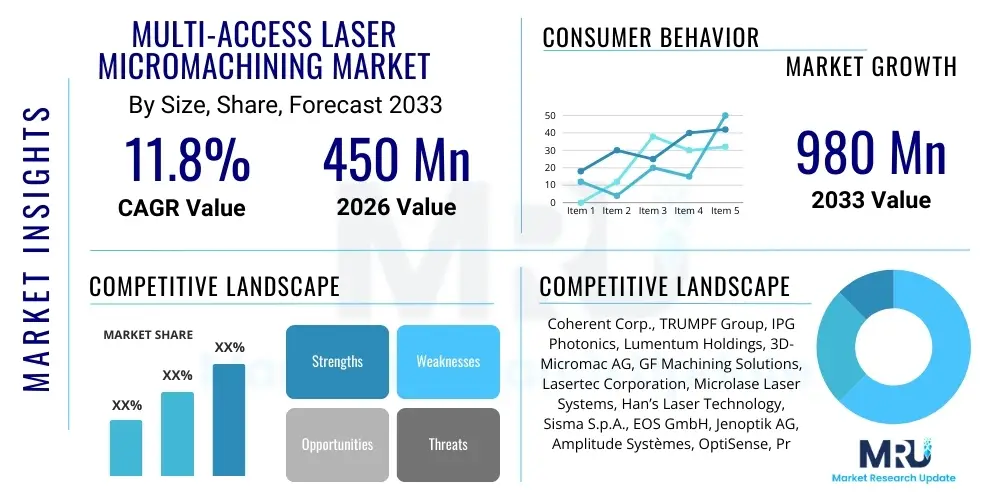

The Multi-access Laser Micromachining Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.8% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 980 Million by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the escalating demand for miniaturized components, particularly within the medical device and semiconductor industries, where ultra-precision manufacturing across complex geometries is paramount for enhancing product performance and reliability.

Multi-access Laser Micromachining Market introduction

The Multi-access Laser Micromachining Market encompasses advanced manufacturing systems utilizing focused laser energy, typically ultra-short pulse (USP) lasers, to ablate or modify materials at micron and sub-micron scales. The defining characteristic is the integration of multiple degrees of freedom (typically 5-axis or more) in the positioning system, allowing for intricate processing of non-planar, three-dimensional surfaces with extreme precision and minimal heat-affected zones (HAZ). This technology is critical for creating complex structures, micro-holes, surface textures, and precision cuts that are impossible or economically unfeasible using traditional mechanical or single-axis laser methods. The precision and versatility offered by multi-axis systems are transforming high-value manufacturing across several critical sectors.

Major applications of multi-access laser micromachining span across semiconductor manufacturing for wafer dicing and intricate circuit structuring, the production of highly complex medical implants and delivery systems (such as stents and catheters), and the aerospace sector for drilling cooling holes in turbine blades. Further applications include the fabrication of microfluidic devices and precision optics. The inherent benefits of using multi-access laser platforms include non-contact processing, which minimizes material stress, high processing speeds, exceptional repeatability, and the ability to process a vast range of materials, including hard ceramics, composite polymers, and specialized metal alloys. The capability to achieve high aspect ratios and tight tolerances on curved or complex geometries provides a significant competitive edge over conventional subtractive manufacturing techniques.

The primary driving factors sustaining market growth include the pervasive trend towards component miniaturization across consumer electronics and specialized industrial equipment, coupled with increasing regulatory demands in the medical field requiring higher precision and biocompatibility standards. Furthermore, advancements in ultra-short pulse laser technology, particularly femtosecond lasers, have enhanced material removal rates while simultaneously improving surface quality, making multi-access laser systems indispensable tools for next-generation product development and mass production. The integration of advanced computational tools for path planning and machine control further solidifies the technological readiness and commercial viability of these sophisticated systems.

Multi-access Laser Micromachining Market Executive Summary

The Multi-access Laser Micromachining Market is undergoing robust expansion, characterized by increasing adoption in high-tech manufacturing hubs globally. Key business trends point toward strategic collaborations between laser manufacturers and systems integrators to deliver turnkey solutions tailored for specific industrial applications, such as high-throughput semiconductor processing and customized medical device fabrication. The competitive landscape is shifting towards providers offering integrated monitoring and control software, leveraging real-time data analysis to optimize process parameters, ensuring high yield and minimizing material waste. Furthermore, sustainability initiatives are driving demand for energy-efficient laser sources and processes that reduce the environmental footprint associated with precision manufacturing.

Regionally, Asia Pacific maintains market dominance due to its formidable electronics manufacturing base and burgeoning medical device production capabilities, with countries like China, Japan, and South Korea being major consumers of advanced laser systems. North America and Europe, while representing mature markets, exhibit strong growth trajectories, primarily fueled by heavy investment in aerospace and defense applications, coupled with stringent quality requirements for specialized orthopedic and neurological implants. Segment trends reveal that the femtosecond laser segment is poised for the fastest growth, largely replacing picosecond and nanosecond platforms in high-precision, heat-sensitive applications due to their superior cold ablation characteristics. Application-wise, the medical devices sector is demonstrating accelerating demand, surpassing established segments like general industrial processing due to the increasing complexity of implantable devices and diagnostic tools.

In summary, the market momentum is strongly linked to technological leaps in ultra-short pulse laser performance and motion control accuracy. The migration from standard 3-axis systems to highly dynamic 5-axis and specialized kinematic configurations enables manufacturers to tackle geometries previously deemed impossible. Strategic focus areas for market participants include enhancing automation capabilities, improving user interfaces for rapid job setup, and focusing on materials processing capabilities for new-generation composites and additive manufactured parts. These trends collectively underscore a market moving towards greater automation, specialization, and process intelligence to meet the rigorous demands of advanced manufacturing.

AI Impact Analysis on Multi-access Laser Micromachining Market

Common user questions regarding AI’s influence center on whether AI can autonomously optimize laser parameters (power, pulse duration, repetition rate) for varying materials, how AI improves defect detection and quality control in real-time, and the potential for machine learning to enhance machine vision and complex path planning for 5-axis systems. Users are also concerned about the required data infrastructure and expertise necessary to implement AI-driven process optimization effectively. Based on this analysis, the key themes summarize that AI is expected to revolutionize process control by enabling self-correction and predictive maintenance, drastically reducing setup times and minimizing scrap rates by interpreting complex material interactions and optimizing tool paths dynamically, thus elevating the overall efficiency and reliability of multi-access micromachining operations.

- AI-driven Process Optimization: Machine learning algorithms analyze historical processing data and real-time sensor feedback (acoustic emissions, optical monitoring) to instantaneously adjust laser power, focus position, and scanning speed, ensuring optimal material removal and surface quality irrespective of minor material variations or machine drift.

- Predictive Maintenance: AI models monitor spindle vibrations, laser source health, and motion system accuracy to predict potential component failures, enabling proactive maintenance scheduling and maximizing machine uptime, which is critical for high-volume manufacturing environments.

- Enhanced Quality Assurance: Deep learning models integrated with high-speed cameras provide real-time defect classification and non-destructive inspection, identifying micron-scale flaws during the process itself, leading to immediate rejection or rework signals and significantly improving yield rates.

- Complex Path Planning and Simulation: AI assists in generating and optimizing complex tool paths for multi-axis systems on intricate 3D geometries, reducing computational time for sophisticated operations and ensuring collision avoidance and uniform energy distribution across curved surfaces.

- Adaptive Calibration and Alignment: AI algorithms automate and expedite system calibration procedures, compensating for thermal drift or mechanical inaccuracies dynamically, maintaining sub-micron accuracy across long operational periods.

DRO & Impact Forces Of Multi-access Laser Micromachining Market

The Multi-access Laser Micromachining Market is propelled by increasing demand for high-precision components in miniaturized devices, particularly in the medical and semiconductor sectors, coupled with technological advancements in ultra-short pulse (USP) laser sources that facilitate cold ablation and superior surface quality. However, growth is restrained by the high capital investment required for these sophisticated systems and the need for highly specialized technical expertise for operation and maintenance. Significant opportunities lie in the expansion into high-volume consumer electronics manufacturing, the processing of novel materials like advanced ceramics and composites, and the integration of smart factory (Industry 4.0) capabilities, enhancing automation and predictive performance. These dynamic factors create impact forces that are constantly reshaping competitive strategies and technological development within the market.

Drivers: The fundamental driver is the pervasive requirement across industries for greater precision, smaller features, and higher aspect ratios, which standard machining processes cannot meet. The demand for next-generation medical implants (such as bioresorbable scaffolds and micro-pumps) requires machining resolutions down to the sub-10 micron range on complex, non-planar surfaces, making multi-access laser systems indispensable. Furthermore, the relentless scaling down of semiconductor components, including advanced packaging technologies like 3D integrated circuits (3D ICs) and through-silicon vias (TSVs), necessitates the high spatial resolution and negligible heat-affected zone offered by femtosecond multi-axis platforms. The increasing adoption of 5-axis and higher-axis kinematics enhances the geometric flexibility and throughput, directly contributing to market expansion.

Restraints: The primary restraint is the considerable financial barrier to entry, encompassing not only the cost of the advanced USP laser sources (which can exceed hundreds of thousands of dollars) but also the expense of precision motion systems, specialized optical components, and integrated sensing packages. This high investment can deter smaller enterprises. Additionally, the complexity of programming and operating multi-axis systems, particularly those using novel laser parameters, demands highly skilled engineers and technicians, leading to a shortage of qualified personnel and adding to operational costs. Furthermore, the inherent limitations in processing speed for certain deep material removal applications, where laser ablation remains slower than macro-scale milling, acts as a niche constraint in high-volume, low-precision industrial tasks.

Opportunities: Major opportunities exist in developing systems specifically optimized for additive manufacturing post-processing, such as high-precision surface finishing or intricate feature removal on 3D printed parts. The adoption of new high-performance materials (e.g., carbon fiber reinforced polymers and advanced technical glasses) across automotive lightweighting and aerospace structural components opens up new application niches for multi-access laser processing. Furthermore, the ongoing digitalization of manufacturing provides a key avenue for growth through the integration of cloud-based monitoring, simulation tools, and AI-driven process optimization, enabling faster iteration and higher yields in contract manufacturing services. The shift towards highly integrated, compact, and cost-effective USP laser modules also promises to expand market accessibility to a broader range of industrial users seeking enhanced precision capabilities.

Segmentation Analysis

The Multi-access Laser Micromachining Market is comprehensively segmented based on the laser technology employed, the degree of axes sophistication, the application sector, and the specific end-user category. This segmentation provides clarity on the diverse technological requirements and tailored solutions necessary to meet the distinct demands of various industries, ranging from the sub-micron requirements of semiconductor fabrication to the high-throughput needs of large-scale contract manufacturing. The performance characteristics, cost structures, and technical complexities vary significantly across these segments, necessitating specialized product offerings from vendors.

The segmentation by laser type is crucial as it determines the material processing capability and precision level; ultra-short pulse (USP) lasers, specifically femtosecond and picosecond, dominate the high-precision market due to minimal thermal interaction. Segmentation by axis configuration—3-axis, 5-axis, and highly articulated systems (more than 5 axes)—reflects the geometric complexity of the components being processed. Furthermore, segmenting by end-user, distinguishing between Original Equipment Manufacturers (OEMs), Contract Manufacturers (CMs), and Research Institutions, highlights the difference between mass production requirements and niche development needs, guiding market strategy and product development efforts across the value chain.

- By Laser Type:

- Femtosecond Lasers (Highest precision, minimal HAZ, fastest growth)

- Picosecond Lasers (High precision, good balance of speed and quality)

- Nanosecond Lasers (Lower cost, higher throughput for non-sensitive materials)

- By Axis Configuration:

- 3-Axis Micromachining Systems (Standard planar processing)

- 5-Axis Micromachining Systems (Complex 3D geometries, most common multi-access system)

- Multi-axis > 5 Systems (Highly specialized, often employing parallel kinematics for ultra-high dexterity)

- By Application:

- Medical Devices (Stents, Catheters, Micro-pumps, Surgical tools)

- Semiconductors and Electronics (Wafer dicing, drilling through-silicon vias (TSVs), display manufacturing)

- Aerospace and Defense (Cooling hole drilling, composite machining, sensor fabrication)

- Automotive (Fuel injection components, micro-sensors, advanced lighting systems)

- Industrial and Research (Microfluidics, Optics fabrication, General precision tooling)

- By End-User:

- Original Equipment Manufacturers (OEMs)

- Contract Manufacturers/Job Shops

- Research and Academic Institutions

Value Chain Analysis For Multi-access Laser Micromachining Market

The value chain for multi-access laser micromachining is structured and highly specialized, beginning with upstream raw material suppliers and culminating in the highly specialized end-user applications. The upstream segment is dominated by critical component manufacturers, including suppliers of specialized optical elements (lenses, mirrors, beam expanders), ultra-short pulse (USP) laser sources (like fiber and solid-state lasers), and precision motion control systems (high-accuracy stages and galvanometers). These suppliers hold significant bargaining power due to the technical complexity and high intellectual property associated with their products. Quality and reliability of these core components directly dictate the performance and longevity of the final micromachining system, making sourcing critical.

The midstream stage involves the systems integrators and equipment manufacturers. These firms acquire the core components and integrate them into complete, multi-axis machine tools, adding proprietary control software, human-machine interfaces (HMIs), and application-specific fixturing. This stage adds the most value through engineering expertise, optical alignment mastery, and software development, transforming disparate components into a unified, high-precision manufacturing solution. Distribution channels are varied, incorporating both direct sales models, particularly for high-value bespoke systems sold to major OEMs, and indirect channels relying on regional distributors and technical agents who provide localized sales support, installation, and post-sales maintenance.

The downstream analysis focuses on the end-users who utilize these advanced machine tools. Direct customers, typically large OEMs in the medical or semiconductor fields, often purchase systems directly for high-volume internal production, necessitating strong, ongoing technical support and maintenance agreements from the machine vendor. Indirect demand comes from Contract Manufacturers (CMs) or specialized job shops who leverage these capabilities to serve multiple smaller clients across various industries, offering access to high-precision machining without the large capital outlay. The ultimate success in the downstream market is determined by the system’s ability to reliably achieve challenging geometric tolerances and material processing requirements efficiently.

Multi-access Laser Micromachining Market Potential Customers

Potential customers for multi-access laser micromachining systems are high-tech manufacturers that require precision component fabrication beyond the capabilities of conventional CNC machining or single-axis laser processing. These customers typically operate in industries where the cost of failure is extremely high, such as critical medical devices or aerospace components, placing a premium on process repeatability, minimized material waste, and exceptional surface finish. Key buyers include global semiconductor foundries requiring complex through-silicon via (TSV) drilling and wafer singulation processes, necessitating micron-level accuracy and minimal debris contamination.

Another major buyer group comprises medical device manufacturers, particularly those focused on implantable electronics, cardiovascular stents, and drug delivery micro-systems. These applications often involve processing delicate, biocompatible materials across curved or complex geometries that demand 5-axis or higher control to maintain perpendicularity and feature integrity. Furthermore, aerospace and defense contractors represent consistent high-value customers, utilizing these machines for drilling precise cooling holes in high-temperature superalloys for turbine components or manufacturing specialized, lightweight sensor housings that require complex internal geometries.

Beyond these high-profile industries, specialized contract manufacturing service providers are increasingly significant customers. These job shops invest in versatile multi-axis laser platforms to offer niche services to clients who cannot justify the capital expenditure themselves. They serve as a critical bridge, allowing smaller innovative firms access to cutting-edge precision manufacturing capabilities, focusing heavily on maximizing machine utilization and process flexibility across a wide range of materials and application requirements.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 980 Million |

| Growth Rate | 11.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Coherent Corp., TRUMPF Group, IPG Photonics, Lumentum Holdings, 3D-Micromac AG, GF Machining Solutions, Lasertec Corporation, Microlase Laser Systems, Han’s Laser Technology, Sisma S.p.A., EOS GmbH, Jenoptik AG, Amplitude Systèmes, OptiSense, Precise Microfab, Synova SA, Novanta Inc., Photonics Industries International, DELTA Group, MKS Instruments. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Multi-access Laser Micromachining Market Key Technology Landscape

The technological landscape of the Multi-access Laser Micromachining Market is defined by the convergence of ultra-short pulse (USP) laser physics, high-speed, high-precision motion control, and sophisticated software integration. Central to this landscape is the dominance of femtosecond lasers, which deliver pulses in the sub-100 femtosecond range. This ultra-short duration ensures that material ablation occurs before significant heat diffusion can take place (known as cold ablation), virtually eliminating the heat-affected zone (HAZ) and micro-cracking, which is crucial for processing heat-sensitive materials like certain polymers or complex metal alloys used in medical and aerospace applications. Ongoing research focuses on boosting the average power of these femtosecond sources while maintaining beam quality and stability, thereby improving throughput without compromising precision.

Beyond the laser source, advancements in machine kinematics are paramount. Modern multi-access systems rely heavily on sophisticated 5-axis platforms, often integrating linear motors and high-resolution encoders to achieve sub-micron positional accuracy and high dynamic performance. A notable trend is the integration of galvo scanners with high-precision stages (often called galvo-scanner hybrid systems). This configuration allows the laser beam to be steered rapidly across a small field of view by the galvos, compensating for the bulk inertia of the mechanical stages, thereby maximizing effective throughput and enabling the high-speed processing of micro-patterns across large areas with maintained accuracy. Continuous software innovation provides the necessary computational power for real-time path corrections and complex geometry handling.

Furthermore, the landscape is increasingly influenced by advanced monitoring and feedback mechanisms. Technologies such as coaxial machine vision systems, optical coherence tomography (OCT), and acoustic emission sensors are integrated to monitor the ablation process in real time. This sensor data, often processed by embedded AI algorithms, allows the system to automatically adjust laser power, focus depth, and speed to compensate for material non-uniformity or surface variations. This closed-loop control mechanism is vital for ensuring high yield and consistency, particularly in high-reliability applications like semiconductor manufacturing, marking a decisive shift towards intelligent, self-optimizing manufacturing systems. The development of compact, reliable, and energy-efficient laser modules further democratizes access to this advanced technology.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest and fastest-growing region in the Multi-access Laser Micromachining Market, driven by the massive scale of electronics manufacturing, including smartphones, display panels, and advanced semiconductor packaging, particularly in China, Taiwan, and South Korea. Furthermore, rapid industrialization and governmental support for high-tech manufacturing, coupled with the rising demand for sophisticated medical devices in populous nations, solidify its dominance. Japan and South Korea remain key hubs for technological innovation and high-precision machinery production and consumption.

- North America: North America holds a significant market share, characterized by robust demand from the aerospace and defense sectors for manufacturing high-tolerance parts like turbine components and specialized sensors. The region is a global leader in advanced medical device manufacturing (especially in the US), driving continuous investment in 5-axis laser systems for intricate implant fabrication. Innovation in ultra-short pulse laser technology and the presence of leading research institutions further stimulate market expansion.

- Europe: Europe represents a mature market with a high concentration of specialized engineering and manufacturing expertise, particularly in Germany, Switzerland, and France. Demand is strong from the automotive sector for micro-sensors and fuel injection systems, and from the high-value industrial machinery segment. Strict quality and environmental standards necessitate the adoption of high-precision, low-waste technologies like femtosecond multi-access micromachining, fostering steady market growth and technological refinement.

- Latin America (LATAM), Middle East, and Africa (MEA): These regions are emerging markets with moderate growth, primarily driven by investments in industrial diversification, localized automotive assembly, and initial expansion of medical device production capabilities. While currently smaller in scale, increasing foreign direct investment in manufacturing infrastructure and developing local expertise are expected to accelerate the adoption of multi-access laser technology for complex tooling and specialized component repair in the long term.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Multi-access Laser Micromachining Market.- Coherent Corp.

- TRUMPF Group

- IPG Photonics

- Lumentum Holdings

- 3D-Micromac AG

- GF Machining Solutions

- Lasertec Corporation

- Microlase Laser Systems

- Han’s Laser Technology

- Sisma S.p.A.

- EOS GmbH

- Jenoptik AG

- Amplitude Systèmes

- OptiSense

- Precise Microfab

- Synova SA

- Novanta Inc.

- Photonics Industries International

- DELTA Group

- MKS Instruments

Frequently Asked Questions

Analyze common user questions about the Multi-access Laser Micromachining market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Multi-access Laser Micromachining and why is it superior to conventional methods?

Multi-access laser micromachining refers to the use of advanced laser systems, typically employing 5-axis or more motion control, to process materials at micron scales across complex, non-planar geometries. Its superiority lies in its ability to achieve ultra-high precision, minimize the Heat-Affected Zone (HAZ) through cold ablation (especially using femtosecond lasers), and process intricate 3D features that mechanical methods or single-axis lasers cannot access, ensuring higher component quality and functional performance.

Which industries are the primary drivers of demand for 5-axis laser systems?

The primary drivers are the Medical Device industry, which requires micro-scale precision for implants, drug delivery systems, and surgical tools on complex surfaces, and the Semiconductor sector, demanding high-resolution fabrication for advanced packaging, such as drilling through-silicon vias (TSVs) and wafer dicing with minimal material damage.

How does the type of laser influence the outcome in micromachining applications?

The laser type, specifically its pulse duration, dictates the thermal interaction with the material. Femtosecond lasers (Ultra-Short Pulse or USP) offer the highest precision and lowest thermal damage (cold ablation), making them ideal for delicate materials. Picosecond lasers offer a balance of speed and precision, while Nanosecond lasers are used for higher material removal rates where thermal effects are less critical.

What role does Artificial Intelligence play in optimizing multi-access micromachining processes?

AI integrates into multi-access micromachining by enabling real-time process optimization, adjusting laser parameters instantaneously based on sensor feedback to ensure consistent quality and high yield. AI also powers predictive maintenance schedules, minimizing unplanned downtime, and assists in complex, collision-free tool path generation for intricate 3D components, significantly enhancing system efficiency and reliability.

What are the major technological challenges currently facing the market?

Major technological challenges include managing the high complexity and cost associated with integrating high-power ultra-short pulse laser sources with precise 5-axis kinematic stages, developing robust software for automated path planning on increasingly complex geometries, and scaling these highly accurate processes from laboratory environments to high-volume industrial manufacturing with maintained repeatability.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager